TIDMFSG

RNS Number : 8877E

Foresight Group Holdings Limited

04 July 2023

LEI: 213800NNT42FFIZB1T09

04 July 2023

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR

INDIRECTLY, IN OR TO THE UNITED STATES, AUSTRALIA, CANADA, NEW

ZEALAND, THE REPUBLIC OF SOUTH AFRICA, JAPAN OR ANY MEMBER STATE OF

THE EEA OR ANY OTHER JURISDICTION IN WHICH THE PUBLICATION,

DISTRIBUTION OR RELEASE OF THIS ANNOUNCEMENT WOULD BE UNLAWFUL

This announcement contains inside information, as that term is

defined in the UK version of the Market Abuse Regulation

(Regulation (EU) No 596/2014) which is incorporated into English

law by virtue of the European Union (Withdrawal) Act 2018.

Full year results for the financial year ended 31 March 2023

A record year of profitability and AUM growth

Foresight Group Holdings Limited ("Foresight", the "Group"), a

sustainability-led infrastructure and private equity investment

manager, is pleased to announce its results for the financial year

ended 31 March 2023 ("FY23", "the period").

Financial and Operational Highlights

-- 58% increase in core EBITDA pre Share-Based Payments ("SBP") to

GBP50.2 million evidencing highly profitable growth

-- Predictable long-term revenue model providing strong platform

for continued growth, with recurring revenue of 86.6% for

the period comfortably within our target range of 85 - 90%

-- High quality asset and portfolio management capabilities

generated GBP5.8 million in performance fees across the

business

-- Exceptional growth of 38% and 35% in Assets under Management ("AUM")

and Funds under Management ("FUM") in FY23 to GBP12.2 billion and

GBP9.0 billion respectively (FY22: GBP8.8 billion AUM and GBP6.7

billion FUM), well in excess of our target

-- Drove a 38% increase in revenue to GBP119.2 million

-- GBP3.3 billion added to AUM through the financially and

strategically accretive acquisitions of Infrastructure Capital

Group (now integrated as Foresight Australia) and the technology

ventures division of Downing LLP

-- In-house sales team drove strong inflows of GBP0.3 billion

into high margin retail products

-- Expansion of high margin regional growth strategy with three

new funds in the UK and a first impact fund in Ireland

-- Continued international expansion and diversification, with

AUM outside the UK having increased from 23% at IPO (February

2021) to 43% as at 31 March 2023

-- Scalable platform facilitates margin expansion while allowing investment

for future growth

-- 5.1 ppts core EBITDA pre-SBP margin improvement to 42.1%

as 38% year-on-year revenue growth outpaced costs

-- Increasing rate of deployment across infrastructure strategies

to GBP690 million, up 42% year-on-year with additional GBP1.7

billion of future deployment rights

-- Entered US market through appointment as sub-adviser to

the Cromwell Foresight Global Sustainable Infrastructure

Fund

-- 56% growth in earnings per share translated into strong cash generation

-- Total dividend of 20.1p per share for FY23, a year-on-year

increase of 46%

-- Final dividend of 15.5p per share will be paid on 20 October

2023 based on an ex-dividend date of 28 September 2023 and

a record date of 29 September 2023

Key Financial Metrics

31 March 2023 31 March 2022 Change

-------------------------------- ------------- ------------- --------

Year-end AUM (GBPm) 12,167 8,839 +38%

Year-end FUM (GBPm) 9,022 6,675 +35%

Total Revenue (GBPm) 119.2 86.1 +38%

Recurring Revenue (% of Total) 86.6% 86.9% -0.3 pts

Core EBITDA pre-SBP (GBPm) 50.2 31.8 +58%

Core EBITDA pre-SBP margin (%) 42.1% 37.0% +5.1 pts

Basic earnings per share before

non-underlying items (pence) 34.6p 22.2p +56%

Dividend per Share (pence) 20.1p 13.8p +46%

-------------------------------- ------------- ------------- --------

Current Trading and Outlook

-- As at 30 June 2023 ("Q1 FY24"), both AUM and FUM were marginally

lower at GBP12.0 billion and GBP8.8 billion respectively

-- This reflects a combination of negative FX movements and

net OEIC outflows, which were partially offset by inflows

into high margin products

-- Additionally, we received further commitments into ARIF

Bernard Fairman, Executive Chairman of Foresight Group Holdings

Limited, commented:

"This was a record year of highly profitable growth for

Foresight, which saw the Group extend its excellent track record of

delivering against ambitious growth targets and materially

increasing shareholder returns with a very significant increase to

the dividend.

"We are now focused on further organic growth and have a strong

pipeline of fundraising across asset classes scheduled for this

year and beyond. This includes established strategies such as ARIF

and FEIP, alongside new opportunities such as core European

renewables and our expansion into adjacent asset classes such as

hydrogen. We also continue to assess the market for accretive

M&A opportunities, although the timing of these remains

unpredictable.

"The market opportunity for Foresight is very significant. Our

infrastructure investment strategies cover the whole spectrum of

renewable energy generation, transition and wider economic

decarbonisation. This positions us well to support the broader

energy transition by investing in real assets that are driving this

change.

"Despite current uncertainty in the markets, we remain confident

in the ability of our diversified business model to deliver

profitable growth in FY24. This will be achieved through a

combination of high-quality recurring revenue and a visible

pipeline of high margin retail and institutional fundraising. "

Annual Report and Sustainability Report

A copy of the 2023 Annual Report has been submitted to the

National Storage Mechanism and will shortly be available at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

The annual report will also be available on the Company's

website at

https://fghl-ar-online-summary.foresightgroup.eu/ where further

information on Foresight can be found.

In accordance with DTR 6.3.5(1A), the unedited full text of the

regulated information required to be made public under DTR 4.1 is

contained within the 2023 Annual Report.

A copy of the company's first Sustainability Report, published

in June 2023 is also available on the Company's website at:

https://foresight.group/sustainability-report-fy23

Analyst Presentation

A pre-recorded presentation will be available to view on the

Company's website ( https://www.foresightgroup.eu/shareholders ) on

4 July 2023.

This presentation will be played at the start of a webcast from

9.00 a.m. (UK time) on 4 July 2023 and be followed by live Q&A

for analysts hosted by Bernard Fairman (Executive Chairman) and

Gary Fraser (CFO).

Those wishing to join the webcast should register via the

following link: Register here

Retail Investor Presentation via Investor Meet Company

Foresight will also provide a live presentation via Investor

Meet Company on 10 July 2023 at 11:00am BST.

The presentation is open to all existing and potential

shareholders and will be hosted by Gary Fraser (CFO). Questions can

be submitted pre-event via your Investor Meet Company dashboard up

until 9am the day before the meeting or at any time during the live

presentation.

Investors can sign up to Investor Meet Company for free and add

to meet Foresight via:

https://www.investormeetcompany.com/foresight-group-holdings-limited/register-investor

Investors who already follow Foresight on the Investor Meet

Company platform will automatically be invited.

For further information please contact:

Foresight Group Investors Citigate Dewe Rogerson

Liz Scorer Caroline Merrell / Toby Moore

+44 (0) 7852 210329 / +44 (0) 7768

+44 (0) 7966 966956 981763

caroline.merrell@citigatedewerogerson.com

ir@foresightgroup.eu /

toby.moore@citigatedewerogerson.com

About Foresight Group Holdings Limited

Foresight Group was founded in 1984 and is a leading listed

infrastructure and private equity investment manager. With a

long-established focus on ESG and sustainability-led strategies, it

aims to provide attractive returns to its institutional and private

investors from hard-to-access private markets. Foresight manages

over 400 infrastructure assets with a focus on solar and onshore

wind assets, bioenergy and waste, as well as renewable energy

enabling projects, energy efficiency management solutions, social

and core infrastructure projects and sustainable forestry assets.

Its private equity team manages eleven regionally focused

investment funds across the UK and an SME impact fund supporting

Irish SMEs. This team reviews over 2,500 business plans each year

and currently supports more than 250 investments in SMEs. Foresight

Capital Management manages four strategies across seven investment

vehicles.

Foresight operates in eight countries across Europe, Australia

and United States with AUM of GBP12.0(1) billion. Foresight Group

Holdings Limited listed on the Main Market of the London Stock

Exchange in February 2021.

https://www.foresightgroup.eu/shareholders

(1) Based on unaudited AUM as at 30 June 2023.

Disclaimer - Forward-looking statements

This announcement, prepared by Foresight Group Holdings Limited

(the "Company"), may contain forward-looking statements about the

Company and its subsidiaries (the "Group"). Such forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "projects",

"estimates", "plans", "anticipates", "targets", "aims",

"continues", "expects", "intends", "hopes", "may", "will", "would",

"could" or "should" or, in each case, their negative or other

various or comparable terminology. Forward-looking statements

involve known and unknown risks, uncertainties, assumptions and

other factors which are beyond the Company's control and are based

on the Company's beliefs and expectations about future events as of

the date the statements are made. If the assumptions on which the

Company bases its forward-looking statements change, actual results

may differ from those expressed in such statements. There are a

number of factors that could cause actual results and developments

to differ materially from those expressed or implied by these

forward-looking statements, including those set out under

"Principal Risks" in the Company's annual report for the financial

year ended 31 March 2023. The annual report can be found on the

Company's website (https://www.foresightgroup.eu/). Forward-looking

statements speak only as of the date they are made. Except as

required by applicable law and regulation, the Company undertakes

no obligation to update these forward-looking statements. Nothing

in this announcement should be construed as a profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR RIMATMTMMMBJ

(END) Dow Jones Newswires

July 04, 2023 02:00 ET (06:00 GMT)

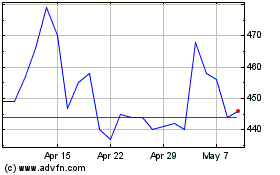

Foresight (LSE:FSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Foresight (LSE:FSG)

Historical Stock Chart

From Apr 2023 to Apr 2024