Heads of Terms agreed for US$35 million Revolving Credit Facility

02 July 2024 - 4:00PM

UK Regulatory

Heads of Terms agreed for US$35 million Revolving Credit Facility

Toronto, Ontario, July 02, 2024 (GLOBE NEWSWIRE)

-- (“Amaroq Minerals” or the

“Company”)

Heads of Terms agreed for US$35 million

Revolving Credit Facility

New agreement replaces undrawn

US$18.5 million facility for construction

activities

TORONTO, ONTARIO – 2 July 2024 – Amaroq Minerals

Ltd. (AIM, TSXV, NASDAQ Iceland: AMRQ), an independent mine

development company with a substantial land package of gold and

strategic mineral assets in Southern Greenland, is pleased to

announce that it has agreed heads of terms, subject to final

documentation, with Landsbankinn for US$35 million in

three Revolving Credit Facilities (the "Facilities"), securing a

substantial increase and extension to its current debt

facilities.

Eldur Olafsson, Amaroq CEO,

commented:

“We are very pleased to have successfully

arranged a substantial increase and extension of our currently

undrawn debt financing package with Landsbankinn. In addition to

simplifying the structure of our debt package under one single

agreement at more favourable rates, the new Facilities strengthen

our liquidity and provide us with further financial flexibility for

years to come.

“With a long-term debt agreement now secured

for general purposes, we are committed to maintaining a strong

capital management plan as we progress the development of our

cornerstone Nalunaq project in South Greenland towards First Gold

this year.”

Highlights

- The Financing replaces the

previously undrawn credit facilities, simplifying the structure of

the debt package and strengthens liquidity for the Company,

increasing financial flexibility.

- Amaroq has signed term sheets for

a US$35 million debt financing package with Landsbankinn

consisting of:

- US$28.5 million facility with a

margin of 9.5% per annum, reducing to 7.5% once the full amount has

been drawn and the Company’s cumulative EBITDA over a three month

period exceeds CAD 6 million. This facility replaces the Company’s

existing revolving credit facilities entered into on 1 September

2023, but not the convertible debt facilities. US$18.5 million of

the facility is to be used towards the completion of the Nalunaq

development with the balance available for general corporate

purposes.

- US$6.5 million facility with a

margin of 7.5% per annum, available for general corporate purposes

once all other facilities have been fully drawn.

- The Facilities have a 1.5%

arrangement fee, a 0.4% commitment fee on unutilised amounts, and

an expected maturity date of 1 October 2026.

- The Facilities will be subject to

certain ongoing covenant tests, further detail of which will be

provided on closing of definitive documentation.

- Amaroq will finalise the

Facilities’ legally binding documentation and expects to be in a

position to sign binding documents before the end of the year. The

Company’s currently undrawn US$28.5 debt facilities will remain in

place until this time.

- The final agreement with

Landsbankinn will be finalised in agreement with current debt

holders, which include Fossar Investment Bank, GCAM LP, JLE

Property Ltd., First Pecos LLC and Linda Investments Limited.

Enquiries:

Amaroq Minerals Ltd.

Eldur Olafsson, Executive Director and CEO

eo@amaroqminerals.com

Eddie Wyvill, Corporate Development

+44 (0)7713 126727

ew@amaroqminerals.com

Stifel Nicolaus Europe Limited (Nominated Adviser and

Joint Broker)

Callum Stewart

Varun Talwar

Simon Mensley

Ashton Clanfield

+44 (0) 20 7710 7600

Panmure Liberum (UK) Limited (Joint Broker)

Hugh Rich

Dougie Mcleod

Scott Mathieson

Kieron Hodgson

+44 (0) 20 7886 2500

Camarco (Financial PR)

Billy Clegg

Elfie Kent

Charlie Dingwall

+44 (0) 20 3757 4980

For Company updates:

Follow @Amaroq_minerals on X (Formerly known as Twitter)

Follow Amaroq Minerals Inc. on LinkedIn

Further Information:

About Amaroq Minerals

Amaroq Minerals' principal business

objectives are the identification, acquisition, exploration, and

development of gold and strategic metal properties in South

Greenland. The Company's principal asset is a 100% interest in the

past producing Nalunaq Gold mine which is due to go into production

towards the end of 2024. The Company has a portfolio of gold and

strategic metal assets in Southern Greenland covering the two known

gold belts in the region as well as advanced exploration projects

at Stendalen and the Sava Copper Belt exploring for Strategic

metals such as Copper, Nickel, Rare Earths and other minerals.

Amaroq Minerals is continued under the Business Corporations Act

(Ontario) and wholly owns Nalunaq A/S, incorporated under the

Greenland Public Companies Act.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Inside Information

This announcement contains inside information

for the purposes of Article 7 of the UK version of Regulation (EU)

No. 596/2014 on Market Abuse ("UK MAR"), as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018,

and Regulation (EU) No. 596/2014 on Market Abuse ("EU MAR").

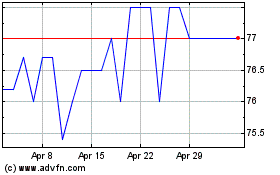

Amaroq Minerals (LSE:AMRQ)

Historical Stock Chart

From Oct 2024 to Nov 2024

Amaroq Minerals (LSE:AMRQ)

Historical Stock Chart

From Nov 2023 to Nov 2024