Private placement of secured notes and investment grade credit rating (1737449)

29 September 2023 - 4:00PM

UK Regulatory

Global Ports Holding PLC (GPH)

Private placement of secured notes and investment grade credit rating

29-Sep-2023 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

Global Ports Holding Plc

Private placement of secured notes and investment grade credit rating

Global Ports Holding Plc ("GPH" or "Group"), the world's largest independent cruise port operator, is pleased to

announce that it has issued USD 330 million of secured private placement notes ("Notes") to insurance companies and

long-term asset managers at a fixed coupon of 7.87%.

The Notes have received an investment grade credit rating from two rating agencies and will fully amortize over 17

years, with a weighted average maturity of c13 years.

The majority of the proceeds have been used to repay in full the outstanding senior secured loan from Sixth Street,

including early repayment fees and accrued interest. The balance of proceeds from the Notes will primarily be used to

fund further Caribbean expansion and the payment of transaction costs.

This financing generates material savings of cash interest expenses and creates a stable, long-term funding base for

the Group. Further, it secures the financing of our growth pipeline.

Global Ports Holding, Co-Founder, Chief Executive Officer and Chairman Mehmet Kutman, said:

"I am delighted that we have reached an agreement with a number of insurance companies, all leading institutions in

the private placement market. Our strategy and the effectiveness of our approach are firmly endorsed by the investment

grade credit ratings achieved for the Notes and we look forward to using this additional capital to continue to

successfully expand our business. I would like to thank our investors for their support of GPH and our management

team."

Global Ports Holding, Chief Financial Officer Jan Fomferra, said:

"The achievement of an investment grade credit rating for these Notes is a testament to the unique strength of our

business model and supports our financing capacity. This financing arrangement will allow us to finance our anticipated

investments in new port expansion projects while also lowering our interest expenses and lengthening the maturity

profile of our debt. I want to also thank our investors as well as our advisors for the success of the debt placing."

CONTACT

For investor, analyst and financial media enquiries: For media enquiries:

Investor Relations Global Ports Holding

Martin Brown Ceylan Erzi

Telephone: +44 (0) 7947 163687 Telephone: +90 212 244 44 40

Email: martinb@globalportsholding.com Email: ceylane@globalportsholding.com

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement that contains inside

information in accordance with the Market Abuse Regulation (MAR),

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BD2ZT390

Category Code: IOD

TIDM: GPH

LEI Code: 213800BMNG6351VR5X06

Sequence No.: 274703

EQS News ID: 1737449

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1737449&application_name=news

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

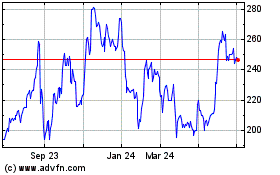

Global Ports (LSE:GPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

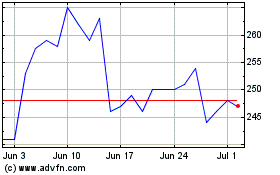

Global Ports (LSE:GPH)

Historical Stock Chart

From Apr 2023 to Apr 2024