Iomart Group PLC Statement re Possible Offer (2333N)

24 July 2014 - 8:39PM

UK Regulatory

TIDMIOM TIDMTTM

RNS Number : 2333N

Iomart Group PLC

24 July 2014

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY (IN WHOLE OR IN PART) IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF

SUCH JURISDICTION.

This announcement is not an announcement of a firm intention to

make an offer under Rule 2.7 of the City Code on Takeovers and

Mergers (the "Code") and there can be no certainty that an offer

will be made, nor as to the terms on which any offer will be

made

iomart Group plc

Statement re Possible Offer for iomart Group plc ("iomart")

The independent directors of iomart (the "Independent

Directors") note the announcement by Host Europe Holdings Ltd

("Host") a company controlled by funds managed by Cinven Capital

Management (V) General Partner Limited (of which Cinven Partners

LLP ("Cinven") is the adviser) that it is considering a possible

offer for iomart.

On 13 June and subsequently on 27 June 2014, the Independent

Directors received approaches from Cinven regarding possible cash

offers for iomart at levels of 275 pence and 285 pence per iomart

share respectively. The Independent Directors concluded that both

offers undervalued iomart and accordingly, both were rejected.

For further information:

iomart Group plc Tel: 0141 931 6400

Ian Ritchie

Peel Hunt LLP Tel: 020 7418 8900

(Financial Adviser, Nominated Adviser and Broker to iomart)

Richard Kauffer

Charles Batten

Daniel Harris

Oliver Jackson

Newgate Threadneedle Tel: 020 7653 9850

Caroline Forde

Hilary Millar

Peel Hunt LLP, which is authorised and regulated in the United

Kingdom by the Financial Conduct Authority, is acting exclusively

for the independent board of iomart and for no one else in

connection with the subject matter of this announcement and will

not be responsible to anyone other than iomart for providing the

protections afforded to its clients or for providing advice in

connection with the subject matter of this announcement. Neither

Peel Hunt nor any of its subsidiaries, branches or affiliates owes

or accepts any duty, liability or responsibility whatsoever

(whether direct or indirect, whether in contract, in tort, under

statute or otherwise) to any person who is not a client of Peel

Hunt LLP in connection with the subject matter of this

announcement.

The release, publication or distribution of this announcement in

certain jurisdictions may be restricted by law. Persons who are not

resident in the United Kingdom or who are subject to other

jurisdictions should inform themselves of, and observe, any

applicable requirements.

This announcement is not intended to, and does not, constitute

or form part of any offer, invitation or the solicitation of an

offer to purchase, otherwise acquire, subscribe for, sell or

otherwise dispose of, any securities whether pursuant to this

announcement or otherwise. The distribution of this announcement in

jurisdictions outside the United Kingdom may be restricted by law

and therefore persons into whose possession this announcement comes

should inform themselves about, and observe such restrictions. Any

failure to comply with the restrictions may constitute a violation

of the securities law of any such jurisdiction.

Dealing and Disclosure requirements of the City Code of

Takeovers and Mergers (the "Code")

Under Rule 8.3(a) of the Code, any person who is interested in

1% or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by no later than

3.30 pm (London time) on the 10th business day following the

commencement of the offer period and, if appropriate, by no later

than 3.30 pm (London time) on the 10th business day following the

announcement in which any securities exchange offeror is first

identified. Relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1% or more of any class of relevant securities of the

offeree company or of any securities exchange offeror must make a

Dealing Disclosure if the person deals in any relevant securities

of the offeree company or of any securities exchange offeror. A

Dealing Disclosure must contain details of the dealing concerned

and of the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror, save to the

extent that these details have previously been disclosed under Rule

8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies

must be made by no later than 3.30 pm (London time) on the business

day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure.

In accordance with Rule 2.10 of the Code, iomart confirms that,

at the date of this announcement, it had 106,694,030 ordinary

shares of 1 pence each in issue and admitted to trading on AIM

(excluding 140,773 ordinary shares in the iomart Group Plc Employee

Benefit Trust and 968,203 shares held in treasury). The

International Securities Identification Number for the iomart

ordinary shares is GB0004281639.

This information is provided by RNS

The company news service from the London Stock Exchange

END

OFDSEAFSLFLSEDW

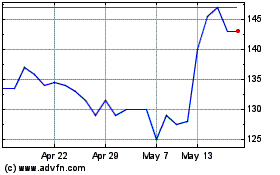

Iomart (LSE:IOM)

Historical Stock Chart

From Oct 2024 to Nov 2024

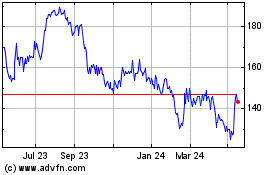

Iomart (LSE:IOM)

Historical Stock Chart

From Nov 2023 to Nov 2024