TIDMPEG

RNS Number : 3261Y

Petards Group PLC

08 September 2015

8 September 2015

PETARDS GROUP PLC

INTERIM RESULTS ANNOUNCEMENT

Petards Group plc ('Petards'), the AIM quoted developer of

advanced security and surveillance systems, reports its interim

results for the six months to 30 June 2015.

Key points:

-- Operational

o June order book remained strong at GBP19 million providing

good revenue cover for the second half of 2015 and beyond

-- Circa 40% of order book currently scheduled for delivery in

the second half of 2015

-- H1 2015 highlights included:

-- Over GBP2.5 million of orders for Petards' eyeTrain CCTV

systems under the framework agreements held with Siemens and

Hitachi, and a new project from Bombardier

-- Strong recurring revenue streams for eyeTrain spares and support

-- Financial

o Strong results for the six months to 30 June 2015

-- Higher margin revenues than 2014 totaled GBP6.1 million

(2014: GBP7.2 million)

-- Gross margins of 36.4% (2014: 27.4%)

-- 39% increase in EBITDA to GBP609,000 (2014: GBP441,000)

-- Operating profit increased to GBP436,000 (2014:

GBP346,000)

-- 30% increase in profit after tax to GBP356,000 (2014:

GBP273,000)

o Finance

-- Cash inflow from operating activities GBP558,000 (2014:

GBP181,000)

-- Cash at 30 June 2015 GBP2.0 million (31 Dec 2014: GBP1.4

million) with no bank debt

-- Basic EPS up 30% to 1.03p per share (2014: 0.79p per

share)

-- Diluted EPS up 23% to 0.76p per share (2014: 0.62p per

share)

Commenting on the current outlook, Raschid Abdullah, Chairman,

said:

"The continued strength of the order book at 30 June provides

good support for revenues for the second half of 2015, with around

40% currently scheduled for delivery before the year end, giving

the Board confidence for a satisfactory outcome for the year."

Contacts:

Petards Group plc www.petards.com

Raschid Abdullah, Chairman Mb: 07768 905004

Andy Wonnacott, Finance Tel: 0191 420 3000

Director

WH Ireland Limited, Nomad www.wh-ireland.co.uk

and Joint Broker

Mike Coe, Ed Allsopp Tel: 0117 945 3470

Hybridan LLP, Joint Broker www.hybridan.com

Claire Louise Noyce Tel: 020 3764 2341

claire.noyce@hybridan.com

St Brides Partners Limited, www.stbridespartners.co.uk

Financial PR

Elisabeth Cowell, Charlotte Tel: 020 7236 1177

Heap

Chairman's Statement

I am pleased to report that the results for the Group for the

six months ended 30 June 2015 show continued improvement in the

Company's trading performance. This reflects significant increases

in margins, profitability and cash flows over the comparable period

in 2014 resulting in greater Balance Sheet strength.

The Group serves three sectors, those of:

-- Transport (Rail - software driven video systems mounted

in-train and externally and automatic passenger counting (APC)

systems sold under eyeTrain brand)

-- Emergency Services (Mobile speed enforcement and ANPR systems

predominantly to Law Enforcement Agencies sold under the ProVida

brand)

-- Defence (Electronic defensive countermeasures and mobile

radio systems predominantly to the UK Ministry of Defence

("MOD"))

The overall order book at the end of June was just under GBP19

million with the level of the Group's eyeTrain products order book

maintained following a number of repeat orders from train

builders.

Operating review

During the period the Group secured a number of new orders for

its eyeTrain systems. In addition to the previously announced order

worth in excess of GBP1.5 million secured in March 2015 from

Siemens Mobility Germany for Driver Only Operation (DOO) systems

and saloon CCTV, the Group was also awarded further orders

totalling GBP1 million by Bombardier Transportation and Hitachi.

The Bombardier order is for further sets of equipment for fitment

to Electrostar trains for delivery in 2016 and a second order by

Hitachi under the framework agreement awarded in August 2013 for

the supply of APC systems for its Class 800 trains for the

Intercity Express Programme. These APC systems will be fitted to

trains to be built at Hitachi's recently opened rail vehicle

manufacturing facility in Newton Aycliffe for use on the East Coast

Main Line with delivery scheduled for 2017/18.

The growing installed base of eyeTrain is leading to an increase

in the levels of recurring revenues from spares and support as wear

and tear take their effect on earlier installations, with revenues

for the first half of 2015 exceeding expectations. It is

anticipated that this trend will continue and increasingly become a

significant contributor to the Group's revenues as the existing

installed base becomes older, the current order book is delivered

and as warranties progressively expire. To support this growth some

additional investment in both personnel and systems was made during

the period.

The Board and management remain conscious that the success of

the business is dependent upon understanding and meeting its

customers' requirements without compromising quality, in particular

in the area of interfacing software. To this end, products continue

to be reviewed for improvement from a cost, functionality and

reliability perspective.

The largest contributor to defence revenues in the first half

year was the modification programme for countermeasures equipment

fitted to certain aircraft within the MOD's fleet. The GBP4.5

million project, which is now over 40% complete, is running to

schedule and in line with budget with completion scheduled for the

second half of 2016.

While performance from the defence business was satisfactory in

the first half of the year, order intake to date has been slower

than anticipated albeit there have been signs of improvement in

recent weeks. In July the MOD awarded the Group a GBP0.3 million

contract spread over three years for the provision of specialist

engineering support services at certain MOD bases in Europe.

Although the Group's activities within the context of the UK

defence sector are relatively small, management believes that with

so much unrest in various parts of the world, in particular in the

Middle East, demand for its defence related products and services,

while unpredictable as to timing, will continue at acceptable

levels.

The Emergency Services part of the Group's business, which has

traditionally been the smallest revenue producer, reflecting the

nature of its product range, has been a good contributor to the

Group's operating profit and remains so. Revenue for the first half

of the year was significantly ahead of the corresponding period

last year following the delivery of a long awaited, substantial

spares order from an overseas government.

While order intake to date for ProVida products has been slower

than anticipated, there exist a good number of active prospects for

the second half of 2015 into 2016. This represents a good area of

business for the Group with interest from the UK market showing

signs of improving and the potential to tackle export markets which

have lapsed over recent years.

As indicated at the time of the publication of the results for

2014, following the heavy investment in product development in that

year, in particular in the area of transport, investment will be

substantially lower in 2015. However, the Group continues to work

on developing and increasing the breadth and capability of its

product range as part of its programme of seeking constant

improvement.

Financial review

Revenues at GBP6.1 million for the six months ended 30 June 2015

were down on the corresponding period last year (2014: GBP7.2

million) as 2014 included GBP3 million of lower margin equipment

deliveries for the MOD's SMRE project whereas the six month period

to June 2015 benefitted from a larger proportion of higher margin

eyeTrain and ProVida products and services, both of which showed

growth over the corresponding period last year.

Revenues from eyeTrain products were ahead of expectations

principally due to much stronger recurring revenues for spares and

support which contributed to the achievement of higher margins.

Similarly the spares order worth in the region of GBP0.4 million

from an overseas government for their existing ProVida mobile ANPR

systems provided a boost to revenues and margins for Emergency

Services. The effect of the above was to substantially increase

gross margins for the Group to 36% (June 2014: 27%).

While administrative expenses rose to GBP1.8 million (June 2014:

GBP1.6 million) half of this increase was due to a higher charge

for amortisation arising from product development costs capitalised

in 2014. Earnings before interest, tax, depreciation and

amortisation (EBITDA) improved by 38% to GBP609,000 (June 2014:

GBP441,000) and operating profit by 26% to GBP436,000 (June 2014:

GBP346,000).

After net financial expenses of GBP80,000 (June 2014: GBP73,000)

and there being no tax charge, the Group recorded a profit after

tax of GBP356,000 (June 2014: GBP273,000), an improvement of 30% on

the corresponding period last year, resulting in a further

strengthening of the balance sheet.

The Group also recorded strong cash generation during the

period. Net cash inflow from operating activities was GBP558,000

(June 2014: GBP181,000) with working capital levels remaining

comparable to those at both June and December 2014. Cash balances

at 30 June 2015 increased to GBP2.0 million up from GBP1.4 million

at 31 December 2014 and after providing for outstanding long term

convertible loan notes that do not mature until 2018, free net cash

totalled GBP0.4 million (December 2014: GBP0.1 million net

debt).

The Board is conscious of the value of dividends to

shareholders. However, at this juncture, the lack of distributable

reserves prevents payments of dividends.

(MORE TO FOLLOW) Dow Jones Newswires

September 08, 2015 02:00 ET (06:00 GMT)

Shortly after the period end the Group increased its available

funding by entering into a GBP1.1 million overdraft and trade

finance facility with Santander UK plc. While it does not presently

envisage utilising the overdraft element of this facility, having

it provides the Board with added flexibility in the financing of

the Group.

Outlook

The objective of the Board remains that of building a

sustainable business built on solid foundations able to adapt to

technological changes and the constantly changing business and

operational environments while satisfying the requirements of its

customers.

Profitability, strong operational cash flow and the

strengthening of the Balance Sheet have enabled the Board to make

investment decisions in support of this objective.

The Board believes that the Company and its management are well

positioned to take on further challenges whether these are driven

by organic growth through product and market development,

acquisition of businesses and/or access to products which will

enhance the existing business model or broaden the corporate

identity of the Group; or a combination of all three.

The continued strength of the order book at 30 June provides

good support for revenues for the second half of 2015, with around

40% currently scheduled for delivery before the year end, giving

the Board confidence for a satisfactory outcome for the year.

Raschid Abdullah

8 September 2015

Condensed Consolidated Income Statement

for the six months ended 30 June 2015

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 June 30 June 31 December

Note 2015 2014 2014

GBP000 GBP000 GBP000

Revenue 6,067 7,163 13,462

Cost of sales (3,860) (5,202) (9,370)

Gross profit 2,207 1,961 4,092

Administrative expenses (1,771) (1,615) (3,323)

Operating profit 436 346 769

----------------------------- ----- --------- --------- ------------------

Analysed as:

Earnings before interest,

tax, depreciation

and amortisation

('EBITDA') 609 441 1,015

Depreciation and

amortisation (172) (95) (246)

Share based payments (1) - -

436 346 769

Financial income 1 2 3

Financial expenses 2 (81) (75) (152)

Profit before tax 356 273 620

Income tax 3 - - -

Profit for the period

attributable to equity

shareholders of the

company 356 273 620

Basic earnings per

share (pence) 4 1.03 0.79 1.80

Diluted earnings

per share (pence) 4 0.76 0.62 1.37

The above results are derived from continuing operations.

Condensed Consolidated Statement of Comprehensive Income

for the six months ended 30 June 2015

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 June 30 June 31 December

2015 2014 2014

GBP000 GBP000 GBP000

Profit for period 356 273 620

Other comprehensive income

Currency translation - - -

on foreign currency net

investments

Total comprehensive income

for the period 356 273 620

Condensed Consolidated Statement of Changes in Equity

for the six months ended 30 June 2015

Currency

Share Share Merger Equity Retained translation Total

capital premium reserve reserve earnings differences equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1

January 2014

(audited) 6,645 25,153 1,075 206 (31,132) (211) 1,736

Profit for the

period - - - - 273 - 273

Other comprehensive - - - - - - -

income

Total comprehensive

income for the

period - - - - 273 - 273

Conversion of

convertible loan

notes 3 17 - (1) 1 - 20

Balance at 30

June 2014 (unaudited) 6,648 25,170 1,075 205 (30,858) (211) 2,029

Balance at 1

January 2014

(audited) 6,645 25,153 1,075 206 (31,132) (211) 1,736

Profit for the

year - - - - 620 - 620

Other comprehensive - - - - - - -

income

Total comprehensive

income for the

year - - - - 620 - 620

Conversion of

convertible loan

notes 4 23 - (2) 2 - 27

Exercise of share

options 2 16 - - - - 18

Balance at 31

December 2014

(audited) 6,651 25,192 1,075 204 (30,510) (211) 2,401

Balance at 1

January 2015

(audited) 6,651 25,192 1,075 204 (30,510) (211) 2,401

Profit for the

period - - - - 356 - 356

Other comprehensive - - - - - - -

income

Total comprehensive

income for the

period - - - - 356 - 356

Equity-settled

share based payments - - - - 1 - 1

Conversion of

convertible loan

notes 1 11 - (1) 1 - 12

Balance at 30

June 2015 (unaudited) 6,652 25,203 1,075 203 (30,152) (211) 2,770

Condensed Consolidated Balance Sheet

at 30 June 2015

Unaudited Unaudited Audited

30 June 30 June 31 December

2015 2014 2014

ASSETS GBP000 GBP000 GBP000

Non-current assets

Property, plant and

equipment 212 170 187

Goodwill 401 401 401

Development costs 983 618 1,103

Deferred tax assets 514 647 516

2,110 1,836 2,207

Current assets

Inventories 1,864 1,900 1,439

Trade and other receivables 2,382 2,283 2,982

Cash and cash equivalents

- escrow deposits - 35 54

Cash and cash equivalents 1,968 1,508 1,434

6,214 5,726 5,909

Total assets 8,324 7,562 8,116

EQUITY AND LIABILITIES

Equity attributable

to equity holders of

the parent

Share capital 6,652 6,648 6,651

Share premium 25,203 25,170 25,192

Equity reserve 203 205 204

Merger reserve 1,075 1,075 1,075

Currency translation

reserve (211) (211) (211)

Retained earnings deficit (30,152) (30,858) (30,510)

Total equity 2,770 2,029 2,401

Non-current liabilities

Interest-bearing loans

and borrowings 1,528 1,515 1,524

Deferred tax liabilities 100 124 100

1,628 1,639 1,624

Current liabilities

Trade and other payables 3,926 3,894 4,091

3,926 3,894 4,091

Total liabilities 5,554 5,533 5,715

Total equity and liabilities 8,324 7,562 8,116

Condensed Consolidated Statement of Cash Flows

(MORE TO FOLLOW) Dow Jones Newswires

September 08, 2015 02:00 ET (06:00 GMT)

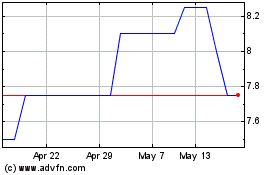

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

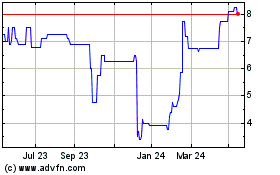

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024