TIDMAV.

RNS Number : 4764V

Aviva PLC

10 August 2022

Page 1

News Release

10 August 2022

Aviva plc 2022 Interim Results Announcement

Continuing momentum with strong first half results demonstrating

benefits of diversified business model

Confident outlook for 2022 despite challenging market

backdrop

Further capital returns - anticipate launching share buyback

with our full year 2022 results

Solvency II Solvency II General insurance Operating 2022 interim

OFG(++) pro forma cover COR(++) profit(++,2) dividend

ratio(1)

GBP538m 213% 94.0% GBP829m 10.3p

+46% +27pp +2.4pp +14% +40%

HY21(3) : GBP369m 2021: 186% HY21(3) : 91.6% HY21(3) : GBP725m HY21: 7.35p

----------------- ---------------- ----------------- -----------------

Amanda Blanc, Group Chief Executive Officer, said:

"Sales are up, operating profit is higher, our financial

position is stronger. This has been an excellent six months for

Aviva.

Our scale and diversification give us resilience and

opportunity, enabling Aviva to withstand the challenging economic

climate. Our market leading positions and our unique ability to

look after a wide range of customers' needs are clear advantages

and have driven robust operating performance. Trading has been

encouraging across all our major businesses in insurance, wealth

and retirement.

Even so, we are very conscious of the pressures currently facing

many of our customers, especially the more vulnerable. In response

we have launched new, low cost, insurance products, and we are

increasing the range and amount of support we provide to

communities, businesses and our own people during this challenging

time.

Delivering for our shareholders is at the core of our strategy.

Our liquidity and capital position is extremely healthy and we are

declaring an interim dividend of 10.3p, in line with our full year

2022 dividend guidance of c.31.0p. We are increasingly confident in

Aviva's prospects and anticipate commencing additional returns of

capital to shareholders with our 2022 full year results."

Strong first half results demonstrating benefits of diversified

business model

-- Solvency II operating own funds generation(++) up 46% to

GBP538m (HY21(3) : GBP369m)

-- Operating profit(++,2) up 14% to GBP829m (HY21(3) :

GBP725m)

-- General insurance gross written premiums (GWP) up 6%(4) to

GBP4,694m (HY21(3) : GBP4,366m) with a strong 94.0% COR(++)

(HY21(3) : 91.6%)

-- UK & Ireland Life sales(5) up 4% to GBP16.8bn (HY21:

GBP16.2bn) with VNB(++) up 13% to GBP300m (HY21: GBP265m)

-- Solvency II return on equity(++) 10.9% (HY21(3,6) : 7.4%),

12.3% (HY21(3,6) : 8.8% ) excluding Heritage

-- Baseline controllable costs(++,7) down 2% to GBP1,342m

(HY21(3) : GBP1,372m) reflecting continued focus on efficiency

-- Cash remittances(++) of GBP798m (HY21(3) : GBP1,063m) in line

with our expectation and medium term target

-- IFRS loss after tax of GBP633m (HY21: GBP198m loss), largely

reflects adverse market movements, with no impact on capital or

cash remittances(++)

-- Interim dividend per share of 10.3p (HY21: 7.35p), up 40%, in

line with our dividend guidance for 2022

Capital position is strong - new share buyback anticipated with

full year 2022 results

-- Solvency II shareholder cover ratio(++) of 234% (2021: 244%)

and centre liquidity(++) (July 22) of GBP2.7bn (Feb 22:

GBP6.6bn)

-- Estimated Solvency II shareholder cover ratio pro forma(1)

for planned GBP1bn further debt reduction, pension scheme payment,

and the acquisition of Succession Wealth of 213%

-- Solvency II debt leverage ratio(++) of 30% (2021: 27%). We

expect this to return below 30% as we complete additional

deleveraging over time

-- Given our strong capital position and prospects, we

anticipate commencing a new share buyback programme with our 2022

full year results, subject to market conditions and regulatory

approval

-- Assuming a new buyback is agreed, its size will be determined

by the Board at year end and will take account of the financial

position at that time, as well as both the drivers of the capital

surplus (including the impact of market movements) and our

preference to return surplus capital regularly and sustainably

Footnotes are shown on page 2

Page 2

Continuing strong operating momentum into first half of 2022

-- Wealth showed resilience in challenging conditions with net

flows(++) of GBP5.0bn (HY21: GBP5.2bn). Workplace added 150,000 new

customers in the period, while our Advisor platform attracted the

2nd(8) highest net flows(++) in the market

-- Annuities & Equity release sales(5) up 12% to GBP2,762m

(HY21: GBP2,466m) and Solvency II operating OFG(++) up 18% to

GBP169m (HY21: GBP143m) driven by growth in BPAs and Equity

Release. Outlook remains positive with higher BPA volumes and

margins expected in H2

-- Protection & Health VNB(++) up 5% to GBP100m (HY21:

GBP95m) reflecting strong performance in Group Protection and

Health partly offset by higher interest rates which impacted

Individual Protection

-- UK & Ireland General Insurance GWP, up 5% to GBP2.8bn

(HY21: GBP2.7bn), and COR(++) of 95.6% (HY21: 93.6%). UK commercial

lines performed strongly with GWP up 12% while personal lines was

1% lower as we maintained pricing discipline to mitigate the impact

of claims inflation. We will continue to take the necessary actions

to price appropriately for the inflationary environment in the

second half

-- Canada GWP up 12% (6% at constant currency) to GBP1,854m

(HY21: GBP1,661m) and a COR(++) of 91.7% (HY21: 88.8%). We saw

excellent growth in both Commercial and Personal lines with GWP up

11% and 4% respectively at constant currency

-- Aviva Investors external net flows(++) recovered well in Q2

to GBP0.2bn in the first half (Q1 2022: GBP0.2bn net outflows),

however remain lower than the prior year (HY21: GBP1.1 billion)

given the volatile market conditions in the first half of 2022

-- International investments operating profit(++,2) flat at

GBP55m with sales(5) 8% lower due to lockdowns in China

Group financial performance Group financial strength

------------------------------------------------------------ ----------------------------------------

General Insurance Life new business IFRS loss for Solvency II Centre liquidity(++)

GWP sales(5) the period shareholder

cover ratio(++)

GBP4.7bn GBP17.4bn GBP(633)m 234% GBP2.7bn

+6%(4) +3% (219)% (10)pp GBP(3.9)bn

HY21(3) : GBP4.4bn HY21(3) : GBP16.9bn HY21: GBP(198)m FY21: 244% Feb 22: GBP6.6bn

------------------ ------------------- --------------- ----------------

Outlook

Our strong first half results reinforce our confidence in the

prospects and outlook for our business, as our strategy to

transform performance continues to build momentum. While

recognising the challenging economic backdrop, we remain well

positioned to drive growth and meet our Group targets.

In UK & Ireland Life we expect to see continued growth. We

anticipate higher BPA volumes in the second half as well as

improving margins. In Wealth and Protection & Health we expect

a continuation of first half trends for the remainder of the year.

We also expect the completion of our acquisition of Succession

Wealth during the second half.

In General Insurance, we expect the rating environment to remain

favourable in commercial lines, while in personal lines we will

continue to price appropriately to manage inflation.

We remain firmly focused on improving efficiency and are on

track to meet the first stage of our cost target to reduce baseline

controllable costs(++,7) by GBP300m (net of inflation) over

2018-22. We are continuing to execute the actions necessary to

deliver the upgraded target we set out in March to reduce costs by

GBP750m (gross of inflation) by 2024.

Cash remittances(++) remain on track to meet our target of

>GBP5.4bn cumulative (2022-24). Solvency II operating own funds

generation(++) also on track to meet our target of GBP1.5bn per

annum by 2024.

++ Denotes Alternative Performance Measures (APMs) and further

information can be found in the 'Other information' section | 1

Solvency II pro forma cover ratio is the estimated Solvency II

shareholder cover ratio at 30 June 2022 adjusted for GBP1bn further

debt reduction, pension scheme payment and acquisition of

Succession Wealth | 2 Operating profit represents Group adjusted

operating profit which is a non-GAAP APM. Operating profit is not

bound by the requirements of IFRS. Further details are included in

the 'Other information' section | 3 Comparatives presented are from

continuing operations | 4 Constant currency | 5 References to sales

represent present value of new business premiums (PVNBP) which is

an Alternative Performance Measure (APM) and further information

can be found in the 'Other information' section | 6 Following a

review of the basis of preparation of Group Solvency II Return on

Equity comparative for the six months ended 30 June 2021 has been

restated. See section '4.ii - Solvency II return on capital/equity'

for details | 7 Baseline controllable costs exclude strategic

investment, cost reduction implementation, IFRS 17 and other costs

not included in the 2018 costs savings target baseline | 8 Latest

data available as at Q1 2022 (Fundscape)

Page 3

Chief Executive's Overview

Overview

I'm pleased to report Aviva has had an excellent first half of

2022 despite the challenging environment.

Our strong first half performance is a timely reminder of the

benefits of Aviva's diversified, high quality and focused business

model and mix. This provides in-built resilience and opportunity

for the Group, allowing us to withstand difficult market

conditions. The Group is now focused on growing in those areas

where it has market leading positions and expertise, and where it

can generate attractive returns. Aviva is well balanced across its

insurance, wealth and retirement propositions in the UK, Ireland

and Canada.

Strong first half results

Profitability improved across the Group during the first half.

We are building clear momentum in our operating performance and we

have made progress against the financial targets we set out in

March.

Solvency II operating own funds generation (OFG), an important

measure of value creation at Aviva and one of our key targets, was

up 46% to GBP538 million (HY21: GBP369 million). We saw improved

volumes and margins in Bulk Purchase Annuities (BPAs), further

performance improvement in UK GI Commercial lines together with

increased GI investment returns, as well as lower Group interest

costs following our debt reduction actions.

Group adjusted operating profit(1) was also up, by 14%, to

GBP829 million.

Cash remittances to the Group centre of GBP798 million in the

first half were in line with our target for over GBP5.4 billion of

gross cash remittances over 2022-24, and this supported a strong

centre liquidity position of GBP2.7 billion as at end July.

In UK & Ireland Life we delivered robust sales(2) growth of

4% to GBP16.8 billion, with volumes in Annuities & Equity

Release up 12% and in Health & Protection up 6%. In our Wealth

business net flows of GBP5.0 billion represented 7%(3) of opening

assets under management, although were lower than last year due to

the challenging market conditions. UK&I Life value of new

business (VNB), a key measure of the profitability of new business,

was up 13% to GBP300 million, driven by a 50% increase in Annuities

& Equity Release as BPA margins improved versus the first half

of last year.

Trading momentum in General Insurance continued in the first

half, and we saw gross written premiums of GBP4.7 billion, an

increase of 6% at constant currency . Commercial Lines delivered

double digit premium growth with strong new business, rate

increases and high retention levels. Personal Lines premiums were

up 1% at constant currency, with UK Personal Lines down 1%

reflecting our resolute focus on returns in a difficult market. The

Group combined operating ratio (COR) was an excellent 94.0%

demonstrating our underwriting discipline and tight management of

claims inflation, with the 2.4pp increase versus the first half of

2021 reflecting a return to more normal claims frequency and

weather patterns.

External net flows in Aviva Investors recovered well in Q2 to

GBP0.2 billion in the first half (Q122: GBP0.2 billion net

outflows), however remain lower than the prior year (HY21: GBP1.1

billion) given the volatile market conditions in the first half of

2022. Overall, Aviva Investors saw total net outflows of GBP4.3

billion in the period reflecting expected outflows from internal

assets, mainly Heritage, and withdrawals by clients previously part

of the Group, mainly in France.

Our focus on cost efficiency continues. First half baseline

controllable costs(4) fell 2% to GBP1.3 billion as we maintained

our cost discipline despite the inflationary environment. We remain

on track to meet our GBP300 million (net of inflation) cost

reduction ambition by the end of this year. We are also very

focused on delivering our GBP750 million (gross of inflation)

ambition by 2024, although offsetting inflationary pressures will

determine how much falls through to the bottom line.

Finally, our balance sheet is strong. On a pro forma basis(5) ,

our Solvency II shareholder cover ratio was 213% at 30 June 2022

(with a headline Solvency II shareholder cover ratio of 234%),

benefitting from operating capital generation in the period as well

as positive market movements. Our asset portfolio is well

positioned with diversification across asset classes, strong credit

ratings, and low loan-to-value ratios in our commercial mortgage

portfolio.

Interim dividend and commitment to further capital returns

The Board of Directors has declared an interim dividend of 10.3

pence per share, up 40% (HY21: 7.35 pence), with a cost of c.GBP289

million (HY21: GBP286 million). This is consistent with our full

year 2022 dividend guidance of c.31.0 pence(6) (approximately

GBP870 million).

Given our strong capital position and prospects, we anticipate

commencing a new share buyback programme with the 2022 full year

results, subject to market conditions and regulatory approval.

Assuming a new buyback is agreed, its size will be determined by

the Board at year end and will take account of the financial

position at that time, as well as both the drivers of the capital

surplus (including the impact of market movements) and our

preference to return surplus capital regularly and sustainably.

Delivering Aviva's Promise

We aim to be a leading player in every major segment where we

operate. Where we are already number one, we plan to build further

on that position. Where we are not, we are pushing hard to get

there. We're focusing on four areas to make that a reality:

Customer: delivering leading customer experience and engagement.

Aviva already has the benefit of being the no.1 insurance customer

franchise in the UK. But we're aiming to go further, by enhancing

our digital capability to provide customers with a simpler, more

personalised offering, with the products they need, when and how

they need them. Our aim is to look after more customers and more of

their needs so that they stay with us for longer.

1 Operating profit represents Group adjusted operating profit

which is a non-GAAP APM. Operating profit is not bound by the

requirements of IFRS. Further details are included in the 'Other

information' section | 2 References to sales represent present

value of new business premiums (PVNBP) which is an Alternative

Performance Measure (APM) and further information can be found in

the 'Other information' section | 3 Net flows annualised as a

percentage of opening assets under management | 4 Baseline

controllable costs exclude strategic investment, cost reduction

implementation, IFRS 17 and other costs not included in the 2018

costs savings target baseline | 5 Solvency II pro forma shareholder

cover ratio is the estimated Solvency II shareholder cover ratio at

30 June 2022 adjusted for GBP1 billion further debt reduction,

pension scheme payment and acquisition of Succession Wealth | 6 The

Board has not approved or made any decision to pay any dividend in

respect of any future period

Page 4

We've been there for our customers during the first half. In

February the UK suffered three storms in a single week. We received

over 19,000 claims, so colleagues from across the business,

including in Canada, helped to process them in good time, settling

10% of claims on the day of notification. That's One Aviva in

action, making a real difference for our customers.

Growth : continued targeted growth in our priority areas across

the Group. We have great capabilities, partnerships, and market

positions, and we're ideally equipped to capitalise on big customer

trends.

In the first half we saw continued excellent growth across the

Group, including in our General Insurance businesses, in Protection

& Health and in Annuities & Equity Release. In Wealth,

where market conditions have been challenging, net flows have

remained strong. We're expanding revenue streams too, where there

are the right opportunities. For example Aviva Zero, our digital

motor insurer in the UK with in-built carbon offset feature, which

launched earlier this year, has now sold over 10,000 policies. Also

in the UK, we have just announced the acquisition of a high net

worth business from Azur, which will move us to number one in that

segment.

Efficiency: we are targeting top quartile efficiency and cost

reduction. That means reducing the number of old systems and

products, making it easier for customers and brokers to deal with

us, automating processes, and reducing our property footprint. Our

baseline controllable costs fell 2% in the first half despite the

inflationary pressures, demonstrating our firm grip on Aviva's cost

base.

Sustainability: continuing to lead the UK financial services

sector on sustainability and living up to our responsibilities to

people and the planet, changing the way we do business and using

our influence to help others do the same.

In May, our Sustainalytics ESG risk rating improved to 11.3, now

ranking Aviva 5th(1) out of 288 global insurers (up from 25th) and

ahead of all UK Financial Services peers. Importantly, we've been

supporting our colleagues, customers, and communities in the face

of economic pressures and the cost-of-living crisis. We have made

financial commitments to communities to provide advice and support

to vulnerable people and businesses, continued to provide

affordable but robust products and premium deferral options, and we

are making a one-off payment to help 7,000 of our colleagues.

Summary

Overall, Aviva is in excellent health and our strategy is

delivering results. We enter the second half of 2022 with

confidence and while we remain mindful of market and macro-economic

challenges, we are on track to meet all of our financial targets.

There is still much to do, but we expect to make continued good

progress to deliver Aviva's promise for our customers and

shareholders.

Amanda Blanc

Group Chief Executive Officer

9 August 2022

Other operating highlights

UK & Ireland

Life * Wealth - strong net flows of GBP5 billion (HY21:

GBP5.2 billion), pleasing performance in challenging

markets

* Workplace pensions - 150,000 net new customers. AUM

8% lower at GBP88.5 billion reflecting impact of

lower equities

* Adviser platform - #2(2) by net flows in the adviser

platform market with net flows GBP2.4 billion. Total

platform AUM 7% lower at GBP40.3 billion (2021:

GBP43.1 billion)

* Annuities - BPA sales(3) of GBP1.9 billion (HY21:

GBP1.6 billion), including GBP0.8 billion of Aviva

staff pension scheme

* Equity release - sales(3) up 27% amid heightened

market activity and introduction of a new proposition

* Group protection - sales(3) up 31% reflecting

excellent retention and new scheme wins

* Ireland Life - margin improvement with VNB up to

GBP16 million (HY21: GBP10 million) driven by

rationalised product offering

--------------- ------------------------------------------------------------

General

Insurance * UK commercial lines GWP up 12% to GBP1,430 million

(HY21: GBP1,280 million)

* UK personal lines GWP 1% lower to GBP1,198 million

(HY21: GBP1,213 million) as we took actions to

maintain pricing discipline

* Canada commercial lines GWP up 17% to GBP716 million

(HY21: GBP614 million), up 11% in constant currency

* Canada personal lines GWP up 9% to GBP1,138 million

(HY21: GBP1,047 million), up 4% in constant currency

--------------- ------------------------------------------------------------

Aviva Investors

* First phase of the transition to a new scalable real

assets operating model with loan servicing

successfully outsourced to Mount Street

--------------- ------------------------------------------------------------

1 As at 9 August 2022 | 2 Latest data available as at Q1 2022

(Fundscape) | 3 References to sales represent present value of new

business premiums (PVNBP) which is an Alternative Performance

Measure (APM) and further information can be found in the 'Other

information' section

Page 5

Full

6 months 6 months Sterling year

2022 2021 % 2021

Cash remittances(++,R) and Centre liquidity(++) GBPm GBPm change GBPm

------------------------------------------------ -------- -------- -------- -----

UK, Ireland, Canada and Aviva Investors 779 1,052 (26)% 1,651

International investments(1) 19 11 73% 11

------------------------------------------------ -------- -------- -------- -----

Cash remittances(++) from continuing operations 798 1,063 (25)% 1,662

Centre liquidity(++) as at end of July/February 2,735 2,817 (3)% 6,644

------------------------------------------------ -------- -------- -------- -----

Full

6 months 6 months Sterling year

2022 2021 % 2021

Profit GBPm GBPm change GBPm

--------------------------------------------------- -------- -------- -------- -----

UK, Ireland, Canada and Aviva Investors 1,040 984 6% 2,231

International investments(1) 55 55 -% 97

Corporate centre costs and Other operations (138) (134) (3)% (379)

Group debt costs and other interest (128) (180) 29% (315)

--------------------------------------------------- -------- -------- -------- -----

Adjusted operating profit(++,R) from continuing

operations(2) 829 725 14% 1,634

IFRS (loss)/profit for the period(3) (633) (198) (219)% 2,036

Operating earnings per share (as reported)(4,++,R) 19.0p 21.0p (10)% 43.8p

Operating earnings per share (normalised)(4,5,++) 23.5p N/A N/A N/A

Basic earnings per share (18.8)p (6.2)p (203)% 50.1p

--------------------------------------------------- -------- -------- -------- -----

Full

6 months 6 months Sterling year

2022 2021 % 2021

Controllable costs(++) GBPm GBPm change GBPm

UK, Ireland, Canada and Aviva Investors 1,227 1,259 (3)% 2,559

Corporate centre costs and Other operations 115 113 2% 295

-------------------------------------------------- -------- -------- -------- -----

Baseline controllable costs(6) 1,342 1,372 (2)% 2,854

Cost reduction implementation, IFRS 17 costs

and other 103 75 37% 242

Strategic investment 34 - -% -

-------------------------------------------------- -------- -------- -------- -----

Controllable costs(++) from continuing operations 1,479 1,447 2% 3,096

-------------------------------------------------- -------- -------- -------- -----

Solvency II operating own funds Solvency II operating Solvency II operating

generation (OFG)(++,R) and Solvency own funds generation capital generation

II operating capital generation

(OCG)(++)

---------------------------------------- ----------------------------------- -----------------------------------

Full Full

6 months 6 months Sterling year 6 months 6 months Sterling year

2022 2021 % 2021 2022 2021 % 2021

GBPm GBPm change GBPm GBPm GBPm change GBPm

---------------------------------------- -------- -------- -------- ----- -------- -------- -------- -----

UK, Ireland, Canada and Aviva Investors 709 550 29% 1,660 722 841 (14)% 1,906

International investments(1) 75 84 (11)% 124 33 37 (11)% 55

Corporate centre costs, Group external

debt costs and Other (246) (265) 7% (597) (199) (484) 59% (597)

---------------------------------------- -------- -------- -------- ----- -------- -------- -------- -----

Group Solvency II operating own

funds generation(++) and Solvency

II operating capital generation(++)

from continuing operations 538 369 46% 1,187 556 394 41% 1,364

---------------------------------------- -------- -------- -------- ----- -------- -------- -------- -----

Restated

Full

6 months 6 months year

2022 2021(7) 2021

Solvency II return on capital/equity(++,R) % % Change %

-------------------------------------------- -------- --------- ------- -----

Solvency II return on capital

UK, Ireland, Canada and Aviva Investors 8.0% 6.1% 1.9pp 8.8%

International investments(1) 15.3% 18.5% (3.2)pp 13.6%

Group Solvency II return on equity(++) from

continuing operations 10.9% 7.4% 3.5pp 10.7%

-------------------------------------------- -------- --------- ------- -----

30 June 31 December 30 June

Capital position 2022 2021 Change 2021

---------------------------------------------------- --------- ----------- ------ ---------

Estimated Solvency II shareholder cover ratio(++,R) 234% 244% (10)pp 203%

Estimated Solvency II surplus GBP10.3bn GBP13.1bn (21)% GBP12.0bn

Solvency II net asset value per share(++) 420p 417p 3p 433p

Solvency II debt leverage ratio(++) 30% 27% 3pp 26%

---------------------------------------------------- --------- ----------- ------ ---------

Full

Sterling year

6 months 6 months % 2021

Dividend 2022 2021 change GBPm

--------------------------- -------- -------- -------- -----

Interim dividend per share 10.3p 7.35p 40% 7.35p

--------------------------- -------- -------- -------- -----

R Symbol denotes key performance indicators used as a base to

determine or modify remuneration | ++ Denotes Alternative

Performance Measures (APMs) and further information can be found in

the 'Other information' section |1 International investments

include Aviva's interest in joint ventures/associates in Singapore,

India and China | 2 Group adjusted operating profit is a non-GAAP

APM and is not bound by the requirements of IFRS. Further details

of this measure are included in the 'Other information' section. |

3 IFRS (loss)/profit for the period represents IFRS (loss)/profit

after tax | 4 Operating earnings per share is derived from the

Group adjusted operating profit APM. Further details of this

measure are included in the 'Other information' section. | 5

Normalised EPS is calculated as if the share consolidation

completed on 16 May 2022 as part of the GBP3.75 billion capital

return, had taken place on 1 January 2022 | 6 Baseline controllable

costs exclude strategic investment, cost reduction implementation,

IFRS 17 and other costs not included in the 2018 costs savings

target baseline

| 7 Following a review of the basis of preparation of Group

Solvency II Return on Equity and Market Solvency II Return on

Capital, comparative amounts for the six months ended 30 June 2021

have been restated. In the numerator, Transitional Measure on

Technical Provisions (TMTP) run-off has been replaced with the

economic cost of holding equivalent capital to the opening value of

TMTP on a shareholder basis and, for Group Solvency II Return on

Equity only, the denominator has been adjusted to exclude excess

capital above our target Solvency II shareholder cover ratio.

Further details can be found in the 'Other information'

section.

Page 6

Group financial headlines

Operating results

Cash remittances

Cash remittances during the first half of 2022 were GBP0.8

billion (HY21(1) : GBP1.1 billion), in line with our existing

target to grow remittances towards GBP1.8 billion in 2023. Strong

remittances in the prior period arose from the decision to retain

cash in our subsidiaries in 2020 to maintain balance sheet strength

following volatility arising from COVID-19.

Profit

Operating profit(2) increased by 14% to GBP829 million (HY21(1)

: GBP725 million). Excluding UK Life management actions and other

of GBP(71) million (HY21: GBP(38) million), operating profit(2) was

up 18% to GBP900 million (HY21: GBP763 million).

UK & Ireland Life operating profit(2) benefitted from strong

results in Annuities & Equity Release which more than offset

marginally lower operating profit(2) in Wealth, as well as lower

operating profit(2) from Protection & Health and management

actions and other compared with the first half of 2021. Heritage

operating profit(2) increased by 33% due to the impact of market

movements on policyholder tax. Excluding management actions and

other, UK Life operating profit(2) was up 19% to GBP696 million

(HY21: GBP583 million).

General Insurance performed robustly against a challenging

market backdrop, with operating profit(2) down 11% predominantly

driven by claims returning to a more normal level following a

strong prior period which included COVID-19 frequency benefit.

Operating earnings per share of 19.0 pence (HY21: 21.0 pence)

with the impact of disposals partly offset by higher operating

profit(2) from continuing operations and a lower share count.

Operating earnings per share on a normalised basis was 23.5

pence.

IFRS loss for the period was GBP(633) million (HY21: GBP(198)

million) while basic earnings per share decreased to (18.8) pence

(HY21: (6.2) pence). Higher operating profit(2) was more than

offset by non-operating items including economic variances of

GBP(1,470) million (HY21: GBP(437) million), with higher interest

rates and widening spreads resulting in an adverse economic

variance impact.

Cost reduction

Baseline controllable costs(3) from continuing operations, fell

by 2% to GBP1,342 million (HY21(1) : GBP1,372 million), despite

headwinds from inflation. We are on track to meet our ambition of a

GBP300 million reduction (net of inflation) in 2022 and to meet our

target of GBP750 million (gross of inflation) cost reduction from

the 2018 baseline by the end of 2024.

Solvency II operating own funds generation (Solvency II OFG)

Solvency II OFG from continuing operations increased by 46% to

GBP538 million (HY21(1) : GBP369 million) with higher Solvency II

OFG from Annuities & Equity Release, Management Actions &

Other and UK GI partially offset by lower Solvency II OFG from

Protection & Health and Canada.

Solvency II operating capital generation (Solvency II OCG)

Solvency II OCG from continuing operations increased by 41% to

GBP556 million (HY21(1) : GBP394 million) as the prior year was

adversely impacted by capital actions and other non-recurring items

which have not repeated in the first half of 2022. This has been

partially offset by lower Solvency II OCG from core business

units.

Solvency II return on equity (Solvency II RoE)

Solvency II RoE was 10.9%, improving by 3.5pp (HY21 restated:

7.4%). Our ambition remains for Solvency II RoE on a continuing

basis to improve to >12% by 2024. The Solvency II RoE was 12.3%

excluding Heritage, which acts as a drag to the headline Solvency

II RoE given it is in run-off.

1 Comparatives presented are from continuing operations | 2

Operating profit represents Group adjusted operating profit which

is a non-GAAP APM. Operating profit is not bound by the

requirements of IFRS. Further details are included in the 'Other

information' section. | 3 Baseline controllable costs exclude

strategic investment, cost reduction implementation, IFRS 17 and

other costs not included in the 2018 costs savings target

baseline

Page 7

Capital and cash

Solvency II capital

At 30 June 2022, Aviva's Solvency II shareholder surplus was

GBP10.3 billion and Solvency II shareholder cover ratio was

234%

(FY21: GBP13.1 billion and 244% respectively). Our pro forma

Solvency II cover ratio allowing for the planned GBP1 billion

further debt reduction, GBP0.1 billion pension scheme payment, and

the acquisition of Succession Wealth, is estimated at 213%.

The solvency capital requirement of GBP7.7 billion includes a

c.GBP1.9 billion benefit from Group diversification.

Solvency II net asset value per share was 420 pence (FY21: 417

pence).

Pro Pro forma

Pro forma 31 December 30 June forma(1) 30 June

GBPbn unless otherwise stated 2021 2022 adjustments 2022

------------------------------------------- ----------- ------- ------------ ---------

Own funds 22.2 18.0 (1.6) 16.4

SCR (9.1) (7.7) (7.7)

------------------------------------------- ----------- ------- ------------ ---------

Surplus 13.1 10.3 (1.6) 8.7

------------------------------------------- ----------- ------- ------------ ---------

Solvency II shareholder cover ratio (%) 244% 234% (21)% 213%

------------------------------------------- ----------- ------- ------------ ---------

Centre liquidity (as at end February/July) 6.6 2.7 1.3

------------------------------------------- ----------- ------- ------------ ---------

Solvency II debt leverage ratio 27% 30% 28%

------------------------------------------- ----------- ------- ------------ ---------

Centre liquidity

At end July 2022, centre liquidity was GBP2.7 billion (February

2022: GBP6.6 billion) with the reduction primarily driven by the

GBP3.75 billion capital return, GBP0.5 billion subordinated debt

redemption and GBP0.5 billion payment of the 2021 final dividend,

partly offset by cash remittances to Group of GBP0.8 billion and

the GBP0.5 billion RT1 debt issuance. Our pro forma centre

liquidity is GBP1.3 billion after allowing for the planned further

GBP1 billion debt reduction, GBP0.1 billion pension payment, and

the acquisition of Succession Wealth.

Solvency II debt leverage

Solvency II debt leverage ratio increased to 30% (FY21: 27%) as

a result of the reduction in own funds following the capital

return. Our

pro forma Solvency II debt leverage ratio is 28% after allowing

for the planned GBP1 billion debt reduction, GBP0.1 billion pension

payment and the acquisition of Succession Wealth.

Dividend

Today we have announced an interim dividend per share for the

first half of 2022 of 10.3 pence (HY21: 7.35 pence) with a cash

cost of approximately GBP289 million.

Our guidance for dividend payments of approximately GBP870

million and GBP915 million for 2022 and 2023 respectively, with

low-to-mid single growth in dividends per share thereafter, remains

unchanged. On a per share basis this is equivalent to approximately

31.0 pence(2) in 2022 and 32.5 pence(2) in 2023.

Capital return

Under our capital framework, we consider capital above 180%

Solvency II shareholder cover ratio as excess, allowing for

reinvestment in the business, focused M&A and returns to

shareholders. We target Solvency II debt leverage ratio of below

30%.

Given our strong capital position and prospects, we anticipate

commencing a new share buyback program with our 2022 full year

results, subject to market conditions and regulatory approval.

Assuming a new buyback is agreed, its size will be determined by

the Board at year end and will take account of the financial

position at that time, as well as both the drivers of the capital

surplus (including the impact of market movements) and our

preference to return surplus capital regularly and sustainably.

1 Solvency II pro forma shareholder cover ratio is the estimated

Solvency II shareholder cover ratio at 30 June 2022 adjusted for

GBP1 billion further debt reduction, pension scheme payment and

acquisition of Succession Wealth | 2 The Board has not approved or

made any decision to pay any dividend in respect of any future

period

Page 8

Business highlights

UK & Ireland Life

Full

6 months 6 months Sterling year

2022 2021 % 2021

Operating profit GBPm GBPm change GBPm

--------------------------- -------- -------- -------- -----

Wealth 71 73 (3)% 147

Annuities & Equity Release 346 265 31% 645

Protection & Health 95 107 (11)% 229

Heritage 184 138 33% 319

Other(1) (71) (38) (87)% 77

Ireland Life 26 - -% 11

--------------------------- -------- -------- -------- -----

Total 651 545 19% 1,428

--------------------------- -------- -------- -------- -----

UK and Ireland Life operating profit(2) was 19% higher at GBP651

million (HY21: GBP545 million) with a strong performance in

Annuities & Equity Release and increased Heritage operating

profit(2) more than offsetting a reduction in management actions

and other non-operating items compared to the first half of 2021.

Annuities & Equity Release operating profit(2) increased 31% to

GBP346 million (HY21: GBP265 million), driven by sales(3) of bulk

purchase annuities, which increased by 15% to GBP1.9 billion (HY21:

GBP1.6 billion), and improved margins. Heritage operating profit(2)

increased by 33% to GBP184 million (HY21: GBP138 million) due to

the impact of market movements on policyholder tax. The operating

loss(2) within Other of GBP(71) million (HY21: GBP(38) million)

reflects a reduction in the carrying value of deferred acquisition

costs as a result of market movements.

Wealth operating profit(2) was 3% lower at GBP71 million (HY21:

GBP73 million). In Protection & Health, operating profit(2)

decreased by

11% to GBP95 million (HY21: GBP107 million), primarily driven by

the absence of favourable claims experience in the first half of

2022.

Ireland Life operating profit(2) improved significantly to GBP26

million (HY21: GBPnil) driven by reduced expenses, improved

underlying performance and modelling improvements.

UK & Ireland Life Solvency II OFG of GBP328 million (HY21:

GBP217 million) was up 51% and up 14% excluding Other. Annuities

& Equity Release Solvency II OFG of GBP169 million (2020:

GBP143 million) was up 18% driven by higher volumes and improved

margins reflecting the higher availability and allocation of

corporate bonds and illiquid assets. Wealth Solvency II OFG was up

10% reflecting higher average AUM. Protection & Health was down

27% to GBP56 million (HY21: GBP77 million) driven by lower volumes

of individual protection and the non-recurrence of favourable

claims experience.

PVNBP VNB

---------------------------- ----------------------------

6 months 6 months Sterling 6 months 6 months Sterling

2022 2021 % 2022 2021 %

New business GBPm GBPm change GBPm GBPm change

----------------------------- -------- -------- -------- -------- -------- --------

Wealth(4) 11,896 11,699 2% 109 110 (1)%

Annuities and Equity Release 2,762 2,466 12% 75 50 50%

Protection & Health 1,327 1,255 6% 100 95 5%

Ireland Life 858 820 5% 16 10 53%

----------------------------- -------- -------- -------- -------- -------- --------

UK & Ireland Life total 16,843 16,240 4% 300 265 13%

----------------------------- -------- -------- -------- -------- -------- --------

Wealth sales(3,4) grew 2% driven by growth in Workplace,

predominantly reflecting incremental growth from the in-force book,

which more than offset new business volumes which were lower as the

prior year comparator benefitted from significant scheme wins that

were delayed from 2020. The growth in Workplace was partly offset

by reduced sales(3) from our adviser platform due to a combination

of lower new business flows, reflecting current market volatility

which has dampened investment activity, and a strong first half in

2021 which saw the benefit from pent up demand from savings

accumulated in 2020. VNB reduced by 1% from the resultant change in

business mix with a higher proportion of Workplace sales(3) .

Our Wealth new business is capital efficient, with profits being

derived from asset management fees less costs. We have a

competitive position in both workplace and retail markets, which

have delivered diversified and resilient earnings and highly

efficient customer acquisition into the Group.

Annuities & Equity Release sales(3) were 12% higher, driven

by BPA sales(3) of GBP1.9 billion (HY21: GBP1.6 billion), despite a

relatively subdued first half where we have maintained pricing

discipline, and a strong start to the year in equity release with

sales(3) up 27% on prior period, reflecting high levels of market

activity. This more than offset lower sales(3) from individual

annuities where volumes were down on internal individual annuities,

despite strong growth in external volumes. VNB for Annuities &

Equity Release was up 50% to GBP75 million

(HY21: GBP50 million) predominantly driven by increased BPA

sales(3) at improved margins from a reduced lag in sourcing higher

yielding illiquid assets to back the liabilities.

Protection & Health VNB was up 5% driven by increased

sales(3) , up by 6%. Growth in Health and Group Protection was

partially offset by a more subdued Individual Protection market due

to lower volumes, as the first half of 2021 benefitted from stamp

duty relief, coupled with higher interest rates have adversely

impacted sales(3) . Our Group Protection business saw a 31%

increase in sales(3) which included a significant scheme win in the

first quarter while Health volumes grew 8% as we saw continued

momentum from the Expert Select proposition launched last year.

Ireland Life PVNBP grew 5% driven by strong sales(3) in unit

linked business, partially offset by lower protection sales(3) .

Our single product range has improved margins and driven VNB up

significantly over the year.

1 UK Life Other represents changes in assumptions and modelling,

non-recurring items and non-product specific overheads | 2

Operating profit represents Group adjusted operating profit which

is a non-GAAP APM. Operating profit is not bound by the

requirements of IFRS. Further details are included in the 'Other

information' section. | 3 References to sales represent present

value of new business premiums (PVNBP) which is an Alternative

Performance Measure (APM) and further information can be found in

the 'Other information' section | 4 Wealth and Other

Page 9

Net flows Assets under management

---------------------------- -----------------------------------

Full

6 months 6 months Sterling 30 June 30 June Sterling year

2022 2021 % 2022 2021 % 2021

GBPm GBPm change GBPm GBPm change GBPm

-------------------------------- -------- -------- -------- ------- ------- -------- -------

Wealth 4,962 5,173 (4)% 140,425 141,234 (1)% 152,207

of which: platform 2,547 2,834 (10)% 40,280 39,012 3% 43,101

of which: workplace 2,699 2,697 -% 88,463 89,154 (1)% 95,798

of which: individual pensions (284) (358) 21% 11,682 13,068 (11)% 13,308

================================ ======== ======== ======== ======= ======= ======== =======

Wealth net flows were down 4% to GBP5.0 billion (HY21: GBP5.2

billion), reflecting lower flows due to the current market

uncertainty. Within our platform business, our adviser platform saw

net flows down 9% to GBP2.4 billion (HY21: 2.7 billion) driven by

subdued new business activity owing to market volatility. Workplace

net flows were flat at GBP2.7 billion despite lower new business as

the prior year benefitted from schemes that were delayed from

2020.

Wealth assets under management reduced by 8% to GBP140 billion

during the first six months (2021: GBP152 billion) due to adverse

market movements.

General Insurance

Full

6 months 6 months Sterling year

2022 2021 % 2021

Operating profit GBPm GBPm change GBPm

------------------------ -------- -------- -------- -----

UK 159 169 (6)% 318

Ireland 12 22 (45)% 38

Canada 204 229 (11)% 406

------------------------ -------- -------- -------- -----

General Insurance Total 375 420 (11)% 762

------------------------ -------- -------- -------- -----

Operating profit(1) decreased to GBP375 million (HY21: GBP420

million), a good performance despite higher claim costs, as the

level of claims returned to a more normal level following lower

claim frequency from COVID-19 restrictions in the prior year, and

less favourable weather compared with the first half of 2021. This

was partially offset by volume growth and an improvement in

long-term investment return due to higher yields from reinvestment

in hedged equities and corporate bonds.

General Insurance Solvency II OFG of GBP367 million (HY21:

GBP315 million) was up 17% in the first half. UK & Ireland GI

Solvency II OFG of

GBP193 million (HY21: GBP121 million) was up 60% driven by a

strong performance in commercial lines and a higher long-term

investment return due to re-risking. In Canada, Solvency II OFG of

GBP174 million (HY21: GBP194 million) was down 10% due to less

favourable weather and

non-recurrence of COVID-19 frequency benefits.

GWP COR

-------- -------- -------- -------- -------- -------- -------- -------- -------- ----- -------- -------- -------- -----

Personal lines Commercial lines Total Total

---------------------------- ---------------------------- -------- -------- -------- ----- -------- -------- -------- -----

Full Full

6 months 6 months Sterling 6 months 6 months Sterling 6 months 6 months Sterling year 6 months 6 months Sterling year

2022 2021 % 2022 2021 % 2022 2021 % 2021 2022 2021 % 2021

GBPm GBPm change GBPm GBPm change GBPm GBPm change GBPm % % change %

-------- -------- -------- -------- -------- -------- -------- -------- -------- -------- ----- -------- -------- -------- -----

UK 1,198 1,213 (1)% 1,430 1,280 12% 2,628 2,493 5% 4,943 95.6% 93.9% 1.7pp 94.6%

Ireland 93 105 (11)% 119 107 11% 212 212 -% 409 96.2% 89.9% 6.3pp 91.7%

Canada 1,138 1,047 9% 716 614 17% 1,854 1,661 12% 3,455 91.7% 88.8% 2.9pp 90.7%

-------- -------- -------- -------- -------- -------- -------- -------- -------- -------- ----- -------- -------- -------- -----

Total 2,429 2,365 3% 2,265 2,001 13% 4,694 4,366 8% 8,807 94.0% 91.6% 2.4pp 92.9%

-------- -------- -------- -------- -------- -------- -------- -------- -------- -------- ----- -------- -------- -------- -----

UK, Ireland and Canada COR increased to 94.0% from 91.6%. UK COR

increased by 1.7pp to 95.6% (HY21: 93.9%) following a return to

more normal claims frequency together with higher UK weather costs

relative to a benign 2021 weather experience, partly offset by

improvements in underwriting performance from commercial lines

supported by strong rate momentum. Canada COR deteriorated 2.9pp to

91.7%

(HY21: 88.8%) due to increased claims costs, as the prior year

result benefitted from higher COVID-19 frequency benefits and

benign weather, partly offset by lower commission and favourable

prior year development compared to the first half of last year.

Total GWP across UK, Ireland and Canada grew 8% (6% in constant

currency) to GBP4.7 billion (HY21: GBP4.4 billion), including 5%

growth in the UK and 12% in Canada (6% in constant currency).

Ireland was flat on the prior year.

UK commercial lines GWP grew 12% to GBP1,430 million (HY21:

GBP1,280 million), reflecting a favourable rating environment, high

retention levels and strong new business growth, benefiting from

our investment in underwriting talent and strong broker

relationships. Canada commercial lines GWP increased 17% (11% in

constant currency) to GBP716 million (HY21: GBP614 million) due to

increased rate in the prevailing hard market and new business

growth in mid-market and large corporate accounts.

UK personal lines GWP was 1% lower at GBP1,198 million (HY21:

GBP1,213 million). Retail premiums were stable with growth in

household business partly offsetting a reduction in motor, as we

maintained pricing discipline in a soft rating environment.

Intermediated premiums were 2% lower as we continue to reshape the

portfolio towards more profitable segments. Canada personal lines

GWP of GBP1,138 million (HY21: GBP1,047 million) was up 9% (4% in

constant currency) due to rate increases against the current

inflationary environment and new business growth in our direct

business.

1 Operating profit represents Group adjusted operating profit

which is a non-GAAP APM. Operating profit is not bound by the

requirements of IFRS. Further details are included in the 'Other

information' section.

Page 10

Aviva Investors

Sterling

6 months 6 months %

Operating profit 2022 2021 change

----------------- -------- -------- --------

Aviva Investors 14 19 (26)%

----------------- -------- -------- --------

Aviva Investors operating profit(1) reduced to GBP14 million

(HY21: GBP19 million), but increased to GBP25 million (HY21: GBP24

million) excluding cost reduction implementation and strategic

investment costs, driven by a bigger impact of cost reduction

initiatives which included the completion of the first phase of the

transition to a new scalable real assets operating model with loan

servicing successfully outsourced to Mount Street. Cost efficiency

measures and streamlining of the business resulted in a 2%

reduction in baseline controllable costs to

GBP165 million (HY21: GBP168 million). The cost income ratio

remained flat at 87% (HY21: 87%).

Net flows Assets under management

---------------------------- --------------------------------------

Full

6 months 6 months Sterling 6 months 6 months Sterling Year

2022 2021 % 2022 2021(3) % 2021

GBPm GBPm change GBPm GBPm change GBPm

----------------------------------- -------- -------- -------- --------- -------- -------- -------

Aviva Investors (4,253) 829 (613)% 231,742 258,382 (10)% 267,780

Of which: Aviva Investors external

assets(2) 202 1,084 (81)% 40,464 53,052 (24)% 51,332

----------------------------------- -------- -------- -------- --------- -------- -------- -------

Aviva Investors outflows, excluding cash and liquidity funds,

totalled GBP(4.3) billion compared to net inflows of GBP0.8 billion

in the first half of 2021. This reflected expected outflows from

internal assets, mainly Heritage, and withdrawals by clients

previously part of the Group, mainly in France. External net

inflows, excluding strategic actions and cash and liquidity funds,

were GBP0.2 billion (HY21: GBP1.1 billion). AUM reduced by GBP36

billion during the first half of 2022 to GBP232 billion,

predominantly driven by adverse market movements across all asset

classes in the period.

Our long-term outlook remains positive as we continue to build

and deliver growth through our strengths of environmental, social

and governance (ESG), real assets, infrastructure, credit and

sustainable equities.

International Investments

International Investments comprises our joint ventures and

associates in Singapore, China and India, providing us with value

creation potential and optionality in attractive and fast-growing

markets.

6 months 6 months Sterling

2022 2021 %

GBPm GBPm change

----------------- -------- -------- --------

Operating profit 55 55 -%

PVNBP 569 617 (8)%

VNB 46 59 (23)%

----------------- -------- -------- --------

Operating profit(1) was flat at GBP55 million (HY21: GBP55

million). PVNBP of GBP569 million (HY21: GBP617 million) and VNB of

GBP46 million

(HY21: GBP59 million) were down on the prior year due to the

impact of COVID-19 restrictions in China impacting volumes and

strong prior year comparatives from new product launches in

Singapore in 2021. Solvency II OFG was down 11% to GBP75 million

(HY21: GBP84 million).

Corporate centre costs, Group debt costs and Other

Corporate centre costs and Other operations of GBP138 million

(HY21: GBP134 million) increased due to higher cost reduction

implementation, IFRS 17 costs and project costs. Excluding these

costs, corporate centre costs of GBP68 million were down 7% versus

HY21.

Group debt costs and other interest reduced to GBP128 million

(HY21: GBP180 million). External debt costs reduced 23% as a result

of GBP1.9 billion reduction in external debt in 2021. Internal

lending arrangements are lower than prior year due to early

repayment of capital towards the end of 2021 and partially offset

by higher interest rates. Net finance income on the main UK pension

scheme increased due to an increase in interest rates and opening

assets.

1 Operating profit represents Group adjusted operating profit

which is a non-GAAP APM. Operating profit is not bound by the

requirements of IFRS. Further details are included in the 'Other

information' section. | 2 External net flows above exclude net

flows from strategic actions. | 3 Assets under management at 30

June 2021 have been re-presented in line with disclosures at 31

December 2021 to reflect movements in continuing and discontinued

business, and a re-classification of certain funds between internal

and external.

Page 11

Cautionary statements

This document should be read in conjunction with the documents

distributed by Aviva plc (the 'Company' or 'Aviva') through The

Regulatory News Service (RNS). This announcement contains, and we

may make other verbal or written 'forward-looking statements' with

respect to certain of Aviva's plans and current goals and

expectations relating to future financial condition, performance,

results, strategic initiatives and objectives. Statements

containing the words 'believes', 'intends', 'expects', 'projects',

'plans', 'will', 'seeks', 'aims', 'may', 'could', 'outlook',

'likely', 'target', 'goal', 'guidance', 'trends', 'future',

'estimates', 'potential' and 'anticipates', and words of similar

meaning, are forward-looking. By their nature, all forward-looking

statements involve risk and uncertainty. Accordingly, there are or

will be important factors that could cause actual results to differ

materially from those indicated in these statements. Aviva believes

factors that could cause actual results to differ materially from

those indicated in forward-looking statements in the announcement

include, but are not limited to: the impact of ongoing uncertain

conditions in the global financial markets and the local and

international political and economic situation generally (including

those arising from the Russia-Ukraine conflict); market

developments and government actions (including those arising from

the evolving relationship between the UK and the EU); the effect of

credit spread volatility on the net unrealised value of the

investment portfolio; the effect of losses due to defaults by

counterparties, including potential sovereign debt defaults or

restructurings, on the value of our investments; changes in

interest rates that may cause policyholders to surrender their

contracts, reduce the value or yield of our investment portfolio

and impact our asset and liability matching; the unpredictable

consequences of reforms to reference rates, including LIBOR; the

impact of changes in short or long-term inflation; the impact of

changes in equity or property prices on our investment portfolio;

fluctuations in currency exchange rates; the effect of market

fluctuations on the value of options and guarantees embedded in

some of our life insurance products and the value of the assets

backing their reserves; the amount of allowances and impairments

taken on our investments; the effect of adverse capital and credit

market conditions on our ability to meet liquidity needs and our

access to capital; changes in, or restrictions on, our ability to

initiate capital management initiatives; changes in or inaccuracy

of assumptions in pricing and reserving for insurance business

(particularly with regard to mortality and morbidity trends, lapse

rates and policy renewal rates), longevity and endowments; a

cyclical downturn of the insurance industry; the impact of natural

and man-made catastrophic events (including the longer-term impact

of COVID-19) on our business activities and results of operations;

the transitional, litigation and physical risks associated with

climate change; failure to understand and respond effectively to

the risks associated with environmental, social or governance

("ESG") factors; our reliance on information and technology and

third-party service providers for our operations and systems; the

impact of the Group's risk mitigation strategies proving less

effective than anticipated, including the inability of reinsurers

to meet obligations or unavailability of reinsurance coverage; poor

investment performance of the Group's asset management business;

the withdrawal by customers at short notice of assets under the

Group's management; failure to manage risks in operating securities

lending of Group and third-party client assets; increased

competition in the UK and in other countries where we have

significant operations; regulatory approval of changes to the

Group's internal model for calculation of regulatory capital under

the UK's version of Solvency II rules; the impact of actual

experience differing from estimates used in valuing and amortising

deferred acquisition costs (DAC) and acquired value of in-force

business (AVIF); the impact of recognising an impairment of our

goodwill or intangibles with indefinite lives; changes in valuation

methodologies, estimates and assumptions used in the valuation of

investment securities; the effect of legal proceedings and

regulatory investigations; the impact of operational risks,

including inadequate or failed internal and external processes,

systems and human error or from external events and malicious acts

(including cyber attack and theft, loss or misuse of customer

data); risks associated with arrangements with third parties,

including joint ventures; our reliance on third-party distribution

channels to deliver our products; funding risks associated with our

participation in defined benefit staff pension schemes; the failure

to attract or retain the necessary key personnel; the effect of

systems errors or regulatory changes on the calculation of unit

prices or deduction of charges for our unit-linked products that

may require retrospective compensation to our customers; the effect

of simplifying our operating structure and activities; the effect

of a decline in any of our ratings by rating agencies on our

standing among customers, broker-dealers, agents, wholesalers and

other distributors of our products and services; changes to our

brand and reputation; changes in tax laws and interpretation of

existing tax laws in jurisdictions where we conduct business;

changes to International Financial Reporting Standards relevant to

insurance companies and their interpretation (for example, IFRS

17); the inability to protect our intellectual property; the effect

of undisclosed liabilities, separation issues and other risks

associated with our business disposals; and other uncertainties,

such as diversion of management attention and other resources,

relating to future acquisitions, combinations or disposals within

relevant industries; the policies, decisions and actions of

government or regulatory authorities in the UK, the EU, the US,

Canada or elsewhere, including changes to and the implementation of

key legislation and regulation (for example, FCA Consumer Duty and

Solvency II). Please see Aviva's most recent Annual Report and

Accounts for further details of risks, uncertainties and other

factors relevant to the business and its securities.

Aviva undertakes no obligation to update the forward looking

statements in this announcement or any other forward-looking

statements we may make. Forward-looking statements in this report

are current only as of the date on which such statements are

made.

This report has been prepared for, and only for, the members of

the Company, as a body, and no other persons. The Company, its

directors, employees, agents or advisers do not accept or assume

responsibility to any other person to who this document is shown or

into whose hands it may come, and any such responsibility or

liability is expressly disclaimed.

Aviva plc is a company registered in England No. 2468686.

Registered office

St Helen's

1 Undershaft

London

EC3P 3DQ

Page 12

Notes to editors

-- All figures have been retranslated at average exchange rates

applying for the period, with the exception of the capital position

which is translated at the closing rates on 30 June 2022. The

average rates employed in this announcement are 1 euro =

GBP0.84

(6 months to 30 June 2021: 1 euro = GBP0.87) and CAD$1 = GBP0.61

(6 months to 30 June 2021: CAD$1 = GBP0.58).

-- Growth rates in the press release have been provided in

sterling terms unless stated otherwise. The following supplement

presents this information on both a sterling and constant currency

basis. All percentages, including currency movements, are

calculated on unrounded numbers so minor rounding differences may

exist.

-- Throughout this report we use a range of financial metrics to

measure our performance and financial strength. These metrics

include Alternative Performance Measures (APMs), which are non-GAAP

measures that are not bound by the requirements of IFRS and

Solvency II. A complete list and further guidance in respect of the

APMs used by the Group can be found in the 'Other information'

section.

-- We are the UK's leading Insurance, Wealth & Retirement

business and we operate in the UK, Ireland and Canada. We also have

international investments in Singapore, China and India.

-- We help our 18.5 million customers make the most out of life,

plan for the future, and have the confidence that if things go

wrong we'll be there to put it right.

-- We have been taking care of people for 325 years, in line

with our purpose of being 'with you today, for a better tomorrow'.

In 2021, we paid GBP30.2 billion in claims and benefits to our

customers.

-- Aviva is a market leader in sustainability. In 2021, we

announced our plan to become a Net Zero carbon emissions company by

2040, the first major insurance company in the world to do so. This

plan means Net Zero carbon emissions from our investments by 2040;

setting out a clear pathway to get there with a cut of 25% in the

carbon intensity of our investments by 2025 and of 60% by 2030; and

Net Zero carbon emissions from our own operations and supply chain

by 2030. Find out more about our climate goals at

www.aviva.com/climate-goals and our sustainability ambition and

action at www.aviva.com/sustainability

-- Aviva is a Living Wage and Living Hours employer and provides

market-leading benefits for our people, including flexible working,

paid carers leave and equal parental leave. Find out more at

www.aviva.com/about-us/our-people

-- As at 30 June 2022, total Group assets under management at

Aviva Group are GBP353 billion and our Solvency II shareholder

capital surplus is GBP10.3 billion. Our shares are listed on the

London Stock Exchange and we are a member of the FTSE 100

index.

-- For more details on what we do, our business and how we help

our customers, visit www.aviva.com/about-us

Click on, or paste the following link into your web browser, to

view the complete Press Release and Half Year Report PDF

document:

http://www.rns-pdf.londonstockexchange.com/rns/4764V_1-2022-8-9.pdf

The document is available to view on the Company's website at

https://www.aviva.com/investors/reports/ and

copies have been submitted to the National Storage Mechanism and

will shortly be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

Enquiries:

Investor Media Contacts Timings

contacts

--------------- ----------- --------------- ----------- ------------------------------------

Rupert Taylor +44(0) 7385 +44(0) 7800 0700 hrs

Rea 494 440 Andrew Reid 694 276 Presentation slides: BST

Joel von +44(0) 7384 +44(0) 7800 Real time media conference 0800 hrs

Sternberg 231 238 Sarah Swailes 694 859 call: BST

+44(0) 7837 +44(0) 7800 Analyst conference 0845 hrs

Michael O'Hara 234 388 Steve Whitelock 691 128 call / audiocast: BST

https://www.aviva.com

--------------- ----------- --------------- ----------- -------------------------- --------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UKSKRUWUWRAR

(END) Dow Jones Newswires

August 10, 2022 02:00 ET (06:00 GMT)

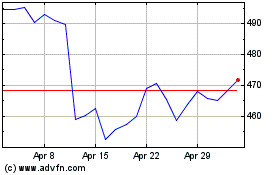

Aviva (LSE:AV.)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aviva (LSE:AV.)

Historical Stock Chart

From Apr 2023 to Apr 2024