JZ Capital Ptnrs Ltd JZCP Announces Sale of Paragon Water Systems

14 March 2018 - 6:00PM

UK Regulatory

TIDMJZCP TIDMJZCC TIDMJZCN

JZ CAPITAL PARTNERS ANNOUNCES SALE OF PARAGON WATER SYSTEMS FOR 1.8x GROSS

RETURN ON INVESTMENT

$16.2 million in gross proceeds realised, delivering an 18.4% IRR

14 March 2018

JZ Capital Partners Limited (LSE:JZCP.L or "JZCP"), the London listed fund that

invests in US and European microcap companies and US real estate, is pleased to

announce the sale of Paragon Water Systems, Inc. ("Paragon") to Culligan Water,

the world leader in residential, office, commercial and industrial water

treatment.

Founded in 1988 and headquartered in Tampa, Florida, Paragon develops and

produces "point-of-use" water filtration products for leading global Original

Equipment Manufacturer ("OEM") clients, big brand suppliers to specialty and

big box retailers, direct sales organisations and companies with national or

international water filtration dealership networks.

JZCP expects to realise approximately $16.2 million in gross proceeds

(including escrows) from the sale, representing an increase of approximately

$3.7 million, or 29.6% on the carrying value of Paragon of approximately $12.5

million as of 31 January 2018. In addition to increasing JZCP's overall NAV as

of January 31, 2018 by 0.4%, this transaction represents a gross multiple of

invested capital ("MOIC") of approximately 1.8x and a gross internal rate of

return ("IRR") of approximately 18.4%.

David Zalaznick, JZCP's Founder and Investment Adviser, commented: "We are

pleased with this realisation above JZCP's net asset value. One of our

objectives is to demonstrate to shareholders and potential new investors that

our NAV is conservatively valued. We hope to continue our realisation cycle and

build liquidity for our previously stated goals of making new investments,

paying down debt and buying back stock."

The transaction follows the recent announcement that JZCP is to sell Bolder

Healthcare Solutions ("BHS") to a subsidiary of Cognizant, one of the world's

leading professional services companies, for gross proceeds of approximately

$108.0 million, representing an increase in NAV of approximately 4.3%, as of 31

January 2018.

Ends

For further information:

Ed Berry / Kit Dunford

FTI Consulting

+44 (0) 20 3727 1143

David Zalaznick

Jordan/Zalaznick Advisers, Inc.

+1 212 485 9410

Paul Ford

JZ Capital Partners

+44 (0) 1481 745383

About JZCP

JZ Capital Partners ("JZCP") is one of the oldest closed-end investment

companies listed on the London Stock Exchange. It seeks to provide shareholders

with a return by investing selectively in US and European microcap companies

and US real estate. JZCP receives investment advice from Jordan/Zalaznick

Advisers, Inc. ("JZAI") which is led by David Zalaznick and Jay Jordan. They

have worked together for more than 35 years and are supported by teams of

investment professionals in New York, Chicago, London and Madrid. JZAI's

experts work with the existing management of microcap companies to help build

better businesses, create value and deliver strong returns for investors. For

more information please visit www.jzcp.com.

END

(END) Dow Jones Newswires

March 14, 2018 03:00 ET (07:00 GMT)

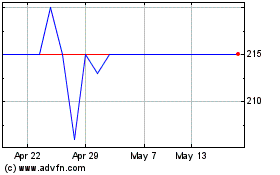

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Apr 2024 to May 2024

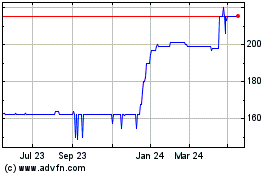

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From May 2023 to May 2024