Oxford Tech 2 VCT Statement Re: Proposed New Class Of Shares

14 January 2019 - 6:00PM

UK Regulatory

TIDMOXH

Oxford Technology 2 VCT Plc ("The Company" or "OT2")

Termination of discussions with Chelverton

On 22 October 2018 the Board of OT2 issued a circular to shareholders

("Circular") announcing that, subject to their approval, it was intended

to launch an offer for a new class of B shares and appoint Chelverton

Asset Management Limited ("Chelverton") to manage this class of shares.

The Circular gave detailed reasons for the offer and the jointly agreed

changes that would be forthcoming.

At a General Meeting on 19 November 2018 shareholders overwhelmingly

voted to approve all the resolutions that would give rise to these

proposed changes. The proposed offer was also subject to the issue of a

prospectus and the proposed offer raising a minimum level of new

subscriptions. As of last week, the existing draft prospectus to

implement the offer was in the process of being finalised by both

Chelverton and OT2; HM Revenue & Customs had also given the Company

conditional assurance that the B Shares would constitute eligible shares

for the purposes of section 273 ITA and that the Company would maintain

its approval as a VCT.

It was therefore with some surprise that your Board received

notification from Chelverton on 11 January 2019 that they had

unilaterally decided not to proceed with the offer.

The Board of OT2 therefore regrets to announce to shareholders that

discussions with Chelverton regarding their planned appointment as

investment manager of OT2 and the launch of an offer for subscription

for new B shares have been formally terminated. The proposed offer for

subscription for a new class of B shares will therefore not proceed at

this time.

Your Board had taken care to ensure that any Circular and prospectus

costs were borne by Chelverton alone. There are no termination costs.

The Company has incurred some minor costs in taking advice on,

negotiating and preparing for the proposed transaction. These costs

amount to around GBP15,000 (less than 0.3p per share). These costs

include an aggregate amount of GBP10,000 to be paid to two of its

directors for work substantially above that envisaged under their

existing letters of appointment. Richard Roth, Chairman of the Company

is to receive a sum of GBP8,000 and Alex Starling GBP2,000. The final

board decision on the payment excluded those directors benefitting from

the payment. The payment to Richard Roth constitutes a smaller related

party transaction under Listing Rule 11.1.10R.

As previously explained in the Circular, your Board remains convinced

that expanding the asset base of the Company by raising funds with a new

manager remains an attractive course of action for OT2's shareholders,

and therefore will continue to pursue other such opportunities to

achieve this goal.

We will make further announcements as and when appropriate, although

there is no certainty that such an opportunity will be found.

Enquiries:

Lucius Cary, Oxford Technology Management

01865 784466

(END) Dow Jones Newswires

January 14, 2019 02:00 ET (07:00 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

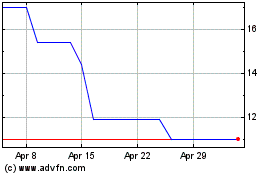

Oxford Technology 2 Vent... (LSE:OXH)

Historical Stock Chart

From Apr 2024 to May 2024

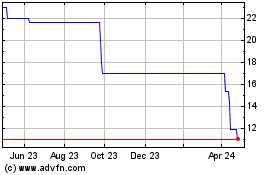

Oxford Technology 2 Vent... (LSE:OXH)

Historical Stock Chart

From May 2023 to May 2024