U.K. Insurer Prudential Splits Into Two -- Update

15 March 2018 - 12:08AM

Dow Jones News

By Philip Georgiadis

British insurer Prudential PLC has split its European and

international arms into two new companies, the latest example of

wide-ranging restructuring of the European insurance sector.

The 170-year-old firm said Wednesday it will demerge M&G

Prudential, its U.K. and European business, leaving investors with

shares in two separately listed companies with entirely different

business models.

Prudential -- which isn't related to Prudential Financial Inc.,

a U.S. financial-services provider -- will become a solely

international firm, focused on the U.S., Asia and Africa, and will

be led by current Chief Executive Mike Wells.

M&G Prudential will focus on its retirement and savings

business in the U.K. and Europe, and will pursue a less-capital

intensive structure, following new rules that require insurers to

hold higher levels of capital.

As part of this, the company also announced the GBP12 billion

($14.9 billion) sale of its U.K. annuity portfolio to insurer

Rothesay Life.

"This is the right thing to do and the right time to do it," Mr.

Wells told reporters on an earnings call.

Shares in Prudential rose nearly 5% in morning trading in

London.

Analysts said a spinoff had looked a possibility since

Prudential combined two if its U.K. businesses last August, but the

move had come about quicker than some expected.

"In an organization as complex and diverse as Pru, a split makes

sense," said Nicholas Hyett, an equity analyst at Hargreaves

Lansdown. "The two businesses that emerge will be distinctive -- a

high-growth emerging market play and a capital-light dividend

machine."

Mr. Wells and highlighted the opportunities available to

Prudential when it is left free to focus entirely on non-European

markets. While many European insurers have struggled to expand in

their home markets, Asia has proved far more attractive.

Prudential's move comes as the European insurance industry

undergoes intensive realignment.

French insurance giant AXA SA earlier this month announced a

$15.3 billion agreement to buy XL Group Ltd., the latest step in

its efforts to cut exposure to financial markets and focus more on

insurance. In February, reinsurance giant Swiss Re AG confirmed a

Wall Street Journal report that it was in talks to sell a minority

stake to Japan's SoftBank Group Corp.

Prudential announced the moves alongside its annual results for

2017, recording a 10% rise in operating profit to GBP4.69

billion.

Write to Philip Georgiadis at philip.georgiadis@wsj.com

(END) Dow Jones Newswires

March 14, 2018 08:53 ET (12:53 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

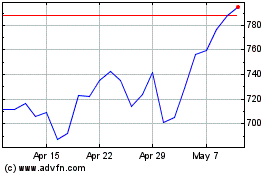

Prudential (LSE:PRU)

Historical Stock Chart

From Jan 2025 to Feb 2025

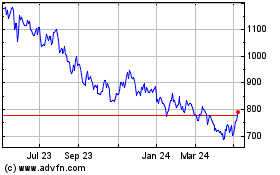

Prudential (LSE:PRU)

Historical Stock Chart

From Feb 2024 to Feb 2025