TIDMDIS

RNS Number : 8533P

Distil PLC

12 October 2023

Distil plc

("Distil", the "Company" or the "Group")

Interim Results for the six months ended 30 September 2023

Distil plc (AIM:DIS), owner of premium drinks brands RedLeg

Spiced Rum, Blackwoods Gin and Vodka, TRØVE Botanical Vodka and

Blavod Black Vodka, announces its unaudited interim results for the

six months ended 30 September 2023.

Operational highlights:

-- Production of RedLeg Limited Edition bottle, available from October

-- Sales and marketing drive for RedLeg in Brighton, including

exclusive rum sponsorship of city-wide event increased distribution

in the city by 179% in the lead-up to the event

-- Further consumer brand activation at Taste of London over the

summer with 55,000 attendees

-- Launch of RedLeg ecommerce site driving brand visibility and

a new revenue stream with attractive margins

-- Additional on-trade listings secured for RedLeg and Blackwoods Gin and Vodka

Financial highlights:

-- Turnover increased by 37% to GBP632k (2022: GBP460k)

-- Gross profit increased by 35% to GBP283k (2022: GBP210k)

-- Volumes (litres) increased by 48%

-- Investment in brand marketing and promotion decreased by 58%

to GBP159k (2022: GBP376k)

-- Administrative costs increased by 12% to GBP489k (2022: GBP436k)

-- Loss before tax of GBP314k (2022: GBP555k)

-- Cash reserves at period end of GBP321k (2022: GBP948k)

Don Goulding, Executive Chairman, commenting on these results

said:

"The first six months of this financial year have enabled us to

embrace the autonomy that the business remodel in H1 2022 was

designed to afford, and I'm pleased to report that the business has

returned to growth.

The period has been marked with consumer-facing brand

activation, new product development and encouraging progress

re-establishing our portfolio within the on-trade with the help of

our partners at Marussia Beverages UK.

H1 has not been without its challenges, as the business

continues to face wide-spread cost of goods increases in response

to inflation and the war in Ukraine, as well as a UK duty increase

on all alcoholic beverages. Reflecting the economic climate,

consumers globally remain cautious, the impact of which is being

felt in the trade and is expected to continue in the short to

medium term.

However, despite this, our year-on-year results are encouraging.

We are rebuilding from a stronger base under the new structure, and

the team is working diligently to ensure that we are well

positioned to continue this growth as we enter our busiest trading

period."

Executive Chairman's Statement

H1 results show double-digit growth year-on-year, which reflects

that, despite the economic backdrop, we are continuing to rebuild

following the business remodel in H1 2022.

The full effects of consumer reaction to duty increases in the

UK, which went live from 1 August, are yet to be seen, however we

have been working closely with our customers to ensure that our

brands remain well positioned and marketed to demonstrate true

value to consumers and minimise the effects of the changes on our

business.

The market remains uncertain due to the economic climate,

particularly in the UK, however we remain excited by the

opportunities presented by the business remodel, and focused on

continuing to grow our brands from a stronger base in both the UK

and export markets to drive value for our shareholders.

Operations

Our operations team has continued to work closely with both

existing and new suppliers to reduce our cost of goods following

significant increases in response to inflation and the conflict in

Ukraine. We anticipate continued cost pressures in the short to

medium term, however we expect to begin to see the benefits of the

reductions secured through this close collaboration from H2

onwards.

Reducing the environmental impact of the business remains a

priority, and the team is working closely with partners at all

stages of the supply chain to minimise emissions and wastage.

Marketing and New Product Development

Investment into brand marketing and promotion decreased 58% as

we lapped H1 2022 which included the RedLeg TV commercial. However,

the remodel in 2022 has given us greater control of our marketing

investment, and as a result, this summer we were able to activate

RedLeg directly with consumers at two key events with a combined

total of 135,000 attendees.

Activation in Brighton for the brand gave us a platform on which

to rebuild on-trade distribution, increasing listings by 179% over

the month leading up to the event, and we hope to continue to build

on this success for the rest of the year and beyond. Taste of

London in Regent's Park saw a fully branded RedLeg pop-up

activation, with the full range showcased in a variety of serves

over the course of the 5-day event, driving revenue across the

brand. Event marketing will continue to be a focus for our brands

moving forward to drive awareness and consumer trial.

These events coincided with the launch of the RedLeg ecommerce

site, selling directly to consumers online. This provides a new

revenue stream and platform on which to launch new products and

branded merchandise, delivering additional volume at attractive

margins.

The RedLeg Limited Edition bottle will be the first line

extension to be launched onto the site. Following development and

trials with our partners, the first batch was bottled in September

and is now available to purchase online and from major grocery. We

are confident that the product will have great stand-out on shelf,

and are delighted to be able to offer something new to consumers.

More information and images can be found at

www.distil.uk.com/news.

Alongside the RedLeg Limited Edition bottle, the team has been

working to lay the groundwork for new product development, which

will include both line extensions and new-to-world brands in

lucrative new categories for the business. We look forward to

sharing more details with shareholders in the second half of the

year.

Exports

Export continues to be a key area for the business and H1 saw

combined sales of Blackwoods gin and vodka increase 125%

year-on-year. This has been driven by existing customers

repurchasing following market recovery post-covid. We have received

resoundingly positive feedback on the 2022 vintage; customers are

excited by the refreshed branding and liquid, and development of

the brand home.

Similarly, we are regaining traction for Blavod within export

markets, tracking an increase of 102% year-on-year, driven

predominantly by Duty Free as consumer confidence in travel

returns.

Ardgowan Distillery Project

Ardgowan Distillery Company hosted its first annual Open Day in

June at the distillery site in Inverkip, with representatives from

Distil in attendance. Ardgowan reported 5,000 visitors on the day

from the local area and as far afield as the USA. Response on the

day was resoundingly positive, and the Blackwoods range continues

to be a hit, with visitors returning to repeat purchase at the

distillery shop. More information regarding the Open Day can be

found here. More information and images can be found at

www.distil.uk.com/news.

Commissioning of the gin still has been delayed due to the need

to change some of the instruments, however we are working closely

with the team to monitor progress with the aim of distilling the

first Blackwoods at Ardgowan as soon as possible.

Results versus same period last year

Despite a difficult economic backdrop total revenues increased

37% to GBP632k during the period as we rebuilt following the

business remodel in H1 2022.

Revenue growth is behind volume (+48% year-on-year), largely due

to sizable increase on Blavod exports (+102% year-on-year) driven

by license sales in travel retail.

The Company reduced the loss before tax by 43% to GBP314k for

the period (2022: GBP555k) despite continued pressure on gross

margins caused by increased production costs. Advertising and

marketing spend was significantly below prior period which included

one-off costs associated with the RedLeg TV campaign. Other

administrative costs increased 12% over the prior period primarily

due to an increase in staff and professional costs.

Cash reserves stood at GBP321k at the end of the period

reflecting the losses incurred during the period, and build-up in

inventory ahead of Q3, our largest and most profitable trading

period.

Outlook

We are confident we will continue to build on promising wins

within both the UK on-trade and export markets for the remainder of

the year, demonstrating that we are successfully rebuilding from a

stronger position.

Amidst a demanding economic climate and shifting consumer

behaviours, the global alcohol market is projected to continue to

grow +2% in value year-on-year from 2022-2027 (IWSR).

We anticipate that rum category growth in the UK trade (+63%

volume vs 4 years ago, off-trade) will continue, and the team is

working to ensure that RedLeg Spiced Rum remains well positioned in

line with consumer needs, and is supported with cross-trade channel

marketing support in order to benefit from the upward trend.

We head into our biggest trading period having implemented price

premiumisation across the portfolio and as a result of this,

coupled with the work of the operations team to reduce cost of

goods, we anticipate that we will begin to recover margins.

H2 will see the launch of the new limited-edition SKU for

RedLeg, the development of further new product development for both

existing and new-to-world brands to diversify our offering, and

increased marketing and promotional support internationally to

drive growth across our portfolio through to the end of the

financial year.

For further information please contact:

Distil plc

Don Goulding Executive Chairman Tel: +44 203 283 4007

----------------------

SPARK Advisory Partners

Limited (NOMAD)

----------------------

Neil Baldwin Tel +44 203 368 3550

Mark Brady

----------------------

Turner Pope Investments

(TPI) Limited (Broker)

----------------------

Andy Thacker / James Pope Tel +44 20 3657 0050

----------------------

This announcement contains inside information as stipulated

under the UK version of the Market Abuse Regulation No 596/2014

which is part of English Law by virtue of the European (Withdrawal)

Act 2018, as amended. On publication of this announcement via a

regulatory information service this information is considered to be

in the public domain

About Distil

Distil Plc is quoted on the AIM market of the London Stock

Exchange. It owns drinks brands in a number of sectors of the

alcoholic drinks market. These include premium spiced rum, vodka,

gin, vodka vanilla cream liqueur and are called RedLeg Spiced Rum.

Blackwoods Vintage Gin, Blackwoods Vodka, Blavod Original Black

Vodka, TRØVE Botanical Spirit and Diva Vodka.

Distil plc - Half Year Results

Consolidated comprehensive interim

income statement

----------- ----------- ----------

Six months Six months Year

ended 30 ended 30 ended

September September 31 March

2023 2022 2023

Un-audited Un-audited Audited

GBP'000 GBP'000 GBP'000

Revenue 632 460 1,320

Cost of sales (349) (250) (636)

----------- ----------- ----------

Gross profit 283 210 684

Administrative expenses:

Advertising and promotional costs (168) (376) (582)

Other administrative expenses (489) (436) (903)

Share based payment expense (17) (30) (3)

Total administrative expenses (674) (842) (1,488)

Operating loss (391) (632) (804)

Finance income 77 77 150

Loss before tax from continuing operations (314) (555) (94)

Income tax - - -

----------- ----------- ----------

Loss for the period (314) (555) (748)

----------- ----------- ----------

Loss per share:

From continuing operations

Basic (pence per share) (0.05) (0.08) (0.11)

Diluted (pence per share) (0.05) (0.08) (0.11)

Consolidated interim statement of

financial position

As at As at As at

30 September 30 September 31 March

2023 2022 2023

Un-audited Un-audited Audited

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Property, plant and equipment 150 159 153

Intangible fixed assets 1,648 1,613 1,633

Financial assets 3,000 3,038 3,000

Deferred tax assets 351 445 351

-------------- -------------- ----------

Total non-current assets 5,149 5,255 5,137

Current assets

Inventories 1,189 793 1,069

Trade and other receivables 479 586 883

Cash and cash equivalents 321 948 717

-------------- -------------- ----------

Total current assets 1,989 2,327 2,669

-------------- -------------- ----------

Total assets 7,138 7,582 7,806

-------------- -------------- ----------

LIABILITIES

Current liabilities

Trade and other payables 483 410 854

Financial liabilities 150 150 150

Total current liabilities 633 560 1,004

Total liabilities 633 560 1,004

-------------- -------------- ----------

Net assets 6,505 7,022 6,802

-------------- -------------- ----------

EQUITY

Equity attributable to equity holders

of the parent

Share capital 1,474 1,474 1,474

Share premium 6,211 6,211 6,211

Share based payment reserve 218 228 201

Accumulated losses (1,398) (891) (1,084)

-------------- -------------- ----------

Total equity 6,505 7,022 6,802

-------------- -------------- ----------

Consolidated interim cash flow statement

----------- ----------- -----------

Six months Six months Year ended

ended 30 ended 30 31 March

September September 2023

2023 2022

Un-audited Un-audited Audited

Cashflows from operating activities GBP'000 GBP'000 GBP'000

Loss before tax (314) (555) (654)

Adjustments for non-cash/non-operating

items:

Finance income (77) (77) (150)

Depreciation 8 8 16

Share based payment expense 17 30 3

Unrealised foreign currency gains 2 - -

(364) (594) (785)

Movements in working capital

Increase in inventories (120) (156) (432)

Decrease/(increase) in trade receivables 404 101 (196)

(Decrease)/increase in trade payables (371) 3 447

----------- ----------- -----------

Cash used in operations (87) (52) (181)

Net cash used in operating activities (451) (646) (966)

Cashflows from investing activities

Purchase of property plant & equipment (5) - (2)

Expenditure relating to the acquisition

and registration of licenses and trademarks (15) (7) (27)

Net cash used in investing activities (20) (7) (29)

Cashflows from financing activities

Interest received on convertible loans 75 38 150

Net cash generated by financing activities 75 38 150

Net decrease in cash and cash equivalents (396) (615) (845)

Cash & cash equivalents at the beginning

of the period 717 1,563 1,562

Cash & cash equivalents at the end of

the period 321 948 717

----------- ----------- -----------

Notes to the interims accounts:

1. Basis of preparation

This interim consolidated financial information for the six

months ended 30 September 2023 has been prepared in accordance with

AIM rule 18, 'Half yearly reports and accounts'. This interim

consolidated financial information is not the group's statutory

financial statements within the meaning of Section 434 of the

Companies Act 2006 (and information as required by section 435 of

the Companies Act 2006) and should be read in conjunction with the

annual financial statements for the year ended 31 March 2023, which

have been prepared under UK-adopted International Accounting

Standards (IFRS) and have been delivered to the Register of

Companies. The auditors have reported on those accounts; their

report was unqualified, did not include references to any matters

to which drew attention by way of emphasis of matter without

qualifying their report and did not contain any statements under

Section 498 (2) or (3) of the Companies Act 2006.

The interim consolidated financial information for the six

months ended 30 September 2023 is unaudited. In the opinion of the

Directors, the interim consolidated financial information presents

fairly the financial position, and results from operations and cash

flows for the period. Comparative numbers for the six months ended

30 September 2022 are also unaudited.

3. Availability

Copies of the interim report will be available from the Distil's

registered office at 201 Temple Chambers, 3-7 Temple Avenue, EC4Y

0DT and also on www.distil.uk.com .

4. Approval of interim report

This interim report was approved by the board on 11 October

2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BFLLFXBLZFBD

(END) Dow Jones Newswires

October 12, 2023 02:00 ET (06:00 GMT)

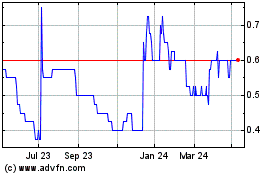

Distil (LSE:DIS)

Historical Stock Chart

From Nov 2024 to Dec 2024

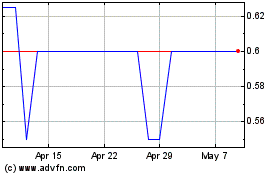

Distil (LSE:DIS)

Historical Stock Chart

From Dec 2023 to Dec 2024