TIDMMILA

RNS Number : 3922U

Mila Resources PLC

29 March 2019

Mila Resources Plc / Index: LSE / Epic: MILA / Sector: Natural

Resources

29 March 2019

Mila Resources Plc

("Mila" or "the Company")

Interim Results

Mila Resources Plc, a London listed natural resources company,

is pleased to present its interim results for the six-month period

ended 31 December 2018.

Highlights:

-- Ongoing appraisal of investment targets in regions and

commodities with strong valuation or cash-flow growth potential

-- Suspension of trading ahead of a potential reverse take-over

while a due diligence process was conducted on a high-grade

minerals sand project in Southern Asia.

-- Strong balance sheet position with cash balance at the end of

the period GBP573,200 due to continuous prudent financial

management. Mila has also negotiated a contribution of GBP37,500

towards Mila's cost from Capital Metals Limited (CML) subject to

them completing a successful listing.

Chairman Statement

I am pleased to present the interim financial statements to

shareholders for the six months ended 31 December 2018.

We formed the Company to undertake an acquisition of a

controlling interest in a company or business (an "Acquisition").

Any Acquisition is expected to constitute a reverse takeover

transaction and consideration for the Acquisition may be in part or

in whole in the form of share-based consideration or funded from

the Company's existing cash resources or the raising of additional

funds.

Following completion of an Acquisition, the objective of the

Company will be to add value to the acquired business or asset

through the deployment of capital with a view to generating value

for its shareholders.

The last year has seen Mila focus on a strategy focused on

investments and acquisition targets in certain specific commodities

and projects within a particular stage of the development cycle.

This strategy has proven challenging to identify explicit targets

at valuations that were justifiable.

We recently mutually terminated a proposed reverse takeover of

Capital Metals Limited, however we continue to see a strong flow of

potential Acquisition opportunities. The Board of Directors,

together with the Company's advisers, are constantly evaluating

these opportunities to ensure that we secure and execute the right

transaction.

I look forward to reporting our progress to you over the coming

the months.

Financial Review

For the half year to 31 December 2018, the Company reports a net

loss of GBP104,650 (2017: GBP124,732). During the six-month period

to 31 December 2018, the Company continued its strict financial

discipline, incurring a net operating cash outflow of GBP128,350

(GBP2017: GBP120,645). The Company held cash at 31 December 2018 of

GBP573,200 (2017: GBP811,389)

Directors

The following directors have held office during the period:

George Donne

Anthony Eastman

Mark Stephenson

Corporate Governance

The UK Corporate Governance Code (September 2014) ("the Code"),

as appended to the Listing Rules, sets out the Principles of Good

Corporate Governance and Code Provisions which are applicable to

listed companies incorporated in the United Kingdom. As a standard

listed company, the Company is not subject to the Code, but the

Board recognises the value of applying the principles of the Code

where appropriate and proportionate and has endeavoured to do so

where practicable.

Responsibility Statement

The Directors are responsible for preparing the Unaudited

Interim Condensed Consolidated Financial Statements in accordance

with the Disclosure and Transparency Rules of the United Kingdom's

Financial Conduct Authority ("DTR") and with International

Accounting Standard 34 on Interim Reporting ("IAS 34"). The

directors confirm that, to the best of their knowledge, this

condensed consolidated interim report has been prepared in

accordance with IAS 34 as adopted by the European Union. The

interim management report includes a fair review of the information

required by DTR 4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the six months ended 31 December 2018 and their impact on the

condensed consolidated financial statements for the period, and a

description of the principal risks and uncertainties for the

remaining six months of the financial year; and

-- related party transactions that have taken place in the six

months ended 31 December 2018 and that have materially affected the

financial position of the performance of the business during that

period.

Outlook

The appetite for listing on the London Standard List is

currently appealing to many domestic and international private

companies. Mila's current existing investment strategy is to

broaden its horizons. Evaluating opportunities across a range of

sectors, the company believes will lead to a more efficient process

of identifying suitable candidates.

On behalf of the board

Mark Stephenson

Director

29 March 2019

MILA RESOURCES PLC

Interim Statement of Comprehensive Income (Unaudited)

For the six months ended 31 December 2018

Notes Six months Six months Year ended

ended ended 30 June

31 December 31 December 2018 Audited

2018 Unaudited 2017 Unaudited

GBP GBP GBP

Revenue - - -

Administrative expenses (104,650) (124,732) (235,264)

Loss before taxation (104,650) (124,732) (235,264)

Income tax expense 3 - - -

Loss for the year (104,650) (124,732) (235,264)

---------------- ---------------- --------------

Other comprehensive income

/ (loss) - - -

---------------- ---------------- --------------

Total comprehensive loss

for the year attributable

to equity holders (104,650) (124,732) (235,264)

---------------- ---------------- --------------

Loss per share (basic

and diluted) attributable

to equity holders (p) 4 (0.45)p (0.54)p (1,01)p

---------------- ---------------- --------------

The income statement has been prepared on the basis that all

operations are continuing operations.

MILA RESOURCES PLC

Interim Statement of Financial Position (Unaudited)

As at 31 December 2018

At 31 December At 31 December At 30 June

2018 Unaudited 2017 Unaudited 2018 Audited

Notes GBP GBP GBP

Current assets

Trade and other receivables 11,651 4,664 8,791

Cash at bank and in hand 573,200 811,389 701,550

---------------- ---------------- --------------

584,851 816,053 710,341

Current liabilities

Trade and other payables 1,537 17,557 22,377

---------------- ---------------- --------------

1,537 17,557 22,377

Net current assets 583,314 798,496 687,964

Net assets 583,314 798,496 687,964

---------------- ---------------- --------------

Equity

Share capital 5 232,000 232,000 232,000

Share premium 5 849,300 849,300 849,300

Share based payment reserve 4,720 4,720 4,720

Retained losses (502,706) (287,524) (398,056)

Equity attributable to

the owners of the parent 583,314 798,496 687,964

---------------- ---------------- --------------

MILA RESOURCES PLC

Statements of changes in equity (Unaudited)

For the six months ended 31 December 2018

Share Share Premium Share Based Retained TOTAL

Capital Account Payment Loss

Reserve

GBP GBP GBP GBP GBP

Balance at 30 June 2017 232,000 849,300 4,720 (162,792) 923,228

Total comprehensive

loss for the period - - - (235,264) (235,264)

Balance at 30 June 2018 232,000 849,300 4,720 (398,056) 687,964

Total comprehensive

loss for the period - - - (104,650) (104,650)

Balance at 31 December

2018 232,000 849,300 4,720 (502,706) 583,314

========= ============== ============ ========== ==========

MILA RESOURCES PLC

Statement of cash flow (Unaudited)

For the six months ended 31 December 2018

Six months Six months 12 months

to 31 December to 31 December to 30 June

2018 2017 2018

GBP GBP GBP

Cash flows from operating activities

Loss for the period (104,650) (124,732) (235,264)

Adjustments for:

Costs settled by the payment of - - -

shares / warrants

----------------

Operating cashflow before working

capital movements (104,650) (124,732) (235,264)

(Increase) / decrease in trade

and other receivables (2,860) (3,423) (7,550)

Increase / (decrease) in trade

and other payables (20,840) 7,510 12,330

---------------- ---------------- ------------

Net cash flow from operating activities (128,350) (120,645) (230,484)

---------------- ---------------- ------------

Net increase in cash and cash equivalents (128,350) (120,645) (230,484)

Cash and cash equivalents at beginning

of the period 701,550 932,034 932,034

Cash and cash equivalents at end

of the period 573,200 811,389 701,550

---------------- ---------------- ------------

MILA RESOURCES PLC

Notes to the financial statements

For the six months ended 31 December 2018

1 General information

Mila Resources Plc (the "Company") looks to identify potential

companies, businesses or asset(s) that have operations in the

natural resources exploration, development and production

sector.

The Company is domiciled in the United Kingdom and incorporated

and registered in England and Wales, with registration number

09620350.

The Company's registered office is Lockstrood Farm, Ditchling

Common, Burgess Hill, West Sussex RH15 0SJ.

2 Accounting policies

The principal accounting policies applied in preparation of

these consolidated financial statements are set out below. These

policies have been consistently applied unless otherwise

stated.

Basis of preparation

The interim unaudited financial statements for the period ended

31 December 2018 have been prepared in accordance with IAS 34

Interim Financial Reporting. This interim financial information is

not the Company's statutory financial statements and should be read

in conjunction with the annual financial statements for the period

ended 30 June 2018, which have been prepared in accordance with

International Financial Reporting Standards (IFRS) and have been

delivered to the Registrars of Companies. The auditors have

reported on those accounts; their report was unqualified, did not

include references to any matters which the auditors drew attention

by way of emphasis of matter without qualifying their report and

did not contain statements under section 498 (2) or (3) of the

Companies Act 2006.

The interim financial information for the six months ended 31

December 2018 is unaudited. In the opinion of the Directors, the

interim consolidated financial information presents fairly the

financial position, and results from operations and cash flows for

the period.

The Directors have made an assessment of the Company's ability

to continue as a going concern and are satisfied that the Company

has adequate resources to continue in operational existence for the

foreseeable future. The Company, therefore, continues to adopt the

going concern basis in preparing its consolidated financial

statements.

The financial information of the Company is presented in British

Pounds Sterling (GBP).

Critical accounting estimates and judgements

The preparation of interim financial information requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities and the reported amounts of

income and expenses during the reporting period. Although these

estimates are based on management's best knowledge of current

events and actions, the resulting accounting estimates will, by

definition, seldom equal related actual results.

In preparing the interim financial information, the significant

judgements made by management in applying the Company's accounting

policies and the key sources of estimation uncertainty were the

same as those that applied to the financial statements for the year

ended 30 June 2018.

3 Income tax expense

No tax is applicable to the Company for the six months ended 31

December 2018. No deferred income tax asset has been recognised in

respect of the losses carried forward, due to the uncertainty as to

whether the Company will generate sufficient future profits in the

foreseeable future to prudently justify this.

MILA RESOURCES PLC

Notes to the financial statements

For the six months ended 31 December 2018 (cont.)

4 Loss per share

Basic loss per ordinary share is calculated by dividing the loss

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the period.

Diluted earnings per share is calculated by adjusting the weighted

average number of ordinary shares outstanding to assume conversion

of all dilutive potential ordinary shares.

There are currently no dilutive potential ordinary shares.

Earnings Weighted average Per-share

GBP number of shares amount

unit pence

Loss per share attributed

to ordinary shareholders (104,650) 23,200,000 (0.45)p

5 Share capital

Number

of shares Share Share

in issue capital premium Total

GBP GBP GBP

Balance at 30 June 2018 23,200,000 232,000 849,300 1,081,300

Movements during the period - - - -

Balance at 31 December 2018 23,200,000 232,000 849,300 1,081,300

=========== ======== ======== ==========

The Company has one class of ordinary share which carries no

right to fixed income.

6 Related party disclosures

Remuneration of directors and key management personnel

The remuneration of the Directors during the six-month period to

31 December 2018 amounted to GBP36,000 (31 December 2017:

GBP36,000).

Shareholdings in the Company

Shares and warrants held by the Directors of the Company which

remained unchanged during the period.

Shares Warrants (1)

Mr George Donne 200,000 400,000

Mr Anthony Eastman 200,000 400,000

Mr Mark Stephenson 600,000 1,200,000

Balance at 31 December

2018 1,000,000 2,000,000

========== =============

(1) Exercisable at GBP0.05, on or before 31 December 2020.

7 Subsequent events

Termination of talks with Capital Management Limited ("CML")

On the 19(th) of March 2019, the Company announced an update on

the negotiations regarding the acquisition of 100% of the share

capital of CML. Unfortunately, the agreement between the two

parties did not materialise, resulting in negotiations being

terminated by mutual consent.

Resignation of Directors

On the 19(th) of March 2019, following the termination of talks

with CML, Mr George Donne and Mr Anthony Eastman, both Executive

Directors, resigned from the board.

New Board Appointment

On the 26(th) of March 2019, Mr Lee Daniels was appointed as a

Non-executive Director.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR SEAFWAFUSEFD

(END) Dow Jones Newswires

March 29, 2019 03:00 ET (07:00 GMT)

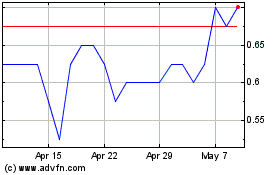

Mila Resources (LSE:MILA)

Historical Stock Chart

From Mar 2024 to May 2024

Mila Resources (LSE:MILA)

Historical Stock Chart

From May 2023 to May 2024