August 4, 2021 -- InvestorsHub NewsWire -- via Hawk Point

Media

As its name implies, Winners, Inc. (OTC

Pink: WNRS) is on a winning streak. And the past two months of

deal-making positions WNRS for its winning ways to continue. In

fact, two deals open WNRS to target two of the nation’s most

lucrative sports betting markets, which simultaneously gives them

access to millions of new customers in the process.

Better still, from a growth perspective, its deals made in New

Jersey and West Virginia can be a transformative moment in its

history. Foremost, those deals immediately offer a significant

opportunity for WNRS to show off its industry-leading platform of

services to other states in the country in its bid to lock up other

value-creating deals.

Indeed, WNRS’s emphasis on building a robust platform targeting

the multi-billion dollar online sports gaming sector is starting to

pay dividends. And with its best-in-class products and services

targeting millions of sports wagering and online gaming enthusiasts

with compelling and original content, revenues could surge in the

coming months. Of course, that’s the plan.

Frankly, WNRS appears to already be in hyper-growth mode,

steadily expanding its service reach in the first half of this

year. The better news is that the 2H of 2021 is expected to be even

better. And a presentation at the Emerging Growth Conference in

July highlighted how it can reach new milestones. The live,

interactive online event drew a lot of attention and helped the

stock rise 5% on the day. It was also informative.

WNRS specifically emphasized the intrinsic value of its

platform, which is expected to snowball higher in sector importance

as the company expands further into the multi-billion-dollar sports

betting markets. And with WNRS primarily generating its revenues

through a commission-based business model, the faster it attracts

users, the quicker they can drive high-margin revenues. And they

are doing both.

Better yet, with WNRS already operating within two of the

nation’s largest betting markets, its growth is happening faster

than many expected.

Still, expect that pace to accelerate in the back half of this

year.

Targeting A Massive $400 Million Market

Opportunity

Moreover, while 2021 has been a knockout year for Winners, it’s

likely the company still has several more catalysts up its sleeve.

They would follow a major one from mid-July when WNRS subsidiary

VegasWINNERS Inc. announced that it earned a Sports Wagering

Interim Supplier License by the State of West Virginia Lottery.

That license allows WNRS to refer customers in West Virginia to

licensed sportsbooks in return for commission payments. And that

deal could be huge, especially when considering that West

Virginia’s total sports wagering is expected to increase from $226

million in 2019 to over $419 million in 2020. There was more in

July.

A second milestone reached adds to the investment proposition.

Also in July, WNRS announced its subsidiary was granted approval

from the New Jersey Division of Gaming Enforcement to operate as a

Registered Vendor Sports Gaming Affiliate in the state of New

Jersey. This approval opens up a substantial opportunity for WNRS,

granting access to one of the country’s most profitable sports

betting markets. Following its legalization in June 2018, the New

Jersey market has become one of the most popular hubs of sports

betting activity, with more than $4.5 billion wagered in its first

year.

Don’t underestimate the New Jersey opportunity. The state

finished 2020 as the largest sports betting market in the United

States, outspending Nevada by more than $1.5 billion in wagers

placed. This means that New Jersey wagers now account for 28% of

all sports betting in the United States, making WNRS’s

certification as a Registered Vendor Sports Gaming Affiliate in the

state a potential catalyst for rapid growth in the coming

weeks.

Moreover, with WNRS generating most of its revenues by directing

its users to gaming operators in exchange for a commission, the

company has been explicit in its plans to attract users with

consistently high-quality and engaging content. Its efforts are not

only growing its user base, but it is also helping build a strong

reputation of quality within the industry.

Krush House Network

One of its key assets is its Krush House Network, a website and

multi-media platform featuring various original programs that

target everyone from seasoned gamblers to sports fans who are

interested in statistics and analyst opinions.

Its “Krush House™” podcast features Frank Nicoterro and former

NFL Quarterback and ESPN analyst Sean Salisbury, who discuss team

performance and analyze betting trends. The weekly podcast also

features interviews with renowned athletes, man-on-the-street

interviews during sporting events, audience involvement and

contests, and other exciting attractions.

Additionally, the Krush House Network produces two other

original shows to assist sports fans in placing legal bets by

learning from some of the industry’s most knowledgeable

handicappers. These programs feature the company’s CEO, Wayne Allyn

Root, also known as “The King of Vegas Sports Gambling” and

“America’s Oddsmaker.”

At its core, the shows offer insight, advice, debates, and

up-to-date information on the latest handicap betting trends in all

major sports. And considering the market’s increasing demand for

quality sports betting news outlets, the promotional value of the

Krush House Network could prove substantial for WNRS.

It also adds considerably to the company’s mission of driving

traffic to gaming operators in exchange for a commission by

providing an engaging platform that covers the world of online

sports betting. And, with multiple episodes of its shows being

released each week, WNRS can keep a grip on its viewers and

capitalize upon the opportunities afforded by the legalized and

rapidly growing sports betting sector.

Indeed, WNRS is making the right moves and winning approvals at

the right time. That bodes well for growth during the back half of

this year.

A Sector Heating Up

From an investor’s standpoint, WNRS appears to be in a better

position than ever to capitalize on several near-term

opportunities. And, when considering the value of its two recent

approvals in some of the nation’s most lucrative sports betting

markets, growth could come sooner rather than later. Investors

should pay attention.

Keep in mind, too, WNRS is accelerating its growth and is

breaking away from competitors by offering products and services

specifically designed to capture the inherent value of the

legalized US sports betting markets. The great news is that its

recently achieved milestones could only be the prelude to better

things to come. If so, the investment proposition becomes even more

compelling.

Hence, heading into the back half of 2021 may show WNRS stock to

be too good to ignore, especially at roughly $0.05 per share. Its

two licenses targeting a near billion-dollar combined market

opportunity alone should shred its current market cap.

Moreover, beyond the inherent value of those deals, their

revenue-generating potential could also be a game-changer for the

company. Best of all, once WNRS provides market updates, investors

may get a taste of what’s in store when these licenses and

opportunities start to mature.

Thus, the untapped value today could become the springboard to

exponential growth tomorrow. And that could be a safe bet about its

future.

Disclaimers: Hawk Point Media Group, LLC. (Hawk Point Media)

is responsible for the production and distribution of this content.

Hawk Point Media is not operated by a licensed broker, a dealer, or

a registered investment adviser. It should be expressly understood

that under no circumstances does any information published herein

represent a recommendation to buy or sell a security. Our

reports/releases are a commercial advertisement and are for general

information purposes ONLY. We are engaged in the siness of

marketing and advertising companies for monetary compensation.

Never invest in any stock featured on our site or emails unless you

can afford to lose your entire investment. The information made

available by Hawk Point Media is not intended to be, nor does it

constitute, investment advice or recommendations. The contributors

may buy and sell securities before and after any particular

article, report and publication. In no event shall Hawk Point Media

be liable to any member, guest or third party for any damages of

any kind arising out of the use of any content or other material

published or made available by Hawk Point Media, including, without

limitation, any investment losses, lost profits, lost opportunity,

special, incidental, indirect, consequential or punitive damages.

Past performance is a poor indicator of future performance. The

information in this video, article, and in its related newsletters,

is not intended to be, nor does it constitute, investment advice or

recommendations. Hawk Point Media strongly urges you conduct a

complete and independent investigation of the respective companies

and consideration of all pertinent risks. Readers are advised to

review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider

reports, Forms 3, 4, 5 Schedule 13D. For some content, Hawk Point

Media, its authors, contributors, or its agents, may be compensated

for preparing research, video graphics, and editorial content. As

part of that content, readers, subscribers, and website viewers,

are expected to read the full disclaimers and financial disclosures

statement that can be found by clicking HERE.

The Private Securities Litigation Reform Act of 1995

provides investors a safe harbor in regard to forward-looking

statements. Any statements that express or involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, goals, assumptions or future events or performance are

not statements of historical fact may be forward looking

statements. Forward looking statements are based on expectations,

estimates, and projections at the time the statements are made that

involve a number of risks and uncertainties which could cause

actual results or events to differ materially from those presently

anticipated. Forward looking statements in this action may be

identified through use of words such as projects, foresee, expects,

will, anticipates, estimates, believes, understands, or that by

statements indicating certain actions & quote; may, could, or

might occur. Understand there is no guarantee past performance will

be indicative of future results.Investing in micro-cap and

growth securities is highly speculative and carries an extremely

high degree of risk. It is possible that an investors investment

may be lost or impaired due to the speculative nature of the

companies profiled.

Media Contact

Company Name: Hawk Point Media

Contact Person: Ken Lawrence

Email: Send

Email

Phone: 3057806988

City: Miami Beach

State: Florida

Country: United States

Website: https://vegaswinners.com/

Source - https://www.digitaljournal.com/pr/winners-inc-value-opportunity-increases-substantially-after-earning-new-jersey-and-west-virginia-licensing-otc-pink-wnrs

SOURCE: Hawk Point Media

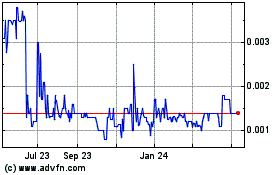

Winners (PK) (USOTC:WNRS)

Historical Stock Chart

From Dec 2024 to Jan 2025

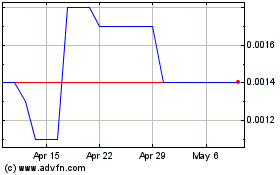

Winners (PK) (USOTC:WNRS)

Historical Stock Chart

From Jan 2024 to Jan 2025