TIDMCNG

China Nonferrous Gold Limited ??????????

('CNG' or the 'Company')

Interim Results for the Six-Month Period Ended 30 June 2019

China Nonferrous Gold Limited (AIM:CNG), the gold producer with

the operational Pakrut Gold Project ('the Pakrut Project') in the

Republic of Tajikistan, today announces its interim results for the

six-month period ended 30 June 2019.

The results below are available on the Company's website at

www.cnfgold.com.

Highlights

-- From January to June 2019, a total of 300,300 tons of ore was

extracted from the Pakrut gold mine; 309,600 tons of ore was

processed; and 15,557.04oz gold ingots was poured

-- From January to June 2019, the Group sold 15,557.04oz of gold ingots,

achieving sales revenue of US$20.881 million

-- the Group intends to carry out a technical renovation of the carbon in

leach ("CIL") process and equipment; an optimization of the

current

mining methods used by the Group; a review of the local staff ;

and

will review other matters to seek to reduce costs and

increase

efficiencies at site.

For further information please visit the Company's website

(www.cnfgold.com) or contact:

China Nonferrous Gold Limited

Yu Lixian, Managing Director

Tel: +86 10 8442 6681

WH Ireland Limited (NOMAD & Broker)

Katy Mitchell, James Sinclair-Ford

Tel: +44 (0)207 220 1666

Blytheweigh (PR)

Tim Blythe, Camilla Horsfall

Tel: +44 (0)20 7138 3224

Project Summary

The Pakrut Gold Project, of which CNG has 100 per cent

ownership, is situated in Tajikistan approximately 120km northeast

of the capital city Dushanbe. Pakrut is located within the Tien

Shan gold belt, which extends from Uzbekistan into Tajikistan,

Kyrgyzstan and Western China, and which hosts a number of

multi-million ounce gold deposits.

CNG has entered the stage of steady state production.

About Tajikistan

Tajikistan is a secular republic located in Central Asia. The

country is a member of the Commonwealth of Independent States and

the Shanghai Cooperation Organisation. Tajikistan hosts numerous

operating precious metal mines as well as the largest aluminum

smelter in Central Asia. CNG's management team has extensive

experience in the mining industry in Tajikistan.

CEO's Statement

As CEO of the board, it gives me great pleasure to present the

CEO's statement of the Interim Results for the Six-Month Period

Ended 30 June 2019. Following the successful trial production in

2018, the Pakrut gold mine entered steady state production and full

operation in 2019, making the Group a gold producer.

From January to June 2019, a total of 300,300 tons of ore was

extracted from the Pakrut gold mine During that same six month

period:

-- 309,600 tons of ore was processed;

-- the average grade of the raw ore was 2.10g/t;

-- the recovery rate of processing was 87.85%;

-- 11,480 tons of concentrate was produced from the processing plant; and

-- 8,210.7 tons of concentrate among them was treated in the smelter (the

recovery rate of smelting was 88.82%) and 15,557.04oz gold

ingots were

poured.

From 2019, the gold price began to rise, especially after May

2019, which has benefited the Group. From January to August 2019,

the Group sold 20,907.53oz of gold ingots, achieving sales revenue

of US$27.87million (unaudited), with an average sales price of

US$1,333.10 / oz.

Going forward, the Group intends to carry out a technical

renovation of the carbon in leach ("CIL") process and equipment; an

optimization of the current mining methods used by the Group; a

review of the local staff ; and will review other matters in order

to reduce costs and increase efficiencies at site.

Financial Results

The Company continued its development and construction work

during the first six months of 2019, Administration expenditure was

US$8,164,099(30 June 2018: US$2,179,000). The big increase was due

to the depreciation of the property, plant and equipment, more

details of which are set out in note 5 below. The operating profit

for the Group was US$278,000 (30 June 2018: loss US$3,363,000).

Total cash equivalents at the end of the period for the Group

amounted to US$16,147,939 (30 June 2018: US$61,896,000). As at 30

June 2019, there was a net liability of $1,363,000 (30 June 2019:

net assets of $9,318,000). The net liability position has arisen

due to CNG's Pakrut project entering into production from 1 January

2019, therefore the expenses relating to the project have not been

capitalized but instead have been expensed, which includes

borrowing costs. It is expected that after the production stage has

stabilized, the associated increase in sales revenue will alleviate

the negative net asset position.

To date the Group has been reliant on support from its major

shareholder, CNMC, and its associates. In January 2019, the Group

drew down US$20 million on a US$100 million loan facility with

China Construction Bank Corporation Macau Branch.

The Group commenced production in January 2019 and accordingly

is now cash generative. As mentioned in previous announcements, in

order to facilitate the repayment of existing loans, a broader

refinancing package will be required. Discussions are ongoing and

further updates will be provided in due course .

Outlook

With the normal production and operation of Pakrut gold mine

restored, the Group remain confident of achieving the production

target of 660,000 tons of ore set at the beginning of this year. In

addition, with the implementation of a series of measures to reduce

costs and increase efficiencies including the technical renovation

of CIL, the production capacity could be improved and the

associated outputs and benefits could be increased and

improved.

The Group has long been dedicated to becoming a significant gold

producer in Central Asia and participating in the "Belt and Road

Initiative" with the substantial support and advantages of major

shareholders. The Group has also established a strong relationship

with the government of Tajikistan and other Central Asian countries

and the directors believe the Company is well positioned to make

acquisitions of more gold resources and gold mines in the future,

so as to create greater benefits for our shareholders in the

future.

I would like to take this opportunity to thank all our

employees, management and advisors for their continued efforts in

2019 and thank our shareholders for their continued support. I very

much look forward to updating our shareholders further on the mine

developments, production levels, new strategy and direction.

Yu Lixia

CEO

26 June 2019

View source version on businesswire.com:

https://www.businesswire.com/news/home/20190925006032/en/

This information is provided by Business Wire

(END) Dow Jones Newswires

September 26, 2019 02:33 ET (06:33 GMT)

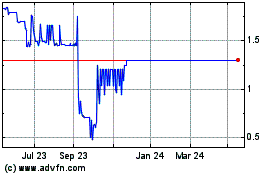

China Nonferrous Gold (LSE:CNG)

Historical Stock Chart

From Apr 2024 to May 2024

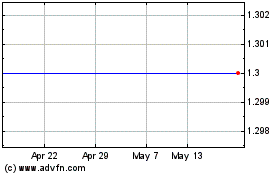

China Nonferrous Gold (LSE:CNG)

Historical Stock Chart

From May 2023 to May 2024