Brunner Investment Trust PLC Net Asset Value(s) (0393F)

12 May 2017 - 11:58PM

UK Regulatory

TIDMBUT

RNS Number : 0393F

Brunner Investment Trust PLC

12 May 2017

The Merchants Trust PLC

LEI: 5299008VJFXCUD2EG312

As recommended by the AIC, net asset values are calculated on

both a capital and a cum-income basis.

The Merchants Trust PLC announces that at close of business on

11 May 2017:

1) based on the par value of the company's long term debt and

preference shares, the capital net asset value per ordinary share

was 519.72p.

2) based on the market value of the company's long term debt and

preference shares, the capital net asset value per ordinary share

was 495.61p.

3) based on the par value of the company's long term debt and

preference shares, the cum-income net asset value per ordinary

share was 531.57p.

4) based on the market value of the company's long term debt and

preference shares, the cum-income net asset value per ordinary

share was 507.46p.

In the valuation of the company's long term debt at market

value, the margin added to the yield of the relevant reference gilt

is derived from the spread of BBB UK corporate bond yields over

gilt yields.

Enquiries:

Kirsten Salt

Tel: 020 3246 7513

12 May 2017

The Brunner Investment Trust PLC

LEI: 529900S0Y9ZINCHB3O93

As recommended by the AIC, net asset values are calculated on

both a capital and a cum-income basis.

The Brunner Investment Trust PLC announces that at close of

business on 11 May 2017:

1) based on the par value of the company's long term debt and

preference shares, the capital net asset value per ordinary share

was 806.12p.

2) based on the market value of the company's long term debt and

preference shares, the capital net asset value per ordinary share

was 783.23p.

3) based on the par value of the company's long term debt and

preference shares, the cum-income net asset value per ordinary

share was 814.45p.

4) based on the market value of the company's long term debt and

preference shares, the cum-income net asset value per ordinary

share was 791.56p.

In the valuation of the company's long term debt at market

value, the margin added to the yield of the relevant reference gilt

is derived from the spread of BBB UK corporate bond yields over

gilt yields.

Enquiries:

Kirsten Salt

Tel: 020 3246 7513

12 May 2017

Allianz Technology Trust PLC

LEI: 549300OMDPMJU23SSH75

As recommended by the AIC, net asset values are calculated on

both a capital and a cum-income basis. The cum-income net asset

value reflects the revenue deficit for the year to date.

Allianz Technology Trust PLC announces that at close of business

on 11 May 2017 excluding shares held in treasury:

1) the capital only net asset value per ordinary share was 1023.22p and

2) the cum-income net asset value per ordinary share was 1022.19p.

The Company currently holds ordinary shares in treasury which

have not been taken into account to dilute the net asset value

calculation above and are not part of the total voting rights of

the Company. Changes to the number of shares held in treasury are

announced when such changes occur.

Enquiries:

Tracey Lago

Tel: 020 3246 7405

12 May 2017

This information is provided by RNS

The company news service from the London Stock Exchange

END

NAVBXGDUGUBBGRD

(END) Dow Jones Newswires

May 12, 2017 09:58 ET (13:58 GMT)

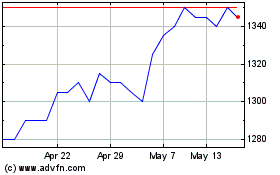

Brunner Investment (LSE:BUT)

Historical Stock Chart

From Apr 2024 to May 2024

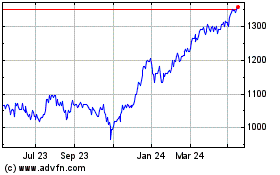

Brunner Investment (LSE:BUT)

Historical Stock Chart

From May 2023 to May 2024