TIDMITM

RNS Number : 8137V

ITM Power PLC

16 December 2021

16 December 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

ITM Power PLC

("ITM", "ITM Power", the "Group" or the "Company")

Trading Update

ITM Power (AIM: ITM), the energy storage and clean fuel company,

provides an update on the Group's work-in-progress, the contracts

backlog and the tender pipeline as well as unaudited financial

results for the half-year to 31 October 2021.

Highlights:

-- Record backlog of 499 MW as at 1 Dec, up by 61% since September 2021

o Contracted: 62 MW compared to 43 MW in September

o In negotiation: 339 MW compared to 169 MW in September

o Preferred supplier: 98 MW unchanged versus September

-- Tender pipeline of 909 MW compared to 1,011 MW in September

2021, reflecting tenders moving to negotiation stage

Dec-21 Sep-21 Change

GBPm denotes

value to ITM MW GBPm MW GBPm MW GBPm

Work in Progress* 62 34 43 36 45% -6%

Contracts backlog** 499 198 310 171 61% 16%

Tender pipeline*** 909 359 1,011 378 -10% -5%

Backlog + Pipeline 1,408 557 1,321 549 7% 1%

*Work in Progress Contracted backlog

**Contracts Contracted backlog and contracts in the final

backlog stages of negotiation and preferred supplier

backlog

***Tender pipeline Quotations submitted in response to commercial

tenders in the last 12 months

New Contract awards:

-- Refhyne II consortium of which ITM is a member was awarded a

grant of EUR32.4m by CINEA (the European Climate, Infrastructure

and Environment Executive Agency) for the development of a 100 MW

electrolyser to be sited at Shell's Energy and Chemicals Park,

Rhineland. The project will see an engineering design phase which

will be followed by a final investment decision (FID) expected in

late 2022 with delivery then scheduled for 2024

-- Contract signed for delivery of 12MW of electrolysis

equipment to be deployed in 2022, and recognised in the 2022/ 23

financial year

-- In November, UK Government Investment was secured for Phase 1

of ScottishPower's 20 MW Whitelee Windfarm hydrogen production and

storage facility

-- New Projects under negotiation of approximately 200 MW

Corporate:

-- Successful GBP250m fund raise completed post period end in November

-- Site for the second 1.5 GW UK factory acquired in Sheffield

-- First overseas factory of 2.5 GW to follow, to create 5 GW of capacity by the end of 2024

-- Continued strengthening of Management Team with the following senior appointments:

o Martin Clay, Operations Director, formerly MD of Kostal UK

Ltd

o Nadia Sparrow, Head of Procurement, formerly Head of UK

Procurement at Alstom

o Helen Baker, Company Secretary, formerly Head of Secretariat

at Coca-Cola Europacific Partners plc

o Chris Yewdall, Projects Director, formerly Head of PMO

(Project Management Office) at Rolls Royce plc

Unaudited Financials for the six months to 31 October:

-- Revenue of GBP4.1m (2020: GBP0.2m)

-- Gross loss of GBP2.4m (2020: loss of GBP2.8m)

-- Adjusted EBITDA loss of GBP13.0m (2020: loss of GBP10.4m)

-- Net cash at half-year-end of GBP166.6m excludes net GBP242m raised in November

-- Cash burn of GBP12.0m (GBP14.0m)

Outlook:

-- Full year guidance of 33-50 MW maintained, with revenue still

expected to be heavily weighted to H2 as previously indicated

-- Continued growth in tender pipeline and backlog expected

-- Planning for manufacturing capacity expansion accelerating

including work on identification of the location for our first

overseas factory

Dr Graham Cooley, CEO of ITM Power, said: "Today's update

provides a compelling endorsement of how fast our markets are

growing and our decision to raise further funds to increase

capacity domestically and internationally to take full advantage of

this growth. Together with our partners, we believe we can gain a

material market share as a result of our experience, expertise and

capacity to help industry to decarbonise using green hydrogen."

For further information please visit www.itm-power.com or

contact:

ITM Power plc

James Collins, Investor Relations +44 (0)114 551 1205

Justin Scarborough, Investor Relations +44 (0)114 551 1080

Investec Bank plc (Nominated Adviser

and Broker) +44 (0)20 7597 5970

Jeremy Ellis / Chris Sim / Ben

Griffiths

Tavistock (Financial PR and IR) +44 (0)20 7920 3150

Simon Hudson / David Cracknell

/ Tim Pearson

About ITM Power PLC:

ITM Power manufactures integrated hydrogen energy solutions for

grid balancing, energy storage and the production of renewable

hydrogen for transport, renewable heat and chemicals. ITM Power PLC

was admitted to the AIM market of the London Stock Exchange in

2004. In October 2019, the Company announced the completion of a

GBP58.8m fundraising, including an investment by Linde of GBP38m,

together with the formation of a joint venture to deliver renewable

hydrogen to large-scale industrial projects worldwide. In November

2020, ITM Power completed a GBP172m fundraising, including a GBP30m

investment by Snam, one of the world's leading energy

infrastructure operators. In January 2021, the Company received an

order for the world's then largest PEM electrolyser of 24MW from

Linde. In October 2021, the Company, with Linde, announced the

deployment of a 100MW electrolyser at Shell's Rhineland refinery,

following the start-up of an initial 10MW facility at the site. In

November 2021, ITM Power raised GBP250m to accelerate

expansion.

ITM Power operates from the world's largest electrolyser factory

in Sheffield with a capacity of 1GW (1,000MW) per annum, with the

announced intention to build a second UK Gigafactory in Sheffield

with a capacity of 1.5GW expected to be fully operational by the

end of 2023. The Group's first international facility, expected to

have a capacity of 2.5GW per annum, is intended to be operational

by the end of 2024, bringing total Group capacity to 5GW per annum.

Customers and partners include Sumitomo, Ørsted, Phillips 66,

Scottish Power, Siemens Gamesa, Cadent, Northern Gas Networks,

Gasunie, RWE, Engie, GNVert, National Express, Toyota, Hyundai and

Anglo American among others.

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGPGMAPUPGGBA

(END) Dow Jones Newswires

December 16, 2021 02:00 ET (07:00 GMT)

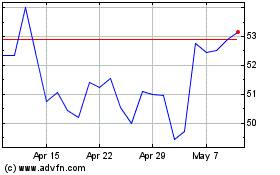

Itm Power (LSE:ITM)

Historical Stock Chart

From Mar 2024 to Apr 2024

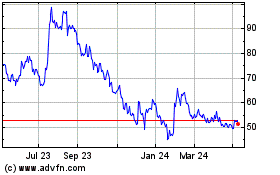

Itm Power (LSE:ITM)

Historical Stock Chart

From Apr 2023 to Apr 2024