TIDMGNC

RNS Number : 9513T

Greencore Group PLC

30 November 2021

Click on, or paste the following link into your web browser, to

view the associated PDF document:

http://www.rns-pdf.londonstockexchange.com/rns/9513T_1-2021-11-29.pdf

FULL YEAR RESULTS STATEMENT

For the year ended 24 September 2021

30 November 2021

Return to revenue and profit growth - emerging strongly from a

challenging period

Greencore Group plc ('Greencore' or the 'Group'), a leading

manufacturer of convenience food in the UK, today issues its

results for the year ended 24 September 2021.

PERFORMANCE (1)

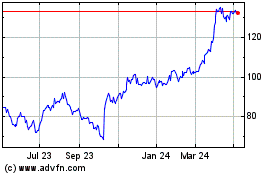

-- Group Revenue up 4.8% to GBP1,324.8m, driven by a return to

growth in food to go categories and solid growth in other

convenience categories

-- Adjusted Operating Profit up 20.0% to GBP39.0m, with Adjusted

Operating Margin of 5.2% in the second half of the year

-- Adjusted EPS of 3.7p

-- Strong free cash flow of GBP72.2m, driven by improved

profitability and working capital inflows as volumes rebounded

-- Significant reduction in net Debt (excluding lease

liabilities) to GBP183.1m, with Net Debt: EBITDA of 2.0x as

measured under financing agreements

-- Cash and undrawn committed bank facilities of GBP433.6m at

year end, and now exited from temporary covenant waiver period as

planned

STRATEGIC DEVELOPMENTS (1)

-- Executed strongly against new business wins, contributing

over a third of the 38% pro forma revenue growth in food to go

categories in Q4 21 and supporting continued diversification of the

Group's product and channel footprint

-- Renewed and extended several commercial relationships, in

line with the long term strategic partnership approach with

customers to support their food to go offerings and to secure

growth for the Group in key categories and open up new growth

opportunities in new categories and formats

-- Progressing well with the previously announced two year

capital investment of approximately GBP30m, supporting delivery of

new business wins across three manufacturing sites

-- Advanced on multiple sustainability goals including the

launch of fully recyclable, plastic free sandwich skillet trials

for customers in September 2021, and the establishment of emission

reduction targets, verified by the Science Based Targets

Initiative

-- Outlined new sustainability commitments for FY22 to transparently share data on the health and sustainability profile of our products with stakeholders, and to ensure all the Group's food surplus goes to feed those in need, and also to reduce by 2030 the average meat content across the Group's product portfolio by 30%, in line with the recommendations of the National Food Strategy

OUTLOOK (1,2)

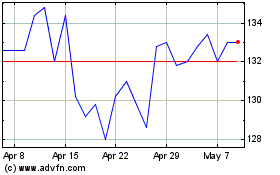

-- Trading in early FY22 has been encouraging with continued

positive revenue momentum across the business. As mobility

increases towards pre-pandemic levels, there is strong demand in

food to go and other convenience categories

-- The Group is committed to recovering against ongoing input

cost and other inflation with customers and is progressing well in

this regard. The pace of profit conversion continues to be impacted

by supply chain and labour challenges that are affecting the

industry overall

-- Though these challenges remain ongoing, the Group expects to

generate an FY22 outturn in line with current market expectations.

This assumes no material resumption of mobility restrictions or

lockdowns arising from increases in COVID-19 infection rates in the

UK. Profitability will be weighted towards the second half of the

year, reflecting the seasonality of the Group's food to go

categories

-- The Board is committed to a dynamic capital management

policy. While the Group remains focused on deleveraging, it will

also balance the ongoing strategic and investment needs of the

business and the capacity to return surplus cash to shareholders.

The Board is currently assessing the specific capital allocation

strategy and is committed to recommencing value return to

shareholders in FY22.

SUMMARY FINANCIAL PERFORMANCE (1)

FY21 FY20 Change

GBPm GBPm

Group Revenue 1,324.8 1,264.7 +4.8%

Pro Forma Revenue Growth +6.2%

Adjusted EBITDA 92.3 85.0 +8.6%

Group Operating Profit 42.8 12.9 +231.8%

Adjusted Operating Profit 39.0 32.5 +20.0%

Adjusted Operating Margin 2.9% 2.6% +30bps

Group Profit/(Loss) Before

Tax 27.8 (10.8)

Adjusted Profit Before Tax 22.6 17.3 +30.6%

Basic EPS (pence) 5.0 (2.6)

Group Exceptional Items (after

tax) 12.1 (20.5)

Adjusted EPS (pence) 3.7 2.9 +27.6%

Total proposed dividend per -

share (pence) -

Free Cash Flow 72.2 (29.7) +GBP101.9m

Net Debt 242.7 411.2

Net Debt (excluding lease liabilities) 183.1 350.5

Net Debt:EBITDA as per financing

agreements 2.0x 4.4x

Return on Invested Capital

("ROIC") 4.5% 4.1%

Commenting on the results, Patrick Coveney, Chief Executive

Officer, said:

"Greencore has weathered the storm and emerged strongly from a

difficult period. Following a challenging first half in FY21, we

made good progress in rebuilding revenues, cashflows and

profitability in H2 and are confident of maintaining this positive

trajectory in the year ahead, particularly in the seasonally

important second half.

The strong recovery of the UK food to go market, as well as

solid performance in other convenience food categories, underpins

this confidence. New business wins achieved last year are

contributing to our momentum, and we anticipate delivery of profits

for the year ahead in line with current market expectations.

With strong free cashflow and a significant reduction in

leverage achieved in FY21, the Group enters the new financial year

on a robust financial footing. Greencore has a strong position in

the dynamic UK convenience food market and, with demand remaining

strong in the early stages of FY22, has confidence in its

medium-term prospects."

___________________________________________________________________________________________________________________

(1) The Group uses Alternative Performance Measures ('APMs')

which are non-IFRS measures to monitor the performance of its

operations and of the Group as a whole. These APMs along with their

definitions are provided in the Appendix to the Full Year Results

Statement.

(2) Consensus market expectations as compiled by Greencore from

available analyst estimates on 19 November 2021 and as reported in

the Investor Relations section of the Group website.

Basis of preparation

The financial information included within this Results Statement

is based on the audited consolidated financial statements of

Greencore Group plc. Details of the basis of preparation can be

found in Note 1 to the attached financial information.

Forward--looking statements

Certain statements made in this document are forward--looking.

These represent expectations for the Group's business, and involve

known and unknown risks and uncertainties, many of which are beyond

the Group's control. The Group has based these forward--looking

statements on current expectations and projections about future

events based on information currently available to the Group. These

forward-looking statements include all statements that are not

historical facts and may generally, but not always, be identified

by the use of words such as 'will', 'aims', achieves',

'anticipates', 'continue', 'could', 'develop', 'should', 'expects',

'is expected to', 'may', maintain', 'grow', 'estimates', 'ensure',

'believes', 'intends', 'projects', 'sustain', 'targets', or the

negative thereof, or similar future or conditional expressions.

By their nature, forward-looking statements involve risk and

uncertainty because they relate to events and depend on

circumstances that may or may not occur in the future and reflect

the Group's current expectations and assumptions as to such future

events and circumstances that may not prove accurate. A number of

material factors could cause actual results and developments to

differ materially from those expressed or implied by

forward-looking statements. There may be risks and uncertainties

that the Group is unable to predict at this time or that the Group

currently does not expect to have a material adverse effect on its

business. You should not place undue reliance on any

forward-looking statements. These forward-looking statements are

made as of the date of this announcement. The Group expressly

disclaims any obligation to publicly update or review these

forward-looking statements other than as required by law.

CONFERENCE CALL

A presentation of the results for analysts and institutional

investors will take place at 8.30am on 30 November 2021 at etc.

venues, 8 Fenchurch Place, London EC3M 4PB. The presentation slides

will be available on the Investor Relations section on

www.greencore.com from 7.00am on 30 November 2021.

This presentation can also be accessed live from the Investor

Relations section on www.greencore.com or alternatively via

conference call. Registration and dial in details are available at

www. greencore.com/investor-relations/

For further information, please contact:

Patrick Coveney Chief Executive Officer Tel: +353 (0)

1 486 3313

Emma Hynes Chief Financial Officer Tel: +353 (0)

1 486 3307

Jack Gorman Head of Investor Relations Tel: +353 (0)

1 486 3308

Rob Greening/ Nick Hayns/ Powerscourt Tel: +44 (0) 20

Sam Austrums 7250 1446

Billy Murphy/ Louise Walsh Drury Communications Tel: +353 (0)

1 260 5000

About Greencore

We are a leading manufacturer of convenience food in the UK and

our purpose is to make every day taste better. We supply all of the

major supermarkets in the UK. We also supply convenience and travel

retail outlets, discounters, coffee shops, foodservice and other

retailers. We have strong market positions in a range of categories

including sandwiches, salads, sushi, chilled snacking, chilled

ready meals, chilled soups and sauces, chilled quiche, ambient

sauces and pickles, and frozen Yorkshire Puddings.

In FY21 we manufactured 645m sandwiches and other food to go

products, 117m chilled prepared meals, and 256m bottles of cooking

sauces, pickles and condiments. We carry out more than 10,500

direct to store deliveries each day. We have 21 world-class

manufacturing units across 16 locations in the UK, with

industry-leading technology and supply chain capabilities. We

generated revenues of GBP1.3bn in FY21 and employ approximately

13,000 people. We are headquartered in Dublin, Ireland.

For further information go to greencore.com or follow Greencore

on social media.

EMERGING STRONGLY FROM A CHALLENGING PERIOD (1)

In a challenging year when demand was significantly impacted by

various COVID-19 related lockdowns and associated mobility

restrictions, the Group performed with resilience and benefitted

from a strong recovery in the second half. Throughout, the Group

focused on three priorities - keeping our people safe, feeding the

UK, and protecting our business. These priorities are aligned with

the Group's purpose and its distinctive, repeatable 'Greencore Way'

of working.

Greencore worked closely with customers to deliver strong

operational service levels in FY21 and to meet increasing demand,

notwithstanding the well documented supply chain and labour

challenges that intensified as the year progressed and which

continue to be faced.

Keeping our people safe

Greencore's people are at the core of its purpose and its

success and keeping colleagues safe remained the key priority

throughout the past year. The Group maintained a vigilant and

highly responsive approach to health and safety protocols to ensure

that all is being done within the business to mitigate the impact

of COVID-19 and to keep colleagues safe.

Building on the extensive range of new measures implemented in

FY20 to support colleague safety across the Group's network, the

Group has carried out many additional actions taken through FY21.

The Group conducted regular COVID-19 risk assessments and

implemented site-specific action plans across every manufacturing

location and distribution facility, implemented weekly lateral flow

testing across the main manufacturing sites and Direct-to-Store

depots, and developed a COVID-19 risk alert tool that uses a

variety of data to dictate what levels of control are required for

each site at any time.

Feeding the UK

The Group's mission to feed the UK throughout the pandemic is

fully aligned with the Group's purpose and its commitment to

producing Great Food. This involves close engagement with

customers, to respond quickly to volatile demand patterns

associated with the changing mobility restrictions and lockdowns

that were introduced across the UK during the year. These strong

customer relationships also enabled the Group to help drive

category growth and range launches as the economy reopened, as well

as to onboard new business successfully. The Group also continued

to scale up the work we do in support of local communities,

especially where food insecurity and hunger exists.

Protecting our business

In FY21 the Group implemented a comprehensive set of actions to

alleviate the material negative short-term impact on the business

caused by COVID-19, and to build back the business profitably as

the pandemic began to ease. This was underpinned by the Group's

purpose through the drive for excellence in all that it does, and

the responsibility to improve continuously the sustainability of

the business.

The combination of recovering demand and strict underlying cost

control allowed the Group to improve revenue, profitability, and

cash flow momentum progressively through FY21. In the first half of

FY21 the Group also launched a set of debt and equity initiatives

to strengthen the balance sheet, including amendments to its debt

agreements and a well-supported equity placing in November 2020,

raising net proceeds of GBP87.1m. These ensured the Group could

protect its operations through COVID-19 induced volatility while

also enable it to invest with customers to secure business and open

up new opportunities in additional categories and formats. The

Group continued to receive UK Government assistance under the

Coronavirus Job Retention Scheme until July 2021.

Strong underlying cash generation in the second half of the year

allowed the Group to deleverage further, ending the period with a

leverage ratio now approaching FY19 levels. The Group had cash and

undrawn committed bank facilities of GBP433.6m at 24 September 2021

(FY20: GBP232.0m)

SUSTAINABILITY

The Group's first standalone sustainability report in FY20

coincided with the launch of the corporate purpose 'Making every

day taste better' and the Group's new sustainability strategy, the

'Better Future Plan'. In addition the National Food Strategy,

published at the beginning of H2 21 and the first independent

review of British food policy in 75 years, highlighted the urgent

need for action in what is an increasingly unsustainable global

food system.

The Group's sustainability strategy is built around three

pillars and aspirations:

-- Sourcing with Integrity: By 2030 we will source our priority

ingredients from a sustainable and fair supply chain

-- Making with Care: By 2040 we will operate with net zero emissions

-- Feeding with Pride: By 2030 we will have increased our

positive impact on society through our products

Good progress was made on strategy in FY21, though COVID-19

continued to have a negative impact on manufacturing efficiencies

and on some of the performance measures that the Group tracks. In

September 2021 the Group launched fully recyclable, plastic free

sandwich skillet trials for customers. The Group also set emission

reduction targets, verified by the Science Based Targets

Initiative, pledging to reduce absolute Scope 1 and Scope 2

emissions by 46.2% by 2030 from a 2019 base year. The Group also

pledged to reduce Scope 3 emissions from purchased goods and

services, and upstream transport and distribution, by 42% per tonne

of product sold by 2030 from a 2019 base year. The Group continued

to advance how it measures and acts to improve the health and

environmental impacts of the product portfolio, including

initiatives in product footprinting and eco-labelling, while the

rollout of site-specific plans for engagement with local

communities was completed.

Transparency and engagement around the Group's sustainability

strategy was also enhanced. The Group now maps its activities

against both Global Reporting Initiative (GRI) Standards and the

Sustainable Accounting Standards (SASB) framework. Stakeholder

engagement on sustainability has increased markedly since the

launch of the Group's strategy in November 2020, including a

detailed presentation at a seminar for the investment community in

February 2021.

New commitments and action points have been established to

advance the Group's progress. In FY22, the Group will transparently

share data on the health and sustainability profile of its products

with its stakeholders and will also ensure all the Group's food

surplus goes to feed those in need. By 2030, the Group commits to

reduce the average meat content across the Group's product

portfolio by 30%, in line with the recommendations of the National

Food Strategy.

OPERATING REVIEW (1)

Convenience Foods UK & Ireland

FY21 FY20 Change Change

GBPm GBPm (As reported) (Pro Forma

basis)

Revenue 1,324.8 1,264.7 +4.8% +6.2%

-------- -------- --------------- ------------

Group Operating Profit 42.8 12.9 +231.8%

-------- -------- --------------- ------------

Adjusted Operating

Profit 39.0 32.5 +20.0%

-------- -------- --------------- ------------

Adjusted Operating

Margin % 2.9% 2.6% +30bps

-------- -------- --------------- ------------

Pro Forma Revenue Growth (versus FY20)

Q1 2021 Q2 2021 Q3 2021 Q4 2021 FY21

--------- --------- -------- -------- -----

Group -15% -22% +53% +27% +6%

--------- --------- -------- -------- -----

Food to go categories -22% -30% +91% +38% +9%

--------- --------- -------- -------- -----

Other convenience

food categories -2% -9% +11% +8% +2%

--------- --------- -------- -------- -----

Pro Forma Revenue Growth (versus FY19)

Q1 2021 Q2 2021 Q3 2021 Q4 2021 FY21

--------- --------- -------- -------- -----

Group -14% -23% -3% +1% -9%

--------- --------- -------- -------- -----

Food to go categories -21% -33% -9% -2% -16%

--------- --------- -------- -------- -----

Other convenience

food categories -1% -3% +13% +10% +4%

--------- --------- -------- -------- -----

Strategic developments

The Group delivered well against its strategic objectives in

what was a challenging period. Central to this delivery was the

Group's close engagement with customers.

In the first half of the year, during periods of mobility

restrictions, the Group worked with customers on effective range

management. Subsequently, as mobility restrictions were lifted in

the UK, the Group designed and implemented growth programmes with

customers, with a focus on building back rapidly in affected

categories, to reactivate product ranges and formats in spring and

early summer. As the year progressed the Group managed through the

operational service challenges arising from supply chain

disruptions and tight labour availability, working effectively with

customers to manage inflation and to align the network and product

ranges to deliver optimally.

The Group secured new business wins representing annualised

pre-COVID revenues of approximately GBP175m, across food to go and

other convenience categories and customers. This supported the

Group's diversification of its product and channel footprint. Many

of these customers were onboarded during the second half of the

year and the Group is encouraged by their performance to date. The

Group has committed to investing approximately GBP30m over FY21 and

FY22, across three existing Greencore manufacturing sites, to

support the delivery of this new business.

In FY21, the Group also expanded its product offering and

extended its category reach with existing customers, in the salads

and fresh meals categories. Furthermore, several commercial

relationships with key customers were renewed and extended in the

period, some of which became effective in FY21 - with the remainder

becoming effective from FY22 onwards. The Group has successfully

operated a model of long-term strategic partnering with customers

for several years. These multi-year, sole supply agreements

typically involve near term investment in capabilities, capital,

and terms that both secure and support growth in key categories and

also open up growth opportunities with these customers in

additional categories and formats.

The Group progressed its Excellence agenda through FY21, albeit

with some restrictions on the deployment of certain initiatives in

light of COVID-19 disruption. The Group commissioned and installed

modular robotic solutions across 15 production lines in three

locations. It also made good progress on the Group's Purchasing

Excellence agenda, implementing new IT solutions to support

analytics and reporting, including a shared portal for managing

packaging data with customers and suppliers. The Group continues to

engage with key suppliers in a structured way to simplify

ingredient supply chains, whilst enabling innovation and

maintaining rigorous quality standards.

Producing great tasting, quality food to the highest technical

and food safety standards is a hallmark of the Greencore business.

Throughout FY21, the Group launched over 1,300 new or reformulated

products with our customers, within the Group's total Stock Keeping

Unit (SKU) range of approximately 2,200 products. An example of

these new initiatives was a first-to-market innovation

transitioning all sandwich bread with one of the Group's largest

customers to a new fibre-enriched loaf, with no compromise on

either taste or shelf life. The Group was also responsive to

changes in consumer behaviour through the COVID-19 disruption and

developed a range of 'dine-at-home' meal boxes with a key customer

to create a premium, restaurant quality meal experience.

Performance

Reported Group revenue increased by 4.8% to GBP1,324.8m in FY21.

On a pro forma basis, revenue increased by 6.2%, after adjusting

for the disposal of the molasses businesses in Q1 21 and for

movements in foreign exchange. Adjusted Operating Profit rose by

20.0% to GBP39.0m and Adjusted Operating Margin advanced by 30bps

to 2.9%. Group Profit Before Tax was GBP27.8m in FY21, compared to

a Loss Before Tax of GBP10.8m in FY20.

The UK trading environment remained volatile during FY21. There

was a pronounced negative impact on demand in food to go categories

in the first half of the year, arising from a reduction in mobility

due to extensive lockdowns and tiered restrictions across the UK.

The trading environment improved markedly from Q3 as the economy

reopened and mobility restrictions were eased, supporting demand

growth in food to go categories in particular. In addition to the

underlying market recovery, the Group benefitted from its strong

market position in the grocery retail channel, its customer and

format mix, and its portfolio across food to go and other

convenience categories. New business increasingly contributed to

Group revenue performance as the year progressed.

As the economy reopened, supply-side challenges emerged across

the UK food industry. This has been primarily driven by tight

labour availability, with a marked impact on logistics and the

supply of inbound materials. Greencore has not been immune to these

impacts but delivered strong operational service levels in this

context, supported by its own Direct-to-Store distribution

network.

FY21 revenue in the Group's food to go categories (comprising

sandwiches, salads, sushi and chilled snacking) totalled GBP842.1m

and accounted for approximately 64% of reported revenue. Reported

and pro forma revenues increased by 9.0% in these categories,

driven by a recovery in underlying demand as the year progressed

and by strong execution on new business wins. Revenue for the

distribution of third party products accounted for approximately 8%

of Group revenue in FY21 and benefitted from new customer wins in

the period.

On a pro forma basis, revenue in food to go categories increased

by approximately 59% in the second half of FY21, and was

approximately 5% below the equivalent pre-COVID levels in H2 19. In

September 2021, the final month of the Group's fiscal year, pro

forma revenue in food to go categories increased by approximately

40% year on year and was only approximately 1% below the equivalent

pre-COVID levels in H2 19.

The Group's other convenience categories comprise activities in

the chilled ready meals, chilled soups and sauces, chilled quiche,

ambient sauces and pickles, and frozen Yorkshire Pudding

categories, as well as an Irish ingredients trading business.

Reported revenue across these businesses decreased by 1.9% to

GBP482.7m in FY21. Adjusting for movements in foreign exchange and

the disposal of the Irish molasses businesses in Q1 21, pro forma

revenue increased by 1.6%. This was driven by strong growth in the

Group's ready meals business through the second half of the year,

while FY21 revenue in the cooking sauce business was broadly

unchanged. Revenue in the Group's remaining Irish ingredients

trading business increased in FY21, recovering from a slower start

to the year.

Inflation trends in the Group's main UK cost components were

broadly as anticipated. Raw material and packaging costs rose by

approximately 1% in FY21. Direct labour inflation was approximately

5%. Both cost components have seen a marked increase in inflation

since early Q4 21.

The Group incurred GBP5.3m of operating costs relating to

COVID-19 (FY20:GBP10.8m). The Group also incurred non-recurring

costs of GBP4.4m relating to an impairment charge on fixed assets,

offset by a GBP4.8m non-recurring gain relating to an insurance

claim credit. These costs were recognised within operating

income.

Overall, Group Operating Profit increased from GBP12.9m to

GBP42.8m. Adjusted Operating Profit increased from GBP32.5m to

GBP39.0m. The increase in Adjusted Operating Profit was driven

primarily by an improvement in profitability in the Group's food to

go categories, as demand recovered in the second half of the year.

Underlying profitability in the Group's other convenience

categories was broadly unchanged in FY21.

In FY21 the Group received UK Government assistance of GBP8.7m

(FY20: GBP21.3m) under the Coronavirus Job Retention Scheme.

Brexit

The Trade and Cooperation Agreement negotiated between the EU

and the UK was applied provisionally from 1 January 2021 and

entered into force from 1 May 2021. While the direct financial

impact on the Group in FY21 was modest, the operational impact was

more challenging due to the additional impact of COVID-19 on labour

availability and the supply chain. The Group continues to work

through these challenges effectively with its customers and

suppliers.

Group Cash Flow and Returns

FY21 FY20 Change

GBPm GBPm (as reported)

Free Cash Flow 72.2 (29.7) +GBP101.9m

------ ------- ---------------

Net Debt (excluding lease

liabilities) 183.1 350.5

------ ------- ---------------

Net Debt:EBITDA as per financing

agreements 2.0x 4.4x

------ ------- ---------------

ROIC 4.5% 4.1%

------ ------- ---------------

Strategic developments

The Group implemented a comprehensive range of operational, debt

and equity measures in FY21 that protected and supported the

business, enabling it to exit the covenant waiver period as

planned, securely. As the business moved back into profitable

growth in the second half of the year, strong free cash generation

allowed the Group to deleverage rapidly.

The Group applied a range of mitigating actions to manage cash

outflows in FY21, particularly in the first half of the year.

Alongside this, the Group secured support from its bank lending

syndicate and its Private Placement Note Holders to a range of

initiatives, including the waiving of certain covenant test

conditions and the refinancing of various debt facilities. In

November 2020 the Group completed an equity placing of 80,357,142

new ordinary shares at 112 pence per share, to raise net proceeds

of GBP87.0m. The Group also completed the disposal of its interest

in its molasses trading businesses in December 2020, and the

disposal of an investment property in September 2021.

As a result of all these measures, in particular the successful

completion of the equity placing, the Group has had sufficient

financial flexibility to navigate through a volatile trading period

while continuing to invest to support future growth in the

business. At 24 September 2021 the Group had cash and undrawn

committed bank facilities of GBP433.6m, comfortably above minimum

liquidity requirements as stipulated in the conditions of the

Group's covenant waivers.

The Group's initiatives continue to be informed by modelling a

set of scenarios that reflect the Group's considered and

conservative view on short and medium term trading, and ensuring

the Group is efficiently and effectively funded through any of

these scenarios.

Performance

Free Cash Flow was an inflow of GBP72.2m in FY21 compared to an

outflow of GBP29.7m in FY20, the increase primarily reflecting

improved profitability and the working capital inflows associated

with the recovery in demand in the Group's food to go categories.

The conversion rate of Adjusted EBITDA was 78.2% in FY21 (FY20:

(34.9%)). Several other factors also supported the levels of net

cash inflow during FY21, principally the equity placing completed

in November 2020 and the disposal of the molasses businesses in

December 2020.

The Group's Net Debt at 24 September 2021 was GBP242.7m, a

reduction of GBP168.5m compared to the prior year period which

includes the impact of IFRS 16 lease obligations of GBP59.6m

(FY20:GBP60.7m). Net Debt excluding lease liabilities decreased to

GBP183.1m from GBP350.5m at the end of FY20. The Group's Net

Debt:EBITDA leverage as measured under financing agreements was

2.0x at year end. This compared to 7.2x at the end of March 2021

and 4.4x at the end of September 2020.

As at 24 September 2021, the Group had total committed debt

facilities of GBP616.4m and a weighted average maturity of 2.7

years. Following the maturing of the Private Placement Notes in

October 2021 and the extension of the maturity on the GBP340m

revolving credit facility in November 2021 , the Group has total

committed debt facilities of GBP568.8m with a weighted average

maturity of 3.4 years.

ROIC increased to 4.5 % for the 12 months ended 24 September

2021, compared to 4.1% for the 12 months ended 25 September 2020.

The increase was driven by increased profitability in the period,

partly offset by a higher effective tax rate and a modest increase

in the Group's average invested capital.

FINANCIAL REVIEW (1)

Revenue and Operating Profit

Reported revenue in the period was GBP 1,324.8 m, an increase of

4.8% compared to FY20, primarily reflecting the recovery in demand

in food to go categories as mobility restrictions eased in the UK

during the year. Pro Forma Revenue increased by 6.2%.

Group Operating Profit increased from GBP12.9m to GBP42.8m as a

result of an improved revenue outturn in FY21 and the movement from

a net exceptional charge to a net exceptional gain in FY21.

Adjusted Operating Profit of GBP 39.0 m was 20.0% higher than in

FY20, driven by an improvement in profits in food to go categories

in FY21 and a broadly unchanged underlying performance in the

Group's other convenience categories. Adjusted Operating Margin was

2.9 %, 30 basis points higher than the prior year.

Net finance costs

The Group's net bank interest payable was GBP 15.0 m in FY21, an

increase of GBP 0.3 m versus FY20. The increase was driven by the

higher cost of debt. The Group also recognised a GBP1.3m interest

charge relating to the interest payable on lease liabilities in the

year (FY20: GBP1.2m).

The Group's non-cash finance charge, before exceptional items,

in FY21 was GBP2.8m (FY20: GBP1.3m). The change in the fair value

of derivatives and related debt adjustments in the period was a

GBP1.0m charge (FY20: GBP1.1m credit) and the non-cash pension

financing charge of GBP 1.7 m was GBP 0.2 m lower than the FY20

charge of GBP1.9m.

Profit before taxation

The Group's Profit before taxation increased from a loss of

GBP10.8m in FY20 to a profit of GBP27.8m in FY21, driven by higher

Group Operating Profit and lower finance costs as compared to the

FY20 costs which included an exceptional finance charge. Adjusted

Profit Before Tax in the period was GBP 22.6 m (FY20: GBP17.3m),

primarily driven by an improvement in Adjusted Operating

Profit.

Taxation

The Group's effective tax rate in FY21 (adjusting

pre-exceptional profit for the change in fair value of derivatives)

was 15 % (FY20: 13%). In March 2021, the UK Government announced an

increase in the UK rate of corporation tax from 19% to 25%, to be

effective from 1 April 2023. This change results in a one-off

credit to the income statement, with a corresponding increase in

the Group's deferred tax asset. This credit is partially offset by

a charge arising from the reassessment of recoverability of

deferred tax assets previously recognised in respect of certain

buildings owned by the Group.

Exceptional items

The Group had a pre--tax exceptional gain of GBP11.7m in FY21,

and an after tax gain of GBP12.1m, comprised as follows:

Exceptional Items GBPm

Profit on disposal of Molasses trading

businesses 11.3

------

Legacy defined benefit pension schemes

restructuring charge (4.0)

------

Non-core property related income 3.3

------

Legacy business provisions 1.1

------

Exceptional items (before tax) 11.7

------

Tax on exceptional items 0.4

------

Exceptional items (after tax) 12.1

------

Earnings per share

The Group's basic earnings per share for FY21 was 5.0 pence

compared to basic loss per share in FY20 of 2.6 pence. This was

driven by a GBP 36.9 m increase in Earnings in FY21, partially

offset by an increase in the weighted average number of shares in

issue in FY21 to 511.8m (FY20: 443.9m).

Adjusted Earnings were GBP18.8m in the period, GBP5.8m ahead of

prior year levels largely due to an increase in Adjusted Operating

Profit. Adjusted earnings per share of 3.7 pence was 27.6% ahead of

FY20 levels.

Cash Flow and Net Debt

Adjusted EBITDA was GBP7.3m higher in FY21 at GBP92.3m. The

Group incurred a net working capital inflow of GBP33.2m.

Maintenance capital expenditure of GBP16.2m was incurred in the

period (FY20: GBP18.9m). The cash outflow in respect of exceptional

charges was GBP3.3m (FY20: GBP10.1m), of which GBP2.9m related to

prior year exceptional charges.

Interest paid in the period was GBP18.8m (FY20: GBP14.3m),

including interest of GBP1.3m on lease liabilities, an increase on

FY20 primarily reflecting the impact of higher debt costs

associated with higher leverage during the year. Cash tax fell by

GBP4.4m to GBP0.2m reflecting a higher FY20 charge relating to a

one-off change in rules for the timing of UK corporation tax

payments impacting FY20. The cash tax rate for the Group is

expected to rise towards the Group's effective rate in the medium

term as a result of increased profitability and a reduction in the

degree to which UK losses may be utilised in any one year. Cash

repayments on lease liabilities increased to GBP14.3m (FY20:

GBP11.2m). The Group's cash funding for defined benefit pension

schemes was GBP7.0m (FY20: GBP9.4m), reflecting the agreement with

Trustees to defer cash contributions in the first half of the

year.

These movements resulted in Free Cash Flow of GBP72.2m compared

to an outflow of GBP29.7m in FY20 driven primarily by higher

profitability and the substantial unwinding of working capital

outflows incurred in FY20.

In FY21, the Group incurred strategic capital expenditure of

GBP24.0m (FY20: GBP13.0m).

The Group did not make any equity dividend cash payments in FY21

(FY20: GBP16.7m in respect of final dividend in FY19) and in

November 2020 the Group completed an equity placing of 80,357,142

new ordinary shares at 112 pence per share, to raise net proceeds

of GBP87.0m. In December 2020 the Group also completed the sale of

its interests in its molasses trading businesses for a final cash

consideration of GBP16.3m. In September 2021 the Group completed

the sale of an investment property for cash consideration of

GBP6.3m.

The Group's Net Debt at 24 September 2021 was GBP242.7m, a

decrease of GBP168.5m compared to the prior year period, driven

primarily by the free cash outflows as described previously and the

cash proceeds from the equity placing in November 2020 and the sale

of the Group's molasses businesses in December 2020.

Financing

As previously announced, the Group secured agreement with its

bank lending syndicate in May 2020 and its Private Placement Note

Holders in July 2020 to waive the Net Debt: EBITDA covenant

condition for the September 2020 and March 2021 test periods.

In November 2020 the Group secured further support from its bank

lending syndicate and its Private Placement Note holders. Of the

key features, the Group:

-- Extended the maturity of its GBP75m revolving credit bank

facility by two years to March 2023;

-- Refinanced the Group's GBP50m bilateral loan for a new three

year term maturing in January 2024;

-- Amended the EBITDA: Interest covenant condition for the March

2021 test period from 3.0x to 2.0x;

-- Amended the Net Debt: EBITDA covenant test at June 2021 from 4.25x to 5.0x

-- Reduced the minimum liquidity requirement on cash and undrawn

facilities to GBP70m for FY21, from a range of GBP100m-GBP125m;

and

-- Increased the maximum net debt requirement to GBP550m to May

2021, and GBP500m to September 2021, from a range of GBP450m-

GBP550m

In July 2021, the Group successfully completed a refinancing of

its near-term debt with its lending syndicate that improves the

maturity profile of the Group's debt and lowers annual interest

costs. The Private Placement Notes of $65m, which matured in

October 2021, were replaced by a new three-year term loan facility

of GBP45m, maturing in June 2024.

In November 2021, the Group also extended the maturity on its

GBP340m revolving credit facility by one year to January 2026.

The Group had total committed debt facilities of GBP616.4m at 24

September 2021 and a weighted average maturity of 2.7 years.

Following the refinancing activities completed after year end, the

Group has total committed debt facilities of GBP568.8m with a

weighted average maturity of 3.4 years. These facilities

comprise:

-- A GBP340m revolving credit bank facility with a maturity date of January 2026

-- A GBP75m revolving credit bank facility with a maturity date of March 2023

-- A GBP50m bilateral bank facility with a maturity date of January 2024

-- A GBP45m bank term loan facility with a maturity date of June 2024

-- GBP18m and $55.9m of outstanding Private Placement notes with

maturities ranging between June 2024 and June 2026

The Group had cash and undrawn committed facilities of GBP433.6m

at 24 September 2021, compared to GBP232.0m as at 25 September

2020.

Pensions

All of the Group's legacy defined benefit pension schemes are

closed to future accrual. The net pension deficit relating to

legacy defined pension schemes, before related deferred tax, at 24

September 2021 was GBP46.0m, GBP36.1m lower than the position at 25

September 2020. The net pension deficit after related deferred tax

was GBP29.3m (FY20: GBP63.8m). The decrease in net pension deficit

was driven principally by an actuarial gain on assets and on

liabilities arising from an increase in the discount rates used to

value these assets and liabilities. The movement in the discount

rate is driven by the corporate bond rate.

In H1 21 the Group entered a formal agreement with the Trustees

of the legacy defined benefit pension scheme in the UK to defer

cash contributions to the pension for a further period of six

months which resulted in a reduction of cash contributions in FY21

of GBP5.1m. Since the beginning of the pandemic to the date of this

announcement, the Group has deferred cash contributions totalling

GBP10.0m.

The valuations and funding obligations of the Group's legacy

defined benefit pension schemes are assessed on a triennial basis

with the relevant Trustees. During H2 21 the Group concluded the

latest assessment of the valuation and funding plan for its

principal UK legacy defined benefit pension scheme. The Group

expects the annual cash funding requirement for all schemes to be

modestly below previously guided levels of GBP15m, inclusive of the

cash contributions that were deferred over the course of the

pandemic.

In FY21 the Group and Trustees of all three Irish defined

benefit schemes agreed a restructuring of its Irish pension schemes

which included the agreement to wind up the two smaller schemes and

to transfer certain assets and liabilities from those schemes to

the principal scheme. Details of the restructuring are detailed in

Note 9 to the Full Year Results Statement.

Dividends

The Group did not pay dividends to shareholders in the

period.

Principal risks and uncertainties

There are a number of potential risks and uncertainties which

could have a material impact on future Group performance and could

cause actual results to differ materially from expected and

historical results. The risks and uncertainties are described in

detail in the section Risks and Risk Management in the Annual

Report and Financial Statements for the year ended 24 September

2021 issued on 30 November 2021.

P.G. Kennedy

Chair

Date: 29 November 2021

GROUP INCOME STATEMENT

For year ended 24 September 2021

2021 2020

Exceptional Exceptional

(Note Pre - (Note

Notes Pre - exceptional 4) Total exceptional 4) Total

GBPm GBPm GBPm GBPm GBPm GBPm

------------------------- ------ ------------------ ------------ -------- ------------- ------------ --------

Revenue 2 1,324.8 - 1,324.8 1,264.7 - 1,264.7

Cost of sales (901.9) - (901.9) (859.5) (2.9) (862.4)

------------------------- ------ ------------------ ------------ -------- ------------- ------------ --------

Gross profit 422.9 - 422.9 405.2 (2.9) 402.3

Operating costs,

net (383.3) 7.7 (375.6) (372.2) (12.8) (385.0)

Impairment of trade

receivables (0.6) - (0.6) (0.5) - (0.5)

------------------------- ------ ------------------ ------------ -------- ------------- ------------ --------

Group operating profit

before acquisition

related amortisation 39.0 7.7 46.7 32.5 (15.7) 16.8

Amortisation of

acquisition

related intangibles (3.9) - (3.9) (3.9) - (3.9)

------------------------- ------ ------------------ ------------ -------- ------------- ------------ --------

Group operating profit 35.1 7.7 42.8 28.6 (15.7) 12.9

Finance income 5 0.1 - 0.1 0.1 - 0.1

Finance costs 5 (19.1) - (19.1) (17.3) (7.1) (24.4)

Share of profit of

associates after

tax - - - 0.6 - 0.6

Profit on disposal

of associates - 4.0 4.0 - - -

------------------------- ------ ------------------ ------------ -------- ------------- ------------ --------

Profit/(loss) before

taxation 16.1 11.7 27.8 12.0 (22.8) (10.8)

Taxation (2.5) 0.4 (2.1) (1.4) 2.3 0.9

------------------------- ------ ------------------ ------------ -------- ------------- ------------ --------

Profit/(loss) for

the financial year 13.6 12.1 25.7 10.6 (20.5) (9.9)

------------------------- ------ ------------------ ------------ -------- ------------- ------------ --------

Attributable to:

Equity shareholders 13.3 12.1 25.4 9.0 (20.5) (11.5)

Non-controlling

interests 0.3 - 0.3 1.6 - 1.6

------------------------- ------ ------------------ ------------ -------- ------------- ------------ --------

13.6 12.1 25.7 10.6 (20.5) (9.9)

------------------------- ------ ------------------ ------------ -------- ------------- ------------ --------

Earnings per share (pence)

Basic earnings per

share 6 5.0 (2.6)

Diluted earnings

per share 6 5.0 (2.6)

------------------------- ------ ------------------ ------------ -------- ------------- ------------ --------

GROUP STATEMENT OF COMPREHENSIVE INCOME

for year ended 24 September 2021

2021 2020

GBPm GBPm

----------------------------------------------------- ------ ------

Items of comprehensive income taken directly to equity

Items that will not be reclassified to profit

or loss:

Actuarial gain on Group legacy defined benefit

pension schemes 36.3 1.6

Tax (charge)/credit on Group legacy defined benefit

pension schemes (1.1) 2.3

------------------------------------------------------ ------ ------

35.2 3.9

----------------------------------------------------- ------ ------

Items that may subsequently be reclassified to

profit or loss:

Currency translation adjustment (3.2) 1.3

Translation reserve transferred to Income Statement

on disposal of subsidiary (1.0) -

Non-controlling interest transferred to Income

Statement on disposal of subsidiary (5.8) -

Cash flow hedges:

fair value movement taken to equity (0.5) 1.4

transfer to Income Statement for the year 1.2 0.1

(9.3) 2.8

----------------------------------------------------- ------ ------

Net income recognised directly within equity 25.9 6.7

Profit/(loss) for the financial year 25.7 (9.9)

------------------------------------------------------ ------ ------

Total comprehensive income for the financial year 51.6 (3.2)

------------------------------------------------------ ------ ------

Attributable to:

Equity shareholders 57.3 (4.9)

Non-controlling interests (5.7) 1.7

------------------------------------------------------ ------ ------

Total comprehensive income for the financial year 51.6 (3.2)

------------------------------------------------------ ------ ------

GROUP STATEMENT OF FINANCIAL POSITION

at 24 September 2021

2021 2020

Notes GBPm GBPm

----------------------------------------------------- ------ -------- --------

ASSETS

Non-current assets

Goodwill and intangible assets 7 473.3 478.5

Property, plant and equipment 7 307.4 313.2

Right-of-use assets 54.1 55.6

Investment property 3.0 6.1

Retirement benefit assets 9 42.1 42.9

Derivative financial instruments - 3.0

Deferred tax assets 48.1 46.1

Trade and other receivables 0.4 -

----------------------------------------------------- ------ -------- --------

Total non-current assets 928.4 945.4

----------------------------------------------------- ------ -------- --------

Current assets

Inventories 47.7 44.7

Trade and other receivables 196.3 157.7

Cash and cash equivalents 119.1 267.0

Derivative financial instruments - 0.6

Current tax receivable - 0.5

Assets held for sale - 11.2

----------------------------------------------------- ------ -------- --------

Total current assets 363.1 481.7

----------------------------------------------------- ------ -------- --------

Total assets 1,291.5 1,427.1

----------------------------------------------------- ------ -------- --------

EQUITY

Capital and reserves attributable to equity holders

of the Company

Share capital 10 5.3 4.5

Share premium 10 89.7 0.4

Reserves 328.2 271.6

----------------------------------------------------- ------ -------- --------

423.2 276.5

Non-controlling interests - 5.7

----------------------------------------------------- ------ -------- --------

Total equity 423.2 282.2

----------------------------------------------------- ------ -------- --------

LIABILITIES

Non-current liabilities

Borrowings 8 209.1 397.5

Lease liabilities 42.0 46.6

Other payables 3.7 3.7

Derivative financial instruments 2.7 2.5

Provisions 5.5 5.4

Retirement benefit obligations 9 88.1 125.0

Deferred tax liabilities 18.2 11.5

----------------------------------------------------- ------ -------- --------

Total non-current liabilities 369.3 592.2

----------------------------------------------------- ------ -------- --------

Current liabilities

Borrowings 8 93.1 220.0

Trade and other payables 375.8 302.0

Lease liabilities 17.6 14.1

Derivative financial instruments 2.9 -

Provisions 2.1 4.5

Current tax payable 7.5 10.4

Liabilities held for sale - 1.7

----------------------------------------------------- ------ -------- --------

Total current liabilities 499.0 552.7

----------------------------------------------------- ------ -------- --------

Total liabilities 868.3 1,144.9

----------------------------------------------------- ------ -------- --------

Total equity and liabilities 1,291.5 1,427.1

----------------------------------------------------- ------ -------- --------

GROUP STATEMENT OF CASH FLOWS

for the year ended 24 September 2021

2021 2020

Notes GBPm GBPm

------------------------------------------------------ ------ -------- -------

Profit/(loss) before taxation 27.8 (10.8)

Finance income 5 (0.1) (0.1)

Finance costs 5 19.1 17.3

Share of profit of associates after tax - (0.6)

Exceptional items 4 (11.7) 22.8

------------------------------------------------------ ------ -------- -------

Operating profit (pre-exceptional) 35.1 28.6

Depreciation and impairment of property, plant

and equipment (including right-of-use assets) 54.6 49.6

Amortisation of intangible assets 7.0 6.8

Employee share-based payment expense 2.1 2.0

Contributions to Group legacy defined benefit

pension scheme 9 (7.0) (9.4)

Working capital movement 33.2 (46.1)

Net cash inflow from operating activities before

exceptional items 125.0 31.5

Cash outflow related to exceptional items (3.3) (10.1)

Interest paid (including lease liability interest) (18.8) (14.3)

Tax paid (0.2) (4.6)

------------------------------------------------------ ------ -------- -------

Net cash inflow from operating activities 102.7 2.5

------------------------------------------------------ ------ -------- -------

Cash flow from investing activities

Dividends received from associates - 0.3

Purchase of property, plant and equipment (37.1) (29.8)

Purchase of intangible assets (3.1) (2.1)

Disposal of undertakings 16.3 -

Disposal of investment property 6.3 -

------------------------------------------------------ ------ -------- -------

Net cash outflow from investing activities (17.6) (31.6)

------------------------------------------------------ ------ -------- -------

Cash flow from financing activities

Proceeds from issue of shares (net of transaction

costs) 87.1 0.3

(Repayment)/drawdown of bank borrowings (130.9) 64.6

Repayment of lease liabilities (14.3) (11.2)

Dividends paid to equity holders of the Company - (16.7)

Dividends paid to non-controlling interests - (2.4)

Net cash (outflow)/ inflow from financing activities (58.1) 34.6

------------------------------------------------------ ------ -------- -------

Increase in cash and cash equivalents and bank

overdrafts 27.0 5.5

------------------------------------------------------ ------ -------- -------

Reconciliation of opening to closing cash and

cash equivalents and bank overdrafts

Cash and cash equivalents and bank overdrafts

at beginning of year 47.0 41.6

Translation adjustment (0.4) (0.1)

Increase in cash and cash equivalents and bank

overdrafts 27.0 5.5

------------------------------------------------------ ------ -------- -------

Cash and cash equivalents and bank overdrafts

at end of year* 73.6 47.0

------------------------------------------------------ ------ -------- -------

* Cash and cash equivalents and bank overdrafts is made up of cash

at bank and in hand of GBP119.1m (2020: GBP267.0m) and bank overdrafts

of GBP45.5m (2020: GBP220.0m).

NOTES TO THE FINANCIAL INFORMATION

1. Basis of preparation

The financial information presented in this full year results

statement represents financial information that has been prepared

in accordance with the recognition and measurement principles of

International Financial Reporting Standards (IFRS) and IFRS

Interpretations Committee interpretations adopted by the European

Union (EU). The financial information does not include all the

information required for a complete set of financial statements

prepared in accordance with EU IFRS, however selected explanatory

notes are included to explain events and transactions that are

significant to an understanding of the changes in the Group's

financial position and performance during the year ended 24

September 2021. The financial information is based on the

information included in the audited Consolidated Financial

Statements of Greencore Group plc for the year ended 24 September

2021, to which an unqualified audit opinion is provided. Full

details of the basis of preparation of the Group Financial

Statements for the year ended 24 September 2021 are included in

Note 1 of the FY21 Annual Report.

The financial information is presented in GBP, which is the

functional currency of the Company and presentation currency of the

Group, rounded to the nearest million.

Adoption of IFRS and International Financial Reporting

Interpretations Committee

The Group assessed the impact of new IFRS and amendments to IFRS

that became effective for the current year and is satisfied that

their adoption did not have a material impact on the Group's

results.

The Group has set out further detail in relation to interest

rate benchmark reform in the Borrowings note (note 8).

Going Concern

The Directors, after making enquiries, have a reasonable

expectation that the Group has adequate resources to continue

operating as a going concern for the foreseeable future.

In the current year, the Group's performance continued to be

impacted by COVID-19. This was particularly evident in the first

half of the year with the mobility restrictions that were imposed

by the UK Government significantly impacting consumer demand. As

the UK began to ease mobility restrictions in March 2021, consumer

demand has continued to respond positively. Despite the increased

customer demand, the Group continues to expect ongoing uncertainty

regarding the duration and impact of COVID-19 on the Group's

trading environment and the impact of supply side disruption

arising from capacity constraints including labour availability and

inflation.

Accordingly, the Directors have considered a number of scenarios

for the next 18 months from the date of approval of the Annual

Report. These scenarios consider the estimated potential impact of

further winter restrictions arising from COVID-19 on the business

along with consideration of the impact of supply chain and service

level constraints. Based on current levels of trading and various

durations of mobility restrictions, the impact on revenue, profit

and cashflow are modelled, including the consequential impact on

working capital.

Under each scenario cost and cashflow mitigating actions are

modelled, including a reduction in non-business critical capital

projects and other discretionary cash flow items including no

payment of dividends. The Group has assumed that no significant

structural changes to the business will be needed in any of the

scenarios modelled.

The Group's scenarios assume:

-- A base case projection which is based on the Group's FY22 budget and strategic plan;

-- A downside scenario is applied to the base case, which

assumes the occurrence of winter restrictions arising as a result

of COVID-19 in H1 FY22 and the financial impact of several material

supply side disruptions; and

-- A severe downside scenario, assuming a longer period of

winter restrictions and more severe supply side disruptions. In

this scenario further mitigating actions are assumed including, but

not limited to, a further reduction in capital expenditure and

reduction of the indirect costs base.

While the Group is in a net current liability position, the

Group retained financial strength and flexibility at year end, with

cash and undrawn committed bank facilities of GBP433.6m at 24

September 2021 (September 2020: GBP232.0m). In addition, the

directors have taken steps to ensure adequate liquidity is

available to the Group including extending the maturity of the

GBP340m revolving credit facility by one year to January 2026.

Based on these scenarios and the resources available to the

Group, the directors believe the Group has sufficient liquidity to

manage through a range of different cashflow scenarios over the

next 18 months from the date of approval of the annual report. If

the Group were not to achieve these scenarios, the Directors could

consider further engagement with lenders. Accordingly, the

directors adopt the going concern basis in preparing the Group

Financial Statements.

2. Segment Information

Convenience Foods UK & Ireland is the Group's operating

segment, which represents its reporting segment. The segment

incorporates many UK convenience food categories including

sandwiches, salads, sushi, chilled snacking, chilled ready meals,

chilled soups and sauces, chilled quiche, ambient sauces and

pickles and, frozen Yorkshire Puddings as well as the Irish

ingredients trading business.

Revenue earned individually from four customers in Convenience

Foods UK & Ireland of GBP278.1m, GBP168.1m, GBP145.0m and

GBP133.9m respectively represents more than 10% of the Group's

revenue (2020: Revenue earned individually from four customers in

Convenience Foods UK & Ireland of GBP274.4m, GBP168.5m,

GBP146.6m and GBP128.9m respectively represents more than 10% of

the Group's revenue).

The following table disaggregates revenue by product categories

in the Convenience Foods UK and Ireland reporting segment:

2021 2020

GBPm GBPm

Revenue

Food to go categories 842.1 772.9

Other convenience categories 482.7 491.8

---------------------------------------------------- -------- --------

Total revenue for Convenience Foods UK and Ireland 1,324.8 1,264.7

---------------------------------------------------- -------- --------

Food to go categories includes sandwiches, salads, sushi and

chilled snacking while the other convenience categories include

chilled ready meals, chilled soups and sauces, chilled quiche,

ambient sauces and pickles, and frozen Yorkshire Puddings as well

as the Irish Ingredients trading business.

3. Seasonality

The Group's convenience foods portfolio is seasonal in nature

with the Group's business being weighted towards the second half of

the year. This weighting is primarily driven by weather and

seasonal buying patterns. While the split of revenue of the Group

in the current year is second half weighed and aligns to the

historic performance of the Group, the Group notes in the current

year that the weighting also aligns to the lifting of the

restrictions in the UK. In the prior year, due to the impact of

COVID-19, the normal seasonality of the business was significantly

impacted.

Total revenue Total revenue

H1 H2 Full H1 H2 Full

FY21 FY21 Year FY20 FY20 Year

GBPm GBPm GBPm GBPm GBPm GBPm

------------------ ------ ------ -------- ------ ------ --------

Reported revenue 577.1 747.7 1,324.8 712.7 552.0 1,264.7

------------------ ------ ------ -------- ------ ------ --------

Food to go Other convenience

categories categories

H1 H2 Full H1 H2 Full

FY21 FY21 Year FY21 FY21 Year

GBPm GBPm GBPm GBPm GBPm GBPm

------------------ ------ ------ ------ ------- ------- ------

Reported revenue 339.2 502.9 842.1 237.9 244.8 482.7

------------------ ------ ------ ------ ------- ------- ------

4. Exceptional Items

Exceptional items are those which should be disclosed separately

by virtue of their nature or amount. Such items are included within

the Group Income Statement caption to which they relate.

The Group reports the following exceptional items:

2021 2020

GBPm GBPm

---------------------------------------------- ----- ------ -------

Profit on disposal of Molasses trading (A)

businesses 11.3 -

Legacy defined benefit pension schemes (B)

restructuring charge (4.0) -

Non-core property related income/(charges) (C) 3.3 (8.2)

Legacy business provisions (D) 1.1 2.2

Transaction and integration costs (E) - (2.9)

Inventory and plant and equipment impairment (E) - (4.8)

Restructuring costs (E) - (2.0)

Debt restructuring and modification (E) - (7.1)

Total exceptional items before taxation 11.7 (22.8)

Tax on exceptional items 0.4 2.3

------------------------------------------------------ ------ -------

Total exceptional items 12.1 (20.5)

------------------------------------------------------ ------ -------

(A) Profit on disposal of Molasses trading businesses

On 2 December 2020, the Group completed the disposal of its

interest in the Molasses trading businesses recognising a profit on

disposal of GBP7.3m for Premier Molasses Company within operating

profit, and GBP4.0m for United Molasses (Ireland) Limited, which

has been recognised within profit on disposal of associates.

Further details on the disposal are set out in Note 11.

(B) Legacy defined benefit pension schemes restructuring charge

During the year, the Group reached agreement with the Trustees

of its three Irish legacy defined benefit pension schemes to

consolidate its Irish legacy defined benefit obligations into one

pension scheme. This required the wind up of the two smaller

schemes and transfer of deferred beneficiaries to the remaining

larger scheme. Gross pension liabilities of GBP15.0m were

eliminated due to the settlement of pensioner obligations through

the purchase of annuities. At 24 September 2021, the transfer

process had substantially completed and the Group recognised a

settlement charge of GBP2.8m for those deferred beneficiaries who

availed of the option to transfer out of the scheme. The Group also

incurred GBP1.2m of costs associated with the restructure. Details

of the restructure are set out at Note 9.

(C) Non-core property related income/(charges)

In September 2021, the Group disposed of an investment property

at Corby, Northamptonshire, UK. Prior to disposal, an assessment

was performed of the recoverable value being the fair value less

costs to sell versus the carrying value of the asset. This

assessment resulted in a reversal of an impairment taken in a

previous year with a credit of GBP3.3m being recognised in the

current year.

In the prior year, the Group completed a review of property

assets held across the Group to assess their recoverable value in

line with the requirements of IAS 36 Impairment of Assets. This

resulted in a charge of GBP8.2m being recorded for impairment of

investment properties and property, plant and equipment.

(D) Legacy business provisions

During the current year, the Group recognised a net credit of

GBP1.1m relating to legacy provisions and discontinued operations.

The net credit primarily related to a legacy US legal case which

settled in the period resulting in a provision release. In

addition, the Group recognised charges for remediation for certain

of the Group's properties.

In the prior year, the Group recognised a credit of GBP2.2m on

the settlement of a legacy US legal case, as an amount was

recovered under a group insurance policy.

(E) Other exceptional items

The disclosures in relation to exceptional items that occurred

in the prior year which have no comparative in the current year are

disclosed in the FY21 Annual Report.

Cash flow on exceptional items

The total net cash outflow during the year in respect of

exceptional charges was GBP3.3m (2020: GBP10.1m), of which GBP2.9m

was in respect of prior year exceptional charges. The net proceeds

from the disposal of the Molasses trading businesses of GBP16.3m

and the disposal of the investment property at Corby of GBP6.3m,

have been recognised separately on the Group Statement of Cash

Flows within investing activities.

5. Finance income and finance costs

2021 2020

GBPm GBPm

--------------------------------------------------------- ------- -------

Finance income

Interest on bank deposits - 0.1

Foreign exchange on inter-company and external balances 0.1 -

where hedge accounting is not applied

--------------------------------------------------------- ------- -------

Total finance income 0.1 0.1

--------------------------------------------------------- ------- -------

Finance costs

Finance costs on cash and cash equivalents, borrowings

and other financing costs (15.0) (14.8)

Interest on lease obligations (1.3) (1.2)

Net pension financing charge (1.7) (1.9)

Unwind of discount on liabilities (0.1) (0.1)

Change in fair value of derivatives and related debt

adjustment (1.0) 1.1

Foreign exchange on inter-company and external balances

where hedge accounting is not applied - (0.4)

--------------------------------------------------------- ------- -------

Total finance costs recognised in the Group Income

Statement before exceptional items (19.1) (17.3)

--------------------------------------------------------- ------- -------

Exceptional items

Debt restructuring and modification - (7.1)

--------------------------------------------------------- ------- -------

Total exceptional finance costs recognised in the Group

Income Statement - (7.1)

--------------------------------------------------------- ------- -------

Total finance costs (19.1) (24.4)

--------------------------------------------------------- ------- -------

6. Earnings per Ordinary Share

The Group raised GBP90m by way of an equity placing which

completed on 26 November 2020. The Group issued 80,357,142 Ordinary

Shares in the Company on the London Stock Exchange, at a placing

price of 112 pence per Ordinary Share. The effect of this on the

weighted average number of shares for FY21 was an increase of

66,707,436 shares.

Numerator for Earnings per Share Calculations

2021 2020

GBPm GBPm

----------------------------------------------------- ------ -------

Profit/(loss) attributable to equity holders of the

Company 25.4 (11.5)

----------------------------------------------------- ------ -------

Denominator for Basic Earnings Per Share Calculations

2021 2020

'000 '000

-------------------------------------------------------- -------- --------

Shares in issue at the beginning of the year 446,157 446,007

Effect of shares held by Employee Benefit Trust (1,116) (2,235)

Effect of shares issued in equity placing in the year 66,707 -

Effect of shares issued during the year 16 112

-------------------------------------------------------- -------- --------

Weighted average number of Ordinary Shares in issue

during the year 511,764 443,884

-------------------------------------------------------- -------- --------

Dilutive effect of share awards 660 1,180

-------------------------------------------------------- -------- --------

Weighted average number of Ordinary Shares for diluted

earnings per share 512,424 445,064

-------------------------------------------------------- -------- --------

2021 2020

pence pence

--------------------------------------- ------- -------

Basic earnings per Ordinary Share 5.0 (2.6)

--------------------------------------- ------- -------

Diluted earnings per Ordinary Share 5.0 (2.6)

--------------------------------------- ------- -------

7. Impairment of goodwill, intangible assets and property, plant and equipment

The Group performed an impairment test on the carrying value of

goodwill (GBP449.4m) at 24 September 2021 using a value in use

model to determine the recoverable amount. The recoverable amount

had significant headroom above the carrying value and therefore, no

impairment was recorded (2020: GBPnil). There was also no

impairment of intangible assets (2020: GBP0.2m). There was an

impairment of GBP4.4m recorded on property, plant and equipment

following a comprehensive review of assets during the year (2020:

GBP6.1m).

8. Borrowings

2021 2020

GBPm GBPm

-------------------------- -------- --------

Bank overdrafts (45.5) (220.0)

Bank borrowings (150.1) (283.5)

Private placement notes (106.6) (114.0)

---------------------------- -------- --------

Total borrowings (302.2) (617.5)

---------------------------- -------- --------

Bank Borrowings

The Group's bank borrowings, net of finance fees comprised of

GBP150.1m at 24 September 2021 (September 2020: GBP283.5m) with

maturities to January 2026. During the year, the Group refinanced

the GBP50m bilateral loan which had been due to mature in January

2022 to a new three- year term maturing in January 2024. The Group

had GBP360.0m (September 2020: GBP185.0m) of undrawn committed bank

facilities in respect of which all conditions precedent had been

met. Uncommitted facilities undrawn at 24 September 2021 amounted

to GBP6.7m (September 2020: GBP7.0m). The Group secured an

additional GBP45.0m three year committed bank facility in June

2021, which was drawndown in October 2021. The Group also extended

the maturity of its GBP340.0m revolving credit facility by one year

to January 2026.

Private Placement Notes

The Group's outstanding Private Placement Notes net of finance

fees comprised of GBP106.6m (denominated as $120.9m and GBP18m) at

24 September 2021 (2020: GBP114.0m, denominated as $120.9m and

GBP18m). These were issued as fixed rate debt in October 2013

($65m) and June 2016 ($55.9m and GBP18m).

The Group swapped the $120.9m Private Placement Notes from fixed

rate US Dollar to fixed rate sterling using cross-currency interest

rate swaps. The fixed rate US dollar to fixed rate sterling swaps

are designated as cash flow hedges.

Subsequent to the year end, the Group repaid the fixed rate debt

of $65m in October 2021.

Reconciliation of movements of liabilities to cash flows arising

from financing activities

The reconciliation of the movement in the Group's liabilities to

cash flows arising from financing activities is included below. In

addition, the Group has presented the movement in the Group's cash

and cash equivalents and bank overdrafts to present the movement in

the Group's overall net debt for the year.

At Translation At

25 September Cash and non-cash 24 September

2020 flow adjustments 2021

GBPm GBPm GBPm GBPm

-------------------------------------- -------------- ------ -------------- --------------

Bank borrowings (283.5) 130.9 2.5 (150.1)

Private Placement Notes (114.0) - 7.4 (106.6)

Lease liabilities (60.7) 15.6 (14.5) (59.6)

Total changes in liabilities arising

from financing activities (458.2) 146.5 (4.6) (316.3)

-------------------------------------- -------------- ------ -------------- --------------

Cash and cash equivalents and

bank overdrafts 47.0 27.0 (0.4) 73.6

-------------------------------------- -------------- ------ -------------- --------------

Net Debt (411.2) 173.5 (5.0) (242.7)

-------------------------------------- -------------- ------ -------------- --------------

Net debt excluding the impact of lease liabilities is used by

the Group for the purpose of calculating leverage under the Group's

financing agreements. The movement in net debt excluding lease

liabilities represents a decrease in net debt of GBP167.4m to

GBP183.1m at 24 September 2021 and is set out in the Alternative

Performance Measures section of this Results Statement on page

23.

Covenants

The Group secured agreement with its bank lending syndicate and

Private Placement Noteholders to waive the Net Debt to EBITDA

covenant condition for the March 2021 test period and amend the Net

Debt to EBITDA covenant condition for the June 2021 test period.

There was a return to normal operating covenant conditions at

September 2021 and the Group was in compliance with all

conditions.

IBOR Reform - Transition to new benchmark interest rates

In response to the transition to new benchmark interest rates,

the Group identified all contracts with reference to LIBOR within

the business and appointed a project team to ensure a smooth

transition to alternative benchmark rates. To date, the Group has

updated all of its floating rate bank borrowing facility agreements

to include appropriate transition language from GBP LIBOR to SONIA

and closed out all existing GBP LIBOR interest rate swaps