TIDMEAAS

RNS Number : 4297A

eEnergy Group PLC

22 January 2024

22 January 2024

eEnergy Group plc

("eEnergy" or "the Company")

New Share Incentive and Bonus Awards

Related Party Transaction

The Board of eEnergy Group plc (AIM: EAAS), the net zero energy

services provider, today announces the implementation of new share

incentive awards ("New Awards") under the new eEnergy Group plc

2024 Share Option Plan to retain and incentivise key management

personnel. The New Awards will work alongside the existing

Management Incentive Plan ("2020 MIP") implemented and announced in

July 2020.

In mid-2023, the independent Non-executive Directors recognised

the need to restructure the Company's existing equity incentive

structure to ensure it remained effective and appropriate in the

light of the prevailing circumstances, and outlook. The economic

terms of the New Awards were agreed in principle during the Summer,

taking into account the Company's share price which was below 5p at

that time. The Company has not, however, been in a position to

implement the New Awards until today due to being in closed periods

for the majority of that time.

The New Awards are being made to four Directors of the Company,

as detailed below, together with an amount reserved for several

members of the senior management team expected to be allocated in

the coming weeks. The New Awards are subject to achieving a minimum

vesting threshold share price of 9.32p. The share price performance

target will be tested three years from award in January 2027, by

reference to the average closing mid-price over the prior 30 days

and would vest at that time only to the extent the share

performance targets had been met.

The terms of the existing 2020 MIP awards, which reward

shareholder value creation delivered in the four years following

grant in July 2020, remain unchanged. Harvey Sinclair, David

Nicholl and Andrew Lawley hold awards under the 2020 MIP. Any

awards which vest under the 2020 MIP will reduce the number of New

Awards for those awardees that could vest on a one-for-one basis.

The New Awards therefore represent the maximum total awards under

both schemes. The total number of awards under all schemes that

could vest is capped at 14.0% of the enlarged shares following

issue.

The New Awards are subject to malus and clawback provisions. The

number of options over which awards vest may be reduced by the

Board if it fairly and reasonably considers that the level of

vesting is not justified by the underlying financial performance of

the Company. On a change of control, the Remuneration Committee

(excluding any awardees) will determine the level of any vesting

based on the extent to which any exercise conditions for

individuals have been met.

The number of New Awards being made to Directors of the Company

are set out in the table below. The share price targets range from

threshold vesting at 9.32p with maximum vesting at 18.4p with

straight-line vesting between agreed midpoints.

9.32p

Number of New (minimum 18.40p (maximum

Awards vesting) 13.00p 15.80p award)

Harvey Sinclair 18,130,000 22,500,000 25,800,000 28,080,000

---------- ---------- ---------- ----------------

Crispin Goldsmith* 6,000,000 7,500,000 8,000,000 8,000,000

---------- ---------- ---------- ----------------

Andrew Lawley 2,780,000 3,400,000 4,000,000 5,500,000

---------- ---------- ---------- ----------------

David Nicholl 2,780,000 3,400,000 4,000,000 5,500,000

---------- ---------- ---------- ----------------

Other employees

(to be allocated) 3,270,000 7,160,000 9,170,000 9,170,000

---------- ---------- ---------- ----------------

Total 32,960,000 43,960,000 50,970,000 56,250,000

---------- ---------- ---------- ----------------

* in respect of Crispin Goldsmith's New Awards, 3,350,000 awards

are EMI-qualifying with the balance being non EMI-qualifying.

In addition, it is intended that, subject to completion of the

sale of the Energy Management Services division, announced earlier

today, one-off success bonuses will be awarded to Harvey Sinclair

and Crispin Goldsmith in the amounts of GBP285,000 and GBP200,000,

respectively ("Transaction Bonuses"). These amounts include any

discretionary performance bonuses payable for the 6-month period to

December 2023.

Related Party Transaction

The New Awards to Harvey Sinclair, Crispin Goldsmith, Andrew

Lawley and David Nicholl and Transaction Bonuses to Harvey Sinclair

and Crispin Goldsmith are considered to be related party

transactions for the purposes of Rule 13 of the AIM Rules. Nigel

Burton and Gary Worby, who are members of the Remuneration

Committee, will not receive New Awards, and do not participate in

the 2020 MIP and will not receive a Transaction Bonus and are

therefore considered to be independent directors for this purpose,

consider, having consulted with the Company's nominated adviser,

Strand Hanson Limited, that the terms of the New Awards and

Transaction Bonuses to the above Directors are fair and reasonable

insofar as the shareholders of eEnergy are concerned. Andrew Lawley

and David Nicholl, who are both receiving New Awards and hold 2020

MIP Shares, have not participated in the deliberations of the

Remuneration Committee on the terms of the New Awards.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 as it forms part of the law

of England and Wales by virtue of the European Union (Withdrawal)

Act 2018.

For further information, please visit www.eenergyplc.com or

contact:

eEnergy Group plc Tel: +44 20 7078 9564

Harvey Sinclair, Chief Executive info@eenergyplc.com

Officer

Crispin Goldsmith, Chief Financial

Officer

Strand Hanson Limited (Nominated Tel: +44 20 7409 3494

Adviser)

Richard Johnson, James Harris

Canaccord Genuity Limited (Joint Tel: +44 20 7523 8000

Broker)

Max Hartley, Harry Pardoe (Corporate

Broking)

Turner Pope Investments (Joint Tel: +44 20 3657 0050

Broker)

Andy Thacker, James Pope info@turnerpope.com

Tavistock Tel: +44 207 920 3150

Jos Simson, Simon Hudson, Katie eEnergy@tavistock.co.uk

Hopkins

About eEnergy Group plc

eEnergy (AIM: EAAS) is a net zero energy services provider,

empowering organisations to achieve net zero by tackling energy

waste and transitioning to clean energy, without the need for

upfront investment. It is making net zero possible and profitable

for all organisations in four ways:

-- Transition to the lowest cost clean energy through the

Group's digital procurement platform and energy management

services.

-- Tackle energy waste with granular data and insight on

energy use and dynamic energy management.

-- Reduce energy use with the right energy efficiency solutions

without upfront cost.

-- Reach net zero with onsite renewable generation and

electric vehicle (EV) charging.

eEnergy is a Top 5 B2B energy company and has been awarded the

Green Economy Mark by London Stock Exchange.

1 Details of the person discharging managerial responsibilities/person

closely associated

a. Name a) Harvey Sinclair

b) Crispin Goldsmith

c) Andrew Lawley

d) David Nicholl

---------------------------- ---------------------------------------------------------------

e Reason for notification

---------------------------------------------------------------------------------------------

a. Position/Status a) Director (CEO)

b) Director (CFO)

c) Non-executive Director

d) Non-executive Director

---------------------------- ---------------------------------------------------------------

b. Initial notification Initial Notification

/Amendment

---------------------------- ---------------------------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

---------------------------------------------------------------------------------------------

a. Name eEnergy Group plc

---------------------------- ---------------------------------------------------------------

b. LEI 2138003SZQSPC16PLX94

---------------------------- ---------------------------------------------------------------

4 Details of the transaction(s): section to be repeated for

(e) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

---------------------------------------------------------------------------------------------

a. Description of Options over Ordinary shares of 0.3p each

the financial

instrument, type

of instrument

GB00BJP1KD31

Identification

Code

---------------------------- ---------------------------------------------------------------

b. Nature of the Grant of Share Options under the Company's

transaction 2024 Share Option Plan

---------------------------- ---------------------------------------------------------------

c. Price(s) and Exercise Price(s) Volume(s)*

volume(s) per share

---------------------------- ------------------

a) 0.3 pence a) 28,080,000

b) 0.3 pence b) 8,000,000

c) 0.3 pence c) 5,500,000

d) 0.3 pence d) 5,500,000

------------------ ---------------

* at maximum option vesting threshold

---------------------------- ---------------------------------------------------------------

d. Aggregated information

* Volume*

47,080,000

0.3 pence

* Price

* at maximum option vesting threshold

---------------------------- ---------------------------------------------------------------

e. Date of the transaction 22 January 2024

---------------------------- ---------------------------------------------------------------

f. Place of the outside a trading venue

transaction

---------------------------- ---------------------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHSEFSSEELSEFF

(END) Dow Jones Newswires

January 22, 2024 02:15 ET (07:15 GMT)

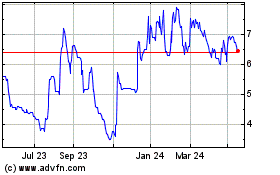

Eenergy (LSE:EAAS)

Historical Stock Chart

From Nov 2024 to Dec 2024

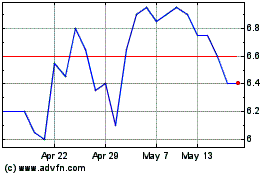

Eenergy (LSE:EAAS)

Historical Stock Chart

From Dec 2023 to Dec 2024