TIDMNAH

RNS Number : 2141U

NAHL Group PLC

24 March 2023

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information for the purposes of Regulation 11 of the Market Abuse

(Amendment) (EU Exit) Regulations 2019/310. With the publication of

this announcement, this information is now considered to be in the

public domain.

24 March 2023

The following announcement replaces the 'Final Results'

announcement released on 22 March 2023 at 0700 under RNS No 7839T.

A full statement has now been included under the heading

'CONSOLIDATED STATEMENT OF FINANCIAL POSITION AT 31 DECEMBER 2022',

which was previously missing. All other details remain unchanged.

The full amended text is shown below.

NAHL Group plc

("NAHL", the "Company" or the "Group")

Final Results

Realising returns on strategic investments and building solid

foundations for future growth

NAHL, a leading UK marketing and services business focused on

the consumer legal services market, announces its Final Results for

the year ended 31 December 2022.

Financial Highlights

Year ended 31 December FY2022 FY2021 Change

Group Revenue GBP41.4m GBP38.9m 6.4%

--------- --------- ------

Operating Profit GBP4.8m GBP4.2m 14.4%

--------- --------- ------

Profit Before Tax GBP0.6m GBP0.2m 142.1%

--------- --------- ------

Net Debt GBP13.3m GBP15.5m -14.0%

--------- --------- ------

-- Group Revenue increased by 6.4% to GBP41.4m (2021: GBP38.9m),

reflecting good progress made across the Group

-- Cash received from settled claims in National Accident Law

(NAL) increased by 67% to GBP3.5m (2021: GBP2.1m)

-- Significant reduction in net debt at 31 December 2022 to GBP13.3m

(2021: GBP15.5m)

-- Strong levels of cash generation resulting in free cash flow

increasing from GBP0.8m in 2021 to GBP2.2m

-- Operating profit increased to GBP4.8m (2021: GBP4.2m) in line

with recently upgraded market expectations

-- Profit before tax increased to GBP0.6m (2021: GBP0.2m) due

to lower-than-expected profit attributable to non-controlling

interests in our LLPs, offset by an increase in borrowing costs

due to higher UK interest rates

-- Basic EPS of 0.8p (2021: 0.3p)

Operational Highlights

-- Both the Consumer Legal Services and Critical Care divisions

advanced their respective growth strategies in the year

-- Continued to rapidly scale NAL and grew headcount to 147 people

(2021: 129 people)

o NAL won 1,894 claims, 60% more than the prior year (2021:

1,187)

o At 31 December 2022, NAL had grown its book of ongoing claims

by 37% to 10,860 (2021: 7,918)

o These claims have an estimated future cash value to NAL (before

processing costs) of GBP11.2m, and an estimated future revenue

of GBP8.2m

-- National Accident Helpline (NAH), generated 34,905 personal

injury enquiries in the year, an increase of 9% over 2021 despite

the wider market remaining subdued, further evidence of its

strong brand and effective marketing strategy

-- NAH also successfully returned to TV advertising in June 2022

and exited the year with its highest share of the non-RTA market

since early 2020

-- Critical Care increased the number of Expert Witness reports

it issued by 10%, whilst investments in marketing and business

development resulted in a 14% increase in the number of new

instructions for Initial Needs Assessments (INA)

-- Further encouraging results in Bush Care Solutions, which was

launched in 2021 and delivered revenue growth of 24% to GBP0.4m

in 2022

-- Critical Care recruited 61 new associates in 2022 to support

its growth and enhance its proposition

Outlook

-- The Group entered 2023 with momentum and the Board are cautiously

optimistic that the Group is well placed to continue its growth

and strong cash generation

-- In Personal Injury, following a successful return to TV advertising

in 2022, the Board plan on increasing advertising investment

in 2023 to gain further market share

-- In the first two months of 2023:

o enquiry numbers are 3% higher than the equivalent period

in 2022, after excluding tariff-only RTA enquiries which are

no longer targeted

o NAL has collected GBP0.6m cash from settlements, 89% more

than the same period last year

o Critical Care Expert Witness and INA reports issued were

27% and 9% ahead of the same period last year respectively

o Expert Witness instructions were 21% higher and INA instructions

were flat compared to the same period last year, due to a

slow start in January

-- Given the persistently high levels of inflation in the UK,

the Board expects UK interest rates to remain at higher levels

in 2023 leading to higher borrowing costs for the Group

-- In response, the Group plans to accelerate cash collection

and further reduce net debt by utilising its flexible placement

model, its maturing book of claims in NAL and the strong levels

of cash originating from its joint ventures and Critical Care

division

James Saralis, CEO of NAHL, commented:

"I am pleased with the financial performance of the Group in

2022. To deliver a significant reduction in net debt, return our

Personal Injury business to profit and continue our growth in

Critical Care, despite the wide-ranging macroeconomic factors

working against both our sector and the economy is testament to our

people and the investments we have made over the last few

years.

"In line with our strategy, we continued to grow our book of

claims in NAL, which now stand at 10,860, 37% ahead of the same

time last year. The Group also collected GBP3.5m of cash from

settlements during the year, up from GBP2.1m in 2021, illustrating

the growing maturity of our claims book. These maturing claims

along with the flexibility of our placement model were instrumental

in the Group being able to reduce its net debt during the year.

"Simultaneously, Critical Care recruited 61 new associates in

2022 to support its growth and further enhance its offering whilst

also investing in its new proposition Bush Care Solutions which

will access adjacent markets and be a key growth enabler for the

future.

"Finally, I would like to reiterate my gratitude to our

employees for their hard work, support and commitment throughout

the year. Without their unwavering dedication, we would not have

had the successes we did in 2022 and I very much look forward to

2023 as we continue to build on the strong foundations we have set

for future growth ."

The Annual Report and notice of Annual General Meeting will be

available by the end of April 2023.

Enquiries:

NAHL Group plc via FTI Consulting

James Saralis (CEO) Tel: +44 (0) 20 3727 1000

Chris Higham (CFO)

Allenby Capital (AIM Nominated Adviser & Broker) Tel: +44 (0) 20 3328 5656

Jeremy Porter / Vivek Bhardwaj (Corporate Finance)

Amrit Nahal (Sales & Corporate Broking)

FTI Consulting (Financial PR) Tel: +44 (0) 20 3727 1000

Alex Beagley NAHL@fticonsulting.com

Sam Macpherson

Amy Goldup

Notes to Editors

NAHL Group plc (AIM: NAH) is a leader in the UK Consumer Legal

Services (CLS) market. The Group provides services and products to

individuals and businesses in the CLS market through its two

divisions:

-- Consumer Legal Services provides outsourced marketing

services to law firms through National Accident Helpline and

Homeward Legal; and claims processing services to individuals

through Your Law, Law Together and National Accident Law. In

addition, it also provides property searches through Searches

UK.

-- Critical Care provides a range of specialist services in the

catastrophic and serious injury market to both claimants and

defendants through Bush & Co.

More information is available at www.nahlgroupplc.co.uk ,

www.national-accident-helpline.co.uk and www.bushco.co.uk

Throughout this document, references to 'joint venture' law firm

relate to our law firms Your Law LLP and Law Together LLP which we

operate in partnership with a minority member. The term 'joint

venture' does not relate to the UK-adopted International Accounting

Standards (IFRS) definition. These law firms are accounted for as

subsidiary undertakings.

Chair's Report

The Group returned to growth in 2022 and delivered results in

line with recently upgraded market expectations, despite a

challenging macro-economic environment. We saw good progress across

the Group with increased revenues and profit and a further

reduction in debt in 2022. Significantly our Personal Injury

business started repaying the investment we have made in its

transformation, and not only returned to growth but was cash

positive and grew market share.

We completed the year with revenues of GBP41.4m (2021:

GBP38.9m), a profit before tax of GBP0.6m (2021: GBP0.2m), and a

further reduction in debt to GBP13.3m (31 December 2021:

GBP15.5m).

Consumer Legal Services

Overall, revenues in the Consumer Legal Services division grew

by 6% to GBP28.3m and operating profit by 12% to GBP4.2m.

These results were driven by a strong performance in our

Personal Injury business which was profitable and cash positive

again following several years of investment into our own law firm

National Accident Law (NAL). NAL now employs 147 people (2021: 129

people) and remains central to the Group's future success by

enabling us to process claims ourselves and keep more of the profit

from those claims. It is beginning to pay back on the investment we

have made in it and for the first time we were able to fund the

working capital cost of NAL from cash generated in the Personal

Injury business itself.

Settlements and the resulting cash receipts in NAL increased in

2022 as claims, started in earlier years, matured. NAL collected

GBP3.5m in cash from settlements made during the year, compared

with GBP2.1m in 2021, representing a 67% increase.

NAL has not yet reached maturity, when the number of cases

starting broadly equals the number of cases concluding in any year,

and we continue to invest in it. During 2022, 8,760 new enquiries

went into NAL which was an increase of 6% compared with 2021.

These new enquiries represent a future pipeline of value for

NAL. By the end of 2022, NAL had increased the volume of ongoing

claims by over 37% to 10,860. These claims have an estimated future

cash value to NAL (before processing costs) of GBP11.2m, and an

estimated future revenue of GBP8.2m. Putting more enquiries into

NAL also has the effect of reducing future payments to our Joint

Venture partners.

Most of the enquiries that did not go to NAL went to our panel

firms who pay for them. This placement model enables us to manage

our cash requirements flexibly as evidenced by our strong reduction

in net debt during the period.

Overall, the Personal Injury business increased the number of

enquiries it generated by around 9% to 34,905 despite the number of

Personal Injury claims in the market remaining flat. This was

achieved through our strong brand and effective marketing, and our

return to television advertising in 2022 after an absence of over

two years due to COVID-19. Our market share in non-RTA enquiries

(the majority of our book) rose to 16.8%, its highest level since

2020, and although our share of RTA enquiries remained relatively

flat at 1.3%, we saw an increasing proportion of higher value

claims in that mix.

Our Residential Property business was impacted by the widely

reported slowdown in the property market due to higher interest

rates, but still contributed a small profit for the year.

Critical Care

Bush & Co (Bush) has continued to invest in its back office

and technology. This investment cycle is coming to an end and these

enhancements should see efficiency gains and margin improvements in

the future as well as providing a more resilient platform for

growth. Bush has also strengthened its marketing and business

development offering.

Case management remains the largest revenue stream in Critical

Care providing support to individuals who have suffered

catastrophic personal injuries. The number of ongoing cases grew by

11% during 2022 and Bush increased the number of employed case

managers to help drive margin improvement. Expert witness services

also saw strong revenue growth in 2022 and now accounts for 36% of

our total revenue compared to 32% in 2019.

Bush Care Solutions was created in 2021 to offer nurse-led care

management services. This is an adjacent market to case management

and enables us to offer a fully managed solution. Revenues grew by

24% in 2022 to GBP0.4m. Although still relatively small, Bush Care

Solutions offers significant opportunity for further growth in this

adjacent market.

Overall revenues in Bush grew by 6% to GBP13.1m and its

operating profit by 4% to GBP3.4m.

Summary

I would like to thank all our employees for their continued

commitment and hard work over the last year. Our people and our

culture are essential to our future success. I would also like to

congratulate Chris Higham who was appointed as a director of the

Company and Group Chief Financial Officer (CFO) during the year,

having previously been acting CFO since August 2021.

I believe we are making good progress across the Group with an

increase in revenue and profit and a further reduction in debt. The

Personal Injury business has returned to growth, is cash positive

and winning more market share. NAL is beginning to pay back on the

investment we have made and at the end of 2022 had nearly 11,000

cases underway that represent a strong pipeline of future value.

Critical Care continues to grow revenues and profit and has

invested to drive future margin improvement. Bush Care Solutions is

not yet two years old but is already showing its potential,

offering the opportunity for growth in an adjacent market.

The Group has created a platform for success and is on track to

build a sustainable and profitable business in the medium term.

Tim Aspinall

Chair

CEO Report

2022 was an important year for NAHL and I'm proud to report on

the progress that our team has delivered.

Overview

Despite the well-documented headwinds across the economy and

specific challenges within our own markets, NAHL achieved its

financial goals in 2022 and returned to growth. The Group increased

revenues by 6% and operating profit by 14%, and we continued to

invest for the future. We have strengthened our financial position,

reducing our debt which ended the year at GBP13.3m. This was a

priority given the challenging and unpredictable macro-economic

environment in the UK.

Both our Consumer Legal Services and Critical Care divisions

advanced their strategies in the year. Our Personal Injury business

returned to profit and was cash generative in 2022 - an important

milestone in our plans. We continue to grow market share in

Personal Injury and our law firm, National Accident Law, is

demonstrating signs of growing maturity. In our Critical Care

division, we have developed our services in the year, added new

specialisms and experienced encouraging early growth in our new

care proposition, Bush Care Solutions.

Whilst these successes demonstrate good progress made in 2022,

there is more to do and we must stay on track if we are to deliver

on our ambitions and build a more sustainable and profitable

business over the next few years. Our strategy for each of our

divisions remains on track and unchanged and we will continue to

invest for future growth.

Financial performance

Group revenue increased by 6% in the year to GBP41.4m (2021:

GBP38.9m) following growth in both of our trading divisions.

Operating profit grew 14% during the year to GBP4.8m (2021:

GBP4.2m) and was in line with recently upgraded market

expectations. Our Consumer Legal Services division grew operating

profit by 12% and our Critical Care division by 4%. As we started

to realise the benefit of past investments in our Personal Injury

business, the Group's operating profit margin increased by 0.8 ppts

from 10.7% in 2021 to 11.5% during the period.

Profit before tax was GBP0.6m (2021: GBP0.2m), which was in line

with recently upgraded market expectations, albeit from a low base.

This was due to lower-than-expected profit attributable to

non-controlling interests in LLPs but offset by an increase in

borrowing costs due to the higher UK interest rates.

Pleasingly, the Group generated strong levels of cash flow

throughout the year with free cash flow increasing from GBP0.8m in

2021 to GBP2.2m in the year. As a result, the Group has reduced net

debt from GBP15.5m at 31 December 2021 to GBP13.3m at 31 December

2022, which was in line with recently upgraded market

expectations.

The Board does not believe that it is appropriate to reinstate

dividends at this time and the Directors have recommended that no

final dividend payment be made in respect of 2022.

Consumer Legal Services

Financial performance

Our Consumer Legal Services division performed well during the

year, delivering a 6% increase in revenues to GBP28.3m (2021:

GBP26.6m) and operating profit increased by 12% to GBP4.2m (2021:

GBP3.7m). This result was driven by a strong performance in our

Personal Injury business, which grew its revenues by 14% to

GBP24.0m (2021: GBP21.0m) and operating profit by 17% to GBP3.9m

(2021: GBP3.4m).

Whilst not a statutory measure, it was particularly pleasing to

see the Personal Injury business return a profit after deducting

members' non-controlling interests in LLPs, which was GBP0.4m in

2022 compared to a loss of GBP0.1m in the prior year. I believe

that this clearly demonstrates the sustainability of this business

and the positive progress that the team have made over the past 18

months.

Market conditions

The UK personal injury market was subdued through the COVID-19

pandemic and this continued into 2022.

According to industry data from the Claims Recovery Unit of the

Ministry of Justice (CRU) and the Official Injury Claim portal for

small claims (OIC), the number of claims registered in 2022 for

road traffic accidents (RTAs) was down 7% compared to the prior

year at c. 371,000 claims, and down 43% compared to the last full

year prior to the pandemic (2019). Our internal analysis estimates

the claimant-side personal injury market to be worth GBP1.1bn in

2021/22 compared with an estimated value of GBP1.6bn in 2019/20(1)

.

This reduction contrasts with traffic volumes on the roads,

which moved closer to pre-pandemic levels in 2022. Government

estimates(2) show motor vehicles travelled 318.6bn vehicle miles in

Great Britain for the year ended March 2022, which was 30% more

than that in the year ended March 2021, but still 6% lower than

pre-pandemic levels (year ended December 2019). Whilst the

equivalent data for the remainder of 2022 is yet to be released, it

is likely that traffic levels had gone on to exceed pre-pandemic

levels by the end of the year. For non-RTA claims, such as

employers' liability, public liability, and occupiers' liability,

claim volumes registered with the CRU in 2022 were broadly flat

compared to that in 2021 at c.95,000 claims (-2%), which was 42%

lower than 2019.

We believe that the cause of this trend of lower claim numbers

is due to the following three factors, which have fundamentally

reset the size of the market during the past 24 months:

1) Firstly, the COVID-19 pandemic resulted in significant

behavioural changes amongst the UK population. This included

changes to working practices and transport usage, including many

more people choosing to work remotely or on a hybrid basis for part

of the week. This has contributed to fewer accidents occurring

during travel time, in workplaces, surrounding shops and urban

areas.

2) Secondly, the implementation of the Civil Liability Act 2018

(Whiplash Reforms) significantly reduced compensation tariffs for

most RTA claims worth GBP5,000 or less and eliminated cost awards

for successful claims. Rather than encouraging victims to manage

their own claims through the OIC portal, the overly complex and

burdensome portal resulted in fewer than 10% of litigants pursuing

a claim themselves and for those relying on a solicitor to support

them, the legislation removed most of the value for the firm,

resulting in many firms withdrawing from the market. We believe

that the significant reduction in compensation combined with the

difficulty of the process has resulted in a lower appetite from

accident victims to make such a claim.

3) Thirdly, research that we commissioned in December indicated

that at least GBP1.4bn(3) of potential personal injury settlements

were unclaimed in 2022 because of people's reluctance to make a

claim. An independent organisation spoke to 2,500 members of the

public, of which 500 people had suffered an accident in the last

three years, and the results were very insightful:

While 11% of people had suffered a no-fault accident in the last

three years, only 50% of these attempted to make a claim and only

half of those went ahead. We found that a quarter of those who

could have made a claim had 'no idea' they were entitled to

compensation, while a similar number did not pursue a claim because

they thought the process 'felt too complicated'. Other reasons for

not claiming included the cost of making a claim, the stigma

associated with claiming and worries about the process and any

potential impact on their job.

We believe that this reluctance to make a claim and the lack of

understanding surrounding the claim process is a result of a

reduction in advertising by firms since the start of the

pandemic.

Our analysis of these three factors leads us to conclude that

whilst the size of the market is smaller now than before the

pandemic, the opportunity remains very significant and there is a

large latent demand that could be unlocked by a firm who can

stimulate the market, educate customers on their rights and change

the perception of claiming.

Strategic progress

Our strategy to succeed in the personal injury market is to grow

the number of accident victims that we can support by leveraging

the strength of the National Accident Helpline brand and processing

an increasing number of those enquiries through our own

consumer-focused law firm, National Accident Law. This will enable

us to develop a sustainable, higher margin business. We will fund

this through our agile and scalable placement model which is

designed to balance the work we place with our panel, and joint

venture partner for in-year profit and cash, with the work we

process ourselves for greater, but deferred profit and cash.

I'm pleased to report that we made clear progress with this

strategy in 2022.

National Accident Helpline generated 34,905 personal injury

enquiries in the year, which was an increase of 9% over 2021. This

number would have been higher had it not been for our decision to

stop targeting tariff-only RTA claims, from February 2022, to focus

on higher-value opportunities. The brand continues to be the "first

choice for people who have had an accident and want legal

representation", according to independent research.

The category mix of enquiries generated was broadly consistent

with last year, with 22% RTA claims, 51% non-RTA and 27% specialist

claims, which we don't process in NAL. Pleasingly, the RTA claims

that we attracted should ultimately be more profitable than last

year, as they comprised a far lower proportion of low value

tariff-only claims.

In June 2022, the business returned to TV advertising for the

first time since January 2020 with its #TellYourStory campaign,

giving accident victims a platform to speak up and feel listened

to. Whilst brand advertising on TV is intended to develop long-term

awareness, the in-year performance of the campaign was encouraging

and it resulted in growth in lead numbers and improved conversion.

Our high-performance digital marketing and conversion-optimised

website also delivered good results in the year and the number of

organic (unpaid) leads to our website increased by 9% compared to

2021.

This activity helped to generate market share gains and in our

key category of non-RTA claims, we consistently grew our trailing

12-month market share from 15.0% on 1 January 2022 to 16.8% by

year-end. This is our highest share of the market since early 2020

and gives me confidence that our marketing investments are

delivering. Furthermore, we remain optimistic about the potential

for additional opportunities when the market begins to grow

again.

In line with our strategy, we continued to rapidly scale NAL

during the year. We allocated 8,760 new enquiries to NAL in 2022,

which was 6% more than in 2021. These enquiries cost GBP2.7m to

generate and our proven model estimates that these will be worth

GBP5.9m in future revenue and cash.

NAL won 1,894 claims in the year, 60% more than prior year

(2021: 1,187) and this generated GBP3.5m in cash from settlements.

This was an increase of 67% (2021: GBP2.1m), further demonstrating

the growing maturity of the firm.

At 31 December 2022, NAL had grown its book of ongoing claims by

37% to 10,860 (2021: 7,918). This book of existing claims has an

embedded value, being the future profits and cash expected to be

generated by processing these claims through to settlement. At 31

December 2022, after already expensing the marketing costs to

generate those claims and processing costs to that date, we

anticipated that the ongoing claims will generate future revenue of

GBP8.2m and future gross profit of GBP7.1m.

The division continued to utilise its flexible placement model

to good effect and enjoyed strong demand for enquiries from its

panel of third-party law firms, increasing its allocation by 7%.

The Group's joint venture law firms, which are now mature, also

performed well during the year. Over the past three years, the

Group has significantly reduced the allocation of new enquiries to

its joint ventures, as growth in NAL has been prioritised in order

to increase profitability over the medium term. In 2022,

approximately 3,000 enquiries were distributed to Law Together LLP

with no new enquiries into Your Law LLP, as planned. Following

investment over a number of years, these relationships continue to

generate good levels of cash flow and delivered GBP3.3m in the year

(2021: GBP3.6m), after deducting drawings to LLP members.

Residential Property

The division's Residential Property business, comprising

Homeward Legal and Searches UK, generated revenues of GBP4.3m,

which was 23% lower than prior year (2021: GBP5.6m). Operating

profit was GBP0.3m (2021: GBP0.4m).

The business experienced a slowdown from the second quarter of

2022, in line with the wider market, and accordingly, Homeward

Legal generated 33% fewer conveyancing instructions than the prior

year. Searches UK proved to be more resilient and the number of

search packs its generated was just 10% lower than the previous

year, reflecting several new customer mandates.

Critical Care

Financial performance

Our Critical Care division, operating as Bush & Co.,

increased its revenues by 6% to GBP13.1m (2021: GBP12.3m).

Operating profit increased by 4% to GBP3.4m (2021: GBP3.3m) and the

business generated GBP3.1m of cash from operations in the year.

Market conditions

Bush & Co. operates in the catastrophic injury market, with

most of the work arising from serious RTA injuries and medical

negligence. Whilst there is no official definition, we categorise

catastrophic injuries as those resulting in damages worth

GBP500,000 or more.

There were fewer serious RTA claims during the COVID-19 pandemic

due to a reduction in traffic on the roads, but this was a

temporary feature. Recent data from the Department for Transport

showed that the number of seriously injured casualties on roads in

Great Britain in the year to June 2022 increased by 18% in the

period but was 6% lower than before the pandemic (2019). Due to the

severity of the victims' injuries, this market is not affected by

the Whiplash Reforms nor any reluctance to claim, as is the case in

our Consumer Legal Services business.

For medical negligence claims, data from NHS Resolution shows

that the number of clinical claims for catastrophic injury made

against the NHS in 2021/22 was slightly down on 2020/21 (-7%).

However, this was 24% more than the average number in each of the

preceding four years, indicating that there has been a step change

in the number of medical negligence claims since 2019/20.

Building on our platform for growth

Our strategy in Bush & Co. is to grow share in our market by

appealing to a broader customer base, extending our competencies

and specialisms and to be more efficient at what we do through the

use of technology.

In 2022, we continued to make good progress with this

strategy.

Revenues from the division's case management service grew by 3%

in the year, and it issued 529 initial needs assessments (INAs),

which was 5% more than the prior year. The business supported 1,354

ongoing case management clients during the year, generating

recurring revenue, although at a lower average revenue per client

than before the pandemic. This is a permanent change because some

of our client support team meetings transitioned online during the

pandemic, which has since become normal practice across the

industry, meaning less time and travel costs becoming

chargeable.

Our investments in marketing and business development resulted

in a 14% increase in the number of new instructions for INAs to 557

(2021: 490).

We started the year trialling a new initiative in which the

business delivered case management services for less complex cases

through a team of three in-house, employed case managers. The

results were encouraging and by the end of the year we had grown

the team to seven employed case managers, operating at a higher

utilisation rate, resulting in enhanced profit margins. We hope to

support more customers with this service in 2023 and grow the team

further.

Our expert witness service had a very strong year in 2022, and

increased revenues by 13%. The business issued 974 reports, which

was 10% more than in 2021, and the average revenue per report

increased due to a favourable mix and additional elements being

required by customers. Instruction numbers increased 7% (1,044

compared to 973 in 2021) to historically high levels.

Finally, I am pleased to report very encouraging results in Bush

Care Solutions, which was launched in 2021. This proposition

provides a support and management service for employing care staff,

which complements our existing case management service and also

attracts standalone work. Bush Care Solutions delivered revenue

growth of 24% to GBP0.4m in 2022, delivering 10 ongoing care

packages at year-end. Whilst currently modest in size, this service

looks to be an important growth driver over the next few years. I

am particularly proud of the excellent job the team have done in

developing this service, which has been well received by customers

as evidenced by its nomination for the Supporting the Industry

award at the 2022 PI Awards.

Bush & Co. continued to develop its range of specialisms in

the year and recruited 61 new associates in 2022 to support its

growth and enhance its proposition. At 31 December 2022, the

business works with 96 associate case managers and 129 expert

witnesses, in addition to its in-house teams.

Our people, culture and communities

At NAHL, we aim to build a sustainable business for the

long-term gain of all our stakeholders. For us, this includes being

a great company to work for, creating long-term value for our

shareholders and also contributing to our communities and the

environment.

The Group employed 283 people at 31 December 2022, which was an

increase of 10% on last year. Much of the growth in employee

numbers has arisen in NAL and, as we look to scale the business, we

have further invested in experienced people in technical areas of

the law firm to support our growth. We also revitalised our

marketing team in Consumer Legal Services during the year,

recruiting a Marketing and Brand Director and several other new

members of the team. I look forward to this investment helping to

take our marketing performance to the next level and build on the

growth in market share that we have been able to generate to date.

Other areas of our recruitment focus have been employing case

managers and care managers in Bush & Co. to facilitate our

growth.

Due to the functionality provided by previous investments in our

systems, 33% of our people now work remotely and 49% on a hybrid

basis. This has been of significant benefit to our business,

opening up new recruitment opportunities and expanding our access

to technical legal talent to support the scaling up of NAL, as well

as offering more choice and improved work-life balance for our

people.

As well as recruiting the best talent available, our People Team

added significant value through the delivery of several in- house

training courses in the year. In addition to courses focused on

developing personal strengths, dealing with imposter syndrome and

developing remote management skills, the team prepared 13 employees

for a leadership role in our year- long Pathway to Leadership

programme. In total, 246 hours of training and coaching were

delivered in 2022.

We also made some changes to our Board in the year. On 30

September 2022, Gillian Kent decided to step down as a Non-

Executive Director after eight years in the role. I'd like to thank

Gillian for her support and wise counsel over the years and wish

her the best of luck in her future endeavours.

Also in September, I was delighted to welcome Chris Higham to

the Board as an Executive Director when he was appointed to the

role of CFO on a permanent basis. Chris has been with the Group for

16 years and his experience, through the IPO and the subsequent

transformation of the Personal Injury business has proved

invaluable. I look forward to continuing to work closely with Chris

as we realise our vision for the Group. With these changes, the

Directors believe that the Board composition is suitable for the

Group in its current state.

Through our company culture, we aim to maintain a high-trust

environment for the benefit of everyone, irrespective of who an

individual is or what they do for the Group. Our people are

recruited to join our teams from a diverse range of backgrounds and

experience as we believe that makes us better able to serve our

customers; and we expect our leaders to engender trust with all our

stakeholders by demonstrating their ability, integrity and

benevolence. When we surveyed our people during the year, 93% said

that they believed that everyone in our business is treated fairly

regardless of race, gender, ethnicity, disability, sexual

orientation or other differences, a result I am very proud of.

As at 31 December 2022, the gender split across the Group was

72% female and 28% male. At a Board level, the Board was 20% female

and 80% male.

The Group's values of Driven, Curious, Passionate and Unified

continue to guide how we do things at NAHL. In June 2022, our

annual employee survey demonstrated the progress we are making with

the culture and the strong levels of employee engagement within the

Group. Our overall engagement score was 78%, which was a 3 ppt

improvement on the previous year and significantly higher than the

UK average of 14%(5) . Significant improvements compared to 2021

were identified in communication and our contribution to our

communities. In December 2022, Investors in People reaccredited our

Personal Injury business with a Gold award to add to the Gold award

held by our Critical Care division and Silver award held by

Residential Property.

We were pleased to support a number of separate charities during

the year by fundraising over GBP50,000 and giving up our time to

help with a number of worthy causes. This included supporting the

Child Brain Injury Trust, Kettering and Daventry foodbanks, and the

DEC's Ukraine Appeal. We continued our work to support the

environment, donating 120 hours of volunteering at the Green Patch

community project in Kettering, and continuing our pledge to fund

the planting of a tree for every new employee that joins the Group.

By 31 December 2022 we had a total of 463 mangrove trees growing in

our forest in Madagascar, which will sequester approximately 139

tonnes of CO2 over their lifetime.

Current trading and outlook

In 2022, in spite of subdued market conditions, we achieved our

financial goals and returned the Group to growth. After several

years of transformation, we delivered a profit before tax in our

Personal Injury business and we can now start to realise a return

on our investments. We also continued to build a strong platform in

our Critical Care business, from which we can grow and expand into

adjacent markets. Pleasingly, we finished the year strongly and

this gave us momentum as we went into 2023.

For these reasons, as I look ahead to 2023 and beyond, I am

cautiously optimistic that the Group is well placed to continue its

growth and strong cash generation.

In our Personal Injury business, we plan to increase our

advertising spend in 2023 to try to win further market share. We

aim to continue to grow the embedded value of our ongoing claims

and win more settlements in NAL, driving cash generation. In the

first two months of the year, we are on track to deliver these

plans. Excluding tariff-only RTA claims, which are no longer being

targeted, enquiry numbers are 3% higher than the equivalent period

in 2022 driven by strong levels of RTA leads. In NAL, we have

collected GBP0.6m of cash from settlements, 89% more than in the

same period in 2022.

In Critical Care, we expect to see continued strong growth in

expert witness services and Bush Care Solutions, with continued,

but modest, growth in case management. Our upgrades to the case

management and finance technology systems are due to be implemented

this year, which should drive improvements in future operating

profit margin over the coming years. In the first two months of

2023, the case management team delivered 83 INAs, which was 9% more

than the same period in the prior year, although instruction

numbers were flat compared to last year. In expert witness, 197

reports were issued in January and February, which was 27% more

than the same period in the prior year, and instructions were up

21%.

Given the persistently high levels of inflation in the UK, the

Board expects UK interest rates to remain at higher levels in 2023

leading to higher borrowing costs for the Group. In response, the

Group will continue to leverage its flexible placement model to

drive short-term cash flow. This, in addition to its maturing book

of claims in NAL and the strong levels of cash originating from its

joint ventures and Critical Care division, will enable the Group to

accelerate cash collection in 2023 and further reduce net debt.

Finally, I want to take this opportunity to pay tribute to our

people who go above and beyond to deliver to the best of their

ability for our customers. I'm proud to be leading such a talented

and committed team and look forward to delivering on our

commitments to our customers and shareholders and continuing to

improve our performance.

James Saralis

Chief Executive Officer

Footnotes:

1. Internal research produced during the year

2. Department for Transport, reported road casualties by

severity and road user type: Great Britain

3. Independent research produced by Censuswide Limited, December 2022

4. Independent Research by The Nursery Research & Planning Ltd, March 2023

5. Gallup 'State of the Global Workplace 2022 Report'

CFO Report

Overview

The year saw the business return to growth and reduce its net

debt. This was despite volumes in our markets remaining subdued, a

pattern we have seen continue since the COVID-19 pandemic.

Our wholly owned law firm, National Accident Law (NAL),

continues to scale and is now generating significant cash receipts

as the book of cases continues to mature.

We continued to invest in new technologies in the Critical Care

division. This investment is now largely complete, setting the

business up for future growth.

From an operational perspective, revenue grew by 6.4% to

GBP41.4m (2021: GBP38.9m) and operating profit grew by 14.4% to

GBP4.8m (2021: GBP4.2m) with growth seen across both divisions.

Review of income statement

2022 2021 Change Change

GBPm GBPm GBPm %

========================================= ======= ======= ======= =======

Consumer Legal Services 28.3 26.6 1.7 6.3%

Critical Care 13.1 12.3 0.8 6.4%

========================================= ======= ======= ======= =======

Revenue 41.4 38.9 2.5 6.4%

========================================= ======= ======= ======= =======

Consumer Legal Services 4.2 3.7 0.5 12.2%

Critical Care 3.4 3.3 0.1 4.3%

Shared Services (1.7) (1.6) (0.1) 5.9%

Other items (1.1) (1.2) 0.1 -10.2%

========================================= ======= ======= ======= =======

Operating Profit 4.8 4.2 0.6 14.4%

========================================= ======= ======= ======= =======

Profit attributable to non-controlling

interest in LLPs (3.6) (3.5) (0.1) 3.0%

Financial income 0.1 0.1 (0.0) -6.3%

Financial expense (0.7) (0.6) (0.1) 28.6%

========================================= ======= ======= ======= =======

Profit before tax 0.6 0.2 0.4 142.1%

========================================= ======= ======= ======= =======

Taxation (0.2) 0.0 (0.2) 132.9%

========================================= ======= ======= ======= =======

Profit and total comprehensive

income for the year 0.4 0.2 0.2 146.8%

========================================= ======= ======= ======= =======

Consumer Legal Services

The Consumer Legal Services division increased revenue by 6% to

GBP28.3m (2021: GBP26.6m) and operating profit grew by 12% to

GBP4.2m (2021: GBP3.7m). Enquiry numbers grew by 9% to 34,905

(2021: 32,132) despite the personal injury market remaining

subdued, as discussed in the CEO report and our strategic decision

to stop accepting low value soft-tissue injury Road Traffic

Accident (RTA) claims in the first quarter of 2022.

The number of enquiries passed across to our wholly owned law

firm, NAL, increased by 6% and the law firm continues to process

all the RTA enquiries generated for accidents in England and Wales.

These enquiries represented an investment of GBP2.7m when taking

into account the cost of advertising and overheads related to the

generation of these enquiries.

The enquiries processed by NAL have a longer revenue cycle than

the panel relationships. The cases can take a number of years to

conclude, and NAL first recognises revenue from a case when an

admission of liability has been received from the defendant. The

enquiries passed to NAL in the year are expected to generate

c.GBP5.9m (2021: GBP6.0m) in revenue across their life cycle.

By the end of the period, NAL was processing 10,860 open cases

(2021: 7,918), an increase of 37% as the law firm continues to

mature. These ongoing cases are expected to contribute c.GBP8.2m

(2021: GBP6.7m) in future revenue and c.GBP11.2m of future cash

receipts (2021: GBP8.4m).

The law firm is yet to reach maturity but cash receipts from

settled cases give an indication of the progress made. Cash

receipts from cases settled grew by 67% to GBP3.5m in the year

(2021: GBP2.1m) and the total cash receipts from settled cases

since inception of the law firm is GBP7.0m. Once the law firm is

fully mature we would expect cash receipts in a period to largely

match the expected revenue from new enquiries added.

The Residential Property business generated a positive

contribution to profit of GBP0.3m (2021: GBP0.4m) after allocation

of shared costs. The business was negatively impacted by the end of

the Stamp Duty Land Tax holiday on properties valued up to

GBP500,000 as well as rising consumer borrowing costs towards the

end of the year.

Critical Care

The Critical Care division grew revenue by 6% to GBP13.1m (2021:

GBP12.3m) with operating profit increasing by 4% to GBP3.4m (2021:

GBP3.3m).

The division benefitted from investment in business development

activity contributing to a 7% increase to expert witness

instructions and a 14% increase in Initial Need Assessment (INA)

instructions. Average revenues per instruction on expert witness

increased in the year due to mix and additional work requested by

customers. Average revenues per instruction for case management has

continued to be impacted by the changes in working practices

brought about by the pandemic. These new patterns are expected to

continue going forward.

The business also saw an encouraging performance from Bush Care

Solutions which delivered GBP0.4m of revenue in the year following

its launch towards the latter part of 2021. Although still

relatively small, Bush Care Solutions offers the opportunity for

further growth in an adjacent market.

Shared Services and other items

The costs for the Group's Shared Services functions increased by

GBP0.1m to GBP1.7m (2021: GBP1.6m) and other items which include

share-based payments and amortisation fell to GBP1.1m (2021:

GBP1.2m).

Financial expense

Costs relating to the financing of debt increased to GBP0.7m in

the year (2021: GBP0.6m) despite net debt falling. This is due to

rising interest rates during the year. Our debt is linked to the

Sterling Overnight Index Average (SONIA) plus 2.25%.

Exceptional and non-underlying items

The Group did not incur any exceptional costs in the year (2021:

GBP0.0m).

Taxation

The Group's tax charge of GBP184,000 (2021: GBP79,000)

represents an effective tax charge of 32.4% (2021: 33.6%). The tax

charge is higher than the standard corporation tax rate of 19% for

the reasons set out in note 3. The deferred tax credit originates

from temporary differences in intangible assets acquired on

business combinations.

Earnings per share (EPS) and dividend

Basic EPS for the year were 0.8p (2021: 0.3p) and the diluted

EPS were 0.8p (2021: 0.3p), reflecting the impact of share options

due to vest in future years.

The Board does not believe it is appropriate to re-instate

dividends at this time and the Directors have recommended that no

final dividend be paid in respect of 2022 (2021: nil).

Review of the statement of financial position

In reviewing the statement of financial position, I consider the

significant items to be working capital, defined as trade and other

receivables less trade and other payables, and net debt.

Working Capital

Trade and other receivables less trade and other payables

totalled GBP17.1m at year end (2021: GBP17.2m).

Trade receivables and accrued income balances related to the

processing of personal injury claims increased to GBP7.5m (2021:

GBP6.9m). The increase is due to cases settling in the more mature

joint ventures offset by a growing claims book in NAL, which is yet

to reach full maturity. Accrued income on open cases in NAL within

this balance was GBP2.7m (2021: GBP1.7m). These claims are yet to

reach the settlement stage but have received an admission of

liability from the defendant. This is in line with the Group's

accounting policy for legal services revenue.

There remains a significant element of uncertainty in estimating

this accrued income. The Directors believe that the assumptions

adopted are appropriate and based on historical experience of

claims processed in our law firms and by our panel. In practice it

is rare for accrued income to be downgraded once an admission of

liability has been received. These assumptions are updated with

actual results as claims settle.

Disbursement receivables remained relatively flat at GBP8.4m

(2021: GBP8.3m).

Receivables not relating to the law firms decreased from

GBP18.2m to GBP17.0m. This is largely due to clearing a historic

GBP1.4m debt owed on a settlement relating to the termination of

National Law Partners, as agreed in 2019.

Payables reduced from GBP16.2m on 31 December 2021 to GBP15.8m

at the balance sheet date largely due to a reduction in

disbursements payable as mature cases settling in the joint

ventures were partly offset by immature cases in NAL.

Net debt and bank facilities

We carefully managed our cash resources during the year to

balance an investment in processing personal injury cases with a

desire to reduce net debt, particularly in light of rising interest

costs towards the end of the year. As a result, net debt fell from

GBP15.5m on 31 December 2021 to GBP13.3m at year-end. Net debt is

defined in note 8 and is comprised of GBP2.6m of cash (2021:

GBP2.5m) offset by borrowings of GBP15.9m (2021: GBP17.9m).

The borrowings represent a balance on the Group's GBP20.0m

Revolving Credit Facility with its lender, Yorkshire Bank. The

facility is in place to run through to 31 December 2024.

Review of the cash flow statement

2022 2021 Change Change

GBPm GBPm GBPm %

======================================= ===== ======= ====== =========

Net cash generated from operating

activities 6.0 5.1 0.9 16.9%

======================================= ===== ======= ====== =========

Net cash used in investing activities (0.3) (0.6) 0.3 56.4%

======================================= ===== ======= ====== =========

Facility arrangement fees 0.0 (0.1) 0.1 -100.0%

Principal element on lease payments (0.3) (0.2) (0.1) -59.0%

Drawings paid to LLP members (3.2) (3.4) 0.2 4.1%

======================================= ===== ======= ====== =========

Net cash using in financing activities

(before borrowings) (3.5) (3.7) 0.2 -2.3%

======================================= ===== ======= ====== =========

Free cash flow 2.2 0.8 1.4 158.7%

======================================= ===== ======= ====== =========

Repayment of borrowings (2.0) (2.0) 0.0 0.0%

======================================= ===== ======= ====== =========

Net increase/(decrease) in cash

and cash equivalents 0.2 (1.2) 1.4 117.1%

======================================= ===== ======= ====== =========

The Group's cash and cash equivalents increased by GBP0.2m in

the year (2021: reduction of GBP1.2m). The significant items in the

consolidated cash flow statement are net cash from operating

activities, drawings paid to LLP members and the repayment of

borrowings.

Net cash from operating activities increased from GBP5.1m to

GBP6.0m. This was driven by maturing receipts from settled cases in

both NAL and the joint venture relationships, generating GBP3.5m

and GBP3.3m respectively. This was partly offset by the continuing

investment of new cases to NAL as the law firm continues to scale

as well as interest payments of GBP0.6m (2021: GBP0.4m).

The Group paid GBP3.2m (2021: GBP3.4m) of drawings to its

partners in the joint venture law firms during the year, under the

terms of our agreements. This reflects the continuing closure of

claims won and settled during the year. The Group also acquired

GBP0.2m (2021: GBP0.3m) of intangible assets in the year as it

continued to improve its technological offering in Critical

Care.

The Group repaid GBP2.0m (2021: GBP2.0m) of borrowings in the

year on its Revolving Credit Facility.

Free Cash Flow (FCF) is the Group's KPI with regards to cash

flow. FCF in 2022 was GBP2.2m compared to GBP0.8m in 2021. The

primary reason for this increase is an increase in personal injury

cash receipts on settled cases as more cases settle in NAL and the

joint venture partnerships. Personal Injury is now entirely

self-funding investment into new cases.

The Group also monitors operating cash conversion. This was 143%

in the year (2021: 150%), a direct reflection of the movements

outlined above.

Conclusion

In conclusion, despite headwinds in our markets and the wider

economy, we have continued to make progress with our strategy,

investing in both divisions to deliver growth whilst continuing to

manage down our debt.

Chris Higham

Chief Financial Officer

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2022

2022 2021

Note GBP000 GBP000

Revenue 1,2 41,421 38,947

Cost of sales (23,586) (21,352)

------------------------------------------------ ---- -------- --------

Gross profit 17,835 17,595

Administrative expenses (13,079) (13,439)

------------------------------------------------ ---- -------- --------

Operating Profit 4,756 4,156

Profit attributable to members' non-controlling

interests in LLPs 2 (3,554) (3,451)

Financial income 80 85

Financial expense (713) (555)

------------------------------------------------ ---- -------- --------

Profit before tax 569 235

Taxation 3 (184) (79)

------------------------------------------------ ---- -------- --------

Profit and total comprehensive income for

the year 385 156

------------------------------------------------ ---- -------- --------

All profits and losses and total comprehensive income are

attributable to the owners of the Company.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AT 31 DECEMBER 2022

2022 2021

Note GBP000 GBP000

Non-current assets

Goodwill 55,489 55,489

Other intangible assets 2,714 3,701

Property, plant and equipment 392 477

Right of use assets 2,027 2,315

Deferred tax asset 50 23

---------------------------------------------------- ---- -------- --------

60,672 62,005

---------------------------------------------------- ---- -------- --------

Current assets

Trade and other receivables (including GBP5,312,000

(2021: GBP4,557,000) due in more than one year) 4 32,886 33,404

Cash and cash equivalents 2,654 2,458

35,540 35,862

---------------------------------------------------- ---- -------- --------

Total assets 96,212 97,867

---------------------------------------------------- ---- -------- --------

Current liabilities

Trade and other payables 5 (15,847) (16,211)

Lease liabilities (263) (242)

Member capital accounts (4,487) (4,210)

Current tax liability (162) (97)

---------------------------------------------------- ---- -------- --------

(20,759) (20,760)

---------------------------------------------------- ---- -------- --------

Non-current liabilities

Lease liabilities (1,724) (1,953)

Other interest-bearing loans and borrowings (15,939) (17,910)

Deferred tax liability (470) (625)

---------------------------------------------------- ---- -------- --------

(18,133) (20,488)

---------------------------------------------------- ---- -------- --------

Total liabilities (38,892) (41,248)

---------------------------------------------------- ---- -------- --------

Net assets 57,320 56,619

---------------------------------------------------- ---- -------- --------

Equity

Share capital 116 116

Share option reserve 4,628 4,312

Share premium 14,595 14,595

Merger reserve (66,928) (66,928)

Retained earnings 104,909 104,524

---------------------------------------------------- ---- -------- --------

Capital and reserves attributable to the owners

of NAHL Group plc 57,320 56,619

---------------------------------------------------- ---- -------- --------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2022

Capital and

reserves

attributable

Share to

the owners

Share option Share Merger Retained of

NAHL Group

capital reserve premium reserve earnings plc

Note GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 January 2021 115 3,912 14,595 (66,928) 104,368 56,062

Total comprehensive income

for the year

Profit for the year - - - - 156 156

Total comprehensive income - - - - 156 156

Transactions with owners,

recorded directly in equity

Issue of new Ordinary Shares 1 - - - - 1

Share-based payments - 400 - - - 400

Total transactions with owners,

recorded

directly in equity 1 400 - - - 401

Balance at 31 December 2021 116 4,312 14,595 (66,928) 104,524 56,619

Total comprehensive income

for the year

Profit for the year - - - - 385 385

Total comprehensive income - - - - 385 385

Transactions with owners,

recorded directly in equity

Share-based payments - 316 - - - 316

Total transactions with owners,

recorded

directly in equity - 316 - - - 316

Balance at 31 December 2022 116 4,628 14,595 (66,928) 104,909 57,320

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEARED 31 DECEMBER 2022

2022 2021

GBP000 GBP000

Cash flows from operating activities

Profit for the year 385 156

Adjustments for:

Profit attributable to members' non-controlling

interests in LLPs 3,554 3,451

Property, plant and equipment Depreciation 168 171

Right of use asset depreciation 288 306

Amortisation of intangible assets 1,186 1,195

Financial income (80) (85)

Financial expense 713 555

Share-based payments 316 400

Taxation 184 79

------------------------------------------------------ ------- -------

6,714 6,228

Decrease in trade and other receivables 448 1,012

Decrease in trade and other payables (364) (1,337)

------------------------------------------------------ ------- -------

Cash generated from operations 6,798 5,903

Interest paid (627) (398)

Tax paid (165) (365)

------------------------------------------------------ ------- -------

Net cash generated from operating activities 6,006 5,140

------------------------------------------------------ ------- -------

Cash flows from investing activities

Acquisition of property, plant and equipment (83) (281)

Acquisition of intangible assets (199) (339)

Interest received 13 2

------------------------------------------------------ ------- -------

Net cash used in investing activities (269) (618)

------------------------------------------------------ ------- -------

Cash flows from financing activities

Repayment of borrowings (2,000) (2,000)

Issue of share capital - 1

Facility arrangement fees - (90)

Principal element of lease payments (264) (166)

Drawings paid to LLP members (3,277) (3,418)

------------------------------------------------------ ------- -------

Net cash used in financing activities (5,541) (5,673)

------------------------------------------------------ ------- -------

Net increase/(decrease) in cash and cash equivalents 196 (1,151)

Cash and cash equivalents at 1 January 2,458 3,609

------------------------------------------------------ ------- -------

Cash and cash equivalents at 31 December 2,654 2,458

------------------------------------------------------ ------- -------

NOTES TO THE FINANCIAL STATEMENTS

1 Accounting policies

Basis of preparation

Consolidated Financial Statements

The preliminary financial statements do not constitute statutory

accounts for NAHL Group plc within the meaning of section 434 of

the Companies Act 2006 but do represent extracts from those

accounts.

The statutory accounts will be delivered to the Registrar of

Companies in due course. The auditors' have reported on those

accounts. Their report was unqualified. The auditors' report does

not contain a statement under either section 498(2) of Companies

Act 2006 (accounting records or returns inadequate or accounts not

agreeing with records and returns), or section 498(3) of Companies

Act 2006 (failure to obtain necessary information and

explanations).

The Group's financial statements have been prepared in

accordance with UK-adopted International Accounting Standards

(IFRS) in conformity with the Companies Act 2006, IFRIC

interpretations and under the historical cost convention.

Going Concern

In determining the appropriate basis of preparation of the

financial statements, the Directors are required to consider

whether the Company and Group can continue in operational existence

for the foreseeable future.

The Audit and Risk Committee has reviewed the Going Concern

assessment prepared by management. The assessment includes detailed

financial forecasts covering the Group's adopted strategy and

considers a range of sensitivities. These forecasts consist of the

2023 budget and extended forecasts and the period considered for

the going concern review is to the end of March 2024, being

approximately 12 months from the date of signing of the 2022 Annual

Report and financial statements. The key assumption in the forecast

is the growth of the Personal Injury division's self- processing

operations as this growth is the key driver for both profitability

and cash going forward. The going concern assessment focuses on two

key areas, being the ability of the Group to meet its debts as they

fall due and being able to operate within its banking facility.

The Group refinanced its banking facilities in December 2021 and

has access to a GBP20.0m revolving credit facility (RCF) with its

bankers. In all of the scenarios the Group has modelled it would

have sufficient liquidity within its current RCF to meet its

liabilities as they fall due and would not need to access

additional funding.

The Group's RCF is subject to quarterly covenant testing and all

of the scenarios modelled suggest that the Group will continue to

operate within its covenants for the foreseeable future.

Considering the above, the Directors have a reasonable

expectation that the Company and Group have adequate resources to

continue in existence for the foreseeable future and have concluded

it is appropriate to adopt the going concern basis of accounting in

the preparation of the financial statements.

New standards and amendments adopted by the Group

There are no new or amended standards applicable for the current

reporting period.

New standards, interpretations and amendments not yet

effective

There are no new standards, interpretations and amendments that

are not yet effective and that would be expected to have a material

impact on the Group in the current or future reporting periods and

on foreseeable future transactions.

2 Operating segments

Consumer Critical Shared Other

Legal Services Care Services items Eliminations(2) Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Year ended 31 December

2022

Revenue 28,264 13,157 - - - 41,421

Depreciation and

amortisation (257) (201) (358) (826) - (1,642)

Operating profit/(loss) 4,179 3,434 (1,715) (1,142) - 4,756

Profit attributable

to non-controlling

interest members

in LLPs (3,554) - - - (3,554)

Financial income 77 - 3 - - 80

Financial expenses - (5) (708) - - (713)

Profit/(Loss) before

tax 702 3,429 (2,420) (1,142) - 569

Trade receivables 2,632 5,610 - - - 8,242

Total assets(1) 29,222 6,780 77,716 - (17,506) 96,212

Segment liabilities(1) (17,874) (1,258) (3,189) - - (22,321)

Capital expenditure

(including intangibles) 95 187 - - - 282

------------------------- -------------- -------- -------- ------- --------------- --------

Year ended 31 December

2021

Revenue 26,583 12,364 - - - 38,947

Depreciation and

amortisation (272) (166) (363) (871) - (1,672)

Operating profit/(loss) 3,726 3,293 (1,592) (1,271) - 4,156

Profit attributable

to non-controlling

interest members

in LLPs (3,451) - - - (3,451)

Financial income 85 - - - - 85

Financial expenses - (10) (545) - - (555)

Profit/(Loss) before

tax 360 3,283 (2,137) (1,271) - 235

Trade receivables 2,999 4,896 - - - 7,895

Total assets(1) 29,625 6,335 79,413 - (17,506) 97,867

Segment liabilities(1) (17,754) (1,306) (3,556) - - (22,616)

Capital expenditure

(including intangibles) 60 326 234 - - 620

------------------------- -------------- -------- -------- ------- --------------- --------

1. Total assets and segment liabilities exclude intercompany

loan balances as these do not form part of the operating activities

of the segment.

2. Eliminations represents the difference between the cost of

subsidiary investments included in the total assets figure for each

segment and the value of goodwill arising on consolidation.

Significant customers

One customer in the Consumer Legal Services segment accounted

for 10.0% of the total Group revenue. No other customers accounted

for greater than 10% of the total Group revenue (2021: no

customers).

Geographic information

All revenue and assets of the Group are based in the UK.

Operating segments

The activities of the Group are managed by the Board, which is

deemed to be the chief operating decision maker (CODM). The CODM

has identified the following segments for the purpose of

performance assessment and resource allocation decisions. These

segments are split along product lines and are consistent with

those reported last year.

Consumer Legal services - Revenue is split along 3 separate

streams being: a) Panel - revenue from the provision of personal

injury and conveyancing enquiries to the Panel Law Firms, based on

a cost plus margin model b) Products - consisting of commissions

received from providers for the sale of additional products by them

to the Panel Law Firms, surveys and the provision of conveyancing

searches and c) Processing - in the case of our ABSs and self-

processing operations, revenue receivable from clients for the

provision of legal services.

Critical Care - Revenue from the provision of expert witness

reports and case management support within the medico-legal

framework for multi-track cases.

Shared Services - Costs that are incurred in managing Group

activities or not specifically related to a product.

Other items - Other items represent share-based payment charges

and amortisation charges on intangible assets recognised as part of

business combinations.

3 Taxation

Recognised in the consolidated statement of comprehensive

income

2022 2021

GBP000 GBP000

Current tax expense

Current tax on income for the year 352 276

Adjustments in respect of prior years 14 13

Total current tax 366 289

Deferred tax credit

Origination and reversal of timing differences (182) (210)

Total deferred tax (182) (210)

Tax expense in statement of comprehensive income 184 79

Total tax charge 184 79

Reconciliation of effective tax rate

2022 2021

GBP000 GBP000

Profit for the year 385 156

Total tax expense 184 79

Profit before taxation 569 235

Tax using the UK corporation tax rate of 19.00%

(2021: 19.00%) 108 45

Non-deductible expenses 68 97

Adjustments in respect of prior years 14 13

Share scheme deductions - (8)

Short-term timing differences (6) (68)

Total tax charge 184 79

------------------------------------------------- ------ ------

Changes in tax rates and factors affecting the future tax

charge

The UK Government announced in the 2021 budget that from 1 April

2023, the rate of corporation tax in the United Kingdom will

increase from 19% to 25%. This was substantively enacted at the

reporting date and so the effects are included within these

financial statements.

4 Trade and other receivables

2022 2021

GBP000 GBP000

Trade receivables: receivable in less than one

year 7,077 7,056

Trade receivables: receivable in more than one

year 1,165 839

Accrued income: receivable in less than one

year 11,137 12,414

Accrued income: receivable in more than one

year 4,147 3,718

Other receivables 26 21

Prepayments 954 913

Corporation tax - 136

Recoverable disbursements 8,380 8,307

Total trade and other receivables 32,886 33,404

------------------------------------------------ ------ ------

A provision against trade receivables and accrued income of

GBP612,000 (2021: GBP740,000) is included in the figures above.

Trade receivables and accrued income receivable in greater than one

year are classified as current assets as the Group's working

capital cycle is considered to be up to 36 months as extended

credit terms are offered as part of commercial agreements.

5 Trade and other payables

Amounts due within one year: 2022 2021

GBP000 GBP000

Trade payables 1,689 1,452

Disbursements payable 6,620 7,222

Other taxation and social security 1,231 1,216

Other payables, accruals and deferred revenue 5,850 5,864

Customer deposits 457 457

------------------------------------------------- ---------------- ------

Total trade and other payables 15,847 16,211

------------------------------------------------- ---------------- ------

6 Earnings per share

The calculation of basic earnings per share at 31 December 2022

is based on the profit attributable to ordinary shareholders of the

parent company of GBP385,000 (2021: profit of GBP156,000) and a

weighted average number of Ordinary Shares outstanding of

46,325,222 (2021: 46,245,345).

Profit attributable to ordinary shareholders

GBP000 2022 2021

Profit for the year attributable to the

shareholders 385 156

-------------------------------------------- ---------- -----------

Weighted average number of ordinary shares

Number 2022 2021

Issued Ordinary Shares at 1 January 46,325,222 46,240,222

Weighted average number of Ordinary Shares

at 31 December 46,325,222 46,245,345

Basic Earnings per share (p)

2022 2021

Group 0.8 0.3

-------------------------------------------- ---------- -----------

The Group has in place share-based payment schemes to reward

employees. At 31 December 2022, there were potentially dilutive

share options under the Group's share option schemes. The total

number of options available for these schemes included in the

diluted earnings per share calculation is 2,329,951 (2021:

1,315,881). There are no other diluting items.

Diluted Earnings per share (p)

2022 2021

Group 0.8 0.3

------ ---- ----

7 Dividends

No dividends were paid in 2022 or 2021.

8 Net debt and changes in liabilities arising from

financing activities

Net debt includes cash and cash equivalents and other

interest-bearing loans and borrowings.

2022 2021

GBP000 GBP000

Cash and cash equivalents 2,654 2,458

Other interest-bearing loans and borrowings (15,939) (17,910)

Net debt (13,285) (15,452)

Lease liabilities (1,987) (2,195)

Set out below is a reconciliation of movements in

net debt during the period.

2022 2021

GBP000 GBP000

Net increase/(decrease) in cash and cash equivalents 196 (1,151)

Net inflow from decrease in debt and debt financing 2,000 2,000

Movement in net borrowings resulting from cash flows 2,196 849

Non-cash movements - net release of prepaid loan arrangement

fees (29) (9)

Net debt at beginning of period (15,452) (16,292)

------------------------------------------------------------- -------- --------

Net debt at end of period (13,285) (15,452)

------------------------------------------------------------- -------- --------

Set out below is a reconciliation of movements in lease

liabilities arising from financing activities:

2022 2021

GBP000 GBP000

Net outflow from decrease in lease liabilities 264 166

Movement in lease liabilities resulting from cash flows 264 166

Non-cash movements arising from initial recognition of

new lease liabilities, revisions and interest charges (56) 82

Lease liabilities at beginning of period (2,195) (2,443)

-------------------------------------------------------- ------- -------

Lease liabilities at end of period (1,987) (2,195)

-------------------------------------------------------- ------- -------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUSVNRONUOUAR

(END) Dow Jones Newswires

March 24, 2023 12:59 ET (16:59 GMT)

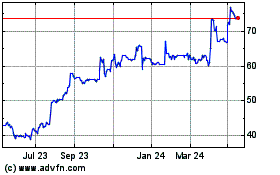

Nahl (LSE:NAH)

Historical Stock Chart

From Jan 2025 to Feb 2025

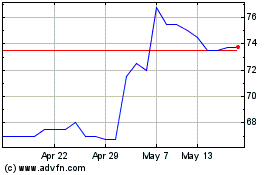

Nahl (LSE:NAH)

Historical Stock Chart

From Feb 2024 to Feb 2025