TIDMLBG

RNS Number : 9851M

LBG Media PLC

20 September 2023

20 September 2023

LBG Media plc

("LBG Media", the "Company" or "Group")

Results for the half year ended 30 June 2023

Good progress across our strategic pillars, on track to meet

full year expectations

LBG Media plc, the UK-based multi-brand, multi-channel digital

youth publisher, is pleased to report its results for the half year

ended 30 June 2023 ("HY23" or "the period"). During the period, the

Group delivered a strong performance, growing its global audience

and content views, and is on track to meet full year market

expectations.

Financial Highlights

HY23 HY22 Change

(GBPm) (GBPm) %

Revenue

* Direct 11.4 10.6 9%

* Indirect 15.3 13.6 13%

* Other 0.5 0.6 (28%)

--------------------------- --------- --------- --------

Total Group Revenue 27.2 24.8 10%

Adjusted EBITDA(1) 3.0 1.6 84%

Adjusted EBITDA margin(1) 11% 7% +4% pts

Loss before tax (1.2) (1.9) 39%

Cash and cash equivalents 32.7 28.6 15%

-- Total Group Revenue of GBP27.2m (HY22: GBP24.8m) up 10% and

in line with the typical seasonal split between H1 and H2, and

which we have experienced historically.

o Direct revenues increased by 9% to GBP11.4m (HY22: GBP10.6m)

driven by the Group's growing reputation for successful campaigns

with global brands. Visibility of booking levels for the second

half of the year has also improved compared to this time last

year.

o Indirect revenue increased by 13% to GBP15.3m (HY22:

GBP13.6m). Year-on-year content views increased by 87%, on the back

of strong growth of 38% in the prior year, enabling the Group to

greater capitalise on the market shift to short-form content that

occurred in the second half of last year.

-- Adjusted EBITDA(1) of GBP3.0m (HY22: GBP1.6m), up 84%,

reflective of the stronger revenue performance of the Group and

disciplined cost management. Loss before tax was GBP1.2m (HY22:

loss of GBP1.9m) representing a 39% improvement in comparison to

the prior year.

-- Cash and cash equivalents at the period-end amounted to

GBP32.7m (FY22: GBP29.3m, HY22: GBP28.6m), reflecting a net

increase in cash of GBP3.4m, after GBP0.5m of consideration paid in

March for the acquisition of Lessons Learned in Life ('LLIL').

Operational Highlights

-- Global audience grew by 95m people (including the LLIL

acquisition with 19.6m followers as at 30 June 2023) to over 410m

(HY22: 315m), with 67.1bn content views in the period, up 87% on

the prior period.

-- In March 2023, the Group completed the acquisition of LLIL -

an under-monetised US Facebook page that is on track to achieve

payback within its first year.

-- Continued to support socially responsible campaigns with a

cross-business, post-earthquake Turkey / Syria appeal fund, working

with the 'If U Care, Share' charity and our recent partnership with

the London Mayor's office supporting the 'Have A Word'

campaign.

-- Achieved direct revenue brief conversion of 29%; a

significant uplift from 18% conversion in HY22.

CEO, Solly Solomou commented:

"We have made good financial and operational progress throughout

the first half of 2023. The significant increase in content views

demonstrates our effective ongoing engagement with the hard to

reach 18 to 34 year-old demographic which remains a highly

attractive proposition for our partner brands and platforms and

will continue to drive the business forward.

"Our growth continued to outperform the wider digital

advertising market as we operate within the fastest growing

segments, giving us confidence as we look forward. In addition, our

strategic progress in the half was encouraging. We continued to

execute on our plans to broaden geographically, with good early

progress in our recently established US operations, to acquire

businesses, plugging in under-monetised brands onto our platform,

and to broaden our capabilities, with our agile business model

ensuring we can reach the widest possible audience.

"We have started H2 with positive momentum and I am excited by

the opportunities that lie ahead."

Outlook

The Board believes that the Group's highly differentiated

offering and strategic programme will continue to fuel our growth.

Normal seasonality in advertising revenue combined with the

relatively even split of costs means that profitability is

significantly weighted towards the second half of the year, as has

been the case in prior years. Notwithstanding the general

challenges in the overall market, our momentum on audience and

content growth, as well as client brief conversion rate, has

continued into H2 and will help us capitalise on that seasonality.

We can confirm the outlook for the full year remains in line with

market expectations(2) .

Notes:

(1) Adjusted EBITDA - earnings before interest, tax,

depreciation, and amortisation adjusted for share based payments

(including employers NIC as appropriate) and adjusting items.

Adjusted EBITDA margin is Adjusted EBITDA divided by Group Revenue

represented as a percentage.

(2) External market consensus for the year ending 31 December

2023 is currently: Revenue of GBP69.3m and Adjusted EBITDA of

GBP19.3m.

Analyst Presentation

LBG Media plc will be hosting an analyst presentation on 20

September 2023 following the release of these results for the half

year ended 30 June 2023. Attendance is by invitation only. Slides

accompanying the analyst presentation, along with a recording, will

be available on the LBG Media plc website following the event.

For further information please contact:

LBG Media plc investors@ladbiblegroup.com

Solly Solomou, Co-founder & CEO

Richard Jarvis, CFO

Mark Mochalski, Investor Relations

Fiona O'Nolan, Investor Relations

Zeus Capital Limited Tel: +44 (0) 161 831 1512

(Nominated Adviser & Broker) www.zeuscapital.co.uk

Dan Bate / Nick Cowles (Investment Banking)

Benjamin Robertson (Equity Capital Markets)

Peel Hunt LLP (Joint Broker) Tel: +44 (0) 207 418 8990

Neil Patel www.peelhunt.com

Paul Gillam

Richard Chambers

Media enquiries Tel: +44 (0) 20 7466 5000

Buchanan www.buchanancom ms.co.uk

Richard Oldworth / Chris Lane / Toto Berger / Jack Devoy

Notes to editors

LBG Media is a multi-brand, multi-channel digital youth

publisher and is a leading disrupter in the digital media and

social publishing sectors. The Group produces and distributes

digital content across a range of mediums including video,

editorial, image, audio, and experience (virtual and augmented

reality). Since its inception in 2012, the Group has curated a

diverse collection of specialist brands using social media

platforms (primarily Facebook, Instagram, Snapchat, Twitter,

YouTube and TikTok) and has built multiple websites to reach new

audiences and drive engagement. Each brand is dedicated to a

distinct popular interest point (e.g. sport, gaming etc.), which is

designed to achieve broader engagement, increase relevance and

ultimately build a loyal community of followers.

The Group operates two core routes to market: Direct revenue,

which is principally generated from the provision of content

marketing services to corporates, brand owners, marketing agencies

and other entities such as government bodies and where the

relationship with the client is held directly by LBG Media; and

Indirect revenue, which is generated via a third-party, such as a

social media platform or via a programmatic advertising exchange /

online marketplace, which holds the relationship with the brand

owner or agency.

BUSINESS REVIEW

Overview

In the period ended 30 June 2023, LBG Media delivered a strong

performance, with revenue growth of 10% to GBP27.2m (HY22:

GBP24.8m), while Adjusted EBITDA increased by 84% to GBP3.0m (HY22:

GBP1.6m). The Group remains cash generative with a healthy cash

position of GBP32.7m (FY22: GBP29.3m, HY22: GBP28.6m).

LBG Media remains focused on delivering relevant and exciting

content to the predominantly youth audience , with the volume of

views continuing to grow in the first half of the year, by 87%

versus HY22, driving growth in market share . The growth in views

came as the Group used its insights and first-mover advantage to

capitalise on the market shift to short-form content that occurred

in the second half of last year.

LBG Media operates within some of the fastest growing segments

of the digital media market, including social video and mobile.

With the global digital advertising revenue forecast to grow at

7.6% this year(1) , LBG Media is once again outgrowing the digital

market.

Revenue

Revenue is generated through our two core revenue channels,

Direct and Indirect. Despite being distinct channels, our

capabilities and opportunities to monetise our audience

relationship can be used across both.

Direct revenue is generated from the provision of content

marketing services to brand owners, marketing agencies and other

entities such as government bodies, and has increased by 9% in HY23

to GBP11.4m (HY22: GBP10.6m). This was driven by strong momentum

with our branded clients such as Vodafone, McDonalds, Google and

Disney. Direct revenue also includes some revenue from direct

display advertising, where brand owners' pay for advertising space

on our websites for an agreed fee.

Indirect revenue is received via third party social media

platforms (e.g. Facebook, Snapchat, YouTube) or via programmatic

partners, which hold the relationship with the brand owner, or

agency. In HY23 indirect revenue increased by 13% to GBP15.3m

(HY22: GBP13.6m), driven by the market shift to short-form video

seen in the second half of 2022. Facebook, YouTube and Snapchat are

already monetised platforms, while TikTok and Instagram are at

earlier stages of monetisation.

Audience, followers & engagement

LBG Media's expert content creators produce engaging and

relevant content for our audience. The content is then distributed

through various platforms and websites and in-depth analysis is

then performed on interactions and audience engagement in real

time. The learnings from this then drive the refinement of content

to make it even more engaging for the audience, in a cycle of

continuous improvement.

In the first half of 2023, our global audience grew to 410m,

which is a 33% growth rate year-on-year. In the UK alone, the Group

reaches almost two thirds of 18 to 34-year-olds. Our content was

viewed over 67.1bn times, up 87% compared to HY22 and this was well

diversified across our brand portfolio.

Brand portfolio

LBG Media's 14 core brands serve both niche and mainstream

audiences. Each of the brands are based around specific interest

points such as sports, gaming, music, technology, and travel. The

portfolio has been enhanced over recent years, with the well

targeted acquisitions of Go Animals in 2022 (since rebranded as

Furry Tails) and LLIL in 2023.

Strategic Progress

In line with the Group's growth strategy, in March 2023, LBG

Media acquired the social media accounts, social media content,

domain names, website, intellectual property licenses, third party

rights and records of LLIL for a consideration of GBP0.5m. This was

an under-monetised asset that is on track to achieve payback within

its first year.

Our presence in the US continues to expand following the launch

of our US operations last year. We are proud to have a

multi-platform global audience, and international represents 17% of

Group revenue.

We saw another significant increase in followers on TikTok, up

66% year-on-year, where we are the largest media publisher.

Growth strategy

LBG Media has a proven track record of delivering strong growth,

both organically and via acquisitions. Our strategy for growth can

be summarized by the three core pillars below:

1) Geographies: LBG Media currently has a physical presence in

five territories - the UK, Ireland, Australia, New Zealand, and

United States. We aim to grow these communities by continuing to

create and publish relevant digital content, further building brand

awareness levels and increasing follower numbers. The majority of

LBG Media's Direct revenue is currently generated in the UK,

however, active audiences in other geographies provide a foundation

for future growth across both the Indirect and Direct revenue

streams and help to de-risk revenue through diversification.

2)

1 - Source: GroupM, This Year Next Year Report, December 2022

Acquisitions: It can be significantly more time and cost

efficient to access markets through selective acquisitions compared

to building a new brand from scratch if an established digital

media brand with a physical presence, existing audiences and

understanding of the local market is already present. We continue

to actively consider and assess acquisition opportunities that have

diversification potential, both geographically and in terms of

genre of content, as we look to increase our audience.

3) Capabilities : Our agile model allows us to actively

replicate content across any new platforms, ensuring it reaches the

widest possible audience and we intend to continue to expand our

capabilities to produce innovative content, as well as using data

and new technologies, including AI, to further enhance our service

offering. Increasing audience monetisation is key to driving LBG

Media's growth. Currently only Facebook, Snapchat and YouTube

facilitate such monetisation of users through adverts, but we

believe that in time these capabilities will be introduced across

all social media platforms as they mature, providing significant

upside opportunities for us.

Events & Awards

LBG Media have proactively reached out to current and potential

direct revenue clients by hosting events within the first six

months of the year. Once again, our headline event was at Heckfield

Place, which gave brands and agencies the chance to learn more

about our commercial capabilities. Over the two-day event, we had a

series of tailored presentations shining a light on Gen Z

behaviours, the new era of social broadcast, the creator economy

and more. Sessions were then interspersed with external speakers

such as ex-international footballer Jill Scott and comedian Mo

Gilligan. The event had exceptional feedback with guests saying

they now had a much deeper understanding of our commercial

capabilities.

During the first half of the year, we were proud to have been

shortlisted for 20 awards recognising the quality of work we

produce within the industry. Our Tango Berry Peachy campaign won in

the Campaign Media Awards for 'Best Social Strategy' and also in

the Digiday Content Marketing Awards in the 'Best Product Launch'

category. Our Budweiser campaign for the 2022 World Cup also took

the winning spot at the Campaign Media Awards in the 'Branded

Content' category.

ESG

As a leading social youth publisher, LBG Media has a powerful

global platform to pursue socially responsible agendas and we have

run several social awareness campaigns recently to help raise

interest of key social issues.

Within the first half of the year, we have actively supported

those impacted by the earthquake in Turkey and Syria by activating

a cross-business fundraising emergency appeal generating more than

GBP50k in just over a week. We also worked with the 'If U Care,

Share' charity to encourage our audience to talk about how they are

feeling.

More recently, we kickstarted a partnership with the London

Mayor's office to combat sexism amongst peer groups supporting the

'Have A Word' campaign. We used LADnation to conduct research into

our engaged youth audience's views and experience of sexual

harassment, before creating original content which we amplified

across our platforms.

FINANCIAL REVIEW

HY23 HY22 Change

GBPm GBPm %

Revenue 27.2 24.8 10%

Net operating expenses (28.5) (26.6) (7%)

--------------------------------- ------ ------ -------

Operating loss (1.3) (1.8) 31%

--------------------------------- ------ ------ -------

Adjusted EBITDA(1) 3.0 1.6 84%

Adjusted EBITDA(1) % 11% 7% +4% pts

Depreciation (0.9) (0.7) (35%)

Amortisation (0.5) (0.4) (39%)

Share based payments (2.2) (2.4) 10%

Adjusting items (0.7) - -

--------------------------------- ------ ------ -------

Operating loss (1.3) (1.8) 31%

--------------------------------- ------ ------ -------

Net finance costs (0.0) (0.1) 95%

Share of joint ventures 0.1 (0.0) 283%

Loss before taxation (1.2) (1.9) 39%

--------------------------------- ------ ------ -------

Corporation tax credit/(expense) (0.6) 0.1 (535%)

Loss for the period (1.7) (1.8) 4%

--------------------------------- ------ ------ -------

Cash and cash equivalents 32.7 28.6 15%

Notes:

(1) Earnings before interest, tax, depreciation, and

amortisation adjusted for share based payments (including employers

NIC as appropriate) and adjusting items. Adjusted EBITDA % is

Adjusted EBITDA divided by Group Revenue represented as a

percentage.

FINANCIAL REVIEW (continued)

Key performance indicators ("KPIs")

The board monitors progress of the Group by reference to the

following KPIs:

HY23 HY22 Change

GBPm GBPm GBPm %

Financial

Revenue 27.2 24.8 2.4 10%

Adjusted EBITDA 3.0 1.6 1.4 84%

Adjusted EBITDA as a % of revenue 11% 7% +4% pts

---------------------------------- ----- -----

Loss before tax (1.2) (1.9) 0.7 39%

---------------------------------- ----- ----- ---- ------

Non-Financial

Global audience (m)* 410 315 95 33 %

Content views (bn)** 67.1 35.8 31.3 87%

Average number of employees (no.) 427 473 (46) (10%)

* Global audience includes social followers, in addition to

average monthly website users for the six months to June.

** Content views is total views of content across all social

platforms and websites.

The definition of what constitutes a view can vary across the

social platforms.

Revenue

HY23 HY22 Change

GBPm GBPm %

Direct 11.4 10.6 9%

Indirect 15.3 13.6 13%

Other 0.5 0.6 (28%)

Total Group Revenue 27.2 24.8 10%

Total Group Revenue of GBP27.2m (HY22: GBP24.8m), representing

growth of 10% and in line with the seasonality we anticipate

between H1 and H2.

Direct revenues increased by 9% to GBP11.4m (HY22: GBP10.6m)

driven by the Group's growing reputation for successful campaigns

with global brands including Vodafone, Google and Disney.

Visibility of booking levels for the second half of the year has

also improved compared to this time last year.

Indirect revenue increased by 13% to GBP15.3m (HY22: GBP13.6m).

Year on year content views increased by 87%, enabling the Group to

greater capitalise on the market shift to short-form content that

occurred in the second half of last year.

Net operating expenses

Net operating expenses increased by 7% to GBP28.5m (HY22:

GBP26.6m).

Production and media costs increased by GBP0.1m to GBP5.0m

(HY22: GBP4.9m), with the increase driven by more branded content

(Direct) in the period.

Establishment costs, the majority of which is technology costs,

increased by GBP0.6m to GBP3.1m (HY22: GBP2.5m), up 22% mainly due

to increased software subscriptions to support our content

production and continued investment to support future growth in

Direct revenue.

Staff costs reduced by GBP0.3m to GBP15.8m (HY22: GBP16.1m).

This reduction is mainly a result of the restructuring exercise

undertaken in the second half of 2022, offset by inflationary pay

rises and our continued investment in our international

businesses.

Travel and expenses decreased by GBP0.3m to GBP0.7m (HY22:

GBP1.0m). The prior half year included the costs of celebrating our

10-year anniversary.

Depreciation of GBP0.9m (HY22: GBP0.7m) was up 35%, mainly

driven by a new property lease in Australia.

Net operating expenses (continued)

Amortisation of GBP0.5m (HY22: GBP0.4m) up 39%, the increase

mainly being due the acquisition of LLIL in March 2023 in addition

to the full six-month period of amortisation of Go Animals (Furry

Tails) social media pages which were acquired in May 2022.

Share based payment costs were GBP2.2m (HY22: GBP2.4m). The

share based payments charge includes GBP0.2m (HY22: GBP0.4m) of

employers NIC on certain share options.

Adjusting items were GBP0.7m (HY22: GBPnil). Adjusting items

includes costs associated with team reorganisation, a one-off

cost-of-living payment and acquisition related fees. More

information on these items can be found in note 4.

Adjusted EBITDA

Adjusted EBITDA was GBP3.0m (HY22: GBP1.6m) representing an 84%

increase in comparison to the prior half year and in line with the

revenue seasonality we anticipate between H1 and H2. Adjusted

EBITDA margin increased to 11% (HY22: 7%).

Normal seasonality in advertising revenue combined with the

relatively even split of costs means that profitability is

significantly weighted towards the second half of the year.

Adjusted EBITDA is used for internal performance analysis to

assess the execution of our strategies. Management believe that

this adjusted measure is an appropriate metric to understand the

underlying performance of the Group. More information on

Alternative Performance Measures (APMs) can be found on page

18.

Net finance costs

Net finance costs of GBP0.0m (HY22: GBP0.1m) were incurred

during the year.

Share of JV

Share in joint ventures was GBP0.1m profit (HY22: GBP0.0m loss)

representing our percentage share in the results of Pubity Group

Ltd.

Loss before tax

Loss before tax was GBP1.2m (HY22: GBP1.9m) representing a 39%

improvement in comparison to the prior year.

Taxation

The tax charge for the period was GBP0.6m (HY22: GBP0.1m

credit).

Balance sheet

Goodwill and other intangible assets increased by GBP0.3m to

GBP15.7m (FY22: GBP15.4m) reflecting additions of the bolt-on

acquisition of LLIL for GBP0.5m and software additions of GBP0.3m,

offset by amortisation of GBP0.5m.

Property plant and equipment (PPE) decreased by GBP0.5m to

GBP3.2m (FY22: GBP3.7m). Within the period we acquired a new

property lease accounting for GBP0.4m, offset by depreciation of

GBP0.9m.

Other receivables reduced to GBP0.1m (FY22: GBP0.6m). Other

receivables reflect long term lease deposits in relation to our

offices. During HY23, we received a significant repayment of

GBP0.5m for the London lease deposit.

Trade and other receivables reduced by GBP0.9m to GBP19.5m

(FY22: GBP20.4m) mainly due to effective cash collection within the

period including a reduction in accrued income of GBP3.9m.

Trade and other payables increased by GBP1.8m to GBP6.1m (FY22:

GBP4.3m) mainly driven by timing differences of our working capital

movements.

Cash flow and cash position

Cash and cash equivalents at the period end amounted to GBP32.7m

(FY22: GBP29.3m, HY22: GBP28.6m).

The increase in cash of GBP3.4m in comparison to the year-end

includes net cash generated from operating activates of GBP5.3m,

and outflows relating to investing and financing activities of

GBP1.8m . More information on the cash flow can be found on page

11.

Solly Solomou Richard Jarvis

Chief Executive Officer Chief Financial Officer

UNAUDITED INTERIM FINANCIAL INFORMATION - LBG MEDIA PLC

UNAUDITED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Note Period ended Period ended

30 June 30 June 2022

2023 GBP'000 GBP'000

(unaudited) (unaudited)

----------------------------------------- ----- -------------- --------------

Revenue 3 27,247 24,763

Net operating expenses (28,499) (26,577)

----------------------------------------- ----- -------------- --------------

Operating loss (1,252) (1,814)

Analysed as:

Adjusted EBITDA(1) 3,013 1,637

Depreciation (911) (677)

Amortisation 6 (507) (366)

Share based payment charge (2,178) (2,408)

Adjusting items 4 (669) -

----------------------------------------- ----- -------------- --------------

Group operating loss (1,252) (1,814)

----------------------------------------- ----- -------------- --------------

Finance income - 5

Finance costs (3) (62)

----------------------------------------- ----- -------------- --------------

Net finance costs (3) (57)

Share of post-tax (loss)/profit of

equity accounted joint venture 84 (46)

Loss before taxation (1,171) (1,917)

Income tax 5 (553) 127

----------------------------------------- ----- -------------- --------------

Loss for the period attributable

to equity holders of the company (1,724) (1,790)

----------------------------------------- ----- -------------- --------------

Currency translation differences (78) -

(net of tax)

Loss and total comprehensive income

for the financial year attributable

to equity holders of the company (1,802) (1,790)

Basic (loss)/earnings per share (pence) 7 (0.8) (0.9)

Diluted (loss)/earnings per share

(pence) 7 (0.8) (0.9)

----------------------------------------- ----- -------------- --------------

(1) Adjusted EBITDA, which is defined as profit before net

finance costs, tax, depreciation, amortisation, share based payment

charge and adjusting items is a non-GAAP metric used by management

and is not an IFRS disclosure.

All results derive from continuing operations.

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Note As at 30 As at 30 As at 31

June 2023 June 2022 December

GBP'000 GBP'000 2022 GBP'000

(unaudited) (unaudited) (audited)

---------------------------------- ----- ------------ ------------ --------------

Assets

Non-current assets

Goodwill and other intangible

assets 6 15,707 15,374 15,436

Property, plant and equipment 3,203 4,038 3,670

Investments in equity-accounted

joint ventures 443 314 359

Other receivables 124 574 592

Deferred tax asset 651 - 260

Total non-current assets 20,128 20,300 20,317

---------------------------------- ----- ------------ ------------ --------------

Current assets

Trade and other receivables 19,500 14,733 20,370

Current tax asset - 434 378

Cash and cash equivalents 32,708 28,554 29,268

Total current assets 52,208 43,721 50,016

---------------------------------- ----- ------------ ------------ --------------

Total assets 72,336 64,021 70,333

---------------------------------- ----- ------------ ------------ --------------

Equity

Called up share capital 207 206 206

Share premium reserve 28,993 28,993 28,993

Accumulated exchange differences (49) - 29

Retained earnings 32,453 23,317 31,998

Total equity 61,604 52,516 61,226

---------------------------------- ----- ------------ ------------ --------------

Liabilities

Non-current liabilities

Lease liability 8 1,428 2,474 1,960

Provisions 502 214 540

Deferred tax liability 445 618 394

Total non-current liabilities 2,375 3,306 2,894

---------------------------------- ----- ------------ ------------ --------------

Current liabilities

Lease liability 8 1,334 1,364 1,282

Trade and other payables 6,077 6,835 4,295

Current tax liabilities 946 - 636

---------------------------------- ----- ------------ ------------ --------------

Total current liabilities 8,357 8,199 6,213

---------------------------------- ----- ------------ ------------ --------------

Total liabilities 10,732 11,505 9,107

---------------------------------- ----- ------------ ------------ --------------

Total equity and liabilities 72,336 64,021 70,333

---------------------------------- ----- ------------ ------------ --------------

UNAUDITED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share capital Share premium Accumulated exchange Retained earnings Total equity

differences

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------

As at 1 January 2022 206 28,993 - 23,082 52,281

Loss for the financial

period - - - (1,790) (1,790)

------------------------- -------------- -------------- ------------------------ ------------------ -------------

Total comprehensive

income for the period - - - (1,790) (1,790)

Share based payments - - - 2,025 2,025

Deferred tax on share - - - - -

options

------------------------- -------------- -------------- ------------------------ ------------------ -------------

Total transactions with

owners, recognised

directly in equity - - - 2,025 2,025

------------------------- -------------- -------------- ------------------------ ------------------ -------------

As at 30 June 2022

(unaudited) 206 28,993 - 23,317 52,516

Profit for the financial

period - - - 7,137 7,137

Currency translation

differences (net of

tax) - - 29 - 29

------------------------- -------------- -------------- ------------------------ ------------------ -------------

Total comprehensive

income for the period - - 29 7,137 7,166

Share based payments - - - 1,527 1,527

Deferred tax on share

options - - - 17 17

------------------------- -------------- -------------- ------------------------ ------------------ -------------

Total transactions with

owners, recognised

directly in equity 206 28,993 - 1,544 30,743

------------------------- -------------- -------------- ------------------------ ------------------ -------------

As at 31 December 2022

and 1 January 2023

(audited) 206 28,993 29 31,998 61,226

Loss for the financial

period - - - (1,724) (1,724)

Currency translation

differences (net of

tax) - - (78) - (78)

------------------------- -------------- -------------- ------------------------ ------------------ -------------

Total comprehensive loss

for the period - - (78) (1,724) (1,802)

Share based payments - - - 2,178 2,178

Deferred tax on share

options - - - 1 1

Share issue 1 - - - 1

-------------------------

Total transactions with

owners, recognised

directly in equity 1 - - 2,179 2,180

------------------------- -------------- -------------- ------------------------ ------------------ -------------

As at 30 June 2023

(unaudited) 207 28,993 (49) 32,453 61,604

------------------------- -------------- -------------- ------------------------ ------------------ -------------

UNAUDITED CONSOLIDATED STATEMENT OF CASH FLOWS

6 months to 30 June 2023 6 months to 30 June 2022 Year ended 31 December 2022

GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (audited)

---------------------------------- ------------------------- ------------------------- ----------------------------

Cash flows from operating

activities

Cash generated/(used) from

operations 5,48 6 (2,900) 1,295

Tax paid (192) (803) (2,693)

---------------------------------- ------------------------- ------------------------- ----------------------------

Net cash generated/(used) from

operating activities 5,294 (3,703) (1,398)

---------------------------------- ------------------------- ------------------------- ----------------------------

Cash flows from investing

activities

Purchase of intangible assets (798) (1,147) (1,675)

Purchase of property, plant and

equipment (191) (315) (544)

Net cash generated/(used) in

investing activities (989) (1,462) (2,219)

---------------------------------- ------------------------- ------------------------- ----------------------------

Cash flows from financing

activities

Lease payments (750) (584) (1,227)

Lease deposits paid - - (105)

Interest paid (50) (60) (121)

Net cash generated/(used) in

financing activities (800) (644) (1,453)

---------------------------------- ------------------------- ------------------------- ----------------------------

Net increase/(decrease) in cash

and cash equivalents 3,505 (5,809) (5,070)

---------------------------------- ------------------------- ------------------------- ----------------------------

Cash and cash equivalents at the

beginning of the period 29,268 34,338 34,338

---------------------------------- ------------------------- ------------------------- ----------------------------

Effect of exchange rate changes

on cash and cash equivalents (65) 25 -

---------------------------------- ------------------------- ------------------------- ----------------------------

Cash and cash equivalents at the

end of the period 32,708 28,554 29,268

---------------------------------- ------------------------- ------------------------- ----------------------------

6 months 6 months Year ended

to 30 June to 30 June 31 December

2023 2022 2022

Cash generated/(used) from operations GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (audited)

--------------------------------------------- -------------- ------------- -------------

(Loss)/profit for the financial period/year (1,724) (1,790) 5,347

Income tax 553 (127) 1,976

Net interest expense 3 57 143

Share of post tax (profits)/losses/

of equity accounted joint venture (84) 46 -

--------------------------------------------- -------------- ------------- -------------

Operating (loss)/profit (1,252) (1,814) 7,466

Depreciation charge 911 677 1,633

Amortisation of intangible assets 507 366 804

(Loss)/profit on disposal - (40) 21

Share based payments 2,178 2,025 3,552

Provisions (38) - -

Decrease/(increase) in trade and other

receivables 1,394 60 (5,210)

(Decrease)/increase in trade and other

payables 1,786 (4,174) (6,971)

--------------------------------------------- -------------- ------------- -------------

Cash generated/(used) from operations 5,486 (2,900) 1,295

--------------------------------------------- -------------- ------------- -------------

NOTES TO THE UNAUDITED INTERIM FINANCIAL INFORMATION

1. General Information

The principal activity of LBG Media plc ('the Company') is that

of a holding company and the principal activity of the Company and

its subsidiaries ('the Group') is that of an online media

publisher. The Company was incorporated on 20 October 2021 and is a

public company limited by shares registered in England & Wales.

The registered office of the Company is 20 Dale Street, Manchester,

M1 1EZ. The Company registration number is 13693251. The Company is

listed on the AIM market of the London Stock Exchange.

A copy of the audited annual statutory accounts for the Group

and the Half Yearly report can be found on the company's website:

https://lbgmedia.co.uk .

2. Basis of preparation

The interim financial information of the Group for the six

months ended 30 June 2023, which is unaudited, has been prepared in

accordance with the recognition and measurement principles of

International Financial Reporting Standards ('IFRS') and the

accounting policies adopted by the Group and set out in the Annual

Report and Financial Statements for the year ended 31 December

2022. The Directors do not anticipate any changes in these

accounting policies for the year ended 31 December 2023.

The unaudited interim financial information has been prepared on

a going concern basis under the historical cost convention. The

unaudited interim financial information is presented in pounds

sterling and all values are rounded to the nearest thousand pounds

(GBP'000), except where otherwise indicated. The interim financial

information, including for the year ended 31 December 2022, does

not constitute statutory accounts for the purposes of section 434

of the Companies Act 2006. The statutory accounts for the year

ended 31 December 2022 have been delivered to the Registrar of

Companies and the auditor's report on those accounts was

unqualified, did not draw attention to any matters by way of

emphasis, and did not contain a statement under 498(2) or 498(3) of

the Companies Act 2006.

This unaudited interim financial information has been prepared

in accordance with the requirements of the AIM Rules for Companies

and in accordance with this basis of preparation.

3. Revenue

The trading operations of the Group are in the online media

publishing industry and are all continuing.

Analysis of revenue

The Group's revenue and operating profit relate entirely to its

principal activity.

The analysis of revenue by stream is:

6 months 6 months to

to 30 June 30 June 2022

2023

GBP'000 GBP'000

(unaudited) (unaudited)

---------- -------------- --------------

Revenue

Direct 11,464 10,545

Indirect 15,321 13,578

Other 462 640

---------- -------------- --------------

27,247 24,763

---------- -------------- --------------

NOTES TO THE UNAUDITED INTERIM FINANCIAL INFORMATION

(continued)

4. Adjusting items

A breakdown of adjusting items is provided below:

6 months 6 months to

to 30 June 30 June 2022

2023

GBP'000 GBP'000

(unaudited) (unaudited)

------------------------------------------ -------------- --------------

Costs associated with team reorganisation 273 -

One-off cost-of-living payment 272 -

Acquisition related fees 124 -

Total adjusting items 669 -

------------------------------------------ -------------- --------------

Restructuring

During the period, the Group continued to review its divisional

and central structures and made a small number of further

redundancies totalling GBP0.3m. Costs associated with team member

reorganisations of GBP0.3m relate to exit costs of personnel

leaving the business on an involuntary basis, due to

reorganisations within our operating divisions and centralised

functions. Due to the nature of these costs, management deem them

to be adjusting items in order to better reflect our underlying

performance. Exit costs outside of these circumstances are treated

as an operating expense.

One-off cost-of-living payment

Recognising the cost-of-living crisis and the need to retain

staff in these challenging times, the Group awarded a one-off

cost-of-living payment to employees within the period with the

condition of continued employment. The payment is repayable by

employees if they were to leave prior to the year end. This is

considered a one-off incentive and there are no current plans to

complete a similar exercise in the future.

Acquisition related fees

During the period, the Group incurred legal and other advisory

costs associated with our acquisition activity totalling

GBP0.1m.

5. Income tax

Tax expense/(credit) included in consolidated statement of

comprehensive income:

6 months 6 months

to 30 June to 30 June

2023 2022

GBP'000 GBP'000

(unaudited) ( unaudited)

----------------------------------------- ------------- -------------

Current period tax:

Current taxation charge for the period 856 171

Adjustments in respect of prior periods 72 -

Total current tax 928 171

----------------------------------------- ------------- -------------

Deferred tax:

Current period (506) (510)

Effect of change in tax rates 13 (16)

Adjustments in respect of prior periods 118 228

----------------------------------------- ------------- -------------

Total deferred tax (375) (298)

----------------------------------------- ------------- -------------

Total tax on loss on ordinary activities 553 (127)

----------------------------------------- ------------- -------------

Equity items

Current tax - -

Deferred tax (1) -

----------------------------------------- ------------- -------------

Total tax recognised in equity (1) -

----------------------------------------- ------------- -------------

NOTES TO THE UNAUDITED INTERIM FINANCIAL INFORMATION

(continued)

5. Income tax (continued)

Reconciliation of tax charge

The tax assessed for the year is higher (2022: higher) than at

the standard rate of corporation tax in the UK. The differences are

explained below:

6 months 6 months to

to 30 June 30 June 2022

2023

GBP'000 GBP'000

(unaudited) (unaudited)

------------------------------------------------------- ------------- -------------

Loss before taxation (1,171) (1,917)

------------------------------------------------------- ------------- -------------

Tax on loss multiplied by standard rate of corporation

tax in the UK at 22% (2022: 19%) (258) (364)

Effects of:

Adjustments in respect of prior periods 190 229

Expenses not deductible 558 285

Non-taxable income (14) (6)

Effect of change in UK tax rates 13 (16)

Effect of overseas tax rates (117) 60

Exempt items 19 12

Amounts not recognised 175 -

FX (12) -

Share valuation (1) (327)

------------------------------------------------------- ------------- -------------

Total taxation (credit)/charge 553 (127)

------------------------------------------------------- ------------- -------------

NOTES TO THE UNAUDITED INTERIM FINANCIAL INFORMATION

(continued)

6. Goodwill and other intangible assets

Trade-marks Software Relation- Brand Content Goodwill Social Total

and licenses ships library Media

Pages

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- -------------- --------- ---------- -------- --------- --------- -------- --------

Cost

At 1 January 2022 28 639 1,300 4,626 300 10,094 - 16,987

Additions - 46 - - - - 1,134 1,180

Reclassifications - - - (128) - - 128 -

Exchange adjustments - - - 2 - - - 2

-------------------------- -------------- --------- ---------- -------- --------- --------- -------- --------

At 30 June 2022 28 685 1,300 4,500 300 10,094 1,262 18,169

Additions - 498 - - - - - 498

Reclassification - - - 188 - - (188) -

Exchange Adjustments - - - 6 - - - 6

At 31 December

2022 28 1,183 1,300 4,694 300 10,094 1,074 18,673

Additions - 340 - - - - 458 798

Exchange Adjustments - - - (11) - - (14) (25)

-------------------------- -------------- --------- ---------- -------- --------- --------- -------- --------

At 30 June 2023 28 1,523 1,300 4,683 300 10,094 1,518 19,446

-------------------------- -------------- --------- ---------- -------- --------- --------- -------- --------

Accumulated Amortisation

At 1 January 2022 21 236 420 1,454 298 - - 2,429

Charge for the

period 4 62 61 224 - - 15 366

-------------------------- -------------- --------- ---------- -------- --------- --------- -------- --------

At 30 June 2022 25 298 481 1,678 298 - 15 2,795

Charge for the

period 2 60 68 269 - - 39 438

Exchange Adjustments - 1 1 2 - - - 4

-------------------------- -------------- --------- ---------- -------- --------- --------- -------- --------

At 31 December

2022 27 359 550 1,949 298 - 54 3,237

Charge for the

period - 90 65 256 2 - 94 507

Exchange Adjustments - - - (4) - - (1) (5)

-------------------------- -------------- --------- ---------- -------- --------- --------- -------- --------

At 30 June 2023 27 449 615 2,201 300 - 147 3,739

-------------------------- -------------- --------- ---------- -------- --------- --------- -------- --------

Net book value

At 30 June 2022 3 387 819 2,822 2 10,094 1,247 15,374

At 31 December

2022 1 824 750 2,745 2 10,094 1,020 15,436

-------------------------- -------------- --------- ---------- -------- --------- --------- -------- --------

At 30 June 2023 1 1,074 685 2,482 - 10,094 1,371 15,707

-------------------------- -------------- --------- ---------- -------- --------- --------- -------- --------

NOTES TO THE UNAUDITED INTERIM FINANCIAL INFORMATION

(continued)

7. Earnings per share

There is no difference between profit as disclosed within the

statement of comprehensive income and earnings used within the

earnings per share calculation for the reporting periods.

Basic earnings per share calculation:

6 months to 30 June 2023 6 months to 30 June 2022 Year ended 31 December 2022

GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (audited)

---------------------------------- ------------------------ --------------------------- ---------------------------

(Loss)/earnings per share from

continuing operations

(Loss)/earnings, GBP'000 (1,724) (1,790) 5,347

Number of shares, number 206,458,742 205,714,289 205,714,289

---------------------------------- ------------------------ --------------------------- ---------------------------

(Loss)/earnings per share, pence (0.8) (0.9) 2.6

---------------------------------- ------------------------ --------------------------- ---------------------------

Diluted earnings per share

calculation:

---------------------------------- ------------------------ --------------------------- ---------------------------

6 months to 30 June 2023 6 months to 30 June 2022 Year ended 31 December 2022

GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (audited)

---------------------------------- ------------------------ --------------------------- ---------------------------

Diluted (loss)/earnings per share

from continuing operations

(Loss)/earnings, GBP'000 (1,724) (1,790) 5,347

Number of shares, number 217,777,464 205,714,289 211,879,344

---------------------------------- ------------------------ --------------------------- ---------------------------

Diluted (loss)/earnings per share,

pence (0.8) (0.9) 2.5

---------------------------------- ------------------------ --------------------------- ---------------------------

Reconciliation from weighted average number of shares used in

basic earnings per share to diluted earnings per share:

6 months to 30 June 2023 6 months to 30 June 2022 Year ended 31 December 2022

(unaudited) (unaudited) (audited)

------------------------------------- ------------------------ ------------------------ ---------------------------

Number of shares in issue at the

start of the period 205,714,289 205,714,289 205,714,289

Effects of shares issued in the

period 744,453 - -

Weighted average number of shares

used in basic earnings per share 206,458,742 205,714,289 205,714,289

Employee share options 11,318,722 - 6,165,055

------------------------------------- ------------------------ ------------------------ ---------------------------

Weighted average number of shares

used in diluted earnings per share 217,777,464 205,714,289 211,879,344

------------------------------------- ------------------------ ------------------------ ---------------------------

8. Borrowings

6 months 6 months Year ended

to 30 June to 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (audited)

------------------- -------------- ------------- -------------

Current

Lease liabilities 1,334 1,364 1,282

------------------- -------------- ------------- -------------

1,334 1,364 1,282

------------------- -------------- ------------- -------------

Non-current

Lease liabilities 1,428 2,474 1,960

------------------- -------------- ------------- -------------

1,428 2,474 1,960

------------------- -------------- ------------- -------------

Total borrowings 2,762 3,838 3,242

------------------- -------------- ------------- -------------

NOTES TO THE UNAUDITED INTERIM FINANCIAL INFORMATION

(continued)

8. Borrowings (continued)

6 months 6 months Year ended

to 30 June to 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000 (audited)

(unaudited)

(unaudited)

-------------------------------------------- ------------- ------------- ------------------

Amount repayable

Within one year 1,334 1,364 1,282

In more than one year but less than two

years 1,131 1,127 1,162

In more than two years but less than three

years 297 1,055 798

In more than three years but less than - 292 -

four years

2,762 3,838 3,242

-------------------------------------------- ------------- ------------- ------------------

During the period to 30 June 2023, GBP750k was paid by the Group

in relation to lease payments and GBP50k of interest paid in

relation to leases.

9. Related parties

The following transactions were carried out with related

parties:

6 months 6 months Year ended

to 30 June to 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (audited)

----------------------------------------------- -------------- ------------- -------------

Entity controlled by key management personnel

Purchase of services (1) 135 140 276

Tax settlement on behalf of Director (2) - - 224

----------------------------------------------- -------------- ------------- -------------

135 140 500

----------------------------------------------- -------------- ------------- -------------

(1) Services are purchased from Kamani Commercial Property Ltd

(an entity controlled by a significant shareholder) on normal

commercial terms and conditions. Kamani Commercial Property Ltd is

a firm belonging to Mahmud Abdullah Kamani, a former Director of

the Group. The Group leases the Manchester Dale Street properties

from Kamani Commercial Property Ltd. The 'purchase of services' in

the table above relates to the payments made in the year for the

Dale Street properties for both rent and service charges. Payments

made to 30 June 2023 totalled GBP135k (31 December 2022: GBP276k,

30 June 2022: GBP140k). The amount outstanding of the lease

liability as at 30 June 2023 is GBPnil (31 December 2022: GBP88k,

30 June 2022: GBP177k). The outstanding service charge balance at

30 June 2023 is GBPnil (31 December 2022: GBPnil, 30 June 2022:

GBPnil) and outstanding property insurance is GBPnil (31 December

2022: GBPnil, 30 June 2022: GBPnil).

(2) In the prior year the Group agreed to settle a PAYE

liability (relating to a previously undisclosed benefit in kind) on

behalf of Solly Solomou and Jess Solomou (former employee and wife

of Solly Solomou), totalling GBP0.2m. This balance remains accrued

as a liability at the half year.

ALTERNATIVE PERFORMANCE MEASURES (APMs) and GLOSSARY OF

TERMS

Introduction

In the reporting of financial information, the Directors have

adopted various Alternative Performance Measures (APMs) of

financial performance, position or cash flows other than those

defined or specified under International Financial Reporting

Standards (IFRS). These measures are not defined by IFRS and

therefore may not be directly comparable with other companies'

APMs, including those in the Group's industry. APMs should be

considered in addition to IFRS measures and are not intended to be

a substitute for IFRS measurements.

Purpose

The Directors believe that these APMs provide additional useful

information on the underlying performance and position of LBG Media

plc's. APMs are also used to enhance the comparability of

information between reporting periods by adjusting for

non-recurring or uncontrollable factors which affect IFRS measures,

to aid the user in understanding LBG Media plc's performance.

Consequently, APMs are used by the Directors and management for

performance analysis, planning, reporting and incentive-setting

purposes and have remained consistent with prior year.

The key APMs that the Group has focused on this period are as

follows:

Adjusted EBITDA This profit measure shows the Group's Earnings before

Interest, Tax, Depreciation and Amortisation adjusted

for asset gains and losses, share based payments

(including employers NIC as appropriate) and adjusting

items.

Adjusted EBITDA is used for internal performance

analysis to assess the execution of our strategies.

Management believe that this adjusted measure is

an appropriate metric to understand the underlying

performance of the Group.

---------------- --------------------------------------------------------

A glossary of other terms used in the interim financial

information can be found below:

Global audience Includes global social media platform followers and

global monthly online users to LBG Media websites.

Content views Content views is the number of views of content across

all social platforms and websites. The definition

of what constitutes a view can vary across the social

platforms. The total excludes content view data form

Instagram which is currently not readily available.

IPO First public sale of shares by privately owned company.

Allowing the company to become publicly listed on

a recognised stock exchange i.e. AIM.

AIM The Alternative Investment Market (AIM) is a sub-market

of the London Stock Exchange.

Multi-platform Refers to the Group operating on multiple social

media platforms including Facebook, Instagram, Snapchat,

TikTok, Twitter and YouTube. In addition, the Group

operates 5 owned and operated websites - www.ladbible.com

, www.sportbible.com , www.tyla.com , www.gamingbible.com

and www.unilad.com .

---------------- -----------------------------------------------------------

Multi-channel Refers to the Group's portfolio of brands more details

can be found in the publicly available admission

document on pages 10 and 11.

---------------- -----------------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EANNNFAXDEFA

(END) Dow Jones Newswires

September 20, 2023 02:00 ET (06:00 GMT)

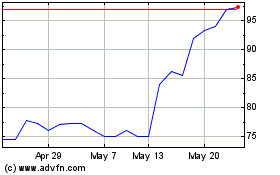

Lbg Media (LSE:LBG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Lbg Media (LSE:LBG)

Historical Stock Chart

From Jan 2024 to Jan 2025