AIM Schedule One - Immediate Acquisition PLC (8672P)

23 June 2022 - 4:00PM

UK Regulatory

TIDMIME

RNS Number : 8672P

AIM

23 June 2022

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

COMPANY NAME:

Immediate Acquisition plc ( "IME" or the "Company")

The Company is proposing to change its name to "Fiinu Group

plc" upon completion of a reverse takeover of Fiinu Holdings

Limited ("Fiinu"), together the Enlarged Group.

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES) :

IME: c/o Charles Russell Speechlys LLP, 5 Fleet Place, London,

England, EC4M 7RD

From Admission: Abbey House, Wellington Way, Brooklands Business

Park, Weybridge, Surrey, KT13 0TT

COUNTRY OF INCORPORATION:

England and Wales

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

www.imeplc.com (at present)

www.fiinuplc.com (on Admission)

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

IME has its shares admitted to trading on AIM and in May 2022

disposed of its main trading subsidiary and became an AIM Rule

15 cash shell. Its main country of operation is the United

Kingdom.

Fiinu intends to be a provider of a consumer banking product,

the Plugin Overdraft (R), which is designed to provide customers

with an overdraft facility without having to change their current

account or request an overdraft from their existing bank. Fiinu's

technology arm manages and develops the platform, using open

banking, and once the platform is fully operational will also

look to develop secondary revenue streams by licensing Fiinu's

intellectual property rights.

Fiinu has two subsidiaries - Fiinu 2 Ltd ("Fiinu 2") (to be

renamed Fiinu Bank Limited on Admission) and Fiinu Services

Ltd (Fiinu Services"). Fiinu 2 was issued an "authorised subject

to capital" letter by the PRA in relation to its application

for a Part 4A deposit taking licence ("Banking Licence"). This

letter set out certain conditions to the confirmation of the

Banking Licence, principally relating to the PRA and FCA's

confirmations of Fiinu 2's capital adequacy - which will be

satisfied by the proceeds of the fundraising and IME's existing

cash balance.

IME (to be renamed Fiinu Group plc) will be the issuer, with

the current Fiinu business acting as the sole operator. Following

Admission, IME will own 100% of Fiinu Holdings Limited which

will have two subsidiaries - Fiinu Bank Limited and Fiinu Services

Limited.

The Admission is sought as a result of a reverse take-over

under AIM Rule 14.

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

Ordinary Shares of GBP0.10 each comprising:

Existing IME shares 37,581,844

Consideration Shares 187,500,017

------------

Placing Shares 40,050,000

------------

Total 265,131,861

------------

Pursuant to Rule 7, for the 12 months following Admission,

the Directors, Proposed Directors and other Applicable Employees,

together with Petri Rahja and Kindred Capital have signed Lock-in

Agreements which prevent them from disposing of any Ordinary

Shares in the Company. This amounts to 153,850,150 Ordinary

Shares representing c58 per cent. of the issued share capital

of the Company at Admission.

CAPITAL TO BE RAISED ON ADMISSION (AND/OR SECONDARY OFFERING)

AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

GBP8.01 million

Target market cap: c.GBP53m

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

58.0%

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM SECURITIES (OR OTHER SECURITIES OF THE COMPANY) ARE

OR WILL BE ADMITTED OR TRADED:

None

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

Existing Directors

Timothy (Tim) Robert Hipperson - Non-Executive Chairman*

Mark Ian Horrocks - Non-Executive Director*

Simon Michael Leathers - Independent Non-Executive Director

On Admission the following individuals will be appointed to

the Board:

David Hopton - Independent Non-Executive Chairman

Christopher (Chris) Francis Sweeney - Chief Executive Officer

Phillip Tansey - Chief Financial Officer

Dr Marko Petteri Sjoblom - Founder and Executive Director

Huw Alistair Evans - Independent Non-Executive Director

Joseph Jerry Liow Yune Loy - Independent Non-Executive Director

*resigning on Admission

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

Shareholder Percentage Percentage

pre- Admission post-Admission

Mark Horrocks 23.60% 9.95%

---------------- ----------------

Trevor (Bruno) Brookes 5.61% < 3%

---------------- ----------------

HSBC James Capel as Principal 4.21% < 3%

---------------- ----------------

Graeme Dickson 3.57% < 3%

---------------- ----------------

Marko Sjoblom - 47.22%

---------------- ----------------

Kindred Capital - 7.40%

---------------- ----------------

Nikki and Jason Rush - 4.30%

---------------- ----------------

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

N/A

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

(i) 31 December (Fiinu will change its accounting reference

date on or around admission).

(ii) For IME 31 December and incorporated by reference, for

Fiinu 31 March.

(iii) 6 months ending 30 June 2022 (by 30 September 2022);

year ending 31 December 2022 (by 30 June 2023) and 6 months

ending 30 June 2023 (by 30 September 2023).

EXPECTED ADMISSION DATE:

8 July 2022

NAME AND ADDRESS OF NOMINATED ADVISER:

SPARK Advisory Partners Limited

5 St John's Lane

London

EC1M 4BH

NAME AND ADDRESS OF BROKER:

SP Angel Corporate Finance LLP

Prince Frederick House

35-39 Maddox St

London

W1S 2PP

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

Copies of this document will be available free of charge to

the public during normal business hours on any day (Saturdays,

Sundays and public holidays excepted) at the offices of SPARK

Advisory Partners, 5 St John's Lane, London, EC1M 4BH in accordance

with the AIM Rules. This document will also be available for

download from the Company's website at www.imeplc.com up to

Admission and at www.fiinuplc.com post Admission.

THE CORPORATE GOVERNANCE CODE THE APPLICANT HAS DECIDED TO

APPLY

The Enlarged Group will adopt the UK Corporate Governance Code,

as published by the Financial Reporting Council.

DATE OF NOTIFICATION:

23 June 2022

NEW/ UPDATE:

NEW

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PAASEUFMEEESEEM

(END) Dow Jones Newswires

June 23, 2022 02:00 ET (06:00 GMT)

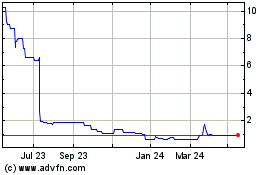

Fiinu (LSE:BANK)

Historical Stock Chart

From Dec 2024 to Jan 2025

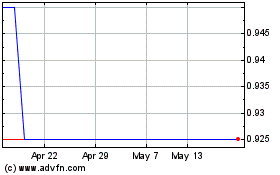

Fiinu (LSE:BANK)

Historical Stock Chart

From Jan 2024 to Jan 2025