Renishaw PLC Trading Statement (3073R)

26 October 2023 - 5:00PM

UK Regulatory

TIDMRSW

RNS Number : 3073R

Renishaw PLC

26 October 2023

Renishaw plc

Trading update

26 October 2023

Steady recent performance in challenging market conditions

Renishaw plc, the global provider of manufacturing technologies,

analytical instruments and medical devices, publishes this trading

update for the three months ended 30 September 2023. It contains

unaudited information that covers the first quarter of the

financial year and the period since.

Trading activity

3 months to 3 months to Change

30 September 30 September

2023 2022

Manufacturing technologies GBP156.8m GBP172.8m -9%

--------------- --------------- -------

Analytical instruments and

medical devices GBP7.7m GBP7.1m +8%

--------------- --------------- -------

Total revenue GBP164.5m GBP179.9m -9%

--------------- --------------- -------

Total revenue at FY2023 exchange

rates GBP169.6m GBP179.9m -6%

--------------- --------------- -------

Adjusted(*) profit before

tax GBP28.0m GBP40.0m -30%

--------------- --------------- -------

Statutory profit before tax GBP28.0m GBP38.6m -27%

--------------- --------------- -------

Revenue was GBP164.5m, compared to GBP179.9m for the

corresponding period last year, representing a 9% reduction and a

6% reduction at constant currency. All regions experienced reduced

demand compared to Q1 FY2023. Whilst there was modest growth for

the Industrial Metrology area of our business, revenues for our

Position Measurement products were substantially below a strong

period last year. However, compared to Q4 FY2023, revenue was 1%

lower at constant currency, with no significant changes to market

conditions.

In our Manufacturing technologies business, revenue amounted to

GBP156.8m, compared to GBP172.8m last year. Revenue for our

Analytical instruments and medical devices business was GBP7.7m, an

increase of 8% compared with GBP7.1m last year.

Adjusted profit before tax for the first quarter amounted to

GBP28.0m (FY2023: GBP40.0m) and was 4% lower than the final quarter

of the previous financial year. Statutory profit before tax

amounted to GBP28.0m (FY2023: GBP38.6m).

Financial position

The Group balance sheet remains strong with net cash and cash

equivalents and bank deposit balances of GBP206.7m at 30 September

2023 (30 June 2023: GBP206.4m).

Outlook

Trading conditions remain challenging due to subdued demand,

most notably from the semiconductor sector. We continue to see

positive investment trends in robotics, defence, low emission

transportation and additive manufacturing.

We continue to carefully manage costs, implement targeted price

rises and focus on productivity improvements.

Our investments in product innovation, infrastructure, and

people leave us well-positioned to benefit from a recovery in our

markets. We are confident in our strategy to deliver sustainable

long-term growth.

The results for the half year ending 31 December 2023 will be

released on 6 February 2024.

Will Lee Allen Roberts

Chief Executive Group Finance Director

26 October 2023

Renishaw plc

Registered office New Mills, Wotton-under-Edge, Gloucestershire,

GL12 8JR

Registered number 01106260

Telephone number +44 (0) 1453 524524

Website www.renishaw.com

* The adjustment to statutory profit relates to the accounting

treatment of certain forward currency contracts used as hedging

instruments which do not qualify for hedge accounting as they do

not meet the hedge effectiveness criteria set out in the

International Accounting Standard IFRS 9 'Financial Instruments'.

The Board deems that the adjusted profit before tax also represents

a useful measure of performance of the Group. All previously

ineffective contracts matured in FY2023 and no further contracts

have been designated as ineffective in FY2024. The following table

reconciles statutory profit before tax to adjusted profit before

tax:

GBP'm 3 months 3 months

to 30 September to 30 September

2023 2022

GBP'000 GBP'000

Statutory profit before tax 28.0 38.6

Fair value (gains)/losses on financial instruments

not eligible for hedge accounting

- reported in revenue - (3.7)

- reported in (gains)/losses from the fair value

of financial instruments - 5.1

Adjusted profit before tax 28.0 40.0

---------------------------------------------------- ----------------- -----------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEASESASKDFFA

(END) Dow Jones Newswires

October 26, 2023 02:00 ET (06:00 GMT)

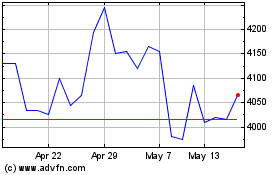

Renishaw (LSE:RSW)

Historical Stock Chart

From Oct 2024 to Nov 2024

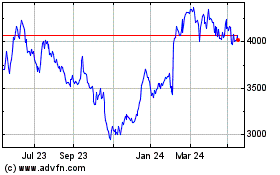

Renishaw (LSE:RSW)

Historical Stock Chart

From Nov 2023 to Nov 2024