TIDMAST

RNS Number : 7424Y

Ascent Resources PLC

18 January 2022

18 January 2022

Ascent Resources plc

("Ascent" or the "Company")

ESG Strategy Update, Operational Update and GBP0.6m Placing

Ascent Resources Plc (LON: AST), the onshore Caribbean, Hispanic

American and European focused natural resources company, is pleased

to announce an update on its ESG Metals strategy, introducing Peru

as its primary target geography alongside the signature of a Joint

Venture agreement with Peru-based Blanco Safi SAC to collaborate on

the identification and subsequent development of precious and base

metal rich tailing and processing operations. The Company also

announces it has raised gross proceeds of GBP0.6m by way of an

issue of 18,181,818 new ordinary shares ('Placing Shares') at 3.3

pence per Placing Share ("Placing Price").

Highlights:

- Peru introduced as primary target geography for new ESG Metals strategy

- Joint Venture collaboration agreement with Blanco Safi SAC,

focused on originating ESG Precious Metals processing transactions

in Peru

- Slovenia non-recourse funding for Slovenia ECT and BIT damages claim expected to close shortly

- Placing of GBP0.6m at a Placing Price of 3.3p (nil discount to closing bid price)

ESG Metals Strategy Update and new Peruvian Joint Venture

In the Company's announcement of 11 February 2021 the Company

set out its ESG Metals strategy, which focuses on secondary mining

and recovery opportunities consistent with global Environmental,

Social and Governance ('ESG') principles. The company expects that

these opportunities will typically involve the reclassification,

through highly efficient recovery techniques, of surface stockpiled

mining waste (previously viewed as a liability for mining

companies) as a valuable asset for processing/reprocessing ahead of

commercial sale to off-takers and/or other third-party buyers.

Whilst the Company continues to evaluate a number of ESG Metal

transactions across Latin and Hispanic America, it has now

identified Peru as its primary target geography. Peru is widely

recognised as one of the largest and most diversified mineral

producers with some of the most extensive reserves in the world

with mining the most important sector in the Peruvian economy (some

10% of national GDP). Peru is currently the world's second largest

Copper and Silver producer and Latin America's largest Gold, Zinc,

Tin and Lead producer.

Peru's Long-Term Credit Rating is rated as BBB by most agencies,

which is amongst the strongest in the region. The country also

benefits from a long history of mining , a robust mining legal

framework and a significant pool of local expertise. Most recently,

the Country enacted a new law that extends the process of

formalisation of artisanal miners to 31 December 2024 alongside a

law that establishes a national policy for small-scale and

artisanal mining.

The Company sees significant opportunity for attractive entry

points in mining following the global pandemic which has triggered

international capital flight and significant capital constraints

for small-scale miners. The Company therefore initially expects to

focus its attention on small-scale operations (up to 350 tpd),

which the Company considers affordable, of an efficient operational

scale and which have multiple local tax and permitting

benefits.

To accelerate its entry into Peru, the Company has today signed

a Joint Venture agreement with Blanco Safi SAC ("Blanco"), based in

Lima. Blanco was founded in 2010 and is a Peruvian registered

professional investment manager which arranges and invests

discretionary fund and third party investment monies in a variety

of Peruvian businesses, where it currently manages over $150 M in

assets, including specifically a number of direct investments in

Peru's small-scale mining sector. The Blanco team has over 30 years

experience in the banking, finance, mine and resource sectors and

is present across offices in five regions throughout Peru,

consequently Blanco have access to a number of high quality

precious metal small-scale mineral processing operations throughout

Peru.

The Joint Venture will focus its attention initially on the

identification, screening and then subsequent negotiation and

potential acquisition of small-scale yet sustainable ESG metals

processing businesses in Peru, ideally adjacent to surface

stockpiled materials for processing. Blanco and the Company already

have a number of attractive prospective leads, as well as an active

network in the small and medium scale miner sector of Peru. Further

announcements will be made as appropriate.

Slovenia Dispute and Damages Claim

The Company anticipates that the completion of the conditions to

the binding damages-based agreement appointing Enyo Law LLP to

represent it in its dispute with the Republic of Slovenia, as

announced 8 November 2021, will take place shortly. Following

completion, the Company and its legal advisor will immediately

progress to compile and execute the required materials and

officially submit the arbitration claim pursuant to the protections

afforded to the Company and its operating subsidiary under the

Energy Charter Treaty and UK-Slovenia Bilateral Investment

Treaty.

Slovenia Operations

Whilst production from PG-10 and PG-11A continues to decline as

expected, the production is sold to local industrial buyers at

Central European Gas Hub daily spot prices. The Company and its JV

partners continue to discuss historic disputes, as previously

announced on 10 March and 11 October 2021, as well as the Company

challenging to renegotiate the monthly fixed cost fee requested by

a service provider (a related party to the Company's JV partner)

which were agreed in 2013 when the project contemplated initial

production levels which were significantly higher than the current

production levels (which have been stifled due to the inability to

mechanically re-stimulate the wells, and which forms a part of the

Company's dispute with the Republic of Slovenia).

The JV partner, who is the Concession License holder for the

Petisovci field, has filed the required materials, ahead of the

required deadline, to be granted an automatic 18-month concession

extension pursuant to Article 11 of the Act on Intervention

Measures implemented in Slovenia to assist the economy in

mitigating the consequences of the COVID-19 pandemic. Accordingly,

the concession expiry date will now be 28 November 2023. The

Company and its JV partner are continuing their workstreams to

progress the formal long-term extension of the concession which is

now expected to be finalised early next year.

New Funding & Issue of Equity

The Company is pleased to announce that it has raised gross

proceeds of GBP0.6m to fund its continued working capital

requirements and wider business development activities as it

continues to execute on its ESG Metals growth strategy.

The Company has today raised total gross new equity proceeds of

GBP0.6m by way of issue of 18,181,818 Placing Shares each with a

nominal value of 0.5 pence per share, to new and existing

shareholders, at a Placing Price of 3.3 pence, representing a nil

discount to the closing bid price. The subscribers for the new

equity shall each receive one new equity warrant for each Placing

Shares subscribed for, with each warrant being exercisable into one

new ordinary share at any time over the next two years by paying a

warrant exercise price of 5 pence per new warrant share. The

Company is also issuing 818,182 Fee Warrants in connection with

costs of the fund raising. The Company has also agreed to satisfy a

GBP10,000 Consultant Invoice with the issue of GBP10,000 worth of

new equity on the same terms as the Placing. The Company has

therefore agreed to issue a further 303,030 Consultancy Shares.

Align Research Limited, who are a substantial shareholder of

Ascent, have subscribed for GBP50,000 of the new equity issue and

this transaction constitutes a related party transaction pursuant

to the AIM Rules for Companies. The independent directors (being

all of the directors), having consulted with WH Ireland Limited,

consider the transaction to be fair and reasonable insofar as the

Company's shareholders are concerned.

Following the placing and pursuant to the terms of the 3,600,000

Warrants issued to RiverFort in December 2021, RiverFort have

agreed to waive the right to have the exercise price reset to the

Placing Price and the Company has instead agreed with RiverFort for

their December 2021 Warrants to be reset to the placing warrant

price of 5 pence per warrant share and in compensation for this

agreement the Company has agreed to issue RiverFort with 1,000,000

Warrants on the same term as the placing warrants.

Admission and Total Voting Rights

Application has been made to the London Stock Exchange for the

Placing Shares and Consultancy Shares to be admitted to trading on

AIM ("Admission") and it is expected that such Admission will occur

at 8.00 a.m. on 27 January 2022 . The Placing and Consultancy

Shares will be issued credited as fully paid and will rank in full

for all dividends and other distributions declared, made or paid

after the admission of the Placing and Consultancy Shares,

respectively and will otherwise be identical to and rank on

Admission pari passu in all respects with the existing Ordinary

Shares. The Placing and Consultancy Shares are not being made

available to the public and are not being offered or sold into any

jurisdiction where it would be unlawful to do so.

Following Admission of the Placing Shares and Consultancy

Shares, the Company will have 127,861,652 Ordinary Shares in issue,

none of which will be held in treasury. Accordingly, the total

number of voting rights in the Company will be 127,861,652 and

shareholders may use this figure as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change to their interest in, the

Company under the FCA's Disclosure Guidance and Transparency

Rules.

Andrew Dennan, CEO, comments; "I am delighted to announce our

joint venture with Blanco Safi. Peru offers huge potential for our

ESG metals strategy and our relationship with our partner will

provide us with both market insight and local access to

transformative precious metals processing opportunities. In

addition, today's fundraising reinforces our financial platform as

we look to build the business materially this year."

Enquiries:

Ascent Resources plc Via Vigo Communications

Andrew Dennan

WH Ireland, Nominated Adviser & Broker

James Joyce / Sarah Mather 0207 220 1666

Novum Securities, Joint Broker

John Belliss 0207 399 9400

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBRMBTMTIBTJT

(END) Dow Jones Newswires

January 18, 2022 02:00 ET (07:00 GMT)

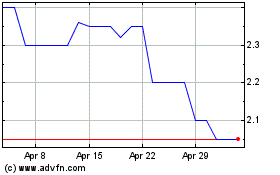

Ascent Resources (LSE:AST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ascent Resources (LSE:AST)

Historical Stock Chart

From Apr 2023 to Apr 2024