TIDMFKE

RNS Number : 0096R

Fiske PLC

24 October 2023

24 October 2023

FISKE PLC

("Fiske" or the "Company" or the "Group")

Final Results, Posting of Annual Report and Notice of AGM

Fiske ( AIM:FKE ) is pleased to announce its final audited

financial results for the year ended 30 June 2023.

Highlights

Year to Period

30 June to 30 June

2023 2022

GBP'000 GBP'000

Total Revenue 5,879 5,764

Profit/(loss) on ordinary activities

before taxation 315 (349)

Profit/(loss) per ordinary share 2.1p (1.5)p

James Harrison, CEO, commenting on the results said:

"We are pleased to report a significant improvement in our

profitability for the year to 30 June 2023. Following our move to

more modern offices and other cost saving initiatives we are

pleased with our progress over the year. Markets remain challenging

despite some improvements in valuations since 2022. We continue to

review our cost base, invest in our people and focus our investment

efforts on looking after our clients in these more challenging

markets."

Our Annual General Meeting will be held on Thursday 23 November

2023 at 12.30pm at our offices at 100 Wood Street, London EC2V

7AN.

Copies of the 2023 Report and Accounts, including the Notice of

AGM and Proxy Voting form will be posted to shareholders shortly

and in accordance with rule 26 of the AIM Rules for Companies, this

information is also available under the Investor Relations section

of the Company's website, www.fiskeplc.com .

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

For further information, please contact:

Fiske PLC

James Harrison (CEO) Tel: +44 (0) 20 8448 4700

100 Wood Street

London

EC2V 7AN

Grant Thornton UK LLP (Nominated Adviser) Tel: +44 (0) 20 7383

5100

Samantha Harrison / Harrison Clarke / Samuel Littler

Chairman's Statement

Trading and revenues

Revenues of GBP5.9m to June 2023 were up on the prior year

equivalent 12-month period and closely matched the 13 months to

June 2022 (GBP5.8m). This was largely due the resurgence of

interest income towards the end of the year which countered the

slightly lower fee and commission revenues due to the flat UK

market.

We remain committed to delivering sustainable profitability for

our shareholders whilst maintaining a strong capital position to

weather market uncertainties. We are pleased to report our total

client assets at June 2023 increased to GBP807m from GBP772m in

June 2022, which represents an increase of 4.5%.

Costs

Costs have remained stable in the year to June 2023 (GBP5.8m)

and broadly the same as the prior year equivalent 12-month period

to June 2022. Overall, we have maintained operating expenses at the

same overall run-rate; GBP5.8m in the year to 30 June 2023 (13

months to June 2022: GBP6.3m). Staff costs were up by some 6% which

reflects both continued investment in growth and inflationary

increases in salaries.

During the year, we have benefitted from the lower cost of our

new modern premises without the relocation and overlap costs

incurred in the prior period.

Outturn

The Group made an operating profit of GBP128,000 in the year to

June 2023 (13 months to June 2022: loss of GBP505,000). Profit on

ordinary activities after taxation was GBP253,000 for the year to

June 2023 (13 months to June 2022: loss of GBP172,000). The cash

flow arising from this is rather better given that there is some

GBP206,000 of phased write down of past goodwill on acquisitions.

Meanwhile, the GBP200,000 dividend income receipt from our holding

in Euroclear helped fund the GBP290,000 acquisition of a customer

base.

Euroclear

Euroclear's operating income increased from EUR1,615m in 2021 to

EUR1,955m in 2022 (after deducting the Russian sanctions impact)

and its operating margin increased from 40% in 2021 to 42% in the

year to December 2022. Net earnings per share increased 30% to

EUR191.7 in 2022 compared to EUR147.0 in 2021.

There were several private transactions in Euroclear shares

during the year and these have helped us to better assess the

appropriate carrying value of our holding in our financial

statements. Considering recent transaction prices in Euroclear

shares, we have marked the carrying value of our investment down to

EUR1,911.50 per share (2022: EUR2,050 per share) being GBP4.3m in

total (2022: GBP4.6m). Our mark down is not a diminution of our

assessment of the company but a reflection of recent trades that

need to be considered. Our holding continues to represent a

significant store of value on our balance sheet and the company

paid us gross dividends amounting to GBP200,000 in the year (2022:

GBP185,000).

Net assets

Shareholder's funds amount to some GBP8.3m (2022: GBP8.3m) and

within this we now hold some GBP3.3m (2022: GBP3.2m) of cash.

Dividend

The Board has resolved not to pay a dividend for the period to

30 June 2023 (2022: GBPnil).

Staff

We would like to thank all members of our dedicated staff for

their continued commitment and hard work. As a company we have

continued to evolve, adapt and improve our modus operandi

throughout the year.

Board

In August 2023 we celebrated our 50th anniversary and, as

mentioned in my last report, as Founder and Chairman I will be

stepping down as Chairman at the conclusion of the Annual General

Meeting in November 2023 and handing over my investment management

responsibilities for clients. The board has elected Tony Pattison

as Chairman to succeed me from the conclusion of our Annual General

Meeting ('AGM') this year. Tony is a former Chairman of Capital

Gearing Trust plc and was the Chairman of Fieldings Investment

Management at the time of our acquisition of this company in July

2017. Tony has been a director of the Company since 1 October 2018

and he and I have worked together during the last year of

transition to ensure a smooth handover of my clients and the

responsibilities of the Chairman.

Strategy

Our commitment to continuous improvement led us to apply

significant efforts in fee automation systems over the past year.

The improved utilisation of the technology platform in which Fiske

has already invested has allowed us to streamline our processes,

deliver more automation and enhance our client servicing

capabilities.

Looking ahead, we will continue to invest in automation

technologies, exploring opportunities to further enhance efficiency

and accuracy while maintaining our commitment to transparency.

Our commitment to improving our back-office systems has resulted

in more efficient operations, enhanced client services, and reduced

risks. We will remain vigilant in this area, continually seeking

ways to stay at the forefront of industry best practices.

Succession planning is a key consideration in our recruitment

strategy, both for Investment Managers and for our Support and

Operations teams. Our acquisition of a customer base in the year to

June 2023 was driven by this strategy and we expect to capitalise

on this in the future both for client satisfaction and business

continuity.

Consumer Duty

The Consumer Duty came into effect on 1(st) August 2023.

Considerable time and effort has been spent implementing the

changes required within our business to ensure the new regulations

are embedded in our policies and processes. Our Consumer Duty

Champion who is also one of our non-executive directors will

continue to assist the management team in ensuring that appropriate

oversight is maintained as we operate under the new rules.

Markets

At present, stock markets generally, and certainly London and

New York, are in a strange period of relative uncertainty which has

been the pattern for some months. It is unusual when the outlook

for major Western economies is so precariously perched between

recession and stagflation. It is rare that no decisive trend has

emerged in stock markets at a time when so much is changing in the

economic and political scene. We have a serious war in Eastern

Europe into which Western countries are being increasingly but

decidedly more involved. We have an unstable situation with the

China/Taiwan standoff. We have had 18 months of sharp and

protracted rises in interest rates in a concerted effort to tame

rampant inflation, which is not helped by the situation in Ukraine,

and which may not have reached its peak yet in spite of the

inevitable optimistic talk amongst the chattering classes.

Meanwhile the tragic events unfolding in Israel and Gaza are

exerting upward pressure on oil and gas prices with the possibility

of military escalation in the Middle East creating further

uncertainty. This is all happening when the West has a series of

weak and hesitant governments who follow events rather than trying

to control them, which is not a good combination. As a result, we

are cautious about the immediate prospects for the stock markets

this autumn.

Outlook

The financial industry has not been immune from the global

economic challenges posed by the current inflationary pressures.

While we understand the concerns this raises, we must strike a

balance between maintaining our service quality and addressing the

impact of inflation on our operational costs.

In light of rising costs, we have conducted a comprehensive

review of our fee structure to ensure it remains fair and

competitive and have applied revised fee rates from April 2023. We

have begun to see the benefits of these new rates in the first few

months of the new financial year.

Annual General Meeting

Shareholders are invited to attend the Annual General Meeting to

be held at our offices at 100 Wood Street, London EC2V 7AN at 12.30

pm on Thursday 23 November 2023. We would like the opportunity to

meet you and for you to meet the management of the Company in which

you are invested.

The Board encourages shareholders to submit their votes via the

CREST system. Shareholders may also submit questions in advance of

the AGM to the Company Secretary via email to info@fiskeplc.com or

by post to the Company Secretary at the address set out on page 53

of the annual report.

Consolidated Statement of Total Comprehensive Income

For Year ended 30 June 2023

Notes Year to 13 months

30 June to

2023 30 June

2022

GBP'000 GBP'000

Revenues 2 5,879 5,764

Operating expenses (5,751) (6,269)

Operating profit / (loss) 128 (505)

Investment revenue 200 185

Finance income 14 -

Finance costs (27) (29)

Profit / (loss) on ordinary activities before

taxation 315 (349)

Taxation (charge) / credit 3 (62) 177

Profit / (loss) on ordinary activities after

taxation 253 (172)

Other comprehensive (expense) / income

Items that may subsequently be reclassified

to profit or loss

Movement in unrealised appreciation of investments (321) 1,017

Deferred tax on movement in unrealised appreciation

of investments 80 (443)

Net other comprehensive (expense) / income (241) 574

Total comprehensive income attributable to

equity shareholders 12 402

Profit / (loss) per ordinary share

Basic 4 2.1p (1.5)p

Diluted 4 2.1p (1.5)p

All results are from continuing operations.

Consolidated Statement of Financial Position

At 30 June 2023

As at As at

30 June 30 June

Notes 2023 2022

GBP'000 GBP'000

Non-current Assets

Intangible assets 5 999 911

Right-of-use assets 6 156 250

Other intangible assets 7 - -

Property, plant and equipment 8 15 21

Investments held at Fair Value Through Other

Comprehensive Income 9 4,300 4,621

Total non-current assets 5,470 5,803

Current Assets

Trade and other receivables 10 2,591 2,450

Cash and cash equivalents 3,333 3,248

Total current assets 5,924 5,698

Current liabilities

Trade and other payables 11 (2,136) (2,147)

Short-term lease liabilities 12 (106) (106)

Current tax liabilities 3 - -

Total current liabilities (2,242) (2,253)

Net current assets 3,682 3,445

Non-current liabilities

Non-current lease liabilities 12 (65) (155)

Deferred tax liabilities 13 (815) (833)

Total non-current liabilities (880) (988)

Net Assets 8,272 8,260

Equity

Share capital 14 2,957 2,957

Share premium 2,085 2,085

Revaluation reserve 2,887 3,128

Retained earnings 343 90

Shareholders' equity 8,272 8,260

The financial statements were approved by the Board of Directors

and authorised for issue on 23 October 2023.

Group Statement of Changes in Equity

For Year ended 30 June 2023

Retained

Share Share Revaluation (losses)/

capital premium reserve profits Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 June 2021 2,939 2,082 2,553 259 7,833

Loss for the financial period - - - (172) (172)

Movement in unrealised appreciation

of investments - - 1,017 - 1,017

Deferred tax on movement

in unrealised appreciation

of investments - - (443) - (443)

Realised disposal of Fair

value through other comprehensive

income investments - - 1 - 1

Total comprehensive income

/ (expense) for the year - - 575 (172) 403

Share based payment transactions - - - 3 3

Issue of ordinary share

capital 18 3 - - 21

Total transactions with

owners, recognised directly

in equity 18 3 - 3 24

Balance at 30 June 2022 2,957 2,085 3,128 90 8,260

Profit for the financial

year - - - 251 251

Movement in unrealised appreciation

of investments - - (321) - (321)

Deferred tax on movement

in unrealised appreciation

of investments - - 80 - 80

Total comprehensive (expense)

/ income for the year - - (241) 251 10

Share based payment transactions - - - 2 2

Total transactions with

owners, recognised directly

in equity - - - 2 2

Balance at 30 June 2023 2,957 2,085 2,887 343 8,272

Group Statement of Cash Flows

For Year ended 30 June 2023

Notes Year to Year to Period Period

30 June 30 June to to

2023 2023 30 June 30 June

2022 2022

Group Company Group Company

GBP'000 GBP'000 GBP'000 GBP'000

Operating profit / (loss) 128 90 (505) (471)

Amortisation of customer relationships

and goodwill 205 206 218 218

Amortisation of other intangible

assets - - 32 32

Depreciation of right-of-use

assets 94 94 79 79

Depreciation of property, plant

and equipment 14 12 31 31

Interest relating to ROU assets (22) (22) (25) (25)

Expenses settled by the issue

of shares 2 2 3 3

Decrease in receivables 605 972 248 431

(Decrease) in payables (895) (902) (389) (365)

Cash generated from/(used in)

operations 131 452 (308) (67)

Tax (paid) - - (49) (49)

Net cash generated from/ (used

in) operating activities 131 452 (357) (116)

Investing activities

Investment income received 200 200 185 185

Interest income received 14 14 - -

Purchases of property, plant

and equipment (8) (8) (28) (28)

Purchases of other intangible

assets (157) (157) - -

Net cash (used in) / generated

from investing activities 49 49 157 157

Financing activities

Interest paid (5) (5) (4) (4)

Proceeds from issue of ordinary

share capital - - 22 22

Repayment of lease liabilities 12 (90) (90) (68) (68)

Net cash used in financing

activities (95) (95) (50) (50)

Net increase/(decrease) in cash

and cash equivalents 85 406 (250) (9)

Cash and cash equivalents at

beginning of period 3,248 2,780 3,498 2,789

Cash and cash equivalents at

end of period 3,333 3,186 3,248 2,780

Notes to the Accounts

For the Year ended 30 June 2023

1. Basis of preparation

The financial statements have been prepared in accordance with

the requirements of IFRS implemented by the Group for the Year

ended 30 June 2023 as adopted by the International Financial

Reporting Interpretations Committee and in conformity with the

Companies Act 2006. The Group financial statements have been

prepared under the historical cost convention, with the exception

of financial instruments, which are stated in accordance with IFRS

9 Financial Instruments: recognition and measurement.

The financial information included in this News Release does not

constitute statutory accounts of the Group for the Year ended 30

June 2023 or 13-month period to 30 June 2022, but is derived from

those accounts. Statutory accounts for the 13-month period ended 30

June 2022 have been reported on by the Group's auditor and

delivered to the Registrar of Companies. Statutory accounts for the

Year ended 30 June 2023 have been audited and will be delivered to

the Registrar of Companies. The report of the auditors for both

years was (i) unqualified and (ii) did not contain a statement

under Section 498 (2) or (3) of the Companies Act 2006.

Copies of the Annual Report will be sent on 24 October 2023 to

shareholders and will also be available on our website at

www.fiskeplc.com

New and revised IFRSs in issue but not yet effective

A number of amendments to existing standards have also been

effective from 1 July 2022 but they do not have a material effect

on the Group financial statements. There are a number of standards,

amendments to standards, and interpretations which have been issued

by the IASB that are effective in future accounting periods that

the Group has decided not to adopt early. The following amendments

are effective for future periods:

IFRS/Std Description Issued Effective

IAS 1 Presentation Amendments regarding February Annual periods

of Financial Statements the disclosure of 2021 beginning on or

accounting policies after 1 January

and classification 2023

of liabilities

IAS 8 Accounting Amendments regarding February Annual periods

Policies, Changes the definition of 2021 beginning on or

in Accounting Estimates accounting estimates after 1 January

and Errors 2023

The Group do not expect these amendments to have a significant

impact on the financial statements.

There were no new standards adopted in the current financial

period.

2. Total revenue and segmental analysis

IFRS 8 requires o perating segments to be identified on the

basis of internal reports about components of the Group that are

regularly reviewed by management to allocate resources to the

segments and to assess their performance. Following the acquisition

of Fieldings Investment Management Limited in August 2017, their

staff and operations have been integrated into the management team

of Fiske plc. Pursuant to this, the Group continues to identify a

single reportable segment, being UK-based financial intermediation.

Within this single reportable segment, total revenue comprises:

Year to Period

30 June to 30 June

2023 2022

GBP'000 GBP'000

Commission receivable 2,863 2,576

Investment management fees 2,982 3,186

5,845 5,762

Other income 34 2

5,879 5,764

Substantially all revenue in the current period and prior year

is generated in the UK and derives solely from the provision of

financial intermediation.

3. Tax

Analysis of tax on ordinary activities:

Year to Period

30 June to 30

2023 June 2022

Notes GBP'000 GBP'000

Current tax

Current period - 6

- 6

Deferred tax

Current period 13 62 (183)

Total tax charge to Statement of Comprehensive

Income 62 (177)

Factors affecting the tax charge for the period

The main corporation tax rate, based on the United Kingdom

standard rate of corporation tax, was increased from 19% to 25%

from 1 April 2023. The deferred tax liability has been calculated

using the expected on-going corporation tax rate of 25% (2022:

25%).

The charge/(credit) for the year can be reconciled to the profit

per the Statement of Comprehensive Income as follows:

Year to Period

30 June to 30 June

2023 2022

GBP'000 GBP'000

Profit / (loss) before tax 315 (349)

Charge / (credit) on profit / (loss) on ordinary

activities at standard rate 60 (66)

Effect of:

Expenses not deductible in determining taxable

profit - -

Non-taxable income (38) (35)

Carry back tax relief 40 (76)

62 (177)

4. Earnings per share

Basic earnings per share has been calculated by dividing the

profit on ordinary activities after taxation by the weighted

average number of shares in issue during the period. Diluted

earnings per share is basic earnings per share adjusted for the

effect of conversion into fully paid shares of the weighted average

number of share options during the period.

Diluted

Year to 30 June 2023 Basic Basic

GBP'000 GBP'000

Profit on ordinary activities after taxation 253 253

Adjustment to reflect impact of dilutive share

options - -

Profit 253 253

Weighted average number of shares (000's) 11,830 11,830

Earnings per share (pence) 2.1 2.1

Diluted

Period to 30 June 2022 Basic Basic

GBP'000 GBP'000

Loss on ordinary activities after taxation (172) (172)

Adjustment to reflect impact of dilutive share

options - -

Loss (172) (172)

Weighted average number of shares (000's) 11,809 11,809

Earnings per share (pence) (1.5) (1.5)

30 June 30 June

2023 2022

Number of shares (000's):

Weighted average number of shares 11,830 11,809

Dilutive effect of share option scheme - -

11,830 11,809

5. Intangible assets

Company Group

Customer Customer

relationships relationships Goodwill Total

GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 June 2021 - 1,312 1,311 2,623

Additions - - - -

At 30 June 2022 - 1,312 1,311 2,623

Additions 293 293 - 293

At 30 June 2023 293 1,605 1,311 2,916

Accumulated amortisation

or impairment

At 1 June 2021 - (525) (969) (1,494)

Charge in year - (131) (87) (218)

At 30 June 2022 - (656) (1,056) (1,712)

Charge in period (7) (138) (67) (205)

At 30 June 2023 (7) (794) (1,123) (1,917)

Net book value

At 30 June 2023 286 811 188 999

At 1 July 2022 - 656 255 911

Goodwill arising through business combinations is allocated to

individual cash-generating units ('CGUs') being acquired

subsidiaries, reflecting the lowest level at which the Group

monitors and test goodwill for impairment purposes. The CGUs to

which goodwill is attributed are as follows:

2023 2022

CGU GBP'000 GBP'000

Ionian Group Limited 106 129

Vor Financial Strategy Limited 82 126

Goodwill allocated to CGUs 188 255

The impairment charge arises from a prudent assessment that

customer relationships and goodwill change over time and are not of

indefinite life. Based on analyses of the relevant customer base

segments, a determination was made as to the expected income

streams arising over the next 6 years. The recoverable amounts of

the goodwill in Ionian Group Limited and in Vor Financial Strategy

Limited are determined based on value-in-use calculations. These

calculations use projections of marginal profit contributions over

the expected remaining stream of attributable value. The key

assumptions used for value-in-use calculations are as follows:

Direct and indirect costs

as % of revenues 60%

Growth rate 0 %

12.5

Discount rate %

Had the discount rate used gone up / down by 1%, impairment

would have been GBP8,000 higher/lower and the carrying amount

commensurately adjusted. Management determined margin contribution

and growth rates based on past performance of those units, together

with current market conditions and its expectations of development

of those CGUs. The discount rate used is pre-tax, and reflects

specific risks relating to the relevant CGU.

6. Right-of-use assets

Property

Group and Company GBP'000

Cost

At 1 June 2021 274

Additions 329

Disposals (274)

At 1 July 2022 329

Additions -

Disposals -

At 30 June 2023 329

Accumulated amortisation

At 1 June 2021 (274)

Charge for the period (79)

On Disposals 274

At 1 July 2022 (79)

Charge for the year (94)

On Disposals -

At 30 June 2023 (173)

Net book value

At 30 June 2023 156

At 1 July 2022 250

A ten-year lease of office premises at Salisbury House came to

an end at December 2021 after a 12 month extension. Since then the

Company has moved to new office premises commencing a new lease to

21 February 2025.

The Group used the following practical expedients when applying

IFRS16 to leases previously classified as operating leases under

IAS17.

-- Applied a single discount rate to a portfolio of leases with similar characteristics;

-- Excluded initial direct costs from measuring the right-of-use

asset at the date of initial application;

-- Used hindsight when determining the lease term if the

contract contains options to extend or terminate the lease.

7. Other intangible assets

Systems

licence

Group and Company GBP'000

Cost

At 1 June 2021 192

Additions -

At 1 July 2022 192

Additions -

At 30 June 2023 192

Accumulated amortisation

At 1 June 2021 (160)

Charge for the period (32)

At 1 July 2022 (192)

Charge for the year -

At 30 June 2023 (192)

Net book value

At 30 June 2023 -

At 1 July 2022 -

8. Property, plant and equipment

Office

furniture Computer Office

and equipment equipment refurbishment Total

Group and Company GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 June 2021 164 278 175 617

Additions 3 25 - 28

Disposals (162) (197) (175) (534)

At 1 July 2022 5 106 - 111

Additions 2 6 - 8

Disposals - - - -

At 30 June 2023 7 112 - 119

Accumulated depreciation

At 1 June 2021 (163) (255) (175) (593)

Charge for the period (1) (30) - (31)

Disposals 162 197 175 534

At 1 July 2022 (2) (88) - (90)

Charge for the year (2) (12) - (14)

Disposals - - - -

At 30 June 2023 (4) (100) - (104)

Net book value

At 30 June 2023 3 12 - 15

At 30 June 2022 3 18 - 21

9. Investments held at Fair Value Through Other Comprehensive Income

2023 2022

Group and Company GBP'000 GBP'000

Opening valuation 4,621 3,604

Opening fair value gains on investments held (4,144) (3,127)

Cost 477 477

Gains on investments 3,823 4,144

Closing fair value of investments held 4,300 4,621

being:

Listed - -

Unlisted 4,300 4,621

FVTOCI investments carried at fair value 4,300 4,621

Gains / (losses) on investments in period 2023 2022

Group and Company GBP'000 GBP'000

Realised gains on sales - -

(Decrease) / increase in fair value (321) 1,017

(Loss) / gain on investments (321) 1,017

The investments included above are represented by holdings of

equity securities. These shares are not held for trading.

10. Trade and other receivables

2023 2023 2022 2022

Group Company Group Company

Group and Company GBP'000 GBP'000 GBP'000 GBP'000

Counterparty receivables 285 285 407 407

Trade receivables 747 747 891 891

1,032 1,032 1,298 1,298

Amount owed by group undertakings - 173 - 563

Other debtors 313 307 57 48

Prepayments and accrued income 1,246 883 1,095 711

2,591 2,395 2,450 2,620

Due to the short-term nature of the current receivables, their

carrying amount is considered to be the same as their fair

value.

Trade receivables

Included in the Group's trade receivables are debtors with a

carrying amount of GBPnil (2022: GBPnil) which are past due at the

reporting date for which the Group has not provided.

Counterparty receivables

Included in the Group's counterparty receivables balance are

debtors with a carrying amount of GBP230,000 (2022: GBP407,000)

which are past due but not considered impaired.

Ageing of counterparty receivables:

2023 2022

GBP'000 GBP'000

0 - 15 days 148 291

16 - 30 days 1 40

31 - 60 days 6 57

Over 60 days 75 19

230 407

11. Trade and other payables

2023 2023 2022 2022

Group Company Group Company

GBP'000 GBP'000 GBP'000 GBP'000

Counterparty payables 963 963 1,214 1,214

Trade payables 17 16 19 20

980 979 1,233 1,234

Other sundry creditors and accruals 1,156 1,054 914 818

2,136 2,033 2,147 2,052

12. Lease liabilities

2023 2023 2022 2022

Group Company Group Company

GBP'000 GBP'000 GBP'000 GBP'000

Current 106 106 106 106

Non-current 65 65 155 155

171 171 261 261

Maturity analysis:

Not later than one year 106 106 106 106

Later than one year and not later

than 5 years 65 65 155 155

171 171 261 261

The cash flow impact is summarised as:

2023 2023 2022 2022

Group Company Group Company

GBP'000 GBP'000 GBP'000 GBP'000

Lease liabilities at beginning

of period 261 261 - -

New lease entered into in period - - 329 329

Repayment of lease liabilities (90) (90) (68) (68)

Lease liabilities at end of period 171 171 261 261

The lease liability is retired over time by the contrasting

interest expense and lease payments.

13. Deferred taxation

Capital Tax Deferred

allowances Investments Losses tax liability

Group and Company GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2022 (1) 1,017 (183) 833

Charge for the period - (80) 62 (18)

At 30 June 2023 (1) 937 (121) 815

Deferred tax assets and liabilities are recognised at a rate

which is substantively enacted at the balance sheet date. The rate

to be taken in this case is 25%, being the anticipated rate of

taxation applicable to the Group and Company in the following year.

A potential deferred tax asset of GBP156,000 relating to trading

losses arising before 1 April 2017 has not been recognised.

14. Called up share capital

2023 2022

No. of No. of

shares GBP'000 shares GBP'000

Allotted and fully paid:

Ordinary shares of 25p

Opening balance 11, 829,859 2,957 11,754,859 2,939

Shares issued - - 75,000 18

Closing balance 11,829,859 2,957 11,829,859 2,957

Included within the allotted and fully paid share capital were

9,490 ordinary shares of 25p each (2022: 9,490 ordinary shares of

25p each) held for the benefit of employees.

At 30 June 2023 there were 125,000 (2022: 125,000) outstanding

options to subscribe for ordinary shares at a weighted average

exercise price of 70p (2022: 70p) and a weighted average remaining

contractual life of 1 years, 6 months. (2022: 4 years, 7 months).

Ordinary shares are entitled to all distributions of capital and

income.

15. Financial commitments

Lease - classified as an IFRS 16 lease

At 30 June 2023 the Group had outstanding commitments for future

minimum lease payments under non-cancellable operating leases which

fall due as follows:

2023 2022

Land Land and

and buildings Other buildings Other

GBP'000 GBP'000 GBP'000 GBP'000

In the next year 112 - 111 -

In the second to fifth years

inclusive 74 - 185 -

Total commitment 186 - 296 -

On 31 December 2021 a 10 year lease over the Company's premises

at Salisbury House expired. In September 2021 the Company entered

into a lease over new premises at Wood Street for a period of some

3 years to 21 February 2025.

16. Clients' money

At 30 June 2023 amounts held by the Company on behalf of clients

in accordance with the Client Money Rules of the Financial Conduct

Authority amounted to GBP52,686,945 (2022: GBP66,435,793). The

Company has no beneficial interest in these amounts and accordingly

they are not included in the consolidated statement of financial

position.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR BUBDGUDDDGXX

(END) Dow Jones Newswires

October 24, 2023 02:05 ET (06:05 GMT)

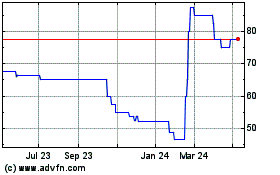

Fiske (LSE:FKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

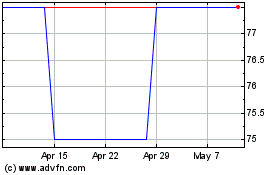

Fiske (LSE:FKE)

Historical Stock Chart

From Apr 2023 to Apr 2024