TIDMEMAN

RNS Number : 7384N

Everyman Media Group PLC

27 September 2023

27 September 2023

Everyman Media Group PLC

("Everyman" or the "Group")

Interim Results

Trading in line with expectations with financial performance on

track for full year

Everyman Media Group PLC, the independent, premium cinema group,

reports its unaudited interim results for the 26 weeks ended 29

June 2023.

Summary of financial performance

-- Revenue of GBP38.3m (H1 2022: GBP40.7m)

-- Adjusted EBITDA(1) of GBP5.8m (H1 2022: GBP7.5m, including a GBP0.9m VAT benefit)

-- Gross Profit Margin of 65.6% (H1 2022: 62.5%)

-- Food & Beverage Spend per Head GBP10.25 (H1 2022: GBP8.96(3) )

-- Paid-for Average Ticket Price GBP11.49 (H1 2022: GBP11.32(3) )

-- Cash generated from operating activities GBP7.2m (H1 2022: GBP9.1m)

Strategic and operational progress

-- Opened four-screen venues in Salisbury and Northallerton and

a three-screen venue in Plymouth. The Group now operates 41 cinemas

and 141 screens.

-- Agreed the sale and leaseback of the Crystal Palace freehold

for consideration of GBP3.9m.

-- Continued innovation across the Group's Food & Beverage

offering, focusing on increased choice, investment into technology,

and increased efficiency of service.

Post-period and outlook

-- Strong trading performance in July and August, summarised as follows:

o August YTD Revenue GBP60.2m (2022: GBP53.1m)

o August YTD EBITDA GBP11.0m (2022: GBP9.8m)

-- Agreed a new three-year loan facility of GBP35m with Barclays

Bank Plc and National Westminster Bank Plc, extendable by a further

two years subject to lender consent. The facility ensures that the

Group is soundly financially structured and well-positioned to take

advantage of opportunities moving forward.

-- The Board remains confident that the financial performance of

the Group for the full year ending 28 December 2023 will be in line

with market expectations(2) .

(1) Adjusted for pre-opening costs, acquisition expenses,

depreciation, amortization and share based payments.

(2) Current market forecasts for the year ended 28 December 2023

are revenue of GBP94.4m and Adjusted EBITDA of GBP17.2m.

(3) Paid for Average Ticket Price and Food & Beverage Spend

per Head comparatives have been adjusted to reflect the reduction

in VAT from 20% to 12.5% until 1 April 2022.

Alex Scrimgeour, Chief Executive of Everyman Media Group PLC,

said:

"We are pleased to report that trading continues to be in line

with the Board's expectations, having achieved robust interim

results despite this year's major film titles falling in the second

half of 2023.

The recent and resounding Box Office success of Barbie and

Oppenheimer drove exceptional performance throughout July and

August, highlighting the value of high-quality original content.

Everyman's strong year to date performance underpins our confidence

in meeting market expectations for the full year, whilst equally

demonstrating that the UK cinema sector is as vibrant as ever.

We remain confident in our prospects as we continue to be

supported by a slate of high-quality second half releases, a

carefully expanded estate and new banking facilities which ensure

we are well configured to take advantage of future

opportunities."

For further information, please contact:

Everyman Media Group plc Tel: 020 3145 0500

Alex Scrimgeour, Chief Executive

Will Worsdell, Finance Director

Canaccord Genuity Limited (NOMAD Tel: 020 7523 8000

and Broker)

Bobbie Hilliam

Harry Pardoe

Alma PR (Financial PR Advisor) Tel: 020 3405 0205

Rebecca Sanders-Hewett

David Ison

Joe Pederzolli

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014 as it forms part of United

Kingdom domestic law by virtue of the European Union (Withdrawal)

Act 2018 (as amended) ("UK MAR").

About Everyman Media Group PLC:

Everyman is the fourth largest cinema business in the UK by

number of venues, and is a premium, high growth leisure brand.

Everyman operates a growing estate of venues across the UK, with an

emphasis on providing first class cinema and hospitality.

Everyman is redefining cinema. It focuses on venue and

experience as key competitive strengths, with a unique

proposition:

-- Intimate and atmospheric venues, which become a destination in their own right

-- An emphasis on a strong quality food and drink menu prepared in-house

-- A broad range of well-curated programming content, from

mainstream and independent films to theatre and live concert

streams, appealing to a diverse range of audiences

-- Motivated and welcoming teams

For more information visit

http://investors.everymancinema.com/

Chief Executive's Statement

Trading in the first half of 2023 was in line with expectations,

with revenue of GBP38.3m (H1 2022: GBP40.7m) and EBITDA of GBP5.8m

(H1 2022: GBP7.5m). H1 2022 included a GBP0.9m EBITDA benefit from

the Temporarily Reduced Rate of VAT, which ended on 31(st) March

2022.

The timing of major releases in 2022 was weighted towards the

first half of the year, with titles such as The Batman, Belfast and

Top Gun: Maverick playing particularly well to Everyman audiences.

The 2023 slate, by contrast, is weighted towards H2, with Indiana

Jones and the Dial of Destiny, Mission Impossible: Dead Reckoning

Part One, Barbie and Oppenheimer arriving post-period end and

contributing to strong July and August trading. At the end of

August 2023, YTD revenue was GBP60.2m (2022: GBP53.1m) and EBITDA

was GBP11.0m (2022: GBP9.8m).

The performance of this year's major summer titles has

demonstrated that the appetite for high-quality, original content

is indisputable; our expectation is that the commercial success of

these films will inspire studios to invest in further new and

innovative releases. It is pleasing to note that five of the

fifteen highest-grossing films of all time have been in the last

two years (Spiderman: No Way Home, No Time to Die, Barbie, Top Gun:

Maverick and Avatar: The Way of Water).

Elevating the Everyman experience

Food & Beverage spend per head increased to GBP10.25

compared to GBP8.96 in 2022, despite the backdrop of a difficult

environment for consumer discretionary spend. We have continued to

focus on giving our customers more choice, with new sharing dishes,

vegan options, quarterly specials and cocktails. We have also

launched a spend incentive for our venue teams, resulting in a

higher proportion of guests ordering and increased participation

(number of items per order).

We continue to invest in technology. Our new website launched in

February, improving user experience and the customer booking

journey. Average monthly visitors since launch have been 940k, an

increase of 17.8%, and we have also made improvements to the

booking journey for our members. Our bar and kitchen screen

roll-out was completed in February, helping to improve speed of

service, and functionality for customers to order from their mobile

devices is being piloted in a small number of venues post-period

end. In addition, development is now underway on a new Android and

iOS app.

We continue to build the Everyman brand. During the period, we

commenced a new partnership with American Express, who have

committed to hosting four nationwide previews, starting with

Asteroid City and Past Lives. American Express have also sponsored

additional events at Everyman Secret Cinema at The Grove Hotel in

Hertfordshire, returning for its third consecutive year.

Our signature partnerships with Jaguar and Green & Black's

go from strength-to-strength. Jaguar sponsored an immersive event

for Babylon at our Crystal Palace venue in January and have

continued to support the Screen on the Canal at Granary Square in

London. During the period, Discovery were added as a new brand

partner, and we hosted the UK premiere of Searchlight's Chevalier,

in partnership with Green & Black's.

Our relationship with Apple TV+ continues to grow, with

screenings of The Reluctant Traveller, Prehistoric Planet, Sharper

and Tetris.

Continued organic expansion

As at 27 September 2023, Everyman currently has 41 cinemas and

141 screens. We opened a four-screen venue in Salisbury, a

four-screen venue in Northallerton and a three-screen venue in

Plymouth in Q2 2023. These new venues are currently trading in line

with management expectations.

Maintaining a prudent attitude to leverage, the Board is

constantly evaluating new opportunities to grow the Everyman

estate. With this in mind, a new two-screen venue will open in

Marlow in Q3 2023. A three-screen venue in Bury St Edmunds is

expected to open in Q1 2024, a four-screen venue in Durham in Q2

2024, a five-screen venue in Cambridge and a three-screen venue in

Stratford (London) in Q3 2024 and a five-screen venue at The

Whiteley (Bayswater) in Q4 2024. The pipeline for 2025 is

well-developed, with several venues at advanced stages of

negotiation.

New banking facilities

On 17 August 2023, the Group agreed a new three-year loan

facility of GBP35m with Barclays Bank Plc and National Westminster

Bank Plc, extendable by a further two years subject to lender

consent. The new facility replaces the existing GBP25m Revolving

Credit Facility and GBP15m Coronavirus Large Business Interruption

Loan Scheme ("CLBILS") held with Barclays Bank Plc and Santander UK

Plc.

The new facility ensures that the Group is soundly financially

structured and well-positioned to take advantage of opportunities

moving forward. We were pleased that there was strong appetite from

multiple lenders to work with Everyman, and that the agreed

commercial terms and loan covenants are materially similar to the

previous agreement.

Performance review

The Group uses the key performance indicators of Admissions,

Paid-for Average Ticket Price and Food & Beverage Spend per

Head to monitor the progress of the Group's activities.

26 weeks 26 weeks

ended ended

29 June 2023 30 June 2022

Admissions 1.6m 1.8m

Paid-for Average Ticket GBP11.49 GBP11.32

Price*

Food & Beverage Spend GBP10.25 GBP8.96

per Head*

*Paid For Average ticket price has been adjusted to reflect the

reduction in VAT from 20% to 12.5% until 1 April 2022.

** Food & Beverage Spend per Head has been adjusted to

reflect the reduction in VAT from 20% to 12.5% across certain items

until 1 April 2022.

Admissions

Admissions in H1 2023 were 1.6m, compared to 1.8m in the same

period last year. 2022 admissions were H1 weighted, with titles

such as The Batman, Belfast and Top Gun: Maverick, all of which

played particularly well for Everyman audiences, releasing in the

first half of the year.

As previously announced, the slate in H1 2023 did not see as

much benefit from high quality, original content; however, the

widely-publicised performance of Barbie and Oppenheimer, as well as

other titles such as Indiana Jones and Mission: Impossible, has led

to a strong start to the second half of the year. At the end of

August 2023, YTD admissions were 2.5m (2022: 2.3m).

Average Ticket Price and Food & Beverage Spend per Head

Spend per Head increased to GBP10.25 compared to GBP8.96 in 2022

with last year's VAT benefit removed, driven by continued

investment in our menu and technology, giving our customers more

choice and enabling quicker and more efficient service to

seats.

Paid-for Average Ticket Price increased to GBP11.49 compared to

GBP11.32 in 2022 with last year's VAT benefit removed. This is

pleasing given that the content in H1 was skewed towards a younger

audience, as well as four new venues opening between H1 2022 and

the end of the period. With some exceptions, new venues open in

lower pricing tiers, which can temporarily reduce average ticket

price until those venues mature.

Hollywood strike

In line with recent press coverage, we welcome the reported

resolution between the Writers Guild of America and the Alliance of

Motion Picture and Television Producers. Our expectation is that a

resolution with the Screen Actors Guild will follow shortly.

There has been minimal disruption to the film slate in 2023;

whilst six titles have been pushed back to next year, twelve have

been added to the slate since the strikes began. Dune: Part Two is

currently the only major release to move to 2024; however, we now

look forward to the recently-announced Taylor Swift: The Eras Tour

on 13(th) October, which achieved the highest-ever single day

pre-sales at AMC in the US.

Outlook

Our optimism for the future continues, with strong second half

performance underpinned by the success of Barbie, Oppenheimer as

well as other releases at the Box Office. Despite the current

discretionary spend environment, we have continued to trade

resiliently, highlighting our guests' desire to be entertained. On

a longer term view, we are well-positioned to benefit further when

the consumer market improves. The differentiated, premium Everyman

offer stands us in good stead going forward.

Alex Scrimgeour

Chief Executive

27 September 2023

Finance Director's Statement

26 Weeks 26 Weeks

Ended 29 Ended 30

June 2023 June 2022

GBP000 GBP000

Revenue 38,253 40,718

Gross Profit 25,101 25,462

------------ ------------

Gross Profit Margin 65.6% 62.5%

Other Operating Income 322 155

Administrative Expenses (27,038) (24,780)

Operating Profit / (Loss) (1,615) 837

------------ ------------

Financial Expenses (2,696) (1,635)

Profit / (Loss) Before

Taxation (4,311) (798)

------------ ------------

Tax Credit / (Charge) - -

Profit / (Loss) For the

Period (4,311) (798)

============ ============

Adjusted EBITDA* 5,782 7,502

============ ============

*Adjusted EBITDA refers to Operating Profit adjusted for the

removal of depreciation, amortisation, profit / loss on disposal of

fixed assets, pe-opening expenses, lease termination costs,

impairment charges and share-based payment expenses.

Revenue and operating profit

Group revenue in H1 2023 was GBP38.3m compared to GBP40.7m in

the same period last year. This was driven by the phasing of

admissions, which were weighted towards H1 in 2022 but towards H2

in 2023. Our three new venues in Salisbury, Northallerton and

Plymouth opened towards the end of the period, and therefore the

Group will begin to see EBITDA contribution from them in the second

half of the year.

Additionally, the comparative period includes a GBP0.9m benefit

from the Temporarily Reduced Rate of VAT, which was 12.5% until 31

March 2022, after which the standard rate of VAT resumed.

Gross Profit Margin increased to 65.6% (H1 2022: 62.5%) as a

result of the increase in Food & Beverage Spend per Head to

GBP10.25 (H1 2022: GBP8.96) growing the mix of Food & Beverage

revenue, which carries a higher margin than Film. We also saw

increases in Private Hire, Events and Partnerships income, all of

which contributed to an improvement in overall Gross Profit

Margin.

Administrative Expenses increased to GBP27.0m (H1 2022:

GBP24.8m). This was driven by the increase in the number of venues

from 37 at the end of the end of H1 2022 to 41 at the end of H1

2023 contributing to an increase in the Group's fixed cost base,

depreciation, and associated pre-opening expenses.

The Group's largest cost increase was Labour, a GBP0.6m increase

vs. H1 2022, due to a 9.7% increase in the National Living Wage in

April 2023 driving pay increases for our teams, and the

aforementioned new openings.

Utilities costs were GBP1.1m during the period (H1 2022:

GBP0.9m), increasing in line with the growing estate. On 21 July

2023, the Group signed new agreements with SSE and Crown to fix our

Electricity and Gas costs for one year, from 1(st) November 2023.

Whilst the agreed rates are in line with management forecasts, the

shorter-term fix is to allow the Utilities market to settle further

prior to seeking a longer-term agreement during 2024.

Net finance costs

The Group's net bank interest payable was GBP1m in H1 2023, a

GBP0.6m increase on the same period last year. This is as a result

of an increase in the base rate to 5% at the end of H1 2023 (H1

2022: 1.25%), as well as an increase in gross debt to GBP22.75m (H1

2022: GBP14.5m) to finance the Group's continued expansion.

The Group's finance charge in H1 2022 was GBP1.6m (H1 2021

GBP1.4m) and represents interest charges relating to the unwinding

of the IFRS 16 lease liability during the period.

Share based payments

The share-based payment expense for the period was GBP0.6m (H1

2022: GBP0.8m) reflecting share option incentives provided to the

Group's management and employees.

Cash flows

Cash held at the end of the period was GBP1.7m (H1 2022:

GBP5.9m).

Net cash generated in operating activities was GBP7.2m (H1 2022:

GBP9.1m). The net cash outflow for the period was GBP2.0m (H1 2022:

GBP1.7m inflow). This is largely represented by investing cash flow

of GBP8.5m (H1 2022: GBP7.5m) relating to build costs for new

venues, infrastructure and new systems to support the growing

business.

Following the agreement of our new banking facilities on 17

August 2023, the Group has access to a GBP35m facility of which

GBP22.75m was drawn at the end of the period.

The Board does not recommend the payment of a dividend at this

stage of the Group's development.

Capital expenditure

During the period, the Group opened a four-screen venue in

Salisbury, a four-screen venue in Northallerton and a three-screen

venue in Plymouth. The Group is due to open a new two-screen venue

in Marlow in Q3 2023. We are on track to open at least five further

venues in 2024, with several potential venues at advanced stages of

negotiation for 2025 and beyond.

Capital investment during the period was GBP12.1m (H1 2022:

GBP6.8m) and landlord contributions were GBP2.8m (H1 2022:

GBP1.3m). As a result, net capital investment was GBP9.3m (H1 2022:

GBP5.5m). Of this, GBP8.3m was on new venues (H1 2022: GBP4.3m).

Residual capital expenditure related to infrastructure and head

office costs to support the continued growth of the business.

Sale and Leaseback of Crystal Palace Venue

On 16(th) January 2023 the Group completed the sale and

leaseback of its freehold at 25 Church Road, London SE19 2TE for

consideration of GBP3.9m. The property was held on the Balance

Sheet at 29(th) December 2022 as an Asset Held for Sale, at a net

book value of GBP3.2m. Under the rules of IFRS 16, and because the

Group has replaced a freehold with a right-of-use asset, the gain

on disposal has been capped at GBP0.1m.

Net Debt

Net debt at the end of the period was GBP21.3m. This was driven

by a lower cash balance at the end of the period, primarily due to

payments to contractors on the three new venues opened during May

and June. At the end of August 2023, net debt had fallen to

GBP17.9m.

Will Worsdell

Finance Director

27 September 2023

Consolidated statement of profit and loss and other

comprehensive income for the period ended 29 June 2023

(unaudited)

26 weeks 26 weeks Year

ended ended ended

29 June 30 June 29 December

2023 2022 2022

Note GBP000 GBP000 GBP000

Revenue 3 38,253 40,718 78,817

Cost of Sales (13,152) (15,256) (28,338)

---------- ---------- -------------

Gross profit 25,101 25,462 50,479

---------- ---------- -------------

Other Operating Income 322 155 622

Administrative expenses (27,038) (24,780) (50,699)

---------- ---------- -------------

Operating profit/(loss) (1,615) 837 402

---------- ---------- -------------

Financial expenses (2,696) (1,635) (3,906)

---------- ---------- -------------

Profit/(Loss) before taxation (4,311) (798) (3,504)

Tax credit/(charge) 4 - - -

Total comprehensive profit/(loss)

for the period (4,311) (798) (3,504)

---------- ---------- -------------

Basic loss per share (pence) 5 (4.73) (0.88) (3.84)

---------- ---------- -------------

Diluted loss per share (pence) 5 (4.73) (0.88) (3.84)

---------- ---------- -------------

All amounts relate to continuing

activities.

Non-GAAP measure: adjusted EBITDA

Adjusted EBITDA 5,782 7,502 14,527

Before:

Depreciation and amortisation (6,328) (5,671) (11,725)

Exceptional items (39) (215) (234)

Disposal of property, plant and equipment 149 - (434)

Pre-opening expenses (588) 5 (195)

Share-based payment expense (591) (784) (1,537)

Operating profit/(loss) (1,615) 837 402

------------------------------------------------------ ---------- ----------

Consolidated balance sheet at 29 June 2023 (unaudited)

Registered in England

and Wales

08684079

29 June 30 June 29 December

2023 2022 2022

GBP000 GBP000 GBP000

Assets

Non-current assets

Property, plant and equipment 99,784 84,923 90,067

Right-of-use assets 61,841 59,449 58,920

Intangible assets 9,231 9,283 9,312

Trade and other receivables 173 173 173

---------- ---------- --------------

171,029 153,828 158,472

---------- ---------- --------------

Asset held for sale - - 3,219

---------- ---------- --------------

171,029 153,828 161,691

Current assets

Inventories 757 662 690

Trade and other receivables 7,113 3,877 5,840

Cash and cash equivalents 1,702 5,903 3,701

---------- ---------- --------------

9,572 10,442 10,231

---------- ---------- --------------

Total assets 180,601 164,270 171,922

---------- ---------- --------------

Liabilities

Current liabilities

Other interest-bearing loans

and borrowings 248 252 247

Trade and other payables 20,636 17,133 15,571

Lease liabilities 2,511 2,985 3,014

23,395 20,370 18,832

---------- ---------- --------------

Non-current liabilities

Other interest-bearing loans

and borrowings 22,750 14,500 22,000

Other provisions 1,362 1,066 1,362

Lease liabilities 90,545 80,112 83,459

114,657 95,678 106,821

---------- ---------- --------------

Total liabilities 138,052 116,048 125,653

---------- ---------- --------------

Net assets 42,549 48,222 46,269

---------- ---------- --------------

Equity attributable to owners

of the Company

Share capital 9,118 9,118 9,118

Share premium 57,112 57,112 57,112

Merger reserve 11,152 11,152 11,152

Other reserve 83 83 83

Retained earnings (34,916) (29,243) (31,196)

---------- ---------- --------------

Total equity 42,549 48,222 46,269

---------- ---------- --------------

Consolidated statement of changes in equity for the period ended

29 June 2023 (unaudited)

Share Share Merger Other Retained Total

capital Premium reserve Reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 29 December

2022 9,118 57,112 11,152 83 (31,196) 46,269

Loss for the period - - - - (4,311) (4,311)

Share-based payments - - - - 591 591

Total transactions with

owners of the parent - - - - (3,720) (3,720)

--------- --------- ---------- --------- ------------ ------------------

Balance at 29 June 2023 9,118 57,112 11,152 83 (34,916) 42,549

--------- --------- ---------- --------- ------------ ------------------

Balance at 30 December

2021 9,117 57,097 11,152 83 (29,229) 48,220

Loss for the year - - - - (3,504) (3,504)

--------- --------- ---------- --------- ------------ ------------------

Shares issued in the period 1 15 - - - 16

Share- based payments - - - - 1,537 1,537

Total transactions with

owners of the parent 1 15 - - 1,537 1,537

--------- --------- ---------- --------- ------------ ------------------

Balance at 29 December

2022 9,118 57,112 11,152 83 (31,196) 46,269

--------- --------- ---------- --------- ------------ ------------------

Consolidated cash flow statement for the period ended 29 June

2023 (unaudited)

29 June 30 June 29 December

2023 2022 2022

Note GBP000 GBP000 GBP000

Cash flows from operating activities

(Loss) for the period (4,311) (798) (3,504)

Adjustments for:

Financial expenses 2,696 1,635 3,906

Operating profit / (loss) (1,615) 837 402

---------- ---------- -------------

Depreciation and amortisation 6,328 5,671 11,725

Gains on derecognition of lease

contract - (99) (99)

Loss/(gain) on disposal of property,

plant and equipment (149) - 434

Equity-settled share-based payment

expenses 591 784 1,537

---------- ---------- -------------

5,155 7,193 13,999

Changes in working capital

Decrease/(increase) in inventories (67) 48 21

Decrease/(increase) in trade and

other receivables (1,273) 1,026 (187)

Increase/(decrease) in trade and

other payables 3,349 1,108 (1,658)

Decrease in provisions - (242) (378)

---------- ---------- -------------

Net cash generated from operating

activities 7,164 9,133 11,797

Cash flows from investing activities

Proceeds from freehold sale 3,900 - -

Acquisition of property, plant

and equipment (12,148) (6,839) (18,884)

Acquisition of intangible assets (300) (654) (1,058)

Net cash used in investing activities (8,548) (7,493) (19,942)

---------- ---------- -------------

Cash flows from financing activities

Proceeds from the issuance of ordinary

shares - 17 16

Proceeds from bank borrowings 750 2,000 9,500

Repayment of bank borrowings - - -

Lease payments - interest (1,645) (1,386) (2,851)

Lease payments - capital (1,549) (1,620) (3,210)

Landlord capital contributions 2,826 1,300 5,005

Interest paid (997) (288) (854)

---------- ---------- -------------

Net cash generated/(used in) from

financing activities (615) 23 7,606

---------- ---------- -------------

Cash and cash equivalents at the

beginning of the period 3,701 4,240 4,240

Net increase / (decrease) in cash

and cash equivalents (1,999) 1,663 (539)

Cash and cash equivalents at the

end of the period 1,702 5,903 3,701

---------- ---------- -------------

Notes to the financial statements

1 General information

Everyman Media Group PLC and its subsidiaries (together, 'the Group')

are engaged in the ownership and management of cinemas in the United

Kingdom. Everyman Media Group PLC (the Company) is a public company

limited by shares domiciled and incorporated in England and Wales

(registered number 08684079). The address of its registered office

is Studio 4, 2 Downshire Hill, London NW3 1NR.

2 Basis of preparation and accounting policies

These condensed interim financial statements of the Group for the

period ended 29 June 2023 have been prepared using accounting policies

consistent with UK adopted International Accounting Standards. The

same accounting policies, presentation and methods of computation

are followed in the condensed set of financial statements as applied

in the Group's latest audited financial statements for the year

ended 29 December 2022.

The financial statements presented in this report have been prepared

in accordance with IFRSs applicable to interim periods. However,

as permitted, this interim report has been prepared in accordance

with the AIM Rules for Companies and does not seek to comply with

IAS34 "Interim Financial Reporting".

These condensed interim financial statements have not been audited,

do not include all of the information required for full annual financial

statements and should be read in conjunction with the Group's statutory

consolidated annual financial statements for the year ended 29 December

2022. The auditor's opinion on these financial statements was unqualified,

did not draw attention to any matters by way of emphasis and did

not contain a statement under s498(2) or s498(3) of the Companies

Act 2006.

Going Concern

As part of the adoption of the going concern basis, Everyman continues

to consider the uncertainty caused by the macroeconomic environment.

The Group's financing arrangements include a GBP35m revolving credit

facility ("RCF") held with Barclays Bank Plc and National Westminster

Bank Plc. This facility was agreed on 17 August 2023 and is repayable

on or before 17 August 2026, and can be extended for up to two further

years, subject to lender consent.

As at 29 June 2023 the Group had drawn GBP22.75m of its previous

GBP25m RCF and GBP15m Coronavirus Large Business Interruption Loan

Scheme ("CLBILS") held with Barclays Bank Plc and Santander Plc,

had accrued interest of GBP0.2m and held cash of GBP1.7m. The net

debt position was GBP21.3m, with the undrawn facility at GBP17.25m.

Management note that net debt was higher than run-rate due to the

opening of three new venues in May and June 2023 and a correspondingly

lower cash balance, and that net debt has fallen to c. GBP17.9m

at the end of August 2023.

The new RCF has leverage and fixed charge cover covenants. The Board

has reviewed forecast scenarios and is confident that the business

can continue to operate with sufficient headroom. These forecasts

consider scenarios in which there is no further growth in admissions

beyond 2023 levels and include realistic assumptions around wage

increases and inflation. Utilities contracts have been fixed for

a year from 1(st) November 2023 and rates achieved on both gas and

electricity are in line with management expectations and forecasts.

In light of this, the Board consider it appropriate to adopt the

going concern basis of accounting in preparing the financial statements.

3 Revenue 26 weeks 26 weeks Year ended

ended ended 29

29 June 30 June December

2023 2022 2022

GBP000 GBP000 GBP000

Film and entertainment 17,644 20,234 39,764

Food and beverages 16,085 16,699 32,250

Other income 4,524 3,785 6,803

---------- ---------- ------------

38,253 40,718 78,817

---------- ---------- ------------

In the 26-week period ended 29 June 2023, GBP0.3m Other

Operating Income was received (H1 2022: GBP0.2m). This consisted

mainly of landlord compensation payments.

4 Taxation 26 weeks 26 weeks Year ended

ended ended 29

29 June 30 June December

2023 2022 2022

GBP000 GBP000 GBP000

Current tax - - -

Adjustments in prior years - - -

-------------------- ---------- ------------

- - -

Deferred tax (credit)/expense

Origination and reversal of temporary - (18) -

differences

Adjustments in respect of prior years - 18 -

Effect of tax rate change - - -

Deferred tax not previously recognised - - -

-------------------- ---------- ------------

Total tax (credit)/charge - - -

-------------------- ---------- ------------

The reasons for the difference between the actual tax charge for

the period and the standard rate of corporation tax in the United

Kingdom applied to the loss for the period are as follows:

Reconciliation of effective 26 weeks 26 weeks Year ended

tax rate ended ended 29

29 June 30 June December

2023 2022 2022

GBP000 GBP000 GBP000

(Loss) before taxation (4,311) (798) (3,504)

Tax at the UK corporation effective tax

rate of 23.5% (H1 2022: 19%) (1,013) (152) (666)

Permanent differences (expenses not deductible

for tax purposes) 662 463 840

Deferred tax not previously - (433) -

recognised

Impact of difference in overseas tax rates - 1 -

De-recognition of losses 351 - 32

Other short term timing differences - 3 -

Effect of change in expected future statutory

rates on deferred tax - 104 (206)

Impact of a drop in share-based payments - (4) -

intrinsic value

Adjustment in respect of previous periods - 18 -

-------------------- ---------- ------------

Total tax (credit)/charge - - -

-------------------- ---------- ------------

5 Earnings per 26 weeks 26 weeks Year

share ended ended ended

29 June 30 June 29

December

2023 2022 2022

GBP000 GBP000 GBP000

Profit/(Loss) used in calculating basic

and diluted earnings per share (4,311) (798) (3,504)

Number of shares (000's)

Weighted average number of shares for

the purpose of basic earnings per share 91,178 91,177 91,178

-------------------- ---------- ------------

Number of shares (000's)

Weighted average number of shares for

the purpose of diluted earnings per share 91,178 91,177 91,178

-------------------- ---------- ------------

Basic earnings per share (pence) (4.73) (0.88) (3.84)

-------------------- ---------- ------------

Diluted earnings per share

(pence) (4.73) (0.88) (3.84)

-------------------- ---------- ------------

Basic earnings per share amounts are calculated by dividing net profit/(loss)

for the period attributable to Ordinary equity holders of the parent

by the weighted average number of Ordinary shares outstanding during

the year.

The Company has 7.8m potentially issuable shares (H1 2022: 6.9m)

all of which relate to the potential dilution from the Group's share

options issued to the Directors and certain employees and contractors,

under the Group's incentive arrangements. In the current period these

options are anti-dilutive as they would reduce the loss per share

and so haven't been included in the diluted earnings per share.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SELFMMEDSEDU

(END) Dow Jones Newswires

September 27, 2023 02:00 ET (06:00 GMT)

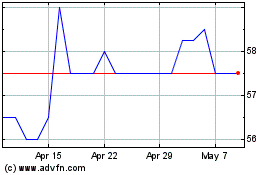

Everyman Media (LSE:EMAN)

Historical Stock Chart

From Apr 2024 to May 2024

Everyman Media (LSE:EMAN)

Historical Stock Chart

From May 2023 to May 2024