TIDMGAW

RNS Number : 0164Z

Games Workshop Group PLC

09 January 2024

GAMES WORKSHOP GROUP PLC

9 January 2024

HALF-YEARLY REPORT

Games Workshop Group PLC ('Games Workshop' or the 'Group')

announces its half-yearly results for the 26 week period to 26

November 2023.

Highlights:

26 weeks to 26 weeks to

26 November 2023 27 November 2022

-------------------------------------- ----------------- -----------------

Core revenue GBP235.6m GBP212.3m

Licensing revenue GBP12.1m GBP14.3m

Revenue GBP247.7m GBP226.6m

Revenue at constant currency GBP254.9m GBP226.6m

Core operating profit GBP83.4m GBP70.7m

Core operating profit at constant GBP87.8m GBP70.7m

currency

Licensing operating profit GBP11.1m GBP12.9m

Licensing operating profit at GBP11.5m GBP12.9m

constant currency

Operating profit GBP94.5m GBP83.6m

Profit before taxation GBP95.2m GBP83.6m

Net increase in cash - pre-dividends GBP85.3m GBP68.1m

paid

Earnings per share 216.9p 202.4p

Dividends per share declared and

paid in the period 195p 165p

Kevin Rountree, CEO of Games Workshop, said:

"Games Workshop and the Warhammer hobby are in great shape. We

continue to perform well during challenging economic times,

delivering record group revenue, profit and dividends in the

period. Morale is good at Games Workshop and our hobbyists are

having fun too."

For further information, please

contact:

Games Workshop Group PLC investorrelations@gwplc.com

Kevin Rountree, CEO

Rachel Tongue, CFO

Investor relations website investor.games-workshop.com

General website www.warhammer.com

See the glossary on page 20 for details on the alternative

performance measures (APMs) used by the Group. Where appropriate, a

reconciliation between an APM and its closest statutory equivalent

is provided.

This announcement contains inside information for the purposes

of the Market Abuse Regulation (EU) no. 596/2014 (including as it

forms part of the laws of England and Wales by virtue of the

European Union (Withdrawal) Act 2018) ('MAR'). Upon the publication

of this announcement, such information will no longer constitute

inside information. Ross Matthews, the Company's General Counsel

and Company Secretary, is the person responsible for making the

notification for the purposes of Article 17 of MAR.

FIRST HALF HIGHLIGHTS

26 weeks to 26 November 2023 and 27 November 2022:

Revenue and operating profit at actual rates

Core Licensing Total

-------------------- ---------------- --------------------- ----------------

2023 2022 2023 2022 2023 2022

GBPm GBPm GBPm GBPm GBPm GBPm

-------------------- ------- ------- ---------- --------- ------- -------

Trade 136.1 120.9 - - 136.1 120.9

Retail 54.7 48.7 - - 54.7 48.7

Online 44.8 42.7 - - 44.8 42.7

Licensing - - 12.1 14.3 12.1 14.3

-------------------- ------- ------- ---------- --------- ------- -------

Revenue 235.6 212.3 12.1 14.3 247.7 226.6

Cost of sales (72.1) (76.0) - - (72.1) (76.0)

-------------------- ------- ------- ---------- --------- ------- -------

Gross profit 163.5 136.3 12.1 14.3 175.6 150.6

-------------------- ------- ------- ---------- --------- ------- -------

Operating expenses (80.1) (65.6) (1.0) (1.4) 81.1 (67.0)

-------------------- ------- ------- ---------- --------- ------- -------

Operating profit 83.4 70.7 11.1 12.9 94.5 83.6

-------------------- ------- ------- ---------- --------- ------- -------

Revenue and operating profit at constant currency

Core Licensing Total

-------------------- ---------------- --------------------- ----------------

2023 2022 2023 2022 2023 2022

GBPm GBPm GBPm GBPm GBPm GBPm

-------------------- ------- ------- ---------- --------- ------- -------

Trade 140.3 120.9 - - 140.3 120.9

Retail 56.5 48.7 - - 56.5 48.7

Online 45.6 42.7 - - 45.6 42.7

Licensing - - 12.5 14.3 12.5 14.3

-------------------- ------- ------- ---------- --------- ------- -------

Revenue 242.4 212.3 12.5 14.3 254.9 226.6

Cost of sales (73.0) (76.0) - - (73.0) (76.0)

-------------------- ------- ------- ---------- --------- ------- -------

Gross profit 169.4 136.3 12.5 14.3 181.9 150.6

-------------------- ------- ------- ---------- --------- ------- -------

Operating expenses (81.6) (65.6) (1.0) (1.4) (82.6) (67.0)

-------------------- ------- ------- ---------- --------- ------- -------

Operating profit 87.8 70.7 11.5 12.9 99.3 83.6

-------------------- ------- ------- ---------- --------- ------- -------

Foreign exchange rates

Our currency exposures are the euro and US dollar:

euro US dollar

2023 2022 2023 2022

Rate used for the balance

sheet at the period end 1.15 1.16 1.26 1.21

Average rate used for earnings 1.16 1.17 1.25 1.18

INTERIM MANAGEMENT REPORT

Games Workshop and the Warhammer hobby are in great shape.

Strategy

We have remained focused on delivering our strategic goal - to

make the best fantasy miniatures in the world, to engage and

inspire our customers, and to sell our products globally at a

profit. We intend to do this forever. Our decisions are focused on

long-term success, not short-term gains.

This relentless focus from all in our vertically integrated

business, continues to deliver record results. We continue to work

tirelessly as a team to ensure we deliver our operational plans,

surprising and delighting our fans.

It's worth noting that we have increased our cash buffer in the

period to GBP75 million in line with the current three month cash

cost of running Games Workshop - on a rainy day we'd prefer to be

able to look after ourselves. Our job is to run the business under

all scenarios.

Licensing - we own what we believe is some of the best under

exploited intellectual property ('IP') globally. In the period

reported, we have continued to patiently seek partners that can

help us fulfil this potential. We will continue to grant licences

to carefully chosen partners that respect the need for us to have

complete ownership of our unique IP, to ensure no harm is done to

the core business: a key risk we highlight every year. We will

ensure we do everything we can to make the day to day IP approval

process seamless. This process now rests within our Warhammer

Studio; with the experts who understand our ambitions and have the

IP knowledge.

Update

A solid six month period, successfully delivering the plans we

set ourselves at the start of the year; with core revenue growth in

all channels and in all major countries. We have improved our core

gross margin and managed our operating expenses well, only allowing

essential investments. These record results are driven by the

launch of a significant number of new products across all of our

IPs and the ongoing performance of products we launched in previous

periods. We have delivered sales growth at constant currency rates,

every month in line with our ambitious plan. Our June 2023 sales

performance set a new benchmark for sales in one month driven by

sales of our new Warhammer 40,000 core set.

We have made significant progress on our other strategic

priorities including, as promised, a reduction in our carbon

footprint; we are ahead of the milestones presented in the 2023

annual report. It's worth noting that we don't need to incentivise

our great staff at Games Workshop with bonuses to do this - they

believe it's the right thing to do. It's on all job specs as part

of the day job, including my own.

Our staff and their team efforts are critical to our ongoing

success. We thank them all for their ongoing support and their

focus on delivering their department's goals. We also thank some of

them for their resilience - our ongoing IT integration projects can

at times test anyone's patience. Removing 20 year old legacy

systems, launching a new online store and maintaining service

levels as we deliver the highest volumes ever at our East Midlands

Gateway ('EMG') warehouse, was never going to be easy. I am very

proud of the team's efforts to date. We thank our impacted

customers (less than 5%) for their significant patience too.

We've not had many people retire from Games Workshop. During the

period, John Blanche stepped down from his job as art director in

our design studio. He is a creative genius, and we thank him for

sharing his enormous talents and enthusiasm with us for nearly 40

years. We all wish him well. He leaves us with a well invested and

talented Warhammer Studio.

Also, after 27 years with the Group and nine years on the board,

Rachel Tongue has informed the board that she does not propose to

offer herself for re-election as chief financial officer at the

next AGM in September 2024. Rachel will continue in her role,

working as an integral part of my team to ensure a smooth transfer

of responsibilities to her successor. Rachel is amazing and she

will be missed enormously.

We thank Rachel for championing our business model and our

culture, her incredible hard work and dedication and her endless

commitment to ensuring we continue to improve every year. She has

played a huge part in helping to deliver our ongoing success, we

all wish her well for the future.

Rachel will step down from the board at the 2024 AGM and will

leave the Group in January 2025. We will be commencing a search for

her successor immediately.

Performance

Sales for the month of December are in line with our

expectations.

At actual exchange rates:

-- Core revenue growth - revenue growth (+11.0%) continues

across Retail (+12.3%) and Trade (+12.6%) and Online (+4.9%).

-- Core gross margin has increased from 64.2% to 69.4%, mainly

due to a reduction of inventory provision charges and a reduction

in carriage costs.

%

Gross margin at November 2022 64.2

Inventory provision +2.2

Logistics +2.1

Materials +0.5

Design +0.3

Production and other -0.1

Gross margin before animation 69.2

Animation +0.2

------------------------------- -----

Gross margin at November

2023 69.4

------------------------------- -----

-- Core operating expenses - up GBP14.5 million to GBP80.1 million.

GBPm

Core operating expenses at

November 2022 65.6

Staff costs +4.3

Group Profit Share Scheme +3.0

Major project expenditure +3.8

IT and software support expenses +0.8

Other +2.6

---------------------------------- -----

Core operating expenses at

November 2023 80.1

---------------------------------- -----

-- Core operating profit - up GBP12.7 million to GBP83.4 million

and profit to sales ratio is up 2.1% to 35.4%.

-- Major projects - to date GBP4.3 million of operating expenses

(2022/23: GBP4.5 million; GBP4.0 million of capital investment and

GBP0.5 million of operating expenses) spent on projects in the

first half, including investment in the new webstore.

-- Returns to shareholders - we have declared GBP64.2 million in

dividends during the period (2022/23: GBP54.2 million).

-- Foreign exchange differences - we don't actively manage

foreign exchange rates and we will continue to report the impact on

our results.

Cash generation - we have continued to:

-- Maintain an appropriate balance sheet to ensure we can withstand any short-term setbacks.

-- Provide for the safe ongoing operation of our global business in an ethical way.

-- Fund our own growth - reinvest to grow sustainably and deliver our strategy.

-- Pay regular dividends to our shareholders - we return any

'truly surplus' cash as dividends as and when we have excess

cash.

-- Cash generated from operations - GBP116.9 million (2022/23:

GBP104.7 million). Included within this are working capital

movements relating to an increase in inventory purchases of GBP4.4

million (higher volumes) and an increase in trade and other

receivables of GBP7.4 million (correlated to higher trade sales and

digital income). There was also an increase in advance payments by

trade and online customers of GBP6.7 million. The advance payments

relate to made to order products and a recent change in the

preorder window for new release products. These orders will have

been taken and paid for but not yet despatched and so not yet

recognised as revenue.

GBPm

Cash and cash equivalents

at May 2023 90.2

Cash generated from operations +116.9

Share issue and interest income +3.6

Lease payments -6.3

Product development -7.0

Purchase of capital assets -6.6

Tax paid -15.3

Dividends paid -64.2

--------------------------------- -------

Cash and cash equivalents

at November 2023 111.3

--------------------------------- -------

We are not planning any share buybacks or acquisitions.

Review of the period

Revenue

Core revenue

Reported core revenue grew by 11.0% to GBP235.6 million for the

period. On a constant currency basis, sales were up by 14.2% to

GBP242.4 million; split by channel this comprised: Trade GBP140.3

million (2022/23: GBP120.9 million), Retail GBP56.5 million

(2022/23: GBP48.7 million) and Online GBP45.6 million (2022/23:

GBP42.7 million).

Trade

Trade grew by 12.6% at actual rates, 16.0% at constant currency

rates. The bulk of our sales to independent retailers are made via

our telesales teams talking directly to our trade accounts. Our

telesales teams strive to deliver excellent service from their

locations in Memphis, Nottingham, Barcelona, Sydney, Tokyo,

Shanghai, Singapore, Hong Kong, and Kuala Lumpur. In the period,

our net number of trade outlets globally increased by c.500

accounts to c.7,000 (not including 2,000+ major chain outlets

stocking some key recruitment products).

Organic sales growth, particularly geographical spread in our

smaller export countries, is an area of focus in the period ahead.

The Warhammer hobby continues to spread globally.

It's worth noting that a large number of independent retailers

also sell our products online, meaning our customers have more

choice than ever about where to buy Warhammer. It's also worth

reminding you that our success with our independents is not

completely in our control. The viability of these stores is

completely dependent on the store owner and their choices on what

to sell. Most are reliant on a mix of product lines to maintain

that viability e.g. collectible cards and board games.

Retail

Retail grew by 12.3% at actual rates, 16.0% at constant currency

rates. Our stores have performed well during the period, with 81%

of our stores delivering like for like growth in the reported

period. The UK is recording record sales levels, including both

Warhammer World at our Nottingham HQ and our UK high footfall store

on Tottenham Court Road in London. North America retail is also at

record sales levels: our new structure, which includes four new

territory managers, has been implemented well. Retail thrives when

we all help our store managers deliver a consistent performance,

these results highlight how well the teams are working together.

Globally we opened, including relocations, 14 stores (our plan is

c.30 new stores for the full year). After closing five stores, our

net total number of stores at the end of the period is 535.

Online

Online grew by 4.9% at actual rates, 6.8% at constant currency

rates. In October we launched our new online store, there were some

teething issues but no showstoppers, once again a great team effort

from the staff involved. We have spent GBP10.8 million on this new

online solution; we don't expect any significant additional

investment in the years ahead.

We remain focused on joined-up customer experiences across all

core sales channels.

Licensing revenue

Licensing revenue from royalty income decreased in the period by

GBP2.2 million to GBP12.1 million (at constant currency, a decrease

of GBP1.8 million to GBP12.5 million). This was partly due to a

reduction of GBP1.1 million in guarantee income on multi-year

contracts signed in the period. Guarantee income in the period was

GBP6.2 million (2022/23: GBP7.3 million). This income was

recognised in full at the inception of the contracts following

assessment of the performance obligations of the contracts.

Reported income is split as follows: 47% PC and console games, 33%

mobile and 20% other.

Total revenue

Total revenue has increased by 9.3% to GBP247.7 million at

actual rates, at constant currency total revenue increased by

12.4%.

Design

We design, make, and sell miniatures and related products under

a number of brands and sub-brands. We have originated and are in

control of a number of strong, globally recognised brands with

their own identities, associations and logos.

Our key consumer facing brand is 'Warhammer' - this unites all

aspects of the Warhammer hobby - collecting, building, painting,

playing, reading, watching, gaming etc. in the worlds of

Warhammer.

We have two main universes/settings - our dark, gritty fantasy

sci-fi universe, which encompasses 'Warhammer 40,000', 'Warhammer

The Horus Heresy' and 'Necromunda', and our unique fantasy setting

that includes 'Warhammer Age of Sigmar', 'Blood Bowl' (albeit a

tongue in cheek parody) and, the soon to be released, 'Warhammer

The Old World'.

IP and design studio payroll costs increased by GBP1.0 million

to GBP8.5 million in the period; as a percentage of core revenue

they have increased by 0.1% to 3.6%. The total number of jobs in

our Warhammer Studio is 310.

Manufacturing

We continue to manufacture all of our core products at our three

factories in Nottingham. Work on improving efficiencies has negated

the need for the purchase of any additional manufacturing equipment

during the period and allowed numerous manufacturing output records

to be broken. As part of our longer term capacity planning, we are

exploring options for Factory 4 on the site next to Factory 2.

Our total manufacturing headcount has increased slightly during

the period with the total number of jobs in our factories now

standing at 361. An increase in temporary staff cost and the annual

pay rise has increased manufacturing payroll costs by GBP0.7

million to GBP6.0 million; 2.5% of core revenue in both

periods.

Warehousing

UK

Project work on our new warehouse management solution at our EMG

location has been completed with the site now processing all UK and

European customer orders (across all sales channels) as well as

international freight to our global hubs. As highlighted earlier

there are still some systems integration problems to resolve as

part of replacing our core, 20 years old, legacy systems that the

new warehouse management system interfaces to. This project

internally is called SIP (Systems Improvement Programme). We don't

expect to be fully optimised until this programme of work is

delivered nor do we expect this to impact sales significantly; it

may cause service levels to fall short at times for some customers.

We will do everything we can to minimise this impact.

The original Eurohub warehouse at our HQ in Nottingham has now

been reconfigured to serve as our dedicated component warehouse

supplying our three factories. It's working well, to agreed KPIs

and milestones.

North America

Additional robotics have been purchased (increasing from 45 to

70 robots) to further increase pick capacity. IT systems here are

less complex than those at EMG (although both warehouses are using

the same technology and robotics solutions), and they are meeting

agreed KPIs and milestones.

Australia

In October we signed an eight year lease for a new facility in

Australia, not far from our current site, which after over 20 years

was no longer big enough. The new site is planned to be operational

in April 2025.

Europe

We continue to review options for improving service levels to

Continental Europe.

Total warehousing costs have increased by GBP0.9 million to

GBP12.9 million at actual rates; as a percentage of core revenue

they have decreased from 5.7% to 5.5%.

Service centres

IT - The team is starting to make some progress. The launch of

our new web store was a key morale boosting milestone for them, and

me too. The goal remains the same: our IT systems and

infrastructure adapt and scale with the business as we grow. We

will continue to invest in the team in the period ahead. In early

2024 I hope to sign off, with full board support, the SIP project

highlighting the IT investment plan for the next two/three years.

More on that in the 2024 annual report.

Customer service - We aim to resolve all queries within 24

hours, however, due to the exceptional volume of queries associated

with the launches of our new webstore and warehouse management

system, we have not achieved the high levels we set ourselves. The

current average is three days.

Total support services operating expenses, excluding marketing

costs, have increased by GBP2.5 million to GBP15.9 million at

actual rates; as a percentage of core revenue they have increased

from 6.3% to 6.7% in line with our operational plan.

Customer focused

Our stores

The staff in our retail stores work cheerfully and relentlessly

to offer great customer service and recruit ever more customers

into the Warhammer hobby. Our stores continue to be the best place

to start your hobby journey with us.

My Warhammer

Registrations for this single login continue to grow at pace and

we have 576,000 active users at the period end (2022/23: 346,000)

up 66% on prior year. Active users are defined as someone who has

engaged with us online in the last six months. My Warhammer is a

central part of our customer journey, enabling us to tailor our

marketing communications to what our customers are most interested

in.

Warhammer Community

Our news and blog site continues to go from strength to

strength. We have seen good growth in the number of hobbyists

enjoying our articles and news stories. Warhammer Community is the

hub for our marketing activities and plays a vital role in

delivering hobby news and information every day of the year.

Email

Our email campaigns continue to be one of our most effective

methods of communication. Subscriber numbers, (defined as the

number of people who opened one of our emails in the last six

months) were 570,000 (2022/23: 476,000) at the period end. We

continue to look for more ways to surprise and delight our loyal

fans and bring new customers into the Warhammer hobby.

Warhammer+

Launched in August 2021, it continues to delight and entertain a

growing subscriber base. Our subscriber numbers are

169,000 at the period end (2022/23: 115,000).

External events/social media

Warhammer events and gaming conventions engaged with customers

and recruited new ones across North America and Europe. We look

forward to more events that inspire our customers, recruit new

ones, and give Warhammer fans across the world the opportunity to

meet up with each other. Social media has an important role in

making customers aware of the breadth of the Warhammer hobby, as

well as the products we sell.

Total marketing operating expenses have increased by GBP1.7

million to GBP4.2 million; as a percentage of core sales they have

increased from 1.2% to 1.8% in line with our operational plan.

Capital investment

In manufacturing, we have invested GBP3.8 million in tooling and

GBP0.6 million in facilities and equipment. We have invested GBP0.6

million on shop fits in new and existing stores and GBP0.4 million

on the Lenton site as well as GBP0.8 million in warehouse

facilities, racking, IT systems and computer equipment.

Licensing business

Our strategy is to exploit the value of our IP beyond our core

tabletop business, leveraging multiple categories and markets

globally. We intend to ensure Warhammer's place as one of the top

fantasy IPs globally. The main areas of focus are:

Media

As we announced on 18 December 2023, we have signed a contract

with Amazon Content Services LLC for the prospective development by

Amazon of Warhammer 40,000 universe into films and television

series. We remain confident we will bring the worlds of Warhammer

to the screen like you have never seen before.

Games Workshop and Amazon will work together for a period of 12

months to agree creative guidelines for the films and television

series to be developed by Amazon. The agreement will only proceed

once the creative guidelines are mutually agreed between Games

Workshop and Amazon.

Video games

During the period, our licensing partners launched two new video

games; Warhammer Age of Sigmar: Realms of Ruin , a real time

strategy PC/console game and Warhammer 40,000: Warpforge , a

collectible card PC/mobile game. We also saw revenue from

established games Darktide, Tacticus and Total War: Warhammer 3

that continued to perform well, often years after launch, through a

mixture of added content and continued marketing. Licensing income

during the period is down; it is, as usual, driven by the success

of game launches and the levels of guarantees booked in the

period.

Risks and uncertainties

The board has overall responsibility for ensuring risk is

appropriately managed across the Group. Our operational risks,

including emerging risks, are identified, and monitored through

discussions at regular risks meetings of the senior management

team. These meetings are coordinated by the internal audit function

and assess the impact of each operational risk as well as

identifying new emerging risks and mitigating actions required.

The key strategic risks to the Group are regularly reviewed by

the board. The principal strategic risks identified in 2023/24 are

discussed below. These risks are not intended to be an extensive

analysis of all risks that may arise but more importantly are the

ones which we believe could cause business interruption.

-- IT strategy and delivery - with a number of significant

business projects in play, all of which are dependent on IT

support, there is a requirement for a robust IT strategy which

enables us to deliver key strategic projects as well as supporting

day to day activities. We are keeping the structure of our global

IT team under review to ensure the IT support needs of the business

can be delivered. We expect to need to spend more money investing

in our systems as we continue our upgrades to our legacy

platforms.

-- Media - whilst this remains an area for future growth, it is

imperative that exploitation of our IP through media channels does

no harm to our core business. Our IP steering team meets every

month to discuss ongoing and future exploitation, to ensure that

all use of our IP, through all channels, is approved, correct and

consistent. It is fully supported by our in-house legal team who

will act when needed. The operational board meets quarterly to

review progress and current status of all licensing projects.

Going concern

After making appropriate enquiries, the directors have a

reasonable expectation that the Group has adequate resources, in

light of the level of cash generation, to continue in operational

existence for at least twelve months from the date of approval of

the condensed consolidated interim financial information. For this

reason, they have adopted the going concern basis in preparing this

condensed consolidated interim financial information.

Statement of directors' responsibilities

The directors confirm that this condensed consolidated interim

financial information has been prepared in accordance with IAS 34,

'Interim Financial Reporting', as adopted by the United Kingdom,

and that the interim management report herein includes a fair

review of the information required by DTR 4.2.7 R and DTR 4.2.8 R,

namely: an indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of (i) the principal risks

and uncertainties for the remaining six months of the financial

period; (ii) related party transactions in the first six months and

(iii) any changes in the related party transactions described in

the last annual report.

There have been no changes to the board since the annual report

for the 52 week period to 28 May 2023.

A list of all current directors is maintained on the investor

relations website at investor.games-workshop.com.

Key priorities

We have made some good progress with our key priorities. Each of

these is designed to ensure we deliver our exciting operational

plan and continue to engage and inspire our loyal customers.

Staff training and development

We care passionately about our global team. We have ambitious

long-term plans, but we also run the business with only the

resources we need. We will continue to recruit essential new jobs

or where we need to back-fill positions. Like last year, many of

these recruits will be in order to scale - in our factories and

warehouse facilities as well as in our support functions, mainly

IT.

We will continue to support lifelong learning and training to

develop the skills needed to enable all our staff to be successful

including offering apprenticeship opportunities for on the job

training. We are also more active in developing orderly succession

plans of both the board and senior management.

Customer focused

We continue to be customer focused - engaging better with our

existing customers and reaching new audiences with the Warhammer

hobby.

In Asia, our Warhammer cafe store in Tokyo recently celebrated

its first year anniversary - it was great fun, we are delighted

with the store and the progress we are making here. We continue to

build our hobby base in Japan and also China, and it's good to see

sales levels are now back to record levels.

Globally we are seeing encouraging performance from our

distribution and trade partners in growing emerging markets: sales

to Mexico, Thailand and closer to home in Switzerland, are at

record levels. It would be great to see some Warhammer stores in

these locations too...

Social responsibility

We have a clear plan and agreed priorities. We have recently

refreshed our equal opportunities training and our global

unconscious bias training. We continue in our commitment to

diversity and inclusion at Games Workshop. We have recently asked

staff to allow us to collect their ethnicity information, with

which over time we will be able to track trends.

Sustainability - climate change

We have made significant progress towards our scope 1 and 2

carbon emissions reduction target. We have switched our Memphis

warehouse electricity supply to a certified renewable source and

are working to secure renewables for our North American and

European retail stores in the rest of this year. We remain focused

on minimising energy usage and material resources, and with

processing any unavoidable waste sustainably. We are on track to

achieve our stated 55% reduction in scope 1 and 2 CO(2) emissions

significantly ahead of our 2032 target, a detailed update on

progress will be given in the 2024 annual report.

Outlook

We continue to perform well during challenging economic times,

delivering record group revenue, profit and dividends in the

period. Morale is good at Games Workshop and our hobbyists are

having fun too.

By order of the board

Kevin Rountree

CEO

Rachel Tongue

CFO

9 January 2024

CONSOLIDATED INCOME STATEMENT

26 weeks

Notes 26 weeks to to 52 weeks

26 November 27 November to

2023 2022 28 May 2023

GBPm GBPm GBPm

------------------------------- -------- -------------- -------------- -------------

Core revenue 235.6 212.3 445.4

Licensing revenue 12.1 14.3 25.4

------------------------------- -------- -------------- -------------- -------------

Revenue 2 247.7 226.6 470.8

Cost of sales (72.1) (76.0) (149.2)

------------------------------- -------- -------------- -------------- -------------

Core gross profit 163.5 136.3 296.2

Licensing gross profit 12.1 14.3 25.4

------------------------------- -------- -------------- -------------- -------------

Gross profit 175.6 150.6 321.6

Operating expenses 2 (81.1) (67.0) (151.4)

------------------------------- -------- -------------- -------------- -------------

Core operating profit 83.4 70.7 148.2

Licensing operating profit 11.1 12.9 22.0

------------------------------- -------- -------------- -------------- -------------

Operating profit 2 94.5 83.6 170.2

Finance income 1.2 0.4 1.3

Finance costs (0.5) (0.4) (0.9)

------------------------------- -------- -------------- -------------- -------------

Profit before taxation 3 95.2 83.6 170.6

Income tax expense 4 (23.8) (17.1) (35.9)

------------------------------- -------- -------------- -------------- -------------

Profit attributable to owners

of the parent 71.4 66.5 134.7

------------------------------- -------- -------------- -------------- -------------

Basic earnings per ordinary

share 5 216.9p 202.4p 409.7p

Diluted earnings per ordinary

share 5 216.3p 202.3p 409.4p

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME AND EXPENSE

26 weeks

to 26 weeks to 52 weeks

26 November 27 November to

2023 2022 28 May 2023

GBPm GBPm GBPm

--------------------------------------------- -------------- ------------- -------------

Profit attributable to owners of

the parent 71.4 66.5 134.7

Other comprehensive income/(expense)

Items that may be subsequently reclassified

to profit or loss

Exchange differences on translation

of foreign operations (0.1) 0.6 (1.5)

--------------------------------------------- -------------- ------------- -------------

Other comprehensive (expense)/income

for the period (0.1) 0.6 (1.5)

--------------------------------------------- -------------- ------------- -------------

Total comprehensive income attributable

to owners of the parent 71.3 67.1 133.2

--------------------------------------------- -------------- ------------- -------------

CONSOLIDATED BALANCE SHEET

26 November 27 November

Notes 2023 2022 28 May 2023

GBPm GBPm GBPm

---------------------------------- -------- ------------ -------------- ------------

Non-current assets

Goodwill 1.4 1.4 1.4

Other intangible assets 8 22.9 26.8 21.2

Property, plant and equipment 9 54.8 55.0 55.7

Right-of-use assets 10 47.5 48.4 48.9

Deferred tax assets 12.5 18.5 12.0

Other non-current receivables 11 16.0 16.4 13.6

---------------------------------- -------- ------------ -------------- ------------

155.1 166.5 152.8

---------------------------------- -------- ------------ -------------- ------------

Current assets

Inventories 36.3 31.8 33.0

Trade and other receivables 12 41.4 52.7 36.3

Current tax assets 5.3 4.3 14.5

Cash and cash equivalents 111.3 85.2 90.2

---------------------------------- -------- ------------ -------------- ------------

194.3 174.0 174.0

---------------------------------- -------- ------------ -------------- ------------

Total assets 349.4 340.5 326.8

---------------------------------- -------- ------------ -------------- ------------

Current liabilities

Lease liabilities (10.0) (9.7) (9.9)

Trade and other payables 13 (50.6) (37.0) (37.0)

Current tax liabilities (0.1) (0.1) (0.4)

Provisions for other liabilities

and charges (0.8) (0.9) (0.9)

---------------------------------- -------- ------------ -------------- ------------

(61.5) (47.7) (48.2)

---------------------------------- -------- ------------ -------------- ------------

Net current assets 132.8 126.3 125.8

---------------------------------- -------- ------------ -------------- ------------

Non-current liabilities

Lease liabilities (38.6) (39.8) (40.0)

Deferred tax liabilities (1.4) (0.4) (0.5)

Other non-current liabilities (0.7) (0.5) (1.4)

Provisions for other liabilities

and charges (1.7) (1.7) (1.6)

---------------------------------- -------- ------------ -------------- ------------

(42.4) (42.4) (43.5)

---------------------------------- -------- ------------ -------------- ------------

Net assets 245.5 250.4 235.1

---------------------------------- -------- ------------ -------------- ------------

Capital and reserves

Called up share capital 1.6 1.6 1.6

Share premium account 21.3 18.6 18.9

Other reserves 1.3 3.5 1.4

Retained earnings 221.3 226.7 213.2

---------------------------------- -------- ------------ -------------- ------------

Total equity 245.5 250.4 235.1

---------------------------------- -------- ------------ -------------- ------------

CONSOLIDATED STATEMENT OF CHANGES IN TOTAL EQUITY

Called

up Share

share premium Other Retained Total

capital account reserves earnings equity

GBPm GBPm GBPm GBPm GBPm

---------------------------------------- --------- --------- ---------- ---------- --------

At 28 May 2023 and 29 May 2023 1.6 18.9 1.4 213.2 235.1

Profit for the 26 weeks to 26

November 2023 - - - 71.4 71.4

Exchange differences on translation

of foreign operations - - (0.1) - (0.1)

---------------------------------------- --------- --------- ---------- ---------- --------

Total comprehensive income

for the period - - (0.1) 71.4 71.3

Transactions with owners:

Share-based payments - - - 0.7 0.7

Shares issued under employee

sharesave scheme - 2.4 - - 2.4

Deferred tax credit relating

to share options - - - 0.2 0.2

Dividends paid to Company shareholders - - - (64.2) (64.2)

---------------------------------------- --------- --------- ---------- ---------- --------

Total transactions with owners - 2.4 - (63.3) (60.9)

---------------------------------------- --------- --------- ---------- ---------- --------

At 26 November 2023 1.6 21.3 1.3 221.3 245.5

---------------------------------------- --------- --------- ---------- ---------- --------

Called

up Share

share premium Other Retained Total

capital account reserves earnings equity

GBPm GBPm GBPm GBPm GBPm

---------------------------------------- --------- --------- ---------- ---------- --------

At 29 May 2022 and 30 May 2022 1.6 16.3 2.9 213.9 234.7

Profit for the 26 weeks to 27

November 2022 - - - 66.5 66.5

Exchange differences on translation

of foreign operations - - 0.6 - 0.6

---------------------------------------- --------- --------- ---------- ---------- --------

Total comprehensive income for

the period - - 0.6 66.5 67.1

Transactions with owners:

Share-based payments - - - 0.5 0.5

Shares issued under employee

sharesave scheme - 2.3 - - 2.3

Deferred tax charge relating

to share options - - - (0.2) (0.2)

Current tax credit relating

to exercised share options - - - 0.2 0.2

Dividends paid to Company shareholders - - - (54.2) (54.2)

---------------------------------------- --------- --------- ---------- ---------- --------

Total transactions with owners - 2.3 - (53.7) (51.3)

---------------------------------------- --------- --------- ---------- ---------- --------

At 27 November 2022 1.6 18.6 3.5 226.7 250.4

---------------------------------------- --------- --------- ---------- ---------- --------

Called

up Share

share premium Other Retained Total

capital account reserves earnings equity

GBPm GBPm GBPm GBPm GBPm

---------------------------------------- --------- --------- ---------- ---------- --------

At 29 May 2022 and 30 May 2022 1.6 16.3 2.9 213.9 234.7

Profit for the 52 weeks to 28

May 2023 - - - 134.7 134.7

Exchange differences on translation

of foreign operations - - (1.5) - (1.5)

---------------------------------------- --------- --------- ---------- ---------- --------

Total comprehensive income for

the period - - (1.5) 134.7 133.2

Transactions with owners:

Share-based payments - - - 1.0 1.0

Shares issued under employee

sharesave scheme - 2.6 - - 2.6

Deferred tax charge relating

to share options - - - (0.2) (0.2)

Current tax credit relating

to exercised share options - - - 0.3 0.3

Dividends paid to Company shareholders - - - (136.5) (136.5)

---------------------------------------- --------- --------- ---------- ---------- --------

Total transactions with owners - 2.6 - (135.4) (132.8)

---------------------------------------- --------- --------- ---------- ---------- --------

At 28 May 2023 1.6 18.9 1.4 213.2 235.1

---------------------------------------- --------- --------- ---------- ---------- --------

CONSOLIDATED CASH FLOW STATEMENT

26 weeks 26 weeks

Notes to to 52 weeks

26 November 27 November to

2023 2022 28 May 2023

GBPm GBPm GBPm

---------------------------------------- -------- ------------- -------------- -------------

Cash flows from operating activities

Cash generated from operations 7 116.9 104.7 231.7

UK corporation tax paid (14.6) (14.6) (31.3)

Overseas tax paid (0.7) (3.7) (7.7)

---------------------------------------- -------- ------------- -------------- -------------

Net cash generated from operating

activities 101.6 86.4 192.7

---------------------------------------- -------- ------------- -------------- -------------

Cash flows from investing activities

Purchases of property, plant

and equipment (6.4) (7.4) (14.8)

Purchases of other intangible

assets (0.2) (0.4) (0.4)

Expenditure on product development (7.0) (7.0) (13.1)

Interest received 1.2 0.4 1.2

---------------------------------------- -------- ------------- -------------- -------------

Net cash used in investing activities (12.4) (14.4) (27.1)

---------------------------------------- -------- ------------- -------------- -------------

Cash flows from financing activities

Proceeds from issue of ordinary

share capital 2.4 2.3 2.6

Repayment of principal under

leases (5.8) (5.8) (11.8)

Lease interest paid (0.5) (0.4) (0.9)

Dividends paid to Company shareholders (64.2) (54.2) (136.5)

---------------------------------------- -------- ------------- -------------- -------------

Net cash used in financing activities (68.1) (58.1) (146.6)

---------------------------------------- -------- ------------- -------------- -------------

Net increase in cash and cash

equivalents 21.1 13.9 19.0

Opening cash and cash equivalents 90.2 71.4 71.4

Effects of foreign exchange rates

on cash and cash equivalents - (0.1) (0.2)

---------------------------------------- -------- ------------- -------------- -------------

Closing cash and cash equivalents 111.3 85.2 90.2

---------------------------------------- -------- ------------- -------------- -------------

The following notes form an integral part of this condensed

consolidated interim financial information.

NOTES TO THE FINANCIAL INFORMATION

1. Basis of preparation

The Company is a limited liability company, incorporated and

domiciled in the United Kingdom. The address of its registered

office is Willow Road, Lenton, Nottingham, NG7 2WS.

The Company has its listing on the London Stock Exchange.

This condensed consolidated interim financial information does

not comprise statutory accounts within the meaning of section 434

of the Companies Act 2006. Statutory accounts for the 52 week

period ended 28 May 2023 were approved by the board of directors on

24 July 2023 and have been delivered to the Registrar of Companies.

The report of the auditor on those accounts was unqualified, did

not contain an emphasis of matter paragraph and did not contain any

statement under either section 498 (2) or section 498 (3) of the

Companies Act 2006.

This condensed consolidated interim financial information has

not been audited or reviewed pursuant to the Auditing Practices

Board guidance on 'Review of Interim Financial Information' and

does not include all of the information required for full annual

financial statements.

This condensed consolidated interim financial information for

the 26 week period ended 26 November 2023 has been prepared in

accordance with the Disclosure and Transparency Rules of the

Financial Conduct Authority and with IAS 34, 'Interim Financial

Reporting' as adopted by the United Kingdom. The condensed

consolidated interim financial information should be read in

conjunction with the annual financial statements for the 52 week

period ended 28 May 2023 which have been prepared in accordance

with IFRSs as adopted by the United Kingdom.

After making appropriate enquiries, the directors have a

reasonable expectation that the Group has adequate resources to

continue in operational existence for the foreseeable future. For

this reason, they have adopted the going concern basis in preparing

this condensed consolidated interim financial information.

This condensed consolidated interim financial information was

approved for issue on 9 January 2024.

This condensed consolidated interim financial information is

available to shareholders and members of the public on the

Company's website at investor.games-workshop.com.

The preparation of interim financial information requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, revenues, and expenses. Actual

results may differ from these estimates.

In preparing this condensed consolidated interim financial

information, the significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those that applied to the

consolidated financial statements for the 52 week period ended 28

May 2023.

Taxes on income in the interim periods are accrued using the tax

rate that would be applicable to expected total annual

earnings.

The accounting policies applied are consistent with those of the

annual financial statements for the 52 week period ended 28 May

2023, as described in those financial statements.

The Group considers that there are no new accounting standards,

amendments or interpretations issued by the IASB, but not yet

applicable, which have had, or are expected to have a significant

effect on the financial statements.

2. Segment information

As Games Workshop is a vertically integrated business,

management assesses the performance of sales channels and

manufacturing and distribution channels separately. Share-based

payment charges and Group Profit Share Scheme charges to employees

have all been included in core operating expenses.

At 26 November 2023. Games Workshop has two segments, core and

licensing:

- Core: the core segment includes all revenue and expenditure

relating to the design, manufacture and sales of our fantasy

miniatures and related products. It also includes the revenue and

expenditure related to Warhammer+.

- Licensing: the licensing segment includes all revenue and

expenditure relating to licences granted to external partners.

We provide further information on revenue and expenses within

the core segment below. The core segment has been divided into

channels as follows:

- Trade: this sales channel sells globally to independent

retailers, agents and distributors. It also includes the Group's

magazine newsstand business and the distributor sales from the

Group's publishing business (Black Library).

- Retail: this includes sales through the Group's retail stores,

the Group's visitor centre in Nottingham and global events.

- Online: this includes sales through the Group's global web

stores, our online subscription service (Warhammer+) and digital

sales through external affiliates.

- Design, manufacturing, logistics and operations, which

includes costs for:

- the Warhammer Studio (which creates all of the IP and the

associated miniatures, artwork, games and publications);

- the production facilities;

- the warehouses and logistics costs;

- charges for inventory provisions. This includes adjustments

for the profit in stock arising from inter-segment sales; and

- support services (marketing, IT, accounting, payroll,

personnel, procurement, legal, health and safety, customer services

and credit control) provided to activities across the Group;

and

- Group: this includes the Company's overheads.

The chief operating decision-maker, identified as the executive

directors, assesses the performance of each segment based on

segmental operating profit. This has been reconciled to the Group's

total profit before taxation below.

The segment information reported to the executive directors for

the periods included in this financial information is as

follows:

26 weeks to 26 November 2023 and 27 November 2022:

Core Licensing Total

---------------------------------- ---------------- ------------------ ----------------

2023 2022 2023 2022 2023 2022

GBPm GBPm GBPm GBPm GBPm GBPm

---------------------------------- ------- ------- -------- -------- ------- -------

Trade 136.1 120.9 - - 136.1 120.9

Retail 54.7 48.7 - - 54.7 48.7

Online 44.8 42.7 - - 44.8 42.7

Licensing - - 12.1 14.3 12.1 14.3

---------------------------------- ------- ------- -------- -------- ------- -------

Revenue 235.6 212.3 12.1 14.3 247.7 226.6

---------------------------------- ------- ------- -------- -------- ------- -------

Cost of sales (72.1) (76.0) - - (72.1) (76.0)

---------------------------------- ------- ------- -------- -------- ------- -------

Gross profit 163.5 136.3 12.1 14.3 175.6 150.6

---------------------------------- ------- ------- -------- -------- ------- -------

Trade (6.5) (5.6) - - (6.5) (5.6)

Retail (32.8) (30.1) - - (32.8) (30.1)

Online (6.8) (5.0) - - (6.8) (5.0)

Design, manufacturing, logistics

and operations (24.0) (18.0) - - (24.0) (18.0)

Licensing - - (1.0) (1.4) (1.0) (1.4)

Group (1.8) (1.9) - - (1.8) (1.9)

Share-based payment charge (0.7) (0.5) - - (0.7) (0.5)

Group Profit Share Scheme (7.5) (4.5) - - (7.5) (4.5)

---------------------------------- ------- ------- -------- -------- ------- -------

Operating expenses (80.1) (65.6) (1.0) (1.4) (81.1) (67.0)

---------------------------------- ------- ------- -------- -------- ------- -------

Operating profit 83.4 70.7 11.1 12.9 94.5 83.6

---------------------------------- ------- ------- -------- -------- ------- -------

Finance income 1.2 0.4 - - 1.2 0.4

Finance costs (0.5) (0.4) - - (0.5) (0.4)

---------------------------------- ------- ------- -------- -------- ------- -------

Profit before tax 84.1 70.7 11.1 12.9 95.2 83.6

---------------------------------- ------- ------- -------- -------- ------- -------

52 weeks to 28 May 2023:

Core Licensing Total

---------------------------------- -------- ---------- --------

GBPm GBPm GBPm

---------------------------------- -------- ---------- --------

Trade 248.0 - 248.0

Retail 106.4 - 106.4

Online 91.0 - 91.0

Licensing - 25.4 25.4

---------------------------------- -------- ---------- --------

Revenue 445.4 25.4 470.8

---------------------------------- -------- ---------- --------

Cost of sales (149.2) - (149.2)

---------------------------------- -------- ---------- --------

Gross profit 296.2 25.4 321.6

---------------------------------- -------- ---------- --------

Trade (11.8) - (11.8)

Retail (61.7) - (61.7)

Online (15.6) - (15.6)

Design, manufacturing, logistics

and operations (41.4) - (41.4)

Licensing - (3.4) (3.4)

Group (4.9) - (4.9)

Share-based payment charge (1.0) - (1.0)

Group Profit Share Scheme (11.6) - (11.6)

---------------------------------- -------- ---------- --------

Operating expenses (148.0) (3.4) (151.4)

---------------------------------- -------- ---------- --------

Operating profit 148.2 22.0 170.2

---------------------------------- -------- ---------- --------

Finance income 1.3 - 1.3

Finance costs (0.9) - (0.9)

---------------------------------- -------- ---------- --------

Profit before tax 148.6 22.0 170.6

---------------------------------- -------- ---------- --------

For information, we analyse core external revenue further

below:

26 weeks 26 weeks 52 weeks

to to to

26 November 27 November 28 May

2023 2022 2023

GBPm GBPm GBPm

----------------------------- ------------- ------------- ---------

Trade

UK and Continental Europe 58.0 50.9 105.0

North America 59.3 55.6 112.8

Australia and New Zealand 8.1 7.5 14.3

Asia 7.3 4.5 10.4

Rest of world 2.2 1.5 3.4

Black Library 1.2 0.9 2.1

Total Trade 136.1 120.9 248.0

----------------------------- ------------- ------------- ---------

Retail

UK 16.3 14.4 32.1

Continental Europe 11.0 9.7 21.1

North America 21.6 18.9 41.0

Australia and New Zealand 4.2 4.7 9.4

Asia 1.6 1.0 2.8

Total Retail 54.7 48.7 106.4

----------------------------- ------------- ------------- ---------

Online

UK 8.7 7.0 16.2

Continental Europe 7.1 7.2 15.6

North America 16.3 17.1 35.7

Australia and New Zealand 2.1 2.3 4.1

Asia 0.3 0.2 0.6

Rest of world 0.4 0.5 1.0

Digital 9.9 8.4 17.8

Total Online 44.8 42.7 91.0

----------------------------- ------------- ------------- ---------

Total core external revenue 235.6 212.3 445.4

----------------------------- ------------- ------------- ---------

3. Profit before taxation

26 weeks

to 26 weeks to 52 weeks

26 November 27 November to

2023 2022 28 May 2023

GBPm GBPm GBPm

--------------------------------------- -------------- -------------- --------------

Profit before taxation is stated

after charging:

Depreciation:

- Owned property, plant and equipment 7.0 6.8 13.7

- Right-of-use assets

Amortisation: 5.9 5.9 11.9

- Owned computer software 0.8 0.8 1.8

- Development costs 4.7 5.4 12.1

Impairment of computer software - - 0.7

Impairment of development costs - - 2.9

Employee and agency staff costs

(excluding capitalised salary costs) 62.8 54.3 115.8

Cost of inventories included in

cost of sales 29.5 30.8 56.0

Inventory provision creation 2.3 4.2 8.0

Unrealised and realised exchange

losses/(gains) 0.3 (0.1) 0.2

Loss on disposal of intangible

assets - - 0.2

Redundancy costs and compensation

for loss of office 0.3 0.4 1.1

--------------------------------------- -------------- -------------- --------------

4. Tax

The taxation charge for the six months to 26 November 2023 is

based on an estimate of the full year effective rate of 25.0%

(2022/23: 20.5%). As the UK and overseas tax rates are now more

closely aligned, the impact of any higher overseas rates is

minimal. The increase from the prior year reflects the rate

increase to 25% on UK taxable profits from 1 April 2023

onwards.

5. Earnings per share

Basic earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to owners of the parent by the weighted average number

of ordinary shares in issue throughout the relevant period.

26 weeks 26 weeks

to to 52 weeks

26 November 27 November to

2023 2022 28 May 2023

----------------------------------- ------------- ------------- ---------------

Profit attributable to owners of

the parent (GBPm) 71.4 66.5 134.7

---------------------------------------- ------------- ----------------- -----------

Weighted average number of ordinary

shares in issue (thousands) 32,919 32,849 32,881

---------------------------------------- ------------- ----------------- -----------

Basic earnings per share (pence

per share) 216.9 202.4 409.7

---------------------------------------- ------------- ----------------- -----------

Diluted earnings per share

The calculation of diluted earnings per share has been based on

the profit attributable to owners of the parent and the weighted

average number of shares in issue throughout the relevant period,

adjusted for the dilution effect of share options outstanding at

the period end.

26 weeks 26 weeks

to to 52 weeks

26 November 27 November to

2023 2022 28 May 2023

---------------------------------------- ------------- ------------- -------------

Profit attributable to owners of

the parent (GBPm) 71.4 66.5 134.7

--------------------------------------------- ------------- ------------- -------------

Weighted average number of ordinary

shares in issue (thousands) 32,919 32,849 32,881

Adjustment for share options (thousands) 93 15 17

--------------------------------------------- ------------- ------------- -------------

Weighted average number of ordinary

shares for diluted earnings per

share (thousands) 33,012 32,864 32,898

--------------------------------------------- ------------- ------------- -------------

Diluted earnings per share (pence

per share) 216.3 202.3 409.4

--------------------------------------------- ------------- ------------- -------------

6. Dividends

Dividends of GBP47.7 million (145 pence per share) and GBP16.5

million (50 pence per share) were declared and paid in the six

months to 26 November 2023.

Dividends of GBP14.8 million (45 pence per share), GBP9.8

million (30 pence per share) and GBP29.6 million (90 pence per

share) were declared and paid in the six months to 27 November

2022.

7. Reconciliation of profit to cash generated from operations

26 weeks

to 52 weeks

26 weeks to 27 November to

26 November 2023 2022 28 May 2023

GBPm GBPm GBPm

---------------------- ---------------------------- ------------- ----------------------

Profit before taxation 95.2 83.6 170.6

Finance income (1.2) (0.4) (1.3)

Finance costs 0.5 0.4 0.9

--------------------------- ---------------------------- ------------- ----------------------

Operating profit 94.5 83.6 170.2

Adjustments for:

Depreciation of property, plant

and equipment 7.0 6.8 13.7

Depreciation of right-of-use assets 5.9 5.9 11.9

Impairment of intangible assets - - 3.6

Loss on disposal of property, plant

and equipment - 0.2 0.1

Loss on disposal of right-of-use

assets - - 0.1

Loss on disposal of intangible

assets - - 0.2

Amortisation of capitalised development

costs 4.7 5.4 12.1

Amortisation of other intangibles 0.9 0.8 1.8

Share-based payments 0.7 0.5 1.0

Exchange movements 1.1 - (1.6)

Changes in working capital:

-(Increase)/decrease in inventories (4.4) 7.8 6.0

-(Increase)/decrease in trade and

other receivables (7.4) (10.2) 8.1

-Increase in trade and other payables 13.9 3.5 4.2

-Increase in provisions - 0.4 0.3

---------------------------------------------- --------- ------------- ----------------------

Cash generated from operations 116.9 104.7 231.7

---------------------------------------------- --------- ------------- ----------------------

8. Other intangible assets

26 November 27 November 28 May 2023

2023 2022 GBPm

GBPm GBPm

--------------------------------- ------------ ------------ ------------

Net book value at beginning of

period 21.2 25.6 25.6

Additions 7.2 7.4 13.5

Disposals - - (0.2)

Amortisation charge (5.5) (6.2) (13.9)

Impairment - - (3.6)

Reclassification - - (0.2)

Net book value at end of period 22.9 26.8 21.2

--------------------------------- ------------ ------------ ------------

9. Property, plant and equipment

26 November 27 November 28 May 2023

2023 2022 GBPm

GBPm GBPm

--------------------------------- ------------ ------------ ------------

Net book value at beginning of

period 55.7 55.0 55.0

Additions 6.2 6.8 14.2

Disposals - (0.2) (0.1)

Depreciation charge (7.0) (6.8) (13.7)

Exchange differences (0.1) 0.2 0.1

Reclassification - - 0.2

Net book value at end of period 54.8 55.0 55.7

--------------------------------- ------------ ------------ ------------

10. Right-of-use assets

26 November 27 November 28 May 2023

2023 2022 GBPm

GBPm GBPm

--------------------------------- -------------- -------------- --------------

Net book value at beginning of

period 48.9 48.1 48.1

Additions 4.9 5.7 12.7

Disposals - (0.1) (0.1)

Depreciation charge (5.9) (5.9) (11.9)

Exchange differences (0.4) 0.6 0.1

Net book value at end of period 47.5 48.4 48.9

--------------------------------- -------------- -------------- --------------

11. Other non-current receivables

26 November 27 November 28 May 2023

2023 2022 GBPm

GBPm GBPm

------------------------------------- ------------ ------------ ------------

Licensing receivables 14.3 14.9 12.6

Other receivables 1.7 1.5 1.0

------------------------------------- ------------ ------------ ------------

Total other non-current receivables 16.0 16.4 13.6

------------------------------------- ------------ ------------ ------------

Licensing receivables represents amounts in respect of guarantee

instalments due in over one year.

12. Trade and other receivables

26 November 27 November 28 May 2023

2023 2022 GBPm

GBPm GBPm

----------------------------------- ------------ ------------ ------------

Trade receivables 14.3 11.8 10.6

Prepayments and accrued income 12.1 14.7 9.3

Licensing receivables 10.5 10.3 11.3

Other receivables 4.5 15.9 5.1

Total trade and other receivables 41.4 52.7 36.3

----------------------------------- ------------ ------------ ------------

Included within licensing receivables is accrued income in

respect of unreported royalties of GBP1.9 million (2022/23: GBP2.2

million). In the previous period other receivables included a VAT

receivable of GBP11.6 million in respect of outstanding European

VAT receipts following Brexit. This has now been received in

full.

13. Trade and other payables

26 November 27 November 28 May 2023

2023 2022 GBPm

GBPm GBPm

--------------------------------- ------------ ------------ ------------

Trade payables 8.0 6.4 9.5

Other taxes and social security 3.0 3.3 3.5

Other payables 17.0 12.0 9.3

Accruals and deferred income 22.6 15.3 14.7

Total trade and other payables 50.6 37.0 37.0

--------------------------------- ------------ ------------ ------------

Included within accruals and deferred income is GBP8.6 million

of deferred income (2022/23: GBP1.9 million) due to an increase in

advance payments by trade and online customers. The advance

payments relate to made to order products and a recent change in

the preorder window for new release products.

14. Seasonality

The Group's monthly sales profile demonstrates an element of

seasonality around the Christmas period with increased sales in the

month of December.

15. Commitments

Capital expenditure contracted for at the balance sheet date but

not yet incurred is GBP4.8 million (2022/23: GBP3.7 million), of

which GBP3.3 million (2022/23: GBP2.7 million) relates to tangible

fixed assets and GBP1.5 million (2022/23: GBP1.0 million) relates

to intangible fixed assets.

The Group has an additional commitment of GBP2.6 million

relating to the Australian warehouse lease where the Group has

entered into an agreement which creates an obligation but does not

yet have control of the underlying asset.

16. Related party transactions

There were no related party transactions during the period.

GLOSSARY

Alternative Performance Measures (APMs)

Closest

equivalent Reconciliation to closest IFRS measure

APM definitions IFRS measure where applicable

----------------------------- ------------------------ ----------------------------------------------

Revenue Core

Core revenue

revenue is

Direct reconciled

sales to

made revenue

of in

our note

core 2

products to

to the

external financial

customers, statements.

through

the

Group's

network

of

retail

stores,

independent

retailers

and

online

through

the

global

web

stores

Gross Core

Core profit gross

gross profit

profit is

Core reconciled

gross to

profit gross

is profit

core in

revenue note

less 2

all to

related the

cost financial

of statements.

sales

Operating Core

Core expenses operating

operating expenses

expenses are

Operating reconciled

expenses to

relating operating

to expenses

the in

core note

business 2

of to

selling the

directly financial

to statements.

external

customers

Operating Core

Core profit operating

operating profit

profit is

Core reconciled

operating to

profit operating

is profit

core in

revenue note

less 2

all to

related the

cost financial

of statements.

sales

and

operating

expenses

----------------------------- ------------------------ ----------------------------------------------

Revenue Licensing

Licensing revenue

revenue is

Income reconciled

relating to

to revenue

royalties in

earned note

from 2

third to

party the

licensees financial

statements.

Gross Licensing

Licensing profit gross

gross profit

profit is

Licensing reconciled

gross to

profit gross

is profit

licensing in

revenue note

less 2

any to

related the

cost financial

of statements.

sales

----------------------------- ------------------------ ----------------------------------------------

Operating Licensing

Licensing expenses operating

operating expenses

expenses are

Operating reconciled

expenses to

relating operating

to expenses

the in

licensing note

segments 2

to

the

financial

statements.

Operating Licensing

Licensing profit operating

operating profit

profit is

Licensing reconciled

operating to

profit operating

is profit

licensing in

revenue note

less 2

all to

related the

cost financial

of statements.

sales

and

operating

expenses

----------------------------- ------------------------ ----------------------------------------------

Revenue at constant Revenue These are calculated by converting underlying

currency revenue, core operating profit and licensing

operating profit amounts at local currency

values for the current period at the

prior period average exchange rate.

Core operating profit Operating

at constant currency profit

Licensing operating Operating

profit at constant currency profit

Amounts for current

and prior periods, stated

at a constant exchange

rate.

2023 2022

Actual Impact Constant Actual

of FX currency

GBPm GBPm GBPm GBPm

------- ------- ---------- -------

Revenue 247.7 7.2 254.9 226.6

Core operating profit 83.4 4.4 87.8 70.7

Licensing operating profit 11.1 0.4 11.5 12.9

-------------------------------------------------------------------------------------------------------

Cash generated - pre Net increase/(decrease) Net increase in cash-pre dividends paid

dividends paid in cash can be calculated by taking the net

Movement in cash in and cash increase/(decrease) in cash and cash

the period before any equivalents equivalents (2023/24: GBP21.1m, 2022/23:

payments of dividends GBP13.9m) and adding back the dividends

are taken into account which have been paid in the period (2023/24:

GBP64.2m, 2022/23: GBP54.2m).

----------------------------- ------------------------ ----------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UPUWUGUPCPUR

(END) Dow Jones Newswires

January 09, 2024 02:00 ET (07:00 GMT)

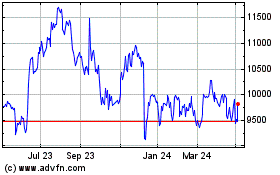

Games Workshop (LSE:GAW)

Historical Stock Chart

From Mar 2024 to Apr 2024

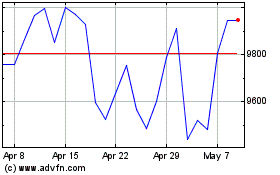

Games Workshop (LSE:GAW)

Historical Stock Chart

From Apr 2023 to Apr 2024