TIDMLIFS

RNS Number : 6504X

LifeSafe Holdings PLC

21 December 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN ARE

RESTRICTED AND ARE NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY

JURISDICTION IN WHICH THE SAME WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE AN OFFER TO SELL OR ISSUE OR A SOLICITATION TO BUY,

SUBSCRIBE FOR OR OTHERWISE ACQUIRE ANY SECURITIES IN ANY

JURISDICTION IN WHICH ANY SUCH OFFER OR SOLICITATION WOULD BE

UNLAWFUL, INCLUDING THE UNITED STATES, CANADA, AUSTRALIA, JAPAN OR

THE REPUBLIC OF SOUTH AFRICA. NEITHER THIS ANNOUNCEMENT NOR

ANYTHING CONTAINED HEREIN SHALL FORM THE BASIS OF, OR BE RELIED

UPON IN CONNECTION WITH, ANY SUCH OFFER, SOLICITATION OR COMMITMENT

WHATSOEVER IN ANY OF THOSE JURISDICTIONS.

LifeSafe Holdings plc

("LifeSafe" or the "Company")

Result of Placing and Share Subscription

LifeSafe (AIM:LIFS), a fire safety technology business with

innovative fire extinguishing fluids and fire safety products,

announces that, further to its announcement of 7.00 a.m today, it

has successfully completed and closed the Placing and Share

Subscription to raise gross proceeds of GBP400,000.

The Placing and Share Subscription has raised, in aggregate,

gross proceeds of GBP400,000 through the placing of 2,312,500 new

Ordinary Shares ("Placing Shares") to certain institutional and

other investors and a subscription by certain other investors

directly with the Company ("Share Subscription") of a further

187,500 new Ordinary Shares ("Subscription Shares") in each case at

a price of 16 pence per share.

The Placing is being conducted in two tranches with the initial

tranche of Placing Shares being issued on 29 December 2023 and the

second tranche of the Placing Shares being issued on 16 January

2024, all shares will be under the Company's pre existing share

capital authorities . The Placing Shares will be issued fully paid

and will rank pari passu in all respects with the Company's

existing Ordinary Shares.

The purpose of this fund raising is to finance, until the second

quarter of 2024, the shortfall in working capital caused by the

Group's performance in 2023 and a delayed HMRC VAT refund of

GBP350,000 forecast to be received by the end of February 2024, and

to commit resource to the new wholesale and industrial

products.

The Placing comprises of a placing of new Ordinary Shares to be

effected in two tranches. The Company intends to issue, in

aggregate, up to 1,729,875 new Ordinary Shares (the "First Placing

Shares"), to raise gross proceeds of approximately GBP276,780. The

First Placing Shares and Subscription Shares are expected to be

admitted to trading on AIM on or around 29 December 2023.

The Company intends to issue up to a further 582,625new Ordinary

Shares (the "Second Placing Shares"), to raise gross proceeds of

approximately a further GBP93,220. The Second Placing Shares are

expected to be admitted to trading on AIM on or around 16 January

2024,.

Share Subscription

Pursuant to the Share Subscription, certain investors have

subscribed for 187,500 Subscription Shares directly with the

Company at the Placing Price raising gross proceeds of

GBP30,000.

The Share Subscription is conditional upon (amongst other

things) the Placing Agreement not having been terminated and First

Admission occurring on or before 8.00 a.m. on 29 December 2023 (or

such later date and/or time as the Bookrunner and the Company may

agree, being no later than 8.00 a.m. on 31 January 2024).

Director and PDMR participation in the Placing

Dominic Berger, the Executive Chairman of the Company, has

agreed to subscribe for 62,500 New Ordinary Shares in the Placing.

Immediately following First and Second Admission, the total number

of New Ordinary Shares held by Dominic Berger would be 980,345

representing 3.5 per cent. Of the Enlarged Share Capital.

Gavin Cornelius, a PDMR of the Company, has agreed to subscribe

for 31,250 New Ordinary Shares in the Placing. Immediately

following First and Second Admission, the total number of New

Ordinary Shares held by Gavin Cornelius would be 1,923,750

representing 6.9 per cent. of the Enlarged Share Capital.

First Admission and Total Voting Rights

Application will be made to the London Stock Exchange for

admission of the First Placing Shares and Subscription Shares to

trading on AIM (the "First Admission"). It is expected that

admission will become effective and dealings in the First Placing

Shares and Subscription Shares commence at 8.00 a.m. on or around

29 December 2023.

First Admission is conditional, inter alia, upon the First

Admission becoming effective and the Placing Agreement not having

been terminated and becoming unconditional in respect of the First

Placing Shares. The First Placing does not require Shareholder

approval as the First Placing Shares will be issued pursuant to the

Company's pre-existing share capital authorities granted at its 22

August 2023 general meeting.

Following First Admission, the total number of Ordinary Shares

in the capital of the Company in issue will be 27,293,358 Ordinary

Shares with voting rights. This figure may be used by shareholders

in the Company as the denominator for the calculations by which

they will determine if they are required to notify their interest

in, or a change to their interest in, the Company's share

capital.

Second Admission and Total Voting Rights

Admission of the Second Placing Shares (the "Second Admission")

is, conditional, inter alia, on the Second Admission becoming

effective, the Placing Agreement not having been terminated and

becoming unconditional.

Application will be made to the London Stock Exchange for

admission of the Second Placing Shares to trading on AIM. It is

expected that admission will become effective and dealings in the

Second Placing Shares commence at 8.00 a.m. on or around 16 January

2024. The Second Placing does not require Shareholder approval as

the Second Placing Shares will be issued pursuant to the Company's

pre-existing share capital authorities granted at its 22 August

2023 general meeting.

Following Second Admission, the total number of Ordinary Shares

in the capital of the Company in issue will be 27,875,983with

voting rights. This figure may be used by Shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company's share capital pursuant to the Company's

Constitution.

The issue of the First Placing Shares and Subscription Shares is

not conditional on issue of the Second Placing Shares. The issue of

the First Placing Shares will not be affected by any or all of the

Second Placing failing to complete for any reason.

The Placing Shares and Subscription Shares will be issued fully

paid and will rank pari passu in all respects with the Company's

existing Ordinary Shares.

Capitalised terms used but not defined in this announcement have

the meanings given to them in the Company's announcement released

this morning in respect of the Placing and Share Subscription

unless the context provides otherwise.

Dominic Berger, Executive Chairman, commented: "The Board is

grateful to investors for their support with this fundraising,

which further strengthens the Company's position and facilitates

the continuation of its successful growth strategy."

For further enquiries:

LifeSafe Holdings plc Via FTI Consulting

Dominic Berger, Chairman info@lifesafetechnologies.com

Neil Smith, Chief Executive

Officer

Mike Stilwell, Chief Financial

Officer

WH Ireland Limited (Nominated Tel: +44 (0) 20 7220 1666

Adviser & Broker)

Chris Fielding

Darshan Patel

Isaac Hooper

FTI Consulting (Financial Communications) Tel: +44 (0) 20 3727 1000

Tom Hufton LifeSafe@fticonsulting.com

Harriet Jackson

Liam Gerrard

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Dominic Berger

------------------------------ -----------------------------------

2 Reason for the notification

-------------------------------------------------------------------

a) Position/status Executive Chairman

------------------------------ -----------------------------------

b) Initial notification Initial notification

/Amendment

------------------------------ -----------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name LifeSafe Holdings plc

------------------------------ -----------------------------------

b) LEI 2138004KSXCPNWGSL119

------------------------------ -----------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------

a) Description Purchase of Placing Shares

of the financial

instrument, ISIN: GB00BP83Y473

type of instrument

Identification

code

------------------------------ -----------------------------------

b) Nature of the

transaction

------------------------------ -----------------------------------

c) Price(s) and Price No. of shares

volume(s) 16 pence 62,500

--------------

------------------------------ -----------------------------------

d) Aggregated information

- Aggregated

volume 62,500 shares

- Price 16 pence

------------------------------ -----------------------------------

e) Date of the 21 December 2023

transaction

------------------------------ -----------------------------------

f) Place of the XLON, AIM

transaction

------------------------------ -----------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Gavin Cornelius

------------------------------ -----------------------------------

2 Reason for the notification

-------------------------------------------------------------------

a) Position/status PDMR

------------------------------ -----------------------------------

b) Initial notification Initial notification

/Amendment

------------------------------ -----------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name LifeSafe Holdings plc

------------------------------ -----------------------------------

b) LEI 2138004KSXCPNWGSL119

------------------------------ -----------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------

a) Description Purchase of Placing Shares

of the financial

instrument, ISIN: GB00BP83Y473

type of instrument

Identification

code

------------------------------ -----------------------------------

b) Nature of the

transaction

------------------------------ -----------------------------------

c) Price(s) and Price No. of shares

volume(s) 16 pence 31,250

--------------

------------------------------ -----------------------------------

d) Aggregated information

- Aggregated

volume 31,250 shares

- Price 16 pence

------------------------------ -----------------------------------

e) Date of the 21 December 2023

transaction

------------------------------ -----------------------------------

f) Place of the XLON, AIM

transaction

------------------------------ -----------------------------------

Notes to Editors

LifeSafe is a fire safety technology business that develops

eco-friendly, novel and innovative fire extinguishing fluids and

life-saving fire safety products. LifeSafe has developed a market

disrupting range of eco-friendly fire safety protection products; a

new patent-pending Thermal Runaway Fluid to combat lithium battery

fires by permanently extinguishing and preventing re-ignition, and

the StaySafe All-in-1, a handheld eco-friendly and fully recyclable

extinguisher which is verified to extinguish ten different types of

fire and the number one selling fire extinguisher on Amazon UK. L

ifeSafe is successfully creating new markets for the Group in fire

safety through its innovative technologies, products, digital

marketing and multi-channel sales; and is continuing to develop new

fluid derivations for applications in various industrial market

sectors.

LifeSafe was admitted to trading on AIM in July 2022 with the

ticker LIFS.

For further information please visit:

https://www.lifesafeholdingsplc.com .

LinkedIn:

https://www.linkedin.com/company/lifesafe-technologies

Twitter: https://twitter.com/LifesafeT

- Ends -

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIZZMZZZMGGFZM

(END) Dow Jones Newswires

December 21, 2023 07:22 ET (12:22 GMT)

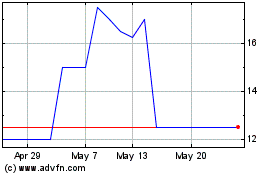

Lifesafe (LSE:LIFS)

Historical Stock Chart

From Apr 2024 to May 2024

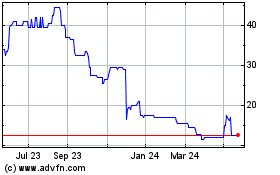

Lifesafe (LSE:LIFS)

Historical Stock Chart

From May 2023 to May 2024