Blue Star Capital plc Fundraise, Issue of Warrants & Broker Appointment (9244Z)

17 January 2024 - 6:00PM

UK Regulatory

TIDMBLU

RNS Number : 9244Z

Blue Star Capital plc

17 January 2024

17 January 2024

Blue Star Capital plc

("Blue Star" or the "Company")

Fundraise, Issue of Warrants and Appointment of Broker

Blue Star Capital plc (AIM: BLU), the investing company with a

focus on esports, payments, technology and its applications within

media and gaming, announces that it has raised GBP100,000, before

expenses, pursuant to a placing of 100,000,000 new ordinary shares

("Placing Shares") ("the Fundraise") at a price of 0.1p per new

ordinary share ("the Issue Price"), representing 1.96% of the

Company's enlarged issued share capital. The Fundraise was

conducted by the Company's newly appointed broker Axis Capital

Markets Limited ("the Broker" or "Axis Capital Markets").

Fundraise and Issue of Warrants

The Fundraise has raised GBP100,000, before expenses, pursuant

to the issue of the 100,000,000 Placing Shares at the Issue Price.

The proceeds of the Fundraise will be used by the Company for

working capital purposes and will provide the Company with working

capital headroom until September 2024, in line with the Company's

forecasted monthly cash burn rate and the anticipated disposal of

the Company's shareholding in SatoshiPay. In addition, for each

share issued, the shareholder participating in the Fundraise will

receive a warrant allowing the holder to subscribe for ordinary

shares in the Company, on a one to one basis, at an exercise price

of 0.1 pence for an exercisable period of 3 years, expiring on 17

January 2027 ("Warrants"). The Warrants are not subject to any

other performance criteria.

Additionally, in line with the Fundraise and to facilitate

immediate free cash to be used for working capital purposes and to

assist in delivering the strategy of the Company, the Directors of

Blue Star have agreed to receive their remuneration in ordinary

shares in the Company, in lieu of cash, on the same terms as the

Placing Shares, which include Warrants, for the period between 1

February 2024 and 30 September 2024. The Directors will not be

issued ordinary shares or Warrants until after 30 September 2024. A

further announcement will be made in due course.

Appointment of Broker

Following the completion of the Fundraise, the Company has

appointed Axis Capital Markets Limited to act as Sole Broker to the

Company, with immediate effect. Axis Capital Markets has elected to

receive its quarterly broker retainer fee in ordinary shares in the

Company, payable quarterly based on an average share price for the

relevant period. A further announcement will be made when any such

shares will be issued.

Admission and Total Voting Rights

The Placing Shares will rank pari passu with the existing

ordinary shares. Application will shortly be made to the London

Stock Exchange to admit the 100,000,000 Placing Shares to trading

on AIM ("Admission") which is expected to occur on or around 22

January 2024.

Following Admission of the Placing Shares, the Company's issued

share capital will comprise 5,092,772,995 ordinary shares which may

be used by shareholders in the Company as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change in their interest in, the

share capital of the Company under the FCA's Disclosure Guidance

and Transparency Rules. The Company does not hold any shares in

treasury.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

For further information, please contact:

Blue Star Capital plc +44 (0) 777 178 2434

Tony Fabrizi

Cairn Financial Advisers LLP +44 (0) 20 7213 0880

(Nominated Adviser)

Jo Turner / Liam Murray

Axis Capital Markets Limited +44 (0) 20 3026 0449

(Sole Broker)

Ben Tadd / Lewis Jones

About Blue Star

Blue Star is an investing company with a focus on new

technologies. Blue Star's investments include SatoshiPay Limited,

an incubator and service provider to de-fi businesses using

blockchain technology; Dynasty Gaming & Media Pte. Ltd., whose

B2B white label platform is a full-stack gaming ecosystem; and

Sthaler Limited, an identity and payments technology business which

enables a consumer to identify themselves and pay using just their

finger.

Forward looking statement disclaimer

Certain statements made in this announcement are forward-looking

statements. These forward-looking statements are not historical

facts but rather are based on the Company's current expectations,

estimates, and projections about its industry; its beliefs; and

assumptions. Words such as 'anticipates,' 'expects,' 'intends,'

'plans,' 'believes,' 'seeks,' 'estimates,' and similar expressions

are intended to identify forward-looking statements. These

statements are not guarantees of future performance and are subject

to known and unknown risks, uncertainties, and other factors, some

of which are beyond the Company's control, are difficult to

predict, and could cause actual results to differ materially from

those expressed or forecasted in the forward-looking statements.

The Company cautions shareholders and prospective shareholder

holders not to place undue reliance on these forward-looking

statements, which reflect the view of the Company only as of the

date of this announcement. The forward-looking statements made in

this announcement relate only to events as of the date on which the

statements are made. The Company will not undertake any obligation

to release publicly any revisions or updates to these

forward-looking statements to reflect events, circumstances, or

unanticipated events occurring after the date of this announcement

except as required by law or by any appropriate regulatory

authority.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEGGGDBGDBDGSR

(END) Dow Jones Newswires

January 17, 2024 02:00 ET (07:00 GMT)

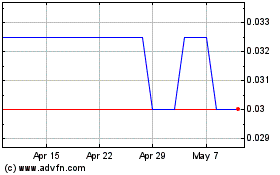

Blue Star Capital (LSE:BLU)

Historical Stock Chart

From Dec 2024 to Dec 2024

Blue Star Capital (LSE:BLU)

Historical Stock Chart

From Dec 2023 to Dec 2024