ONESAVINGS BANK PLC Onesavings Bank Plc : Directorate Change

15 May 2017 - 11:01PM

UK Regulatory

TIDMOSB

15 May 2017

OneSavings Bank plc

(the 'Company')

OneSavings Bank ("OSB") announces the resignation of Nathan Moss,

Non-Executive Director

OneSavings Bank announces today that after three years as a

Non-Executive Director of the Company, Mr Nathan Moss has tendered his

resignation from the Board, effective 31 May 2017. Nathan joined the

Board in May 2014 and is a member of the Audit, Remuneration, and

Nomination and Governance Committees.

OSB Chief Executive, Andy Golding said: "I would like to thank Nathan

for the valuable and constructive contribution he has made to the

success of OneSavings Bank. Nathan joined the Board prior to our IPO and

has helped the Bank grow and establish itself as a FTSE250 company.

Nathan will be missed and I wish him well in the future."

Nathan Moss said: "I have enjoyed being part of the OneSavings Bank

success story and wish the Board and Management the very best in

continuing to build on the success to date."

Enquiries:

OneSavings Bank plc

Alastair Pate t: 01634 838 973

Brunswick Group

Robin Wrench / Simone Selzer t: 020 7404 5959

Notes

For the purposes of section 430 (2B) of the Companies Act 2006, Nathan

will receive his pro-rata entitlement to Non-Executive Director fees for

the month of May 2017. No payment for loss of office will be made to

him.

About OneSavings Bank plc

OneSavings Bank plc ('OSB') began trading as a bank on 1 February 2011

and was admitted to the main market of the London Stock Exchange in June

2014 (OSB.L). OSB joined the FTSE 250 index in June 2015. OSB is a

specialist lending and retail savings group authorised by the Prudential

Regulation Authority, part of the Bank of England, and regulated by the

Financial Conduct Authority and Prudential Regulation Authority.

OSB primarily targets underserved market sub-sectors that offer high

growth potential and attractive risk-adjusted returns in which it can

take a leading position and where it has established expertise,

platforms and capabilities. These include private rented sector

Buy-to-Let, commercial and semi-commercial mortgages, residential

development finance, bespoke and specialist residential lending and

secured funding lines. OSB originates organically through specialist

brokers and independent financial advisers. It is differentiated

through its use of high skilled, bespoke underwriting and efficient

operating model.

OSB is predominantly funded by retail savings originated through the

long established Kent Reliance name, which includes online and postal

channels, as well as a network of branches in the South East of England.

Diversification of funding is currently provided by access to a

securitisation programme; and the Funding for Lending Scheme and Term

Funding Scheme, which OSB joined in 2014 and 2016, respectively.

This announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: OneSavings Bank plc via Globenewswire

http://www.osb.co.uk/

(END) Dow Jones Newswires

May 15, 2017 09:00 ET (13:00 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

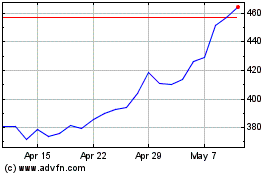

Osb (LSE:OSB)

Historical Stock Chart

From Apr 2024 to May 2024

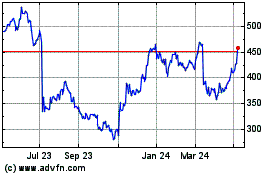

Osb (LSE:OSB)

Historical Stock Chart

From May 2023 to May 2024