Aston Martin 2022 Pretax Loss Widened as Pound Weakens Against Dollar

01 March 2023 - 7:04PM

Dow Jones News

By Kyle Morris

Aston Martin Lagonda Global Holdings PLC said Wednesday that it

pretax loss widened for 2022 as it booked a hit from the weakening

of the U.K. pound against the U.S. dollar.

The luxury car maker posted a widened pretax loss of 495.0

million pounds ($595.1 million) compared with a loss of GBP213.8

million a year before. It booked a GBP156 million negative noncash

forex revaluation of U.S. dollar-denominated debt as the pound

weakened significantly against the dollar during the year.

Adjusted earnings before interest, taxes, depreciation and

amortization was GBP190.2 million compared with GBP137.9 million a

year earlier. The increase was driven by higher revenue and gross

profit, partially offset by higher reinvestment into brand,

marketing and new product launch activities, as well as

inflation.

Revenue was GBP1.38 billion compared with GBP1.10 billion in

2021.

Total wholesales increased 4% to 6,412 from 6,178 in 2021.

For 2023, the company expects wholesale volume growth to around

7,000, and up to an around 20% adjusted Ebitda margin.

"We delivered in line with expectations, took actions to address

the short-term impacts of supply-chain issues, and continued to

make progress in a number of key areas that will support our

ability to meet strong customer demand and deliver our growth

ambitions," Chief Executive Amedeo Felisa said.

Write to Kyle Morris at kyle.morris@dowjones.com

(END) Dow Jones Newswires

March 01, 2023 02:49 ET (07:49 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

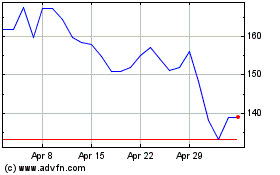

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From Apr 2023 to Apr 2024