TIDMPEG

RNS Number : 4614H

Petards Group PLC

16 March 2015

16 March 2015

PETARDS GROUP PLC

FINAL RESULTS FOR THE YEAR ENDED 31 DECEMBER 2014

Petards Group plc ('Petards'), the AIM quoted developer of

advanced security and surveillance systems, reports its audited

results for the year ended 31 December 2014.

Key points:

-- Operational

o Order book maintained to close at GBP20 million (2013: GBP20

million)

o Secured five year framework agreement with Siemens Mobility

Division for the supply of Petards train related products and

services under which over GBP3 million of orders received to

date

o Other significant orders secured during the year included:

-- Over GBP5.5 million for electronic countermeasure related

projects from the MOD

-- Re-awarded framework contract by MOD to supply to it private

mobile radio equipment, ancillaries and engineering support

-- Further orders from other leading global train builders

including Bombardier Transportation and Hitachi Europe

-- Financial

o Petards returns to profitability

o Results for 2014

-- Revenues more than doubled to GBP13.5 million (2013: GBP6.3

million)

-- Gross margin 30% (2013: 40%) reflecting higher

defence-related equipment revenues

-- EBITDA GBP1.0 million profit (2013: GBP0.7 million loss)

-- Operating profit GBP0.8 million (2013: GBP1.3 million

loss)

-- Profit after tax GBP0.6 million (2013: GBP2.3 million

loss)

o Finance

-- Generated GBP0.8 million of operating cash inflows

-- Cash at 31 December 2014 GBP1.4 million (31 Dec 2013: GBP1.4

million) and no bank debt

-- Convertible loan notes of GBP1.5 million maturing in

September 2018 providing long term finance (31 Dec 2013: GBP1.5

million)

-- Basic EPS of 1.8p earnings per share (2013: 15.9p loss per

share)

-- Diluted EPS of 1.4p earnings per share (2013: 15.9p loss per

share)

-- Outlook

o Over 50% of opening order book scheduled for delivery in

2015

o Performance in 2015 to date in line with management's

expectations

Raschid Abdullah, Chairman of Petards, commented:

"I am pleased to say for the year to date the Group has traded

in line with expectations and that it remains well placed to add to

the achievements of 2014. The visibility provided by the Group's

current forward order book and its pipeline of order prospects

provides the Board with confidence that further progress will be

made in 2015."

Contacts

Petards Group plc www.petards.com

Raschid Abdullah, Chairman Mb: 07768 905004

Andy Wonnacott, Finance Tel: 0191 420 3000

Director

WH Ireland Limited, Nomad www.wh-ireland.co.uk

and Joint Broker

Mike Coe, Ed Allsopp Tel: 0117 945 3470

Hybridan LLP, Joint Broker www.hybridan.com

Claire Louise Noyce Tel: 020 3713 4581

claire.noyce@hybridan.com

Chairman's statement

Corporate Overview

I am pleased to report that for the year to 31 December 2014

Petards Group plc ("Petards" or "the Group" or "the Company")

recorded pre-tax profits of GBP620,000 building on the return to

pre-tax profitability of GBP273,000 announced at the interim

stage.

This has been achieved with no diminution of order book which

stood at GBP20 million at the start of 2015 of which over 50% is

scheduled to be delivered in the current year.

The Group's strengthened financial position has also enabled

investment to be made in both our people and products, which the

Board have continued into 2015.

Operating Review

The Group serves three sectors, those of:

-- Transport (Rail - software driven video systems mounted

in-train and externally and automatic passenger counting

systems)

-- Defence (Electronic defensive countermeasures and mobile

radio systems predominantly to the UK Ministry of Defence

("MOD"))

-- Emergency Services (Mobile speed enforcement and ANPR systems

predominantly to the Law Enforcement Agencies sold under the

Provida brand).

Having built a solid foundation for the future based on a strong

order book and appropriate financing in the latter part of 2013,

the challenges faced by the Group in 2014 were to continue to

develop the Group's potential while profitably delivering on the

order book and at the same time maintaining its level. I am pleased

to say that these challenges were met successfully.

The Board's strategy to develop the Group's presence in the new

train build market continues to bear fruit. At the half year stage

I reported on the five year framework agreement that the Group had

entered into with Siemens' rail business. To date, under the

framework agreement two significant orders have been obtained.

While under the framework agreement there can be no guarantee that

future business will be obtained, it has provided Petards with the

opportunity to develop its strategic relationship with Siemens, a

leader in the global rail market.

In addition, during the year significant orders as well as day

to day transactional business was obtained from other leading

global new train builders including Bombardier Transportation and

Hitachi Rail Europe.

While every new train builder has its own preferred way of

operating with its suppliers, wherever possible it remains

management's objective to seek to work closer with its customers in

the areas of product development and service within an established

framework.

Defence products continue to form an important part of the

Group's revenues and profitability with several significant

contracts being secured during the year, in particular a GBP4.5

million order from the MOD in June to modify electronic

countermeasures equipment fitted to many of its aircraft was

followed in December by an order from MOD for in excess of GBP1

million for electronic countermeasures equipment for helicopters in

the Royal Navy's Merlin fleet.

In addition, the Board and management were pleased to be awarded

by the MOD in open tender an 'enabling contract' to supply it with

private mobile radio equipment, ancillaries and engineering

support. The contract, which has historically produced annual

revenues of circa GBP500,000, is for two years with the MOD having

the option to extend for a further two years and replaces the

previous contract the Company had held for a number of years.

While Emergency Services forms the smallest of the three areas

in which Petards operates it is a useful contributor of revenue

working from a small operational cost base and provides a useful

contribution when measured on returns on capital employed and Group

resources utilised. Its Provida 4000 in-car video evidence and

speed enforcement system remains one of only two such systems that

currently have UK Home Office Type Approval. During the year it

received a steady flow of orders from UK Law Enforcement Agencies

with trading in the second half year being broadly similar to that

experienced in the first half. As well as the home market,

Emergency Services products also have the potential for sales to

overseas markets, an area of marketing activity management intends

to selectively pursue in 2015.

Revenues for eyeTrain products were higher in the second half of

the year with deliveries on projects for Bombardier, Hyundai Rotem

and Siemens being the main contributors. The MOD's Secure

Management Radio Equipment ("SMRE") project won in 2013 formed a

significant proportion of Defence revenues in the first half year.

However, as the majority of the related equipment had been

delivered by June, deliveries in the second half were much less

significant and by the year end almost 95% of the equipment had

been delivered. The SMRE contract includes GBP1.7 million for the

support of that equipment for 10 years, revenues for which will be

recognised over the period that the support is provided.

As I reported in September, our 'Fit 4 Growth' is now focussed

on the continuous improvement and development of the Group.

Since the beginning of the second half of 2014, additional

resources have been recruited to support both increased levels of

activity and to enhance the Group's business and product

development service offering to its customers. The Board recognises

the importance of such costs remaining in step with revenues and

profitability and as such they will continue to be closely

monitored.

Overview of the Results

The results for 2014 benefitted significantly from a strong

opening order book with revenues more than doubled to GBP13.5

million (2013: GBP6.3 million) on which the Group made an operating

profit of GBP0.8 million (2013: GBP1.3 million loss). While

revenues for Provida remained flat, those for eyeTrain and Defence

products both saw increases well in excess of 100% over the

previous year resulting from significant orders received from the

MOD, Siemens, Bombardier and Hyundai Rotem.

Gross margin for the second half year was higher than that

achieved in the first half year at 33.8% (H1 2014: 27.4%) and

totalled 30.4% for the year (2013: 40.4%). The differing product

mix was the principal reason for this improvement as the first half

year, in line with management's forecasts, included the supply of a

significant volume of lower margin third party equipment on the

SMRE project whereas the second half revenues included a much

greater proportion of Petards own eyeTrain related products and

services.

Administrative expenses of GBP3.3 million for the year remained

tightly controlled and were GBP0.5 million lower than the prior

year when they totalled GBP3.8 million including GBP0.3 million of

restructuring costs.

Net financial expenses were GBP0.1 million almost all of which

related to cash and amortised interest on the 7% convertible loan

notes issued in September 2013. The prior year net expense of

GBP1.1 million included exceptional finance costs of GBP1.0 million

relating to the debt for equity swap undertaken with Water Hall

Group in 2013.

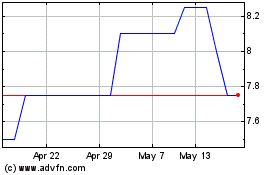

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

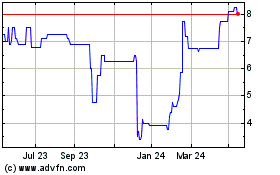

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024