Fisher (James) & Sons plc Half year trading update (1487G)

17 July 2023 - 4:00PM

UK Regulatory

TIDMFSJ

RNS Number : 1487G

Fisher (James) & Sons plc

17 July 2023

17 July 2023

James Fisher and Sons plc

Half year trading update

James Fisher and Sons plc (FSJ.L) ("James Fisher" or the

"Group"), today provides an update on trading for the six months

ended 30 June 2023 ("the period"), ahead of the publication of its

Half Year results on 21 September 2023.

Trading summary

The Board is pleased to report that the encouraging start to the

year was maintained through the second quarter. Group revenue from

continuing operations in the period is expected to be c.GBP250m,

representing growth of c.16% compared to the same period in 2022.

Underlying operating profit and operating profit margin from

continuing operations are both expected to show modest growth

compared to the same period in 2022, with the revenue uplift more

than offsetting increased investment to strengthen core

capabilities within the Group, including the formation of our

Business Excellence team.

All three divisions delivered revenue and profit growth compared

to the same period in 2022, with the Energy division performing

particularly well following strong market demand for well-testing,

bubble curtain and artificial lift products and services. Defence

is expected to report a modest profit for the period compared to a

modest loss in 2022. Within the Maritime Transport division,

Tankships has maintained its good performance, with high tanker

utilisation and solid day rates for spot charters. Fendercare's

ship-to-ship transfer business has stabilised at levels in line

with H2 2022.

Financial position

Net bank borrowings at 30 June 2023 were c.GBP147m, compared to

GBP133m at 31 December 2022. The normal seasonality of the

business, unwind of working capital balances and costs associated

with the GBP210m new revolving credit facility have led to a cash

outflow in the first half of the year despite asset sales

generating net proceeds of c.GBP20m in the period. The Group

continues to expect net bank borrowings to reduce by the end of the

2023 financial year, in line with its usual trading profile.

Outlook

The Group enters the second half of the year mindful of

heightened macro-economic uncertainty, however the Group's markets

remain resilient and the Board's expectations for the full year

remain unchanged.

Jean Vernet, Chief Executive Officer, commented:

"I am pleased with the Group's first half performance, with all

three divisions contributing to revenue growth of 16%, alongside a

modest improvement in margins. We are starting to see the benefits

of the operational improvements being implemented throughout James

Fisher. These, combined with the previously announced business and

asset disposals and the refinancing concluded in June, provide us

with a stronger platform for the future. Despite uncertainty in the

macro-economic environment, the Group's markets remain resilient

and the Board's outlook for the full year remains unchanged."

For further information:

Chief Executive

Officer

James Fisher and Sons Jean Vernet Chief Financial

plc Duncan Kennedy Officer 020 7614 9503

Richard Mountain

FTI Consulting Susanne Yule 0203 727 1340

-------------------------------------- --------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGPUQWMUPWPUQ

(END) Dow Jones Newswires

July 17, 2023 02:00 ET (06:00 GMT)

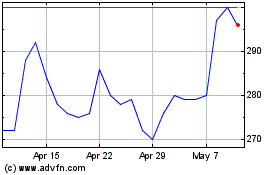

Fisher (james) & Sons (LSE:FSJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

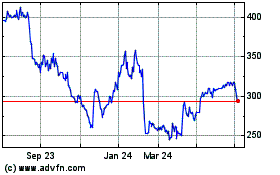

Fisher (james) & Sons (LSE:FSJ)

Historical Stock Chart

From Apr 2023 to Apr 2024