Grainger PLC Trading Update (6979O)

05 October 2023 - 5:00PM

UK Regulatory

TIDMGRI

RNS Number : 6979O

Grainger PLC

05 October 2023

5 October 2023

Grainger plc

("Grainger", the "Group", or the "Company")

POST-CLOSE TRADING UPDATE

Another year of record delivery:

Acceleration in rental growth and sales

-- Five new schemes completed

-- Like-for-like PRS rental growth 8.0%

-- Record occupancy 98.6% (PRS)

-- GBP194m of sales, including,

-- GBP70m of vacant regulated sales

Grainger plc, the UK's largest listed provider of private rental

homes with an operational portfolio of c.10,000 rental homes and a

further c.6,000 build-to-rent homes in the pipeline, today provides

a post-close trading update for the twelve months to the end of

September 2023. The Company will announce its full year financial

results on 22 November 2023.

Helen Gordon, Chief Executive of Grainger, said:

"Our strong performance in delivering rental growth has

continued through the remainder of our financial year. The team

continue to deliver exceptional operational performance across all

areas of the business and particularly in the completion and lease

up of our new schemes. Sales remain robust, valuations continue to

demonstrate resilience, and our balance sheet remains strong. We

continue to successfully execute on our growth plans which will see

our post tax EPRA earnings double in the next three years.

"This year is another year of record delivery of new homes for

Grainger. We are due to complete over 1,600 new build-to-rent homes

in 2023, driving a further step change in EPRA earnings and

bringing our total operational portfolio to over 10,000 homes.

"We are delivering these new homes into one of the strongest

occupational markets we have seen. Current leasing at our

newly-opened schemes is exceeding underwriting and we continue to

drive a step up in rental income across our national portfolio.

However, we remain mindful of protecting our customers' rental

affordability and, therefore, continue to ensure that rental growth

across our portfolio moves broadly in line with wage inflation.

"Our strong operational performance is coupled with a strong

balance sheet, positioning us well in the current market. We have

fixed the cost of our debt in the mid 3%'s for the next five years.

Our asset recycling programme continues at an elevated level in

line with our previously reported plans."

Our market-leading operational platform is a competitive

differentiator and continues to deliver significant value:

* Like-for-like rental growth continues to build:

o Total like-for-like rental growth: 7.7% (HY23: 6.8%)

o PRS like-for-like rental growth: 8.0% (HY23: 6.9%)

9.2% (HY23: 8.2%)

* New Lets:

7.2% (HY23: 6.1%)

* Renewals:

o Regulated tenancy like-for-like rental 5.9% (HY23: 5.8%)

growth:

* Occupancy in our stabilised PRS portfolio remains at

record-high levels

o Spot occupancy at the end of September: 98.6% (HY23: 98.5%)

-- Vacant sales from our Regulated Tenancy Portfolio are

performing well, with prices achieved within c.2% of September 2022

valuations.

-ENDS-

For further information:

Grainger plc

Helen Gordon / Rob Hudson / Kurt Mueller

London Office Tel: +44 (0) 20 7940 9500

Camarco (Financial PR adviser)

Ginny Pulbrook / Geoffrey Pelham-Lane Tel: +44 (0) 20 3757

4992/4985

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBBBDGCGGDGXS

(END) Dow Jones Newswires

October 05, 2023 02:00 ET (06:00 GMT)

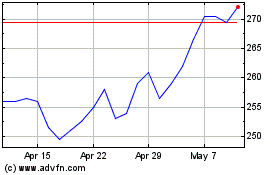

Grainger (LSE:GRI)

Historical Stock Chart

From Feb 2025 to Mar 2025

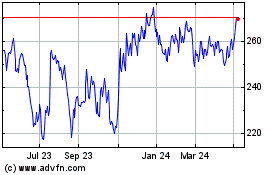

Grainger (LSE:GRI)

Historical Stock Chart

From Mar 2024 to Mar 2025