TIDMATM

RNS Number : 4449T

Andrada Mining Limited

20 March 2023

20 March 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 (MAR) as in force in

the United Kingdom pursuant to the European Union (Withdrawal) Act

2018. Upon the publication of this announcement via Regulatory

Information Service (RIS), this inside information will be in the

public domain.

Andrada Mining Limited

("Andrada" or the "Company")

Quarterly, FY 2023 production and Company update

Lithium development on track and production capacity

significantly increased.

Andrada Mining Limited (AIM: ATM), an African technology metals

mining company with a portfolio of mining and exploration assets in

Namibia, provides an unaudited production update for the Uis Mine

("Uis") for its fourth quarter ("Q4") and full financial year ended

28 February 2023 ("FY 2023").

Highlights

Lithium

-- Anticipated completion of the lithium bulk-testing pilot facility in June 2023.

-- Metallurgical testwork done by Geolabs Global, an independent

test facility in South Africa has identified a process that could

produce a lithium concentrate suitable for buyers' specifications

in industrial and battery feedstock markets.

-- Drilling on the ML129 licence area (B1C1 pegmatites), to

investigate the visible spodumene mineralisation, commenced in

January 2023.

-- Field mapping of drill targets on the ML133 licence area (Nai Nais pegmatites) finalised.

-- Detailed exploration update scheduled for release in June 2023.

-- Andrada is exploring several options for achieving early

lithium revenues in the second half of the 2023 calendar year

including concentrate production from the bulk pilot plant.

Operations

-- Record quarterly production of 361 tonnes of tin concentrate

in FY Q4 2023, containing 214 tonnes of tin metal.

-- 19% increase in tin concentrate production year-on-year

("YoY") to 960 tonnes (FY 2022: 804 tonnes).

-- 18% increase in contained tin to 586 tonnes (FY 2022: 496 tonnes).

-- Lowest ever quarterly all-in sustaining costs ("AISC") at USD

18,236 per tonne of contained tin in Q4 2023 .

-- Full year AISC fell by 9% to USD 24,939 YoY.

-- Commencement of confirmatory drilling in February 2023 to

upgrade historic resources on proximal pegmatites.

Financing

-- Significant progress towards fulfilling the precedent

conditions for the Orion Resource Partners ("Orion") and the

Development Bank of Namibia ("DBN") financing.

-- Cash balance at the end of February 2023 increased by 16% to

GBP 8.6 million (USD 10.3 million) from GBP 7.4 million (USD 9.9

million) on 28 February 2022.

Management restructuring

-- Appointment of Frans Van Daalen as Chief Strategy Officer

("CSO") to drive business development strategy, with a focus on

accelerating the lithium project and Chris Smith as the Chief

Operations Officer ("COO"), both non-board positions.

Operational guidance for the 12 months ending 29 February 2024

("FY 2024")

-- Tin concentrate production guidance of between 1,400 tonnes

and 1,500 tonnes, an expected increase of between 45% to 56% YoY,

due to the plant expansion ramp-up.

-- Average operating cash costs excluding selling expenses

defined as C1 operating cash costs are projected to be between

USD17,000 and USD20,000. These are costs within management's

control that are expected to remain relatively flat from levels in

Q4 2023 (post expansion) and subject only to exchange rate

fluctuations.

-- Average operating cash cost per tonne produced including

selling expenses (shipping, freight, and royalties) projected to be

between USD20, 000 and USD25,000 and AISC between USD25,000 and

USD30,000. These costs are expected to rise mainly because of a

temporary increase in stripping rates for the V1/V2 pit and the

inclusion of the 4.5% royalty costs associated with the proposed

Orion transaction. The pushback width in the pit has increased from

approximately 50 metres to 75 metres in line with the expanded

capacity and the provision of safer and more efficient

operations.

The guidance excludes potential lithium and tantalum revenues.

Management will provide guidance following the commissioning of the

lithium pilot plant and tantalum circuit expected in June 2023.

Anth ony Viljoen, Chief Executive Officer, commented:

"The exceptional fourth quarter production performance is a

demonstration of the execution capability of Andrada's management

team. We have made excellent progress in realising the significant

economies of scale inherent in this uniquely large ore body. We

believe these economies of scale and the bringing online of lithium

production, will rapidly enhance the value of this outstanding

asset over the coming months.

The imminent completion of the bulk testing pilot facility will

enable Andrada to expedite the production of lithium, which could

place the Company as one of the foremost lithium producers on AIM.

Concurrent drilling programmes on the proximal pegmatites within

the ML 134 licence area aim to increase the size and confidence of

this resource. Furthermore, the recently commenced drilling

programmes on adjacent licence areas are designed to confirm our

belief that the Erongo region is one of the emerging tech-metals

provinces globally. Andrada's significant first mover advantage is

its ability to capitalise on the existing proven operational

footprint.

The completion of an inaugural Sustainability Report paves the

way for Andrada to not only be a producer of metals for the green

transition but also play its role as a responsible and sustainable

resource company of the future."

Operational summary

Table 1: Uis Mine actual quarterly production and cost

performance

Description Unit Q1 FY Q2 FY Q3 Q4 FY FY FY YoY

2023 2023 FY 2023* 2023 2023 2022 % <DELTA>

Plant

availability % 89 89 73 90.4 86.8 88.1 2

------------ -------- -------- ---------- -------- -------- -------- -----------

Plant

utilisation % 78 69 63 81.1 66.3 68.7 4

------------ -------- -------- ---------- -------- -------- -------- -----------

Plant

processing

rate tph 99 100 107 125 106 99 7

------------ -------- -------- ---------- -------- -------- -------- -----------

Ore processed t 152,243 134,315 90,278 196,982 573,818 541,700 6

------------ -------- -------- ---------- -------- -------- -------- -----------

Feed grade % Sn 0.149 0.145 0.140 0.154 0.154 0.148 4

------------ -------- -------- ---------- -------- -------- -------- -----------

Tin concentrate t 239 214 145 361 960 780 23

------------ -------- -------- ---------- -------- -------- -------- -----------

Contained

tin in

concentrate t 152 133 87 214 587 482 22

------------ -------- -------- ---------- -------- -------- -------- -----------

Tin recovery % 67 69 68 71 68 60 13

------------ -------- -------- ---------- -------- -------- -------- -----------

Uis mine US$/t

operating contained

C1 cost(1) tin 17,624 22,903 30,907 14,761 19,762 21,839 10

------------ -------- -------- ---------- -------- -------- -------- -----------

Uis mine US$/t

operating contained

cash cost(2) tin 20,989 25,245 33,207 17,303 22,287 25,209 12

------------ -------- -------- ---------- -------- -------- -------- -----------

US$/t

Uis mine contained

AISC(3) tin 23,526 29,282 38,570 18,236 24,939 27,515 9

------------ -------- -------- ---------- -------- -------- -------- -----------

US$/t

Tin price contained

achieved tin 34,367 22,975 22,625 25,265 25,051 38,604 35

------------ -------- -------- ---------- -------- -------- -------- -----------

(1) C1 refers to operating cash costs per unit of production

excluding the selling expenses

(2) Operating cash cost is the C1 including selling expenses

(logistics, smelting and royalties), it excludes sustaining capital

expenditure associated with Uis Mine.

(3) All-in sustaining cost incorporates all costs related to

sustaining production as well as the capital expenditure associated

with developing and maintaining the Uis operation, including

pre-stripping waste mining costs.

* Production period includes a five - week shutdown of the

processing plant from 7 September 2022 - 13 October 2022 which was

required to complete the construction and commissioning of the

expanded crushing and tin concentrating circuits .

LITHIUM

Metallurgical testing update

The metallurgical test work programme is focussed on producing a

lithium concentrate suitable to both the industrial lithium market

and the battery feedstock market. Laboratory scale test work has

established three suitable technologies for beneficiating lithium

in the ore, namely DMS, flotation and sensor-based ore sorting.

Test results from Geolab Global, have repeatedly produced

high-grade petalite concentrate (+/- 90% petalite, > 4.0% Li O)

displaying low contaminant levels (< 0.05% Fe O , < 1.0%

alkalis). The Company is now conducting bulk scale DMS, flotation

and ore sorting test work to optimise metallurgical parameters and

to determine ore variability. The results of the bulk test work,

and trials at the lithium pilot plant, will inform a definitive

feasibility study for lithium expansion to the current processing

plant.

Lithium pilot plant and tantalum circuit construction on

schedule

The lithium pilot plant project is progressing to schedule, with

the completion of construction targeted for June 2023. The project

is approximately 60% complete with all long lead equipment ready

for shipment to the mine. The major plant equipment is being

manufactured off-site and the earthworks have been completed. The

tantalum circuit construction is approximately 50% complete and on

track for full completion in June 2023.

Meanwhile, several early revenue options are being evaluated

such as potential output of a lithium concentrate from the lithium

bulk testing facility.

Progress on the lithium exploration programme over the mining

licences

Mining licence 129: B1 C1 pegmatites

Multiple exploration programmes were initiated during Q4. A

drill programme was initiated on the ML129 mining licence during

January 2023 to investigate the existence of spodumene

mineralisation within the B1 and C1 pegmatites. This on-going

programme comprises 17 diamond drill holes and to date all

completed holes have yielded visual confirmation of spodumene

within the pegmatite intersections. The analysis of drill core will

begin immediately after the completion of the programme, targeted

for end of March 2023.

Mining licence 133: Nai Nais pegmatites

A first-pass Reverse Circulation drilling programme will

commence in April 2023 on the Nai-Nais (ML133) licence area to

investigate the subsurface continuation of lithium and tin

mineralisation identified during the 2022 calendar year mapping and

sampling programme. An infill surface exploration programme started

in January 2023 to enhance the data resolution and to confirm the

continuity of lithium mineralisation along an identified strike

length of 6km.

OPERATIONS

Successful modular expansion of existing operations

Tin concentrate production increased by 19% to 960 tonnes

resulting in an 18% increase of contained tin to 586 tonnes YoY

confirming the success of the mine expansion. This double-digit

increase was achieved despite the requisite plant shutdown that

resulted in 35% loss of production in the third quarter (Q3") FY

2023. Production capacity has increased by approximately 70%

because of the expansion programme. The significantly higher

tonnage output reduced operating costs and AISC by 12% and 9%

respectively YoY, confirming the view that large scale bulk mining

at Uis is amenable to favourable economies of scale.

Resource expansion

The Uis proximal drilling campaign, on the ML134 mining licence

commenced in February 2023 and aims to validate the historical

drill information and increase confidence in the mineral resource

classification for tin. This campaign will also provide initial

information on the lithium and tantalum endowment of these

pegmatites. Approximately 78 drill holes have been planned for an

initial programme that targets the southern cluster, following

which an investigation will target the pegmatites north of the V1V2

resource. An improvement in the mineral resource confidence

classification will allow for the inclusion of the proximal

pegmatites into the techno-financial valuation of the project.

FINANCE

Cash balance

The combined cash and cash equivalent balance on 28 February

2023 was GBP 8.6 million (USD 10.3 million), provides sufficient

capital for the Company to execute its near-term capital

commitments for the pilot facility and tantalum circuit, whilst in

the interim the various conditions precedent for the additional

financing are being completed.

Orion Resource Partners ("Orion") and Development Bank of

Namibia ("DBN") funding update

The conditional finance arrangements for Orion and DBN,

previously announced on 5 July 2022, 15 September 2022, and 17

November 2022, have been combined into a single legal workstream to

reduce the timeline to financial closure. The Company still expects

to complete the process by the end of May 2023. Further updates

will be provided in due course.

EXECUTIVE STRUCTURE

Structural changes to align with strategic intent.

Andrada has strengthened its management structure by appointing

Chris Smith as the Chief Operations Officer, taking over from Frans

Van Daalen, who has been appointed to lead the business development

strategy as the CSO from February 2023, both are non-board

positions.

Chris Smith is a qualified chemist with a career spanning over

36 years at various senior management levels in the mining and

metallurgical industries. He joined Andrada in 2020 as the General

Manager in charge of operations, during which time he successfully

ramped up production ahead of the scheduled timelines and improved

safety performance by 60%. Chris has significant experience in

process optimisation and a proven track record of stimulating

operational performance. In the past six months, he has surpassed

the targets for plant expansion and will be instrumental in

optimising the operational processes for the next level of

growth.

Frans Van Daalen is a qualified engineer with over 20 years of

operational and technical experience across multiple commodities.

He was a co-founder and director of VBKom, a mining and industrial

engineering consultancy for approximately 10 years. Frans joined

the Company at inception and is well placed to drive the Company's

development as a significant global lithium producer.

Glossary of abbreviations

AISC All in sustaining cost

FY Financial year for the period March to April

---------------------------------------------

GBP British pound sterling

---------------------------------------------

Sn Symbol for tin

---------------------------------------------

t Tonnes

---------------------------------------------

tph Tonnes per hour

---------------------------------------------

Glossary of terms

AISC Incorporates all costs related to sustaining production. Includes the sustaining capital

expenditure

associated with developing and maintaining the Uis operation such as unaudited stripping waste

mining costs.

Operating cash cost Excludes the unaudited sustaining capital expenditure associated with developing and

maintaining

the Uis operation.

------------------------------------------------------------------------------------------------

Andrada Mining Limited +27 (11) 268 6555

Anthony Viljoen, CEO

Sakhile Ndlovu, Head of Investor

Relations

Nominated Adviser +44 (0) 207 220 1666

WH Ireland Limited

Katy Mitchell

Corporate Advisor and Joint Broker

H&P Advisory Limited

Andrew Chubb

Jay Ashfield +44 (0) 20 7907 8500

Stifel Nicolaus Europe Limited +44 (0) 20 7710 7600

Ashton Clanfield

Callum Stewart

Varun Talwar

Tavistock Financial PR (United

Kingdom) +44 (0) 207 920 3150

Emily Moss

Catherine Drummond

Adam Baynes

_______________________________________________________________________________________

About Andrada Mining Limited

Andrada Mining Limited, formerly Afritin Mining Limited, is a

London-listed technology metals mining company with a vision to

create a portfolio of globally significant, conflict-free,

production and exploration assets. The Company's flagship asset is

the Uis Mine in Namibia, formerly the world's largest hard-rock

open cast tin mine.

Lithium laboratory test work completed during the 2022 calendar

year indicated a high-grade, ultra-low iron lithium petalite

concentrate. The test work to convert lithium petalite concentrate

to battery-grade lithium hydroxide was initiated with Nagrom, a

leading Australian processing company, and commercial engagements

with lithium petalite concentrate off - takers are on-going. An

exploration drilling programme is currently underway with the aim

of expanding the tin resource over the fourteen additional,

historically mined pegmatites, all of which occur within a 5 km

radius of the current processing plant. The Company has set a

mineral resource target of 200 Mt to be delineated within the next

5 years. The substantial mineral resource potential allows the

Company to consider economies of scale.

Andrada is managed by a board of directors with extensive

industry knowledge and a management team with deep commercial and

technical skills. Furthermore, the Company is committed to the

sustainable development of its operations and the growth of its

business. This is demonstrated by how the leadership team places

significant emphasis on creating value for the wider community,

investors, and other key stakeholders. Andrada has established an

environmental, social and governance system which has been

implemented at all levels of the Company and aligns with

international standards.

--

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDBGDXDGBDGXC

(END) Dow Jones Newswires

March 20, 2023 03:00 ET (07:00 GMT)

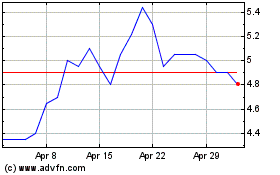

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Feb 2024 to Feb 2025