TIDMKEFI

RNS Number : 1900A

Kefi Gold and Copper PLC

18 January 2024

18 January 2022

KEFI Gold and Copper plc

("KEFI" or the "Company")

GMCO JV Arrangements in Saudi Arabia Facilitate Rapid Growth and

Provide Funding Solutions

KEFI Gold and Copper Plc (AIM: KEFI), the gold and copper

exploration and development company, which has focused on the

Arabian-Nubian Shield since 2008, is pleased to announce an update

regarding the Company's arrangements in the Kingdom of Saudi

Arabia, where KEFI's minority-owned Gold & Minerals Ltd

("GMCO") joint venture is growing rapidly, whilst in in Ethiopia

KEFI continues its preparations to launch the high-grade Tulu Kapi

Gold Project.

Background

The successful overhaul of the Saudi Arabian minerals sector has

triggered an inrush of investors, miners and explorers. In the view

of the board, the global interest in, and the growth momentum of

the Arabian Nubian Shield, and Saudi Arabia in particular,

surpasses that of any other region globally. KEFI and its partner

ARTAR's foresight to have formed the GMCO joint venture in 2008 has

provided a first mover advantage that has seen GMCO amass over

1,000 square kilometres of ground selected from GMCO's proprietary

database, focusing on some of the most prospective exploration

targets in Saudi Arabia.

This has already led to the discoveries of the Jibal Qutman Gold

Project ("Jibal Qutman") and at Hawiah Copper-Gold Project

("Hawiah") in respect of which GMCO is rapidly advancing

development studies, as well as the identification of additional

satellite deposits currently undergoing further exploration.

Elsewhere across GMCO's portfolio, which includes more targets

selected from GMCO's proprietary database, earlier stage

exploration is also underway which is expected to maintain a

healthy project pipeline targeting a third discovery.

Accordingly, GMCO and its two shareholders are now focused on

how to best position the joint venture for the next stage of its

development within what is now considered by the KEFI directors as

the world's highest-growth country for metals and mining resources,

and already the world-leader for hydrocarbon natural resources.

Some important decisions have been made.

Refinement of JV Arrangements

In order to facilitate maximum growth, KEFI and ARTAR have

agreed to refine their GMCO shareholders agreement and respective

working arrangements. As previously announced, extensive

feasibility study and exploration work has been undertaken in 2023

in Saudia Arabia and is still ongoing. The gross cost of the

programme in 2023 was c.GBP19 million and the Company will provide

updates over the coming weeks and months with respect to the highly

encouraging results that the directors expect to be achieved.

ARTAR funded GBP3.5 million of KEFI's pari passu 2023

contributions and continues to do so as GMCO pushes forward to

define the preferred development scenario over coming months for

its first discovery Jibal Qutman, as well as the resource upgrade

and expansion at its second discovery Hawiah, as well as further

resource expansion and discovery.

Additionally, the partners' respective shareholdings of GMCO are

now being adjusted to the expected 75% ARTAR and 25% KEFI. KEFI

formerly held 27% of GMCO.

These GMCO joint venture refinements continue a longstanding

pattern of refinement and reinforcement of the relationship between

KEFI and ARTAR in order to facilitate GMCO's progress. It also

enables KEFI to allocate its capital principally to the

finance-closing and launch in H1 2024 of its Ethiopian gold project

at Tulu Kapi, whilst ARTAR supports GMCO's continued rapid

progress.

To provide further flexibility for project financing across the

portfolio of Saudi assets, licences for GMCO's exploration and

mining project are being transferred from ARTAR's name directly

into GMCO's. It is envisaged existing and future advanced projects

will subsequently be transferred into separate subsidiaries to

enable further flexibility on specific mining projects.

In addition, attractive development funding scenarios are

available within Saudi Arabia for GMCO to consider, minimising the

equity requirements for mining projects in general. As an

illustration, the Company expects the project financing of GMCO's

mine developments to be available along the following lines:

-- up to 75% of costs (including both feasibility and

development expenditures) potentially being provided as

Shariah-compliant project loans at internationally low rates from

the Saudi Industrial Development Fund; plus

-- the remaining capital requirement of approximately 25% to be

optimised by the GMCO partners who will ordinarily plan to fund it

pari passu, or could potentially consider the range of mezzanine

and equity finance now on offer in Saudi Arabia, if warranted at

the time.

The mining sector in Saudi Arabia is particularly exciting and

the GMCO joint venture is very well positioned for growth and value

creation. Two Saudi Government announcements were made last week

which were relevant for KEFI itself: the prioritisation of creating

a Saudi metals and mining exchange and the offer of a 30-year tax

holiday to companies moving their regional head office to Saudi

Arabia. Both policy initiatives reinforce KEFI's commitment to

Saudi Arabia for the long term and are being considered

seriously.

At this stage, KEFI's beneficial interest in the mineral

resources of GMCO's projects is similar (at 1.1 million gold ounce

equivalent) to its planned c.70% interest in the Ethiopian Tulu

Kapi Gold Project of 1.2 million oz), and KEFI's growth prospects

are strong in both countries.

KEFI's Executive Chairman, Harry Anagnostaras-Adams commented:

"KEFI is very fortunate to be a partner in GMCO. We have an

excellent partnership with majority partner ARTAR and we are

collectively and efficiently advancing our portfolio of mining

assets in a location that is becoming one of the mining industry's

top priorities.

"We have a head start on most parties now entering the Arabian

Nubian Shield in both Saudi Arabia and Ethiopia. The arrangements

announced today will reinforce both GMCO's and KEFI's position

still further.

"KEFI expects to benefit from the ongoing GMCO success in

exploration and development preparations, whilst also launching the

Tulu Kapi project in Ethiopia, which the Company envisages will

lead to a materially higher valuation being ascribed to the

Company.

"Given the sizeable exploration expenditure during 2023, as well

as ongoing drilling and studies, the Company has a substantial

pipeline of results to report, which it will release as appropriate

during the current quarter and beyond."

Webinar

Harry Anagnostaras-Adams, Executive Chairman, will provide a

live presentation via the Investor Meet Company platform today, 18

January 2024, at 2pm GMT.

The presentation is open to all existing and potential

shareholders. Questions can be submitted at any time during the

live presentation.

Investors can sign up to Investor Meet Company for free and add

to meet KEFI via:

https://www.investormeetcompany.com/kefi-gold-and-copper-plc/register-investor

This investor webinar will commence with a presentation which

will also be uploaded to the Company's website and will then move

onto addressing questions as submitted.

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Enquiries

KEFI Gold and Copper plc

Harry Anagnostaras-Adams (Managing Director) +357 99457843

John Leach (Finance Director) +357 99208130

SP Angel Corporate Finance LLP (Nominated

Adviser) +44 (0) 20 3470 0470

Jeff Keating, Adam Cowl

Tavira Securities Limited (Lead Broker) +44 (0) 20 7100 5100

Oliver Stansfield, Jonathan Evans

IFC Advisory Ltd (Financial PR and IR) +44 (0) 20 3934 6630

Tim Metcalfe, Florence Chandler

3PPB LLC International (Institutional IR)

Patrick Chidley +1 (917) 991 7701

Paul Durham + 1 (203) 940 2538

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKZGMMZRFGDZM

(END) Dow Jones Newswires

January 18, 2024 07:54 ET (12:54 GMT)

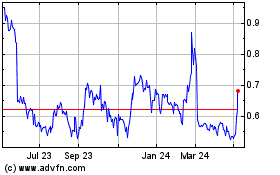

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Nov 2024 to Dec 2024

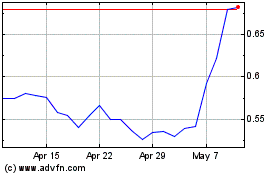

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Dec 2023 to Dec 2024