0001434601

false

2024

Q1

--05-31

0001434601

2023-06-01

2023-08-31

0001434601

2023-10-17

0001434601

2023-08-31

0001434601

2023-05-31

0001434601

2022-06-01

2022-08-31

0001434601

us-gaap:PreferredStockMember

2023-05-31

0001434601

us-gaap:CommonStockMember

2023-05-31

0001434601

TMGI:CommonStockPayableMember

2023-05-31

0001434601

us-gaap:AdditionalPaidInCapitalMember

2023-05-31

0001434601

us-gaap:RetainedEarningsMember

2023-05-31

0001434601

us-gaap:PreferredStockMember

2022-05-31

0001434601

us-gaap:CommonStockMember

2022-05-31

0001434601

TMGI:CommonStockPayableMember

2022-05-31

0001434601

us-gaap:AdditionalPaidInCapitalMember

2022-05-31

0001434601

us-gaap:RetainedEarningsMember

2022-05-31

0001434601

2022-05-31

0001434601

us-gaap:PreferredStockMember

2023-06-01

2023-08-31

0001434601

us-gaap:CommonStockMember

2023-06-01

2023-08-31

0001434601

TMGI:CommonStockPayableMember

2023-06-01

2023-08-31

0001434601

us-gaap:AdditionalPaidInCapitalMember

2023-06-01

2023-08-31

0001434601

us-gaap:RetainedEarningsMember

2023-06-01

2023-08-31

0001434601

us-gaap:PreferredStockMember

2022-06-01

2022-08-31

0001434601

us-gaap:CommonStockMember

2022-06-01

2022-08-31

0001434601

TMGI:CommonStockPayableMember

2022-06-01

2022-08-31

0001434601

us-gaap:AdditionalPaidInCapitalMember

2022-06-01

2022-08-31

0001434601

us-gaap:RetainedEarningsMember

2022-06-01

2022-08-31

0001434601

us-gaap:PreferredStockMember

2023-08-31

0001434601

us-gaap:CommonStockMember

2023-08-31

0001434601

TMGI:CommonStockPayableMember

2023-08-31

0001434601

us-gaap:AdditionalPaidInCapitalMember

2023-08-31

0001434601

us-gaap:RetainedEarningsMember

2023-08-31

0001434601

us-gaap:PreferredStockMember

2022-08-31

0001434601

us-gaap:CommonStockMember

2022-08-31

0001434601

TMGI:CommonStockPayableMember

2022-08-31

0001434601

us-gaap:AdditionalPaidInCapitalMember

2022-08-31

0001434601

us-gaap:RetainedEarningsMember

2022-08-31

0001434601

2022-08-31

0001434601

TMGI:CEOAgreement2017Member

2023-08-31

0001434601

TMGI:CEOAgreement2017Member

2023-05-31

0001434601

TMGI:WifeOfCEOMember

2023-08-31

0001434601

TMGI:WifeOfCEOMember

2023-05-31

0001434601

TMGI:MotherOfCEOMember

2023-08-31

0001434601

TMGI:MotherOfCEOMember

2023-05-31

0001434601

TMGI:ServiceProviderMember

2023-08-31

0001434601

TMGI:ServiceProviderMember

2023-05-31

0001434601

TMGI:ServiceProvider1Member

2023-08-31

0001434601

TMGI:ServiceProvider1Member

2023-05-31

0001434601

TMGI:TwoOtherServiceProvidersMember

2023-08-31

0001434601

TMGI:TwoOtherServiceProvidersMember

2023-05-31

0001434601

2022-06-01

2023-05-31

0001434601

TMGI:NotePayable1Member

2023-08-31

0001434601

TMGI:NotePayable1Member

2023-05-31

0001434601

TMGI:NotePayable2Member

2023-08-31

0001434601

TMGI:NotePayable2Member

2023-05-31

0001434601

TMGI:NotePayable3Member

2023-08-31

0001434601

TMGI:NotePayable3Member

2023-05-31

0001434601

TMGI:NotePayable4Member

2023-08-31

0001434601

TMGI:NotePayable4Member

2023-05-31

0001434601

TMGI:NotePayable5Member

2023-08-31

0001434601

TMGI:NotePayable5Member

2023-05-31

0001434601

TMGI:NotePayable6Member

2023-08-31

0001434601

TMGI:NotePayable6Member

2023-05-31

0001434601

TMGI:NotePayable7Member

2023-08-31

0001434601

TMGI:NotePayable7Member

2023-05-31

0001434601

TMGI:NotePayable8Member

2023-08-31

0001434601

TMGI:NotePayable8Member

2023-05-31

0001434601

TMGI:NotePayable9Member

2023-08-31

0001434601

TMGI:NotePayable9Member

2023-05-31

0001434601

TMGI:NotePayable10Member

2023-08-31

0001434601

TMGI:NotePayable10Member

2023-05-31

0001434601

TMGI:NotePayable11Member

2023-08-31

0001434601

TMGI:NotePayable11Member

2023-05-31

0001434601

TMGI:NotePayable12Member

2023-08-31

0001434601

TMGI:NotePayable12Member

2023-05-31

0001434601

TMGI:NotePayable13Member

2023-08-31

0001434601

TMGI:NotePayable13Member

2023-05-31

0001434601

TMGI:NotePayable14Member

2023-08-31

0001434601

TMGI:NotePayable14Member

2023-05-31

0001434601

TMGI:NotePayable15Member

2023-08-31

0001434601

TMGI:NotePayable15Member

2023-05-31

0001434601

TMGI:NotePayable16Member

2023-08-31

0001434601

TMGI:NotePayable16Member

2023-05-31

0001434601

TMGI:NotePayable17Member

2023-08-31

0001434601

TMGI:NotePayable17Member

2023-05-31

0001434601

TMGI:NotePayable18Member

2023-08-31

0001434601

TMGI:NotePayable18Member

2023-05-31

0001434601

TMGI:NotePayable19Member

2023-08-31

0001434601

TMGI:NotePayable19Member

2023-05-31

0001434601

TMGI:NotePayable20Member

2023-08-31

0001434601

TMGI:NotePayable20Member

2023-05-31

0001434601

TMGI:NotePayable21Member

2023-08-31

0001434601

TMGI:NotePayable21Member

2023-05-31

0001434601

TMGI:NotePayable22Member

2023-08-31

0001434601

TMGI:NotePayable22Member

2023-05-31

0001434601

TMGI:NotePayable23Member

2023-08-31

0001434601

TMGI:NotePayable23Member

2023-05-31

0001434601

TMGI:NotePayable24Member

2023-08-31

0001434601

TMGI:NotePayable24Member

2023-05-31

0001434601

TMGI:NotePayable25Member

2023-08-31

0001434601

TMGI:NotePayable25Member

2023-05-31

0001434601

TMGI:NotePayable26Member

2023-08-31

0001434601

TMGI:NotePayable26Member

2023-05-31

0001434601

TMGI:LenderAMember

2023-08-31

0001434601

TMGI:LenderAMember

2023-05-31

0001434601

TMGI:LenderBMember

2023-08-31

0001434601

TMGI:LenderBMember

2023-05-31

0001434601

TMGI:OtherLenders14Member

2023-08-31

0001434601

TMGI:OtherLenders14Member

2023-05-31

0001434601

TMGI:CompanyLawFirmMember

2023-08-31

0001434601

TMGI:CompanyLawFirmMember

2023-05-31

0001434601

TMGI:OZCorporationMember

2023-08-31

0001434601

TMGI:OZCorporationMember

2023-05-31

0001434601

srt:ChiefExecutiveOfficerMember

2023-08-31

0001434601

srt:ChiefExecutiveOfficerMember

2023-05-31

0001434601

TMGI:WifeOfCEOMember

2023-08-31

0001434601

TMGI:WifeOfCEOMember

2023-05-31

0001434601

TMGI:ConvertibleNote1Member

2023-08-31

0001434601

TMGI:ConvertibleNote1Member

2023-05-31

0001434601

TMGI:ConvertibleNote2Member

2023-08-31

0001434601

TMGI:ConvertibleNote2Member

2023-05-31

0001434601

TMGI:ConvertibleNote3Member

2023-08-31

0001434601

TMGI:ConvertibleNote3Member

2023-05-31

0001434601

TMGI:ConvertibleNote4Member

2023-08-31

0001434601

TMGI:ConvertibleNote4Member

2023-05-31

0001434601

TMGI:ConvertibleNote5Member

2023-08-31

0001434601

TMGI:ConvertibleNote5Member

2023-05-31

0001434601

TMGI:ConvertibleNote6Member

2023-08-31

0001434601

TMGI:ConvertibleNote6Member

2023-05-31

0001434601

TMGI:ConvertibleNote7Member

2023-08-31

0001434601

TMGI:ConvertibleNote7Member

2023-05-31

0001434601

TMGI:ConvertibleNote8Member

2023-08-31

0001434601

TMGI:ConvertibleNote8Member

2023-05-31

0001434601

TMGI:ConvertibleNote9Member

2023-08-31

0001434601

TMGI:ConvertibleNote9Member

2023-05-31

0001434601

TMGI:ConvertibleNote10Member

2023-08-31

0001434601

TMGI:ConvertibleNote10Member

2023-05-31

0001434601

TMGI:ConvertibleNote11Member

2023-08-31

0001434601

TMGI:ConvertibleNote11Member

2023-05-31

0001434601

TMGI:LenderAMember

2023-08-31

0001434601

TMGI:LenderAMember

2023-05-31

0001434601

TMGI:LenderBMember

2023-08-31

0001434601

TMGI:LenderBMember

2023-05-31

0001434601

TMGI:LenderCMember

2023-08-31

0001434601

TMGI:LenderCMember

2023-05-31

0001434601

TMGI:LenderDMember

2023-08-31

0001434601

TMGI:LenderDMember

2023-05-31

0001434601

TMGI:OtherLenders5Member

2023-08-31

0001434601

TMGI:OtherLenders5Member

2023-05-31

0001434601

2020-06-01

2021-05-31

0001434601

2022-04-20

2022-04-21

0001434601

TMGI:SimplyWhimMember

2022-09-19

2022-09-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| (Mark One) |

| |

|

| x |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

|

| For the quarterly period ended August 31, 2023 |

| |

|

| o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______to______

Commission File Number: 000-54163

| The Marquie Group, Inc. |

| (Exact name of registrant as specified in its Charter) |

| Florida |

|

26-2091212 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employee Identification No.) |

| |

|

|

|

7901 4th ST N, Suite 4000

St. Petersburg, FL 33702 |

|

33702 |

| (Address of principal executive office) |

|

(Zip Code) |

(800) 351-3021

(Registrant’s telephone number, including

area code)

Not Applicable

(Former Name, former address, and former fiscal

year, if changed since last report)

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was

required to submit such files). Yes ☒ No ☐

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting

company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated Filer ☐ |

Accelerated Filer ☐ |

| Non-accelerated Filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company ☐ |

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to section 13(a) of the Exchange Act. ☐

Indicate by check mark whether

the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding

of each of the issuer’s classes of common stock as of the latest practicable date: As of October 17, 2023, there were 756,612,000

shares of $0.0001 par value common stock, issued and outstanding.

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

THE MARQUIE GROUP, INC.

(formerly Music of Your Life, Inc.)

Consolidated Balance Sheets

| | |

| | | |

| | |

| | |

August 31, | | |

May 31, | |

| | |

2023 | | |

2023 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 117 | | |

$ | – | |

| | |

| | | |

| | |

| Total Current Assets | |

| 117 | | |

| – | |

| | |

| | | |

| | |

| OTHER ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Investment in Acquisition | |

| 6,200,000 | | |

| 6,200,000 | |

| Loans receivable, related party | |

| 28,247 | | |

| 28,247 | |

| Music inventory, net of accumulated depreciation of $20,949 and $20,719, respectively | |

| 699 | | |

| 929 | |

| Trademark costs | |

| 10,365 | | |

| 10,365 | |

| | |

| | | |

| | |

| Total Other Assets | |

| 6,239,311 | | |

| 6,239,541 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 6,239,428 | | |

$ | 6,239,541 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' DEFICIT | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| | |

| | | |

| | |

| Bank overdraft | |

$ | – | | |

$ | 46 | |

| Accounts payable | |

| 67,639 | | |

| 50,664 | |

| Accrued interest payable on notes payable | |

| 666,491 | | |

| 578,017 | |

| Accrued consulting fees | |

| 1,205,917 | | |

| 1,145,917 | |

| Notes payable, net of debt discounts of $42,669 and $66,794, respectively | |

| 1,489,263 | | |

| 1,465,138 | |

| Notes payable to related parties | |

| 2,091,272 | | |

| 2,090,772 | |

| Derivative liability | |

| 492,775 | | |

| 1,035,998 | |

| | |

| | | |

| | |

| Total Current Liabilities | |

| 6,013,357 | | |

| 6,366,552 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES | |

| 6,013,357 | | |

| 6,366,552 | |

| | |

| | | |

| | |

| STOCKHOLDERS' DEFICIT | |

| | | |

| | |

| | |

| | | |

| | |

| Preferred Stock, $0.0001 par value; 20,000,000 shares authorized, 200 and 200 shares issued and outstanding | |

| – | | |

| – | |

| Common stock, $0.0001 par value; 50,000,000,000 shares authorized, 756,612,000 and 756,612,000 shares issued and outstanding, respectively | |

| 75,663 | | |

| 75,663 | |

| Common stock payable - 1 share | |

| 8,460 | | |

| 8,460 | |

| Additional paid-in-capital | |

| 14,486,896 | | |

| 14,486,896 | |

| Accumulated deficit | |

| (14,344,948 | ) | |

| (14,698,030 | ) |

| | |

| | | |

| | |

| Total Stockholders' Deficit | |

| 226,071 | | |

| (127,011 | ) |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT | |

$ | 6,239,428 | | |

$ | 6,239,541 | |

The

accompanying notes are an integral part of these financial statements

THE MARQUIE GROUP, INC.

(formerly Music of Your Life, Inc.)

Consolidated Statements of Operations

(Unaudited)

| | |

| | | |

| | |

| | |

For the Three Months Ended | |

| | |

August 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| NET REVENUES | |

$ | – | | |

$ | – | |

| | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | |

| | |

| | | |

| | |

| Accrued Salaries and Consulting fees | |

| 60,000 | | |

| 60,000 | |

| Professional fees | |

| 16,976 | | |

| 38,121 | |

| Other selling, general and administrative | |

| 567 | | |

| 1,305 | |

| | |

| | | |

| | |

| Total Operating Expenses | |

| 77,543 | | |

| 99,426 | |

| | |

| | | |

| | |

| LOSS FROM OPERATIONS | |

| (77,543 | ) | |

| (99,426 | ) |

| | |

| | | |

| | |

| OTHER INCOME (EXPENSES) | |

| | | |

| | |

| | |

| | | |

| | |

| Income (expense) from derivative liability | |

| 543,223 | | |

| 41,194 | |

| Interest expense (including amortization of debt discounts of $24,125, and $14,878, respectively) | |

| (112,598 | ) | |

| (53,208 | ) |

| | |

| | | |

| | |

| Total Other Income (Expenses) | |

| 430,625 | | |

| (12,014 | ) |

| | |

| | | |

| | |

| | |

| | | |

| | |

| INCOME TAX EXPENSE | |

| – | | |

| – | |

| | |

| | | |

| | |

| NET INCOME (LOSS) | |

$ | 353,082 | | |

$ | (111,440 | ) |

| | |

| | | |

| | |

| BASIC AND DILUTED: | |

| | | |

| | |

| Net income (loss) per common share | |

$ | 0.00 | | |

$ | (0.01 | ) |

| | |

| | | |

| | |

| Weighted average shares outstanding | |

| 756,612,000 | | |

| 16,192,332 | |

The accompanying notes are

an integral part of these financial statements

THE MARQUIE GROUP, INC.

(formerly Music of Your Life, Inc.)

Consolidated Statements of Stockholders' Deficit

(Unaudited)

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Three Months Ended August 31, 2023 | |

| | |

Preferred Stock | | |

Common Stock | | |

Common Stock | | |

Additional | | |

Accumulated | | |

Total Stockholders' | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Payable | | |

Paid-in Capital | | |

Deficit | | |

Deficit | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance, May 31, 2023 | |

| 200 | | |

$ | – | | |

| 756,612,000 | | |

$ | 75,663 | | |

$ | 8,460 | | |

$ | 14,486,896 | | |

$ | (14,698,030 | ) | |

$ | (127,011 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income for the three months ended August 31, 2023 | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 353,082 | | |

| 353,082 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, August 31, 2023 | |

| 200 | | |

$ | – | | |

| 756,612,000 | | |

$ | 75,663 | | |

$ | 8,460 | | |

$ | 14,486,896 | | |

$ | (14,344,948 | ) | |

$ | 226,071 | |

| | |

Three Months Ended August 31, 2022 | |

| | |

Preferred Stock | | |

Common Stock | | |

Common Stock | | |

Additional | | |

Accumulated | | |

Total Stockholders' | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Payable | | |

Paid-in Capital | | |

Deficit | | |

Deficit | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance, May 31, 2022 | |

| 200 | | |

$ | – | | |

| 16,189,732 | | |

$ | 1,621 | | |

$ | 8,460 | | |

$ | 10,213,431 | | |

$ | (15,878,189 | ) | |

$ | (5,654,677 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Round up of shares from reverse stock split | |

| – | | |

| – | | |

| 2,600 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss for the three months ended August 31, 2022 | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (111,440 | ) | |

| (111,440 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, August 31, 2022 | |

| 200 | | |

$ | – | | |

| 16,192,332 | | |

$ | 1,621 | | |

$ | 8,460 | | |

$ | 10,213,431 | | |

$ | (15,989,629 | ) | |

$ | (5,766,117 | ) |

The

accompanying notes are an integral part of these financial statements

THE MARQUIE GROUP, INC.

(formerly Music of Your Life, Inc.)

Consolidated Statements of Cash Flows

(Unaudited)

| | |

| | | |

| | |

| | |

For the Three Months Ended | |

| | |

August 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| | |

| | | |

| | |

| Net income (loss) | |

$ | 353,082 | | |

$ | (111,440 | ) |

| Adjustments to reconcile net income (loss) to net cash used by operating activities: | |

| | | |

| | |

| Depreciation of music inventory | |

| 230 | | |

| 389 | |

| Income from derivative liability | |

| (543,223 | ) | |

| (41,194 | ) |

| Amortization of debt discounts | |

| 24,125 | | |

| 14,878 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts payable | |

| 16,975 | | |

| 20,421 | |

| Accrued interest payable on notes payable | |

| 88,474 | | |

| 34,451 | |

| Accrued consulting fees | |

| 60,000 | | |

| 55,700 | |

| | |

| | | |

| | |

| Net Cash Used by Operating Activities | |

| (337 | ) | |

| (26,795 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| – | | |

| – | |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| | |

| | | |

| | |

| Bank overdraft | |

| (46 | ) | |

| 62 | |

| Proceeds from notes payable | |

| – | | |

| 38,880 | |

| Repayments of notes payable to related parties | |

| – | | |

| (12,500 | ) |

| Proceeds from notes payable to related parties | |

| 500 | | |

| – | |

| | |

| | | |

| | |

| Net Cash Provided by Financing Activities | |

| 454 | | |

| 26,442 | |

| | |

| | | |

| | |

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | |

| 117 | | |

| (353 | ) |

| | |

| | | |

| | |

| CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD | |

| – | | |

| 353 | |

| | |

| | | |

| | |

| CASH AND CASH EQUIVALENTS, END OF PERIOD | |

$ | 117 | | |

$ | – | |

| | |

| | | |

| | |

| SUPPLEMENTAL CASH FLOW INFORMATION | |

| | | |

| | |

| | |

| | | |

| | |

| Cash Payments For: | |

| | | |

| | |

| Interest | |

$ | – | | |

$ | – | |

| Income taxes | |

$ | – | | |

$ | – | |

| | |

| | | |

| | |

| Non-cash investing and financing activities: | |

| | | |

| | |

| Initial derivative liability charged to debt discounts | |

$ | – | | |

$ | 38,880 | |

The accompanying notes are an integral part of these financial statements

THE MARQUIE GROUP, INC.

(formerly Music of Your

Life, Inc.)

Notes

to the Consolidated Financial Statements

August

31, 2023

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

AND ORGANIZATION

Basis of Presentation

The accompanying unaudited financial

statements are presented in accordance with generally accepted accounting principles for interim financial information and the instructions

to Form 10-Q and Article 8 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by generally

accepted accounting principles for complete financial statements. In the opinion of management, all adjustments (consisting only of normal

recurring accruals) considered necessary in order to make the financial statements not misleading, have been included. Operating results

for the three months ended August 31, 2023 are not necessarily indicative of results that may be expected for the year ending May 31,

2024.

Organization

The Marquie Group, Inc. (formerly Music

of Your Life, Inc.) (the “Company”) was incorporated under the laws of the State of Florida on January 30, 2008 under the

name of “Zhong Sen International Tea Company”. From January 2008 to May 2013, the Company operated with the principal business

objective of providing sales and marketing consulting services to small to medium sized Chinese tea producing companies who wished to

export and distribute high quality Chinese tea products worldwide. On May 31, 2013 (the “Closing Date”), the Company entered

into a Merger Agreement (the “Merger Agreement”) by and among the Company, Music of Your Life, Inc., a Nevada corporation

(“MYL Nevada”) incorporated October 10, 2012, and Music of Your Life Merger Sub, Inc., a Utah corporation ("Merger Sub"),

pursuant to which MYL Nevada merged with Merger Sub. As a result of the merger, MYL Nevada became a wholly owned subsidiary of the Company,

and on July 26, 2013, the Company changed its name to Music of Your Life, Inc., a syndicated radio network. On May 20, 2014 the Company

acquired 100% of the outstanding stock of iRadio, Inc., a Utah corporation. The Company was the surviving corporation. iRadio was an entity

related to the Company by common ownership.

Acquisition of The Marquie

Group, Inc.

On August 16, 2018 (see Note 8), the

Company merged with The Marquie Group, Inc. (“TMGI”) in exchange for the issuance of a total of 100 shares of our common stock

to TMGI’s stockholders. Following the merger, the Company had 102 shares of common stock issued and outstanding. On December 5,

2018, the Company amended and restated its Articles of Incorporation providing for a change in the Company’s name from “Music

of Your Life, Inc.” to “The Marquie Group, Inc.” The TMGI business plan is to license, develop and launch a direct-to-consumer,

health and beauty product line called “Whim” that use innovative formulations of plant-based, amino-acids and other natural

alternatives to chemical ingredients.

NOTE 2 - MUSIC INVENTORY

Music inventory consisted of the following:

| Schedule of inventory | |

| | | |

| | |

| | |

August 31, 2023 | | |

May 31, 2023 | |

| Digital music acquired for use in operations – at cost | |

$ | 21,648 | | |

$ | 21,648 | |

| Accumulated depreciation | |

| (20,949 | ) | |

| (20,719 | ) |

| Music inventory – net | |

$ | 699 | | |

$ | 929 | |

THE MARQUIE GROUP, INC.

(formerly Music of Your

Life, Inc.)

Notes

to the Consolidated Financial Statements

August

31, 2023

The Company purchases digital music

to broadcast over the radio and internet. During the three months ended August 31, 2023, the Company purchased $-0- worth of music inventory.

For the three months ended August 31, 2023 and 2022, depreciation of music inventory was $230 and $389, respectively.

NOTE 3 – ACCRUED CONSULTING FEES

Accrued consulting fees consisted of

the following:

| Schedule of consulting fees payable | |

| | | |

| | |

| | |

August 31, 2023 | | |

May 31, 2023 | |

| Due to Company Chief Executive Officer pursuant to Consulting Agreement dated March 1, 2017 – monthly compensation of $10,000 to May 31, 2022, increased to $20,000 after May 31, 2022 | |

$ | 548,817 | | |

$ | 488,817 | |

| Due to wife of Company Chief Executive Officer pursuant to consulting agreement effective August 16, 2018 – monthly compensation of $15,000 (which was terminated May 31, 2021) | |

| 305,200 | | |

| 305,200 | |

| Due to mother of Company Chief Executive Officer pursuant to Consulting Agreement dated September 1, 2015 (which was terminated November 30, 2019) – monthly compensation of $5,000 to November 30, 2019 | |

| 131,350 | | |

| 131,350 | |

| Due to service provider pursuant to Consulting Agreement dated September 1, 2015 (which was terminated February 28, 2019) – monthly compensation of $5,000 to February 28, 2019 | |

| 144,700 | | |

| 144,700 | |

| Due to service provider pursuant to Consulting Agreement dated September 1, 2015 (which was terminated November 30, 2019) – monthly compensation of $1,000 to November 30, 2019 | |

| 48,000 | | |

| 48,000 | |

| Due to two other service providers | |

| 27,850 | | |

| 27,850 | |

| | |

| | | |

| | |

| Total | |

$ | 1,205,917 | | |

$ | 1,145,917 | |

The accrued consulting fees balance

changed as follows:

| Schedule of accrued consulting fees activity | |

| | | |

| | |

| | |

Three Months Ended

August 31, 2023 | | |

Year Ended

May 31, 2023 | |

| Balance, beginning of period | |

$ | 1,145,917 | | |

$ | 926,217 | |

| | |

| | | |

| | |

| Compensation expense accrued pursuant to consulting agreements | |

| 60,000 | | |

| 240,000 | |

| Payments to consultants | |

| – | | |

| (20,300 | ) |

| | |

| | | |

| | |

| Balance, end of period | |

$ | 1,205,917 | | |

$ | 1,145,917 | |

See Note 8 (Commitments and Contingencies).

THE MARQUIE GROUP, INC.

(formerly Music of Your

Life, Inc.)

Notes

to the Consolidated Financial Statements

August

31, 2023

NOTE 4 - NOTES PAYABLE

Notes payable consisted of the following:

| Schedule of notes payable | |

| | | |

| | |

| | |

August 31, 2023 | | |

May 31, 2023 | |

| Notes payable to an entity, non-interest bearing, due on demand, unsecured | |

$ | 64,700 | | |

$ | 64,700 | |

| Note payable to an individual, due on May 22, 2015, in default (B) | |

| 25,000 | | |

| 25,000 | |

| Note payable to an entity, non-interest bearing, due on February 1, 2016, in default (D) | |

| 50,000 | | |

| 50,000 | |

| Note payable to a family trust, stated interest of $2,500, due on October 31, 2015, in default (E) | |

| 7,000 | | |

| 7,000 | |

| Note payable to a corporation, stated interest of $5,000, due on October 21, 2015, in default (G) | |

| 50,000 | | |

| 50,000 | |

| Note payable to a corporation, stated interest of $5,000, due on November 6, 2015, in default (H) | |

| 50,000 | | |

| 50,000 | |

| Note payable to an individual, due on December 20, 2015, in default, 24% default rate from January 20, 2016 (I) | |

| 25,000 | | |

| 25,000 | |

| Convertible note payable to an entity, interest at 12%, due on December 29, 2016, in default (M) | |

| 40,000 | | |

| 40,000 | |

| Note payable to a family trust, interest at 10%, due on November 30, 2016, in default (P) | |

| 25,000 | | |

| 25,000 | |

| Convertible note payable to an individual, interest at 10%, due on demand (V) | |

| 46,890 | | |

| 46,890 | |

| Convertible note payable to an individual, interest at 8%, due on demand (W) | |

| 29,000 | | |

| 29,000 | |

| Convertible note payable to an individual, interest at 8%, due on demand (X) | |

| 21,500 | | |

| 21,500 | |

| Convertible note payable to an entity, interest at 10%, due on demand (Y) | |

| 8,100 | | |

| 8,100 | |

| Convertible note payable to an entity, interest at 10%, due on March 5, 2019, in default (DD) | |

| 35,000 | | |

| 35,000 | |

| Convertible note payable to an entity, interest at 10%, due on September 18, 2019, in default (GG) | |

| 8,505 | | |

| 8,505 | |

| Convertible note payable to an entity, interest at 12%, due on November 30, 2021, in default, net of discount of $-0- and $85,233, respectively (SS) | |

| 154,764 | | |

| 154,764 | |

| Convertible note payable to an entity, interest at 10%, due on June 4, 2022, in default (VV) | |

| 170,212 | | |

| 170,212 | |

| Convertible note payable to an entity, interest at 8%, due on August 27, 2022, in default (WW) | |

| 14,000 | | |

| 14,000 | |

| Convertible note payable to an entity, interest at 12%, due on December 21, 2022, in default (YY) | |

| 58,250 | | |

| 58,250 | |

| Convertible note payable to an entity, interest at 12%, due on February 8, 2023, in default (ZZ) | |

| 245,000 | | |

| 245,000 | |

| Convertible note payable to an entity, interest at 12%, due on June 10, 2023, in default, net of discount of $-0- and $1,065, respectively (AA) | |

| 38,880 | | |

| 37,815 | |

| Convertible note payable to an entity, interest at 12%, due on November 4, 2023, net of discount of $5,441 and $13,143, respectively (C) | |

| 25,114 | | |

| 17,412 | |

| Convertible note payable to an entity, interest at 12%, due on April 10, 2024, net of discount of $37,228 and $52,586, respectively (F) | |

| 23,872 | | |

| 8,514 | |

| Note payable to the Small Business Administration under the Payroll Protection Program, interest at 1%, due in installments through May 4, 2022, forgivable in part or whole subject to certain requirements | |

| 70,000 | | |

| 70,000 | |

| Note payable to the Small Business Administration under the Payroll Protection Program, interest at 1%, due in installments through April 5, 2023, forgivable in part or whole subject to certain requirements | |

| 100,000 | | |

| 100,000 | |

| Notes payable to individuals, non-interest bearing, due on demand | |

| 103,476 | | |

| 103,476 | |

| Total Notes Payable | |

| 1,489,263 | | |

| 1,465,138 | |

| Less: Current Portion | |

| (1,489,263 | ) | |

| (1,465,138 | ) |

| Long-Term Notes Payable | |

$ | – | | |

$ | – | |

(B) On April 22, 2015, the Company issued

a $25,000 Promissory Note, non-interest bearing (interest at 24% per annum after May 22, 2015), due at maturity on May 22, 2015.

(D) On July 24, 2015, the Company issued

a $50,000 Promissory Note to Kodiak Capital Group, LLC (“Kodiak”) for services rendered in association with an Equity Purchase

Agreement. As amended and restated January 4, 2016, the note is non-interest bearing and was due on February 1, 2016.

THE MARQUIE GROUP, INC.

(formerly Music of Your

Life, Inc.)

Notes

to the Consolidated Financial Statements

August

31, 2023

(E) On July 31, 2015, the Company issued

a $25,000 Promissory Note with a stated interest amount of $2,500 due at maturity on October 31, 2015.

(G) On August 6, 2015, the Company issued

a $50,000 Promissory Note with a stated interest amount of $5,000 due at maturity on October 21, 2015.

(H) On August 21, 2015, the Company

issued a $50,000 Promissory Note with a stated interest amount of $5,000 due at maturity on November 6, 2015.

(I) On September 21, 2015, the

Company issued a $25,000 Promissory Note with a stated interest amount of $2,500 due at maturity on December 20, 2015. In the event

that all principal and interest are not paid to the lender by January 20, 2016, interest is to accrue at a rate of 24% per annum

commencing on January 21, 2016.

(M) On December 29, 2015, the Company

issued a $20,000 Convertible Promissory Note to a lender for net loan proceeds of $15,000. The note bears interest at a rate of 12% per

annum, was due on December 29, 2016, and is convertible at the option of the lender into shares of the Company common stock at a Conversion

Price equal to 50% of the lowest closing bid price during the 30 Trading Day period prior to the Conversion Date. See Note 6 (Derivative

Liability).

(P) On June 3, 2016, the Company issued

a $25,000 Promissory Note. The note bears interest at a rate of 10% per annum and was due on November 30, 2016.

(V) On May 3, 2017, the Company issued

a $72,750 Convertible Promissory Note to a lender as a replacement for the principal and interest due on a promissory note due on October

14, 2014. The note bears interest at a rate of 10% per annum, is due on demand, and is convertible at the option of the lender into shares

of the Company common stock at a Conversion Price equal to $0.1293 per share.

(W) On April 5, 2017, the Company issued

a $35,000 Convertible Promissory Note to a lender as a replacement for the principal and interest due on a promissory note due on August

23, 2015. The note bears interest at a rate of 8% per annum, is due on demand, and is convertible at the option of the lender into shares

of the Company common stock at a Conversion Price equal to 40% of the lowest Trading Price during the 5 Trading Day period prior to the

Conversion Date. See Note 6 (Derivative Liability).

(X) On April 5, 2017, the Company issued

a $27,500 Convertible Promissory Note to a lender as a replacement for the principal and interest due on a promissory note due on October

31, 2015. The note bears interest at a rate of 8% per annum, is due on demand, and is convertible at the option of the lender into shares

of the Company common stock at a Conversion Price equal to 40% of the lowest Trading Price during the 5 Trading Day period prior to the

Conversion Date. See Note 6 (Derivative Liability).

(Y) On March 1, 2017, the Company issued

a $8,600 Convertible Promissory Note to a vendor of the Company to convert certain accounts payable due to the vendor. The note bears

interest at a rate of 10% per annum, is due on demand, and is convertible at the option of the lender into shares of the Company common

stock at a Conversion Price equal to the higher of $0.04 per share or 60% of the lowest Trading Price during the 5 Trading Day period

prior to the Conversion Date.

THE MARQUIE GROUP, INC.

(formerly Music of Your

Life, Inc.)

Notes

to the Consolidated Financial Statements

August

31, 2023

(DD) On March 5, 2018, the Company issued

a $35,000 Convertible Promissory Note to a lender for net loan proceeds of $33,000. The note bears interest at a rate of 10% per annum,

was due on March 5, 2019, and is convertible at the option of the lender into shares of the Company common stock at a Conversion Price

equal to 50% of the lowest Trading Price during the 20 Trading Day period prior to the Conversion Date. See Note 6 (Derivative Liability).

(GG) On September 18, 2018, the Company

issued a $18,000 Convertible Promissory Note to a lender for net loan proceeds of $14,000. The note bears interest at a rate of 10% per

annum, was due on September 18, 2019, and is convertible at the option of the lender into shares of the Company common stock at a Conversion

Price equal to 50% of the lowest Trading Price during the 20 Trading Day period prior to the Conversion Date. See Note 6 (Derivative Liability).

(SS) On November 30, 2020, the Company

issued a $170,000 Convertible Promissory Note to a lender which paid off some of the accrued interest for the note described in (RR) above.

The Company received net proceeds of $32,500. The note bears interest at a rate of 12% per annum, is due on November 30, 2021, and is

convertible at the option of the lender into shares of the Company common stock at a Conversion Price equal to the lesser of (1) 105%

of the closing bid price of the Common Stock on the Issue Date, or (2) the closing bid price of the Common Stock on the Trading Day immediately

preceding the date of the conversion. See Note 6 (Derivative Liability).

(VV) On June 4, 2021, the Company issued

a $238,596 Convertible Promissory Note to a lender which paid off the principal and accrued interest for the notes described in (EE),

(FF), (KK), (LL), (MM), (NN) and (PP) above. The note bears interest at a rate of 10% per annum, is due on June 4, 2022, and is convertible

at the option of the lender into shares of the Company common stock at a Conversion Price equal to the lesser of (1) $0.00004, or (2)

50% of the lowest trading price of the common stock for the previous 15 day trading period. See Note 6 (Derivative Liability).

(WW) On August 27, 2021, the Company

issued a $14,000 Convertible Promissory Note to a lender for net loan proceeds of $10,000. The note bears interest at a rate of 8% per

annum, is due on August 27, 2022, and is convertible at the option of the lender into shares of the Company common stock at a Conversion

Price equal to 65% of the lowest trading price in the 10 Trading Day period prior to the Conversion Date. See Note 6 (Derivative Liability).

(YY) On December 21, 2021, the Company

issued a $58,250 Convertible Promissory Note to a lender for net loan proceeds of $49,925. The note bears interest at a rate of 12% per

annum, is due on December 21, 2022, and is convertible at the option of the lender into shares of the Company common stock at a Conversion

Price equal to the higher of (1) $0.10, or (2) the par value of the Common Stock.

(ZZ) On February 8, 2022, the Company

issued a $245,000 Convertible Promissory Note to a lender for net loan proceeds of $218,000. The note bears interest at a rate of 12%

per annum, is due on February 8, 2023, and is convertible at the option of the lender into shares of the Company common stock at a Conversion

Price equal to the higher of (1) $0.10, or (2) the par value of the Common Stock.

(AA) On June 10, 2022, the Company issued

a $38,880 Convertible Promissory Note to a lender for net loan proceeds of $31,800. The note bears interest at a rate of 12% per annum,

is due on June 10, 2023, and is convertible at the option of the lender into shares of the Company common stock at a Conversion Price

equal to the lower of (1) $0.05, or (2) 50% of the lowest trading price in the 10 Trading Day period prior to the Conversion Date. See

Note 6 (Derivative Liability).

THE MARQUIE GROUP, INC.

(formerly Music of Your

Life, Inc.)

Notes

to the Consolidated Financial Statements

August

31, 2023

(C) On November 4, 2022, the Company

issued a $30,555 Convertible Promissory Note to a lender for net loan proceeds of $25,000. The note bears interest at a rate of 12% per

annum, is due on November 4, 2023, and is convertible at the option of the lender into shares of the Company common stock at a Conversion

Price equal to the lower of (1) $0.005, or (2) 50% of the lowest trading price in the 10 Trading Day period prior to the Conversion Date.

See Note 6 (Derivative Liability).

Concentration of Notes Payable:

The principal balance of notes payable

was due to:

| Schedule of notes payable by lender | |

| | | |

| | |

| | |

August 31, 2023 | | |

May 31, 2023 | |

| | |

| | |

| |

| Lender A | |

$ | 458,014 | | |

$ | 458,014 | |

| Lender B | |

| 170,212 | | |

| 170,212 | |

| 14 other lenders | |

| 903,706 | | |

| 903,706 | |

| | |

| | | |

| | |

| Total | |

| 1,531,932 | | |

| 1,531,932 | |

| | |

| | | |

| | |

| Less debt discounts | |

| (42,669 | ) | |

| (66,794 | ) |

| | |

| | | |

| | |

| Net | |

$ | 1,489,263 | | |

$ | 1,465,138 | |

NOTE 5 - NOTES PAYABLE – RELATED PARTIES

Notes payable – related parties

consisted of the following:

| Schedule of related party notes payable | |

| | | |

| | |

| | |

August 31,

2023 | | |

May 31,

2023 | |

| | |

| | |

| |

| Note payable to Company law firm (and owner of 2,500 shares of common stock since August 16, 2018), non-interest bearing, due on demand, unsecured | |

$ | 2,073 | | |

$ | 2,073 | |

| Notes payable to The OZ Corporation (owner of 2,500 shares of common stock since August 16, 2018), non-interest bearing, due on demand, unsecured | |

| 69,250 | | |

| 69,250 | |

| Note payable to the Chief Executive Officer, non-interest bearing, due on demand, unsecured | |

| 19,949 | | |

| 19,449 | |

| Note payable to the wife of the Chief Executive Officer as part of the 25% acquisition of Simply Whim, interest at 12%, due on September 20, 2023, unsecured (See Note 10) | |

| 2,000,000 | | |

| 2,000,000 | |

| Total Notes Payable | |

| 2,091,272 | | |

| 2,090,772 | |

| Less: Current Portion | |

| (2,091,272 | ) | |

| (2,090,772 | ) |

| Long-Term Notes Payable | |

$ | – | | |

$ | – | |

THE MARQUIE GROUP, INC.

(formerly Music of Your

Life, Inc.)

Notes

to the Consolidated Financial Statements

August

31, 2023

NOTE 6 - DERIVATIVE LIABILITY

The derivative liability at August

31, 2023 and May 31, 2023 consisted of:

| Schedule of derivative liabilities | |

| | | |

| | | |

| | | |

| | |

| | |

August 31, 2023 | | |

May 31, 2023 | |

| | |

Face Value | | |

Derivative Liability | | |

Face Value | | |

Derivative Liability | |

| Convertible note payable issued December 29, 2015, due December 29, 2016 (M) | |

$ | 40,000 | | |

$ | 74,286 | | |

$ | 40,000 | | |

$ | 81,481 | |

| Convertible note payable issued April 5, 2017, due on demand (W) | |

| 29,000 | | |

| 51,556 | | |

| 29,000 | | |

| 81,093 | |

| Convertible note payable issued April 5, 2017, due on demand (X) | |

| 21,500 | | |

| 38,222 | | |

| 21,500 | | |

| 60,120 | |

| Convertible note payable issued March 5, 2018, due on March 5, 2019 (DD) | |

| 35,000 | | |

| 65,000 | | |

| 35,000 | | |

| 71,296 | |

| Convertible note payable issued September 18, 2018, due on September 18, 2019 (GG) | |

| 8,506 | | |

| 15,796 | | |

| 8,506 | | |

| 17,326 | |

| Convertible note payable issued November 30, 2020, due on November 30, 2021 (SS) | |

| 154,764 | | |

| 33,979 | | |

| 154,764 | | |

| 151,020 | |

| Convertible note payable issued June 4, 2021, due on June 4, 2022 (VV) | |

| 170,212 | | |

| 36,245 | | |

| 170,212 | | |

| 153,285 | |

| Convertible note payable issued August 27, 2021, due on August 27, 2022 (WW) | |

| 14,000 | | |

| 16,769 | | |

| 14,000 | | |

| 18,707 | |

| Convertible note payable issued June 10, 2022, due on June 10, 2023 (AA) | |

| 38,880 | | |

| 35,867 | | |

| 38,880 | | |

| 154,078 | |

| Convertible note payable issued November 4, 2022, due on November 4, 2023 (C) | |

| 30,555 | | |

| 87,300 | | |

| 30,555 | | |

| 92,797 | |

| Convertible note payable issued April 10, 2023, due on April 10, 2024 (F) | |

| 61,100 | | |

| 37,755 | | |

| 61,100 | | |

| 154,795 | |

| | |

| | | |

| | | |

| | | |

| | |

| Totals | |

$ | 603,517 | | |

$ | 492,775 | | |

$ | 603,517 | | |

$ | 1,035,998 | |

The above convertible notes contain

a variable conversion feature based on the future trading price of the Company common stock. Therefore, the number of shares of common

stock issuable upon conversion of the notes is indeterminate. Accordingly, we have recorded the fair value of the embedded conversion

features as a derivative liability at the respective issuance dates of the notes and charged the applicable amounts to debt discounts

and the remainder to other expense. The increase (decrease) in the fair value of the derivative liability from the respective issuance

dates of the notes to the measurement dates is charged (credited) to other expense (income). The fair value of the derivative liability

of the notes is measured at the respective issuance dates and quarterly thereafter using the Black Scholes option pricing model.

THE MARQUIE GROUP, INC.

(formerly Music of Your

Life, Inc.)

Notes

to the Consolidated Financial Statements

August

31, 2023

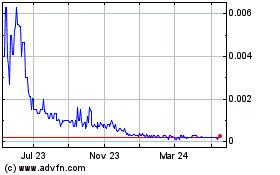

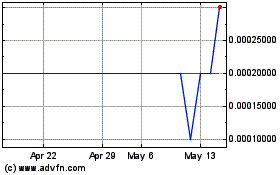

Assumptions used for the calculations

of the derivative liability of the notes at August 31, 2023 include (1) stock price of $0.001 per share, (2) exercise prices ranging from

$0.00004 to $0.00045 per share, (3) terms ranging from 0 days to 223 days, (4) expected volatility of 2,193% and (5) risk free interest

rates ranging from 5.52% to 5.61%.

Assumptions used for the calculations

of the derivative liability of the notes at May 31, 2023 include (1) stock price of $0.0041 per share, (2) exercise prices ranging from

$0.00004 to $0.001755 per share, (3) terms ranging from 0 days to 315 days, (4) expected volatility of 2,189% and (5) risk free interest

rates ranging from 4.65% to 5.28%.

Concentration of Derivative Liability:

The derivative liability relates to

convertible notes payable due to:

| Schedule of derivative liability by Lender | |

| | | |

| | |

| | |

August 31, 2023 | | |

May 31, 2023 | |

| | |

| | |

| |

| Lender A | |

$ | 33,979 | | |

$ | 151,020 | |

| Lender B | |

| 36,245 | | |

| 153,285 | |

| Lender C | |

| 35,867 | | |

| 415,233 | |

| Lender D | |

| 97,565 | | |

| 107,329 | |

| 5 other lenders | |

| 289,119 | | |

| 209,131 | |

| | |

| | | |

| | |

| Total | |

$ | 492,775 | | |

$ | 1,035,998 | |

THE MARQUIE GROUP, INC.

(formerly Music of Your

Life, Inc.)

Notes

to the Consolidated Financial Statements

August

31, 2023

NOTE 7 - EQUITY TRANSACTIONS

During the year ended May 31, 2021,

the Company issued an aggregate of 4,304,842 shares of common stock for the conversion of notes payable and accrued interest in the aggregate

amount of $835,050. We incurred a loss on the conversion of notes payable and accrued interest of $1,445,042, which represents the excess

of the $2,280,092 fair value of the 4,304,842 shares at the dates of conversion over the $835,050 amount of debt satisfied.

Effective April 21, 2022, the Company

effectuated a 1 for 1,000 reverse split of the Company’s Common Stock (“Reverse Split”), meaning that each 1,000 shares

of Common Stock is consolidated into 1 share of Common Stock following the reverse split, provided however, that fractional shares would

be rounded up to the nearest whole share. Following the Reverse Split, the Company had 16,192,332 common shares issued and outstanding.

The accompanying financial statements have been retroactively adjusted to reflect this reverse stock split.

On October 13, 2022 (the “Closing

Date”), the Company entered into a Standby Equity Commitment Agreement (the “Equity Agreement” by and among the Company,

and MacRab, LLC, a Florida limited liability company ("MacRab"), pursuant to which MacRab has agreed to purchase at the Company’s

sole discretion, up to five million dollars ($5,000,000) of the Company's common stock (the “Put Shares”) at a purchase price

of 90% of the average of the two (2) lowest volume weighted average prices of the Company’s Common Stock on OTCQB during the six

(6) Trading Days immediately following the Clearing Date.

Contemporaneous therewith, the Company

and MacRab also entered into a Registration Rights Agreement, whereby the Company has agreed to provide certain registration rights under

the Securities Act of 1933, as amended. Pursuant to the Registration Rights Agreement, the Company has registered the Put Shares pursuant

in a registration statement on Form S-1 (the “Registration Statement”). The Registration Statement was filed on October 21,

2022.

Also on the Closing Date, pursuant to

the Equity Agreement, the Company issued to MacRab a warrant (the “Warrant”) to acquire 11,764,706 shares of the Company’s

common stock.

THE MARQUIE GROUP, INC.

(formerly Music of Your

Life, Inc.)

Notes

to the Consolidated Financial Statements

August

31, 2023

NOTE 8 - COMMITMENTS AND CONTINGENCIES

Consulting Agreements with Individuals

The Company has entered into Consulting

Agreements with the Company’s Chief Executive Officer, the wife of the Company’s Chief Executive Officer, the mother of the

Company’s Chief Executive Officer, and other service providers (see Note 3 – Accrued Consulting Fees). The Consulting Agreement

with the Company’s Chief Executive Officer provided for monthly compensation of $10,000 through May 31, 2022 and was increased to

$20,000 after May 31, 2022. The Consulting Agreement with the wife of the Company’s Chief Executive Officer provided for monthly

compensation of $15,000 and expired on May 31, 2021. The Consulting Agreement with the mother of the Company’s Chief Executive Officer

provided for monthly compensation of $5,000 and was terminated as of November 30, 2019. The other 3 consulting agreements provided for

monthly compensation totaling $6,500 and were terminated as of November 30, 2019.

Corporate Consulting Agreement

On March 14, 2018, the Company executed

a Corporate Consulting Agreement (the “Agreement”) with a consulting firm entity (the “Consultant”). The Agreement

provided for the Consultant to perform certain investor relations and other services for the Company. The term of the Agreement was 4

months but the Agreement provided that the Company could terminate the Agreement for any reason at any time upon 5 days written prior

notice. The Agreement provided for 8 payments of cash fees totaling $240,000 to be paid to the Consultant over 4 months.

On April 1, 2018, the Company notified

the Consultant that the Agreement was terminated. A total of $25,000 was paid to the Consultant in March 2018 which was expensed and included

in “Salaries and Consulting Fees” in the Consolidated Statement of Operations for the year ended May 31, 2018. No other amounts

were paid or accrued subsequent to May 31, 2018.

On October 16, 2018 (see Note 7), the

Company issued 5,000 shares of its common stock to the Consultant. On October 26, 2018, the Consultant advised the Company that it had

not been notified that the Agreement was terminated on April 1, 2018 and that the Company is in default of the Agreement.

NOTE 9 - GOING CONCERN

The accompanying financial statements

have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and satisfaction

of liabilities in the normal course of business. At August 31, 2023, the Company had negative working capital of $6,013,240 and an accumulated

deficit of $14,344,948. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern.

THE MARQUIE GROUP, INC.

(formerly Music of Your

Life, Inc.)

Notes

to the Consolidated Financial Statements

August

31, 2023

To date the Company has funded its operations

through a combination of loans and sales of common stock. The Company anticipates another net loss for the fiscal year ended May 31, 2024

and with the expected cash requirements for the coming year, there is substantial doubt as to the Company’s ability to continue

operations.

The Company is attempting to improve

these conditions by way of financial assistance through issuances of notes payable and additional equity and by generating revenues through

sales of products and services. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

NOTE 10 – INVESTMENT IN ACQUISITION

On September 20, 2022, the Company entered

into an agreement to acquire 25% of the outstanding shares of SIMPLY WHIM, INC., a Wyoming corporation (“SIMPLY WHIM”), in

exchange for 666,666,668 shares of common stock of the Company and a promissory note in the face amount of $2,000,000. SIMPLY WHIM is

a skin care product development company. At the date of the acquisition, the price per share of the company shares was $0.0063. The total

consideration paid by the company (value of stock issued and promissory note) was $6,200,000 which has been recorded as Investment in

Acquisition on the balance sheet.

Item 2. Management’s

Discussion and Analysis of Financial Condition and Results of Operation

The following discussion contains forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 relating

to future events or our future performance. Actual results may materially differ from those projected in the forward-looking statements

as a result of certain risks and uncertainties set forth in this prospectus. Although management believes that the assumptions made and

expectations reflected in the forward-looking statements are reasonable, there is no assurance that the underlying assumptions will, in

fact, prove to be correct or that actual results will not be different from expectations expressed in this report.

BUSINESS OVERVIEW

The

Marquie Group, Inc. is an emerging direct-to-consumer firm specializing in product development and media, including a dynamic radio and

digital network. We craft and promote top-tier health and beauty solutions that enrich lives, showcased through engaging radio content

for our audience. We maintain a website at www.themarquiegroup.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current

reports on Form 8-K, and any amendments to these reports are available free of charge through our website as soon as reasonably practicable

after those reports are electronically filed with or furnished to the SEC. The information on our website is not a part of or incorporated

by reference into this or any other report of the company filed with, or furnished to, the SEC.

We

have three operating segments: (1) Broadcast, (2) Digital Media, and (3) Health and Beauty, which also qualify as reportable segments.

Our operating segments reflect how we assess the performance of each operating segment and determine the appropriate allocations of resources

to each segment. We continually review our operating segment classifications to align with operational changes in our business and may

make changes as necessary.

We

measure and evaluate our operating segments based on operating income and operating expenses that exclude costs related to corporate functions,

such as accounting and finance, human resources, legal, tax and treasury. We also exclude costs such as amortization, depreciation, taxes,

and interest expense when evaluating the performance of our operating segments.

Broadcasting

Our

foundational business is radio broadcasting, which includes the ownership and operation of a syndicated radio network including our affiliated

radio stations subscribing to our programming delivery.

Advertising

revenue generated from our syndicated radio operations is reported as broadcast revenue in our Consolidated Financial Statements. Advertising

revenue is recorded on a gross basis unless an agency represents the advertiser, in which case revenue is reported net of the commission

retained by the agency.

Broadcast

revenue is impacted by the rates radio stations can charge for programming and advertising time, the level of airtime sold to programmers

and advertisers, the number of impressions delivered, or downloads made, and the number of listener responses in the case of pay-per-call.

Advertising rates are based upon the demand for advertising time, which in turn is based on our stations’ and networks’ ability

to produce results for their advertisers. We market ourselves to advertisers based on the responsiveness of our audiences. We do not subscribe

to traditional audience measuring services for most of our radio stations.

Each

of our radio station affiliates allocates 3 minutes per hour of advertising time for our commercials at a preset time every hour based

on the Music of Your Life clock.

Our

results are subject to seasonal fluctuations. As is typical in the broadcasting industry, our second and fourth quarter advertising revenue

typically exceeds our first and third quarter advertising revenue. Seasonal fluctuations in advertising revenue correspond with quarterly

fluctuations in the retail industry. Additionally, we experience increased demand for political advertising during election even numbered

years, over non-election odd numbered years. Political advertising revenue varies based on the number and type of candidates as well as

the number and type of debated issues.

Broadcast

operating expenses include: (i) employee salaries, commissions and related employee benefits and taxes, (ii) facility expenses such as

lease expense and utilities, (iii) marketing and promotional expenses, (iv) production and programming expenses, and (v) music license

fees. In addition to these expenses, our network incurs programming costs and lease expenses for satellite communication facilities.

Digital Media

Revenue

generated from this segment is reported as digital media revenue in our Consolidated Statements of Operations. Digital media revenue is

impacted by the rates our sites can charge for advertising time, the level of advertisements sold, the number of impressions delivered,

or the number of products sold, and the number of digital subscriptions sold. Like our broadcasting segment, our second and fourth quarter

advertising revenue from our digital media segment generally exceeds the segment’s first and third quarter advertising revenue.

This seasonal fluctuation in advertising revenue corresponds with quarterly fluctuations in the retail advertising industry. We also experience

fluctuations in quarter-over-quarter comparisons based on the date on which Easter is observed, as this holiday generates a higher volume

of product downloads from our church product websites. Additionally, we experience increased demand for advertising time and placement

during election years for political advertisements.

The

primary operating expenses incurred by our digital media businesses include: (i) employee salaries, commissions and related employee benefits

and taxes, (ii) facility expenses such as lease expense and utilities, (iii) marketing and promotional expenses, (iv) royalties, (v) streaming

costs, and (vi) cost of goods sold associated with e-commerce sites.

Health and Beauty

Except for AminoMints®,

our health and beauty operations are owned by Simply Whim, Inc., and include Whim®, an emerging beauty brand blending Nature, Nutrition,

and Science to offer safe and effective products. Whim’s founder, a 3-time cancer survivor under treatment, recognizes the U.S.'s

regulatory lapses and strives for better standards. Exclusively made in the USA, Whim® aims to provide responsible beauty options.

We forecast strong sales growth next year, driven by demand for safer beauty solutions, and plan to exceed these expectations with continued

innovation.

Expenses which comprise the

costs of goods sold will include licensing agreements and royalties, as well as operational and staffing costs related to the management

of the Company’s syndicated radio network, product development and product marketing costs. General and administrative expenses

are comprised of administrative wages; office expenses; outside legal, accounting, and other professional fees; travel and other miscellaneous

office and administrative expenses. Selling and marketing expenses include selling/marketing wages and benefits, advertising, and promotional

expenses, as well as travel and other miscellaneous related expenses.

Because we have incurred losses,

income tax expenses are immaterial. No tax benefits have been booked related to operating loss carryforwards, given our uncertainty of

being able to utilize such loss carryforwards in future years. We anticipate incurring additional losses during the coming year.

RESULTS OF OPERATION

Following is management’s

discussion of the relevant items affecting results of operations for the three months ended August 31, 2023 and 2022.

Revenues. The Company

generated no net revenues during the three months ended August 31, 2023 and 2022. Revenues in the past have been generated from spot sales

on our syndicated radio network.

Cost of Sales. Our

cost of sales were $-0- for the three months ended August 31, 2023 and 2022. Our cost of sales in the future will consist principally

of licensing costs and royalties associated with our syndicated radio network, other related services provided directly or outsourced

through our affiliates, as well as operational and staffing costs with respect thereto.

Salaries and Consulting

Expenses. Executive salaries remain unpaid and accruing for the year ending May 31, 2023. Accrued salaries and consulting expenses

were $60,000 and 60,000 for the three months ended August 31, 2023 and 2022, respectively. We expect that salaries and consulting expenses,

that are cash-based instead of share-based, will increase as we add personnel to build our health and beauty business.

Professional Fees.

Professional fees were $16,976 and $38,121 for the three months ended August 31, 2023 and 2022, respectively. Professional fees consist

mainly of the fees related to the audits and reviews of the Company’s financial statements as well as the filings with the Securities

and Exchange Commission. We anticipate that professional fees will increase in future periods as we scale up our operations.

Other Selling, General

and Administrative Expenses. Other selling, general and administrative expenses were $567 and $1,305 for the three months ended August

31, 2023 and 2022, respectively. We anticipate that SG&A expenses will increase commensurate with an increase in our operations.

Other Income (Expenses).

The Company had net other income of $430,625 for the three months ended August 31, 2023 compared to net other expenses of $12,014 for

the three months ended August 31, 2022. During the three months ended August 31, 2023 and 2022, the company recorded income on the change

in the fair value of the derivative liability in the amount of $543,223 and $41,194, respectively. During the three months ended August

31, 2023 and 2022, other expenses incurred were comprised of interest expenses related to notes payable in the amount of $112,598 and

$53,208, which included the amortization of debt discounts of $24,125 and $14,878, respectively.

LIQUIDITY AND CAPITAL RESOURCES

As of August 31, 2023, our

primary source of liquidity consisted of $117 in cash and cash equivalents. We hold our cash reserves in a major United States bank. Since

inception, we have financed our operations through a combination of short and long-term loans, and through the private placement of our

common stock.

We have sustained significant

net losses which have resulted in negative working capital and an accumulated deficit at August 31, 2023 of $6,013,240 and $14,344,948,

respectively, which raises doubt about our ability to continue as a going concern. We generated net income for the three months ended

August 31, 2023 of $353,082, however, most of that income was the result of income from derivative liability rather than operating income.

Without additional revenues, working capital loans, or equity investment, there is substantial doubt as to our ability to continue operations.

We believe these conditions

have resulted from the inherent risks associated with small public companies. Such risks include, but are not limited to, the ability

to (i) generate revenues and sales of our products and services at levels sufficient to cover our costs and provide a return for investors,

(ii) attract additional capital in order to finance growth, and (iii) successfully compete with other comparable companies having financial,

production and marketing resources significantly greater than those of the Company.

We believe that our capital

resources are insufficient for ongoing operations, with minimal current cash reserves, particularly given the resources necessary to expand

our multi-media entertainment business. We will likely require considerable amounts of financing to make any significant advancement in

our business strategy. There is presently no agreement in place that will guarantee financing for our Company, and we cannot assure you

that we will be able to raise any additional funds, or that such funds will be available on acceptable terms. Funds raised through future

equity financing will likely be substantially dilutive to current shareholders. Lack of additional funds will materially affect our Company

and our business and may cause us to substantially curtail or even cease operations. Consequently, you could incur a loss of your entire

investment in the Company.

CRITICAL ACCOUNTING PRONOUNCEMENTS

Our financial statements and

related public financial information are based on the application of generally accepted accounting principles in the United States (“GAAP”).

GAAP requires the use of estimates, assumptions, judgments, and subjective interpretations of accounting principles that have an impact

on the assets, liabilities, revenues, and expense amounts reported. These estimates can also affect supplemental information contained

in our external disclosures including information regarding contingencies, risk, and financial condition. We believe our use of estimates

and underlying accounting assumptions adhere to GAAP and are consistently and conservatively applied. We base our estimates on historical

experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially

from these estimates under different assumptions or conditions. We continue to monitor significant estimates made during the preparation

of our financial statements.

Our significant accounting

policies are summarized in Note 2 of our financial statements included in our May 31, 2023 Form 10-K. While all these significant accounting

policies impact our financial condition and results of operations, we view certain of these policies as critical. Policies determined

to be critical are those policies that have the most significant impact on our financial statements and require management to use a greater

degree of judgment and estimates. Actual results may differ from those estimates. Our management believes that given current facts and

circumstances, it is unlikely that applying any other reasonable judgments or estimate methodologies would cause a material effect on

our results of operations, financial position or liquidity for the periods presented in this report.

We recognize revenue on arrangements

in accordance with FASB ASC No. 605, “Revenue Recognition”. In all cases, revenue is recognized only when the price

is fixed and determinable, persuasive evidence of an arrangement exists, the service is performed, and collectability of the resulting

receivable is reasonably assured.

RECENT ACCOUNTING PRONOUNCEMENTS

We have reviewed accounting

pronouncements issued during the past two years and have adopted any that are applicable to the Company. We have determined that none

had a material impact on our financial position, results of operations, or cash flows for the periods presented in this report.

OFF-BALANCE SHEET ARRANGEMENTS

We do not have any off-balance

sheet arrangements, financings, or other relationships with unconsolidated entities or other persons, also known as “special purpose

entities” (“SPE”s).

Item 3. Quantitative and Qualitative Disclosures

about Market Risks

Not applicable because we

are a smaller reporting company.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Pursuant to Rule 13a-15(b)

under the Securities Exchange Act of 1934 (“Exchange Act”), the Company carried out an evaluation, with the participation

of the Company’s management, including the Company’s Chief Executive Officer (“CEO”) and Chief Financial Officer

(“CFO”), of the effectiveness of the Company’s disclosure controls and procedures (as defined under Rule 13a-15(e) under

the Exchange Act) as of the end of the period covered by this report. Based upon that evaluation, the Company’s CEO and CFO concluded

that the Company’s disclosure controls and procedures were not effective to ensure that information required to be disclosed by

the Company in the reports that the Company files or submits under the Exchange Act, is recorded, processed, summarized and reported,

within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to the

Company’s management, including the Company’s CEO and CFO, as appropriate, to allow timely decisions regarding required disclosure

as a result of continuing material weaknesses (such as the absence of an audit committee and absence of qualified independent directors)

in its internal control over financial reporting. The disclosure controls and procedures were ineffective because there was no segregation

of duties. One member of our management team handles all accounting duties including the recording of transactions, paying bills, and

reconciling the bank account. We have minimized this risk by having an external accountant review all transactions and make the appropriate

adjustments before the review by our external auditor.

Changes in Internal Controls Over Financial

Reporting

There have been no changes

in the Company's internal control over financial reporting during the latest fiscal quarter that have materially affected, or are reasonably

likely to materially affect, the Company's internal control over financial reporting.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings.

Currently we are not aware

of any litigation pending or threatened by or against the Company.

Item 1A. Risk Factors

Not applicable because we

are a smaller reporting company.

Item 2. Unregistered Sales of Equity Securities

and Use of Proceeds