Report of Foreign Issuer (6-k)

26 January 2017 - 1:48AM

Edgar (US Regulatory)

1934 ACT FILE NO. 001-14714

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of January 2017

Yanzhou Coal

Mining Company Limited

(Translation of Registrant’s name into English)

298 Fushan South Road

Zoucheng, Shandong Province

People’s Republic of China

(Address of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by

check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this

Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

82-

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Yanzhou Coal Mining Company Limited

|

|

|

|

|

|

Date

January 25, 2017

|

|

|

|

By /s/ Jin Qingbin

|

|

|

|

|

|

Name:

|

|

Jin Qingbin

|

|

|

|

|

|

Title:

|

|

Company Secretary

|

Certain statements contained in this announcement may be regarded as forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking

statements involve inherent risks and uncertainties that may cause the actual performance, financial condition or results of operations of the Company to be materially different from any future performance, financial condition or results of

operations implied by such forward-looking statements. Further information regarding these risks and uncertainties is included in the Company’s filings with the U.S. Securities and Exchange Commission. The forward-looking statements included in

this announcement represent the Company’s views as of the date of this announcement. Except as required by law, the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new

information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. These forward-looking statements should not be relied upon as representing the Company’s views as of

any date subsequent to the date of this announcement.

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no

responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the

contents of this announcement.

YANZHOU COAL MINING COMPANY LIMITED

(A joint stock limited company incorporated in the People’s Republic of China with limited liability)

(Stock Code: 1171)

DISCLOSEABLE TRANSACTION

SUBSCRIPTIONS OF WEALTH MANAGEMENT PRODUCTS

|

|

|

Reference is made to the announcement of the Company regarding the subscriptions of wealth management products dated 5 February 2016. Given that the

wealth management products subscribed by the Company as disclosed in the Announcement have matured, the Board announces that, on 25 January 2017, the Company purchased wealth management products from Industrial Bank and BOCOM.

Since the highest relevant applicable percentage ratio (as defined under the Hong Kong

Listing Rules) in respect of the subscription amount under each of the Purchase of Wealth Management Products of Industrial Bank and the Purchase of Wealth Management Products of BOCOM exceeds 5% but is less than 25%, each of the purchases

constitutes a discloseable transaction of the Company and is subject to the reporting and announcement requirements under the Hong Kong Listing Rules.

|

Reference is made to the announcement of the Company regarding the subscriptions of wealth

management products dated 5 February 2016 (the “

Announcement

”). Given that the wealth management products subscribed by the Company as disclosed in the Announcement have matured, the Board announces that, on 25 January 2017,

the Company purchased wealth management products from Industrial Bank and BOCOM.

1

|

II.

|

DETAILS OF SUBSCRIPTIONS OF THE WEALTH MANAGEMENT PRODUCTS

|

1. The Purchase of Wealth Management

Products of Industrial Bank

On 25 January 2017, the Company entered into the Golden Snowball RMB Wealth Management Plan Product Agreement with

Industrial Bank to purchase RMB wealth management plan product, details of which are as follows:

|

(1)

|

Name of product: Golden Snowball RMB Wealth Management Plan Product of Industrial Bank

|

|

(2)

|

Investment currency: RMB

|

|

(3)

|

Type of product: principal-guaranteed and return-guaranteed wealth management product

|

|

(4)

|

Subscription amount: RMB2.0 billion

|

|

(5)

|

Expected annualized return rate: 4.0%

|

|

(6)

|

Principle for calculation of product returns: return on the product is calculated based on the investment principal of the Company, days of investment and the actual annualized return rate (365 days a year).

|

|

(7)

|

Value date of product: 25 January 2017

|

|

(8)

|

Maturity date of product: 25 April 2017

|

|

(9)

|

Principal guaranteed: Industrial Bank guarantees to return 100% of the principal amount and the product return to the Company on maturity date.

|

|

(10)

|

Right of early termination: The Company has no right of early termination. If, among others, there is market volatility or substantial impact on the security of the assets of the product which, in Industrial Bank’s

reasonable opinion, makes it difficult for Industrial Bank to provide wealth management plan to its clients in accordance with the product description, Industrial Bank has the right to declare the wealth management plan not established. In such a

case, Industrial Bank will announce the date of early termination and specify the payment date on Industrial Bank branches and Industrial Bank’s website one working day in advance (generally the payment date is within three working days after

the date of early termination). Industrial Bank will return the principal to the designated account of the Company on the designated payment date (the payment date will be postponed to the next working day if it is a Banking Holiday). Interest for

the period from the date of early termination(inclusive) to the date of return of the principal will not be calculated.

|

|

(11)

|

The payment of principal and return: the principal and return will be transferred to the Company’s designated account on the day after the maturity date. No interest will be borne from the maturity date to the

actual payment date of the principal and return.

|

|

(12)

|

Description of connected relationship: To the best knowledge, information and belief of the Directors having made all reasonable enquiry, Industrial Bank and its ultimate beneficial owners are the third parties

independent of the Company and connected persons of the Company, and are not connected persons of the Company.

|

2

2. The Purchase of Wealth Management Products of BOCOM

On 25 January 2017, the Company entered into the Yuntongcaifu Daily Profit Increase Wealth Management Plan Agreement with BOCOM to purchase RMB wealth

management corporate products, details of which are as follows:

|

(1)

|

Name of product: Yuntongcaifu 32 Days of Daily Profit Increase RMB Wealth Management Corporate Products

|

|

(2)

|

Investment currency: RMB

|

|

(3)

|

Type of product: principal-guaranteed and return-guaranteed wealth management product

|

|

(4)

|

Subscription amount: RMB2.0 billion

|

|

(5)

|

Expected annualized return rate: 4.10%

|

|

(6)

|

Principle for calculation of product returns: return on the product is calculated based on the investment principal of the Company, days of investment and the actual annualized return rate (365 days a year).

|

|

(7)

|

Value date of product: 26 January 2017

|

|

(8)

|

Maturity date of product: 27 February 2017

|

|

(9)

|

Principal guaranteed: the principal amount of such wealth management product is guaranteed by BOCOM and the return on the product will be calculated by the annualized return rate.

|

|

(10)

|

Right of early termination: BOCOM has the right of early termination of the wealth management product if the 3 months Shanghai Interbank Offered Rate is lower than 2.5% on the 10th working date prior to the maturity

date. BOCOM also has the right to early terminate of the wealth management product on the 9th working date prior to the maturity date.

|

|

(11)

|

The payment of principal and return: the principal and return will be paid to the Company on the maturity date. If the maturity date is a

non-working

day, the payment will be made

on the next working day, the return on the product will be calculated based on the actual investment period.

|

|

(12)

|

Description of connected relationship: To the best knowledge, information and belief of the Directors having made all reasonable enquiry, BOCOM and its ultimate beneficial owners are the third parties independent of the

Company and connected persons of the Company, and are not connected persons of the Company.

|

|

III.

|

REASONS AND BENEFITS FOR PURCHASING WEALTH MANAGEMENT PRODUCTS

|

Without affecting the Company’s

project constructions, operational liquidity and fund security, the Company utilized certain idle funds to subscribe for highly secured principal-guaranteed wealth management products from banks. Such subscription will not affect the need of working

capital of the Company. Appropriate short-term wealth management with low risk exposure is conducive to enhancing the utilization of capital and increasing income from idle funds.

Therefore, the Directors consider that the Purchase of Wealth Management Products of Industrial Bank and the Purchase of Wealth Management Products of BOCOM

are fair and reasonable and in the interests of the Company and the Shareholders as a whole.

|

IV.

|

IMPLICATION OF THE HONG KONG LISTING RULES

|

Since the highest relevant applicable percentage ratio (as

defined under the Hong Kong Listing Rules) in respect of the subscription amount under each of the Purchase of Wealth Management Products of Industrial Bank and the Purchase of Wealth Management Products of BOCOM exceeds 5% but is less than 25%,

each of the purchases constitutes a discloseable transaction of the Company and is subject to the reporting and announcement requirements under the Hong Kong Listing Rules.

3

Information of the parties

The Company

The Company is principally engaged in the

business of mining, preparation, processing and sales of coal and coal chemicals. The Company’s main products are steam coal for use in large-scale power plants, coking coal for metallurgical production and prime quality low sulphur coal for

use in pulverized coal injection.

Industrial Bank

Industrial Bank is a licensed bank incorporated under the laws of the PRC. CGB is principally engaged in the businesses as approved by China Banking Regulatory

Commission in accordance with the relevant laws, administrative rules and other regulations.

BOCOM

BOCOM is one of the major financial services providers in China. Its business scope includes commercial banking, securities services, trust services, financial

leasing, fund management, insurance and offshore financial services. The shares of BOCOM are listed on the Hong Kong Stock Exchange and the Shanghai Stock Exchange.

4

DEFINITIONS

In this announcement, unless the context requires otherwise, the following terms have the meanings set out below:

|

|

|

|

|

“A Shares”

|

|

domestic shares in the ordinary share capital of the Company, with a nominal value of RMB1.00 each, which are listed on the Shanghai Stock Exchange;

|

|

|

|

|

“Board”

|

|

the board of directors of the Company;

|

|

|

|

|

“BOCOM”

|

|

Jining Zhoucheng branch of Bank of Communications Co., Ltd.;

|

|

|

|

|

“Company”

|

|

, Yanzhou Coal Mining Company Limited, a joint stock limited company established under the laws of the PRC in 1997, and the H Shares, American depositary shares and A Shares of which are listed on the Hong Kong Stock

Exchange, New York Stock Exchange and the Shanghai Stock Exchange, respectively;

, Yanzhou Coal Mining Company Limited, a joint stock limited company established under the laws of the PRC in 1997, and the H Shares, American depositary shares and A Shares of which are listed on the Hong Kong Stock

Exchange, New York Stock Exchange and the Shanghai Stock Exchange, respectively;

|

|

|

|

|

“connected person(s)”

|

|

has the meaning ascribed thereto under the Hong Kong Listing Rules;

|

|

|

|

|

“Director(s)”

|

|

the director(s) of the Company;

|

|

|

|

|

“H Shares”

|

|

overseas listed foreign invested shares in the ordinary share capital of the Company with a nominal value of RMB1.00 each, which are listed on the Hong Kong Stock Exchange;

|

|

|

|

|

“Hong Kong Listing Rules”

|

|

the Rules Governing the Listing of Securities on the Hong Kong Stock Exchange;

|

|

|

|

|

“Hong Kong Stock Exchange”

|

|

The Stock Exchange of Hong Kong Limited;

|

|

|

|

|

“Industrial Bank”

|

|

Industrial Bank Co., Ltd., Jiniing Branch

|

|

|

|

|

“PRC”

|

|

the People’s Republic of China;

|

|

|

|

|

“Purchase of Wealth Management Products of BOCOM”

|

|

the purchase of wealth management products of BOCOM according to the agreement entered into between the Company and BOCOM on 25 January 2017;

|

|

|

|

|

“Purchase of Wealth Management Products of Industrial Bank”

|

|

the purchase of wealth management products of Industrial Bank according to the agreement entered into between the Company and Industrial Bank on 25 January 2017;

|

|

|

|

|

“RMB”

|

|

Renminbi, the lawful currency of the PRC;

|

|

|

|

|

“Shareholders”

|

|

the shareholders of the Company;

|

|

|

|

|

“%”

|

|

percentage.

|

5

|

|

|

|

|

|

|

By order of the Board

|

|

|

|

Yanzhou Coal Mining Company Limited

|

|

|

|

Li Xiyong

|

|

|

|

Chairman of the Board

|

Zoucheng, Shandong Province, the PRC

25 January 2017

As at the date of this announcement,

the directors of the Company are Mr. Li Xiyong, Mr. Li Wei, Mr. Wu Xiangqian, Mr. Wu Yuxiang, Mr. Zhao Qingchun, Mr. Guo Dechun and Mr. Guo Jun, and the independent

non-executive

directors of the Company are Mr. Wang Lijie, Mr. Jia Shaohua, Mr. Wang Xiaojun and Mr. Qi Anbang.

About the Company

For more information, please contact:

Yanzhou Coal Mining Company Limited

Jin Qingbin, Company

Secretary

Tel: +86 537 538 2319

Address: 298 Fushan South

Road, Zoucheng, Shandong Province, 273500 PRC

6

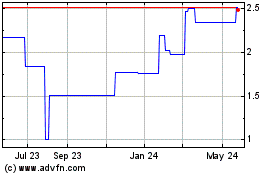

Yanzhou Coal Mining (QX) (USOTC:YZCHF)

Historical Stock Chart

From Jan 2025 to Feb 2025

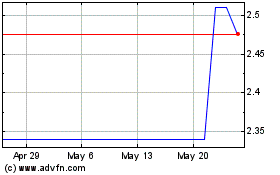

Yanzhou Coal Mining (QX) (USOTC:YZCHF)

Historical Stock Chart

From Feb 2024 to Feb 2025