Report of Foreign Issuer (6-k)

03 January 2017 - 10:12PM

Edgar (US Regulatory)

1934 ACT FILE NO. 001-14714

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of December 2016

Yanzhou Coal

Mining Company Limited

(Translation of Registrant’s name into English)

298 Fushan South Road

Zoucheng, Shandong Province

People’s Republic of China

(Address of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this

Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

82-

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Yanzhou Coal Mining Company Limited

|

|

|

|

|

|

Date

December 30, 2016

|

|

|

|

By /s/ Zhang Baocai

|

|

|

|

|

|

Name:

|

|

Zhang Baocai

|

|

|

|

|

|

Title:

|

|

Director

|

Certain statements contained in this announcement may be regarded as forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements

involve inherent risks and uncertainties that may cause the actual performance, financial condition or results of operations of the Company to be materially different from any future performance, financial condition or results of operations implied

by such forward-looking statements. Further information regarding these risks and uncertainties is included in the Company’s filings with the U.S. Securities and Exchange Commission. The forward-looking statements included in this announcement

represent the Company’s views as of the date of this announcement. Except as required by law, the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future

events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent

to the date of this announcement.

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for

the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this

announcement.

YANZHOU COAL MINING COMPANY LIMITED

(A joint stock limited company incorporated in the People’s Republic of China with limited liability)

(Stock Code: 1171)

ANNOUNCEMENT

PROVISION

OF FINANCIAL GUARANTEE TO WHOLLY OWNED

SUBSIDIARIES AND CONTROLLED SUBSIDIARY

This announcement is made pursuant to Part XIVA of the Securities and Futures Ordinance and Rule 13.09(2)(a) and 13.10B of the

Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited.

I. Summary of the Guarantee

In order to reduce financing costs of Shandong Zhongyin International Trade Co., Ltd., Zhongyan Trading Co., Ltd of Qingdao Free Trade Zone, both wholly-owned

subsidiaries of Yanzhou Coal Mining Company Limited (the “

Company

”), and Qingdao Zhongyin Ruifeng International Trade Company Limited, a controlled subsidiary of the Company (together, the “

Guaranteed Parties

”) and

to safeguard the capital needs of the Guaranteed Parties arising from

day-to-day

operations, the Company proposed to provide financial guarantee of an amount not

exceeding RMB12,000,000,000 to the Guaranteed Parties.

1

At the twenty-seventh meeting of the sixth session of the board of directors of the Company held on

30 December 2016, the Proposal in Relation to Provision of Financial Guarantee to Wholly-Owned and Controlled Subsidiaries of the Company was considered and approved, which approved relevant arrangements for provision of financial guarantee at

the amount not exceeding RMB12,000,000,000 to the Guaranteed Parties and such proposal would be submitted to the first extraordinary general meeting of 2017 for consideration and approval. Please refer to the announcement of the Company dated

30 December 2016 in relation to resolutions passed at the twenty-seventh meeting of the sixth session of the board of directors for further details.

II. Basic information of the Guaranteed Parties

For the

basic information of the Guaranteed Parties, please refer to “Appendix - Basic information of the Proposed Guaranteed Wholly-Owned and Controlled Subsidiaries of Yanzhou Coal Mining”.

III. Contents of the Guarantee Agreement

Currently, the

Company has not yet signed any guarantee agreement. The Company will process the guarantee arrangements, taking into account the arrangements of the financing activities and actual situation of the Company and strictly within the scope of

authorization to be granted by the general meeting during the term of the guarantee.

IV. Opinion of the Board of Directors

All members of the board of directors of the Company (including the independent directors of the Company) are of the view that the provision of the guarantee

by the Company to the Guaranteed Parties will provide stable financial support to their trading businesses, help expanding their trading channels and also meet the requirements of overall industrial layout of the Company and operational development

of its subsidiaries. The risk arising from the guarantee can effectively be controlled and prevented in light of the fact that the Guaranteed Parties are either wholly-owned or controlled subsidiaries of the Company, and therefore the aforesaid

provision of guarantee will not be detrimental to the interests of the Company and its shareholders as a whole.

V. Amount of cumulative external

guarantees and outstanding guarantees

As at the date of this announcement, the cumulative amount of the external guarantees provided by the Company

was RMB31.311 billion in aggregate, representing 72.82% of the Company’s audited net assets as calculated according to Chinese accounting standards in the year 2015. The Company does not have any overdue guarantee matter.

VI. Documents for Inspection

Resolutions Passed at

the Twenty-Seventh Meeting of the Sixth Session of the Board of Directors of Yanzhou Coal Mining Company Limited

2

|

|

|

|

|

|

|

|

|

|

|

By order of the Board

|

|

|

|

|

|

Yanzhou Coal Mining Company Limited

|

|

|

|

|

|

Li Xiyong

|

|

|

|

|

|

Chairman of the Board

|

Zoucheng, Shandong Province, the PRC

30 December 2016

As at the date of this announcement,

the directors of the Company are Mr. Li Xiyong, Mr. Li Wei, Mr. Wu Xiangqian, Mr. Wu Yuxiang, Mr. Zhao Qingchun, Mr. Guo Dechun and Mr. Guo Jun, and the independent

non-executive

directors of the Company are Mr. Wang Lijie, Mr. Jia Shaohua, Mr. Wang Xiaojun and Mr. Qi Anbang.

About the Company

For more information, please contact:

Yanzhou Coal Mining Company Limited

Zhang Baocai, Director

Tel: +86 537 538 3310

Address: 298 Fushan South Road,

Zoucheng, Shandong Province, 273500 PRC

3

Appendix - Basic information of the Proposed Guaranteed Wholly-Owned and Controlled Subsidiaries

of Yanzhou Coal Mining

Unit: RMB100 million

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No.

|

|

Name of the

Company

|

|

Place of

incorporation

|

|

Registered

capital

|

|

Shareholding

held by the

Company

|

|

Business scope

|

|

As at 30 November 2016

|

|

January to

November 2016

|

|

|

|

|

|

|

|

Total

assets

|

|

Total

liabilities

|

|

Net

assets

|

|

Debt-to-

assets

ratio

|

|

Current

liabilities

|

|

Bank

loans

|

|

Revenue

|

|

Net

profit

|

|

1

|

|

Qingdao Zhongyin Ruifeng International Trade Company Limited

|

|

Qingdao,

Shandong

|

|

2

|

|

51%

|

|

International trade, transit trade; trade in import and export of various commercial goods

|

|

38.77

|

|

36.66

|

|

2.11

|

|

94.56%

|

|

36.66

|

|

0

|

|

104.79

|

|

0.11

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

|

|

Shandong Zhongyin International Trade Co., Ltd.

|

|

Jinan,

Shandong

|

|

3

|

|

100%

|

|

Goods and technology import & export; sales of coal, coal mine mechanical equipment and parts etc.

|

|

3.36

|

|

0.36

|

|

3

|

|

10.71%

|

|

0.36

|

|

0

|

|

79.85

|

|

-0.009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3

|

|

Zhongyan Trading Co., Ltd of Qingdao Free Trade Zone

|

|

Qingdao,

Shandong

|

|

0.5

|

|

100%

|

|

Financial leasing services; leasing services; sale and purchase of leasing assets inside and outside of the PRC; handling and repair of the remaining value of financial leasing assets

|

|

4.55

|

|

3.98

|

|

0.57

|

|

87.47%

|

|

3.98

|

|

0

|

|

82.78

|

|

0.01

|

4

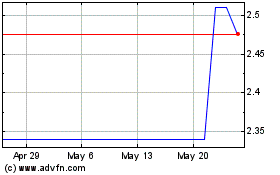

Yanzhou Coal Mining (QX) (USOTC:YZCHF)

Historical Stock Chart

From Jan 2025 to Feb 2025

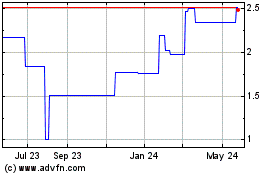

Yanzhou Coal Mining (QX) (USOTC:YZCHF)

Historical Stock Chart

From Feb 2024 to Feb 2025