UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

(Rule 14c-101)

INFORMATION REQUIRED IN INFORMATION STATEMENT

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities

Exchange Act of 1934

| Check the appropriate box: |

| [ ] |

Preliminary Information Statement |

| [ ] |

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| [X] |

Definitive Information Statement |

| [ ] |

Definitive Additional Materials |

| [ ] |

Soliciting Material Under §240.14(a)(12) |

| TWO HANDS CORPORATION |

| (Name of Registrant as Specified in Its Charter) |

| |

|

|

| Payment of Filing Fee (Check the appropriate box): |

| |

|

| [X] |

No fee required. |

| |

|

| [ ] |

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| |

1) |

Title of each class of securities to which transaction applies: |

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

4) |

Proposed maximum aggregate value of the transaction: |

| |

5) |

Total fee paid: |

| |

|

| [ ] |

Fee paid previously with preliminary materials. |

| |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

1) |

Amount Previously Paid: |

| |

2) |

Form, Schedule or Registration Statement No.: |

| |

3) |

Filing Party: |

| |

4) |

Date Filed: |

TWO HANDS CORPORATION

1035 Queensway East, Mississauga

Ontario, Canada L4Y 4C1

(416) 357-0399

SCHEDULE 14C INFORMATION

Preliminary Information Statement Pursuant to Regulation

14C

of the Securities Exchange Act of 1934 as amended

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY.

To the Stockholders of Two Hands Corporation:

This Information Statement (“Information

Statement”) has been filed with the Securities and Exchange Commission (the “SEC”) by Two Hands Corporation,

a Delaware corporation (the “Company,” “we, “us,” “our” and

similar expressions), pursuant to Section 14C of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and is being furnished to the holders of the Company’s outstanding shares of common stock, par value $0.0001 per share (the

“Common Stock”), as of the close of business on April 5, 2023 (the “Record Date”).

The purpose of this Information Statement

is to notify holders of our Common Stock as of the Record Date (the “Stockholders”) that the Company’s Board

of Directors (the “Board”) and the holder of a majority of our outstanding voting capital stock (the “Majority

Stockholder”) approved of the following corporate action (the “Corporate Action”):

| n | To amend the Company’s Articles to effect a reverse split of the Company’s

outstanding shares of Common Stock at a ratio of up to one-for-one thousand (1-for-1,000), with rounding fractional shares resulting from

the reverse split up to the nearest whole number. |

The Majority Stockholder approved the Corporate

Action by written consent in place of a stockholders’ meeting as permitted under the Delaware General Company Law (the “DGCL”)

and our Articles and Bylaws. Accordingly, your consent is not required and is not being solicited in connection with the approval of the

Corporate Action. Our board is not soliciting your proxy or consent in connection with the Corporate Action. You are urged to read this

Information Statement carefully and in its entirety for a description of the Corporate Action approved by the Board and the Majority Stockholder.

Stockholders who were not afforded an opportunity to consent or otherwise vote with respect to the Corporate Action taken have no right

under the DGCL or our Articles and Bylaws to dissent or require a vote of all Stockholders.

Pursuant to Rule 14c-2 under the Exchange

Act, the Corporate Action will not become effective before a date which is twenty (20) calendar days after a Definitive Information Statement

is first provided to stockholders as of the Record Date (the “Effective Date”). The Information Statement will be provided

to our stockholders of record as of the close of business on the Record Date upon filing the Definitive Information Statement, anticipated

to be on or about April 20, 2023. The Company will bear the entire cost of furnishing this Information Statement. We anticipate that the

Corporate Action will be effective on or before December 31, 2023.

PLEASE NOTE THAT THIS IS NOT A NOTICE OF A

MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER THE MATTERS DESCRIBED HEREIN. THIS INFORMATION STATEMENT

IS BEING FURNISHED TO YOU SOLELY FOR THE PURPOSE OF INFORMING STOCKHOLDERS OF THE MATTERS DESCRIBED HEREIN PURSUANT TO SECTION 14(c) OF

THE EXCHANGE ACT AND THE REGULATIONS PROMULGATED THEREUNDER, INCLUDING REGULATION 14C.

| |

|

By Order of the Board of Directors, |

| April 17, 2023 |

|

/s/ Nadav Elituv |

| |

|

Nadav Elituv - Chief Executive Officer |

TWO HANDS CORPORATION

1035 Queensway East, Mississauga

Ontario, Canada L4Y 4C1

(416) 357-0399

SCHEDULE 14C INFORMATION

Preliminary Information Statement Pursuant to Regulation

14C

of the Securities Exchange Act of 1934 as amended

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY.

This Information Statement advises stockholders

of Two Hands Corporation, a Delaware corporation (the “Company”), of the following corporate action (the “Corporate

Action”) approved by Nadav Elituv, a member of the Company’s Board of Directors (the “Board”), and

holder of a majority of our outstanding voting capital stock (the “Majority Stockholder”) by written consent in place

of a meeting of stockholders (the “Written Consent”) on April 5, 2023 (the “Record Date”):

| n | To amend the Company’s Certificate of Incorporation to effect a reverse split

of the Company’s outstanding shares of Common Stock at a ratio of up to one-for-one thousand (1-for-1,000), with rounding fractional

shares resulting from the reverse split up to the nearest whole number. |

The Corporate Action will be effective on or

before December 31, 2023 (the “Effective Date”). The Company will advise stockholders when Corporate Action is effective

by filing a Current Report on Form 8-K with the SEC.

WE ARE NOT ASKING YOU

FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY.

THE MAJORITY STOCKHOLDER OF

OUR COMPANY HAS CONSENTED TO THE ADOPTION OF THE CORPORATE ACTION TO OUR CERTIFICATE OF INCORPORATION BY OWNING IN EXCESS OF THE REQUIRED

NUMBER OF OUR OUTSTANDING VOTING SECURITIES TO ADOPT THE AMENDMENT UNDER DELAWARE LAW, AND HAS DONE SO. NO FURTHER CONSENTS, VOTES OR

PROXIES ARE NEEDED, AND NONE IS REQUESTED.

Delaware Law

Pursuant to Section 228 of the

DCGL and the Company’s bylaws, any action that can be taken at an annual or special meeting of stockholders may be taken without

a meeting, without prior notice, and without a vote if the holders of outstanding stock having not less than the minimum number of votes

necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted consent to

such action in writing. As the holders of the Company’s Common Stock are entitled to vote on such matters, approval of each Corporate

Action required the approval of a majority of the Company’s outstanding voting stock. As of the Record Date, the Company had 193,226,548

shares of Common Stock issued and outstanding with the holders thereof being entitled to cast one vote per share. On the Record Date,

the Written Consent was executed by Nadav Elituv, the holder of 91,054,392 shares of Common Stock and 6,346,035 shares of Common Stock

held by 2130555 Ontario Limited, of which Nadav Elituv is the President, equal to 50.04% of voting rights of the Company’s outstanding

voting capital stock. Nadav Elituv is also a member of the Company’s Board of Directors and serves as the Company’s Chief

Executive Officer and President.

We have obtained all necessary

board and stockholder approvals in connection with the Corporate Action. We are not seeking a written consent from any other stockholder,

and other stockholders will not be given an opportunity to vote with respect to the actions described in this Information Statement, as

no meeting or special meeting of the stockholders will be required. This Information Statement is furnished solely for the purposes of

advising stockholders of the action approved by the Written Consent and giving stockholders notice of the Corporate Action as required

by the DGCL and the U.S. Securities Exchange Act of 1934, as amended.

DESCRIPTION

OF THE COMPANY’S CAPITAL STOCK

General

The Company’s authorized capital stock

currently consists of a total of 12 billion shares of Common Stock, par value $0.0001 per share, and 1,000,000 shares of “blank

check” Preferred Stock, par value $0.001 per share (the “Preferred Stock”).

| n | On August 6, 2013, the board approved and the Company filed a Certificate of Designation with the Delaware

Secretary of State, therein designating two hundred thousand (200,000) shares of “blank check” Preferred Stock as “Series

A Convertible Preferred Stock” (the “Series A Preferred Stock”). On April 21, 2022, the Company filed with the

Secretary of State of Delaware an Amended and Restated Certificate of Designation of Preferences, Rights and Limitations of the Company’s

Series A Preferred Stock (the “Amended and Restated Designation”). The Amended and Restated Designation, which became effective

with the Secretary of State of Delaware on April 21, 2022, amended the Certificate of Designation of the Series A Preferred Stock, previously

filed by the Company with the Secretary of State of Delaware on August 6, 2013, solely to amend Section 2 - Voting Rights. All other items

remained unchanged. |

| n | On December 12, 2019, the board approved and the Company filed a Certificate of Designation with the Delaware

Secretary of State therein designating one hundred thousand (100,000) shares of “blank check” Preferred Stock as “Series

B Convertible Preferred Stock” (the “Series B Preferred Stock”). |

| n | On October 7, 2020, the board approved, and the Company filed a Certificate of Designation with the Delaware

Secretary of State, therein designating five thousand (5,000) shares of Preferred Stock as “Series C Convertible Preferred Stock”

(the “Series C Preferred Stock”). On June 30, 2021, the Company filed an Amended and Restated Certificate of Designation

with the Delaware Secretary of State to increase the authorized Series C Preferred Stock to thirty thousand (30,000) shares. On July 5,

2022, the Company filed an Amended and Restated Certificate of Designation with the Delaware Secretary of State to increase the authorized

Series C Preferred Stock to thirty thousand (150,000) shares. |

| n | On September 1, 2021, the Company filed a Certificate of Designation with the Delaware Secretary of State,

therein designating two hundred thousand (200,000) shares of Preferred Stock as Series D Convertible Preferred Stock, par value $0.001

per share (the “Series D Preferred Stock”). |

| n | On October 4, 2022, the Company filed a Certificate of Designation

with the Delaware Secretary of State therein designating three hundred thousand (300,000) shares of Preferred Stock as Series

E Convertible Preferred Stock, par value of $0.0001 per share (the “Series E Preferred Stock”). |

As of the Record Date, there were 193,226,548

shares of Common Stock, 25,000 shares of Series A Preferred Stock, 4,000 shares of Series B Preferred Stock, 90,000 shares of Series C

Preferred Stock, and 0 shares of Series D Preferred Stock, 0 Series E Preferred Stock issued and outstanding.

Common Stock

Holders of the Common Stock are entitled

to one vote for each share held on all matters submitted to a vote of the Company’s stockholders. Holders of Common Stock are entitled

to receive ratably any dividends that may be declared by the Board of Directors out of legally available funds, subject to any preferential

dividend rights of any outstanding Preferred Stock. Upon the Company’s liquidation, dissolution, or winding up, the holders of Common

Stock are entitled to receive ratably the Company’s net assets available after the payment of all debts and other liabilities and

subject to the prior rights of any outstanding Preferred Stock. Holders of Common Stock have no preemptive, subscription, redemption,

or conversion rights. The outstanding shares of Common Stock are fully paid and nonassessable. The rights, preferences, and privileges

of holders of Common Stock are also subject to and may be adversely affected by the rights of holders of shares of any series of Preferred

Stock which the Company may designate and issue in the future without further stockholder approval.

Preferred Stock

The board is currently authorized, without

stockholder approval, to issue from time to time up to an aggregate of 1,000,000 shares of Preferred Stock in one or more series and to

fix or alter the designations, preferences, rights, qualifications, limitations, or restrictions of the shares of each series, including

the dividend rights, dividend rates, conversion rights, voting rights, term of redemption including sinking fund provisions, redemption

price or prices, liquidation preferences and the number of shares constituting any series or designations of such series without further

vote or action by the stockholders. The issuance of Preferred Stock may have the effect of delaying, deferring, or preventing a change

in control of management without further action by the stockholders and may adversely affect the voting and other rights of the holders

of Common Stock. The issuance of Preferred Stock with voting and conversion rights may adversely affect the voting power of the holders

of Common Stock, including the loss of voting control to others.

Series A Convertible

Preferred Stock

On August 6, 2013, the board approved, and

the Company filed a Certificate of Designation with the Delaware Secretary of State, designating two hundred thousand (200,000) shares

of “blank check” Preferred Stock as “Series A Convertible Preferred Stock” (the “Series A Preferred Stock”).

Our Series A Preferred Stock has voting rights

equal to a 1:100,000 basis, such that each share of Series A Preferred Stock is entitled to 100,000 votes in any vote of the Company’s

Common Stock. The Series A Preferred Stock is not entitled to dividends. Such dividends are payable only as and if declared by the Company’s

Board of Directors out of legally available funds. Upon the Company’s liquidation, dissolution, or winding up, holders of Series

A Preferred Stock are entitled to receive ratably the Company’s net assets available after the payment of all debts and other liabilities

and subject to the prior rights of any outstanding senior Preferred Stock, the amount payable in cash equal to the original purchase price

paid by such holder for its shares of Series A Preferred Stock. After the payment of such amounts, the Company’s remaining assets

shall be distributed ratably to the holders of the Series A Preferred Stock, junior classes of outstanding Preferred Stock, and then to

the holders of Common Stock of the Company. Subject to certain conditions, the holders of our Series A Preferred Stock may convert each

share of Series A Preferred Stock into 1,000 shares of Common Stock. Holders of the Series A Preferred Stock are entitled to certain protective

provisions relating to potential issuances of new shares of Series A Preferred Stock.

On April 21, 2022, the Company filed with

the Secretary of State of Delaware an Amended and Restated Certificate of Designation of Preferences, Rights and Limitations of the Company’s

Series A Preferred Stock (the “Amended and Restated Designation”). The Amended and Restated Designation, which became effective

with the Secretary of State of Delaware on April 21, 2022, amended the Certificate of Designation of the Series A Preferred Stock, previously

filed by the Company with the Secretary of State of Delaware on August 6, 2013, solely to amend Section 2 - Voting Rights. All other items

remained unchanged.

All of the outstanding 25,000

shares of Series A Preferred Stock are held by Nadav Elituv, the Company’s Chief Executive Officer, board member, and the Majority

Stockholder. The 25,000 shares of Series A Preferred Stock entitles Mr. Elituv to 25,000,000 shares of common stock issuable up on the

conversion of 25,000 shares of Series A Convertible Preferred Stock

Series B Convertible

Preferred Stock

In December 2019, the Company filed a Certificate

of Designation with the Delaware Secretary of State, designating one hundred thousand (100,000) shares of Preferred Stock as Series B

Convertible Preferred Stock (the “Series B Preferred Stock”).

After a one-year holding period, each share

of Series B Preferred Stock is convertible into one thousand (1,000) shares of Common Stock of the Company. The Series B Preferred Stock

is non-voting, except as otherwise required by law or to amend the Certificate of Designation or create a class of securities senior or

pari passu with the Series B Preferred Stock.

Upon the liquidation, dissolution, or winding-up

of the Company, whether voluntary or involuntary (a “Liquidation”), and junior to the Series A Preferred Stock, the

holders of the Series B Preferred Stock shall be entitled to receive out of the assets of the Company, whether such assets are capital

or surplus, for each share of Series B Preferred Stock an amount equal to the holder’s pro rata share of the assets and funds of

the Company to be distributed, assuming their conversion of Series B Preferred Stock to Common Stock and if the assets of

the Company shall be insufficient to pay in full such amounts, then the entire assets to be distributed to the holders shall be distributed

among the holders ratably in accordance with the respective amounts that would be payable on such shares if all amounts payable thereon

were paid in full.

On December 19, 2019, the Company issued

4,000 shares of Series B Preferred Stock with a fair value of $1,520,000 ($380 per share) for services to be provided from December 19,

2019 to December 19, 2020.

On November 15, 2021, the Company issued

17,000 shares of Series B Preferred Stock with a fair value of $44,100 ($0.00259 per share) to settle liabilities.

On April 28, 2022, the Holders of Series

Preferred B Stock elected to convert 4,000 shares of Series Preferred B Stock into 4,000,000 shares of common stock resulting in a $39,521

reduction in the carrying value of Series Preferred B Stock.

On September 26, 2022, the Holder of Series

Preferred B Stock elected to convert 6,000 shares of Series Preferred B Stock into 6,000,000 shares of common stock resulting in a $59,281

reduction in the carrying value of Series Preferred B Stock.

On March 3, 2023, the Holder of Series Preferred

B Stock elected to convert 7,000 shares of Series Preferred B Stock into 7,000,000 shares of common stock resulting in a $69,162 reduction

in the carrying value of Series Preferred B Stock.

Series C Convertible Preferred Stock

On October 7, 2020, the Company filed a Certificate

of Designation with the Delaware Secretary of State, designating five thousand (5,000) shares of Preferred Stock as Series C Convertible

Preferred Stock (the “Series C Preferred Stock”).

On June 30, 2021, the Company filed an Amended

and Restated Certificate of Designation with the Delaware Secretary of State, increasing the authorized amount of Series C Preferred Stock

to thirty thousand (30,000) shares. Each share of Series C Preferred Stock (i) has a liquidation value of $100, subject to various anti-dilution

protections, and is junior to the Series A and B Preferred Stock; (ii) is convertible into shares of Common Stock of the Company six months

after the date of issuance at a price of $0.002 per share, subject to various anti-dilution protections (iii) on conversion will receive

an aggregate number of shares of Common Stock as is determined by dividing the liquidation value by the conversion price. The Series C

Preferred Stock is non-voting, except as otherwise required by law or to amend the Amended and Restated Certificate of Designation or

create a class of securities senior or pari passu with the Series C Preferred Stock.

On July 5, 2022, the Company filed an Amended

and Restated Certificate of Designation with the Delaware Secretary of State to increase the authorized Series C Preferred Stock to thirty

thousand (150,000) shares.

On October 7, 2020, the Company entered into

a Securities Purchase Agreement with SRAX, Inc. (the “SRAX”) pursuant to which the Company issued 5,000 shares of Series C

Preferred Stock to SRAX with a fair value of 542,857 ($108.57 per share) for a one-year subscription to an online marketing platform to

support the gocart.city grocery delivery application.

On June 24, 2021, the Company entered into

a Securities Purchase Agreement with SRAX pursuant to which the Company issued 10,000 shares of Series C Preferred Stock to SRAX with

a fair value of $1,153,571 ($115.36 per share) for a one-year subscription to an online marketing platform to support the gocart.city

grocery delivery application.

On July 28, 2021, August 23, 2021, September

14, 2021 and November 29, 2021, SRAX converted 1,000, 1,000, 2,500 and 500 shares of Series C Preferred Stock, respectively, into an aggregate

of 250 million shares of common stock.

On June 30, 2022 the Company issued 80,000

of Series C Convertible Preferred Stock with a fair value of $2,288,000.

As of the Record Date SRAX, holds 90,000

shares of its Series C Preferred Stock.

Series D Convertible

Preferred Stock

On September 1, 2021, the Company filed a

Certificate of designation with the Delaware Secretary of State, designating 200,000 shares of preferred stock as Series D Convertible

Preferred Stock (the “Series D Preferred Stock”). Each share of Series D Preferred Stock is convertible into

100 shares of common stock after the Series D Preferred Stock has been held for six months from the date of issuance. The Series D Preferred

Stock is non-voting, other than as required by law.

Upon any Liquidation, and junior to the

Series A, B, and C Preferred Stock, the holders of the Series D Preferred Stock shall be entitled to receive out of the assets of the

Company, whether such assets are capital or surplus, for each share of Series D Preferred Stock an amount equal to the holder’s

pro rata share of the assets and funds of the Company to be distributed, assuming their conversion of Series D Preferred Stock to Common

Stock and if the assets of the Company shall be insufficient to pay in full such amounts, then the entire assets to be distributed to

the holders shall be distributed among the holders ratably in accordance with the respective amounts that would be payable on such shares

if all amounts payable thereon were paid in full.

During

September 2021, the Company, in private sales, issued a total of 40,000 shares of its Series D Preferred Stock for total cash proceeds

of CDN$1,000,000. On May 4, 2022, the Holders of Series D Stock elected to convert 40,000 shares of Series D Stock into 4,000,000 shares

of common stock resulting in a $39,521 reduction in the carrying value of Series D Stock.

Series E Convertible

Preferred Stock

On October 4,

2022, the Company filed a Certificate of Designation with the Delaware Secretary of State that had the effect of designating 300,000 shares

of preferred stock as Series E Convertible Preferred Stock (the “Series E Stock”). Series E Stock are non-voting, have

a par value of $0.0001 per share and have a stated value of $1.00 per share. Each share of Series E Stock carries an annual

cumulative dividend of 10% of the stated value. The Company may redeem Series E Stock in cash, if redeemed within 60

days of issuance date, at 110% of the stated value plus accrued unpaid dividends and between 61 days and 180 days at 115% of the stated

value plus unpaid accrued dividends. After 180 days of the issuance date, the Company does not have the right to redeem Series E Stock.

After 180 days after the issue date, Series E Stock at the stated value together with any unpaid accrued dividends are convertible into

shares of common stock of the Company at the Holder’s option at a variable conversion price calculated at 75% of the market price

defined as the lowest three average trading price during the ten trading day period ending on the latest trading day prior to the conversion

date. After 18 months following the issuance date, the Company must redeem for cash Series E Stock at its stated value plus any accrued

unpaid dividends and the default adjustment, if any.

On October 6,

2022, the Company entered into a Series E Preferred Stock Purchase Agreement (the “Agreement”) with 1800 Diagonal Lending

LLC (the “Buyer”). Pursuant to the Agreement, the Company agreed to sell to Buyer 169,675 shares of its Series E

Convertible Preferred Stock at a purchase price of $154,250 less transaction costs of $4,250 for $150,000 in cash.

On December 1, 2022, the Company paid the Buyer $189,182

in cash to redeem and cancel 169,675 shares of Series E Preferred Stock

AMENDMENT

OF ARTICLES OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT

On the Record Date, our Board and the Majority

Stockholder approved the Amendment, which will have the effect to authorize a reverse split no later than December 31, 2023 in a ratio

of up to one thousand pre-split shares for every one post-split share.

As of the Record Date, there

were 193,226,548 shares of Common Stock, and 25,000 shares of Series A Preferred Stock issued and outstanding. All 25,000 shares of Series

A Preferred Stock are held by Mr. Elituv, the Company’s Chief Executive Officer and board member, and is entitled to 25,000,000

shares of common stock issuable up on the conversion of 25,000 shares of Series A Convertible Preferred Stock.

Purposes of the Reverse

Split

The Company's Board of Directors may effect a reverse

stock split anytime during the twelve months following the date of the Special Meeting of Shareholders based upon any ratio up to a maximum

rate of one-for-one thousand, with the exact ratio to be established within this range by the Board of Directors in its sole discretion

at the time it elects to effect the split. The Board of Directors believes that the Reverse Split is in the Company's best interests in

that it may increase the trading price of the Common Stock. An increase in the price of the Common Stock should, in turn, generate greater

investor interest in the Common Stock, thereby enhancing the marketability of the

Common Stock to the financial community. In addition, the resulting reduction in the number of issued and outstanding shares of Common

Stock, together with the proposed increase in the number of authorized shares of Capital Stock, as discussed above, will provide the Company

with additional authorized but unissued shares.

Effects of the Reverse

Split

The immediate effect of the Reverse Split will be

to reduce the number of issued and outstanding shares of Common Stock from 193,226,548 to approximately 193,227, assuming the ratio of

the maximum rate of one-for-one thousand reverse split. Although the Reverse Split may also increase the market price of the Common Stock,

the actual effect of the Reverse Split on the market price cannot be predicted. The market price of the Common Stock may not rise in proportion

to the reduction in the number of shares outstanding as a result of the Reverse Split. Further, there is no assurance that the Reverse

Split will lead to a sustained increase in the market price of the Common Stock. The market price of the Common Stock may also change

as a result of other unrelated factors, including the Company's operating performance and other factors related to its business as well

as general market conditions. The Reverse Split will affect all of the holders of the Company's Common Stock uniformly and will not affect

any shareholder's percentage ownership interest in the Company or proportionate voting power, except for insignificant changes that will

result from the rounding of fractional shares either up or down (see discussion below).

Procedure for Effecting

the Amendment of our Articles

The Reverse Split of the Company's Common Stock will

become effective at the discretion of the Board of Directors (the “Effective Date”) within the twelve months following the

date of the Special Meeting of Shareholder. The Reverse Split will take place on the Effective Date without any action on the part of

the holders of the Common Stock and without regard to current certificates representing shares of Common Stock being physically surrendered

for certificates representing the number of shares of Common Stock each shareholder is entitled to receive as a result of the Reverse

Split. New certificates of Common Stock will not be issued.

Fractional Shares: No fractional shares will be issued

in connection with the Reverse Split. Shareholders who would otherwise be entitled to receive fractional shares because they hold a number

of shares of Common Stock that is not evenly divisible by 1,000 will have the number of new shares to which they are entitled rounded

to the nearest whole number of shares. The number of new shares will be rounded up in the case of fractional shares. No shareholders will

receive cash in lieu of fractional shares.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth,

as of the Record Date, certain information with respect to our equity securities owned of record or beneficially by (i) each of our Officers

and Directors; (ii) each person who owns beneficially more than 5% of each class of our outstanding equity securities; and (iii) all Directors

and Executive Officers as a group.

| |

|

Common Stock |

|

Series A Convertible Preferred Stock |

| Beneficial Owner (1) |

|

Number of Shares Beneficially Owned |

|

Percentage of Class (2) |

|

Number of Shares Beneficially Owned |

|

Percentage of Class (3) |

| |

|

|

|

|

|

|

|

|

| Nadav Elituv, Chief Executive Officer and Director |

|

122,400,427 (4) |

|

56.09% |

|

25,000 (5) |

|

100% |

| |

|

|

|

|

|

|

|

|

| Ryan Wilson, Director |

|

42,501 |

|

0.02% |

|

- |

|

- |

| |

|

|

|

|

|

|

|

|

| Bradley Southam, Director |

|

42,503 |

|

0.02% |

|

- |

|

- |

| |

|

|

|

|

|

|

|

|

| Steven Gryfe, CFO |

|

42,502 |

|

0.02% |

|

- |

|

- |

| |

|

|

|

|

|

|

|

|

| All directors and executive officers (4 persons) |

|

122,527,933 |

|

56.15% |

|

25,000 |

|

100% |

Notes:

| |

(1) |

Unless otherwise noted, the address of the reporting person is c/o Two Hands Corporation, 1035 Queensway East, Mississauga, Ontario, Canada L4Y 4C1. |

| |

(2) |

Based on 193,226,548 shares of common stock outstanding as of April 5, 2023 and shares of common stock that the reporting person has the right to acquire within 60 days from the date thereof. |

| |

(3) |

Based on 25,000 shares of Series A Convertible Preferred Stock outstanding as of April 5, 2023. |

| |

(4) |

Includes 91,054,392 shares of common stock held personally by Mr. Elituv individually, 25,000,000 shares of common stock issuable up on the conversion of 25,000 shares of Series A Convertible Preferred Stock and 6,346,035 shares of common stock held by 2130555 Ontario Limited. |

| |

(5) |

Each share of our Series A Convertible Preferred Stock converts into 1,000 shares of our common stock. Series A Convertible Preferred Stock are non-voting. |

We are not aware of any person

who owns of record, or is known to own beneficially, five percent or more of the outstanding securities of any class of the Company, other

than as set forth above. We are not aware of any person who controls the Company as specified in Section 2(a)(1) of the 1940 Act. There

are no classes of stock other than Common Stock, and Preferred Stock issued or outstanding. We do not have an investment advisor.

Anti-Takeover Provisions

The Company’s authorized but unissued

Common Stock and Preferred Stock will be available for future issuances without stockholder approval and could be utilized for various

corporate purposes, including future offerings to raise additional capital, acquisitions, and employee benefit plans. The existence of

authorized but unissued and unreserved Common Stock and Preferred Stock could render more difficult or discourage an attempt to obtain

control of the Company by means of a proxy contest, tender offer, merger, or otherwise.

DISTRIBUTION

AND COSTS

We will pay the cost of preparing,

printing, and distributing this Information Statement. Only one Information Statement will be delivered to multiple stockholders sharing

an address unless contrary instructions are received from one or more such stockholders. Upon receiving a written request at the address

noted above, we will deliver a single copy of this Information Statement and future stockholder communication documents to any stockholders

sharing an address to which multiple copies are now delivered.

DELIVERY

OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

We will only deliver one information statement

to multiple stockholders sharing an address unless we have received contrary instructions from one or more of the stockholders. Also,

we will promptly deliver a separate copy of this information statement and future stockholder communication documents to any stockholder

at a shared address to which a single copy of this information statement was delivered, or deliver a single copy of this information statement

and future stockholder communication documents to any stockholder or stockholders sharing an address to which multiple copies are now

delivered, upon written request to us at our address noted above. Stockholders may also address future requests regarding the delivery

of information statements or reports by contacting us at the address noted above.

WHERE

YOU CAN FIND MORE INFORMATION

We file annual, quarterly, current

reports, proxy statements, and other information with the SEC. The periodic reports and other information we have filed with the SEC

may be inspected and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington DC 20549. You may obtain

information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website

that contains reports, proxy statements, and other information about issuers, like the Company, who file electronically with the

SEC. The address of that site is www.sec.gov. Copies of these documents may also be obtained by writing our secretary at the address

specified above.

| |

By Order of The Board of Directors, |

| |

|

| Date: April 17, 2023 |

By: |

|

/s/ Nadav Elituv |

| |

|

|

Name: Nadav Elituv |

| |

|

|

Title: Chief Executive Officer |

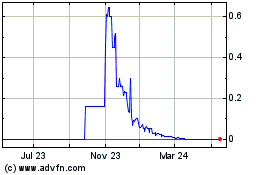

Two Hands (PK) (USOTC:TWOH)

Historical Stock Chart

From May 2024 to Jun 2024

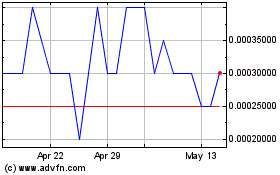

Two Hands (PK) (USOTC:TWOH)

Historical Stock Chart

From Jun 2023 to Jun 2024