TIDMKP2

RNS Number : 0815M

Kore Potash PLC

12 September 2023

12 September 2023

Kore Potash Plc

("Kore Potash" or the "Company")

(The "Group" refers to Kore Potash Plc and its subsidiaries)

Financial Results for Half Year Ended 30 June 2023

Kore Potash, the potash development company with 97%-ownership

of the Kola and DX Potash Projects in the Sintoukola Basin, located

within the Republic of Congo ("RoC"), today reports its unaudited

financial results and operational highlights for the half year

ended 30 June 2023 ("the Period").

The full financial report is available online at the Company's

website at

https://korepotash.com/wp-content/uploads/2023/09/20230911-Half-Year-Interim-Report-2023.pdf

The financial statements contained within this announcement should

be read in conjunction with the notes contained within the full

financial report.

Highlights

-- Discussions continue towards finalising terms for the

Engineering, Procurement and Construction ("EPC") contract at the

Kola Project.

-- PowerChina International Group Limited ("PowerChina") and

SEPCO Electric Power Construction Corporation ("SEPCO") have

commenced work to support the provision of guarantees regarding an

EPC contract for Kola.

-- Summit Consortium has confirmed that the financing proposal

for the full capital cost of Kola will be provided within six weeks

of finalisation of EPC contract terms.

-- On 24 January 2023, the Company announced an update of the

JORC (2012) compliant Mineral Resource, Ore Reserve, Pre

Feasibility Study ("PFS") information and Production Target at the

DX Project. The updated Mineral Resource incorporates the most

recent drilling results and interpretation of the geophysical

data.

-- Cash and cash equivalents, at 30 June 2023 was USD 2,555,254.

-- The exploration and evaluation assets at 30 June 2023 was USD

167,201,357, an increase of USD 4,472,163 from USD 162,729,194 at

31 December 2022. During the Period the Company capitalised USD

1,882,884 in exploration and evaluation expenditure and the

expenditure increased by USD 2,589,279 as a result of the weakening

of the USD against the currency of the RoC.

-- Despite the on-going Russian/Ukraine conflict and increasing

fuel prices, the Group's operations have not been materially

impacted during the Period.

Kola Potash Project

Kore Potash signed a Memorandum of Understanding with the Summit

Consortium in April 2021 for the Optimisation of Kola, the

provision of an EPC contract proposal and to provide a debt and

royalty financing proposal for the full construction cost of

Kola.

The results of the Optimisation Study announced on 27 June 2022

supported moving to the next phase of Kola's development.

On 28 June 2022, the Company announced that it had signed a Head

of Agreement ("HoA") for the construction of Kola with SEPCO.

Under the HoA, SEPCO undertook to continue negotiations with

Kore Potash towards an EPC contract for the construction of Kola.

Importantly, the HoA recognises the outcomes of the Optimisation

Study, and confirmed the capital cost of Kola, the construction

period and related EPC contract terms.

Discussions with SEPCO to finalise key EPC terms continue.

Recognising the world-class scale of Kola, the length of the

proposed construction period and the total financing requirement,

Kore Potash has requested that SEPCO's parent company, PowerChina,

provides the typically required EPC contract guarantees, including

performance and retention bonds supporting the completion of

construction and the operating performance of Kola.

PowerChina is now actively involved in the process to finalise

the EPC contract terms. As part of this process, PowerChina is

reviewing aspects of the Kola design and the planned construction

schedule and has had direct communications with the management of

Kore Potash.

PowerChina's review has generated a number of potential design

improvements to the Kola Project that identify potential

opportunities to further reduce the capital cost and the

construction schedule. Discussions on incorporating these design

improvements into the EPC contract continue.

PowerChina has engaged a number of external experts to support

its review of the Kola design and they require completion of this

review to support the provision of the required EPC contract

guarantees.

Kore Potash continues to work with the Summit Consortium to

provide financing for the full construction cost of Kola which is

intended to be based on royalty and debt finance.

The successful outcomes of the Optimisation Study were in line

with the Consortium's requirements and supported the ongoing

financing discussions. The financing parties of the Consortium have

again reinforced their ongoing strong interest in financing Kola

and await finalisation of the EPC contract terms.

The Consortium has advised that the financing proposal for the

full construction cost of Kola will be provided to the Company

within six weeks of EPC terms being finalised.

Kore Potash continues to hold the view that the members of the

Consortium have the capability to provide the required financing to

commit to the construction of Kola and that pursuing this financing

opportunity currently remains the best strategy for Kore Potash's

shareholders.

Key members of the Kore Potash Board and the Summit Consortium,

including SEPCO and PowerChina, met with the Ministry of Mines

during the period. The Ministry of Mines feedback from the visit

was positive and that it improved the Ministry's understanding of

the financing process.

Dougou Extension ("DX") Sylvinite Defined Feasibility Study

Phase 1

The DX Project update of the JORC (2012) compliant Mineral

Resource, Ore Reserve, PFS information and Production Target was

announced on the 24 January 2023. The updated Mineral Resource

incorporates the most recent drilling results and interpretation of

the geophysical data. A summary of the results is presented

below:

o Production Target of 15.5Mt sylvinite at a grade of 30.63 %

KCl demonstrates initial project life of 12 years at a production

rate of 400,000 tpa Muriate of Potash ("MoP").

o Production Target based on Proven and Probable Ore Reserves

and 13% of the Inferred Mineral Resources that represents 30% of

the life of project MoP production.

o NPV 10 (real) of USD 275 million and 27% IRR on a real post

tax basis at life of project average granular MoP price of USD

450/t.

o Approximately 2.9 years post-tax payback period from first

production.

o Proven and Probable Ore Reserve of 9.31 Mt sylvinite at an

average grade of 35.7% KCl.

o Mineral Resource of 129 Mt at an average grade of 24.8%

KCl.

o Higher confidence in the distribution of Sylvinite within the

Top Seams and improved understanding of the Sylvinite/Carnallite

boundary within the Hanging Wall Seam.

The updated information confirms that the DX Project is a

financially attractive, low capital cost project with a shorter

construction period than Kola.

At present, the Company remains focused on completing the

financing of Kola and moving forward to construction of Kola as

soon as possible. The Company is now exploring what strategic

options are available for the DX project.

The financial statements below should be read in conjunction

with the notes contained within the full financial report which is

available online at the Company's website at

https://korepotash.com/wp-content/uploads/2023/09/20230911-Half-Year-Interim-Report-2023.pdf

CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER

COMPREHENSIVE INCOME FOR THE 6 MONTHSED 30 JUNE 2023

6 months 6 months Year ended

ended ended

30 June 2023 30 June 31 Dec 2022

2022

USD USD USD

Unaudited Unaudited Audited

Directors' remuneration (151,769) (198,521) (418,962)

Equity compensation benefits - (8,523) (9,412)

Salaries, employee benefits and

consultancy expense (95,704) (207,766) (293,292)

Administration expenses (273,020) (222,798) (546,507)

Interest income 51,348 17,029 66,956

Interest and finance expenses (1,395) (2,182) (3,935)

Net realised and unrealised foreign

exchange gain (loss) 5,557 (280,449) (308,801)

------------------- ------------------ ---------------

Loss before income tax expense (464,983) (903,210) (1,513,953)

------------------- ------------------ ---------------

Income tax income/(expense) - - -

------------------- ------------------ ---------------

Loss for the period (464,983) (903,210) (1,513,953)

------------------- ------------------ ---------------

Other comprehensive income/(loss)

Items that may be reclassified

subsequently to profit or loss

Exchange differences gain/(loss)

on translating

operations 2,540,490 (11,887,165) (8,660,408)

------------------- ------------------ ---------------

Other comprehensive profit/(loss)

for the period 2,540,490 (11,887,165) (8,660,408)

------------------- ------------------ ---------------

Total comprehensive profit/(loss)

for the period 2,075,507 (12,790,375) (10,174,361)

------------------- ------------------ ---------------

Loss attributable to:

Owners of the Company (464,474) (903,210) (1,513,822)

Non-controlling interest (509) - (131)

------------------- ------------------ ---------------

(464,983) (903,210) (1,513,953)

------------------- ------------------ ---------------

Total comprehensive profit/(loss)

attributable to:

Owners of the Company 2,076,016 (12,790,375) (10,174,230)

Non-controlling interest (509) - (131)

------------------- ------------------ ---------------

2,075,507 (12,790,375) (10,174,361)

------------------- ------------------ ---------------

Loss per share

Basic and diluted loss per share

(cents per share) (0.01) (0.03) (0.04)

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 30

JUNE 2023

30 June 2023 30 June 2022 31 Dec 2022

USD USD USD

Unaudited Unaudited Audited

ASSETS

Current Assets

Cash and cash equivalents 2,555,254 7,628,417 5,046,629

Trade and other receivables 140,479 145,458 200,251

--------------- --------------- ---------------

Total Current Assets 2,695,733 7,773,875 5,246,880

--------------- --------------- ---------------

Non-Current Assets

Trade and other receivables 39,218 99,562 38,597

Property, plant and equipment 373,633 433,385 385,103

Exploration and evaluation

expenditure 167,201,357 157,518,638 162,729,194

--------------- --------------- ---------------

Total Non-Current Assets 167,614,208 158,051,585 163,152,894

--------------- --------------- ---------------

TOTAL ASSETS 170,309,941 165,825,460 168,399,774

--------------- --------------- ---------------

LIABILITIES

Current Liabilities

Trade and other payables 572,417 803,064 749,469

Derivative financial liability 26 26 26

--------------- --------------- ---------------

Total Current Liabilities 572,443 803,090 749,495

--------------- --------------- ---------------

Non-Current Liabilities

--------------- --------------- ---------------

Total Non-Current Liabilities - - -

--------------- --------------- ---------------

TOTAL LIABILITIES 572,443 803,090 749,495

--------------- --------------- ---------------

NET ASSETS 169,737,498 165,022,370 167,650,279

--------------- --------------- ---------------

EQUITY

Issued share capital - Ordinary

Shares 3,421,937 3,420,177 3,420,177

Reserves 223,948,269 218,347,816 221,586,467

Accumulated losses (57,069,485) (56,183,040) (56,793,651)

--------------- --------------- ---------------

Equity attributable to the

shareholders of

Kore Potash plc 170,300,721 165,584,953 168,212,993

Non-controlling interests (563,223) (562,583) (562,714)

--------------- --------------- ---------------

TOTAL EQUITY 169,737,498 165,022,370 167,650,279

--------------- --------------- ---------------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE 6

MONTHSED 30 JUNE 2023

Ordinary Share Merger Accumulated Option Foreign Owners Non- Total

Shares Premium Reserve Reserve Currency of the controlling Equity

Reserve Parent Interest

USD USD USD Losses USD Translation USD USD USD

Reserve

USD USD

------------ ------------- -------------- --------------- ------------ --------------- --------------- ------------ ---------------

Balance

as at

1 Jan

2023 3,420,177 44,537,309 203,738,800 (56,793,651) 734,259 (27,423,901) 168,212,993 (562,714) 167,650,279

------------ ------------- -------------- --------------- ------------ --------------- --------------- ------------ ---------------

Loss

for the

period - - - (464,474) - - (464,474) (509) (464,983)

Other

Comprehensive

(loss)/gain - - - - - 2,540,490 2,540,490 - 2,540,490

------------ ------------- -------------- --------------- ------------ --------------- --------------- ------------ ---------------

Total

Comprehensive

(loss)/gain - - - (464,474) - 2,540,490 2,076,016 (509) 2,075,507

------------ ------------- -------------- --------------- ------------ --------------- --------------- ------------ ---------------

Transactions

with owners:

Issue

of Shares 1,760 - - - - - 1,760 - 1,760

Conversion

of

performance

rights - - - 188,640 (188,640) - - - -

Share

Based

payments - - - - 9,952 - 9,952 - 9,952

------------ ------------- -------------- --------------- ------------ --------------- --------------- ------------ ---------------

Balance

at 30

June 2023 3,421,937 44,537,309 203,738,800 (57,069,485) 555,571 (24,883,411) 170,300,721 (563,223) 169,737,498

------------ ------------- -------------- --------------- ------------ --------------- --------------- ------------ ---------------

Ordinary Share Merger Accumulated Option Foreign Owners Non- Total

Shares Premium Reserve Reserve Currency of the controlling Equity

Reserve Parent Interest

USD USD USD Losses USD Translation USD USD USD

Reserve

USD USD

------------ ------------- -------------- --------------- ------------ --------------- --------------- ------------ ---------------

Balance

as at

1 Jan

2022 3,375,494 44,205,971 203,738,800 (55,422,779) 708,486 (18,623,503) 177,982,470 (562,583) 177,419,887

------------ ------------- -------------- --------------- ------------ --------------- --------------- ------------ ---------------

Loss

for the

period - - - (903,210) - - (903,210) - (903,210)

Other

Comprehensive

(loss)/gain - - - - - (11,887,165) (11,887,165) - (11,887,165)

------------ ------------- -------------- --------------- ------------ --------------- --------------- ------------ ---------------

Total

Comprehensive

(loss)/gain - - - (903,210) - (11,887,165) (12,790,375) - (12,790,375)

------------ ------------- -------------- --------------- ------------ --------------- --------------- ------------ ---------------

Kore

Potash

Ltd Southt

Africa

wound

down - - - 138,500 - (139,989) (1,489) - (1,489)

Transactions

with owners:

Issue

of Shares 44,683 331,338 - - - - 376,021 - 376,021

Conversion

of

performance

rights - - - 4,449 (4,449) - - - -

Share

Based

payments - - - - 18,327 - 18,327 - 18,327

------------ ------------- -------------- --------------- ------------ --------------- --------------- ------------ ---------------

Balance

at 30

June 2022 3,420,177 44,537,309 203,738,800 (56,183,040) 722,364 (30,650,657) 165,584,953 (562,583) 165,022,370

------------ ------------- -------------- --------------- ------------ --------------- --------------- ------------ ---------------

Ordinary Share Merger Accumulated Option Foreign Owners Non- Total

Shares Premium Reserve Losses Reserve Currency of the controlling Equity

Reserve Parent Interest

Losses Translation

Reserve

USD USD USD USD USD USD USD USD USD

------------ ------------- -------------- --------------- ------------ --------------- --------------- ------------ ---------------

Balance

at 1 Jan

2022 3,375,494 44,205,971 203,738,800 (55,422,779) 708,486 (18,623,503) 177,982,470 (562,583) 177,419,887

------------ ------------- -------------- --------------- ------------ --------------- --------------- ------------ ---------------

Loss for

the period: - - - (1,513,822) - .- (1,513,822) (131) (1,513,953)

Other

comprehensive

(loss)/gain - - - - - (8,660,408) (8,660,408) - (8,660,408)

------------ ------------- -------------- --------------- ------------ --------------- --------------- ------------ ---------------

Total

comprehensive

(loss)/gain - - - (1,513,822) - (8,660,408) (10,174,230) (131) (10,174,361)

------------ ------------- -------------- --------------- ------------ --------------- --------------- ------------ ---------------

Kore Potash

Ltd SA

Divestment - - - 138,501 - (139,989) (1,488) - (1,488)

Transactions

with owners:

Conversion

of

performance

rights - - - 4,449 (4,449) - - - -

Share

issues 44,683 331,338 - - - - 376,021 - 376,021

Share

issue

costs - - - - 11,895 - 11,895 - 11,895

Share

based

payments - - - - 18,327 - 18,327 - 18,327

Balance

at 31

Dec 2022 3,420,177 44,537,309 203,738,800 (56,793,651) 734,259 (27,423,901) 168,212,993 (562,714) 167,650,279

------------ ------------- -------------- --------------- ------------ --------------- --------------- ------------ ---------------

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE 6 MONTHSED 30 JUNE 203

6 months ended 6 months ended Year ended

30 June 2023 30 June 2022 31 Dec 2022

USD USD USD

Unaudited Unaudited Audited

Cash Flows from Operating

Activities

Payments to suppliers and

employees (577,006) (697,416) (1,236,245)

--------------- --------------- ---------------

Net cash flows (used in) ( 1,236,245

operating activities (577,006) (697,416) )

--------------- --------------- ---------------

Cash Flows from Investing

Activities

Payments for plant and equipment - (658) (633)

Payments for exploration and

evaluation (1,984,021) (2,497,533) (4,574,363)

Interest received 51,348 17,029 66,956

--------------- --------------- ---------------

Net cash flows (used in)

investing activities (1,932,673) (2,481,162) (4,508,040)

--------------- --------------- ---------------

Cash Flows from Financing

Activities

Proceeds from issue of shares 1,760 550 550

Net cash flows generated

from

--------------- --------------- ---------------

financing activities 1,760 550 550

--------------- --------------- ---------------

Net decrease in cash and

cash

Equivalents (2,507,919) (3,178,028) (5,743,735)

Cash and cash equivalents

at beginning of

period 5,046,629 11,092,509 11,092,509

Foreign currency differences 16,544 (286,064) (302,145)

--------------- --------------- ---------------

Cash and Cash Equivalents

at Period End 2,555,254 7,628,417 5,046,629

--------------- --------------- ---------------

Market Abuse Regulation

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

This announcement has been approved for release by the Board of

Kore Potash.

For further information, please visit www.korepotash.com or

contact:

Kore Potash Tel:

Brad Sampson - + 27

CEO 84

603

6238

Tavistock Tel:

Communications +44

Nick Elwes (0)

Adam Baynes 20

7920

3150

SP Angel Tel:

Corporate +44

Finance - (0)

Nomad 20

and Joint 7470

Broker 0470

Ewan Leggat

Charlie

Bouverat

Shore Capital Tel:

- Joint Broker +44

Toby Gibbs (0)

James Thomas 20

7408

4050

Forward-Looking Statements

This release contains certain statements that are

"forward-looking" with respect to the financial condition, results

of operations, projects and business of the Company and certain

plans and objectives of the management of the Company.

Forward-looking statements include those containing words such as:

"anticipate", "believe", "expect," "forecast", "potential",

"intends," "estimate," "will", "plan", "could", "may", "project",

"target", "likely" and similar expressions identify forward-looking

statements. By their very nature forward-looking statements are

subject to known and unknown risks and uncertainties and other

factors which are subject to change without notice and may involve

significant elements of subjective judgement and assumptions as to

future events which may or may not be correct, which may cause the

Company's actual results, performance or achievements, to differ

materially from those expressed or implied in any of our

forward-looking statements, which are not guarantees of future

performance.

Neither the Company, nor any other person, gives any

representation, warranty, assurance or guarantee that the

occurrence of the events expressed or implied in any

forward-looking statement will occur. Except as required by law,

and only to the extent so required, none of the Company, its

subsidiaries or its or their directors, officers, employees,

advisors or agents or any other person shall in any way be liable

to any person or body for any loss, claim, demand, damages, costs

or expenses of whatever nature arising in any way out of, or in

connection with, the information contained in this document.

In particular, statements in this release regarding the

Company's business or proposed business, which are not historical

facts, are "forward-looking" statements that involve risks and

uncertainties, such as Mineral Resource estimates market prices of

potash, capital and operating costs, changes in project parameters

as plans continue to be evaluated, continued availability of

capital and financing and general economic, market or business

conditions, and statements that describe the Company's future

plans, objectives or goals, including words to the effect that the

Company or management expects a stated condition or result to

occur. Since forward-looking statements address future events and

conditions, by their very nature, they involve inherent risks and

uncertainties. Actual results in each case could differ materially

from those currently anticipated in such statements. Shareholders

are cautioned not to place undue reliance on forward-looking

statements, which speak only as of the date they are made. The

forward-looking statements are based on information available to

the Company as at the date of this release. Except as required by

law or regulation (including the ASX Listing Rules), the Company is

under no obligation to provide any additional or updated

information whether as a result of new information, future events,

or results or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KFLFFXKLEBBV

(END) Dow Jones Newswires

September 12, 2023 02:00 ET (06:00 GMT)

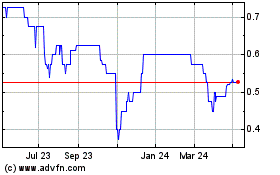

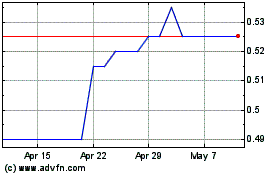

Kore Potash (LSE:KP2)

Historical Stock Chart

From Apr 2024 to May 2024

Kore Potash (LSE:KP2)

Historical Stock Chart

From May 2023 to May 2024