Intermediate Capital Intermediate Capital Group Plc : Q1 Trading Statement For The Three Months Ended 30 June 2023

20 July 2023 - 4:00PM

UK Regulatory

TIDMICP

Fee-earning AUM +2% in the quarter,

positive momentum across ICG platform

Highlights

-- Total AUM of $82.1bn; fee-earning AUM ($64.1bn) +2%

in the quarter, +18% annualised over the last five

years1

-- Fundraising of $2.6bn including $1bn for Strategic

Equity V; $0.6bn for Europe Mid Market II2; and

$0.6bn in Private Debt. Fundraising guidance

maintained

-- Senior Debt Partners V, our flagship direct lending

strategy, performing strongly: nine transactions

totalling EUR2bn signed since December 2022

-- Real Assets franchise building momentum:

Infrastructure II activated at EUR125m third-party

AUM, continuing to fundraise (Infrastructure I:

EUR1.5bn total fund size); first seed investment made

for Infrastructure Asia; ICG Real Estate announced

formation of Metropolitan Last Mile

-- Breadth of ICG platform has supported activity levels

in recent quarters, pipeline building in many

strategies

-- Many opportunities for further growth lie ahead for

ICG: our continued performance and long-term track

record reinforce confidence in our ability to

successfully execute on them

1. AUM growth on a constant currency basis; 2. Europe

Mid Market II is not yet activated or in fee-earning

AUM

Unless otherwise stated the financial results discussed

herein are on the basis of alternative performance

measures (APM) basis unless otherwise stated; see

full year results

Long-term growth

Last five years CAGR(1)

------------------------------- -----------------------

Third-party AUM 19 %

Fee-earning AUM 18 %

1 On a constant currency basis

AUM

30 June 2023 31 March 2023 Change(1)

------------------------------- ------------- -------------- -----------

Total AUM $82.1bn $80.2bn 2 %

Third-party AUM $78.9bn $77.0bn 2 %

Fee-earning AUM $64.1bn $62.8bn 2 %

1 On a constant currency basis

Business

activity

Fundraising Deployment(1) Realisations(1,2)

------------- ------------------- ------------------- ---------------------

Q1 Q1 Q1 Q1

$bn FY24 FY23 LTM FY24 FY23 LTM Q1 FY24 Q1 FY23 LTM

------------- ------ ------ --- ------ ------ --- ------- ------- ---

Structured

and Private

Equity 1.7 2.7 2.5 0.2 0.8 3.7 0.1 0.6 1.8

Private Debt 0.6 0.5 3.9 0.4 1.3 3.6 0.4 1.2 1.1

Real Assets 0.3 0.5 1.0 0.4 0.7 1.4 0.1 0.3 0.8

Credit -- 0.9 1.0

------------- ------ ------ --- ------ ------ --- ------- ------- ---

Total 2.6 4.6 8.4 1.0 2.8 8.7 0.6 2.1 3.7

------------- ------ ------ --- ------ ------ --- ------- ------- ---

1 Direct investment funds; 2 Realisations of third-party

fee-earning AUM

AUM

-- Dry powder of $22.5bn, $14.6bn of which is not yet paying fees and will

do so when the capital is invested or enters its investment period

-- At 30 June 2023, funds that were fundraising included SDP V and SDP SMAs;

Strategic Equity V; North America Credit Partners III; Europe Mid-Market

II; Infrastructure II; LP Secondaries I; Life Sciences I; and various

Real Estate and Credit strategies

Structured

Third-party AUM and Private Private

($m) Equity Debt Real Assets Credit Total

------------------- ----------- ----------- ----------- ------------- -----------

At 31 March 2023 27,728 23,641 7,863 17,755 76,987

------------------- ----------- ----------- ----------- ------------- -----------

Additions 1,696 662 324 19 2,701

Realisations (78) (186) (91) (555) (910)

FX and other (156) (6) 124 139 101

------------------- ----------- ----------- ----------- ------------- -----------

At 30 June 2023 29,190 24,111 8,220 17,358 78,879

------------------- ----------- ----------- ----------- ------------- -----------

Change $m 1,462 470 357 (397) 1,892

Change % 5 % 2 % 5 % (2) % 2 %

Change % (constant

exchange rate) 5 % 1 % 2 % (3) % 2 %

------------------- ----------- ----------- ----------- ------------- -----------

Structured

Fee-earning AUM and Private

($m) Equity Private Debt Real Assets Credit Total

------------------- ----------- ------------ ----------- ------------- -----------

At 31 March 2023 23,840 14,249 6,862 17,898 62,849

------------------- ----------- ------------ ----------- ------------- -----------

Funds raised:

fees on

committed

capital 1,009 -- 147 -- 1,156

Deployment of

funds: fees on

invested

capital 47 419 376 121 963

Total additions 1,056 419 523 121 2,119

Realisations (60) (425) (126) (561) (1,172)

FX and other 110 94 (100) 214 318

------------------- ----------- ------------ ----------- ------------- -----------

At 30 June 2023 24,946 14,337 7,159 17,672 64,114

------------------- ----------- ------------ ----------- ------------- -----------

Change $m 1,106 88 297 (226) 1,265

Change % 5 % 1 % 4 % (1) % 2 %

Change % (constant

exchange rate) 5 % -- % 2 % (2) % 2 %

------------------- ----------- ------------ ----------- ------------- -----------

Balance sheet

-- At 30 June 2023 the balance sheet investment portfolio was valued at

GBP2,894m, broadly flat compared to 31 March 2023 (GBP2,902m)

GBPm 30 June 2023 31 March 2023

----------------------------------- ------------ -------------

Structured and Private Equity 1,737 1,751

Private Debt 163 169

Real Assets 304 289

Credit 351 363

Seed investments 339 330

----------------------------------- ------------ -------------

Balance sheet investment portfolio 2,894 2,902

----------------------------------- ------------ -------------

-- During the period, private placements with a value of GBP51m at 31 March

2023 matured and were repaid from cash resources

-- At 30 June 2023 the Group had total liquidity of GBP1,081m (FY23:

GBP1,100m), cash of GBP531m (FY23: GBP550m) and net financial debt of

GBP919m (FY23: GBP988m)

FOREIGN EXCHANGE RATES

30

June

2023

Average rate Average rate Average rate period 30 June 2022 31 March 2023

Q1 FY24 Q1 FY23 FY23 end period end year end

-------- ------------ ------------ ------------ ------ ------------ -------------

GBP:EUR 1.1561 1.1760 1.1560 1.1637 1.1617 1.1375

GBP:USD 1.2570 1.2452 1.2051 1.2703 1.2178 1.2337

EUR:USD 1.0874 1.0588 1.0426 1.0916 1.0483 1.0846

-------- ------------ ------------ ------------ ------ ------------ -------------

ENQUIRIES

Shareholders / analysts:

Chris Hunt, Head of Shareholder Relations, ICG +44 (0)20 3545 2020

Media:

Fiona Laffan, Global Head of Corporate Affairs, ICG +44 (0)20 3545 1510

This results statement may contain forward looking statements.

These statements have been made by the Directors in good faith

based on the information available to them up to the time of their

approval of this report and should be treated with caution due to

the inherent uncertainties, including both economic and business

risk factors, underlying such forward looking information.

ABOUT ICG

ICG provides flexible capital solutions to help companies

develop and grow. We are a global alternative asset manager with

over 30 years' history, operating across four asset classes:

Structured and Private Equity, Private Debt, Real Assets, and

Credit.

We develop long-term relationships with our business partners to

deliver value for shareholders, clients and employees. We are

committed to being a net zero asset manager across our operations

and relevant investments by 2040.

ICG is listed on the London Stock Exchange (ticker symbol: ICP).

Further details are available at www.icgam.com.

(END) Dow Jones Newswires

July 20, 2023 02:00 ET (06:00 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

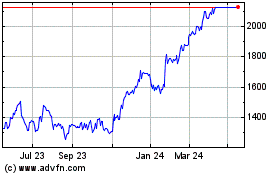

Intermediate Capital (LSE:ICP)

Historical Stock Chart

From Dec 2024 to Jan 2025

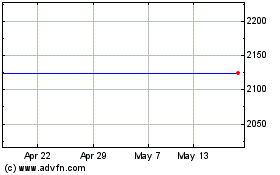

Intermediate Capital (LSE:ICP)

Historical Stock Chart

From Jan 2024 to Jan 2025