TIDMBOOT

RNS Number : 6102N

Boot(Henry) PLC

24 January 2023

24 January 2023

HENRY BOOT PLC

('Henry Boot' or 'the Group')

TRADING UPDATE FOR THE YEARED 31 DECEMBER 2022

The Board of Henry Boot PLC issues the following trading update

for the year ended 31 December 2022 ahead of the preliminary

statement of results which will be issued on 21 March 2023.

Tim Roberts, Chief Executive Officer commented:

"Having seen strong sales across the Group, we have had our best

year ever at an underlying profit level. Reflecting a particularly

challenging backdrop as the year progressed, during which a

noteworthy GBP30m of accretive sales was achieved in a weak market,

the year-end valuation movements in our investment portfolio have

had an impact on our 2022 profit before tax. Whilst it's too early

to predict the outturn for 2023 at this stage, the Group expects

this year to be more challenging than 2022. We remain convinced,

however, that in the medium term our three key markets, and the

resilience of our business model, will allow us to continue to meet

our strategic growth and return ambitions."

Trading update for the year ended 31 December 2022

Henry Boot has benefited from strong sales within its property

development and strategic land businesses, driving the Group's best

ever financial results on an underlying profit basis, which

excludes unrealised valuation movements on investment property. In

line with the fall of UK commercial property values, the investment

portfolio reduced in value, resulting in the Group expecting profit

before tax for the year ended 31 December 2022 to be slightly below

market expectations. *

Throughout 2022, the Group continued to recycle capital

achieving profitable sales whilst continuing to invest in the

business's high quality development programme. Concurrently, the

business has remained selective on new projects, with net debt

increasing only marginally to c.GBP49m (2021: GBP44m), remaining at

the lower end of our targeted gearing range of 10-20%. Whilst there

is a need to be cautious about the near-term trading environment

given macro-economic headwinds, the Group continues to make

progress against its strategic objectives and remains confident

about achieving its medium-term growth and return targets.

Hallam Land Management (HLM) traded strongly in 2022, exceeding

its strategic target of selling 3,500 plots per annum, with sales

materially higher than in the prior year primarily due to a major

disposal of 2,170 plots to Taylor Wimpey and Persimmon Homes at

Didcot. The site's community benefits include a total of 54 acres

of public open space, within which 15 acres of new woodland will be

planted.

In 2022, HLM continued to source new opportunities to grow its

land bank securing 21 sites which have the potential to deliver

c.6,900 plots. The total land portfolio has increased to 95,407

plots (2021: 92,667) of which 9,325 plots have planning. Whilst

demand for land from the national housebuilders reduced in H2 22

against the backdrop of a slowing economy, the ongoing challenges

of the planning system combined with critical housing shortages

will ensure that demand for HLM's stock of permissioned sites

remains robust. This is reflected in the level of forward sales

with HLM ending the year with 992 plots (2021: 1,880 plots)

unconditionally exchanged for completion in 2023/24.

Henry Boot Developments (HBD) has performed well, completing

developments with a Gross Development Value (GDV) of GBP117m (HBD

share GBP83m, 2021: HBD share GBP68m), of which 92% have been

pre-let or pre-sold. In the year, HBD completed on:

-- Five industrial schemes totalling 497,000 sq ft with a

combined GDV of GBP86m (HBD share: GBP60m).

-- Two residential land sales with a GDV of GBP23m (HBD share:

GBP15m), comprising a 184-unit scheme in Skipton, which was

pre-sold to Bellway, as well as a sale of land to Aberdeen City

Council for the construction of 536 houses.

-- A 23-unit residential scheme at York, Clocktower, with a GDV of GBP8m (HBD share: GBP8m).

The committed development programme now totals a GDV of GBP395m

(HBD share: GBP240m) and is currently 63% pre-let or pre-sold, with

97% of the development costs fixed. After securing pre-lets with

DPD and DHL at Preston East (HBD share: GBP15m) in H2 22, the

150,000 sq ft industrial & logistics development was

subsequently pre-sold to Titan Investments, at 10% above book

value, with completion expected in Q4 23. Further to this, HBD has

committed to Momentum, Rainham (HBD share: GBP24m) a 380,000 sq ft

speculative industrial development in an 80:20 joint venture with

Barings. Whilst formal marketing has not yet begun, the scheme is

already attracting strong occupier interest.

As previously highlighted, the Group tactically reduced the

value of the investment portfolio (including share of properties

held in JVs), which at the year-end, was valued at GBP106m (2021:

GBP126m). This was primarily due to sales within the portfolio and

property valuation losses. Whilst the CBRE index shows values have

fallen by 13% over 2022, HBD completed three sales in H2 2022 for a

total of GBP29.6m, representing a 17% premium to the last reported

book value and therefore the portfolio is expected to outperform

the Index. There are still several opportunities to replenish and

grow the level of standing assets by retaining completed

developments, in line with the business's strategic target of

GBP150m.

Stonebridge Homes (SBH) has continued to grow and during 2022

delivered 175 completions (2021: 120). In common with many in the

industry, material and supply chain challenges have impacted SBH

with completed sales below our target of 200 but strong selling

prices means the business is in line with budget. SBH enters 2023

with a total of 124 units forward sold, including the remaining 25

units from 2022 which are expected to complete in Q1. SBH total

owned and controlled land bank now comprises 1,094 units (2021:

1,157) - of which 872 plots have detailed or outline planning. The

strategic objective of growing the business to achieve 600

completions per annum remains on track, with strong selling prices

mitigating the effects of build cost inflation.

The construction segment traded ahead of expectations in 2022.

Henry Boot Construction is trading in line with management

expectations, delivering its order book for 2022 despite a

challenging environment with regard to labour and material

supplies, beginning the year with 68% of the 2023 order book

secured. Banner Plant has seen record levels of trading activity

after experiencing strong demand from its customers. Road Link has

performed well as a result of traffic volumes increasing and the

added benefit of high inflation feeding into higher toll

revenues.

Outlook

There are encouraging levels of pre-sales for both land and

houses, providing the business with a degree of insulation to a

slowing residential market in the early part of this year. The

planning environment is becoming increasingly challenging which

supports demand for the 9,325 approved plots in HLM's portfolio.

Demand for SBH homes, whilst reducing from the record levels

experienced in the middle of last year, has also proven resilient

since year end. Whilst the investment market has slowed,

occupational demand continues to hold up with the Group

experiencing robust appetite for high-quality industrial space. It

is too early to predict the outturn for 2023, however overall, the

Group expects this year to be more challenging than 2022.

Henry Boot has conviction that, in the medium-term, demand will

remain in its three key markets, and with gearing comfortably at

the bottom end of its targeted range, the Group expects to continue

to invest this year in growing the business in line with our

strategic objectives. A full outlook for 2023 will be provided in

the FY 22 results announcement in March.

*Market expectations being the average of current analyst

consensus of GBP48.1m profit before tax, comprising three forecasts

from Numis, Peel Hunt and Panmure Gordon.

-ends-

This announcement contains inside information for the purposes

of article 7 of EU Regulation 596/2014. The person responsible for

making this announcement on behalf of Henry Boot is Amy Stanbridge,

Company Secretary.

Enquiries:

Henry Boot PLC

Tim Roberts, Chief Executive Officer

Darren Littlewood, Chief Financial Officer

Daniel Boot, Group Communications Manager

Tel: 0114 255 5444

www.henryboot.co.uk

Numis Securities Limited

Joint Corporate Broker

Ben Stoop

Tel: 020 7260 1000

Peel Hunt LLP

Joint Corporate Broker

Charles Batten/Harry Nicholas

Tel: 020 7418 8900

FTI Consulting

Financial PR

Giles Barrie/Richard Sunderland

Tel: 020 3727 1000

henryboot@fticonsulting.com

About Henry Boot PLC

Henry Boot PLC (BOOT.L) was established over 135 years ago and

is one of the UK's leading and long-standing property investment

and development, land promotion and construction companies. Based

in Sheffield, the Group is comprised of the following three

segments:

Land Promotion:

Hallam Land Management Limited

Property Investment and Development:

Henry Boot Developments Limited (HBD) , Stonebridge Homes

Limited

Construction:

Henry Boot Construction Limited , Banner Plant Limited , Road

Link (A69) Limited

The Group possesses a high-quality strategic land portfolio, a

proven reputation in the property development market for creating

places with purpose, backed by a substantial investment property

portfolio and an expanding, jointly owned, housebuilding business.

It has a construction specialism in both the public and private

sectors, a plant hire business, and generates strong cash flows

from its PFI contract, Road Link (A69) Limited.

www.henryboot.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTNKNBPFBKDQDB

(END) Dow Jones Newswires

January 24, 2023 02:00 ET (07:00 GMT)

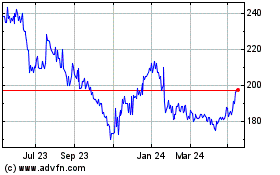

Boot (henry) (LSE:BOOT)

Historical Stock Chart

From Dec 2024 to Jan 2025

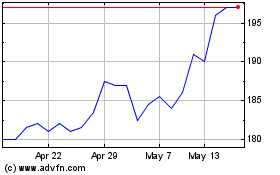

Boot (henry) (LSE:BOOT)

Historical Stock Chart

From Jan 2024 to Jan 2025