VEON 3Q24 Trading Update: Another Billion Dollar Revenue Quarter,

Digital Drives Growth

Amsterdam and Dubai, 14 November 2024

07:00AM CET

VEON Q3 2024 Highlights

- Q3 Total revenue of USD 1,038 million, +9.8% YoY; revenue

growth in local currency +14.1% YoY (+16.0% YoY underlying revenue

growth in local currency)

- Q3 Direct digital revenue of USD 121 million, +35.1% YoY

(+32.6% YoY in local currency)

- Q3 Telecom and infrastructure revenue USD 916 million, +7.2%

YoY (+12.2% YoY in local currency)

- Q3 EBITDA of USD 438 million, -1.5% YoY, +3.5% YoY growth in

local currency (+9.8% YoY underlying growth in local currency)

- Total cash and cash equivalents of USD 1,019 million, with USD

453 million at headquarters (“HQ”); and gross debt at USD 4.0

billion (decreased by USD 335 million YoY), with net debt excluding

lease liabilities at USD 2.1 billion

- LTM Equity Free Cash Flow of USD 421million, +22.2% YoY; LTM

Capex increased 16.3% YoY

VEON Ltd. (Nasdaq: VEON, Euronext Amsterdam: VEON), a global

digital operator that provides converged connectivity and online

services, announces selected financial and operating results for

the third quarter ended 30 September 2024.

In 3Q24 VEON demonstrated robust growth, reporting an increase

in revenues both in reported and local currencies. Total revenues

reached USD 1,038 million, an increase of 9.8% YoY in reported

currency (+14.1% YoY in local currency). EBITDA reached USD 438

million and represented a 1.5% YoY decrease in reported currency

terms (+3.5% YoY in local currency). This quarter's EBITDA was

primarily impacted by identified items, including operational

pressures in Bangladesh and restructuring costs.

Capex in 3Q24 was USD 198 million, an increase of 51.2% YoY. LTM

capex increased 16.3% YoY, with LTM capex intensity of 19.2%

(+1.5p.p. YoY). Total cash and cash equivalents as of 30 September

2024 amounted to USD 1,019 million (including USD 143 million

related to banking operations in Pakistan and excluding USD 211

million in Ukrainian sovereign bonds that are classified as

investments) with USD 453 million held at the HQ level.

Blended weighted average inflation rates in the countries we

operate in declined from 16.5% in Q3 2023, to 8.2% in Q3 2024, a

reduction of 830 basis points. We are encouraged to see revenue

growth exceeding average inflation levels in our markets.

For the full year we expect total revenue growth of 8%-10% YoY

and EBITDA growth of 4%-6% YoY in USD terms, assuming current FX

rates. We are revising our prior local currency guidance, given the

above considerations, to 12%-14% YoY growth for total revenue, and

9%-11% YoY growth for EBITDA, each in local currency terms.

Underlying growth in local currency, excluding identified items,

is expected to be 15%-16% YoY growth in revenue, and 10-11% YoY

growth in EBITDA. This marks a change from our previous guidance of

16-18% growth for revenue, and 18-20% growth in EBITDA for 2024 in

local currency terms which was normalised for the Ukrainian

cyberattack. In addition to deceleration in blended inflation rates

across VEON’s operating markets, our new local currency guidance

also reflects the business impact of civil unrest in Bangladesh and

the sale of the TNS+ infrastructure asset in Kazakhstan.

Commenting on the results, Kaan Terzioğlu said:

“I am pleased to report a 14% YoY increase in revenue in local

currency terms, exceeding the 8%

blended inflation across our markets. Despite the impact of the

civil unrest in Bangladesh, the sale of the TNS+ infrastructure

asset in Kazakhstan, and with current currency levels in mind, we

expect to finish the year with solid revenue growth of 8 to 10% in

USD terms.

This achievement highlights our rapid expansion and innovation,

supported by 8 million new 4G subscribers and 103 million digital

service users. Direct digital revenues, now comprising 12% of our

total revenue for the quarter, grew by 35% year-over-year. These

gains, stemming from digital financial services, entertainment,

healthcare, advertising, and super-apps, are not only enhancing

user engagement and retention but also significantly boosting our

ARPU and contributing directly to our top-line growth through

diverse streams like interest income, advertising revenues,

subscription services, platform commissions, and pay-per-view

revenues.

Looking forward, I am enthusiastic about the future as we

continue to drive growth and enrich

customer experiences through advanced digital offerings and

cutting-edge technologies like

augmented intelligence. This approach not only cements our position

at the forefront of the digital revolution but also ensures

sustained growth and success in rapidly evolving frontier

markets.”

Additional information

View the full 3Q24 trading update

View 3Q24 trading update presentation

View 3Q24 factbook

3Q24 results conference

call

VEON will also host a results conference call with senior

management at 14:00 CET (13:00 GMT, 8:00 EST) today.

To register and access the event, please click here or copy and

paste this link to the address bar of your

browser: https://veon-Q3-2024-trading-update.open-exchange.net/.

Once registered, you will receive registration confirmation on

the email address mentioned during registration with the link to

access the webcast and dial-in details to listen to the conference

call over the phone.

We strongly encourage you to watch the event through the webcast

link, but if you prefer to dial in, then please use the dial-in

details.

Q&A

If you want to participate in the Q&A session, we ask that you

select the ‘Yes' option on the ‘Will you be asking questions live

on the call?’ dropdown. That will bring you to a page where you can

join the Q&A room by clicking 'Connect to meeting’.

You will be brought into a zoom webinar where you can listen to

the presentation and once Q&A begins, if you have a question,

please use the ‘raise hand button’ on the bottom of your zoom

screen. When it is your turn to speak, the moderator will announce

your name as well as sending a message to your screen asking you to

confirm you want to talk. Once accepted, please unmute your mic and

ask your question.

You can also submit your questions prior the webcast event to

VEON Investor Relations at ir@veon.com.

About VEON

VEON is a digital operator that provides converged connectivity

and digital services to nearly 160 million customers. Operating

across six countries that are home to more than 7% of the world’s

population, VEON is transforming lives through technology-driven

services that empower individuals and drive economic growth. VEON

is listed on NASDAQ and Euronext. For more information,

visit: https://www.veon.com.

Notice to readers: financial information

presented

VEON's results and other financial information presented in this

document are, unless otherwise stated, prepared in accordance with

International Financial Reporting Standards ("IFRS") based on

internal management reporting, are the responsibility of

management, and have not been externally audited, reviewed, or

verified. As such, you should not place undue reliance on this

information. This information may not be indicative of the actual

results for any future period.

Notice to readers: impact of the war in

Ukraine

The ongoing war in Ukraine, and the resulting sanctions adopted

by the United States, member states of the European Union, the

European Union itself, the United Kingdom, Ukraine and certain

other nations, countersanctions and other legal and regulatory

responses, as well as responses by our service providers, partners,

suppliers and other counterparties, and the other indirect and

direct consequences of the war have impacted and, if the war, such

responses and other consequences continue or escalate, may

significantly impact our results and aspects of our operations in

Ukraine, and may significantly affect our results and aspects of

our operations in the other countries in which we operate. We are

closely monitoring events in Ukraine, as well as the possibility of

the imposition of further legal and regulatory restrictions in

connection with the ongoing war in Ukraine and any potential impact

the war may have on our results, whether directly or

indirectly.

Our operations in Ukraine continue to be affected by the war. We

are doing everything we can to protect the safety of our employees,

while continuing to ensure the uninterrupted operation of our

communications, financial and digital services.

Disclaimer

VEON's results and other financial information presented in this

document are, unless otherwise stated, prepared in accordance with

International Financial Reporting Standards ("IFRS") and have not

been externally reviewed and audited. The financial information

included in this document is preliminary and is based on a number

of assumptions that are subject to inherent uncertainties and

subject to change. The financial information presented herein is

based on internal management accounts, is the responsibility of

management and is subject to financial closing procedures which

have not yet been completed and has not been audited, reviewed or

verified. Certain amounts and percentages that appear in this

document have been subject to rounding adjustments. As a result,

certain numerical figures shown as totals, including those in the

tables, may not be an exact arithmetic aggregation of the figures

that precede or follow them. Although we believe the information to

be reasonable, actual results may vary from the information

contained above and such variations could be material. As such, you

should not place undue reliance on this information. This

information may not be indicative of the actual results for the

current period or any future period.

This document contains “forward-looking statements”, as the

phrase is defined in Section 27A of the U.S. Securities Act of

1933, as amended, and Section 21E of the U.S. Securities Exchange

Act of 1934, as amended. These forward-looking statements may be

identified by words such as “may,” “might,” “will,” “could,”

“would,” “should,” “expect,” “plan,” “anticipate,” “intend,”

“seek,” “believe,” “estimate,” “predict,” “potential,” “continue,”

“contemplate,” “possible” and other similar words. Forward-looking

statements include statements relating to, among other things,

VEON’s plans to implement its strategic priorities, including

operating model and development plans; anticipated performance,

including VEON’s growth trajectory and ability to generate

sufficient cash flow; VEON’s intended expansion of its digital

experience including through technologies such as artificial

intelligence; VEON’s assessment of the impact of the war in

Ukraine, including related sanctions and counter-sanctions, on its

current and future operations and financial condition; VEON’s

assessment of the impact of the political conflict in Bangladesh;

future market developments and trends; operational and network

development and network investment, including expectations

regarding the roll-out and benefits of 3G/4G/LTE networks, as

applicable; spectrum acquisitions and renewals; the effect of the

acquisition of additional spectrum on customer experience; VEON’s

intended delisting from Euronext Amsterdam; VEON’s planned HQ

relocation to the Dubai International Financial Centre in the

United Arab Emirates; VEON’s ability to realize the acquisition and

disposition of any of its businesses and assets and to execute its

strategic transactions in the timeframes anticipated, or at all;

VEON’s ability to realize financial improvements, including an

expected reduction of net pro-forma leverage ratio following the

successful completion of certain dispositions and acquisitions; its

dividends; and VEON’s ability to realize its targets and commercial

initiatives in its various countries of operation.

The forward-looking statements included in this document are

based on management’s best assessment of VEON’s strategic and

financial position and of future market conditions, trends and

other potential developments. These discussions involve risks and

uncertainties. The actual outcome may differ materially from these

statements as a result of, among other things: further escalation

in the war in Ukraine, including further sanctions and

counter-sanctions and any related involuntary deconsolidation of

our Ukrainian operations; demand for and market acceptance of

VEON’s products and services; our plans regarding our dividend

payments and policies, as well as our ability to receive dividends,

distributions, loans, transfers or other payments or guarantees

from our subsidiaries; continued volatility in the economies in

VEON’s markets; governmental regulation of the telecommunications

industries; general political uncertainties in VEON’s markets;

government investigations or other regulatory actions; litigation

or disputes with third parties or regulatory authorities or other

negative developments regarding such parties; the impact of export

controls and laws affecting trade and investment on our and

important third-party suppliers' ability to procure goods, software

or technology necessary for the services we provide to our

customers; risks associated with our material weakness in internal

control over financial reporting; risks associated with data

protection or cyber security, other risks beyond the parties’

control or a failure to meet expectations regarding various

strategic priorities, the effect of foreign currency fluctuations,

increased competition in the markets in which VEON operates and the

effect of consumer taxes on the purchasing activities of consumers

of VEON’s services.

Certain other factors that could cause actual results to differ

materially from those discussed in any forward-looking statements

include the risk factors described in VEON’s Annual Report on Form

20-F for the year ended 31 December 2023 filed with the U.S.

Securities and Exchange Commission (the “SEC”) on 17 October 2024

and other public filings made from time to time by VEON with the

SEC. Other unknown or unpredictable factors also could harm our

future results. New risk factors and uncertainties emerge from time

to time and it is not possible for our management to predict all

risk factors and uncertainties, nor can we assess the impact of all

factors on our business or the extent to which any factor, or

combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements.

Under no circumstances should the inclusion of such forward-looking

statements in this document be regarded as a representation or

warranty by us or any other person with respect to the achievement

of results set out in such statements or that the underlying

assumptions used will in fact be the case. Therefore, you are

cautioned not to place undue reliance on these forward-looking

statements. The forward-looking statements speak only as of the

date hereof. We cannot assure you that any projected results or

events will be achieved. Except to the extent required by law, we

disclaim any obligation to update or revise any of these

forward-looking statements, whether as a result of new information,

future events or otherwise, after the date on which the statements

are made, or to reflect the occurrence of unanticipated events.

Furthermore, elements of this document contain or may contain,

“inside information” as defined under the Market Abuse Regulation

(EU) No. 596/2014.

Contact Information

VEON

Investor Relations

Faisal Ghori

ir@veon.com

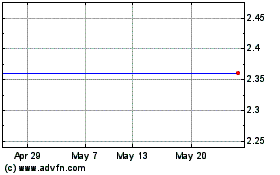

Veon (LSE:0RO7)

Historical Stock Chart

From Jan 2025 to Feb 2025

Veon (LSE:0RO7)

Historical Stock Chart

From Feb 2024 to Feb 2025