Panther Securities PLC PDMR/Director dealings (2907G)

18 July 2023 - 4:00PM

UK Regulatory

TIDMPNS

RNS Number : 2907G

Panther Securities PLC

18 July 2023

18 July 2023

Panther Securities PLC

(the "Company")

PDMR/Director dealings

Panther Securities PLC was informed that, on 17 July 2023, Paul

Saunders, a Non-Executive Director of the Company, bought a total

of 3,000 ordinary shares of 25 pence each in the Company ("Ordinary

Shares") at a weighted average price of 273.33 pence per Ordinary

Share. Following the above purchases, Paul Saunders now has a total

beneficial interest in 3,500 Ordinary Shares, equivalent to

approximately 0.02 per cent. of the voting rights in the

Company.

The notification below, made in relation to the requirements of

the EU Market Abuse Regulation (as retained and applicable in the

UK), provides further detail.

For further information:

Panther Securities plc: Tel: 01707 667 300

Andrew Perloff / Simon Peters

Allenby Capital Limited (Nomad and Joint Broker) Tel: 020 3328

5656

Alex Brearley / Piers Shimwell

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them.

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Paul Saunders

--------------------------------- -----------------------------

2 Reason for the notification

----------------------------------------------------------------

a) Position/status Non-Executive Director

--------------------------------- -----------------------------

b) Initial notification /Amendment Initial notification

--------------------------------- -----------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

----------------------------------------------------------------

a) Name Panther Securities PLC

--------------------------------- -----------------------------

b) LEI 2138007J2Y5R916YE715

--------------------------------- -----------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

----------------------------------------------------------------

a) Description of the financial Ordinary Shares of 25p each

instrument, type of instrument

Identification code GB0005132070

--------------------------------- -----------------------------

b) Nature of the transaction Purchases of ordinary shares

--------------------------------- -----------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

280p 1,000

270p 2,000

--------------------------------- -----------------------------

d) Aggregated information

- Aggregated volume 3,000

- Price GBP8,200.00

--------------------------------- -----------------------------

e) Date of the transaction 17 July 2023

--------------------------------- -----------------------------

f) Place of the transaction London Stock Exchange, XLON

--------------------------------- -----------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHRRMPTMTTBBRJ

(END) Dow Jones Newswires

July 18, 2023 02:00 ET (06:00 GMT)

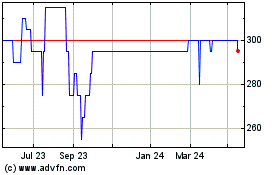

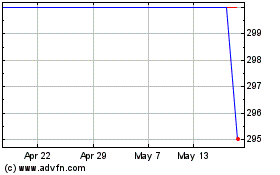

Panther Securities (LSE:PNS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Panther Securities (LSE:PNS)

Historical Stock Chart

From Dec 2023 to Dec 2024