Ruffer Investment Company Limited Monthly Investment Report - March 2019 (3484V)

06 April 2019 - 3:13AM

UK Regulatory

TIDMRICA

RNS Number : 3484V

Ruffer Investment Company Limited

05 April 2019

RUFFER INVESTMENT COMPANY LIMITED

(a closed-ended investment company incorporated in Guernsey with

registration number 41996)

LEI 21380068AHZKY7MKNO47

Attached is a link to the Investment Monthly Report for March

2019.

http://www.rns-pdf.londonstockexchange.com/rns/3484V_1-2019-4-5.pdf

During March, the net asset value of the Company rose by 1.8%

(including the dividend of 0.9p that was paid during the month).

This compares with a rise of 3.2% in the FTSE All-Share index.

The defining feature in March has been the sharp falls in bond

yields (prices up) across developed markets. Early in the month,

the European Central Bank downgraded their forecasts for economic

growth, which immediately sent German bunds towards zero for the

first time since 2016. This move was further catalysed by the

Federal Reserve, who completed their volte-face on interest rates

in definitive fashion. As recently as September the Fed had

forecast as many as four interest rate rises in 2019, but at their

most recent meeting they implied they do not expect to raise rates

again until 2020, while financial markets are now assuming the most

likely next move is for rates to be cut. This shift is as close to

confirmation that the words from Chairman Jerome Powell in the

fourth quarter amounted to a significant error in communication,

one requiring substantial efforts to correct. This backdrop of

soothing actions and words from policy makers has given comfort to

equity markets, which ended the month at the highs for the year. We

continue to have just under 40% of the fund invested in equities,

enabling us to capture a reasonable share of the returns, whilst

continuing to hold protection should the market lose faith in the

powers of central bankers.

We have long-described a world where financial markets are too

weak to tolerate higher interests rates. The events of 2018, and

the most recent pronouncements from the Fed, have confirmed to all

market participants this is correct. The patient continues to be

reliant on the drugs, and the doctors are reluctant to see if they

can cope without. The greater the market belief in policy makers

the harder it is to control. Consider what will happen the next

time the Fed seems cornered, facing a buoyant market with loose

financial conditions and incipient inflationary pressure. The

market, sensing the Fed may wish to tighten financial conditions,

may well pre-empt Fed action and tighten financial conditions

endogenously, ie equity and credit markets will fall sharply. The

new additional risk is that if markets have been justified in their

recessionary fears, then the Fed will have to act in dramatic

fashion, they cannot risk a nine foot jump over a ten foot gap,

they need a twelve foot jump. The threshold for this is

substantial.

We have absolute conviction in our view that markets remain

structurally fragile, for which we hold protection, whilst if the

Fed have postponed the reckoning we have sufficient equities in the

fund to enjoy the remaining sunshine.

Enquiries:

Praxis Fund Services Limited

Shona Darling

DDI: +44(0)1481 755528

Email: ric@praxisifm.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

PFUUGUBUCUPBGQA

(END) Dow Jones Newswires

April 05, 2019 12:13 ET (16:13 GMT)

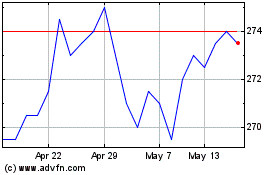

Ruffer Investment (LSE:RICA)

Historical Stock Chart

From Apr 2024 to May 2024

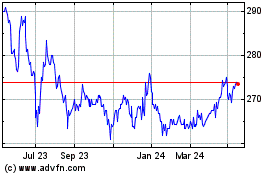

Ruffer Investment (LSE:RICA)

Historical Stock Chart

From May 2023 to May 2024