TIDMENOG

RNS Number : 9346T

Energean PLC

23 March 2023

Energean plc

("Energean" or the "Company")

2022 Full Year Results

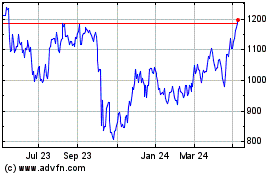

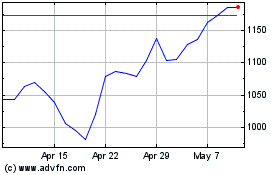

London, 23 March 2023 - Energean plc (LSE: ENOG, TASE: ) is

pleased to announce its audited full-year results for the year

ended 31 December 2022 (" FY 2022 ").

Mathios Rigas, Chief Executive of Energean, commented:

" 2022 was a year of transformation for Energean - where a

long-held vision became an operational reality. It was a year of

positive delivery. We commenced production from the only FPSO in

the strategically vital Eastern Mediterranean region, paid

dividends to our shareholders, and laid the foundation for our

future growth through the discovery and de-risking of new natural

gas resources adjacent to our infrastructure. Energean was the sole

owner-operator of five deepwater wells, which drove a 20% increase

in our reserve base, and marked the 15(th) consecutive year of

reserve and resource base increases for Energean. We are proud to

be on track to deliver between 4.5 and 5.5 bcm of gas into the

Israeli domestic gas market this year, contributing towards the

security of energy supply of the region and improving the living

conditions of the Israeli public through the reduction of emissions

from the displacement of coal-fired power generation.

"The first quarter of 2023 has continued the positive trend.

Production from Karish is in line with our expectations, and in

February we supplied the first Israeli hydrocarbon liquids export

cargo to international markets. In Egypt, we achieved first gas at

NEA/NI with three further wells due to come onstream during the

year. In Italy, we are the third largest producer of natural gas

and look forward to increasing our contribution towards the

country's energy supply. And in Greece, we are continuing our

efforts to explore the untapped resources of the country.

"The remainder of 2023 will see us present the development

concept for the Olympus Area, offshore Israel, and increase the

capacity of the Energean Power FPSO to 8 bcm/yr. This is alongside

delivery of production in line with guidance plus on-target

returns, as promised, to our shareholder base. Through our gas

contracting strategy we are in a unique position to have a very

predictable and stable cashflow despite turbulence and challenges

in the international financial markets.

"We are committed to investing in projects where we can create

value for all stakeholders. The global energy crisis is not over -

the global gas market remains dangerously tight and benefitted from

a mild European winter, but thousands of industrial jobs are now at

risk not just to price but also to availability. We therefore hope

that governments understand the value of enhanced domestic and

regional energy production, that can only be delivered through

long-term investment."

Highlights

-- Delivered first gas from Karish in October 2022

o Production and ramp up in line with expectations

o Energean is now sequentially notifying gas buyers that the

commissioning period under the gas sales and purchase agreements

("GSPAs") has ended and the start date for commercial obligations

has commenced. The Company expects to have completed this process

for all gas buyers by the end of March 2023

-- Initiated hydrocarbon liquid exports from Karish field to international markets

-- Delivered first production from NEA/NI, Egypt, in March 2023

-- On track to deliver 200 kboed production target in 2H 2024

-- Confirmed year-end 2P reserves of 1,161 mmboe (+20% increase

versus end-2021) representing a reserve replacement ratio of

1400%

o Including the addition of 31 bcm (approximately 206 mmboe) of

2P reserves in the Olympus Area, offshore Israel, that have now

been certified by Energean's reserves auditor, Degolyer and

McNaughton ("D&M")

-- Delivered strong financial performance, underpinned by strong commodity prices

o 2022 revenues of $737.1 million, represented a 48.3% increase

(2021: $497.0 million)

o 2022 EBITDAX of $421.6 million, represented a 98.8% increase

(2021: $212.1 million)

o 2022 profit-after-tax of $17.3 million was an improvement on

last year's loss (2021: $(96.2) million). Profit after tax was

negatively impacted by $119.4 million of windfall taxes in Italy

[1] , which we expect have been applied on a one-off basis

o Group cash as of 31 December 2022 was $502.7 million

(including restricted amounts of $74.8 million) and total liquidity

was $720.0 million. In March 2023, Energean signed a $350 million

term loan which, although expected to remain undrawn, provides

additional financial flexibility

-- Announced dividend strategy and initiated dividend payments

o Cumulative dividends paid of 60 US$ cents with a further 30

US$ cents declared and will be paid on 30 March 2023, representing

an annualised yield of approximately 9% [2] .

-- Carbon Disclosure Project ("CDP") rating increased to A-

(from B), outperforming the global average for E&Ps of C

Outlook

-- 2023 production guidance confirmed at 131 - 158 kboed,

including 4.5 - 5.5 bcm of gas from Karish

-- Mid-term targets now considered near-term: on track to

achieve production, financial targets and leverage targets in 2H

2024 [3] through execution of key development projects

o Karish growth projects to increase the capacity of the

Energean Power FPSO are on track for year-end 2023, following which

Israel production is expected to be 140 - 155 kboed on plateau

o Three additional wells to be brought onstream at NEA/NI by

year-end 2023, following which production in Egypt is expected to

be more than 40 kboed

o Cassiopea expected to deliver first gas in 2024, following

which production in Italy is expected to be approximately 20

kboed

-- Communication of development concept for the Olympus Area expected in the coming months

-- Orion-1X well, Egypt, (Energean 30%, expected to farm down to

18%) expected to spud in late 2023, slightly delayed due to rig

availability

-- Declaration of quarterly dividends in line with previously communicated policy

o $50 million per quarter initially, rising to $100 million per

quarter following achievement of near-term targets

o Cumulative dividends of at least $1 billion by end-2025

o Post-2025 target to maintain a progressive dividend policy,

underpinned by existing reserve volumes

Financial Summary

FY 2022 FY 2021 % Change

Average working interest

production kboed 41.2 41.0 0.5%

----------- -------- -------- ---------

Sales and other revenue $ million 737.1 497.0 48.3%

----------- -------- -------- ---------

Cash Cost of Production $ million 284.3 261.6 8.7%

----------- -------- -------- ---------

Adjusted EBITDAX [4] $ million 421.6 212.1 98.8%

----------- -------- -------- ---------

Profit/(loss) after

tax $ million 17.3 (96.2) 118.0%

----------- -------- -------- ---------

Capital expenditure $ million 728.8 403.5 80.6%

----------- -------- -------- ---------

Exploration expenditure $ million 141.0 48.7 189.5%

----------- -------- -------- ---------

Decommissioning expenditure $ million 8.9 2.7 229.6%

----------- -------- -------- ---------

Cash (including restricted

amounts) $ million 502.7 930.5 (46.0%)

----------- -------- -------- ---------

Net debt - consolidated $ million 2,518.2 2,016.6 24.9%

----------- -------- -------- ---------

Net debt - plc excluding

Israel $ million 143.8 102.6 40.2%

----------- -------- -------- ---------

Net debt - Israel $ million 2,374.4 1,914.0 24.1%

----------- -------- -------- ---------

Webcast & conference call

A webcast will be held today at 08:30 GMT / 10:30 Israel

Time

Webcast: https://edge.media-server.com/mmc/p/o83rjj7h

Conference call registration link:

https://register.vevent.com/register/BI8d6748462e8b4aa68a4f11f2d7e52ef2

After completing your conference call registration you will

receive dial-in details on screen and via email. Please note the

dial-in pin number is unique and cannot be shared.

The presentation slides will be made available on the website

shortly at www.energean.com .

Enquiries

For capital markets: ir@energean.com

Kate Sloan, Head of IR and ECM Tel: +44 7917 608 645

For media: pblewer@energean.com

Paddy Blewer, Head of Corporate Communications Tel: +44 7765 250

857

Operational Review

Production and Reserves

Full year 2022 working interest 2P reserves were 1,161 mmboe, a

20% increase versus 2021 (965 mmboe) and representing a reserve

replacement ratio of 1400%. The year-on-year changes are due mainly

to:

-- Certification of 2P reserves of 31 bcm (approximately 206

mmboe) in the Athena, Zeus and Hera structures in block 12, Olympus

Area, Israel

-- Offset by 15 mmboe of production across the portfolio

2022 2P Reserves 2021 2P Reserves % increase /

mmboe (% gas) mmboe (% gas) (decrease)

Israel 940 (89%) 744 (86%) 26%

----------------- ----------------- -------------

Egypt 99 (87%) 103 (87%) (4%)

----------------- ----------------- -------------

Rest of Portfolio 122 (38%) 119 (59%) 3%

----------------- ----------------- -------------

Total 1,161 (84%) 965 (81%) 20%

----------------- ----------------- -------------

Production

In 2022, total production was 41.2 kboed

-- Production excluding Israel was 35.7 kboed, the mid-point of

the guidance range of 34.0 - 37.0 kboed.

-- Israel 2022 production was lower than forecast due to the

project being in the commissioning phase in 2022, as previously

communicated.

2023 is expected to be a critical year for Energean and a key

step towards its near-term goal of 200 kboed, which it expects to

achieve in 2H 2024 (annualised). Energean maintains the guidance

range of 131 - 158 kboed that was communicated in its January

trading update

-- Underlying production (excluding Israel) is expected to

increase by approximately 12% at the mid-point of the guidance

range (2023: 37.0 - 43.0 kboed), benefitting from contribution by

the NEA/NI development, offshore Egypt.

-- Israel gas production is expected to be between 4.5 and 5.5

bcm of sales; year-to-date production has ramped up in line with

expectations.

Further to the progress of commissioning activities on the

Karish Field and the Energean Power FPSO, Energean is now

sequentially notifying gas buyers that the commissioning period

under the GSPAs has ended and the start date for commercial

obligations has commenced. Energean expects to have completed this

process for all gas buyers by the end of March 2023.

-- The first sale of Karish hydrocarbon liquids was completed in

February 2023, and Energean expects Israel to contribute 15 - 18

kboed of hydrocarbon liquids production in 2023, at an estimated

one lifting per month.

2022 2021 % increase / (decrease)

kboed (% gas) kboed (% gas)

Israel 5.4 (92%) - -

--------------- --------------- ------------------------

Egypt 25.1 (87%) 29.1 (87%) (14%)

--------------- --------------- ------------------------

Rest of portfolio 10.7 (40%) 11.9 (36%) (10%)

--------------- --------------- ------------------------

Total 41.2 (75%) 41.0 (72%) 0%

--------------- --------------- ------------------------

Development

Israel - Karish Growth Projects

During 2023, Energean will complete installation of the second

gas export riser and second oil train, whilst also delivering first

production from Karish North. Combined, these projects will

increase the total capacity of the FPSO to a maximum of 8

bcm/yr.

-- The second export riser and the Karish North flowline were

transported from the UK to Israel in March 2023. The riser will be

installed shortly and will connect the production facilities on the

FPSO to the pipeline-to-shore.

-- Key upcoming activities ahead of Karish North first gas

include installation of the Karish North manifold, umbilical and

spool, ahead of opening of the well before year-end 2023.

-- Construction of the second oil train is progressing in line

with expectations in Dubai. The oil train will be installed and

commissioned in-situ, and is expected to be ready to process

hydrocarbon liquids by year-end 2023.

Israel - Olympus

D&M has certified 31 bcm (approximately 206 mmboe) of 2P

reserves and 37 bcm (approximately 237 mmboe) of unrisked

prospective resources in the Olympus Area, which is located in

block 12 and the Tanin lease, offshore Israel. The associated

Competent Person's Report ("CPR") will be made available on

Energean's website.

The addition to Energean's development portfolio was a direct

result of its successful 2022 growth drilling campaign. The Zeus

and Athena wells, both in block 12, discovered 25 bcm

(approximately 167 mmboe) of natural gas resources. D&M's

analysis determined that the proximate Hera prospect, was also

sufficiently de-risked to be classified as 2P reserves. Together,

these total 31 bcm of 2P reserves, as mentioned above.

Energean is finalising the development concept for the combined

68 bcm of reserves and de-risked prospective resources that will

underpin this development. Several development concepts are under

evaluation, and Energean is focused on delivering the optimal

solution to align with its goal of maximising stakeholder

returns.

The CPR provides an indicative profile and economics for one of

these potential options, although readers should note that D&M

includes only the Olympus 2P within the overall profile, whilst the

actual development will also envisage the development of the 37 bcm

of de-risked prospective resources. The production profile in the

CPR envisages the Olympus development being positioned between that

of Karish North and Tanin, with block 12 economics benefitting

compared to those of Tanin owing to its closer proximity to the

FPSO and absence of royalties payable to the original seller of the

Karish and Tanin leases.

Energean is also considering development options to access key

regional export markets and also to further increase the overall

capacity of its infrastructure through the addition of a third gas

processing train.

Egypt

NEA/NI

In January 2021, Energean sanctioned the NEA/NI project, located

in shallow water, offshore Egypt and adjacent to the producing Abu

Qir field. First gas from NEA/NI was successfully delivered in

March 2023 from the NEA#6 well, approximately two years and two

months following final investment decision.

NEA/NI contains an estimated 39 mmboe [5] of 2P reserves (88%

gas) with net working interest production expected to peak at 15 -

20 kboed (88% gas) in 2024. The development leverages existing

infrastructure and involves the subsea tieback of four wells to

Energean's North Abu Qir PIII platform; the first well is now

onstream with the remaining three wells expected onstream during

2023.

Abu Qir drilling programme

Following the completion of the NEA/NI drilling programme,

Energean expects to use the El Qaher-1 rig to drill four production

wells on the Abu Qir licence. First gas from these wells is

expected throughout 2024.

Rest of portfolio

Cassiopea, Italy

First gas from Cassiopea (W.I. 40%) is expected in 2024. Onshore

work is progressing well and offshore installation activities are

expected to begin in Q2 2023. The operator expects to start

drilling activities in the summer 2023, which includes two new

wells and two recompletions.

Epsilon, Greece

First oil from Epsilon continues to be expected in 2024. The

installation of the platform jacket at the field is expected to

take place in Q2 2023.

Exploration and Appraisal

Egypt

North East Hap'y Offshore

Orion X1 well (Energean, 30%), located on the North East Hap'y

block, offshore Egypt, is expected to spud in late 2023, which has

been delayed due to rig availability. Energean expects to farm down

its interest in the licence to 18% ahead of spudding the well.

Rest of Portfolio

The Izabela-9 well (Energean, 70%) located offshore Croatia, is

expected to spud in Q2/Q3 2023.

Energean also expects to participate in two exploration wells

(W.I. 40%), offshore Sicily in Italy, with its partner ENI (60%) in

2024. The low-risk Gemini and Centauro prospects are located close

to the Cassiopea development, for which the infrastructure contains

tie-in points for future discoveries.

2023 Guidance

FY 2023

Production

--------------------------

Israel (kboed) 94 - 115

(including 4.5 - 5.5 bcm

of sales gas)

--------------------------

Egypt (kboed) 28 - 32

--------------------------

Rest of portfolio (kboed) 9 - 11

--------------------------

Total production (including Israel, kboed) 131 - 158

--------------------------

Total production (excluding Israel, kboed) 37 - 43

--------------------------

Consolidated net debt ($ million) 2,600 - 2,800

--------------------------

Cash Cost of Production (operating costs

plus royalties)

--------------------------

Israel ($ million) 350 - 400

--------------------------

Egypt ($ million) 50 - 60

--------------------------

Rest of portfolio ($ million) 200 - 240

--------------------------

Total Cash Cost of Production ($ million) 600 - 700

--------------------------

Development and production capital expenditure

--------------------------

Israel ($ million) 140 - 160

--------------------------

Egypt ($ million) 140 - 150

--------------------------

Rest of portfolio ($ million) 300 - 330

--------------------------

Total development & production capital

expenditure ($ million) 580 - 640

--------------------------

Exploration expenditure ($ million) 40 - 60

--------------------------

Decommissioning expenditure ($ million) 30 - 40

--------------------------

Corporate Review

HSE

In 2022, Energean delivered another strong HSE record with zero

serious injuries recorded. The Loss Time Injury Frequency ("LTIF")

Rate of 0.47 (2021: 0.33) and Total Recordable Incident Rate

("TRIR") of 1.18 (2021: 0.77) were lower than their respective

targets of 0.50 and 1.20.

Financing

Energean ended 2022 with total available liquidity of $720

million (2021: approximately $1 billion), including undrawn amounts

of $174 million under the Revolving Credit Facility signed in

September 2022 [6] . Following the signature of the term loan in

March 2023, liquidity has increased to over $1 billion. This

position ensures that the Company is well-funded for its

projects-under-development.

Energean undertook a series of refinancings in 2021, which fixed

nearly all of the Company's exposure to floating rates; Energean's

average cost of debt in 2022 was 5.25% and substantially unimpacted

by the global rise in interest rates. The only facility within

Energean's capital structure that is impacted by global interest

rate rises is the EUR90.5 million Greek facility and therefore the

impact of the rate rises on the overall cost of debt has been

minimal.

In 2024, the first tranche of Energean Israel Finance Limited's

senior secured notes, is set to mature. The note is for an amount

of $625 million and carries a coupon rate of 4.5%. Energean is

currently considering its options to refinance this note, the

preferred option for which is a repeat structure issuance in the

debt capital markets.

Energean remains committed to its near-term target of reducing

leverage, which it defines as net debt / EBITDAX, to below 1.5x.

The company's EBITDAX stream is underpinned by long-term contracts

with floor pricing provisions and take-or-pay and/or exclusivity

provisions, which gives the Board confidence that, in the absence

of additional projects, maintaining gross debt within the business

at or around current levels represents an appropriate capital

structure.

On the 17 March 2023 Energean also signed an unsecured $350

million two year term loan facility, which offers additional

financial flexibility for the Group. The loan is expected to remain

undrawn.

ESG and Climate Change

Energean is committed to net zero emissions by 2050 and

industry-leading disclosure of its energy transition

intentions.

Emissions reduction

Energean maintains a rolling carbon intensity reduction plan and

currently anticipates a reduction in carbon emissions intensity of

7 - 9 kgCO2/boe by 2025, a reduction of more than 85% versus the

base year of 2019, the key driver being the influence of Karish,

which has a very low carbon emissions intensity of 4 - 5 kgCO2/boe.

The Group recorded full-year 2022 emissions intensity of 16.0

kgCO2/boe, a 13% year-on-year reduction, and expects to further

reduce emissions intensity to 7 - 9 kgCO2/boe in 2023.

The Prinos CCS project proposal is to provide long-term storage

for carbon dioxide emissions captured from both local and more

remote emitters, and is proposed to be a scaleable CO2 injection

and storage project leveraging existing onshore and offshore

infrastructure that is fully owned and operated by Energean.

ESG ratings and affirmation

In December 2022, the Carbon Disclosure Project ("CDP") upgraded

its Climate Change rating for Energean to A-, from B in the

previous year, outperforming the global average of E&P peers of

C. Also in 2022, Energean was rated AA by MSCI (for the second year

running), 76 out of 280 for E&Ps by Sustainalytics (top 30%),

platinum by the Maala Index (increased from gold) and awarded the

"Best ESG Energy Growth Strategy Europe 2022" by CFI for a second

year running.

In August 2022, Energean was confirmed as a constituent of the

FTSE4Good Index Series, following the its June 2022 review. The

FTSE4Good Index Series is designed to measure the performance of

companies demonstrating strong ESG practices.

Energean has also continued to comply with the Task Force on

Climate Related Financial Disclosure ("TCFD") recommendations, full

disclosure on which will be provided in the Annual Report and

Accounts.

Financial Review

Financial results summary

Change

2022 2021 from 2021

-------- --------

Average working interest production

(kboepd) 41.2 41.0 0.5%

======== ======== ===========

Revenue ($m) 737.1 497.0 48.3%

======== ======== ===========

Cash cost of production ($m) 284.3 261.6 8.7%

======== ======== ===========

Cost of production ($/boe) 18.9 17.5 8.1%

======== ======== ===========

Administrative & selling expenses

($m) 45.9 43.0 6.7%

======== ======== ===========

Operating profit ($m) 232.2 32.1 623.4%

======== ======== ===========

Adjusted EBITDAX ($m) 421.6 212.1 98.8%

======== ======== ===========

Profit/ (Loss) after tax ($m) 17.3 (96.2) 118.0%

======== ======== ===========

Cash flow from operating activities

($m) 272.2 132.5 105.4%

======== ======== ===========

Capital expenditure ($m) 869.8 407.9 113.2%

======== ======== ===========

Cash capital expenditure ($m) 460.2 452.2 1.8%

======== ======== ===========

Net debt ($m) 2,518.2 2,016.6 24.9%

======== ======== ===========

Net debt/equity (%) 387.3 281.2 37.7%

======== ======== ===========

Revenue, production, and commodity prices

Revenue increased by $240.1 million (2021: $497.0 million) to

$737.1 million primarily a result of higher realised commodity

prices. The Group's realised weighted average pre-hedging oil and

gas price for the year was $81.2/bbl (2021: $57.1/bbl) and

$11.2/mcf (2021:5.2 $/mcf), respectively.

Working interest production averaged 41.2 kboepd in 2022 (2021:

41.0 kboepd), with the Abu Qir gas-condensate field, offshore

Egypt, accounting for over 60% of total output.

Adjusted EBITDAX amounted to $421.6 million (2021: $212.1

million). The increase from 2021 was due to higher revenue

partially offset by slightly higher operating costs from the

enlarged group. Included within revenue is the realised loss on the

PSV (Italian gas price) hedges of $55.2 million, excluding this

lost revenue would result in an adjusted EBITDA of $476.8 million;

which is an increase of $264.7million (124.5%) compared to

2021.

Cash cost of production

Cash production costs for the period were $18.9 /boe (2021:

$17.5/boe). The increase in cash unit production cost was primarily

driven by increased royalties paid (2022: $45.8 million,

2021:$24.8million) and increased energy costs across the group. The

cash production costs excluding royalties are $238.5 million (2021:

$236.8million) and the related cost per boe is $15.9 (2021:

$:15.8)

Depreciation, impairments and write-offs

Depreciation charges before impairment on production and

development assets decreased by 14.6% to $83.3 million (2021: $97.5

million) with the related decrease in the depreciation unit expense

to $5.5/boe (2021: $6.5/boe).

The Group recognised a pre-tax impairment charge of $27.6million

(2021: $0million) in 2022, a result of revisions to decommissioning

estimates on the Group's non-producing assets, in Italy and UK..

The Group performed an impairment assessment at 31 December 2022

and did not identify any cash generating units ("CGU") for which a

reasonably possible change in a key assumption would result in

impairment or impairment reversal, except for the Vega oil field in

Italy. An 8% decrease in Brent prices would eliminate the current

headroom of the Vega CGU.

Management has considered how the Group's identified climate

risks and climate related goals may impact the estimation of the

recoverable amount of cash-generating units and as part of the

impairment assessment has run sensitivity scenarios for the IEA's

2022 WEO climate scenarios (Stated Policies Scenario (STEPS),

Announced Pledges Scenario (APS) and Net-Zero Emissions by 2050

Scenario (NZE)). The Groups CGUs in Italy (Vega) and Greece are the

most sensitive to the impact of the IEA scenarios, which applied,

with no management mitigating actions taken, could result in

impairment.

The anticipated extent and nature of the future impact of

climate on the Group's operations and future investment, and

therefore estimation of recoverable value, is not uniform across

all cash-generating units. There is a range of inherent

uncertainties in the extent that responses to climate change may

impact the recoverable value of the Group's CGUs, with many of

these being outside the Group's control. These include the impact

of future changes in government policies, legislation and

regulation, societal responses to climate change, the future

availability of new technologies and changes in supply and demand

dynamics.

Exploration and evaluation expenditure and new ventures

During the period the Group expensed $71.4 million (2021: $87.7

million) for exploration and new ventures evaluation activities.

This includes impairment costs of $65.7million ($82.1 million) for

projects that will not progress to development, primarily Glengorm;

Energean will exit the Glengorm licence within 2023.

In addition, new ventures evaluation expenditure amounted to

$5.8 million (2021: $5.6 million), mainly related to pre-licence

and time-writing costs.

General and administrative (G&A) expenses

Energean incurred G&A costs of approximately $45.9 million

in 2022 (2021: $43.0 million). Cash SG&A was $36.0 million

(2021: $34.8 million).

Cash G&A excludes certain non-cash accounting items from the

Group's reported G&A. Cash G&A is calculated as follows:

Administrative and Selling and distribution expenses, excluding

depletion and amortisation of assets and share-based payment charge

that are included in G&A.

2022 ($m) 2021 ($m)

----------

Administrative expenses 45.9 43.0

========== ==========

Less:

========== ==========

Depreciation 3.9 2.5

========== ==========

Share-based payment charge included

in G&A 6.0 5.7

========== ==========

Cash G&A 36.0 34.8

========== ==========

Net other expenses

Net other expenses of $1.0 million in 2022 (2021: $10.9 million

income) includes restructuring costs ($3.2million), net reversal of

expected credit loss provisions of $7.9 million and other

non-recurring items. In 2021 the amount predominantly related to

$6.8 million of income due to a decrease in estimates of

decommissioning provisions for certain UK producing assets,

representing the amount of the decrease that was in excess of their

book value.

Unrealised loss on derivatives

The Group has recognised unrealised loss on derivative

instruments of $5.2 million (2021: $21.5million) related to the

Cassiopea contingent consideration. A contingent consideration of

up to $100.0 million is payable and determined on the basis of

future Italian gas prices recorded at the time of the commissioning

of the field, which is expected in 2024.

As at 31 December 2022, the two- year Italian gas (PSV) futures

curve indicated higher pricing than that at the date of

acquisition, with a forward price in excess of EUR20/Mwh. As a

result, the fair value of the Contingent Consideration as at 31

December 2022 was estimated to be $86.3 million based on a Monte

Carlo simulation (31 December 2021: $78.5 million).

Net financing costs

Financing costs before capitalisation for the period were $236.7

million (2021: $278.4 million). Finance costs include: $167.4

million of interest expenses incurred on Senior Secured notes

(2021: $107.0 million), $1.5million on debt facilities (2021: $96.7

million), $14.7million of interest expenses relating to long-term

payables (2021:$4.1 million), $37.4million unwinding of discount on

deferred consideration, contingent consideration, convertible loan

notes and decommissioning provisions (2021: $27.8 million); $15.6

million commissions for guarantees and other bank charges of (2021:

$17.8 million). The 2021 finance costs included $18.1million for

unamortised debt issuance costs under the Greek and Egypt RBL,

written off due to repayments prior to their maturity dates.

Net finance costs include foreign exchange losses of $22.2

million (2021: $6.9 million) and finance income of $9.6 million

(2021: $3.0 million), including Interest income from time

deposits.

Taxation

Energean recorded tax charges of $89.7 million in 2022 (2021:

$5.4 million), split between a current year tax expense of $200.1

million (2021: $44.6 million), and a deferred tax credit of $110.4

million (2021: credit $39.2 million) and representing an effective

tax rate of 84% (2021: 6%).

The increase in current tax from 2021 is primarily a result of

the windfall tax in Italy. During 2022, Italy introduced: 1) a

windfall tax in the form of a law decree which imposed a 25%

one-off tax on profit margins that rose by more than $5.26 million

(EUR5.0 million) between October 2021 and April 2022 compared to

the same period a year earlier. The amount of the windfall tax paid

by Energean Italy was $29.3million and 2) in November 2022, Italy

introduced a new windfall tax that imposed a 50% one-off tax,

calculated on 2022 taxable profits that are 10% higher than the

average taxable profits between 2018-2021. This amount has a

ceiling equal to 25% of the value of the net assets at end-2021.

Based on this, Energean would be required to pay an additional

one-off tax of $92.8 million (EUR87.0 million) in June 2023.

Operating cash flow

Cash from operations before tax and movements in working capital

was $311.3million (2021: $131.7 million). After adjusting for tax

and working capital movements, cash from operations was $272.2

million (2021: $132.5 million).

Capital Expenditure

During the year, the Group incurred capital expenditure of

$869.8 million (2021: $407.9 million). Capital expenditure mainly

consisted of development expenditure in relation to the Karish Main

and Karish North Fields in Israel ($534.5 million) , NEA/NI project

in Egypt ($107.9 million), Cassiopea field in Italy ($77.0

million), Scott field in UK ($9.2 million) and exploration

expenditures in Athena, Zeus, Hermes and Hercules in Israel ($123.0

million).

Net Debt

As at 31 December 2022, net debt of $2,518.2million (2021:

$2,016 million) consisted of $2,500 million Israeli senior secured

notes, $450 million of corporate senior secured notes, $63.5million

draw down of the Greek loans and $50 million of convertible loan

notes, less deferred amortised fees, equity component of

convertible loan ($10.5 million) and cash balances of $502.7

million. Net debt excluding Israel is $143.8 million (2021: $102.6

million).

In accessing the debt capital markets, Energean is only exposed

to floating interest rates for the Greek loan. Refer to note 26.3

in the financial statements for the interest risk sensitivity.

Credit ratings

Energean maintains corporate credit ratings with Standard and

Poor's (S&P) and Fitch Ratings (Fitch).

On 4 November 2021 Energean plc was assigned its first corporate

credit ratings from S&P and Fitch, following the issuance of

the $450 million senior secured notes which mature in 2027.

-- In February 2023 S&P upgraded the ratings from B to B+

for both Energean plc corporate and the senior secured notes

maturing in 2027, with Stable Outlook. This reflects first gas from

the Karish field in Israel and associated track record of

production.

-- Fitch assigned a B+ corporate credit rating to Energean plc

and B+ rating for the senior secured notes maturing in 2027. In

November 2023 the Outlook was upgraded to Positive to reflect the

improvement in financial performance since 2021, due to stronger

price environment and timely delivery projects including the Karish

gas field in Israel.

Risk management

Principal risks

There are no significant changes to the headline principal risks

from those disclosed in the 2022 Interim results. A full

description of Energean's principal risks is disclosed in the

strategic review of the 2022 Annual Report & Accounts.

Liquidity risk management and going concern

The Group carefully manages the risk of a shortage of funds by

closely monitoring its funding position and its liquidity risk. The

going concern assessment covers the period from the date of

approval of the Group Financial Statements on 22 March 2023 to 30

June 2024 'the Assessment Period'. The Assessment Period has been

extended such that it includes the $625 million bond repayment due

in March 2024.

As of 31 December 2022 the Group's available liquidity was

approximately $720 million. This available liquidity figure

includes: (i) c. $43 million of undrawn facility under the EUR100

million loan backed by the Greek State signed in December 2021 for

the development of the Prinos Area in Greece, including the Epsilon

development; and (ii) c. $174 million available under the $275

million Revolving Credit Facility ('RCF') signed by the Group in

September 2022 (with the remainder being utilized to issue Letters

of Credit for the Group's operations). Subsequent to 31 December

2022, the Group signed a $350 million Term Loan Facility. The Group

has a $625 million bond, at the Energean Israel level, maturing in

March 2024. Management expects to refinance this bond during 2023;

however, for the purposes of the Going Concern assessment it has

been assumed that the bond is repaid in full and not

refinanced.

The going concern assessment is founded on a cashflow forecast

prepared by management, which is based on a number of assumptions,

most notably the Group's latest life of field production forecasts,

budgeted expenditure forecasts, estimated of future commodity

prices (based on recent published forward curves) and available

headroom under the Group's debt facilities. The going concern

assessment contains a 'Base Case' and a 'Reasonable Worst Case'

('RWC') scenario.

The Base Case scenario assumes Brent at $80/bbl in 2023 and

$75/bbl in 2023 and PSV (Italian gas price) at EUR50/MWH in 2023

and EUR45/MWH in 2024. A reasonable ramp-up of production from the

Karish Field is assumed throughout the going concern assessment

period, with prices for gas sold assumed at contractually agreed

prices. Under the Base Case, sufficient liquidity is maintained

throughout the going concern period.

The Group also routinely performs sensitivity tests of its

liquidity position to evaluate adverse impacts that may result from

changes to the macro-economic environment, such as a reduction in

commodity prices. These downsides are considered in the RWC going

concern assessment scenario. The Group is not materially exposed to

floating interest rate risk since the majority of its borrowings

are fixed-rate. The Group also looks at the impact of changes or

deferral of key projects and downside scenarios to budgeted

production forecasts in the RWC.

The two primary downside sensitivities considered in the RWC

are: (i) reduced commodity prices; (ii) reduced production - these

downsides are applied to assess the robustness of the Group's

liquidity position over the Assessment Period. In a RWC downside

case, there are appropriate and timely mitigation strategies,

within the Group's control, to manage the risk of funding

shortfalls and to ensure the Group's ability to continue as a going

concern. Mitigation strategies, within management's control,

modelled in the RWC include deferral of capital expenditure on

operated assets, deferral or cancellation of exploration and/or

discretionary spend and exercise of rights under contractual

arrangements to improve liquidity. Under the RWC scenario, after

considering mitigation strategies, liquidity is maintained

throughout the going concern period.

Reverse stress testing was also performed to determine what

commodity price or production shortfall would need to occur for

liquidity headroom to be eliminated. The conditions necessary for

liquidity headroom to be eliminated are judged to have a remote

possibility of occurring, given the diversified nature of the

Group's portfolio and the 'natural hedge' provided by virtue of the

Group's fixed-price gas contracts in Israel and Egypt. In the event

a remote downside scenario occurred, prudent mitigating strategies,

consistent with those described above, could also be executed in

the necessary timeframe to preserve liquidity. There is no material

impact of climate change within the Assessment Period and therefore

it does not form part of the reverse stress testing performed by

management.

In forming its assessment of the Group's ability to continue as

a going concern, including its review of the forecasted cashflow of

the Group over the Forecast Period, the Board has made judgements

about:

-- Reasonable sensitivities appropriate for the current status

of the business and the wider macro environment; and

-- the Group's ability to implement the mitigating actions

within the Group's control, in the event these actions were

required.

After careful consideration, the Directors are satisfied that

the Group and Company has sufficient financial resources to

continue in operation for the foreseeable future, for the

Assessment Period from the date of approval of the Group Financial

Statements on 22 March 2023 to 30 June 2024. For this reason, they

continue to adopt the going concern basis in preparing the

consolidated financial statements.

Events since December 2022

On the 9 February 2023 Energean declared its 4Q dividend of

US$30 cents per share, to be paid on 30 March 2023.

On the 17 March 2023 Energean also signed an unsecured $350

million two year term loan facility, which offers additional

financial flexibility for the Group. The loan is expected to remain

undrawn.

Non-IFRS measures

The Group uses certain measures of performance that are not

specifically defined under IFRS or other generally accepted

accounting principles. These non-IFRS measures include Adjusted

EBITDAX, cost of production, capital expenditure, cash capital

expenditure, net debt and gearing ratio and are explained

below.

Cash cost of production

Cash cost of production is a non-IFRS measure that is used by

the Group as a useful indicator of the Group's underlying cash

costs to produce hydrocarbons. The Group uses the measure to

compare operational performance period to period, to monitor costs

and to assess operational efficiency. Cash cost of production is

calculated as cost of sales, adjusted for depreciation and

hydrocarbon inventory movements.

($m) 2022 2021

---------

Cost of sales 358.9 345.1

========= =========

Less:

========= =========

Depreciation (79.4) (94.6)

========= =========

Change in inventory 4.7 11.1

========= =========

Cost of production(1) 284.3 261.6

========= =========

Total production for the period (kboe) 15,038.0 14,963.5

========= =========

Cash cost of production per boe ($/boe) 18.9 17.5

========= =========

(1Numbers may not sum due to rounding)

Adjusted EBITDAX

Adjusted EBITDAX is a non-IFRS measure used by the Group to

measure business performance. It is calculated as profit or loss

for the period, adjusted for discontinued operations, taxation,

depreciation and amortisation, other income and expenses (including

the impact of derivative financial instruments and foreign

exchange), net finance costs and exploration costs. The Group

presents Adjusted EBITDAX as it is used in assessing the Group's

growth and operational efficiencies, because it illustrates the

underlying performance of the Group's business by excluding items

not considered by management to reflect the underlying operations

of the Group.

($m) 2022 2021

--------

Adjusted EBITDAX 421.6 212.1

======== =======

Reconciliation to profit/(loss):

======== =======

Depreciation and amortisation (83.4) (97.5)

======== =======

Share-based payment (6.0) (5.7)

======== =======

Exploration and evaluation expense (71.4) (87.7)

======== =======

Impairment loss on property, plant and (27.6) -

equipment

======== =======

Other expense (15.2) (7.0)

======== =======

Other income 14.1 17.9

======== =======

Finance expenses (107.3) (97.4)

======== =======

Finance income 9.6 3.0

======== =======

Unrealised loss on derivatives (5.2) (21.5)

======== =======

Net foreign exchange (22.2) (6.9)

======== =======

Taxation income/(expense) (89.7) (5.4)

======== =======

Profit/ (Loss) for the year 17.3 (96.2)

======== =======

Capital expenditure

Capital expenditure is a useful indicator of the Group's organic

expenditure on oil and gas assets and exploration and appraisal

assets incurred during a period. Capital expenditure is defined as

additions to property, plant and equipment and intangible

exploration and evaluation assets less decommissioning asset

additions, right-of-use asset additions, capitalised share-based

payment charge and capitalised borrowing costs:

($m) 2022 2021

--------

Additions to property, plant and equipment 877.7 521.4

======== =======

Additions to intangible exploration and

evaluation assets 141.0 54.8

======== =======

Less:

======== =======

Capitalised borrowing cost 109.2 181.0

======== =======

Impairment of property, plant and equipment 27.9

======== =======

Leased assets additions and modifications 2.0 8.7

======== =======

Lease payments related to capital activities (12.7) (10.9)

======== =======

Capitalised share-based payment charge 0.2 0.2

======== =======

Capitalised depreciation 0.6 0.2

======== =======

Change in decommissioning provision 21.7 (11.0)

======== =======

Total capital expenditure 870.0 408.0

======== =======

Movement in working capital (409.8) 44.3

======== =======

Cash capital expenditure per the cash

flow statement 460.2 452.3

======== =======

Cash Capital Expenditure

($m) 2022 2021

------

Payment for purchase of property, plant

and equipment 395.8 403.5

====== ======

Payment for exploration and evaluation,

and other intangible assets 64.4 48.7

====== ======

Total Cash Capital Expenditure 460.2 452.2

====== ======

Net debt/(cash) and gearing ratio

Net debt is defined as the Group's total borrowings less cash

and cash equivalents. Management believes that net debt is a useful

indicator of the Group's indebtedness, financial flexibility and

capital structure because it indicates the level of borrowings

after taking account of any cash and cash equivalents that could be

used to reduce borrowings. The Group defines capital as total

equity and calculates the gearing ratio as net debt divided by

total equity.

($m) 2022 2021

--------

Current borrowings 45.6 -

======== ========

Non-current borrowings 2,975.3 2,947.1

======== ========

Total borrowings 3,020.9 2,947.1

======== ========

Less: Cash and cash equivalents and bank

deposits (427.9) (730.8)

======== ========

Restricted cash (74.8) (199.7)

======== ========

Net Debt 2,518.2 2,016.6

======== ========

Total equity 650.2 717.1

======== ========

Gearing Ratio 387.3% 281.2%

======== ========

Forward looking statements

This announcement contains statements that are, or are deemed to

be, forward-looking statements. In some instances, forward-looking

statements can be identified by the use of terms such as

"projects", "forecasts", "on track", "anticipates", "expects",

"believes", "intends", "may", "will", or "should" or, in each case,

their negative or other variations or comparable terminology.

Forward-looking statements are subject to a number of known and

unknown risks and uncertainties that may cause actual results and

events to differ materially from those expressed in or implied by

such forward-looking statements, including, but not limited to:

general economic and business conditions; demand for the Company's

products and services; competitive factors in the industries in

which the Company operates; exchange rate fluctuations;

legislative, fiscal and regulatory developments; political risks;

terrorism, acts of war and pandemics; changes in law and legal

interpretations; and the impact of technological change.

Forward-looking statements speak only as of the date of such

statements and, except as required by applicable law, the Company

undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise. The information contained in this

announcement is subject to change without notice.

Group Income Statement

YEARED 31 DECEMBER 2022

------------------------------------

2022 2021

Notes $'000 $'000

------------------------------------- ------ ---------- ----------

Revenue 4 737,081 496,985

Cost of sales 5a (358,930) (345,112)

------------------------------------- ------ ---------- ----------

Gross profit 378,151 151,873

Administrative expenses 5b (45,942) (42,973)

Exploration and evaluation expenses 5c (71,395) (87,678)

Impairment of property, plant and

equipment 8 (27,628) -

Other expenses 5d (15,161) (7,019)

Other income 5e 14,133 17,884

------------------------------------- ------ ---------- ----------

Operating profit 232,158 32,087

Finance income 6 9,572 2,950

Finance costs 6 (107,315) (97,380)

Unrealised loss on derivatives 17 (5,203) (21,477)

Net foreign exchange (losses)/gains 6 (22,207) (6,922)

------------------------------------- ------ ---------- ----------

Loss before tax 107,005 (90,742)

Taxation expense 7 (89,734) (5,412)

------------------------------------- ------ ---------- ----------

Loss for the year 17,271 (96,154)

Attributable to:

Owners of the parent 17,271 (96,046)

Non - controlling interests - (108)

------------------------------------- ------ ---------- ----------

17,271 (96,154)

===================================== ====== ========== ==========

Basic and diluted earnings/ (loss)

per share (cents per share)

------------------------------------ ------ --------

Basic 2 $0.10 ($0.52)

Diluted 2 $0.12 ($0.52)

------------------------------------ ------ --------

Group Statement of Comprehensive Income

YEARED 31 DECEMBER 2022

2022 2021

$'000 $'000

------------------------------------- ------------ ----------- --- ---- ------------

Profit/(Loss) for the year 17,271 (96,154)

--------------------------------------------------- ----------- --- ---- ------------

Other comprehensive profit/(loss):

Items that may be reclassified

subsequently to profit or

loss

Cash Flow hedges

Gain/(loss) arising in the

period 11,665 (6,182)

Income tax relating to items

that may be reclassified to

profit or loss (2,799) 1,546

Exchange difference on the

translation of

foreign operations, net of

tax 6,996 (12,781)

--------------------------------------------------- ----------- --- ---- ------------

15,862 (17,417)

-------------------------------------------------- ----------- --- ---- ------------

Items that will not be reclassified

subsequently to profit or

loss

Remeasurement of defined benefit

pension plan 267 (165)

Income taxes on items that

will not be reclassified to

profit or loss (64) 40

--------------------------------------------------- ----------- --- ---- ------------

203 (125)

Other comprehensive profit/(loss)

after tax 16,065 (17,542)

--------------------------------------------------- ----------- --- ---- ------------

Total comprehensive profit/(loss)

for the year 33,336 (113,696)

=================================================== ----------- === ==== ============

Total comprehensive loss

attributable to :

Owners of the parent 33,336 (113,590)

Non-controlling interests - (106)

--------------------------------------------------- ----------- --- ---- ------------

33,336 (113,696)

================================================== =========== === ==== ============

Group Statement of Financial Position

YEARED 31 DECEMBER 2022

2022 2021

Notes $'000 $'000

---------------------------------- ------ ---------- ----------

ASSETS

Non-current assets

Property, plant and equipment 8 4,231,904 3,499,473

Intangible assets 9 296,378 228,141

Equity-accounted investments 4 4

Other receivables 13 26,940 52,639

Deferred tax asset 10 242,226 154,798

Restricted cash 12 2,998 100,000

4,800,450 4,035,055

---------------------------------- ------ ---------- ----------

Current assets

Inventories 93,347 87,203

Trade and other receivables 13 337,964 288,526

Restricted cash 12 71,778 99,729

Cash and cash equivalents 11 427,888 730,839

---------------------------------- ------ ----------

930,977 1,206,297

----------

Total assets 5,731,427 5,241,352

---------------------------------- ------ ---------- ----------

EQUITY AND LIABILITIES

Equity attributable to owners

of the parent

Share capital 2,380 2,374

Share premium 415,388 915,388

Merger reserve 139,903 139,903

Other reserves 16,557 7,488

Foreign currency translation

reserve (5,827) (12,823)

Share-based payment reserve 25,589 19,352

Retained earnings 56,208 (354,559)

Total equity 650,198 717,123

---------------------------------- ------ ---------- ----------

Non-current liabilities

Borrowings 14 2,975,346 2,947,126

Deferred tax liabilities 1 0 56,114 67,425

Retirement benefit liability 1,675 2,767

Provisions 15 809,727 801,026

Other payables 16 318,058 225,987

4,160,920 4,044,331

---------------------------------- ------ ---------- ----------

Current liabilities

Trade and other payables 16 756,874 454,986

Current portion of borrowings 14 45,550 -

Derivative financial instruments - 12,546

Current tax liability 7 109,509 -

Provisions 15 8,376 12,366

920,309 479,898

---------------------------------- ------ ---------- ----------

Total liabilities 5,081,229 4,524,229

---------- ----------

Total equity and liabilities 5,731,427 5,241,352

---------------------------------- ------ ---------- ----------

--------------------------------------------------------------------

Group Statement of Changes

in Equity YEARED 31

DECEMBER

2022

Hedges Equity

and component

Defined of Share

Benefit convertible based

Share Share plans bonds(2) payment Translation Retained Merger Non-controlling

capital premium reserve(1) reserve(3) reserve(4) earnings reserves Total interests Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

----------------- --------- ---------- ----------- ------------ ----------- ------------ ---------- --------- ---------- ---------------- -------------

At 1 January

2021 2,367 915,388 1,792 - 13,419 (42) (144,734) 139,903 928,093 266,299 1,194,392

========= ========== =========== ============ =========== ============ ========== ========= ========== ================ =============

Loss for the

period (96,046) (96,046) (108) (96,154)

Remeasurement of

defined

benefit pension

plan (125) (125) (125)

Hedges net of

tax (4,638) (4,638) 2 (4,636)

Exchange

difference on

the translation

of foreign

operations (12,781) (12,781) (12,781)

--------- ---------- ----------- ------------ ----------- ------------ ---------- --------- ---------- ---------------- -------------

Total

comprehensive

income - - (4,763) - - (12,781) (96,046) - (113,590) (106) (113,696)

--------- ---------- ----------- ------------ ----------- ------------ ---------- --------- ---------- ---------------- -------------

Transactions

with owners

of the company

Share capital

increase

in subsidiary 5,940 5940 5,940

Employee share

schemes 7 (7) - -

Acquisition of

non-controlling

Interests - - - 10,459 - - (113,779) - (103,320) (266,193) (369,513)

--------- ---------- ----------- ------------ ----------- ------------ ---------- --------- ---------- ---------------- -------------

At 1 January

2022 2,374 915,388 (2,971) 10,459 19,352 (12,823) (354,559) 139,903 717,123 - 717,123

========= ========== =========== ============ =========== ============ ========== ========= ========== ================ =============

Profit for the

period 17,271 17,271 - 17,271

Remeasurement of

defined

benefit pension

plan 203 203 - 203

Hedges, net of

tax 8,866 8,866 - 8,866

Exchange

difference on

the translation

of foreign

operations 6,996 6,996 6,996

Total

comprehensive

income - - 9,069 - - 6,996 17,271 - 33,336 - 33,336

--------- ---------- ----------- ------------ ----------- ------------ ---------- --------- ---------- ---------------- -------------

Transactions

with owners

of the company

Share based

payment charges 6,243 6,243 6,243

Exercise of

Employee

Share Options 6 (6) - -

Share Premium

Reduction (500,000) 500,000 - -

Dividends (note

18) (106,504) (106,504) (106,504)

At 31 December

2022 2,380 415,388 6,098 10,459 25,589 (5,827) 56,208 139,903 650,198 - 650,198

--------- ---------- ----------- ------------ ----------- ------------ ---------- --------- ---------- ---------------- -------------

(1 Reserve is used to recognise remeasurement gain or loss on

cash flow hedges and actuarial gain or loss from the defined

benefit pension plan. In the Statement of Financial Position this

reserve is combined with the 'Equity component of convertible

bonds' reserve.)

(2 Refers to the Equity component of $50million of convertible

loan notes, which were issued in February 2021 and have a maturity

date of 29 December 2023.)

(3 Share-based payments reserve is used to recognise the value

of equity-settled share-based payments granted to parties including

employees and key management personnel, as part of their

remuneration.)

(4 Reserve is used to record unrealised exchange differences

arising from the translation of the financial statements of

entities within the Group that have a functional currency other

than US dollar.)

Group Cashflows Statement

YEARED 31 DECEMBER 2022

2022 2021

Note $'000 $'000

------------------------------------------ ----- ---------- ------------

Operating activities

Profit/ (Loss) before taxation 107,005 (90,742)

Adjustments to reconcile loss

before taxation to net cash provided

by operating activities:

Depreciation, depletion and amortisation 8, 9 83,360 97,451

Impairment loss on property,

plant and equipment(1) 8 27,628 -

Loss from the sale of property,

plant and equipment 1,102 36

Impairment loss on intangible

assets 9 65,550 82,125

Defined benefit (gain) (351) (4,061)

Movement in provisions 15 (4,742) (4,462)

Compensation to gas buyers 4 18,029 (22,958)

Change in decommissioning provision

estimates - (10,198)

Finance income 6 (9,572) (2,951)

Finance costs 6 107,315 97,374

Unrealised loss on derivatives 17 5,203 21,477

Expected credit loss (ECL) on

trade receivables 565 (1,853)

Non-cash revenues from Egypt(2) (57,766) (39,100)

Impairment loss on inventory 1,207 -

Share-based payment charge 6,044 5,734

Net foreign exchange loss 6 22,207 6,922

------------------------------------------ ----- ---------- ------------

Cash flow from operations before

working capital 372,784 136,648

------------------------------------------ ----- ---------- ------------

(Increase) in inventories (10,278) (16,484)

(Increase)/Decrease in trade

and other receivables (74,454) 46,351

Increase/(Decrease) in trade

and other payables 23,405 (34,726)

------------------------------------------ ----- ---------- ------------

Cash from operations 311,457 131,789

------------------------------------------ ----- ---------- ------------

Income tax (paid)/received (39,304) 715

------------------------------------------ ----- ---------- ------------

Net cash inflow from operating

activities 272,153 132,503

------------------------------------------ ----- ---------- ------------

Investing activities

Payment for purchase of property,

plant and equipment 8 (395,753) (403,503)

Payment for exploration and evaluation,

and other intangible assets 9 (64,414) (48,674)

Acquisition of a subsidiary,

net of cash acquired - 841

Movement in restricted cash 124,953 (199,729)

Proceeds from disposal of property, 227 -

plant and equipment

Amounts received from INGL related to

the future transfer 16

of property, plant and equipment 17,371 5,673

Interest received 9,675 2,609

------------------------------------------ ----- ---------- ------------

Net cash outflow for investing

activities (307,941) (642,783)

------------------------------------------ ----- ---------- ------------

Financing activities

Drawdown of borrowings 14 63,463 175,000

Repayment of borrowings 14 - (1,807,140)

Senior secured notes Issuance 14 - 3,068,000

Acquisition of non-controlling

interests (30,000) (175,000)

Transaction costs related to acquisition

of non-controlling interest - (1,677)

Repayment of obligations under

leases (14,023) (10,852)

Debt arrangement fees paid - (48,377)

Finance cost paid for deferred

license payments (1,501) (3,494)

Finance costs paid (178,914) (136,694)

Dividends paid (106,504) -

------------------------------------------ ----- ---------- ------------

Net cash (outflow)/inflow financing

activities (267,479) 1,059,765

------------------------------------------ ----- ---------- ------------

Net (decrease)/increase in cash

and cash equivalents (303,267) 549,485

------------------------------------------ ----- ---------- ------------

Cash and cash equivalents at

beginning of the period 730,839 202,939

Effect of exchange rate fluctuations

on cash held 316 (21,585)

------------------------------------------ ----- ---------- ------------

Cash and cash equivalents at

end of the period 11 427,888 730,839

------------------------------------------ ----- ---------- ------------

(1 The impairment of property, plant and equipment is a result

of changes in the decommissioning provision.)

(2 Non-cash revenues from Egypt arise due to taxes being

deducted at source from invoices as such revenue and tax charges

are grossed up to reflect this deduction but no cash inflow or

outflow results.)

1. Basis of preparation and presentation of financial

information

Whilst the financial information in this preliminary

announcement has been prepared in accordance with UK-adopted

International Accounting Standards (UK-adopted IAS) and with the

requirements of the United Kingdom Listing Authority (UKLA) Listing

Rules, this announcement does not contain sufficient information to

comply with IFRS. The Group will publish full financial statements

that comply with IFRS in April 2022. The financial information for

the year ended 31 December 2022 does not constitute statutory

accounts as defined in sections 435 (1) and (2) of the Companies

Act 2006. The group and parent company financial statements for the

year ended 31 December 2021 have been delivered to the Registrar of

Companies; the auditor's report on these accounts was unqualified,

did not include a reference to any matters by way of emphasis and

did not contain a statement under Section 498 (2) or Section 498

(3) of the UK Companies Act 2006.

The accounting policies applied are consistent with those

adopted and disclosed in the Group's financial statements for the

year ended 31 December 2022. There have been a number of amendments

to accounting standards and new interpretations issued by the

International Accounting Standards Board which were applicable from

1 January 2022, however these have not any impact on the accounting

policies, methods of computation or presentation applied by the

Group. Further details on new International Financial Reporting

Standards adopted will be disclosed in the 2022 Annual Report and

Accounts.

Certain new accounting standards and interpretations have been

published that are not mandatory for 31 December 2022 reporting

periods and have not been early adopted by the Group. These

standards are not expected to have a material impact on the entity

in the current or future reporting periods and on foreseeable

future transactions.

2. Earnings/ (Loss) per share

Basic earnings per ordinary share amounts are calculated by

dividing net income for the year attributable to ordinary equity

holders of the parent by the weighted average number of ordinary

shares outstanding during the year. Diluted income per ordinary

share amounts are calculated by dividing net income for the year

attributable to ordinary equity holders of the parent by the

weighted average number of ordinary shares outstanding during the

year plus the weighted average number of ordinary shares that would

be issued if dilutive employee share options were converted into

ordinary shares.

2022 2021

$'000 $'000

----------------------------------------- ----------------- ------------------- -------------

Total profit/(loss) attributable to

equity shareholders 17,271 (96,046)

Effect of dilutive potential ordinary 4,054 -

shares(1)

----------------------------------------- ----------------- ------------------- -------------

21,325 (96,046)

Basic weighted average number of shares 177,931,019 177,278,840

Dilutive potential ordinary shares 6,714,731 -

Diluted weighted average number of

shares 184,645,750 177,278,840

Basic earnings/(loss) per share $0.10/share $(0.54)/share

Diluted earnings/ (loss) per share $0.12/share $(0.54)/share

1 The $4.1million is the unwinding of the discount on the

convertible loan notes (as disclosed in note 9) that will no longer

be incurred on conversion to shares.

3. Segmental reporting

The information reported to the Group's Chief Executive Officer

and Chief Financial Officer (together the Chief Operating Decision

Makers) for the purposes of resource allocation and assessment of

segment performance is focused on four operating segments: Europe,

(including Greece, Italy, UK, Croatia), Israel, Egypt and New

Ventures (Montenegro and Malta).

The Group's reportable segments under IFRS 8 Operating Segments

are Europe, Israel and Egypt. Segments that do not exceed the

quantitative thresholds for reporting information about operating

segments have been included in Other.

Segment revenues, results and reconciliation to profit before

tax

The following is an analysis of the Group's revenue, results and

reconciliation to profit/(loss) before tax by reportable

segment:

($'000) Europe Israel Egypt Other & inter-segment transactions Total

----------------------------------------- -------- -------- -------- ---------------------------------- ---------

Year ended 31 December 2022

Revenue from Oil 206,959 - - - 206,959

Revenue from Gas 328,506 45,153 156,264 - 529,923

Other (31,298) (18,031) 57,131 (7,603) 199

Total revenue 504,167 27,122 213,395 (7,603) 737,081

Adjusted EBITDAX(1) 262,655 (4,498) 164,581 (1,125) 421,613

Reconciliation to profit before tax:

Depreciation and amortisation expenses (27,199) (12,112) (43,266) (783) (83,360)

Share-based payment charge (1,423) (214) (89) (4,318) (6,044)

Exploration and evaluation expenses (61,071) (1,819) - (8,505) (71,395)

Impairment loss on property, plant and

equipment (27,628) - - - (27,628)

Other expense (5,742) (1,102) - (8,317) (15,161)

Other income 1,284 54 12,067 728 14,133

Finance income 3,777 6,379 1,705 (2,289) 9,572

Finance costs (32,395) (29,811) (858) (44,251) (107,315)

Unrealised loss on derivatives (5,203) - - - (5,203)

Net foreign exchange gain/(loss) 4,065 (3,085) (7,498) (15,689) (22,207)

Profit/(loss) before income tax 111,120 (46,208) 126,642 (84,549) 107,005

Taxation income / (expense) (42,283) 10,951 (57,766) (636) (89,734)

Profit/(loss) from continuing operations 68,837 (35,257) 68,876 (85,185) 17,271

----------------------------------------- -------- -------- -------- ---------------------------------- ---------

Year ended 31 December 2021

Revenue from oil 165,496 - - 144 165,640

Revenue from Gas 137,468 - 133,503 (2) 270,969

Other 12,156 - 55,446 (8,226) 60,376

Total revenue 316,120 - 188,949 (8,084) 496,985

Adjusted EBITDAX(1) 88,288 (4,969) 130,634 (1,881) 212,072

Reconciliation to profit before tax:

Depreciation and amortisation expenses (55,001) (93) (41,626) (731) (97,451)

Share-based payment charge (967) (231) - (4,523) (5,721)

Exploration and evaluation expenses (86,490) (50) - (1,138) (87,678)

Other expense (2,150) (461) (1,543) (2,865) (7,019)

Other income 16,065 19 1,851 (51) 17,884

Finance income 13,450 7,849 985 (19,334) 2,950

Finance costs (28,318) (18,526) (9,059) (41,477) (97,380)

Unrealised loss on derivatives (21,477) - - - (21,477)

Net foreign exchange gain/(loss) 31,000 520 479 (38,921) (6,922)

Profit/(Loss) before income tax (45,600) (15,942) 81,721 (110,921) (90,742)

Taxation income / (expense) 29,026 5,017 (39,100) (355) (5,412)

Profit/(Loss) from continuing operations (16,574) (10,925) 42,621 (111,276) (96,154)

----------------------------------------- -------- -------- -------- ---------------------------------- ---------

1 Adjusted EBITDAX is a non-IFRS measure used by the Group to

measure business performance. It is calculated as profit or loss

for the period, adjusted for discontinued operations, taxation,

depreciation and amortisation, share-based payment charge,

impairment of property, plant and equipment, other income and

expenses (including the impact of derivative financial instruments

and foreign exchange), net finance costs and exploration and

evaluation expenses.

The following table presents assets and liabilities information

for the Group's operating segments as at 31 December 2022 and 31

December 2021, respectively :

Year ended 31 December 2022 Europe Israel Egypt Other & inter-segment Total

($'000) transactions

--------------------------------- --------- --------- -------- -------------------------------- ---------

Oil & Gas properties 536,874 3,264,364 409,732 (14,440) 4,196,530

Other fixed assets 13,365 4,750 17,325 (65) 35,375

Intangible assets 48,249 219,354 20,639 8,136 296,378

Trade and other receivables 141,509 82,611 131,453 (17,609) 337,964

Deferred tax asset 244,394 - - (2,168) 242,226

Other assets 883,576 24,933 96,942 (382,497) 622,954

Total assets 1,867,967 3,596,012 676,091 (408,643) 5,731,427

Trade and other payables 220,706 540,459 50,563 114,505 926,233

Borrowings 61,437 2,471,030 - 488,429 3,020,896

Decommissioning provision 724,457 84,299 - - 808,756

Current tax payable 109,468 - - 41 109,509

Other liabilities 124,201 40,882 18,498 32,254 215,835

--------------------------------- --------- --------- -------- -------------------------------- ---------

Total liabilities 1,240,270 3,136,670 69,061 635,229 5,081,229

Other segment information

Capital Expenditure(2)

Property, plant and equipment 85,840 537,527 105,792 (368) 728,791

Intangible, exploration

and evaluation assets 12,143 124,718 193 3,970 141,024

Year ended 31 December 2021

($'000)

Oil & Gas properties 537,600 2,584,828 342,528 (9,694) 3,455,262

Other fixed assets 16,578 3,917 24,076 (360) 44,211

Intangible assets 74,868 95,941 20,484 36,848 228,141

Trade and other receivables 164,131 22,769 102,605 (979) 288,526

Deferred tax asset 154,798 - - - 154,798

Other assets 674,157 379,248 98,720 (81,711) 1,070,414

Total assets 1,622,132 3,086,703 588,413 (55,896) 5,241,352

Trade and other payables 197,865 74,115 25,511 152,216 449,706

Current tax payable 4,932 - - 347 5,279

Borrowings - 2,463,524 - 483,602 2,947,126

Decommissioning provision 766,573 35,525 - 802,098

Other liabilities 113,808 180,689 24,663 858 320,018

--------------------------------- --------- --------- -------- -------------------------------- ---------

Total liabilities 1,083,178 2,753,853 50,174 637,024 4,524,229

Other segment information

Capital Expenditure(2)

Property, plant and equipment 72,782 247,463 52,085 (14,330) 358,000

Intangible, exploration

and evaluation assets 40,523 6,342 215 3,329 50,409

(2 Capital expenditure is defined as additions to property,

plant and equipment and intangible exploration and evaluation

assets less decommissioning asset additions, right-of-use asset

additions, capitalised share-based payment charge and capitalised

borrowing costs.)

Segment cash flows

Year ended 31 December 2022 ($'000) Europe Israel Egypt Other & inter-segment transactions Total

-------------------------------------- --------- --------- --------- ---------------------------------- ---------

Net cash from / (used in) operating

activities 225,780 (7,850) 66,946 (12,723) 272,153

Cash outflow for investing activities (287,490) (180,040) (54,229) 213,818 (307,941)

Net cash from financing activities 54,977 (133,953) (2,528) (185,975) (267,479)

Net increase/(decrease) in cash and

cash equivalents (6,733) (321,843) 10,189 15,120 (303,267)

Cash and cash equivalents at beginning

of the period 71,312 349,827 19,254 290,446 730,839

Effect of exchange rate fluctuations

on cash held (6,451) (3,159) (2,617) 12,543 316

Cash and cash equivalents at end of

the period 58,128 24,825 26,826 318,109 427,888

-------------------------------------- --------- --------- --------- ---------------------------------- ---------

Year ended 31 December 2021 ($'000)

Net cash from / (used in) operating

activities 43,394 (28,764) 128,659 (10,785) 132,504

Cash outflow from investing activities (99,040) (490,381) (53,553) 191 (642,783)

Net cash from financing activities 120,446 831,677 (132,414) 240,056 1,059,765

Net increase/(decrease) in cash and

cash equivalents 64,800 312,532 (57,308) 229,462 549,486

Cash and cash equivalents at beginning

of the period 13,609 37,421 76,240 75,669 202,939

Effect of exchange rate fluctuations

on cash held (7,093) (125) 322 (14,690) (21,586)

Cash and cash equivalents at end of

the period 71,316 349,828 19,254 290,441 730,839

-------------------------------------- --------- --------- --------- ---------------------------------- ---------

4. Revenue

2022 2021

$'000 $'000

---------------------------------------- --------- --------

Revenue from crude oil sales 206,959 165,924

Revenue from gas sales 529,923 270,969

Revenue from LPG sales 21,747 20,945

Revenue from condensate sales 35,384 34,126

Compensation to gas buyers (18,031) -

Gain/(Loss) on forward transactions (55,189) (285)

Petroleum products sales 2,697 4,618

Rendering of services 1,001 688

---------------------------------------- --------- --------

Revenue from contracts with customers 724,491 496,985

---------------------------------------- --------- --------