TIDMPEG

RNS Number : 9898R

Petards Group PLC

11 May 2009

PETARDS GROUP PLC

PRELIMINARY RESULTS ANNOUNCEMENT

Petards Group plc ('Petards'), the AIM quoted developer of advanced surveillance

systems, announces preliminary audited results for the year ended 31 December

2008, which report a move into profitability.

Financial Results

* Revenues up 7% to GBP18.9m (2007: GBP17.7m)

* Revenues on a like-for-like basis (excluding UK software business disposed of in

2007) up 30%

* Operating profits of GBP0.9m (2007: GBP0.1m loss)

* Administrative expenses reduced by one third to GBP5.0m (2007: GBP7.7m)

* Profit after tax GBP1.0m (2007: GBP0.5m loss)

* Operating cash inflow of GBP0.5m (2007: GBP0.2m outflow) and net debt reduced to

GBP2.2m (2007: GBP2.3m)

* Renegotiated GBP2.1m term loan and committed GBP1.75m working capital facilities

secured into 2010

Other highlights

* Launch and first orders of next generation eyeTrain(TM) digital CCTV systems for

trains

* Contracts awarded to fit forward facing camera technology on Virgin trains and

to supply and install eyeTrain(TM) digital CCTV systems vehicles in Portugal and

New Zealand

* Strong performance of ProVida(TM) products for the Emergency Services with

revenues up over 40% and two significant orders during the year

* Defence business continues to perform well

Commenting on current outlook, Tim Wightman, Chairman, said:

"Having put in place appropriate medium term banking facilities at the end of

2008, the Group starts 2009 in a better position than it was at the start of

2008 and it has continued to trade profitably in 2009. Net debt continues to be

within forecast levels and the Group will commence repayments on its term loan

as scheduled in July 2009.

"Undoubtedly the current economic climate is having some impact on the markets

that we serve although we are not exposed to market sectors that are

particularly vulnerable to the downturn. While we saw evidence of some customers

delaying the placement of orders for financial reasons in the last quarter of

2008, order intake for the first four months of 2009 is ahead of that for the

same period in 2008. We have recently secured some very good orders and our

pipeline of order prospects continues to grow.

"Whilst the level of profitability in 2009 is dependant upon the timing of

placement of future orders, the Board is confident that the business will

continue to make progress in 2009 and 2010."

Contacts:

+------------------------------------+------------------------------------+

| Petards Group plc | www.petards.com |

| | |

+------------------------------------+------------------------------------+

| Andy Wonnacott, Finance Director | Tel: 0191 420 3000 |

+------------------------------------+------------------------------------+

| | |

+------------------------------------+------------------------------------+

| Collins Stewart Europe Limited | |

+------------------------------------+------------------------------------+

| Piers Coombs, Stewart Wallace | Tel: 020 7523 8322 |

+------------------------------------+------------------------------------+

| | |

+------------------------------------+------------------------------------+

| Walbrook PR Limited | Tel: 020 7933 8788 |

| | |

+------------------------------------+------------------------------------+

| Ben Knowles | Mob: 07900 346 978 |

+------------------------------------+------------------------------------+

| | ben.knowles@walbrookpr.com |

+------------------------------------+------------------------------------+

Chairman's statement

Overview

I am pleased to report that in spite of the prevailing adverse economic and

financial environment, the Group made a profit after tax of GBP1.0m (2007:

GBP0.5m loss). This represents a tremendous achievement given the difficulties

faced by the Group during that period and demonstrates the strength of its

relationships with its stakeholders including customers, suppliers and staff.

The year was dominated by the severe tightening of credit availability and

Petards was among the first companies to suffer from the resulting lack of

liquidity in the banking sector. However, by the end of the year we had

successfully re-negotiated our term loan and secured a committed working capital

facility until 31 March 2010.

Results

Operating profits for the year were GBP0.9m (2007: GBP0.1m loss) on revenues

that increased by 7% to GBP18.9m (2007: GBP17.7m). Revenues on a like-for-like

basis were up 30%, once the effect of UK software products business that was

disposed of in December 2007 is taken into account.

Gross margins were lower at 32% (2007: 37%) reflecting the difference in the mix

of business between the two years. In particular, firstly 2007 included revenues

from the disposed software products business which made higher gross margins

(albeit with a very high associated overhead) and secondly, in 2008 revenues

from the sale of electronic countermeasures equipment, for which Petards is the

UK licensee and which attract lower margins, were over 65% higher and accounted

for 35% of revenues for the year.

Administrative expenses have been reduced by one third to GBP5.0m (2007:

GBP7.7m). Approximately 30% of the savings came from an overhead reduction

programme implemented in the year and the balance was due to the exclusion of

overheads related to the disposed software products business. In making savings,

we are seeking to invest in customer facing and product development activities

while continuing to reduce other non-customer facing activities.

Net financial expenses were GBP0.2m (2007: GBP0.4m). These include the benefit

of foreign exchange gains of GBP0.1m.

Cash and Balance Sheet

Following an operating cash outflow of GBP0.4m in the first half year that

reflected the increased working capital requirements of higher revenues, the

Group generated an operating cash inflow in the second half year of GBP0.9m.

Operating cash inflow for the year as a whole was GBP0.5m (2007: GBP0.2m

outflow) and net debt at 31 December 2008 reduced to GBP2.2m (2007: GBP2.3m).

The Board is conscious of the need to strengthen the Group's balance sheet and

while the retained earnings for the period have had a positive impact, the Board

intends to deal with this issue by increasing the Company's equity base when

practicable.

Business review

The Group made progress during the year in the achievement of its goals to

develop the geographic markets that it seeks to serve and appropriate

technologies that meet customers' demands.

The next generation of our highly regarded eyeTrain(TM) digital CCTV systems for

trains was launched towards the end of the year and we received the first orders

for these systems before the year end.

In October Virgin Trains awarded us the contract to fit our new forward facing

camera technologies onto its West Coast Main Line Pendolino fleet endorsing our

view that over time most of the UK fleet will be fitted with forward facing

cameras.

The Group has a strong position in the UK on-board train CCTV market and has

been seeking to develop its presence in overseas markets. Given the Group's

limited resources, progress against this objective is taking longer than the

Board would like. However, we are encouraged by the fact that in the fourth

quarter we won an order to supply eyeTrain(TM) digital systems that are to be

fitted onto vehicles belonging to Metro de Porto in Portugal which was followed

early in 2009 by our first order from Hyundai Rotem of Korea, worth GBP0.8m, for

equipment to be fitted on a new fleet of trains being supplied to New Zealand.

The strong first half performance that I reported in respect of our ProVida(TM)

products for the Emergency Services sector continued in the second half albeit

at a slower pace. Revenues for this product range were up over 40% on the prior

year. Whilst the average order value in this sector is lower than the other

market sectors in which we operate, we fulfilled two significant orders during

the year.

The first of these was worth almost GBP1m and was for the supply of ProVida(TM)

Automatic Number Plate Recognition (ANPR) systems to a North African end-user.

In addition we delivered the first tranche of ProVida(TM) speed detection and

in-car video systems to our Italian distributor for supply to the Italian

Police, and this has been followed in 2009 by the second order for approximately

GBP0.4m for the next phase of their project.

Our defence business continued to perform well across the board. We opened 2008

with an exceptionally high order book of GBP4.3m in respect of electronic

countermeasures dispensing equipment for the MoD and revenues in 2008 relating

to these systems were over GBP6.5m. The margins on these systems which, as a

licensed product, are much lower than in our other areas of business, were

adversely affected by the strength of the dollar. Therefore, while we expect

revenues from countermeasures dispensing equipment to be lower in future, impact

on profitability is expected to be low.

While opportunities to win business on new UK defence equipment projects

continue to be scarce due to slippage in programmes, our strong position with

legacy programmes means that the slippage in those programmes creates good

opportunities as the MoD seeks to extend the life of existing equipment. A good

example of this was the GBP2m of orders received in respect of the Sustain

Programme in the first half of the year.

Employees

I would like to thank all of our employees for their hard work and determination

shown again during a challenging year for the Group.

Outlook

Having put in place appropriate medium term banking facilities at the end of

2008, the Group starts 2009 in a better position than it was at the start of

2008 and it has continued to trade profitably in 2009. Net debt continues to be

within forecast levels and the Group will commence repayments on its term loan

as scheduled in July 2009.

Undoubtedly the current economic climate is having some impact on the markets

that we serve although we are not exposed to market sectors that are

particularly vulnerable to the downturn. While we saw evidence of some customers

delaying the placement of orders for financial reasons in the last quarter of

2008, order intake for the first four months of 2009 is ahead of that for the

same period in 2008. We have recently secured some very good orders and our

pipeline of order prospects continues to grow.

Whilst the level of profitability in 2009 is dependant upon the timing of

placement of future orders, the Board is confident that the business will

continue to make progress in 2009 and 2010.

Tim Wightman

Chairman 11 May 2009

Consolidated Income Statement

for year ended 31 December 2008

+----------------------------------------------------+------+----------+----------+

| |Note | 2008 | 2007 |

+----------------------------------------------------+------+----------+----------+

| | | GBP000 | GBP000 |

+----------------------------------------------------+------+----------+----------+

| | | | |

+----------------------------------------------------+------+----------+----------+

| Revenue | 2 | 18,862 | 17,680 |

+----------------------------------------------------+------+----------+----------+

| Cost of sales | | (12,887) | (11,104) |

+----------------------------------------------------+------+----------+----------+

| | | | |

+----------------------------------------------------+------+----------+----------+

| Gross profit | | 5,975 | 6,576 |

+----------------------------------------------------+------+----------+----------+

| | | | |

+----------------------------------------------------+------+----------+----------+

| Other operating income - net gain on disposal of | | - | 971 |

| business | | | |

+----------------------------------------------------+------+----------+----------+

| Other operating income - other | | - | 8 |

+----------------------------------------------------+------+----------+----------+

| Other operating income | | - | 979 |

+----------------------------------------------------+------+----------+----------+

| Administrative expenses | | (5,031) | (7,672) |

+----------------------------------------------------+------+----------+----------+

| | | | |

+----------------------------------------------------+------+----------+----------+

| Operating profit/(loss) | | 944 | (117) |

+----------------------------------------------------+------+----------+----------+

| Financial income | | 147 | 18 |

+----------------------------------------------------+------+----------+----------+

| Financial expenses | | (387) | (388) |

+----------------------------------------------------+------+----------+----------+

| | | | |

+----------------------------------------------------+------+----------+----------+

| Profit/(loss) before tax | | 704 | (487) |

+----------------------------------------------------+------+----------+----------+

| Income tax | 3 | 296 | 12 |

+----------------------------------------------------+------+----------+----------+

| | | | |

+----------------------------------------------------+------+----------+----------+

| Profit/(loss) for the year attributable to equity | | 1,000 | (475) |

| shareholders of the parent | | | |

+----------------------------------------------------+------+----------+----------+

| | | | |

+----------------------------------------------------+------+----------+----------+

| | | | |

+----------------------------------------------------+------+----------+----------+

| Basic and diluted earnings/(loss) per share | 4 | 0.16 | (0.07) |

| (pence) | | | |

+----------------------------------------------------+------+----------+----------+

| | | | |

+----------------------------------------------------+------+----------+----------+

| | | | |

+----------------------------------------------------+------+----------+----------+

Consolidated Statement of Recognised Income and Expense

for year ended 31 December 2008

+----------------------------------+----------------+-----------+-------------+

| | | 2008 | 2007 |

+----------------------------------+----------------+-----------+-------------+

| | | GBP000 | GBP000 |

+----------------------------------+----------------+-----------+-------------+

| | | | |

+----------------------------------+----------------+-----------+-------------+

| Currency translation on foreign | | (317) | 3 |

| currency net investments | | | |

+----------------------------------+----------------+-----------+-------------+

| | | | |

+----------------------------------+----------------+-----------+-------------+

| Net (expense)/income recognised | | (317) | 3 |

| directly in equity | | | |

+----------------------------------+----------------+-----------+-------------+

| Profit/(loss) for the year | | 1,000 | (475) |

+----------------------------------+----------------+-----------+-------------+

| | | | |

+----------------------------------+----------------+-----------+-------------+

| Total recognised income and | | 683 | (472) |

| expense for the year | | | |

| attributable to equity holders | | | |

| of the parent | | | |

+----------------------------------+----------------+-----------+-------------+

| | | | |

+----------------------------------+----------------+-----------+-------------+

Consolidated Balance Sheet

at 31 December 2008

+-----------------------------------+------+----------+----------+----------+----------+

| | | | | 2008 | 2007 |

+-----------------------------------+------+----------+----------+----------+----------+

| | | | | GBP000 | GBP000 |

+-----------------------------------+------+----------+----------+----------+----------+

| Non-current assets | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| Property, plant and equipment | | | | 339 | 446 |

+-----------------------------------+------+----------+----------+----------+----------+

| Goodwill | | | | 401 | 401 |

+-----------------------------------+------+----------+----------+----------+----------+

| Development costs | | | | 345 | 60 |

+-----------------------------------+------+----------+----------+----------+----------+

| Deferred tax assets | | | | 310 | 245 |

+-----------------------------------+------+----------+----------+----------+----------+

| | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| | | | | 1,395 | 1,152 |

+-----------------------------------+------+----------+----------+----------+----------+

| | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| Current assets | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| Inventories | | | | 1,373 | 1,415 |

+-----------------------------------+------+----------+----------+----------+----------+

| Trade and other receivables | | | | 2,635 | 3,237 |

+-----------------------------------+------+----------+----------+----------+----------+

| Cash and cash equivalents - | | | | 268 | 267 |

| available for use | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| Cash and cash equivalents - not | | | | - | 2,400 |

| available for use | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| Other financial assets | | | | - | 75 |

+-----------------------------------+------+----------+----------+----------+----------+

| | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| | | | | 4,276 | 7,394 |

+-----------------------------------+------+----------+----------+----------+----------+

| | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| Total assets | | | | 5,671 | 8,546 |

+-----------------------------------+------+----------+----------+----------+----------+

| | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| Non-current liabilities | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| Interest-bearing loans and | | | | (1,756) | - |

| borrowings | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| Current liabilities | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| Bank overdraft payable on demand | | | | - | (847) |

+-----------------------------------+------+----------+----------+----------+----------+

| Other interest-bearing loans and | | | | (675) | (4,073) |

| borrowings | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| Trade and other payables | | | | (4,801) | (5,896) |

+-----------------------------------+------+----------+----------+----------+----------+

| Provisions | | | | - | (11) |

+-----------------------------------+------+----------+----------+----------+----------+

| Other financial liabilities | | | | - | (4) |

+-----------------------------------+------+----------+----------+----------+----------+

| | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| | | | | (5,476) | (10,831) |

+-----------------------------------+------+----------+----------+----------+----------+

| | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| Total liabilities | | | | (7,232) | (10,831) |

+-----------------------------------+------+----------+----------+----------+----------+

| | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| Net liabilities | | | | (1,561) | (2,285) |

+-----------------------------------+------+----------+----------+----------+----------+

| | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| Equity attributable to equity | | | | | |

| holders of the parent | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| Share capital | | | | 6,367 | 6,367 |

+-----------------------------------+------+----------+----------+----------+----------+

| Share premium | | | | 23,255 | 23,255 |

+-----------------------------------+------+----------+----------+----------+----------+

| Currency translation reserve | | | | (317) | - |

+-----------------------------------+------+----------+----------+----------+----------+

| Retained earnings deficit | | | | (30,866) | (31,907) |

+-----------------------------------+------+----------+----------+----------+----------+

| | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

| Total equity | | | | (1,561) | (2,285) |

+-----------------------------------+------+----------+----------+----------+----------+

| | | | | | |

+-----------------------------------+------+----------+----------+----------+----------+

Consolidated Cash Flow Statement

for year ended 31 December 2008

+----------------------------------------+-----+-----+----------+----------+----------+

| | | | | 2008 | 2007 |

+----------------------------------------+-----+-----+----------+----------+----------+

| | | | | GBP000 | GBP000 |

+----------------------------------------+-----+-----+----------+----------+----------+

| Cash flows from operating activities | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| Profit/(loss) for the year | | | | 1,000 | (475) |

+----------------------------------------+-----+-----+----------+----------+----------+

| Adjustments for: | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| Depreciation | | | | 208 | 325 |

+----------------------------------------+-----+-----+----------+----------+----------+

| Amortisation of intangible assets | | | | 73 | 47 |

+----------------------------------------+-----+-----+----------+----------+----------+

| Financial income | | | | (147) | (18) |

+----------------------------------------+-----+-----+----------+----------+----------+

| Financial expense | | | | 387 | 388 |

+----------------------------------------+-----+-----+----------+----------+----------+

| Loss on sale of property, plant and | | | | 9 | - |

| equipment | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| Gain on sale of business and assets | | | | - | (971) |

+----------------------------------------+-----+-----+----------+----------+----------+

| Equity settled share-based payment | | | | 41 | 56 |

| expenses | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| Income tax credit | | | | (296) | (12) |

+----------------------------------------+-----+-----+----------+----------+----------+

| | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| | | | | 1,275 | (660) |

+----------------------------------------+-----+-----+----------+----------+----------+

| Change in trade and other receivables | | | | 746 | 571 |

+----------------------------------------+-----+-----+----------+----------+----------+

| Change in inventories | | | | 46 | 678 |

+----------------------------------------+-----+-----+----------+----------+----------+

| Change in trade and other payables | | | | (1,389) | (367) |

+----------------------------------------+-----+-----+----------+----------+----------+

| Change in provisions | | | | (11) | (110) |

+----------------------------------------+-----+-----+----------+----------+----------+

| | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| | | | | 667 | 112 |

+----------------------------------------+-----+-----+----------+----------+----------+

| Interest received | | | | 147 | 18 |

+----------------------------------------+-----+-----+----------+----------+----------+

| Interest paid | | | | (407) | (343) |

+----------------------------------------+-----+-----+----------+----------+----------+

| Income tax received | | | | 56 | - |

+----------------------------------------+-----+-----+----------+----------+----------+

| | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| Net cash generated from/(absorbed by) | | | | 463 | (213) |

| operating activities | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| Cash flows from investing activities | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| Proceeds from sale of property, plant | | | | 5 | - |

| and equipment | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| Disposal of business (see below) | | | | 2,400 | - |

+----------------------------------------+-----+-----+----------+----------+----------+

| Acquisition of property, plant and | | | | (99) | (129) |

| equipment | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| Capitalised development expenditure | | | | (358) | (37) |

+----------------------------------------+-----+-----+----------+----------+----------+

| | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| Net cash inflow/(outflow) from | | | | 1,948 | (166) |

| investing activities | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| Cash flows from financing activities | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| Increase on committed overdraft | | | | 356 | - |

| facility | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| Repayment of borrowings | | | | (1,990) | - |

+----------------------------------------+-----+-----+----------+----------+----------+

| Payment of finance lease liabilities | | | | (8) | (33) |

+----------------------------------------+-----+-----+----------+----------+----------+

| | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| Net cash outflow from financing | | | | (1,642) | (33) |

| activities | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| Net increase/(decrease) in cash and | | | | 769 | (412) |

| cash equivalents | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| Cash and cash equivalents at 1 January | | | | (580) | (172) |

+----------------------------------------+-----+-----+----------+----------+----------+

| Effect of exchange rate fluctuations | | | | 79 | 4 |

| on cash held | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| Cash and cash equivalents at 31 | | | | 268 | (580) |

| December | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

| | | | | | |

+----------------------------------------+-----+-----+----------+----------+----------+

The receipt of GBP2,400,000 from the disposal of the UK software products

business on 21 December 2007 was held in a separate bank account at 31 December

2007 and was not available for use by the Group or Company. This amount was

excluded from cash and cash equivalents as disclosed in the 2007 Cash Flow

Statements on the basis that it was not available for use by either the Group or

Company at that date. The GBP2,400,000 has been recognised as a cash inflow in

the 2008 Cash Flow Statements when it was released from escrow.

1. Basis of preparation and status of financial information

The financial information set out above has been prepared in accordance with the

recognition and measurement criteria of International Financial Reporting

Standards as adopted by the EU (Adopted IFRSs).

The financial information set out above does not constitute the Group's

statutory accounts for the years nded 31 December 2008 or 2007. Statutory

accounts for 2007 have been delivered to the registrar of companies, and those

for 2008 will be delivered in due course. The auditors have reported on those

accounts; their report was (i) unqualified, (ii) did not include a reference to

any matters to which the auditors drew attention by way of emphasis without

qualifying their report and (iii) did not contain a statement under section

237(2) or (3) of the Companies Act 1985.

2. Segmental information

The directors consider the Group to have only one business segment, being the

development, supply and maintenance of technologies used in advanced security

and surveillance systems. An analysis of segmental information by geographical

component is set out below. This information is presented by geography of

revenue by source.

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| | UK | USA | Consolidated |

+----------------------------+--------------------+----------------------+----------------------+

| | 2008 | 2007 | 2008 | 2007 | 2008 | 2007 |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| | GBP000 | GBP000 | GBP000 | GBP000 | GBP000 | GBP000 |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| | | | | | | |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| Segment revenue | 18,056 | 15,909 | 806 | 1,771 | 18,862 | 17,680 |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| | | | | | | |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| Segment adjusted operating | 1,082 | 556 | (24) | (570) | 1,058 | (14) |

| profit/(loss) | | | | | | |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| Intangible amortisation | (73) | (47) | - | - | (73) | (47) |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| Share based payments | (41) | (56) | - | - | (41) | (56) |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| | | | | | | |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| Operating profit/(loss) | 968 | 453 | (24) | (570) | 944 | (117) |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| | | | | | | |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| Net financing costs | | | | | (240) | (370) |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| Income tax | | | | | 296 | 12 |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| | | | | | | |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| Profit/(loss) for the year | | | | | 1,000 | (475) |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| | | | | | | |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| Depreciation charge | 173 | 303 | 35 | 22 | 208 | 325 |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| | | | | | | |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| Capital expenditure | 99 | 120 | - | 7 | 99 | 127 |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| | | | | | | |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| Segment assets | 5,245 | 7,745 | 426 | 801 | 5,671 | 8,546 |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| | | | | | | |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| Segment liabilities | (5,755) | (9,289) | (1,477) | (1,542) | (7,232) | (10,831) |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| | | | | | | |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| Net cash flows from | 788 | 487 | (325) | (700) | 463 | (213) |

| operating activities | | | | | | |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| | | | | | | |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| Cash flows from investing | 1,946 | (159) | 2 | (7) | 1,948 | (166) |

| activities | | | | | | |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| | | | | | | |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| Cash flows from financing | (1,642) | (33) | - | - | (1,642) | (33) |

| activities | | | | | | |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

| | | | | | | |

+----------------------------+---------+----------+----------+-----------+-----------+----------+

Revenue by geographical destination can be analysed as follows:

+---------------------------------------------------------+---------+--+-----------+

| | 2008 | | 2007 |

+---------------------------------------------------------+---------+--+-----------+

| | GBP000 | | GBP000 |

+---------------------------------------------------------+---------+--+-----------+

| | | | |

+---------------------------------------------------------+---------+--+-----------+

| United Kingdom | 15,909 | | 14,479 |

+---------------------------------------------------------+---------+--+-----------+

| Continental Europe | 2,067 | | 1,367 |

+---------------------------------------------------------+---------+--+-----------+

| Rest of World | 886 | | 1,834 |

+---------------------------------------------------------+---------+--+-----------+

| | | | |

+---------------------------------------------------------+---------+--+-----------+

| | 18,862 | | 17,680 |

+---------------------------------------------------------+---------+--+-----------+

| | | | |

+---------------------------------------------------------+---------+--+-----------+

Included in the above amounts are revenues of GBP5,073,000 (2007: GBP5,106,000)

in respect of construction contracts.

3. Taxation

Recognised in the income statement

+------------------------------------------------------+------------+------------+

| | 2008 | 2007 |

+------------------------------------------------------+------------+------------+

| | GBP000 | GBP000 |

+------------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------------+------------+------------+

| Current tax expense/(credit) | | |

+------------------------------------------------------+------------+------------+

| Current year | - | - |

+------------------------------------------------------+------------+------------+

| Adjustments in respect of prior years | (231) | - |

+------------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------------+------------+------------+

| Deferred tax expense/(credit) | (231) | - |

+------------------------------------------------------+------------+------------+

| Origination and reversal of temporary | (8) | 8 |

| differences | | |

+------------------------------------------------------+------------+------------+

| Recognition of previously unrecognised tax | (57) | (20) |

| losses | | |

+------------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------------+------------+------------+

| Total tax in income statement | (296) | (12) |

+------------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------------+------------+------------+

The adjustments in respect of prior years principally arise from Research and

Development tax credits. The claims for these were submitted in 2008 but relate

to expenditure in earlier years.

Reconciliation of effective tax rate

+------------------------------------------------------+------------+------------+

| | 2008 | 2007 |

+------------------------------------------------------+------------+------------+

| | GBP000 | GBP000 |

+------------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------------+------------+------------+

| Profit/(loss) for the period | 704 | (487) |

+------------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------------+------------+------------+

| Tax using the UK corporation tax rate of 28.5% | 201 | (146) |

| (2007: 30%) | | |

+------------------------------------------------------+------------+------------+

| Non-deductible expenses | 37 | 150 |

+------------------------------------------------------+------------+------------+

| Non-taxable income | (103) | - |

+------------------------------------------------------+------------+------------+

| Effect of tax losses generated in year not provided | 70 | 306 |

| for in deferred tax | | |

+------------------------------------------------------+------------+------------+

| Impact of change in deferred tax rate to 28% | - | 7 |

+------------------------------------------------------+------------+------------+

| Recognition of previously unrecognised tax losses | (57) | (212) |

+------------------------------------------------------+------------+------------+

| Utilisation of tax losses | (45) | - |

+------------------------------------------------------+------------+------------+

| Change in unrecognised temporary differences | (168) | (89) |

+------------------------------------------------------+------------+------------+

| Adjustments in respect of prior years | (231) | (28) |

+------------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------------+------------+------------+

| Total tax credit | (296) | (12) |

+------------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------------+------------+------------+

For the year ended 31 December 2008, the Group was subject to UK corporation tax

at a base rate of 30% during the 3 months to 31 March 2008 and 28% from 1 April

2008 to 31 December 2008 (2007: 30%).

4. Earnings per share

The calculation of basic earnings per share for 2008 was based on the profit

attributable to ordinary shareholders of GBP1,000,000 (2007: GBP475,000 loss)

divided by the weighted average number of ordinary shares outstanding during the

year ended 31 December 2008 of 636,706,423 (2007: 636,706,423).

Diluted earnings per share is identical to the basic earnings per share. In 2008

none of the share options are dilutive as the exercise prices are higher than

the average market price of the shares. In 2007 any dilution would have reduced

the loss per share and therefore the options are treated as non-dilutive.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR APMRTMMMMBIL

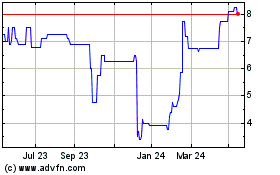

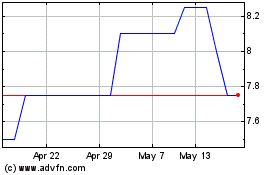

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024