TIDMGKP

RNS Number : 8295C

Gulf Keystone Petroleum Ltd.

20 March 2014

Not for release, publication or distribution, directly or

indirectly, in whole or in partin or into the United States or any

jurisdiction other than the United Kingdom and Bermuda where to do

so would constitute a contravention of the relevant laws or

regulations of such jurisdiction. This announcement (and the

information contained herein) does not contain or constitute an

offer to sell or the solicitation of an offer to purchase, nor

shall there be any sale of securities in any jurisdiction where

such offer, solicitation or sale would constitute a contravention

of the relevant laws or regulations of such jurisdiction.

20 March 2014

Gulf Keystone Petroleum Ltd. (AIM: GKP)

("Gulf Keystone" or "the Company")

Publication of Prospectus and Notice of Cancellation of Trading

on AIM

Further to previous announcements, Gulf Keystone is pleased to

confirm today that the Company's prospectus (the "Prospectus") in

connection with the admission, with a standard listing, of its

entire issued share capital to the Official List of the United

Kingdom Listing Authority ("UKLA") and to trading on the London

Stock Exchange's Main Market for listed securities (together,

"Admission") has been published. Terms defined in the Prospectus

are used in this announcement.

It is expected that Admission will become effective and that

dealings in Gulf Keystone's common shares on the London Stock

Exchange's Main Market will commence at 8.00a.m.GMT on 25 March

2014. Pursuant to Rule 41 of the AIM Rules, the Company hereby

gives notice that trading in the Company's common shares on AIM

will be cancelled on the same day with effect from 8.00 a.m.

GMT.

The Company is not raising any funds or issuing any new common

shares in connection with Admission. The Company's TIDM code on the

London Stock Exchange will remain 'GKP' and, on Admission, there

will be 888,933,057 common shares in issue.

Whilst the company announced on 19 March that it is undertaking

a series of fixed income investor meetings in the US, Europe and

Asia with a debt offering of up to US$250 million in accordance

with Reg S/144A expected to follow, subject to market conditions,

the Company has made the following statement in the Prospectus:

The Company is of the opinion that the Group does not have

sufficient working capital for its present requirements, that is,

for at least the next 12 months from the date of the

Prospectus.

The Group is dependent on its existing cash resources, which

totalled US$82 million at 31 January 2014, together with production

revenues from its interest in the Shaikan Block in order to meet

its future working capital requirements. Existing cash resources at

31 January 2014 include the GBP16.9 million reimbursement of the

Group's litigation costs by Excalibur, which was received in early

January 2014. Further litigation costs may be recovered as

discussed in paragraph 18 of Part 16: "Additional Information -

Litigation" of the Prospectus, but receipt of these further amounts

has not been assumed as part of the Group's working capital

calculation.

Existing cash resources may be enhanced over the next 12 months

by:

-- achieving further consistent oil production and domestic and

export sales from Shaikan increasing up to 40,000 bopd;

-- the exercise of the Shaikan Government Option, the Shaikan

Third Party Option, the Akri-Bijeel Government Option and/or the

Akri-Bijeel Third Party Option under the terms of the Shaikan and

Akri-Bijeel PSCs;

-- any proceeds from the potential sale of the Group's interest

in the Akri-Bijeel Block; and/or

-- reimbursement of the additional GBP5.6 million litigation costs by Excalibur.

Whilst the Company believes that one or more of the above events

are likely to occur, if none of these events occur, and the Company

is unable to otherwise enhance its existing cash resources, then

the Directors would expect the Company to require additional

working capital by the end of May 2014. On that basis, the Company

would be expected to have a shortfall of approximately U.S.$20

million by the end of May 2014, which would increase throughout the

working capital period by between U.S.$10 million and U.S.$15

million per month, on average, until 31 January 2015, where an

estimated maximum cash deficit of approximately U.S.$103 million

would be reached. Subsequent to this date, the cash deficit is

forecast to decrease. These shortfalls are calculated on a

reasonable worst-case scenario basis with the Company applying

available mitigations. Further details on these scenarios and

actions to address this potential shortfall can be found in

paragraph 17 of Part 8 "The Business - Working Capital" of the

Prospectus.

The Company also announces today, and as disclosed in the

Prospectus, that Lord Guthrie has stepped down as Deputy Chairman

to be replaced by Jeremy Asher with immediate effect. Lord Guthrie

will continue in the role of Non-Executive Director. Andrew Simon,

Non-Executive Director, has been appointed Senior Independent

Director of the Company.

Copies of the Prospectus will shortly be available for

inspection from the office of Memery Crystal LLP, 44 Southampton

Buildings, London WC2A 1AP during normal business hours and will

shortly be available on the Company's website

http://www.gulfkeystone.com/investor-centre/documents-for-inspection.

The Prospectus has been submitted to the UKLA and to the

National Storage Mechanism and will be available for inspection

within 24 hours.

Gulf Keystone is due to announce its full year results for the

year ended 31 December 2014 on 27 March 2014.

Enquiries:

Gulf Keystone Petroleum: +44 (0) 20 7514 1400

Simon Murray, Non-Executive Chairman

Todd Kozel, Chief Executive Officer

Anastasia Vvedenskaya, Investor

Relations

Strand Hanson Limited +44 (0) 20 7409 3494

Stuart Faulkner / Rory Murphy

/ James Harris

Mirabaud Securities LLP +44 (0) 20 7878 3362

Peter Krens

Bell Pottinger +44 (0) 20 7861 3232

Mark Antelme / Henry Lerwill

or visit: www.gulfkeystone.com

Notes to Editors:

-- Gulf Keystone Petroleum Ltd. (AIM: GKP) is an independent oil

and gas exploration and production company focused on exploration

in the Kurdistan Region of Iraq.

-- Gulf Keystone Petroleum International (GKPI) holds Production

Sharing Contracts for four exploration blocks in Kurdistan,

including the Shaikan, Sheikh Adi, Ber Bahr and Akri-Bijeel

blocks.

-- GKPI is the Operator of the Shaikan Block, which is a major

commercial discovery, with a working interest of 75% and is

partnered with Kalegran Ltd. (a 100% subsidiary of MOL Hungarian

Oil and Gas plc.) and Texas Keystone Inc., which have working

interests of 20% and 5% respectively. Texas Keystone Inc. holds its

interest in trust for Gulf Keystone, pending transfer of its

interest to the Company.

-- Gulf Keystone is moving into the large-scale phased

development of the Shaikan field targeting 100,000 bopd of

production capacity during Phase 1, following the approval of the

Shaikan Field Development Plan in June 2013.

Disclaimer

This announcement contains certain forward-looking statements.

These statements are made by the Directors in good faith based on

the information available to them up to the time of their approval

of this announcement but such statements should be treated with

caution due to inherent uncertainties, including both economic and

business factors, underlying such forward-looking information. This

announcement has been prepared solely to provide additional

information to shareholders to assess the Group's strategies and

the potential for those strategies to succeed. This announcement

should not be relied on by any other party or for any other

purpose.

This communication and the information contained herein is not

an offer of securities for sale in the United States. Securities

may not be offered or sold in the United States unless they are

registered or are exempt from registration. Any public offering of

securities to be made in the United States would be made by means

of a prospectus that would contain detailed information about the

company and its management, as well as financial statements. The

company does not intend to register any portion of this offering in

the United States or to conduct a public offering in the United

States or any other jurisdiction. Any public offering of securities

to be made in the United States would be made by means of a

prospectus that would contain detailed information about the

Company and its management, as well as financial statements.Copies

of this communication are not being, and should not be, distributed

in or sent into the United States.

This communication is directed only at (i) persons who are

outside the United Kingdom or (ii) persons who have professional

experience in matters relating to investments falling within

Article 19(2) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005, as amended from time to time (the

Order) or (iii) high net worth entities, and other persons to whom

it may lawfully be communicated, falling within Article 49(2) of

the Order or (iv) certified high net worth individuals and

certified and self-certified sophisticated investors as described

in Articles 48, 50, and 50A respectively of the Order or (v)

persons to whom this communication may otherwise be lawfully

communicated (all such persons together being referred to as

relevant persons). Any investment activity to which this

communication relates will only be available to and will only be

engaged with, relevant persons. Any person who is not a relevant

person should not act or rely on this document or any of its

contents.

This communication is distributed in any member state of the

European Economic Area which applies Directive 2003/71/EC (this

Directive together with any implementing measures in any member

state, the Prospectus Directive) only to those persons who are

qualified investors for the purposes of the Prospectus Directive in

such member state, and such other persons as this document may be

addressed on legal grounds, and no person that is not a relevant

person or qualified investor may act or rely on this document or

any of its contents.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEBLFLZXFXBBV

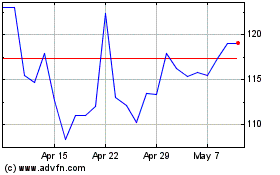

Gulf Keystone Petroleum (LSE:GKP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Gulf Keystone Petroleum (LSE:GKP)

Historical Stock Chart

From Jan 2024 to Jan 2025