Coking Coal Prices To Rise As Supplies Likely To Remain Tight - Analysts

19 January 2011 - 1:09AM

Dow Jones News

Coking coal supplies are likely to remain tight for another

three months and prices may rise by a third from about $300 a

metric ton now after floods in Australia's Queensland state hit

output of the key steelmaking raw material, industry analysts said

Tuesday.

Mines in Queensland supply two-thirds of the most-valued hard

coking coal traded in the global seaborne market and they are

unlikely to return to full-scale operations in the next three

months, Managing Editor Marian Hookham of Energy Publishing's

Australian company said at the Global Steel 2011 conference in New

Delhi.

Six million tons of coking coal production has been lost in

January alone, Hookham said. "We are looking at a severe situation

at the moment."

Supplies of coking coal--which is mixed with iron ore in blast

furnaces to produce steel--are highly dependent on coalfields in

Queensland. Seven of the biggest coking coal producers--BHP

Billiton Ltd. (BHP), Xstrata PLC. (XTA.LN), Rio Tinto PLC (RIO),

Anglo American PLC. (AAL.LN), Peabody Energy Corp. (BTU),

Wesfarmers Ltd. (WES.AU) and Macarthur Coal Ltd. (MCC.AU)--have

declared force majeure on parts of their production in Australia

over the past month.

Mines accounting for nearly a quarter of Australia's annual

333.4 million ton coal production have announced production

problems due to floods.

Energy Consultant Wood Mackenzie said the affected mines account

for 55% of Australia's coal exports, and 80% of the affected stocks

is of coking coal.

Arun Kumar Jagataramka, chairman of India's Gujarat NRE Coke

Ltd. (512579.BY), which owns two coal mines in Australia, estimated

the coking coal production loss at 15 million-20 million tons until

now due to the floods.

The full impact of the production loss is unlikely to be felt

for some weeks as Asian steel mills have stockpiled large volumes

of the material in advance and Australian mines and ports are

working through their own stockpiles.

Still, prices have started rising.

"I won't be surprised if hard coking coal prices touch $400 a

ton," Jagatramka said, adding that prices have already reached $300

a ton. They were about $200 a ton before the floods.

A Dow Jones Newswires poll of six commodity analysts suggested

that quarterly hard coking coal contracts would settle at $308 a

ton for deliveries in the second quarter of 2011, while spot coking

coal prices are likely to go above $400 a ton.

-By Arpan Mukherjee, Dow Jones Newswires; 91-11-4356-3310;

arpan.mukherjee@dowjones.com

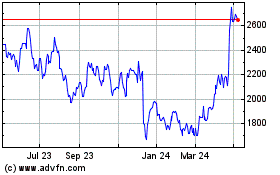

Anglo American (LSE:AAL)

Historical Stock Chart

From Jan 2025 to Feb 2025

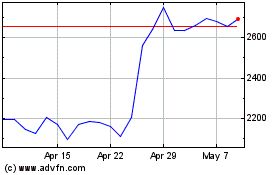

Anglo American (LSE:AAL)

Historical Stock Chart

From Feb 2024 to Feb 2025