TIDMHOT

RNS Number : 4833I

Henderson Opportunities Trust PLC

19 June 2017

Legal Entity Indentifier (LEI): 2138005D884NPGHFQS77

HERSON OPPORTUNITIES TRUST PLC

Financial Report for the Half Year ended 30 April 2017

FINANCIAL HIGHLIGHTS (Unaudited) (Unaudited) (Audited)

30 April 30 April 31 October

2017 2016 2016

------------------------------------ ------------ ------------ -------------------------

Net Asset Value per ordinary share 1,131.9p 974.8p 997.2p

Ordinary share price 962.5p 830.0p 823.0p

Discount 15.0% 14.9% 17.5%

Total return per ordinary share 148.2p (24.7p) 3.2p

Revenue return per ordinary share

- basic and diluted 10.1p 10.3p 20.5p

Dividends per ordinary share 6.0p 5.5p 19.0p

Net Gearing(1) 15.9% 18.1% 14.0%

(1) The net gearing percentage reflects the amount of borrowings

(bank loans or overdrafts) the Company has used to invest in the

market less cash and investment cash funds, divided by net assets

multiplied by 100.

TOTAL RETURN PERFORMANCE

(including dividends reinvested and excluding transaction costs)

------------------------------------------------------------------------------

6 Months 1 Year 3 Years 5 Years

% % % %

Net asset value per ordinary

share (1) 14.9 18.2 26.8 114.8

Benchmark Index(2) 7.1 20.1 21.8 58.6

Share Price (3) 18.6 18.4 11.9 142. 8

Sector Average NAV(4) 13.6 18.4 26.8 86. 8

Sources: Morningstar for the AIC, Datastream

1. Net Asset Value (NAV) per ordinary share total return with

income reinvested

2. FTSE All-Share Index total return

3. Share price total return using mid-market closing price

4. Average NAV of the AIC UK All Companies Sector with income

reinvested

For further information please

contact:

James Henderson Peter Jones

Fund Manager Chairman

Janus Henderson Investors Henderson Opportunities Trust

Telephone: 020 7818 4370 plc

Telephone: 020 7818 4082

INTERIM MANAGEMENT REPORT

CHAIRMAN'S STATEMENT

Performance

In the six months to 30 April 2017, the Company's net asset

value ('NAV') increased by 14.9% on a total return basis, compared

to an increase of 7.1% in our benchmark, the FTSE All-Share Index.

The outperformance resulted from a recovery in smaller company

share prices after a period of relative weakness last year. At the

half year the Company's share price stood at a 15% discount to NAV,

reflecting a modest improvement on the position at the start of the

financial year.

Gearing

During the period, gearing averaged 16.0%, which has been

significantly beneficial to performance in a period of robust

market growth. At the half year gearing stood at 15.9%. The Board's

current policy is to allow the Fund Managers to gear up to 25% of

net assets at the time of drawdown, although a more cautious

approach is preferred during periods of market uncertainty or

volatility. Our current borrowing facility allows for up to

GBP20million of debt, and we do not anticipate any requirement to

adjust this in the near term.

Share Capital

As at 30 April 2017 there were 8,000,858 shares in issue, there

having been no change in share capital in the period under review.

Notwithstanding the discount to NAV we have not engaged in any

share buy-backs as we believe this would reduce demand over the

longer term.

Dividend

An interim dividend of 6.0 pence per ordinary share (2016: 5.5

pence) has been declared payable on 22 September 2017 to

shareholders on the register of the Company on 18 August 2017.

Investment Manager

The Board have noted the merger of Henderson Group plc with

Janus Capital Group Inc effective on 30 May 2017. This will not

lead to any change of personnel responsible for the day to day

management of your Company.

Outlook

The outcome of the General Election on 8th June was not the one

expected when the campaign began but, from a portfolio perspective,

it should not necessarily be seen negatively. The prospects for a

'soft Brexit' have almost certainly improved and if, as seems

likely, there is now an imperative to retain an open border in

Ireland, this could arguably require that the UK remains part of

the single market. Although inevitable political uncertainty will

discourage some investment, the obverse may well be increased

public spending and continuing sterling weakness, both of which

might be viewed positively by many UK businesses.

Ultimately our portfolio's performance will of course reflect

the companies we pick and the excellent products and services they

deliver. Regardless of any near term political uncertainty we will

therefore continue to concentrate on holding companies that clearly

evidence these attributes.

Peter Jones

Chairman

19 June 2017

FUND MANAGERS' REPORT

Investment Background

Following hot on the heels of the UK's Brexit vote another

unexpected voter response was the election of Donald Trump as the

new US President. Global markets took political surprises in their

stride with investors focusing on the positive business and

economic factors. In the period under review, the UK economy has

continued to perform well in general, although a squeeze is

apparent for UK consumers as inflation from last year's sterling

devaluation feeds through into higher prices at the tills. The US

has been helped by moves to normalise monetary policy. In Europe

the economy is growing on a broad front finally emerging from the

impact of the global financial crisis, whereas Chinese growth

threatens to stall somewhat.

Fund Performance

The Company has had a good six months with the NAV total return,

i.e. including income, of 14.9% against a benchmark FTSE All-Share

Index which rose by 7.1%. The share price rose by 18.6% adjusting

for income. Post the US election, markets have been in an ebullient

mood with most major indices making strong advances. This backdrop,

together with very low market volatility, has favoured a return to

more targeted small and medium size company investing where

underlying growth prospects are typically better than the global

mature giants which investors had retreated to post the Brexit

vote.

Portfolio Activity

In the half year under review we have been active in buying or

selling in 40 companies (44 last year) of which 4 were complete

exits (13) while we started 10 new positions (8) bringing our total

number of holdings of value to 93.

Portfolio Attribution Analysis

Top Five

Blue Prism, robotic software automation, has been a stunning

success since IPO in March 2016 at 78p. Repeated upgrades to

revenue and new business forecasts have been catalysts. Keywords

Studios, an IPO from July 2013, had an awkward birth as a public

company. Involved in language, art and testing services to the

global video games industry good organic growth supplemented by

acquisitions in a fragmented industry has produced a stream of

profit upgrades. One of the smaller stocks is Serica Energy, North

Sea oil and gas production, where production and cash flow have

exceeded expectations from the 2014 acquisition of BP's interest in

the Erskine field. Conviviality Retail is a drinks wholesaler and

convenience retailer, which has been transformed from IPO in 2013

by the acquisition of Matthew Clark and Bibendum, driving material

synergies and growth. XP Power, electrical power supplies, has seen

all end markets improve and profits exceed forecasts.

Bottom Five

4D Pharma, the live bio therapeutics company, was our largest

holding but has fallen sharply recently. News flow from the company

has been as expected and the best we can say is that the bio tech

space is subject to large sentiment swings. The holding has added

considerable value since acquisition. The total investment in the

company has been GBP1.4m and sales made have come to GBP2.2m. The

holding at the period end was worth GBP2.6m. Atlantis, the tidal

power generation play, has successfully brought on stream its first

project in Scotland, however, the Government has moved the

goalposts for renewable energy support which will result in lower

returns on future projects. The company is exploring alternative

projects and locations including overseas. NAHL, a marketing and

legal services business, has re-aligned its business model to the

changing landscape of small claims and personal injury. We are

confident that waiting for this to play out will be well rewarded.

Imagination Technologies, fell sharply as its largest customer,

Apple, determined not to use their IP in future versions of the

iPhone. Until the future direction becomes clearer we will retain

our position. Lastly, IG, a global leader in online trading

including CFDs, was hit last year with the rest of the industry

when European and UK Regulators decided to consult on ways in which

certain aspects of the market operated. IG as the market leader is

fully engaged in this process. We await the outcome.

Outlook

There are over 1,000 stocks quoted in the UK on the main market

or on AIM that we could invest in. Amongst these stocks there are

many companies that in time will be substantially bigger businesses

than they are today. We try and blend companies that have different

operational drivers into a mix that will give good growth at a

reduced level of volatility. It is by paying attention to what

companies say and do that allows us to build a diverse list of

excellent stocks that can grow strongly over time. We will retain a

mix of large, medium and small companies. We will keep holding a

relatively long list of stocks which dilutes the impact of those

stocks which encounter difficulties. It is some of these stocks

though that will produce the most substantial returns over

time.

James Henderson and Colin Hughes

Fund Managers

19 June 2017

Principal Risks and Uncertainties

The principal risks and uncertainties associated with the

Company's business can be divided into various areas:

-- Investment activity and strategy;

-- Financial instruments and the management of risk;

-- Operational;

-- Accounting, legal and regulatory;

-- Liquidity;

-- Net gearing; and

-- Failure of the Manager.

Detailed information on these risks is given in the Strategic

Report and in the Notes to the Financial Statements in the

Company's latest Annual Report for the year to 31 October 2016.

In the view of the Board these principal risks and uncertainties

are as applicable to the remaining six months of the financial year

as they were to the six months under review.

Directors' Responsibility Statement

(Disclosure GUIDANCE and Transparency Rule (DTR) 4.2.10R)

The Directors confirm that, to the best of their knowledge:

-- the condensed set of financial statements has been prepared

in accordance with "FRS 104 Interim Financial Reporting";

-- the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and the principal risks and

uncertainties for the remaining six months of the year); and

-- the interim management report and financial statements

include a fair review of the information required by DTR 4.2.8R

(disclosure of related party transactions and changes therein).

For and on behalf of the Board

Peter Jones

Chairman

19 June 2017

INVESTMENT PORTFOLIO at 30 April 2017

Company Valuation Portfolio Company Valuation Portfolio

GBP'000 % GBP'000 %

------------------------- ---------- --------------------- ------------------------ ---------- ----------------

RWS(1) 3,352 3.2 GKN 897 0.9

Blue Prism(1) 2,708 2.6 NAHL(1) 888 0.8

Micro Focus 2,662 2.5 Eurocell 873 0.8

Keywords Studios(1) 2,642 2.5 Accrol(1) 872 0.8

4D Pharma(1) 2,638 2.5 Ubisense(1) 871 0.8

HSBC 2,582 2.5 Prudential 858 0.8

Conviviality Retail(1) 2,472 2.4 Joules(1) 831 0.8

Ricardo 2,457 2.3 SDX Energy(1) 806 0.8

XP Power 1,982 1.9 Luceco 804 0.8

Clinigen(1) 1,837 1.7 Dairy Crest 718 0.7

Ten Largest 25,332 24.1 Sixty Largest 87,223 83.1

Vertu Motors(1) 1,821 1.7 Hollywood Bowl 710 0.7

Redde(1) 1,780 1.7 On The Beach 692 0.7

Tracsis(1) 1,722 1.7 Ted Baker 691 0.7

SDL 1,702 1.6 Sportech 687 0.7

Assura 1,684 1.6 Servelec 677 0.7

Faroe Petroleum(1) 1,671 1.6 Quantum Pharma(1) 672 0.6

Johnson Matthey 1,639 1.6 Redcentric(1) 671 0.6

Tarsus 1,612 1.6 Miton(1) 647 0.6

Senior 1,608 1.5 Ilika(1) 645 0.6

ITV 1,575 1.5 CML Microsystems 645 0.6

Twenty Largest 42,146 40.2 Seventy Largest 93,960 89.6

Tribal(1) 1,564 1.5 Countryside Properties 641 0.6

Rio Tinto 1,531 1.5 Freeagent(1) 570 0.6

Cohort(1) 1,522 1.4 Oxford Biodynamics(1) 566 0.5

Safestyle(1) 1,496 1.4 Xaar 563 0.5

Standard Chartered 1,442 1.4 Electric Word(1) 557 0.5

Royal Dutch Shell

'B' shares 1,437 1.4 IG 543 0.5

International

Consolidated

Airlines 1,400 1.3 Velocys(1) 538 0.5

Serica Energy(1) 1,387 1.3 Medica 515 0.5

Ebiquity(1) 1,328 1.3 Vodafone 498 0.5

Workspace 1,297 1.2 Berkeley Energia(1) 494 0.5

Thirty Largest 56,550 53.9 Eighty Largest 99,445 94.8

Oxford Instruments 1,293 1.2 Oxford Pharmascience(1) 481 0.5

Revolution Bars 1,226 1.2 Pearson 479 0.5

Gateley(1) 1,222 1.2 Lakehouse 478 0.5

Rolls Royce 1,218 1.2 Fidessa 473 0.4

Burberry 1,210 1.1 WYG(1) 465 0.4

Atlantis(1) 1,185 1.1 Xafinity 456 0.4

BHP Billiton 1,175 1.1 Plexus(1) 444 0.4

IP 1,161 1.1 Alpha FX(1) 431 0.4

Flowtech(1) 1,146 1.1 Premier Oil 413 0.4

Horizon Discovery(1) 1,142 1.1 Digital Barrier(1) 378 0.4

Forty Largest 68,528 65.3 Ninety Largest 103,943 99.1

Loopup(1) 1,140 1.1 SCS 377 0.4

Oxford Sciences

Up Global Sourcing 1,115 1.1 Innovation(2) 333 0.3

Imagination

The Gym Group 1,081 1.0 Technologies 252 0.2

hVIVO(1) 1,081 1.0

Character(1) 1,080 1.0

Learning Technologies(1) 1,036 1.0

Be Heard(1) 979 0.9

Aveva 955 0.9

Benchmark(1) 910 0.9

Van Elle(1) 900 0.9

Fifty Largest 78,805 75.1 Total 104,905 100.0

(1) Quoted on the Alternative Investment

Market ('AIM') (2) Unlisted

Attribution Analysis

The table below sets out the top and bottom five contributors to

NAV.

Top Five Contributors Share Price Contribution

Return % to NAV %

Blue Prism 122.3 +1.8

Keywords Studios 86.0 +1.4

Serica Energy 129.0 +0.9

Conviviality Retail 50.6 +0.9

XP Power 58.8 +0.8

Bottom Five Contributors Share Price Contribution

Return % to NAV %

4D Pharma -57.0 -3.6

Atlantis -29.1 -0.6

NAHL -34.1 -0.5

Imagination Technologies -63.4 -0.4

IG -33.0 -0.4

Analysis by Index

Index FTSE All-Share Portfolio

Index % %

---------------- --------------- ----------

FTSE 100 79.5 19.5

FTSE 250 16.9 9.3

FTSE SMALLCAP 3.6 13.5

FTSE FLEDGLING - 2.0

FTSE AIM - 49.2

OTHER - 6.5

Total 100.0 100.0

Analysis by Market Capitalisation

Index FTSE All-Share Portfolio

Index % %

--------------------- --------------- ----------

Greater than GBP2bn 89.1 19.6

GBP1bn - GBP2bn 5.3 7.3

GBP500m - GBP1bn 3.3 14.1

GBP200m - GBP500m 1.9 24.9

GBP100m - GBP200m 0.4 17.9

GBP50m - GBP100m - 11.8

Less than GBP50m - 4.4

Total 100.0 100.0

Source: Factset

CONDENSED INCOME STATEMENT

(Unaudited) (Unaudited) (Audited)

Half Year ended Half Year ended Year ended

30 April 2017 30 April 2016 31 October 2016

Revenue Capital Revenue Capital Revenue Capital

return return Total return return Total return return Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- --------- --------- --------- --------- --------- --------- --------- --------- ---------

Gains/(losses)

from investments

held at fair

value through

profit or loss - 11,283 11,283 - (2,562) (2,562) - (941) (941)

Income from

investments

held at fair

value through

profit or loss 1,053 - 1,053 1,058 - 1,058 2,099 - 2,099

Interest

receivable

and other income 12 - 12 5 - 5 25 - 25

--------- --------- --------- --------- --------- --------- --------- --------- ---------

Gross revenue

and

capital

gains/(losses) 1,065 11,283 12,348 1,063 (2,562) (1,499) 2,124 (941) 1,183

--------- --------- --------- --------- --------- --------- --------- --------- ---------

Management fee

(note 2) (71) (166) (237) (62) (146) (208) (124) (291) (415)

Performance fee

(note 2) - - - - - - - - -

Administrative

expenses (153) - (153) (144) - (144) (300) - (300)

--------- --------- --------- --------- --------- --------- --------- --------- ---------

Net return/(loss)

on ordinary

activities

before finance

costs and

taxation 841 11,117 11,958 857 (2,708) (1,851) 1,700 (1,232) 468

Finance costs (29) (67) (96) (36) (85) (121) (64) (149) (213)

--------- --------- --------- --------- --------- --------- --------- --------- ---------

Net return/(loss)

on ordinary

activities

before taxation 812 11,050 11,862 821 (2,793) (1,972) 1,636 (1,381) 255

Taxation on net

return on

ordinary

activities (2) - (2) - - - - - -

--------- --------- --------- --------- --------- --------- --------- --------- ---------

Net return/(loss)

on ordinary

activities

after taxation 810 11,050 11,860 821 (2,793) (1,972) 1,636 (1,381) 255

--------- --------- --------- --------- --------- --------- --------- --------- ---------

Return/(loss)

per ordinary

share - basic

and diluted (note

4) 10.12p 138.11p 148.23p 10.26p (34.91p) (24.65p) 20.45p (17.26p) 3.19p

--------- --------- --------- --------- --------- --------- --------- --------- ---------

The total columns of this statement represent the Income

Statement of the Company, prepared in accordance with FRS 104. The

revenue and capital columns are supplementary to this and are

published under guidance from the Association of Investment

Companies.

The Company has no recognised gains or losses other than those

disclosed in the Income Statement and Statement of Changes in

Equity.

All items in the above statement derive from continuing

operations. No operations were acquired or discontinued during the

period.

The accompanying notes are an integral part of the condensed

financial statements.

CONDENSED STATEMENT OF CHANGES IN EQUITY

(Unaudited)

Half Year ended 30 April 2017

Called Share Capital Other

up share premium redemption capital Revenue

capital account reserve reservesGBP'000 reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ---------- --------- ------------ ----------------- ---------- ----------

At 1 November 2016 2,000 14,838 2,431 57,917 2,596 79,782

Dividends paid on

the ordinary shares - - - - (1,080) (1,080)

Net return on ordinary

activities after

taxation - - - 11,050 810 11,860

---------- --------- ------------ ----------------- ---------- ----------

At 30 April 2017 2,000 14,838 2,431 68,967 2,326 90,562

---------- --------- ------------ ----------------- ---------- ----------

(Unaudited)

Half Year ended 30 April 2016

Called Share Capital Other capital

up share premium redemption reserves Revenue

capital account reserve GBP'000 reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ---------- --------- ------------ -------------- ---------- ----------

At 1 November 2015 2,000 14,838 2,431 59,298 2,440 81,007

Dividends paid on

the ordinary shares - - - - (1,040) (1,040)

Net return on ordinary

activities after

taxation - - - (2,793) 821 (1,972)

---------- --------- ------------ -------------- ---------- ----------

At 30 April 2016 2,000 14,838 2,431 56,505 2,221 77,995

---------- --------- ------------ -------------- ---------- ----------

(Audited)

Year ended 31 October 2016

Called Share Capital Other

up share premium redemption capital Revenue

capital account reserve reserves reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ---------- --------- ------------ ---------- ---------- ----------

At 1 November 2015 2,000 14,838 2,431 59,298 2,440 81,007

Dividends paid on

the ordinary shares - - - - 1,480 1,480

Net return on ordinary

activities after

taxation - - - (1,381) 1,636 255

---------- --------- ------------ ---------- ---------- ----------

At 31 October 2016 2,000 14,838 2,431 57,917 2,596 79,782

---------- --------- ------------ ---------- ---------- ----------

The accompanying notes are an integral part of these condensed

financial statements.

CONDENSED STATEMENT OF FINANCIAL POSITION

(Unaudited) (Unaudited) (Audited)

30 April 2017 30 April 2016 31 October

2016 GBP'000

GBP'000 GBP'000

---------------------------------- --------------- --------------- ---------------

Investments held at fair value

through profit or loss

Listed at market value 50,984 46,650 45,570

Quoted on AIM at market value 53,588 46,031 45,174

Unlisted at market value 333 333 333

--------------- --------------- ---------------

104,905 93,014 91,077

--------------- --------------- ---------------

Current assets

Investments held at fair value

through profit or loss (note

5) 2 2 2

Debtors 311 276 201

Cash at bank and in hand 482 948 605

--------------- --------------- ---------------

795 1,226 808

Creditors: amounts falling due

within one year

Bank loans (14,873) (15,048) (11,811)

Other creditors (265) (1,197) (292)

Net current liabilities (14,343) (15,019) (11,295)

--------------- --------------- ---------------

Net assets 90,562 77,995 79,782

--------------- --------------- ---------------

Capital and reserves

Called up share capital (note

7) 2,000 2,000 2,000

Share premium account 14,838 14,838 14,838

Capital redemption reserve 2,431 2,431 2,431

Other capital reserves 68,967 56,505 57,917

Revenue reserves 2,326 2,221 2,596

Total shareholders' funds 90,562 77,995 79,782

--------------- --------------- ---------------

Net asset value per ordinary

share - basic and diluted (note

8) 1,131.9p 974.8p 997.2p

--------------- --------------- ---------------

The accompanying notes are an integral part of these condensed

financial statements.

CONDENSED STATEMENT OF CASH FLOWS

(Unaudited) (Unaudited) (Audited)

Half Year Half Year

ended ended Year ended

30 April 30 April 31 October 2016

2017 2016 GBP'000

GBP'000 GBP'000

------------------------------------------- ------------ ------------ -----------------

Cash flows from operating activities

Net return on ordinary activities

before taxation 11,862 (1,972) 255

Add back: finance costs 96 121 213

(Less)/add (gains)/losses on investments

held at fair value through profit

or loss (11,283) 2,562 941

(Increase)/decrease in debtors (120) (9) 76

Decrease in creditors (36) (783) (748)

------------ ------------ -----------------

Net cash inflow/(outflow) from operating

activities 519 (81) 737

Cash flows from investing activities

Purchase of investments (9,533) (7,361) (18,772)

Sale of investments 6,994 9,358 23,386

------------ ------------ -----------------

Net cash (outflow)/inflow from investing

activities (2,539) 1,997 4,614

Cash flows from financing activities

Equity dividends paid (net of refund

of unclaimed distributions and reclaimed

distributions) (1,080) (1,040) (1,480)

Net loans drawn down/(repaid) 3,062 (314) (3,551)

Interest paid (85) (122) (223)

Net cash inflow/(outflow) from financing

activities 1,897 (1,476) (5,254)

Net (decrease)/increase in cash

and cash equivalents (123) 440 97

Cash and cash equivalents at start

of year 605 508 508

Cash and cash equivalents at end

of year 482 948 605

------------ ------------ -----------------

Comprising:

Cash at Bank 482 948 605

------------ ------------ -----------------

The accompanying notes are an integral part of these condensed

financial statements.

NOTES TO THE CONDENSED FINANCIAL STATEMENTS

1 Accounting policies - basis of preparation

The condensed set of financial statements has been prepared in

accordance with FRS 104, Interim Financial Reporting, issued in

March 2015, the revised reporting standard for half-year reporting

that was issued following the introduction of FRS 102, the Financial

Reporting Standard applicable in the UK and Republic of Ireland,

which is effective for periods commencing on or after 1 January

2015. The Statement of Recommended Practice for "Financial Statements

of Investment Trust Companies and Venture Capital Trusts", in

accordance with which the Company's financial statements are also

prepared, was reissued by the Association of Investment Companies

in November 2014 and updated in January 2017 with consequential

amendments.

The condensed set of financial statements has been neither audited

nor reviewed by the Company's auditors.

2 Expenses: management fees and performance fees

Henderson Investment Funds Limited ("HIFL") is appointed to act

as the Company's Alternative Investment Fund Manager. HIFL delegates

investment management services to Henderson Global Investors Limited.

References to the Manager within these results refer to the services

provided by both entities. The management fee is calculated, quarterly

in arrears, as 0.55% per annum on the net assets. Arrangements

are in place for the Manager to earn a performance fee. The cap

on total fees that can be earned in a financial year is 1.5% of

the average net assets over the year. There is no performance

fee accrual for the current period (30 April 2016: GBPnil; 31

October 2016: GBPnil). Since 1 November 2013, the Company has

allocated 70% of its management fees and finance costs to the

capital return of the Income Statement with the remaining 30%

being allocated to the revenue return. Performance fees payable

are allocated 100% to the capital return.

3 Dividends

The Board has declared an interim dividend of 6.0p per ordinary

share (2016: 5.5p), to be paid on 22 September 2017 to shareholders

on the Register at the close of business on 18 August 2017. The

ex-dividend date will be 17 August 2017. Based on the number of

ordinary shares in issue on 19 June 2017 of 8,000,858, the cost

of this dividend will be GBP480,000.

No provision has been made for the interim dividend in these condensed

financial statements. The final dividend of 13.5p per ordinary

share, paid on 24 March 2017 in respect of the year ended 31 October

2016, has been recognised as a distribution in this period.

4 Return per ordinary share - basic and diluted

(Unaudited) (Unaudited) (Audited)

Half Year ended Half Year Year ended

30 April 2017 ended 31 October

GBP'000 30 April 2016 2016

GBP'000 GBP'000

---------------------------------------- ---------------------------------------- ------------------------------------------

The return

per

ordinary

share

is based on

the

following

figures:

Revenue

return 810 821 1,636

Capital

return 11,050 (2,793) (1,381)

---------------------------------------- ---------------------------------------- ------------------------------------------

Total

return 11,860 (1,972) 255

---------------------------------------- ---------------------------------------- ------------------------------------------

Weighted

average

number of

ordinary

shares in

issue

for the

period 8,000,858 8,000,858 8,000,858

Revenue

return per

ordinary

share 10.12p 10.26p 20.45p

Capital

return per

ordinary

share 138.11p (34.91p) (17.26p)

---------------------------------------- ---------------------------------------- ------------------------------------------

Total

return per

ordinary

share 148.23p (24.65p) 3.19p

---------------------------------------- ---------------------------------------- ------------------------------------------

5 Investments held at fair value through profit of loss

The table below analyses fair value measurements for investments

held at fair value through profit or loss. These fair value measurements

are categorised into different levels in the fair value hierarchy

based on the valuation techniques used and are defined as follows

under FRS 102:

Level 1: valued using quoted prices in active markets for identical

assets

Level 2: valued by reference to valuation techniques using observable

inputs other than quoted prices included in Level 1

Level 3: valued by reference to valuation techniques using inputs

that are not based on observable market date Investments held at fair value Level Level Level Total

through profit or loss at 30 1 2 3 GBP'000

April 2017 (unaudited) GBP'000 GBP'000 GBP'000

-------------------------------- --------- --------- --------- ---------

Investments 104,572 - 333 104,905

Current asset investments 2 - - 2

Total 104,574 - 333 104,907

Investments held at fair value Level Level Level Total

through profit or loss at 30 1 2 3 GBP'000

April 2016 (unaudited) GBP'000 GBP'000 GBP'000

-------------------------------- --------- --------- --------- ---------

Investments 92,681 - 333 93,014

Current asset investments 2 - - 2

Total 92,683 - 333 93,016

Investments held at fair value Level Level Level Total

through profit or loss at 31 1 2 3 GBP'000

October 2016 (audited) GBP'000 GBP'000 GBP'000

-------------------------------- --------- --------- --------- ---------

Investments 90,744 - 333 91,077

Current asset investments 2 - - 2

-------------------------------- --------- --------- --------- ---------

Total 90,746 - 333 91,079

There have been no transfers between levels of the fair value

hierarchy during the period.

The valuation techniques used by the Company are explained in

the accounting policies note in the Company's Annual Report for

the year ended 31 October 2016.

6 Current asset investment

The Company has a holding in Deutsche Global Managed Platinum

Income Fund, a money market fund which is used to invest cash

balances that would otherwise be placed on short term deposit.

At 30 April 2017 this holding had a value of GBP2,000 (30 April

2016: GBP2,000; 31 October 2016: GBP2,000).

7 Called up share capital

There were 8,000,858 ordinary shares of 25p each in issue at 30

April 2017 (30 April 2016 and 31 October 2016: 8,000,858). No

shares were bought back or issued during the period.

8 Net asset value per ordinary share - basic and diluted

The net asset value per ordinary share is based on the net assets

attributable to the ordinary shares of GBP90,562,000 (30 April

2016: GBP77,995,000; 31 October 2016: GBP79,782,000) and on the

8,000,858 ordinary shares of 25p each in issue at 30 April 2017

(30 April 2016: 8,000,858 and 31 October 2016: 8,000,858).

9 Transaction costs

Purchase transaction costs for the half-year ended 30 April 2017

were GBP16,000 (30 April 2016: GBP9,000; 31 October 2016: GBP35,000);

these comprise mainly stamp duty and commissions. Sale transaction

costs for the half-year ended 30 April 2017 were GBP4,000 (30

April 2016: GBP9,000; 31 October 2016: GBP20,000); these comprise

mainly commissions.

10 Related party transactions

The Company's transactions with related parties for the period

were with the Directors, and the Manager. There have been no material

transactions between the Company and its Directors during the

half year other than the amounts paid to them which were in respect

of expenses and remuneration. In relation to the provision of

services by the Manager, other than fees payable by the Company

in the ordinary course of business and the provision of sales

and marketing services there have been no material transactions

with the Manager affecting the financial position of the Company

during the half year period.

11 Going concern

The assets of the Company consist of securities that are readily

realisable and, accordingly, the Directors believe that the Company

has adequate resources to continue in operational existence for

at least twelve months from the date of approval of the financial

statements. Having assessed these factors and the principal risks,

the Board has determined that it is appropriate for the financial

statements to be prepared on a going concern basis.

12 General information

a) Investment Objective:

The Company's objective is to achieve above average capital growth

from investment in a portfolio of predominately UK listed companies.

Investment Portfolio - Asset Allocation: The strategy is to invest

in a concentrated portfolio of shares on an unconstrained basis

across the whole range of market capitalisations. The investment

portfolio is characterised by focus on growth, recovery and 'special

opportunities' company shares which the Fund Managers believe

should achieve the investment objective.

Benchmark: The benchmark is the FTSE All-Share Index.

b) Company Status:

Henderson Opportunities Trust plc is registered in England and

Wales No. 1940906, has its registered office at 201 Bishopsgate,

London EC2M 3AE and is listed on the London Stock Exchange. The

SEDOL number is 0853657. The London Stock Exchange (EPIC) Code

is HOT. The Company's Global Intermediary Identification Number

(GIIN) is LVAHJH.99999.SL.826 and its Legal Entity Identifier

(LEI) is 2138005D884NPGHFQS77.

c) Directors and Secretary:

The Directors of the Company are Peter Jones (Chairman of the

Board), Peter May (Chairman of the Audit Committee), Frances Daley,

Chris Hills and Malcolm King. The Company Secretary is Henderson

Secretarial Services Limited, represented by Melanie Stoner, FCIS.

d) Website:

Details of the Company's share price and net asset value, together

with general information about the Company, monthly factsheets

and data, copies of announcements, reports and details of general

meetings can be found at www.hendersonopportunitiestrust.com.

13 Comparative information

The financial information contained in the half-year financial

report does not constitute statutory accounts as defined in section

434 of the Companies Act 2006. The figures and financial information

for the year ended 31 October 2016 are extracted from the latest

published accounts and do not constitute the statutory accounts

for that year. Those accounts have been delivered to the Registrar

of Companies and included in the report of the independent auditors,

which was unqualified and did not include a statement under either

section 498(2) or 498(3) of the Companies Act 2006.

14 Financial report for the half year ended 30 April 2017

The Half Year Report will be available on the Company's website

or in hard copy from the Company's registered office, 201 Bishopsgate,

London, EC2M 3AE. An abbreviated version of this Report, the 'Update',

will be posted to shareholders in early July 2017.

Neither the contents of the Company's website not the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BBGDLBDBBGRC

(END) Dow Jones Newswires

June 19, 2017 07:25 ET (11:25 GMT)

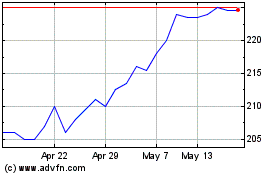

Henderson Opportunities (LSE:HOT)

Historical Stock Chart

From Mar 2024 to May 2024

Henderson Opportunities (LSE:HOT)

Historical Stock Chart

From May 2023 to May 2024