Wolters Kluwer to Acquire Remaining Shares of Third Coast Holdings, Inc.

26 February 2014 - 6:05PM

Wolters Kluwer announced today that its Corporate Legal

Services (CLS) group has signed an agreement to acquire the

remaining 62% of Third Coast Holdings, Inc. it does not already own

for $180 million in cash, subject to closing adjustments, bringing

its total cash investment since 2002 to $197 million. This

acquisition supports Wolters Kluwer's strategy of focusing its

capital on its high growth businesses. Completion of the

transaction is subject to Hart-Scott-Rodino regulatory review and

other customary closing conditions.

Third Coast Holdings and its operating companies provide

enterprise legal management software and services for general

counsel and law firms in the U.S. and internationally. Wolters

Kluwer has had a minority interest in Third Coast Holdings, Inc. or

its predecessor since 2002 and has accounted for its minority share

of net profit or loss within equity-accounted associates.

Third Coast Holdings and its subsidiaries have seen strong

growth in the past several years and reached estimated revenues of

over $57 million in 2013. Over 80% of revenue is subscription

based. Following completion, and including integration benefits,

the business is expected to deliver a return on total investment

above Wolters Kluwer's after tax cost of capital (8%) within 3 to 5

years. The transaction is expected to be slightly earnings

enhancing in the first full year following completion. Wolters

Kluwer is expected to record a non-cash book profit of

approximately $100 million on its minority investment at the time

of closing, subject to accounting adjustments.

The acquisition and subsequent integration of the business as a

part of Wolters Kluwer Corporate Legal Services will enhance CLS'

capabilities to offer enterprise legal management solutions, open

additional avenues for international expansion, and create

operational efficiency opportunities.

Nancy McKinstry, CEO and Chairman of the Executive Board of

Wolters Kluwer, commented "This agreement underscores our strategy

to extend our Corporate Legal Services business, one of our high

growth positions in the portfolio."

"This is an exciting opportunity for our company and our

customers. Following completion of this acquisition, we will be

able to provide a broader range of truly best-in-class solutions to

serve enterprise legal management customers with different

preferences and needs, across multiple segments," said Richard

Flynn, Group President and CEO of Wolters Kluwer Corporate Legal

Services.

About Wolters Kluwer Corporate Legal Services

Wolters Kluwer Corporate Legal Services (CLS) is a leader in legal

and compliance services, serving 70% of the Fortune 500, 90% of the

AmLaw 100, 80% of the top 100 U.S. banks, and hundreds of thousands

of small business owners. Through its operating units, CLS offers

legal compliance, lien management, brand management and enterprise

legal management solutions. Wolters Kluwer Corporate Legal Services

is part of Wolters Kluwer, a leading global information services

and solutions provider with annual 2013 revenues of €3.6 billion

($4.9 billion) and approximately 19,000 employees worldwide.

|

Investors/Analysts |

Media |

Media |

| Meg

Geldens |

Nicole

Young |

Caroline

Wouters |

| Investor

Relations |

CLS

Communications |

Corporate

Communications |

| +31 172 641

407 |

+1 212 590

9311 |

+31 172 641

459 |

|

ir@wolterskluwer.com |

n.young@wolterskluwer.com |

press@wolterskluwer.com |

Forward-looking Statements

This press release contains forward-looking statements. These

statements may be identified by words such as "expect," "should,"

"could," "shall," and similar expressions. Wolters Kluwer cautions

that such forward-looking statements are qualified by certain risks

and uncertainties that could cause actual results and events to

differ materially from what is contemplated by the forward-looking

statements. Factors which could cause actual results to differ from

these forward-looking statements may include, without limitation,

general economic conditions; conditions in the markets in which

Wolters Kluwer is engaged; behavior of customers, suppliers, and

competitors; technological developments; the implementation and

execution of new ICT systems or outsourcing; and legal, tax, and

regulatory rules affecting Wolters Kluwer's businesses, as well as

risks related to mergers, acquisitions, and divestments. In

addition, financial risks such as currency movements, interest rate

fluctuations, liquidity, and credit risks could influence future

results. The foregoing list of factors should not b e construed as

exhaustive. Wolters Kluwer disclaims any intention or obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events, or otherwise.

PDF version of Press Release

http://hugin.info/130682/R/1764616/598393.pdf

HUG#1764616

Wolters Kluwer (PK) (USOTC:WTKWY)

Historical Stock Chart

From Jan 2025 to Feb 2025

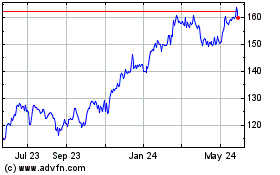

Wolters Kluwer (PK) (USOTC:WTKWY)

Historical Stock Chart

From Feb 2024 to Feb 2025